Professional Documents

Culture Documents

FTL 108951609v1

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTL 108951609v1

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

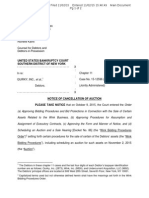

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re BACK YARD BURGERS, INC., et al. 1 Debtors. Chapter 11 Case No.

12-12882 (PJW) (Jointly Administered)

NOTICE OF COMMENCEMENT OF CHAPTER 11 BANKRUPTCY CASES, MEETING OF CREDITORS AND FIXING OF CERTAIN DATES On October 17, 2012, the above-captioned debtors and debtors-in-possession in the above-captioned cases (collectively, the Debtors) filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code, 11 U.S.C. 101 through 1330 (the Bankruptcy Code). The Debtors, and their respective addresses, case numbers and federal tax identification numbers are as follows: DEBTOR (Other names, if any, used by the Debtor in the last 6 years appear in brackets) Back Yard Burgers, Inc. BYB Properties, Inc. Nashville BYB, LLC Little Rock Back Yard Burgers, Inc. ADDRESS CASE NO. EID#

500 Church Street, Suite 200 St. Clouds Building Nashville, TN 37219 500 Church Street, Suite 200 St. Clouds Building Nashville, TN 37219 500 Church Street, Suite 200 St. Clouds Building Nashville, TN 37219 500 Church Street, Suite 200 St. Clouds Building Nashville, TN 37219

12-12882 12-12883 12-12884 12-12885

64-0737163 52-2059046 27-3966507 62-1509133

DATE, TIME AND LOCATION OF MEETING OF CREDITORS. November 19, 2012 at 1:00 p.m. (Prevailing Eastern Time), J. Caleb Boggs Federal Bldg., 844 King Street, 5th Floor, Room 5209, Wilmington, Delaware 19801. DEADLINE TO FILE A PROOF OF CLAIM. Notice of a deadline will be sent at a later time. NAME, ADDRESS AND TELEPHONE NUMBER OF TRUSTEE. None appointed to date.

The Debtors in these chapter 11 Cases, along with the last four digits of each Debtors federal tax identification number, are: Back Yard Burgers, Inc. (7163), BYB Properties, Inc. (9046), Nashville BYB, LLC (6507) and Little Rock Back Yard Burgers, Inc. (9133). The mailing address of the Debtors is: St. Clouds Building, 500 Church Street, Suite 200, Nashville, TN 37219.

FTL 108951609v1

COUNSEL FOR THE DEBTORS. Dennis A. Meloro, Esq. GREENBERG TRAURIG, LLP 1007 North Orange Street Suite 1200 Wilmington, Delaware 19801 Telephone: (302) 661-7000 Nancy A. Mitchell, Esq. Maria DiConza, Esq. Matthew L. Hinker, Esq. GREENBERG TRAURIG, LLP 200 Park Avenue New York, New York Telephone: (212) 801-9200

COMMENCEMENT OF CASES. Petitions for reorganization under chapter 11 of the Bankruptcy Code have been filed in this Court by the Debtors listed above, and orders for relief have been entered. You will not receive notice of all documents filed in this case. All documents filed with the Court, including lists of the Debtors property and debts, are available for inspection at the Office of the Clerk of the Bankruptcy Court. In addition, such documents may be available at www.deb.uscourts.gov. PURPOSE OF CHAPTER 11 FILING. Chapter 11 of the U.S. Bankruptcy Code enables a debtor to reorganize pursuant to a plan. A plan is not effective unless approved by the court at a confirmation hearing. Creditors will be given notice concerning any plan, or in the event the case is dismissed or converted to another chapter of the Bankruptcy Code. The Debtors will remain in possession of their property and will continue to operate any business unless a trustee is appointed. CREDITORS MAY NOT TAKE CERTAIN ACTIONS. A creditor is anyone to whom a debtor owes money or property. Under the Bankruptcy Code, a debtor is granted certain protection against creditors. Common examples of prohibited actions by creditors are contacting a debtor to demand repayment, taking action against a debtor to collect money owed to creditors or to take property of a debtor, and starting or continuing foreclosure actions or repossessions. If unauthorized actions are taken by a creditor against a debtor, the Court may penalize that creditor. A creditor who is considering taking action against a debtor or the property of a debtor should review 362 of the Bankruptcy Code and may wish to seek legal advice. The staff of the Clerk of the Bankruptcy Court are not permitted to give legal advice. MEETING OF CREDITORS. The Debtors representative, as specified in Rule 9001(5) of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules), is required to appear at the meeting of creditors on the date and at the place set forth above for the purpose of being examined under oath. Attendance by creditors at the meeting is welcomed, but not required. At the meeting, the creditors may examine the Debtors and transact such other business as may properly come before the meeting. The meeting may be continued or adjourned from time to time by notice at the meeting, without further written notice to the creditors. CLAIMS. Schedules of creditors will be filed pursuant to Bankruptcy Rule 1007. Any creditor holding a scheduled claim which is not listed as disputed, contingent, or unliquidated as to amount may, but is not required to, file a proof of claim in these cases. Creditors whose claims are not scheduled or whose claims are listed as disputed, contingent, or unliquidated as to amount and who desire to participate in the cases or share in any distribution must file their proofs of claim. A creditor who desires to rely on the schedule of creditors has the responsibility for determining that the claim is listed accurately. Separate notice of the deadlines to file proofs of claim and proof of claim forms will be provided to the Debtors known creditors. Proof of claim forms also are available in the clerks office of any bankruptcy court. Proof of Claim forms are also available from the Courts web site at www.deb.uscourts.gov, Rust Consulting/Omni Bankruptcy is the claims agent in these cases and can provide a proof of claim form if you cannot obtain one from your local bankruptcy court. Rust Consulting/Omni Bankruptcy can be reached as follows:

