Professional Documents

Culture Documents

Ref. Docket No. 6

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ref. Docket No. 6

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

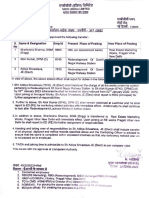

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE

In re: Cordillera Golf Club, LLC, 1 dba The Club at Cordillera, Debtor. Chapter 11 Case No. 12-11893 (CSS)

Ref. Docket No. 6

ORDER PURSUANT TO SECTIONS lOS(a), 363(b), 541, AND 507(a)(8) OF THE BANKRUPTCY CODE AUTHORIZING (I) PAYMENT OF CERTAIN PREPETITION TAXES AND FEES, AND (II) FINANCIAL INSTITUTIONS TO PROCESS AND CASH RELATED CHECKS AND TRANSFERS

Upon the Motion2 of the debtor and debtor in possession in the above-captioned case (the "Debtor") for entry of an order pursuant to sections 1OS(a), 363(b), 541, and 507(a)(8) of title 11 of the United States Code (the "Bankruptcy Code") (i) authorizing the Debtor to pay prepetition taxes and fees, including but not limited to, sales and use, income and franchise, property, unemployment taxes and other Taxes and Fees necessary to operate its businesses, including, but not limited to, any taxes subsequently determined upon audit to be owed for the periods prior to the commencement ofthe Debtor's chapter 11 case, to various U.S., state, county and city taxing and licensing authorities (the "Authorities"), and (ii) authorizing the Debtor's banks and financial institutions (the "Banks"), when requested by the Debtor in its sole discretion, to process, honor, and pay any and all checks and electronic fund transfers related to the prepetition Taxes, all as more fully described in the Motion; and upon consideration of the Motion and all pleadings related thereto, including the First Day Declaration; and due and proper notice of this Motion having been given; and it appearing that no other or further notice is

1

The Debtor in this chapter II case, and the last four digits of its employer tax identification number, is: :XXXXX1317. The corporate headquarters address for the Debtor is 97 Main Street, Suite E202, Edwards, CO 81632.

2

All capitalized terms used and not defined herein shall have the meanings ascribed to them in the Motion.

required; and it appearing that the Court has jurisdiction to consider the Motion in accordance with 28 U.S.C. 157 and 1334; and it appearing that this is a core proceeding pursuant to 28 U.S.C. 157(b)(2); and it appearing that venue of this proceeding and this Motion is proper pursuant to 28 U.S.C. 1408 and 1409; and it appearing that the relief requested is in the best interest of the Debtor, its estate, and creditors and after due deliberation, and sufficient cause appearing therefor, IT IS HEREBY ORDERED THAT: 1. 2. The Motion is granted, to the extent set forth herein. The Debtor is authorized, but not directed, in its sole discretion, to pay, in

the ordinary course of its business, all prepetition Taxes and Fees relating to the period prior to the commencement of its chapter 11 case (the "Petition Date"), including all those Taxes and Fees subsequently determined upon audit, or otherwise, to be owed for periods prior to the Petition Date, to the Authorities, up to an aggregate maximum amount of $44,000.00, provided, however, unless objections are filed with this Court by~

It(

I3

, 2012 at 4:00p.m.

(ET) (the "Objection Deadline") and served upon the Debtor's counsel, the Debtors shall be authorized to pay all Prepetition Taxes and Fees up to an aggregate maximum amount of $475,000.00, provided further, that to the extent that an objection is filed by the Objection Deadline, a final hearing with respect to the payment of prepetition Taxes and Fees will be held on

~ l(' 27 , 2012 at j:t)D -f. . m. (ET).

