Professional Documents

Culture Documents

Counsel For Trimont Real Estate Advisors, Inc. As Special Servicer

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Counsel For Trimont Real Estate Advisors, Inc. As Special Servicer

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

US2008 1517450.

3

KILPATRICK STOCKTON LLP Hearing Date: September 1, 2010 at 8:30 a.m.

Todd C. Meyers, Esq.

Rex R. Veal, Esq.

Mark A. Fink, Esq.

1100 Peachtree Street, Suite 2800

Atlanta, GA 30309-4530

Telephone: (404) 815-6500

Facsimile: (404) 541-6555

Michael D. Crisp, Esq.

Jonathan E. Polonsky, Esq.

31 West 52nd Street, 14th Floor

New York, NY 10019

Telephone: (212) 775-8703

Facsimile: (212) 775- 8819

Counsel for TriMont Real Estate Advisors, Inc.

as Special Servicer

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re:

)

)

Chapter 11

)

INNKEEPERS USA TRUST, et al., ) Case No. 10-13800 (SCC)

)

Debtors. ) Jointly Administered

)

OMNIBUS DECLARATION OF TRAVIS SHELHORSE IN SUPPORT OF:

(I) OBJECTION OF TRIMONT REAL ESTATE ADVISORS, INC.,

AS SPECIAL SERVICER, TO DEBTORS MOTION FOR AN ORDER

(A) AUTHORIZING THE DEBTORS TO ASSUME THE PLAN SUPPORT

AGREEMENT AND (B) GRANTING RELATED RELIEF; AND

(II) LIMITED OBJECTION OF TRIMONT REAL ESTATE ADVISORS, INC.,

AS SPECIAL SERVICER, TO DEBTORS MOTION FOR THE ENTRY OF

AN ORDER AUTHORIZING THE DEBTORS TO OBTAIN

POSTPETITION FINANCING FROM AN AFFILIATE OF LEHMAN ALI INC.

ON A PRIMING BASIS PURSUANT TO SECTIONS 364(c)(1),

364(c)(2), 364(c)(3), 364(d)(1), AND 364(e) OF THE BANKRUPTCY CODE.

I, Travis Shelhorse, am an authorized representative of TriMont Real Estate Advisors,

Inc. (TriMont), as special servicer for the benefit of SASCO 2008-C2, LLC, as 100%

US2008 1517450.3

participant and owner of all economic and beneficial interests in the loans described on Exhibit

A (SASCO or the Mezzanine Lender).

I am authorized to submit this Declaration in support of the Objection of TriMont Real

Estate Advisors, Inc., as Special Servicer, to Debtors Motion for an Order (A) Authorizing the

Debtors to Assume the Plan Support Agreement and (B) Granting Related Relief (the PSA

Objection). The PSA Objection was filed in opposition to the Debtors Motion for an Order (A)

Authorizing the Debtors to Assume the Plan Support Agreement and (B) Granting Related Relief

filed on July 19, 2010 [Docket No. 15] (the PSA Motion).

This Declaration is also in support of the Limited Objection of TriMont Real Estate

Advisors, Inc., as Special Servicer, to Debtors Motion for the Entry of an Order Authorizing the

Debtors to Obtain Postpetition Financing From an Affiliate of Lehman ALI Inc. on a Priming

Basis Pursuant to Sections 364(c)(1), 364(c)(2), 364(c)(3), 364(d)(1), and 364(e) of the

Bankruptcy Code (the Solar DIP Objection). The Solar DIP Objection was filed in opposition

to the Debtors Motion for the Entry of an Order Authorizing the Debtors to Obtain Postpetition

Financing from an Affiliate of Lehman ALI Inc. on a Priming Basis Pursuant to Sections

364(c)(1), 364(c)(2), 364(c)(3), 364(d)(1) and 364(e) of the Bankruptcy Code also filed on July

19, 2010 [Docket No. 23] (the Solar DIP Motion).

I declare, in accordance with section 1746 of title 28 of the United States Code

that the following is true and correct to the best of my knowledge, information and belief

based on my personal knowledge, as well as review of pleadings filed in the above-

captioned jointly-administered cases, and the documents prepared and/or maintained by

TriMont in the ordinary course of business.

US2008 1517450.3

1. On July 19, 2010 (the Petition Date), Innkeepers USA Trust and certain of its

affiliates, including the Floating Rate Property Level Borrowers, the Floating Rate Mezzanine

Borrower, KPA HS Anaheim and the Anaheim Mezzanine Borrower (collectively, the

Debtors), filed voluntary petitions for relief under chapter 11 of Title 11, United States Code

(the Bankruptcy Code).

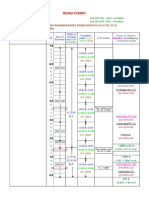

The Mezzanine Lenders Mezzanine Loans

2. Twenty separate property level owners (the Floating Rate Property Level

Borrowers)

1

are co-borrowers under a loan agreement dated as of June 29, 2007 (as amended,

the Floating Rate Mortgage Loan Agreement) with Lehman ALI, Inc. (Lehman ALI) as

lender. The Floating Rate Mortgage Loan Agreement provides for a mortgage loan (the

Floating Rate Mortgage Loan) to the Floating Rate Property Level Borrowers in the original

principal amount of $250 million, collateralized by the twenty hotels owned by the Floating Rate

Property Level Borrowers (the Floating Rate Property Level Collateral).

2

3. Grand Prix Mezz Borrower Floating 2, LLC (the Floating Rate Mezzanine

Borrower) is the owner of the membership interests in the Floating Rate Property Level

Borrowers. On or about June 29, 2007, Lehman ALI made a loan to the Floating Rate

Mezzanine Borrower in the original principal amount of $117,658,725.00 (the Floating Rate

Mezzanine Loan) evidenced by, among other things, that certain mezzanine loan agreement (as

amended, the Floating Rate Mezzanine Loan Agreement) dated as of June 29, 2007, and a

1

A list of the Floating Rate Property Level Borrowers is set forth on Exhibit B.

2

TriMont understands the outstanding principal balance of the Floating Rate Mortgage Loan as of the Petition Date

(defined below) to be approximately $220.2 million after application to the debt shortly before the Petition Date of

approximately $17.5 million that had been deposited with Lehman ALI to fund certain property improvement

programs, or PIPs and to fund other reserves. As discussed in further detail in the Solar DIP Objection, a Lehman

ALI affiliate now proposes to fund the same PIPs through debtor-in-possession financing, albeit with significant

additional entitlements not available to Lehman ALI had it funded the PIPs with the deposited funds as

contemplated.

US2008 1517450.3

promissory note of even date therewith. As of May 22, 2008, certain Lehman ALI affiliates,

namely, Lehman Brothers Holdings Inc. (LBHI) and/or Lehman Commercial Paper Inc.

(LCPI), owned the Floating Rate Mezzanine Loan. On or about May 22, 2008, LBHI and

LCPI, as sellers, sold and conveyed to SASCO, as purchaser, among other things, a 100%

participation interest in the Floating Rate Mezzanine Loan. As a consequence of this sale and

conveyance, the sellers retained only bare legal title and no economic interest in the Floating

Rate Mezzanine Loan, and SASCO, the Mezzanine Lender, became the holder of all of the

economic and beneficial interests in the Floating Rate Mezzanine Loan.

3

The membership

interests in the Floating Rate Property Level Borrowers owned by the Floating Rate Mezzanine

Borrower secure repayment of the Floating Rate Mezzanine Loan, 100% of the economic and

beneficial interests in which is held by SASCO. As a result, the equity in the Floating Rate

Property Level Collateral, consisting principally of 20 hotel properties, constitutes the primary

collateral and source of recovery for the Floating Rate Mezzanine Loan.