FTL 108951609v1

Rust Consulting/Omni Bankruptcy 5955 DeSoto Avenue, Suite 100 Woodland Hills, CA 91367 Phone: (818) 906-8300 Website: www.omnimgt.com/backyardburgers DISCHARGE OF DEBTS. Confirmation of chapter 11 plan may result in a discharge of debts, which may include all or part of your debt. See Bankruptcy Code 1141(d). A discharge means that you may never try to collect the debt from the debtor, except as provided in the plan. For the Court: /s/ David D. Bird Clerk of the U.S. Bankruptcy Court Dated: October 25, 2012

FTL 108951609v1

You might also like

- Notice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesDocument3 pagesNotice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesChapter 11 DocketsNo ratings yet

- Et Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Document2 pagesEt Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Chapter 11 DocketsNo ratings yet

- IN RE: DAVID JOHNSON - 6 - Certificate of NoticeDocument3 pagesIN RE: DAVID JOHNSON - 6 - Certificate of NoticeJack RyanNo ratings yet

- Deadline To File A Proof of Claim: No Deadline Has Yet Been Set. Notice of Deadline Will Be Sent at A Later Time. Foreign CreditorsDocument2 pagesDeadline To File A Proof of Claim: No Deadline Has Yet Been Set. Notice of Deadline Will Be Sent at A Later Time. Foreign CreditorsChapter 11 DocketsNo ratings yet

- 10000021166Document24 pages10000021166Chapter 11 DocketsNo ratings yet

- 10000019315Document2 pages10000019315Chapter 11 DocketsNo ratings yet

- Debt Collector Disclosure StatementDocument5 pagesDebt Collector Disclosure StatementBhakta Prakash94% (16)

- U. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Document45 pagesU. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Chapter 11 DocketsNo ratings yet

- 2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4Document11 pages2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4api-360769610No ratings yet

- Hearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 7 and 43Document37 pagesHearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 7 and 43Chapter 11 DocketsNo ratings yet

- Tro Filing On Forclosure Sale No BreachDocument24 pagesTro Filing On Forclosure Sale No BreachJulio Cesar Navas100% (1)

- Proof Steve Shapiro and Peter Lewit Are Liars.Document7 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Notice of Chapter 13 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocument5 pagesNotice of Chapter 13 Bankruptcy Case, Meeting of Creditors, & DeadlinesBill StewartNo ratings yet

- FDCPA ComplaintDocument5 pagesFDCPA ComplaintJesse Sweeney100% (4)

- U. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Document2 pagesU. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Chapter 11 DocketsNo ratings yet

- PublishedDocument16 pagesPublishedScribd Government DocsNo ratings yet

- Usdc Bankruptcy Filing of Mortgage Companies June 2012Document3 pagesUsdc Bankruptcy Filing of Mortgage Companies June 2012Julie Hatcher-Julie Munoz Jackson100% (1)

- Notice of Chapter 11 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocument2 pagesNotice of Chapter 11 Bankruptcy Case, Meeting of Creditors, & DeadlinesGriswoldNo ratings yet

- 10000009931Document6 pages10000009931Chapter 11 DocketsNo ratings yet

- 10000000657Document50 pages10000000657Chapter 11 DocketsNo ratings yet

- Response To San Diego Home Funding LLCDocument17 pagesResponse To San Diego Home Funding LLCNick CruzNo ratings yet