3. The Debtor's Banks shall be, and hereby are, authorized, when requested

by the Debtor in its sole discretion, to process, honor, and pay any and all checks or electronic fund transfers drawn on the Debtor's bank accounts to pay all prepetition Taxes and Fees owed

to the Authorities, whether those checks were presented prior to or after the Petition Date, provided that sufficient funds are available in the applicable accounts to make the payments. 4. The Debtor's Banks may rely on the representations of the Debtor with

respect to whether any check or other transfer drawn or issued by the Debtor prior to the Petition Date should be honored pursuant to this Order, and any such Bank shall not have any liability to any party for relying on such representations by the Debtor as provided for in this Order. 5. Nothing in the Motion or this Order shall be construed as impairing the

Debtor's right to contest the validity or amount of any Taxes and Fees allegedly due or owing to any Authorities, and all of the Debtor's rights with respect thereto are hereby reserved. 6. Notwithstanding any applicability of Bankruptcy Rule 6004(h), the terms

and conditions of this Order shall be immediately effective and enforceable upon its entry. 7. The requirements set forth in Bankruptcy Rule 6003(b) are satisfied

because the relief in the Motion is necessary to avoid immediate and irreparable harm. 8. This Court shall retain jurisdiction with respect to all matters arising from

or related to the implementation and/or interpretation of this Order. Dated: Wilmington, Delaware June 2*7, 2012

You might also like

- For The District of Colorado: TedstatesbankruptcycourtDocument2 pagesFor The District of Colorado: TedstatesbankruptcycourtChapter 11 DocketsNo ratings yet

- Hearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 6 and 42Document23 pagesHearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 6 and 42Chapter 11 DocketsNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document10 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- Boyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Document3 pagesBoyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Chapter 11 DocketsNo ratings yet

- 10000005755Document5 pages10000005755Chapter 11 DocketsNo ratings yet

- Ref. Docket No. 7Document3 pagesRef. Docket No. 7Chapter 11 DocketsNo ratings yet

- Et Al.Document9 pagesEt Al.Chapter 11 DocketsNo ratings yet

- Et Al./: These CasesDocument34 pagesEt Al./: These CasesChapter 11 DocketsNo ratings yet

- Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeDocument8 pagesHearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeChapter 11 DocketsNo ratings yet

- Motion of The Debtors For An Order Establishing Procedures For Monthly and Quarterly Compensation and Reimbursement of Expenses of ProfessionalsDocument18 pagesMotion of The Debtors For An Order Establishing Procedures For Monthly and Quarterly Compensation and Reimbursement of Expenses of ProfessionalsChapter 11 DocketsNo ratings yet

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayDocument15 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court For The District of Delaware: Et Al.Document15 pagesUnited States Bankruptcy Court For The District of Delaware: Et Al.Chapter 11 DocketsNo ratings yet

- Ref. DocketDocument5 pagesRef. DocketChapter 11 DocketsNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- 10000005760Document6 pages10000005760Chapter 11 DocketsNo ratings yet

- Interim Rules of Procedure On Corporate RehabDocument21 pagesInterim Rules of Procedure On Corporate RehabSharmen Dizon GalleneroNo ratings yet

- Docket No. 39 July 13, 2009: MotionDocument6 pagesDocket No. 39 July 13, 2009: MotionChapter 11 DocketsNo ratings yet

- Jwezmm RDocument3 pagesJwezmm RChapter 11 DocketsNo ratings yet

- Honorable Carol A. DoyleDocument3 pagesHonorable Carol A. DoyleChapter 11 DocketsNo ratings yet

- Et Al.Document32 pagesEt Al.Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Presentment Date and Time: March 10, 2011 at 12:00 P.M. Eastern Time Objection Date and Time: March 10, 2011 at 11:30 A.M. Eastern TimeDocument13 pagesPresentment Date and Time: March 10, 2011 at 12:00 P.M. Eastern Time Objection Date and Time: March 10, 2011 at 11:30 A.M. Eastern TimeChapter 11 DocketsNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- De Laney v. City and County of Denver Etal. in Re White, 185 F.2d 246, 10th Cir. (1950)Document11 pagesDe Laney v. City and County of Denver Etal. in Re White, 185 F.2d 246, 10th Cir. (1950)Scribd Government DocsNo ratings yet

- Order Approving Debtors' Motion For Order Establishing Deadlines For Filing Proofs of Claim and Approving Form and Manner of Notice ThereofDocument36 pagesOrder Approving Debtors' Motion For Order Establishing Deadlines For Filing Proofs of Claim and Approving Form and Manner of Notice ThereofChapter 11 DocketsNo ratings yet