4. KPA HS Anaheim LLC (KPA HS Anaheim) is the obligor under a loan

agreement dated as of June 14, 2005 (as amended, the Anaheim Mortgage Loan Agreement)

with Lehman ALI as lender. The Anaheim Mortgage Loan Agreement provides for a mortgage

loan under which KPA HS Anaheim is obligated in the original principal amount of $13.7

million, collateralized by a property known as the Hilton Suites in Anaheim, California (the

Anaheim Hotel).

5. Grand Prix Mezz Borrower Term LLC (the Anaheim Mezzanine Borrower), is

the owner of 100% of the membership interest in KPA HS Anaheim. On or about June 29, 2007,

Lehman ALI made a loan (the Anaheim Mezzanine Loan; collectively with the Floating Rate

3

See Master Participation Agreement, dated as of May 22, 2008, between LBHI and LCPI (as Sellers) and SASCO

(as Purchaser), pp. 6-8, a true copy of which is attached as hereto as Exhibit C.

US2008 1517450.3

Mezzanine Loan, the Mezzanine Loans) to the Anaheim Mezzanine Borrower in the original

principal amount of $21,300,000.00, evidenced by, among other things, a mezzanine loan

agreement dated as of June 29, 2007 (as amended, the Anaheim Mezzanine Loan Agreement)

and a promissory note of even date therewith. As of May 22, 2008 LBHI and/or LCPI owned the

Anaheim Mezzanine Loan. See Exhibit C. On or about May 22, 2008, LBHI and LCPI, as

sellers, sold and conveyed to SASCO, as purchaser, among other things, a 100% participation

interest in the Anaheim Mezzanine Loan. As a consequence of this sale and conveyance, the

sellers retained only bare legal title and no economic interest in the Anaheim Mezzanine Loan,

and SASCO became the holder of all of the economic and beneficial interests in the Anaheim

Mezzanine Loan. The Anaheim Mezzanine Borrowers membership interest in KPA HS

Anaheim secures repayment of the Anaheim Mezzanine Loan, 100% of the economic and

beneficial interests in which is held by SASCO. As a result, the equity in the Anaheim Hotel

constitutes the primary collateral and source of recovery for the Anaheim Mezzanine Loan.

4

Capital Improvement Documents Affecting Floating Rate Property Level Collateral

6. At the time the Floating Rate Mezzanine Loan was closed, on or about June 29,

2007, it was recognized that certain capital improvements were necessary to be made to the

Floating Rate Hotel Properties in accordance with certain property improvement plans (the

PIPs) that had been developed for the properties. The Floating Rate Mezzanine Loan

Agreement required that the PIPs be effectuated and the capital improvements (the Required

4

Contrary to the averment in paragraph 31 of the Amended Declaration of Dennis Craven, Chief Financial Officer

of Innkeepers USA Trust, in Support of First-Day Pleadings [Docket No. 33] (the Craven Declaration) that,

pursuant to an intercreditor agreement, the Anaheim Mezzanine Loan is subordinate to not only the obligations due

pursuant to the Anaheim Mortgage Loan Agreement but also obligations due under the Floating Rate Mortgage

Loan Agreement, the Anaheim Mezzanine Loan is only subordinate to the obligations due under the Anaheim

Mortgage Loan Agreement (and such subordination is subject to certain exceptions).

US2008 1517450.3

Capital Improvements) be made as set forth in the agreement. It also required that reserves be

established for the funding of the Required Capital Improvements.

5

7. With respect to the reserves otherwise required to be funded to pay for the Required

Capital Improvements, the Floating Rate Loan Agreements permitted the substitution of

guaranties from Apollo in lieu thereof. Opting for this alternative, on or about June 29, 2007,

Apollo executed and delivered, in connection with the Floating Rate Mezzanine Loan, a

Required Capital Improvements Guaranty (Mezzanine Loan) (the Apollo Guaranty),

guaranteeing the payment and performance of the Floating Rate Mezzanine Borrowers

obligations and liabilities to complete the Required Capital Improvements (other than Immediate

PIP Work and Initial Construction Work to the extent sufficient cash reserves for such work

were deposited with the Mezzanine Lender or the Floating Rate Mortgage Lender).

6

8. On or about July 31, 2009, pursuant to, among other agreements, a third amendment

to the Floating Rate Mezzanine Loan Agreement, Lehman ALI released the Apollo Guaranty in

return for the funding of reserves to be held by Lehman ALI to pay for the Required Capital

Improvements (the RCI Funds).

7

Thereafter, Lehman ALI held RCI Funds that could have

been used to pay for the Required Capital Improvements.

9. In the spring of 2010, Lehman ALI and affiliates entered into discussions with

Apollo about a restructuring of the debt of Innkeepers USA Trust and its affiliates (collectively,

5

The Floating Rate Mezzanine Loan and the Floating Rate Mortgage Loan were made substantially

contemporaneously. In many respects, the respective loan agreements (the Floating Rate Loan Agreements)

mirrored each other. In this regard, the Floating Rate Property Level Borrowers and the Floating Rate Mezzanine

Borrower were obligated under their respective loan agreements to cause the Required Capital Improvements to be

made and to fund reserves for such improvements.

6

A copy of the Apollo Guaranty is attached hereto as Exhibit D. A similar guaranty was also executed and

delivered by Apollo for the benefit of Lehman ALI as the Floating Rate Mortgage Lender.

7

See Confirmation of Termination of Documents, by Lehman ALI Inc in favor of Apollo Investment Corporation

dated as of July 31, 2009 (the Apollo Guaranty Release), attached hereto as Exhibit E.

US2008 1517450.3

Innkeepers).

8

These discussions resulted in a plan support agreement that envisioned that

Innkeepers would file for chapter 11 relief and restructure pursuant to a prenegotiated plan of

reorganization that, among other things, would extinguish the equity in the Floating Rate

Property Level Borrowers, the principal source of recovery for the Floating Rate Mezzanine

Loan.

10. Fully aware that the pre-planned Innkeepers bankruptcy filing was imminent, on or

about July 16, 2010 (just 3 days before the Petition Date), Lehman ALI applied the RCI Funds

and certain other funds held as reserves under the Floating Rate Mortgage Loan Agreement

(collectively, the Applied Funds) to the Floating Rate Mortgage Loan. The purpose of this

action appears to have been to convert approximately $17.5 million of prepetition secured debt

into superlien, superpriority postpetition debt by lending the Applied Funds back to the Debtors

through a Lehman affiliate in the form of debtor-in-possession financing (the DIP Financing).

The Debtors Plan Support Agreement

11. On the Petition Date, the Debtors filed the Craven Declaration. A Plan Support

Agreement (the PSA) by and among the Debtors and Lehman ALI was filed as an exhibit to

the Craven Declaration. At the same time, the Debtors filed the PSA Motion in which they seek,

among other things, to assume the PSA in accordance with section 365 of the Bankruptcy Code.

12. The plan envisioned by the PSA provides, among other things, that Lehman ALI

will receive, in satisfaction of its secured mortgage claims in respect of the Floating Rate

Mortgage Loan debt, 100% of the issued and outstanding new shares of common stock issued by

8

Motion of Lehman Commercial Paper Inc. Pursuant to Section 363 of the Bankruptcy Code for Authority to (I)

Consent to Its Non-Debtor Affiliate Lehman ALI Inc. (A) Entry Into Plan Support Agreement Related to the

Restructuring of Innkeepers USA Trust; and (B) Consummation of the Transactions Set Forth in the Plan Term

Sheet; and (II) Provide Funds to Solar Finance Inc., a Non-Debtor Affiliate, to Provide Debtor-In-Possession

Financing, p.13, attached hereto as Exhibit F.

US2008 1517450.3

the reorganized Debtors. Other key elements of the Debtors plan dictated by the PSA include

the following:

The remaining property level secured lenders will receive new secured notes with

a value that is no less than the value of the collateral securing their pre-petition

debt;

The Mezzanine Loans will be deemed cancelled and the Mezzanine Lender will

receive no distribution;

Unsecured creditors (including, it appears, creditors holding unsecured deficiency

claims) will receive a share of a cash allocation; and

Holders of interests in the Debtors, including common and preferred stock, will

have their interests cancelled, and no distributions will be made on account of

such interests.