- Chapter 11 GuidelinesDocument32 pagesChapter 11 Guidelinesricetech100% (9)

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncChapter 11 DocketsNo ratings yet

- Davis ObjectionDocument15 pagesDavis Objectionmarie_beaudetteNo ratings yet

- PublishedDocument30 pagesPublishedScribd Government DocsNo ratings yet

- Notice of Chapter 7 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocument2 pagesNotice of Chapter 7 Bankruptcy Case, Meeting of Creditors, & Deadlinesarsmith718100% (1)

- Coleman v. Community Trust Bank, 4th Cir. (2005)Document15 pagesColeman v. Community Trust Bank, 4th Cir. (2005)Scribd Government DocsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument10 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- U. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Document2 pagesU. S. Bankruptcy Court, 411 West Fourth Street, Suite 2030, Santa Ana, CA 92701 4593Chapter 11 DocketsNo ratings yet

- Objection Deadline: May 2, 2012 at 4:00 P.M. (ET) Hearing Date: May 18, 2012 at 10:00 A.M. (ET)Document29 pagesObjection Deadline: May 2, 2012 at 4:00 P.M. (ET) Hearing Date: May 18, 2012 at 10:00 A.M. (ET)Chapter 11 DocketsNo ratings yet

- Attorneys For Five Mile Capital Partners LLCDocument31 pagesAttorneys For Five Mile Capital Partners LLCChapter 11 DocketsNo ratings yet

- Objection Deadline: May 2, 2012 at 4:00 P.M. (ET) Hearing Date: May 18, 2012 at 10:00 A.M. (ET)Document34 pagesObjection Deadline: May 2, 2012 at 4:00 P.M. (ET) Hearing Date: May 18, 2012 at 10:00 A.M. (ET)Chapter 11 DocketsNo ratings yet

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsNo ratings yet

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument24 pagesJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- Notice of Chapter 13 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocument2 pagesNotice of Chapter 13 Bankruptcy Case, Meeting of Creditors, & DeadlinesBill StewartNo ratings yet

- Background: Docket #5075 Date Filed: 7/6/2010Document14 pagesBackground: Docket #5075 Date Filed: 7/6/2010Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument4 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- HB 12-1156: Public Trustee Foreclosure Document RequirementsDocument2 pagesHB 12-1156: Public Trustee Foreclosure Document RequirementsSenator Mike JohnstonNo ratings yet

- Example of How US Bank Filed Motion For Relief From Stay For A Home in A Securities Trust in NCM CaseDocument4 pagesExample of How US Bank Filed Motion For Relief From Stay For A Home in A Securities Trust in NCM Case83jjmackNo ratings yet

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncChapter 11 DocketsNo ratings yet

- United States v. Steven Oscher, 11th Cir. (2011)Document10 pagesUnited States v. Steven Oscher, 11th Cir. (2011)Scribd Government DocsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument44 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Legacy Construction (Hardy) BankruptcyDocument13 pagesLegacy Construction (Hardy) BankruptcyLas Vegas Review-JournalNo ratings yet

- Southern District of New YorkDocument17 pagesSouthern District of New YorkChapter 11 DocketsNo ratings yet

- NRA Bankruptcy Petition For Special Debtor's CounselDocument53 pagesNRA Bankruptcy Petition For Special Debtor's Counseljpr9954No ratings yet

- Order Combined With Notice of Chapter 11 Bankruptcy Case, Meeting of Creditors, & DeadlinesDocument2 pagesOrder Combined With Notice of Chapter 11 Bankruptcy Case, Meeting of Creditors, & DeadlinesChapter 11 DocketsNo ratings yet

- InerrogatoriesDocument14 pagesInerrogatoriesagray43No ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument25 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In Re: Charity M. Seymour, 9th Cir. BAP (2013)Document19 pagesIn Re: Charity M. Seymour, 9th Cir. BAP (2013)Scribd Government DocsNo ratings yet

- 10000021350Document55 pages10000021350Chapter 11 DocketsNo ratings yet

- Filed: Patrick FisherDocument9 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- 10000005743Document48 pages10000005743Chapter 11 DocketsNo ratings yet

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncDocument16 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncChapter 11 DocketsNo ratings yet

- 10000021165Document25 pages10000021165Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument9 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- 10000001858Document124 pages10000001858Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument7 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Rodriguez v. Value Home Loan Breach of Contract Fraud ClaimsDocument10 pagesRodriguez v. Value Home Loan Breach of Contract Fraud Claimsheren95825No ratings yet