- Original: Et Al.Document15 pagesOriginal: Et Al.Chapter 11 DocketsNo ratings yet

- Ref. Docket Nos. 922 and 1287Document3 pagesRef. Docket Nos. 922 and 1287Chapter 11 DocketsNo ratings yet

- New Jersey Foreclosure Rule 4:64-1 2010Document5 pagesNew Jersey Foreclosure Rule 4:64-1 2010guapsterNo ratings yet

- Marsh RoseDocument19 pagesMarsh RosepvtNo ratings yet

- In Re:) : Debtors.)Document16 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Standing Order of Reference From The United States District Court For The District of DelawareDocument44 pagesStanding Order of Reference From The United States District Court For The District of DelawareLuis Fernando Pino RangelNo ratings yet

- G.R. No. 181556Document4 pagesG.R. No. 181556Mika AkimNo ratings yet

- Moreno, Ma. Christela M. (BLN1Ar) - BALM105 Asynchronous (October 11)Document12 pagesMoreno, Ma. Christela M. (BLN1Ar) - BALM105 Asynchronous (October 11)Christela MorenoNo ratings yet

- FTL 108944861v2Document6 pagesFTL 108944861v2Chapter 11 DocketsNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Document10 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Benedict AlvarezNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument8 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Rem Notes Part 1Document35 pagesRem Notes Part 1Priscilla DawnNo ratings yet

- Re: D.I. 86Document66 pagesRe: D.I. 86Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument3 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- CBTEQ Commonwealth Biotech Disclosure StatementDocument59 pagesCBTEQ Commonwealth Biotech Disclosure StatementstockenfraudNo ratings yet

- In Re:) : Debtors.)Document9 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Original: Et AlDocument3 pagesOriginal: Et AlChapter 11 DocketsNo ratings yet

- Asian Trading Corp vs. CADocument9 pagesAsian Trading Corp vs. CAAlexander Julio ValeraNo ratings yet

- Et SeqDocument9 pagesEt SeqChapter 11 DocketsNo ratings yet

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument24 pagesJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- Peter Mallon Loses Summary Judgment 3 First Settlement He Paid Big TimeDocument9 pagesPeter Mallon Loses Summary Judgment 3 First Settlement He Paid Big Timejimsmith1772No ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- B of A Consent OrderDocument86 pagesB of A Consent OrderEsquireNo ratings yet

- Revised Rules of Procedure For Small Claims CasesDocument7 pagesRevised Rules of Procedure For Small Claims CasesStibun JureonNo ratings yet

- 10000001730Document208 pages10000001730Chapter 11 DocketsNo ratings yet

- 55 PDIC v. Stockholders of Intercity Savings & Loan Bank GR No. 181556 December 14, 2009Document4 pages55 PDIC v. Stockholders of Intercity Savings & Loan Bank GR No. 181556 December 14, 2009RexNo ratings yet

- 10000022227Document99 pages10000022227Chapter 11 DocketsNo ratings yet

- Bach v. Ongkiko Kalaw Manhit Acorda LawDocument10 pagesBach v. Ongkiko Kalaw Manhit Acorda LawDayle ManlodNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument2 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Objection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Document19 pagesObjection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsNo ratings yet

- Nunc Pro Tunc To The Petition DateDocument14 pagesNunc Pro Tunc To The Petition DateChapter 11 DocketsNo ratings yet

- Insolvency-Suspension of PaymentsDocument8 pagesInsolvency-Suspension of PaymentsSalma GurarNo ratings yet

- Am No.00!8!10-Sc (Rehab Corporate)Document14 pagesAm No.00!8!10-Sc (Rehab Corporate)Jose BonifacioNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Cundy Smith Civil Litigation Law School PDFDocument347 pagesCundy Smith Civil Litigation Law School PDFFAJECS Intl100% (1)

- Arbit Part VDocument27 pagesArbit Part VangelescrishanneNo ratings yet

- Cultural Revolution CommonLitDocument7 pagesCultural Revolution CommonLitCheeseit 67No ratings yet