13. On information and belief, Lehman ALI is the only significant creditor of the

Debtors that has agreed to the terms of the PSA.

14. The PSA prohibits both Lehman ALI and the Debtors from negotiating, supporting,

or engaging in any discussions relating to any alternate chapter 11 plan. PSA, Section 4(a)(iii).

15. The PSA obligates the Debtors to meet certain Plan Milestones or risk

termination of the PSA. For instance, the Debtors must, among other things: (1) file a plan and

disclosure statement consistent with the PSA no later than 45 days after the Petition Date; (2)

obtain approval of a disclosure statement consistent with the PSA no later than 120 days after the

Petition Date; (3) obtain an order confirming a plan consistent with the PSA no later than 240

days after the Petition Date; and (4) implement a Plan Effective Date no later than 270 days after

the Petition Date. Failure of the Debtors to meet any of these timelines constitutes a Termination

Event.

9

9

All capitalized undefined terms used herein shall have the meanings ascribed to them in either the Declaration or

the PSA.

US2008 1517450.3

16. Additionally, Section 8(b) of the PSA provides that, upon the occurrence of select

Termination Events, the Debtors must choose between immediate stay relief in favor of Lehman

ALI or a section 363 sale of the Floating Rate Property Level Collateral at which Lehman ALI

will have the right to credit bid the unpaid balance of the Floating Rate Mortgage Loan:

As long as this Agreement has not otherwise been terminated, (x) upon

the occurrence of a Termination Event set forth in Section 6(a)(vii) or

6(a)(viii); (y) if a trustee is appointed for the Chapter 11 Cases of all those

Debtors obligated under the Floating Rate Debt, Fixed Rate Debt,

Mezzanine Debt, and Other Secured Debt, or (z) if the company files a

motion to dismiss all of the Chapter 11 Cases for those Debtors obligated

under the Floating Rate Debt, Fixed Rate Debt, Mezzanine Debt, and Other

Secured Debt, the Company shall, immediately upon the occurrence of such

Termination Event, elect one of the following remedies, provided, however,

that if the company fails to make such election within one day after the

occurrence of the applicable Termination Event, Lehman shall have the

right to elect either option:

(i) The Company will be deemed to have consented to the

modification of the automatic stay to permit Lehman to exercise any and all

remedies with respect to the [Floating Rate Property Level Collateral], the

automatic stay shall be so modified and no further Bankruptcy Court

approval shall be required; or

(ii) The Company will sell the [Floating Rate Property

Level Collateral] pursuant to Section 363 of the Bankruptcy Code, subject

to the following conditions, which shall be incorporated into any order

approving this Agreement: (i) the sale procedures shall be agreed upon no

later than 120 days after the Petition Date; (ii) Lehman shall have the right

to credit bid the Floating Rate Debt; (iii) if sale proceeds are not paid to

Lehman within 60 days of the Termination Event, title to the [Floating Rate

Property Level Collateral] shall be conveyed to Lehman free and clear of all

liens, claims and encumbrances; (iv) the 60-day period shall not be

extended and the Company waives its right to seek any extension (sic) such

period.

PSA, Section 8(b).

17. Specifically, Lehman ALI will be entitled to immediate relief from stay or a section

363 sale of the Floating Rate Property Level Collateral if the Debtors do not (1) obtain an order

confirming a plan consistent with the PSA within 240 days after the Petition Date and (2)

US2008 1517450.3

implement a Plan Effective Date within 270 days after the Petition Date. PSA, Sections

6(a)(vii)-(viii) and 8(b)(i)-(ii).

18. Moreover, what is not set forth in the PSA or the accompanying term sheet is that

Lehman ALI already has agreed to sell a 50% interest in reorganized Innkeepers to Apollo

Investment Corporation (Apollo), the direct or indirect parent of all of the Debtors. Indeed,

despite knowing of an executed agreement between Apollo and Lehman ALI prior to the Petition

Date, the Debtors made only a passing reference to this transaction in their amended

Declaration. Compare Declaration, 13 (disclosing only that [i]t is the Debtors understanding

that, subject to certain terms and conditions, [Apollo] may become the purchaser[] of the 50%

interest in reorganized Innkeeprs) with Beilinson Deposition, 35:1-12 (admitting that the Debtors

were aware, prior to the Petition Date, that Apollo and Lehman ALI had executed an agreement

on July 16, 2010 for the acquisition of the 50% interest in reorganized Innkeepers).

19. Likewise, the Debtors have not marketed the 100% interest in reorganized

Innkeepers to anyone other than Lehman ALI nor has Lehman ALI marketed the 50% interest in

reorganized Innkeepers to anyone other than Apollo. Beilinson Deposition, 138:8-140:14;

Lascher Deposition 155:5-21.

The Debtors Proposed Solar DIP Facility

20. On the Petition Date, the Debtors filed the Solar DIP Motion seeking approval for a

$17,498,095.52 debtor-in-possession financing facility (the DIP Facility) to be provided by

Solar Finance Inc. (an affiliate of Lehman ALI) (Solar or the DIP Lender).

10

21. The proceeds from the DIP Facility are to be used principally to fund the Required

Capital Improvements.

10

All capitalized undefined terms used herein shall have the meanings ascribed to them in the Motion.

US2008 1517450.3

22. The DIP Facility is to be secured by, among other things, a priming lien on the

Floating Rate Property Level Collateral. As discussed above, the equity in the Floating Rate

Property Level Collateral constitutes the primary collateral and source of recovery for the

Floating Rate Mezzanine Loan.

23. On August 13, 2010, the Debtors filed their Notice of Filing of Supplement to the

Debtors Motion for the Entry of an Order Authorizing the Debtors to Obtain Postpetition

Financing from an Affiliate of Lehman ALI Inc. on a Priming Basis Pursuant to Sections

364(c)(1), 364(c)(2), 364(c)(3), 364(d)(1), and 364(e) of the Bankruptcy Code [Docket No. 200]

(the Supplement). A proposed order (the Proposed Order) and a form of credit agreement

for the DIP Facility (the DIP Credit Agreement) were attached as exhibits to the Supplement.

24. Section 8.2(d) of the DIP Credit Agreement provides that any final order approving

the DIP Facility will contain a waiver of the automatic stay in favor of the DIP Lender. DIP

Credit Agreement, 8.2(d). In furtherance of this provision, Paragraph 13 of the Proposed Order

provides:

Modification of Automatic Stay to Permit Exercise of Remedies Upon

Termination. The automatic stay provisions of section 362 of the

Bankruptcy Code are hereby modified as necessary to effectuate all of the

terms and provisions of this Final Order, including, without limitation,

that the automatic stay shall be vacated and modified, and the Floating

Rate Debtors shall be deemed to have consented to such vacatur and

modification, upon the occurrence of a Termination Event or an Event of

Default, to the extent necessary to permit the Floating Rate DIP Lender to

take any or all of the following actions without further order of or

application to the Court; provided, however, that the Floating Rate DIP

Lender shall provide the Floating Rate Debtors with five (5) business days

prior written notice, with a copy of such notice to counsel for the

Committee and counsel to the Floating Rate Debtors, prior to exercising

remedies (excluding acceleration of the Floating Rate DIP Indebtedness)

under this Final Order or the Floating Rate DIP Loan Documents:

