Professional Documents

Culture Documents

10000003305

Uploaded by

Chapter 11 DocketsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10000003305

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

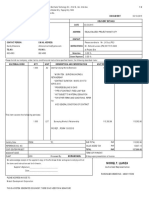

A l ~ G I S

PROPERTY GROUP

CliENT FOCUSED REAL ESTATE SOLUTIONS

June 22, 2012

Raymond H. Lemisch, Esquire

Benesch, Friedlander, Coplan & Aronoff LLP

222 Delaware Avenue, Suite 801

Wilmington, DE 19801

(302)442-7012 (fax)

rlem isch@bnesch law .com

The Office of the United States Trustee, District of Delaware

844 King Street, Suite 2207, Lockbox 35

Wilmington, DE 19810

Attn: Juliet Sarkessian

(302)573-6497 (fax)

Juliet.M.Sarkessian@usdoj.gov

Subject: In re FastShip, Inc. (Case No. 12-10968 (BLS)), FastShip Atlantic, Inc. (Case

No. 12-10970 (BLS)) and Thornycroft, Giles & Co., Inc. (Case No. 12-10971

(BLS))

TO WHOM IT MAY CONCERN:

I am an officer of Aegis Property Group, Ltd., an unsecured creditor in the above

entitled bankruptcy case, with an address of 1600 Market Street, Suite 1701, Philadelphia,

PA 19103.

Aegis Property Group, Ltd.'s ballot is attached. The basis for our objection to the plan

is that it discriminates unfairly against certain unsecured creditors. In our case, our claim

which was acknowledged by Debtor in its initial filing as $205,834 for project management

services performed over an extended period of time, was reduced to $5,834. The rationale

for the reduction was since Aegis Property Group, Ltd. agreed to defer up to $200,000 until

a financial close, it shouldn't be counted as an obligation. Specifically, the Disclosure

Statement stated in Section IV, C, 3 on page 24 "Because the event of a financial close is an

impossibility, it is the Debtors' view that these obligations, being non-existing, are not

Claims".

In fact, the intent of the contract was to defer payment on the amount due to a point

in time when funds would be available. If there is a settlement or recovery under the lawsuit

with the US Government, and that settlement produces sufficient funds to pay off the

creditors with priority over our claim, we think it only fair and equitable that any excess be

next used to pay our prorata share of the full amount of the Claim prior to any payment to

PROJECT MANAGEMENT j DEVELOPMENT I TRANSACTION MANAGEMENT

1600 MARKET STREET, SUITE 1701 I PHILADELPHIA. PA 19103 J 215.568.5050 FAX: 215 568 6525 I WWW.AEGISPG.COM

June 22, 2012

Page 2 of 2

shareholders. Effectively, a settlement or recovery under the current litigation should be

considered the equivalent of a financial close.

Thank you for your consideration.

Sincerely,

Robert J. Rittenhouse

Secretary

cc: FastShip, Inc. et al. Claims Processing

cjo Omni Management Group

5955 DeSoto Avenue, Suite 100

Woodland Hills, CA 91367

Ballot ID: 873

Clm No\Sch ID: Cl Creditor:AEGIS PROPERTY GROUP, LTD.

Ballot Amt: $205,834.00

CaseNo: 12-10968 (BLS)

IN THE UNITED STATES BANKRUPTCY COURT .

FOR THE DISTRICT OF DELAWARE

In re: ) Chapter 11

)

FASTSHIP, INC., eta!., ) Case No. 12-10968 (BLS)

) . (Jointly Administered)

Debtors.

1

)

)

. L._

BALLOT FOR CLASS 3 FOR ACCEPTING OR REJECTING PLAN OF

REORGANIZATION OF THE DEBTORS UNDER CHAPTER 11 OF THE

BANKRUPTCY CODE

THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN

IS 5:00 P.M., PREVAILING EASTERN TIME, ON JUNE 25, 2012

This Ballot is submitted to you to solicit your vote to accept or reject the Joint Liquidating Plan

of FastShip Inc. and Its Subsidiaries Pursuant to Chapter 11 of the United States Bankruptcy

Code (the "Plan"). The Plan is Exhibit A to the Disclosure Statement for the Joint Liquidating

Plan ofFastShip Inc. and Its Subsidiaries Pursuant to Chapter 11 of the United States Bankruptcy

Code (the "Disclosure Statement"). Both the Plan and the Disclosure Statement are included in

the materials accompanying this Ballot. Each capitalized term used but not otherwise defined

herein shall have the meaning ascribed thereto in the Plan.