- Analysis of Narrative Structure in Thriller FilmsDocument3 pagesAnalysis of Narrative Structure in Thriller Filmsapi-249309902100% (1)

- Smith Bell Dodwell Shipping Agency Corporation vs. BorjaDocument7 pagesSmith Bell Dodwell Shipping Agency Corporation vs. BorjaElephantNo ratings yet

- ObasanDocument4 pagesObasanPriyam PaulNo ratings yet

- Case DigestDocument22 pagesCase DigestKimNo ratings yet

- Assignment Insurance LawDocument5 pagesAssignment Insurance LawJetheo100% (1)

- 13 Office of The Solicitor General v. Ayala Land, Inc PDFDocument15 pages13 Office of The Solicitor General v. Ayala Land, Inc PDFLeona SanchezNo ratings yet

- Ruks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media AdsDocument2 pagesRuks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media Adsluis capulongNo ratings yet

- PEOPLE OF THE PHILIPPINES vs. VICTOR TANEODocument4 pagesPEOPLE OF THE PHILIPPINES vs. VICTOR TANEOSarah Monique Nicole Antoinette GolezNo ratings yet

- Adr Reviewer Atty HiguitDocument130 pagesAdr Reviewer Atty HiguitAnonymous q3mpt1B6No ratings yet

- Boy PajamsDocument2 pagesBoy PajamsMatt PotvinNo ratings yet

- Vetting CertificateDocument2 pagesVetting Certificateadv shilpa pathey100% (2)

- Jordan Trademark Case: IssueDocument3 pagesJordan Trademark Case: IssueKeisya Naomi NababanNo ratings yet

- Human Rights Law Final PaperDocument6 pagesHuman Rights Law Final PaperKvyn HonoridezNo ratings yet

- Hanak V GreenDocument23 pagesHanak V GreenLordMarlockNo ratings yet

- Lcso Daily Booking Report 06292021Document2 pagesLcso Daily Booking Report 06292021WCTV Digital TeamNo ratings yet

- Biographical Sketch For Students Format Solved Examples Worksheet PDFDocument6 pagesBiographical Sketch For Students Format Solved Examples Worksheet PDFAyush NayakNo ratings yet

- The Stanford Prison ExperimentDocument26 pagesThe Stanford Prison ExperimentAsdfac AcsfacNo ratings yet

- Get Inside Her: Dirty Dating Tips & Secrets From A WomanDocument176 pagesGet Inside Her: Dirty Dating Tips & Secrets From A Womanspamme1100% (6)

- 1 - The Barn at The End of Our Term - Granta 97 - Best of Young American Novelists 2 - Archive - Granta MagazineDocument15 pages1 - The Barn at The End of Our Term - Granta 97 - Best of Young American Novelists 2 - Archive - Granta MagazineabujeiNo ratings yet

- How To Plant ChurchesDocument9 pagesHow To Plant ChurchesJack BrownNo ratings yet

- United States Ex Rel. Willie Richardson v. Daniel McMann Warden, Clinton Prison, Dannemora, New York, 408 F.2d 48, 2d Cir. (1969)Document8 pagesUnited States Ex Rel. Willie Richardson v. Daniel McMann Warden, Clinton Prison, Dannemora, New York, 408 F.2d 48, 2d Cir. (1969)Scribd Government DocsNo ratings yet

- Apple Samsung SettlementDocument7 pagesApple Samsung Settlementjeff_roberts881No ratings yet

- Sagebrush Residents File A LawsuitDocument8 pagesSagebrush Residents File A LawsuitbparkTCNNo ratings yet

- D.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFDocument9 pagesD.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFJayashree ChatterjeeNo ratings yet

- Files O 12 22 2022 986644Document1 pageFiles O 12 22 2022 986644Prince RanaNo ratings yet

- Lectures On Code of Civil Procedure: by Ashutosh Kumar Shukla Asst - Prof. Amity Law SchoolDocument9 pagesLectures On Code of Civil Procedure: by Ashutosh Kumar Shukla Asst - Prof. Amity Law Schoolchhaayaachitran akshuNo ratings yet

- Important Notes: EconomyDocument2 pagesImportant Notes: Economydodi_auliaNo ratings yet