(i) accelerate the Floating Rate DIP Indebtedness upon the occurance and

during the continuation of an Event of Default and (ii) exercise rights and

remedies as to all or such part of the Floating Rate Collateral that the

US2008 1517450.3

Floating Rate DIP Lender shall elect in its sole and absolute discretion,

including, without limitation: (a) the right to realize on all Floating Rate

Collateral securing the Floating Rate DIP Facility; (b) the right to exercise

any remedy available under the Floating Rate DIP Facility, the Floating

Rate DIP Documents, including the Floating Rate DIP Agreement, and

applicable law (including, without limitation, the right (but not the

obligation) to complete the Marriott PIP Work, the Other Franchise PIP

Work and the Cycle Renovations (as such terms are defined in the Floating

Rate DIP Agreement) and to apply any of the proceeds of the DIP Facility

on account thereof); and (c) the right to foreclose upon and sell all or a

portion of the Floating Rate Collateral. Notwithstanding the occurrence of

a Termination Event, Event of Default, or termination of the commitments

under the Floating Rate DIP Agreement or anything herein, all of the rights,

remedies, benefits, and protections provided to the Floating Rate DIP

Lender under the Floating Rate DIP Documents and this Final Order shall

survive the occurrence of a Termination Event or an Event of Default. If

the Debtors and/or the Committee request entry of an order to re-impose or

continue the automatic stay following a Termination Event or an Event of

Default (and it being a term of this Final Order that no other party

shall have standing to do so), then the only issue the Floating Rate

Debtors and/or the Committee shall be allowed to assert in support of

such relief is whether such Termination Event or an Event of Default

actually occurred or was properly cured under the Floating Rate DIP

Documents. This Court shall retain exclusive jurisdiction to hear and

resolve any disputes and enter any orders required by the provisions of this

paragraph and relating to the application, re-imposition, or continuance of

the automatic stay as provided hereunder.

Proposed Order, 13 (emphasis added).

25. Forty-two Events of Default are specified in the DIP Credit Agreement, including

events such as termination of the exclusive period for Borrower to file a plan of reorganization in

the Debtors chapter 11 cases.

11

DIP Credit Agreement 8.1(a)(v)(R). In addition, if the cost of

certain renovations actually exceeds the amounts budgeted therefor, an Event of Default will

occur under the DIP Credit Agreement. Id. 8.1(a)(ix). Moreover, among the Events of Default

11

The plan the Debtors intend to file proposes to extinguish all equity interests in the Debtors, including equity

interests in solvent Debtors. That parties will seek to propose competing plans is evident.

US2008 1517450.3

enumerated in the DIP Credit Agreement are breaches of any of the fourteen negative covenants

set forth in Section 5.2 of the agreement. Id. 8.1(a)(xi).

12

26. The negative covenants section of the DIP Credit Agreement provides, inter alia,

with certain exceptions not here relevant, that Borrower shall not permit, without the prior

written consent of the DIP Lender, a Sale or Pledge of an interest in any Restricted Party and

denotes such a Sale or Pledge as an impermissible Transfer. Id. 5.2.10(a). Sale or Pledge

is defined as a voluntary or involuntary sale conveyance, transfer or pledge of a direct or

indirect legal or beneficial interest. Id. 1.1 (emphasis added). Impermissible Transfers are

stated in the negative covenants section to include, if a Restricted Party is a limited liability

company (such as the Floating Rate Property Level Borrowers), the Sale or Pledge of the

membership interest of a managing member (or if no managing member, any member) . . . or the

Sale or Pledge of non-managing membership interests . . . . Id. 5.2.10(b) (emphasis added).

27. Restricted Party is defined to mean Borrower or Operating Lessee or any

Affiliated Manager or any shareholder, partner, member or non-member manager, or any direct

or indirect legal or beneficial owner of Borrower or Operating Lessee or any Affiliated Manager

or any non-member manager. Id. at 1.1 (emphasis added). Because each of the Floating Rate

Property Level Borrowers is included within the definition of Borrower in the DIP Credit

Agreement (Id., Preamble, Signature Page) and is thus a Restricted Party, even an involuntary

transfer of the Floating Rate Mezzanine Borrowers membership interest in a Floating Rate

Property Level Borrower would trigger an Event of Default under the DIP Credit Agreement.

28. As previously stated, the Mezzanine Lenders primary collateral and source of

recovery for the Floating Rate Mezzanine Loan is the equity in the Floating Rate Property Level

12

A cure period limited to only thirty days is provided for breaches of negative covenants the DIP Lender believes,

in its reasonable discretion, are capable of being cured in such thirty-day period. There is no cure period for other

negative covenant breaches. Credit Agreement 8.1(a)(xi).

US2008 1517450.3

Collateral represented by the Floating Rate Mezzanine Borrowers membership interests in the

Floating Rate Property Level Borrowers, which are pledged to the Mezzanine Lender. The

Floating Rate Mezzanine Borrower (a Debtor in these chapter 11 cases) is a party to the

prenegotiated plan that provides for the cancellation of its membership interests in the Floating

Rate Property Level Borrowers, thereby extinguishing the collateral it pledged to the Mezzanine

Lender to secure repayment of the Floating Rate Mezzanine Loan. The Mezzanine Lender,

accordingly, has no choice but to seek relief from the automatic stay in order to exercise its

remedies under the Uniform Commercial Code with respect to the membership interests in the

Floating Rate Property Level Borrowers, so that it can realize the value of the interests by sale to

a third party or take control of the Floating Rate Property Level Borrowers and restructure their

debt under chapter 11. Yet, a transfer of these membership interests pursuant to the exercise of

these remedies would trigger an Event of Default under the DIP Credit Agreement, and the

automatic stay relief afforded in advance to the DIP Lender under the Proposed Order would

enable the DIP Lender to deprive the Floating Rate Property Level Borrowers of the opportunity

to reorganize under chapter 11 for the benefit of all their constituents, including their equity

holder.

29. Under the provisions of the Proposed Order, upon the occurrence of an Event of

Default or Termination Event, the DIP Lender would be free, after providing five days notice to

the Floating Rate Property Level Borrowers, their counsel and counsel for the Committee only,

to foreclose on the Floating Rate Property Level Collateral. The Mezzanine Lender would have

no standing to seek re-imposition or continuation of the automatic stay. Moreover, the only issue

the Floating Rate Property Level Borrowers or the Committee would be permitted to assert in

US2008 1517450.3

seeking re-imposition or continuation of the stay would be whether an Event of Default or

Termination Event actually had occurred or was properly cured. Proposed Order, 13.

I declare under penalty of perjury that the foregoing is true and correct to the best of my

knowledge, information and belief.

15

Travis Shelhorse

Authorized Signatory

EXHIBIT A

TriMont Real Estate Advisors, Inc. is the Special Servicer with respect to the mezzanine

loans identified below and is authorized to act on behalf of SASCO 2008-C2, LLC, the

owner of all of the economic and beneficial interests in such mezzanine loans.

1. Borrower: Grand Prix Mezz Borrower Term LLC

Guarantor: Grand Prix Holding, LLC

Operating Lessee: Grand Prix Anaheim Orange Lessee LLC

Date: June 29, 2007 (and as subsequently amended from time to time)

Original Principal Balance: $21,300,000.00

2. Borrower: Grand Prix Mezz Borrower 2 Floating LLC

Guarantor: Grand Prix Holdings , LLC

Operating Lessee: Grand Prix Floating Lessee LLC

Date: June 29, 2007 (and as subsequently amended from time to time)