Please use this Ballot to cast your vote to accept or reject the Plan. The Disclosure Statement has

been approved by the Bankruptcy Court as providing adequate information to assist you in

deciding how to vote on the Plan. The Bankruptcy Court's approval of the Disclosure Statement

does not indicate approval of the Plan.

The Plan can be confirmed by the Bankruptcy Court and thereby made binding on you if the

Plan: (1) for a class of Claims- is accepted by the holders of at least two-thirds in amount and

more than one-half in number of the Claims in each Impaired Class of Claims who vote on the

Plan, (2) for a class of Equity Interests - is accepted by at least two-thirds of the amount of

Equity Interests in each Impaired Class of Equity Interests who vote on the Plans and (3)

otherwise satisfies the applicable requirements of section 1129(a) of the Bankruptcy Code. If the

requisite acceptances are not obtained, the Bankruptcy Court nonetheless may confinn the Plan if

it finds that the Plan (a) provides fair and equitable treatment to, and does not unfairly

discriminate against, the Class or Classes rejecting the Plan and (b) otherwise satisfies the

requirements of section 1129(b) ofthe Bankruptcy Code.

The Debtors, along with the last four digits of each Debtor's tax identification number, are as follows: FastShip, Inc. (8309)

(Case No. 12-1 096R (BLS)), FastShip Atlantic, Inc. (0980) (Case No. 12-10970 (BLS)) and Thomycroft, Giles & Co., Inc.

(1142) (Case No. 12-10971 (BLS)). The mailing address for the Debtors is 1608 Walnut Street, Suite 50 I, Philadelphia, PA

19103.

NID-40084-5-Cl

Ballot ID: 873

Clm No\Sch ID: Cl

Creditor: AEGIS PROPERTY GROUP, LTD.

Ballot Amt: $205,834.00

Case No: 12-10968 (BLS)

You should review the Disclosure Statement and the Plan before you vote. You may wish to

seek legal advice concerning the Plan and the classification and treatment of your Claim or

Equity Interests under the Plan. You may receive multiple ballots. If you hold Claims and/or

Equity Interests in more than one Class or in multiple accounts, you are entitled to vote each

separate Claim and Equity Interest.

Upon completion, this originally executed Ballot should be returned to the Debtors' Voting

Agent, Omni Management Group, by mail, overnight courier or personal delivery so that the

ballot is received by June 25, 2012 at 5:00p.m. (ET) at the following address:

FastShip, Inc. et al. Claims Processing

c/o Omni Management Group

5955DeSoto Avenue, Suite 100

Woodland Hills, California 91367

If your Ballot is not received by the Voting Agent on or before the Voting Deadline and such

deadline is not extended, your vote will not count as either an acceptance or rejection of the Plan.

Ballots must bear the original signature of the Claim or Equity Interest Holder. Ballots will not

be accepted by facsimile or electronic transmission. No unsigned Ballots or non- originally

executed Ballots will be counted. If the Plan is confirmed by the Bankruptcy Court, it will be

binding on you whether or not you vote.

THE VOTING DEADLINE IS 5:00 P.M. EASTERN TIME ON JUNE 25, 2012.

PLEASE READ THE FOLLOWING

INSTRUCTIONS BEFORE COMPLETING THIS BALLOT.

HOW TO VOTE:

1. COMPLETE ITEMS 1, 2 AND 3.

2. REVIEW THE CERTIFICATION CONTAINED IN ITEM 3.

3. SIGN AND DATE THE BALLOT.

4. RETURN THE BALLOT IN THE ENCLOSED PRE-ADDRESSED ENVELOPE.

5. YOU MUST VOTE THE FULL AMOUNT OF YOUR CLAIM OR EQUITY

INTEREST IN ANY ONE CLASS, EITHER TO ACCEPT OR TO REJECT THE PLAN

AND MAY NOT SPLIT YOUR VOTE.