- Joe Six Pack VodDocument12 pagesJoe Six Pack VodTeresa ReneeNo ratings yet

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsFrom EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsRating: 5 out of 5 stars5/5 (12)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Yap vs. Lagtapon (Digest)Document2 pagesYap vs. Lagtapon (Digest)Justin IsidoroNo ratings yet

- Criminal Law 2 Case Digests ART. 114 127Document10 pagesCriminal Law 2 Case Digests ART. 114 127Gin FernandezNo ratings yet

- Affidavit of Adverse Claim (Gaby S. Tay)Document3 pagesAffidavit of Adverse Claim (Gaby S. Tay)Benedict Ontal100% (2)

- Electronic Evidence in ArbitrationDocument5 pagesElectronic Evidence in ArbitrationPrateek VodoorNo ratings yet

- Password Reset B2+ CST 4BDocument1 pagePassword Reset B2+ CST 4BSebastian GrabskiNo ratings yet

- Canley Community Church Welcome LeafletDocument2 pagesCanley Community Church Welcome LeafletjonrogersukNo ratings yet

- Suspects Apprehended After Vaal River Murder - OFMDocument1 pageSuspects Apprehended After Vaal River Murder - OFMAmoriHeydenrychNo ratings yet

- Case Digest - LegphilDocument32 pagesCase Digest - LegphilAndrea Gural De Guzman100% (2)

- AmenorrheaDocument51 pagesAmenorrheabisharatNo ratings yet

- 2021 Kapsabet Cre P 2 Teacher - Co .KeDocument2 pages2021 Kapsabet Cre P 2 Teacher - Co .Kecatherine.kemboi1No ratings yet

- Right To Freedom of Religion With Respect To Anti-Conversion LawsDocument11 pagesRight To Freedom of Religion With Respect To Anti-Conversion LawsAditya SantoshNo ratings yet

- Contract MootDocument14 pagesContract MootCLAT SIMPLIFIEDNo ratings yet

- Naruto Shiraga No Tensai by DerArdian-lg37hxmnDocument312 pagesNaruto Shiraga No Tensai by DerArdian-lg37hxmnMekhaneNo ratings yet

- Philippine Presidents Administration EcoDocument32 pagesPhilippine Presidents Administration EcoLucille BallaresNo ratings yet

- The Geography of The Provincial Administration of The Byzantine Empire (Ca. 600-1200) (Efi Ragia)Document32 pagesThe Geography of The Provincial Administration of The Byzantine Empire (Ca. 600-1200) (Efi Ragia)Agis Tournas100% (1)

- CTM DWB400 Motor Safety and Installation InstructionsDocument1 pageCTM DWB400 Motor Safety and Installation Instructionsjeffv65No ratings yet

- Intermediate GW 12aDocument2 pagesIntermediate GW 12aKarol Nicole Huanca SanchoNo ratings yet

- Sapno An and Tolentino Rea CLED Activity 1Document2 pagesSapno An and Tolentino Rea CLED Activity 1Rea Camille D. TolentinoNo ratings yet

- SPM TRIAL 2007 English Paper 2Document19 pagesSPM TRIAL 2007 English Paper 2Raymond Cheang Chee-CheongNo ratings yet

- North 24 Parganas court document on property disputeDocument5 pagesNorth 24 Parganas court document on property disputeBiltu Dey89% (9)

- Guidelines For RemisiersDocument15 pagesGuidelines For Remisierssantosh.pw4230No ratings yet

- Criminal Law Assignment 2Document13 pagesCriminal Law Assignment 2Ideaholic Creative LabNo ratings yet

- Ninety SeventiesDocument6 pagesNinety Seventiesmuhammad talhaNo ratings yet

- Holiday List - 2020Document3 pagesHoliday List - 2020nitin369No ratings yet

- USCIS Policy Memo Perez-Olano Settlement AgreementDocument7 pagesUSCIS Policy Memo Perez-Olano Settlement AgreementValeria GomezNo ratings yet

- Challan Office Copy Challan Candidate'SDocument1 pageChallan Office Copy Challan Candidate'SVenkatesan SwamyNo ratings yet

- Angelou's "Caged BirdDocument2 pagesAngelou's "Caged BirdRodrigo CanárioNo ratings yet

- 笔记整理Document189 pages笔记整理lin lin ZhangNo ratings yet

- COMELEC resolution on 2001 special senate election upheldDocument2 pagesCOMELEC resolution on 2001 special senate election upheldA M I R ANo ratings yet

- Think For Bulgaria B1 P2 Unit Tests KeyDocument9 pagesThink For Bulgaria B1 P2 Unit Tests KeyKristian Hristov100% (3)