Original Principal Balance: $117,658,725.00

EXHIBITB

FLOATING RATE PROPERTY LEVEL BORROWERS

Borrower Name Bankruptcy Case Property

Number

KP A/GP Valencia LLC 10-13893 Embassy Suites, Valencia, CA

Grand Prix West Palm Beach 10-13875 Best Western, West Palm Beach, FL

LLC

K.PAIGP Ft. Walton LLC 10-13890 Sheraton Four Points, Fort Walton

Beach, FL

Grand Prix Ft. Wayne LLC 10-13829 Residence Inn, Fort Wayne, IN

Grand Prix Indianapolis LLC 10-13838 Residence Inn, Indianapolis, IN

KP A/GP Louisville (HI) LLC 10-13892 Hampton Inn Louisville Downtown,

Louisville, KY

Grand Prix Bulfinch LLC 10-13816 Bulfinch, Boston, MA

Grand Prix Woburn LLC 10-13879 Hampton Inn, Woburn, MA

Grand Prix Rockville LLC 10-13862 Sheraton, Rockville, MD

Grand Prix East Lansing LLC 10-13822 Residence Inn, East Lansing, MI

Grand Prix Grand Rapids LLC 10-13833 Residence Inn, Grand Rapids, MI

Grand Prix Troy (Central) 10-13871 Residence Inn Troy Central, Troy, MI

LLC

Grand Prix Troy (SE) LLC 10-13872 Residence Inn Troy Southeast,

Madison Heights, MI

Grand Prix Atlantic City LLC 10-13811 Courtyard, Atlantic City, NJ

Grand Prix Montvale LLC 10-13849 Courtyard, Montvale, NJ

Grand Prix Morristown LLC 10-13850 Westin Inn, Morristown, NJ

Grand Prix Albany LLC 10-13805 Hampton Inn Albany, Cohoes, NY

Grand Prix Addison (SS) LLC 10-13804 Summerfield Suites, Addison, TX

Grand Prix Harrisburg LLC 10-13834 Residence Inn, Harrisburg, P A

Grand Prix Ontario LLC 10-13855 Residence Inn, Ontario, CA

EXHIBITC

Master Participation Agreement dated as of May 22, 2008, between LBHI and LCPI (as Sellers)

and SASCO (as Purchaser)

EXECUTION VERSION

MASTER PARTICIPATION AGREEMENT

Dated as of May 22, 2008

by and among

LEHMAN BROTHERS HOLDINGS INC.

and

LEHMAN COMMERCIAL PAPER INC.,

(as the Sellers)

SASCO 2008-C2, LLC

(as the Purchaser)

USActive 12824081.13

MASTER PARTICIPATION AGREEMENT

This Master Participation Agreement (this "Agreement") is entered into as of May 22,

2008, between (i) Lehman Brothers Holdings Inc. whose office is at 745 7th Avenue, New York,

New York 10019; and (ii) Lehman Brothers Commercial Paper Inc., whose office is at whose

office is at 745 7th Avenue, New York, New York 10019 (each a "Seller" and together, the

"Sellers"); and (iii) SASCO 2008-C2, LLC (the "Purchaser").

RECITALS:

WHEREAS, each Seller owns interests (each a "Lehman Asset" and collectively, the

"Lehman Assets") in the loans and other securities and investments (each a "Loan" and

collectively, the "Loans") identified in Schedule A (as supplemented and amended from time to

time) belonging to it and consisting of loans, advances, as well as participations in the foregoing

pursuant to various credit agreements, indentures, note purchase agreements and other similar

documents, each between a borrower (each, a "Borrower" and collectively, the "Borrowers"), and

a lender or noteholder, or where applicable, an agent for the relevant lenders or noteholders (such

credit agreements, note purchase agreements and/or participation agreements, as amended,

supplemented, novated or otherwise modified from time to time, together with all guarantees,

security agreements, mortgages, deeds of trust, letters of credit, reimbursement agreements,

waivers and any other documents executed in connection therewith, hereinafter are referred to as

the "Underlying Instruments"); and

WHEREAS, each Seller desires to sell, assign and transfer to Purchaser, without recourse,

a participation interest in all or a specified portion of that Seller's Lehman Assets and Purchaser

desires to purchase and assume from each Seller, without recourse, a participation interest in such

portion of that Seller's Lehman Assets (each such participation interest, a "Transferred Interest"

and collectively, the "Transferred Interests").

AGREEMENT

NOW THEREFORE, in consideration of the premises and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the each of the

Sellers and the Purchaser hereby agree as follows:

Section I. Definitions. Capitalized terms used herein and not defined herein

shall have the respective meanings attributed to them in the Indenture. In addition, as used herein,

the following terms shall have the following respective meanings:

"A Note": A promissory note secured by a mortgage on commercial real estate

property that is not subordinate in right of payment to any separate promissory note

secured by a direct or beneficial interest in the same property.

USActive 12824081.13

"B Note": A promissory note secured by a mortgage on commercial real estate

property that is subordinate in right of payment to one or more separate promissory notes

secured by a direct or beneficial interest in the same property.

"CDO Servicing Agreement": That certain servicing agreement dated May 22,

2008, between the Purchaser, as Issuer, the Sellers, Wachovia Bank, National Association,

as CDO Servicer, and TriMont Real Estate Advisors, Inc., as CDO Special Servicer.

"CDO Special Servicer": TriMont Real Estate Advisors, Inc.

"CMBS Security": As defined in the Indenture

"Collateral File": Means the following, as applicable:

(a) With respect to each Transferred Interest as to which the related Lehman

Asset is a Mortgage Loan, a copy of the original promissory note, a copy of the mortgage,

a copy of the loan agreement and of the assignment of leases and rents (and any

intervening assignments thereof) and copies of all other documents and instruments in the

seller's possession evidencing or guaranteeing or otherwise materially affecting such

Mortgage Loan.

(b) With respect to each Transferred Interest as to which the related Lehman

Asset is a Mezzanine Loan, a copy of the original promissory note and a copy of the

security or pledge agreement, the loan agreement, the intercreditor agreement, the

assignment and assumption agreement and all other documents and instruments in the

Seller's possession evidencing or guaranteeing or otherwise materially affecting such

Mezzanine Loan.

(c) With respect to each Transferred Interest as to which the related Lehman

Asset is a REBL Term Loan or REBL Revolving Credit Facility, a copy of the credit

agreement or equivalent instrument (or senior and/or subordinate participations therein), a

copy of the guarantee (if any) and all other documents and instruments in the Seller's

possession evidencing or guaranteeing or otherwise materially affecting such interest.

(d) With respect to each Transferred Interest as to which the related Lehman

Asset is a Participation Interest, a copy of the participation certificate (if any) endorsed by

the most recent endorsee prior to the seller and a copy of the participation agreement, the

assignment and assumption agreement and a copy of all other documents and instruments

in the Seller's possession evidencing or guaranteeing or otherwise materially affecting

such interest.

(e) With respect to each Transferred Interest as to which the related Lehman

Asset is a B Note, a copy of the promissory note endorsed to the Seller or endorsed in

blank, a copy of the mortgage, the loan agreement, the assignment of leases and rents (and

any intervening assignments thereof) and a copy of all other documents and instruments in

the seller's possession evidencing or guaranteeing or otherwise materially affecting such

interest.

USActive 12824081.13

3

"Collections": All payments or distributions received by or on behalf of a Seller

from any Borrower in respect of the Lehman Assets (without any adjustments with respect

to any subsequent acquisitions or transfers by the applicable Seller of interests in the

applicable Loan or any subsequent funding of a Retained Future Advance Obligation) and

the proceeds of any collateral applied by a Seller to such Lehman Assets.

"CRE COO Security": As defined in the Indenture.

"Delayed-Draw Loan": A loan with respect to which a Seller may, under the terms

of the relevant Underlying Instruments, be obligated to make or otherwise fund future

term-loan advances to a borrower; provided, that once such loan (or portion thereof) has

been funded, such loan (or portion thereof) shall cease to constitute a Delayed-Draw Loan.

"Document Defect": Any document or documents constituting a part of a

Collateral File which has not be properly executed, has not been delivered or contains

information that does not conform in any material respect to the information on Schedule

A.

"Exception Schedule": The schedule identifying any exceptions to the

representations and warranties made with respect to the Transferred Interests conveyed

hereunder, which is attached hereto as Schedule C.

"Future Advance": With respect to any Future Advance Loan, Delayed-Draw Loan

or REBL Revolving Credit Facility, amounts to be advanced by a lender under the relevant

Underlying Instrument to provide additional funding on any future date to the relevant

Borrower.

"Future Advance Loan": As defined in the Indenture.

"Indenture": The indenture dated as of May 22, 2008 between the Purchaser as the

Issuer, Wachovia Bank, National Association as Advancing Agent and Wells Fargo Bank,

National Association as the Trustee, as amended or supplemented from time to time.