6. ANY EXECUTED BALLOT RECENED THAT DOES NOT INDICATE EITHER AN

ACCEPTANCE OR REJECTION OF THE PLAN OR THAT INDICATES BOTH AN

ACCEPTANCE AND A REJECTION OF THE PLAN, WILL NOT BE COUNTED.

2

NID-40084-5-Cl

Ballot ID: 873

Clm No\Sch ID: Cl Creditor: AEGIS PROPERTY GROUP, LTD.

Ballot Amt: $205,834.00

Case No: 12-10968 (BLS)

Item 1. Class. The undersigned is the holder of a Claim or Equity Interest as of May 31, 2012

designated as Class 3, pursuant to the Plan and Disclosure Statement votes to (check one box):

0 ACCEPT the Plan D 0 REJECT the Plan IX]

Item 2. Amount of Claim Voted. The undersigned certifies that as of the Petition Date the

undersigned held the Claim or Equity Interest in the following amount: $205,834.00.

Item 3. Certification. By returning this Ballot, the undersigned Holder of the Claim or Equity

Interest identified above certifies that (i) it has full power and authority to vote to accept or reject

the Plan with respect to the Claim or Equity Interest identified above, (ii) it was the Holder of the

Claim or Equity Interest identified above as of May 31, 2012, (iii) all Ballots to vote this Class 3

Claim or Equity Interest submitted by the Holder indicate the same vote to accept or reject the

Plan that the Holder has indicated on this Ballot, and (iv) it has received a copy of the Disclosure

Statement (including the exhibits thereto) and understands that the solicitation of votes for the

Plan is subject to all the terms and conditions set forth in the Disclosure Statement and Plan.

YOUR RECEIPT OF THIS BALLOT DOES NOT SIGNIFY

THAT YOUR CLAIM HAS BEEN OR WILL BE ALLOWED.

Name ofPrepetition Claim or Equity Interest Holder: Aegis Property Group

(Print or Type)

Account Number (if ______________ _

Social Security or Federal Tax J.D. No.: ______________ _

(Optional)

Signature:

PrintName: Robert J. Rittenhouse

Title: Secretary

(If Appropriate)

Street Address: 1600 Market Street, Suite 1701

City, State, Zip Code: Philadelphia, PA 19103

Telephone Number: _,.(..,.2_,.,1..,.9.__..:::5:..::6:..::8'---=5:::..:0:::.:5:::..0::<__ ______________________ __...:..

Date Completed:. _ _____________________ _

This Ballot shall not constitute or be deemed a proof of claim or Equity Interest, an assertion of a

Claim or Equity Interest, or the allowance of a Claim or Equity Interest.

3

NID-40084-5-Cl

BallotiD:873

Clm No\Sch ID: C 1

Creditor: AEGIS PROPERTY GROUP, LTD.

Ballot Amt: $205,834.00

Case No: 12-10968 BLS)

UPON COMPLETION, THIS BALLOT SHOULD BE RETURNED TO THE

DEBTORS' VOTING AGENT, AS DIRECTED. IF YOUR BALLOT IS NOT

RECEIVED BY THE VOTING AGENT ON OR BEFORE THE VOTING

DEADLINE AND SUCH DEADLINE IS NOT EXTENDED, YOUR VOTE

\VILL NOT COUNT AS EITHER AN ACCEPTANCE OR REJECTION OF

THE PLAN.

IF YOU HAVE ANY QUESTIONS REGARDING TillS BALLOT OR THE VOTING

PROCEDURES, OR IF YOU NEED A BALLOT OR ADDITIONAL COPIES OF THE

DISCLOSURE STATEMENT OR OTHER ENCLOSED MATERIALS, PLEASE

CONTACT THE VOTING AGENT AT (818) 906-8300 or FastShip@omnimgt.com

4

NID-40084-5-C 1

This page left blank.

.. . -

NID-40084-5-Cl

AEGIS PROPERTY GROUP, LTD.

ATTN: ROBERT J. RITTENHOUSE

1600 MARKET STREET, SUITE 1701

PHILADELPHIA, PA 19103

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- International Bill of Exchange TemplateDocument1 pageInternational Bill of Exchange Templatejj85% (89)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Progress Test GD1613 - IPR102 - Nguyễn Tuấn Hưng - HE163987Document4 pagesProgress Test GD1613 - IPR102 - Nguyễn Tuấn Hưng - HE163987hung151202No ratings yet

- Obligations and Contracts Virtual TextbookDocument33 pagesObligations and Contracts Virtual TextbookJhay-R Marj Louise Ramirez TerradoNo ratings yet

- Cloudberry Saas Reseller AgreementDocument4 pagesCloudberry Saas Reseller Agreementrobogineer100% (1)

- Arrieta v. NARICDocument3 pagesArrieta v. NARICEmir Mendoza100% (3)

- Sonja Age 25 Recently Purchased A 100 000 Ordinary Life InsuranceDocument1 pageSonja Age 25 Recently Purchased A 100 000 Ordinary Life InsuranceAmit PandeyNo ratings yet

- Offer Letter - Tanmayee SahuDocument3 pagesOffer Letter - Tanmayee SahuSidharth PandaNo ratings yet

- Employment Agreement (Executive)Document11 pagesEmployment Agreement (Executive)Legal FormsNo ratings yet

- Sps Villaluz Vs LBP PDFDocument2 pagesSps Villaluz Vs LBP PDFWayne Libao ForbesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Irrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsDocument4 pagesIrrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsjungNo ratings yet

- Proposed Amendments & Judicial Pronouncements in ArbitrationDocument32 pagesProposed Amendments & Judicial Pronouncements in ArbitrationMAHANTESH GNo ratings yet

- Motion For Release of Excess Appeal Bond - MendezDocument3 pagesMotion For Release of Excess Appeal Bond - MendezElmer MendozaNo ratings yet

- Credit Line AgreementDocument9 pagesCredit Line Agreementalnazherkaray55No ratings yet

- PNB v. Natl City Bank of NYDocument19 pagesPNB v. Natl City Bank of NYAndrea RioNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Doctrine of 'Indoor Management': Leading Cases of Turquand's RuleDocument7 pagesDoctrine of 'Indoor Management': Leading Cases of Turquand's Rulepinku13No ratings yet

- 7 Steps To Starting Your Own CorporationDocument2 pages7 Steps To Starting Your Own CorporationDaryl J. S. Badajos100% (1)

- Liquidation - ReviewerDocument2 pagesLiquidation - ReviewertelleNo ratings yet

- Hawaiian Philippines Co v. HernaezDocument2 pagesHawaiian Philippines Co v. HernaezdelayinggratificationNo ratings yet

- Contract of Agency: Submitted ToDocument3 pagesContract of Agency: Submitted ToTamim RahmanNo ratings yet

- Click Wrap Under IT ActDocument3 pagesClick Wrap Under IT ActKanchan MehraNo ratings yet

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDocument1 pageRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountSurya GoudNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Obligation and Contracts CasesDocument14 pagesObligation and Contracts CasesLexa L. DotyalNo ratings yet

- MP Manulife ADA Retry FormDocument1 pageMP Manulife ADA Retry FormRhuejane Gay Maquiling0% (1)

- .ES - Surveying Works & Retainership ExtensionDocument2 pages.ES - Surveying Works & Retainership ExtensionMaverick OmnesNo ratings yet

- Credit Default Swaps and The Credit Crisis: René M. StulzDocument21 pagesCredit Default Swaps and The Credit Crisis: René M. StulzRenjie XuNo ratings yet

- Winding-up-Of-companies Final (8 Slides)Document8 pagesWinding-up-Of-companies Final (8 Slides)Ashutosh K TripathyNo ratings yet

- Important Business Law QuestionsDocument4 pagesImportant Business Law QuestionsfarazmilyasNo ratings yet

- Monitor Signos Vitales Datascope Spectrum or de MindrayDocument152 pagesMonitor Signos Vitales Datascope Spectrum or de Mindrayleopa78No ratings yet

- Activity For Chapter 2 of ObliconDocument4 pagesActivity For Chapter 2 of ObliconCarlo Garcia100% (7)

- PP02201810982 HDFC Life Click 2 Retire Brochure Retail BrochureDocument16 pagesPP02201810982 HDFC Life Click 2 Retire Brochure Retail BrochureRamakrishnan VSNo ratings yet