"Loan": As defined in the recitals hereto.

"Material Document Defect": (i) A Document Defect that materially and adversely

affects the value of a Transferred Interest or the ownership interests of the Issuer or its

assignee therein, and (ii) with respect to the Transferred Interest identified on Schedule A

as "The Hotel Portfolio" a defect in the remaining documents to be provided by the Seller

to the Rating Agencies for their review that does not conform materially to such Rating

Agencies' criteria for the inclusion of such Transferred Interest in the Collateral Interests

(as defined in the Indenture).

"Mezzanine Loan": Any loan secured by one or more direct or indirect ownership

interests (which may be only partial ownership interests) in a company, partnership or

other entity owning, operating or controlling, directly or through subsidiaries or affiliates,

one or more commercial or multifamily properties, including a participation interest

therein.

USActive 12824081.13

4

"Mortgage": The mortgage, deed of trust, deed to secure debt or similar

instrument that secures a note and creates a lien on the fee or leasehold interest in

commercial or multi-family real property or properties.

"Mortgage Loan": Each loan (including, without limitation, an A Note) secured by

a Mortgage on commercial or multi-family real property or properties.

"Obligors": Collectively, the Borrowers and each guarantor, pledgor, subordinator

or other person or entity directly or indirectly obligated in respect of the Lehman Assets.

"Participation Interest": A participation interest in a Mortgage Loan, a Mezzanine

Loan, a B Note, a REBL Term Loan or a REBL Revolving Credit Facility.

"Rating Agencies" shall have the meaning specified in the Indenture.

"REBL Loan": A bank loan (or a participation interest therein) that is an

obligation (direct or by way of guarantee) of a corporation, partnership or other entity

organized under the laws of the United States (or any State thereof) that is engaged

primarily in the business of real estate, all or a portion of which may be unsecured, for

which the expected source of repayment is income from real estate assets.

"REBL Revolving Credit Facility": A REBL Loan that provides a borrower with a

line of credit against which one or more borrowings may be made up to the stated principal

amount of such facility and provides that such borrowed amount may be repaid and re-

borrowed from time to time.

"REBL Term Loan": A REBL Loan that requires the repayment of amounts due

thereunder at a specified maturity date.

"REIT Debt Securities": As defined in the Indenture.

"Retained Future Advance Obligation": The portion of a Future Advance Loan,

Delayed-Draw Loan or Revolving Credit Facility retained by the Seller (and not

transferred to the Purchaser hereunder) consisting of the obligation to provide Future

Advances to the relevant Borrower in accordance with the relevant Underlying Instrument.

"Transferred Interest": As defined in Section 2(a) herein.

"Transferred Percentage Interest": With respect to each Transferred Interest, as of

the Transfer Date, a fraction, expressed as a percentage, in which the numerator is the

outstanding principal balance of such Transferred Interest and the denominator is the

outstanding principal balance of the related Lehman Asset (without any adjustments with

respect to any subsequent acquisitions or transfers by the applicable Seller of interests in

the applicable Loan, or any subsequent funding of a Retained Future Advance Obligation).

"Transferred Interest Repurchase Price": An amount equal to the sum of the

following (in each case, without duplication) as of the date of such repurchase: (i) the

outstanding principal amount thereof, plus (ii) accrued and unpaid interest on such

Collateral Interest, plus (iii) any unreimbursed advances, plus (iv) accrued and unpaid

USActive 12824081.13

5

interest on advances on the Collateral Interest, plus (v) any reasonable costs and expenses

(including, but not limited to, the cost of any enforcement action, incurred by the

Purchaser or the Trustee in connection with any such purchase by a Seller).

"Underlying Instruments": The indenture, Joan agreement, note, mortgage,

intercreditor agreement, pooling and servicing agreement, participation agreement or other

agreement pursuant to which a Lehman Asset has been issued or created and each other

agreement that governs the terms of or secures the obligations represented by such

Lehman Asset.

"Underlying Mortgage Property": With respect to (i) a Loan (other than a

Participation or Mezzanine Loan), the commercial mortgage property or properties

securing the Loan, (ii) a Participation, the commercial mortgage property or properties

securing the related Mortgage Loan, or (iii) a Mezzanine Loan, the commercial mortgage

property or properties related to the Mezzanine Loan.

Section 2. Participations.

(a) Subject to the terms and conditions of this Agreement, each Seller hereby

sells, and Purchaser shall be entitled to, and by its acceptance hereof purchases, as of the Transfer

Date (as hereinafter defined), a pro rata participation interest in each of the Lehman Assets owned

by such Seller in an amount equal to the initial principal balance of the Transferred Interest as

indicated on Schedule A hereto (each, a "Transferred Interest" and, collectively, the "Transferred

Interests"), which shall entitle the Purchaser to receive:

(i) the Transferred Percentage Interest of all Collections (as hereinafter defined)

received in respect of the principal on such Lehman Assets;

(ii) the Transferred Percentage Interest of all Collections of interest, fees and

make-whole amounts, if any, on the Lehman Assets accruing from and after the Transfer

Date and with respect to Transferred Interests that are indicated on Schedule A as being

transferred with accrued interest, any Collections related to accrued interest purchased by

the Purchaser;

(iii)the Transferred Percentage Interest in the proceeds of all claims, suits,

causes of action and any other right of the Seller (in its capacity as a lender under the

Lehman Asset or purchaser under any participation interest), whether known or unknown,

against the Borrower, lender, any other Obligor or any of their respective affiliates, agents,

representatives, contractors, advisors or any other Person arising under or in connection

with the Underlying Instruments or that is in any way based on or related to any of the

foregoing or the loan transactions governed thereby, including the proceeds of any contract

claims, tort claims, malpractice claims, statutory claims and all other claims at Jaw or in

equity related to the rights and obligations sold and purchased pursuant to this Agreement;

and

(iv) the Transferred Percentage Interest of any other amounts received by the

Seller on the Lehman Assets.

USActive 12824081.13

6

(b) The parties hereto hereby acknowledge and agree that with respect to the

Transferred Interests set forth in Schedule A, the sale, transfer, assignment, grant and conveyance

of such Transferred Interests is being effected via the sale, transfer, grant and conveyance of a

participation interest in such Lehman Assets instead of an assignment of the Sellers' title to the

related Lehman Assets. The transfer of the Transferred Interests shall have the consequence that

the Seller holds only legal title but not any economic interest in such Transferred Interests and the

Purchaser shall hold all of the economic interests in such Transferred Interests. Each of the

Sellers hereby acknowledges and consents to the Issuer's assignment pursuant to Indenture of the

all of its right, title and interest in, to and under this Master Participation Agreement and agrees

that all of the representations and agreements made hereunder are also for the benefit of, and

enforceable by, the Trustee under the Indenture.

(c) From and after the date hereof, administration of the Transferred Interests

and the Lehman Assets shall be governed by this Agreement, the Indenture and (except with

respect to any Lehman Assets that are REBL Loans) the CDO Servicing Agreement.

(d) With respect to each Lehman Asset, each of the Purchaser and the related

Seller (or its successors and assigns) shall be entitled to vote and otherwise exercise any rights that

it may have with respect to any servicing or other matters under the related Underlying Instrument

or servicing agreements, in accordance with the respective outstanding principal amounts of their

beneficial interests in such Lehman Asset. With respect to the Lehman Assets serviced under the

CDO Servicing Agreement, the CDO Servicer will have the sole authority to service and

administer such Lehman Asset, except:

(i) with respect to (A) any extension of the maturity date of any Lehman Asset,

except as permitted by the Underlying Instruments without the lender's consent, (B) any

decrease ofthe interest rate of any Lehman Asset, (C) any increase in the principal amount

of any Lehman Asset, and (D) the substitution or release of material collateral securing a

Lehman Asset except as permitted by the Underlying Instruments without the lender's

consent, the CDO Special Servicer will be required to obtain the consent of I 00% of the

beneficial interests of such Lehman Asset (based on the outstanding principal balances of

the beneficial interests of the Purchaser and the applicable Seller (or its successors and

assigns)), subject to the Servicing Standard Override (as defined in the CDO Servicing

Agreement);

(ii) with respect to (A) any proposal to release the Borrower or guarantor from

liability, including by acceptance of an assumption of the Lehman Asset by a successor

borrower and (B) an assumption of the guaranty by a replacement guarantor, the CDO

Special Servicer will be required to obtain the consent of 66-2/3% of the beneficial

interests of such Lehman Asset (based on the outstanding principal balances of the

beneficial interests of the Purchaser and the applicable Seller (or its successors and

assigns)), subject to the Servicing Standard Override (as defined in the CDO Servicing

Agreement);

(iii)with respect to all other Major Decisions (as defined in the CDO Servicing

Agreement), the CDO Special Servicer will be required to obtain the consent of a majority

of the beneficial owners of such Lehman Asset (based on the outstanding principal

balances of the beneficial interests of the Purchaser and the applicable Seller (or its

USActive 12824081.13

7

successors and assigns)), subject to the Servicing Standard Override (as defined in the

CDO Servicing Agreement); provided that if a majority of such beneficial owners are

unable to agree on a particular course of action, the CDO Servicer will be required to

determine the course of action with respect to such Major Decision in accordance with the

CDO Servicing Agreement and Accepted Servicing Practices (as defined in the COO

Servicing Agreement).

Section 3. Intention of the Parties. It is the intention of the parties hereto that

each sale ofthe Transferred Interests hereunder shall be absolute and irrevocable and will provide

the Purchaser with the full risks and benefits of ownership of the Transferred Interests so

purchased (such that the Transferred Interests would not constitute property of any Seller's estate

in the event of a Seller's bankruptcy) and shall constitute a "sale of accounts," as such term is

used in Article 9 of the UCC of the State of New York, to the extent applicable, and not a loan

secured by such Transferred Interests. In the event that, contrary to the mutual intent of the

Sellers and the Purchaser, any purchase of Transferred Interests hereunder is not characterized as

a sale but rather as a collateral transfer for security (or the transactions contemplated hereby are

characterized as a financing transaction), it is the intent of the parties hereto that this Agreement

shall constitute a security agreement under applicable law and that each purchase of the

Transferred Interests shall be deemed to be a secured loan made by the Purchaser to each Seller in

an amount equal to the aggregate of all amounts due and owing by such Seller to the Purchaser

hereunder, whether now or hereafter existing, due or to become due, direct or indirect or absolute

or contingent, which loan shall be secured by a security interest in all of such Seller's right, title

and interest now or hereafter existing and hereafter arising in, to and under (i) all of its respective

Transferred Interests, (ii) all of its respective Collections (as defined herein) and (iii) all proceeds

of the foregoing (collectively, with regard to each Seller, its "Seller's Collateral"). In furtherance

of the foregoing, each Seller hereby grants (A) to the Purchaser in order to secure the repayment

of all amounts due and owing by such Seller to the Purchaser hereunder, whether now or hereafter

existing, due or to become due, direct or indirect, or absolute or contingent, and (B) to the Trustee

under the Indenture in order to secure the Purchaser's obligations under the Indenture, but only to

the extent an event of default under the Indenture shall have occurred as a result of the failure of

such Seller to perform any of its obligations hereunder, a security interest in all of such Seller's

right, title and interest now or hereafter existing in, to and under its Seller's Collateral.

Section 4. Transfer Date. With respect to each Transferred Interest, from and

after the date as indicated on Schedule A on which such Transferred Interest is purchased by the

Purchaser hereunder (such date of transfer, as applicable to each Transferred Interest, the

"Transfer Date"), the Transferred Interests purchased hereunder shall be for the account and risk

of the Purchaser, without any recourse to the Sellers, except as expressly provided herein. The

transfer of the Transferred Interests shall be deemed effective as of the Transfer Date. The

Purchaser hereby assumes full risk and responsibility with respect to repayment of the Transferred

Interests without recourse to the Sellers and, in the event of any failure by any Borrower to fulfill

any of its obligations under the terms of the related Underlying Instruments, none of the Sellers

shall be under any liability to the Purchaser for payment of principal, interest or fees other than as

provided in Section 5.

Section 5. Payments. Each Seller or the CDO Servicer, as applicable, shall

promptly remit or cause to be remitted to Purchaser, as received, all amounts received in respect

of its respective Transferred Interests described in clauses (i) through (iv) of Section 2(a) of this

USActive 12824081.13

8

Agreement without set-off, counterclaim or deduction of any kind within one (1) business day

after receipt thereof from a Borrower, to the account specified by the Purchaser to such Seller in

writing. If the applicable payment is received by a Seller not later than 12:00 noon (New York

City time) on any day, the corresponding payment shall be made to the Purchaser not later than

5:00p.m. (New York City time) on such day, and otherwise not later than 5:00p.m. (New York

City time) on the immediately succeeding business day.

Section 6. Sharing of Liabilities and Expenses. each of the Sellers and the

Purchaser shall be responsible for their pro rata share of all liabilities, losses, out-of-pocket costs

and expenses (including reasonable attorneys' fees) (collectively, the "Liabilities") suffered or

incurred by such Seller or CDO Servicer (as applicable) from and after the Transfer Date in

administering and collecting on their respective Lehman Assets and Transferred Interests or which

otherwise arise in connection therewith or in connection with preserving any collateral security

therefor, except for such Liabilities as may be caused by the negligence or willful misconduct of

such Seller or CDO Servicer (as applicable) and except to the extent that such Seller or CDO

Servicer (as applicable) has theretofore been reimbursed for such Liabilities by or on behalf of any

Borrower. Each of the Sellers and the Purchaser shall be entitled to any such amounts recovered

from, or on behalf of, any Borrower after such Seller or Purchaser has paid such Liabilities. Each

Seller and each CDO Servicer shall promptly remit to the Purchaser an amount equal to any

payment received by that Seller or CDO Servicer (as applicable) on account of increased costs,

break funding payments or expenses incurred by the Purchaser in connection with the

Participation Interest.

Section 7. Information; No Recourse or Warranty; Responsibilities. Each

Seller represents that it, or a custodian acting on its behalf, holds in its possession for the benefit

of itself and the Purchaser true and complete originals of all of the documents in connection with

its respective Lehman Assets which constitute all documents that the Seller considers necessary in

deciding to enter into this Agreement and participate in the Lehman Assets as provided herein. It

is understood and agreed that none of the Sellers make any express or implied representations or

warranties of any kind or character with respect to the genuineness, validity, effectiveness,

enforceability, value, priority, perfection or collectability of the Lehman Assets, any collateral

security therefor or the Underlying Instruments, nor with respect to the solvency, financial

condition or financial statements of any of the Borrowers, and by its acceptance hereof, Purchaser

agrees that the Sellers shall be free of liability on account of Purchaser's Transferred Interests

described herein with respect to anything a Seller may do or refrain from doing in good faith and

in the exercise of its judgment, provided, however, that each Seller agrees to use the same care in

protecting the interests of the Purchaser in the Lehman Assets as it uses for similar interests held

by it solely for its own account and each Seller agrees to account to Purchaser as herein set forth

for the share from time to time applicable to Purchaser's Transferred Percentage Interest in

Collections. Whenever the Seller or the CDO Servicer, as applicable, receives a payment of

principal of, or interest, fees and make-whole amounts, if any, on the Transferred Interests, the

Seller or CDO Servicer, as applicable, will be instructed to accept such payment for the account

and sole benefit of, and as agent for, the Purchaser and promptly pay over to the Purchaser the

amount so received. In administering the Lehman Assets and the Underlying Instruments, the

CDO Servicer shall not be bound to ascertain or inquire as to the performance of any of the terms,

provisions or conditions of any thereof on the part of any Borrower or any other person, shall be

entitled to rely upon any statement or notice, however sent, believed by it to be genuine and

USActive 12824081.13

9

correct and believed by it to be sent by the proper person, may consult with counsel and shall be

fully protected in any action taken or omitted to be taken by it in accordance with the advice or

opinion of such counsel, may employ agents or attorneys-in-fact and shall not be liable for the

default or misconduct of any such person selected by it with due care, and shall not be responsible

for the performance of the payment or other obligations of the Borrowers or the value of any

collateral securing the same.

Section 8. Borrower Information. Upon request of Purchaser, a Seller shall

provide Purchaser with copies o( any information in that Seller's possession which was received

pursuant to the provisions of any Underlying Instrument and, to the extent not otherwise available

to Purchaser, the relevant Seller shall use commercially reasonable efforts to provide Purchaser,

following Purchaser's written request therefor, such current factual information that Purchaser

specifically requests that is then in the Seller's possession and relating to the status of the Lehman

Assets or any Borrower's financial condition; provided that that Seller shall not be required to

provide Purchaser with any information in violation of any law or any contractual restriction set

forth in the Underlying Instruments on the disclosure thereof.

Section 9. Representations and Warranties.

(a) Each party hereby represents and warrants to the other party that (i) it is

duly organized or incorporated, as the case may be, and validly existing as an entity under the

laws of the jurisdiction in which it is incorporated, chartered or organized, (ii) it has the requisite

power and authority to enter into and perform this Agreement and (iii) this Agreement has been

duly authorized by all necessary action, has been duly executed by one or more duly authorized

officers and is the valid and binding agreement of such party enforceable against such party in

accordance with its terms.

(b) Each Seller further represents and warrants to the Purchaser, as of the

Transfer Date, as to the Transferred Interests being sold by such Seller, that:

(i) none of the execution, delivery or performance by such Seller of this

Agreement (x) conflicts with, results in any breach of or constitutes a default (or an event

which, with the giving of notice or passage of time, or both, would constitute a default)

under, any term or provision of the organizational documents of such Seller, or any

material indenture, agreement, order, decree or other material instrument to which such

Seller is party or by which such Seller is bound which materially adversely affects such

Seller's ability to perform its obligations hereunder or (y) violate any provision of any law,

rule or regulation applicable to such Seller of any regulatory body, administrative agency

or other governmental instrumentality having jurisdiction over such Seller or its properties

which has a material adverse effect;

(ii) no consent, license, approval or authorization from, or registration or

qualification with, any governmental body, agency or authority, nor any consent, approval,

waiver or notification of any creditor, lessor or any other Person is required in connection

with the execution, delivery and performance by such Seller of this Agreement the failure

of which to obtain would have a material adverse effect except such as have been obtained

and are in full force and effect; and

USActive 12824081.13

10

(iii)such Seller shall use reasonable efforts to give proper notice under each

Underlying Instrument or servicing agreement, instructing any obligor, paying agent or

servicer, as applicable, responsible for forwarding or distributing payments to the holders

of the Transferred Interest, to make such payments to the COO Servicer or the Trustee and

shall promptly remit to the COO Servicer or Trustee any payment on the Transferred

Interests received on or after the Transfer Date.

(c) Each Seller further represents and warrants to the Purchaser as of the

Transfer Date with respect to the Transferred Interests being sold by that Seller, that:

(i) the sale of the initial Transferred Interests by such Seller to the Purchaser

and the Purchaser's Grant to the Trustee does not contravene the terms of the restrictions

relating to transfer of such Transferred Interests contained in the Underlying Instruments

with respect to such related Transferred Interests;

(ii) the information set forth with respect to the related Transferred Interests in

Schedule A hereto is true and correct; and

(iii)with respect to each Transferred Interest, except as set forth in the Exception

Schedule, the representations and warranties set forth in Schedule B(3) are true and

correct;

provided that with respect to representations and warranties made by a Seller with respect

to Transferred Interests sold by such Seller on an Transfer Date occurring after May 22,

2008, such representations and warranties may be subject to any modification, exception,

limitation or qualification as permitted pursuant to the terms of the Indenture.

(d) Each Seller further represents and warrants to the Purchaser as of the

Transfer Date with respect to the Transferred Interests being sold by that Seller, that:

(i) the Seller owns and has good and marketable title to such Transferred

Interest free and clear of any lien, claim or encumbrance of any Person (subject to the fees,

penalties and contingent interest payments retained by the Sellers herein);

(ii) in the case of each Transferred Interest, the Seller has acquired its ownership

in such Transferred Interest in good faith without notice of any adverse claim as defined in

Section 8-102(a)(l) ofthe UCC as in effect on the date hereof;

(iii)the Seller has not, pledged, assigned, sold, granted a security interest in, or

otherwise conveyed any of the Transferred Interests;

(iv) the Seller has not authorized the filing of and is not aware of any financing

statements against the Seller that include a description of collateral covering the

Transferred Interests other than that which has been terminated; the Seller is not aware of

any judgment or Pension Benefit Guarantee Corporation lien and tax lien filings against

the Seller; and

USActive 12824081.13

II

(v) the Seller has received all consents and approvals required by the terms of

each Transferred Interest and the Underlying Instruments to grant to the Purchaser its

interest and rights in such Transferred Interest hereunder.

(e) Each Seller hereby acknowledges and consents to the collateral assignment

by the Purchaser ofthis Agreement and all right, title and interest thereto to the Purchaser and by

the Purchaser to the Trustee, for the benefit of the Secured Parties.

(f) Each Seller hereby covenants and agrees that all of the representations,

covenants and agreements made by or otherwise entered into by it in this Agreement shall also be

for the benefit of the Purchaser and the Trustee on behalf of the Secured Parties and agrees that

enforcement of any rights hereunder by the Trustee shall have the same force and effect as if the

right or remedy had been enforced or executed by the Purchaser but that such rights and remedies

shall not be any greater than the rights and remedies of the Purchaser as described herein.

(g) Each Seller has delivered a fully executed original of this Agreement to the

Trustee. For administrative purposes, each Seller agrees to use good faith efforts deliver a copy of

the Collateral File within 30 days of the Transfer Date to the Purchaser or, at the direction of the

Purchaser, to the Trustee, with respect to each Transferred Interest sold by such Seller to the

Purchaser hereunder. Each Seller further represents and warrants that the failure to deliver such

Collateral Files within 30 days of the Transfer Date will not have a material adverse effect on the

value of the Transferred Interests or the Purchaser's rights therein. Each Seller hereby covenants

and agrees that it shall deliver to the Trustee copies of all notices, statements, communications and

instruments delivered or required to be delivered to the Purchaser by each party pursuant to this

Agreement. For the avoidance of doubt, the only original document to be delivered to the Trustee

with respect to the Transferred Interests pursuant to this Agreement shall be this Agreement.

Section 10. Further Assurances. From and after the date hereof, Purchaser and

each Seller each covenants and agrees to execute and deliver all such agreements, instruments and

documents and to take all such further actions as the other party hereto may reasonably deem

necessary from time to time to carry out the intent and purposes of this Agreement and to

consummate the transactions contemplated hereby.

Section 11. Records. Each Seller will at it own expense in order to reflect the

purchase and sale transaction accurately on its books, prepare and execute (or cause to be

prepared) for filing a financing statement relating to the sale of the Transferred Interests set out in

Schedule A or amendments thereto (as permitted pursuant hereto).

Section 12. Other Business Activities. The Purchaser acknowledges that the

Sellers may make loans or otherwise extend credit to, and generally engage in any kind of

business with, any Borrower and its affiliates, and receive on such other loans or

extensions of credit to any Borrower and its affiliates and otherwise act with respect thereto freely

and without accountability in the same manner as if this Agreement and the transactions

contemplated hereby were not in effect.

Section 13. Amendments, Waivers, etc.

USActive 12824081.13 12

(a) Amendments of Underlying Instruments. None of the Sellers may enter

into any amendment or modification of, or waive compliance with the terms of, or vote in relation

to any event, matter or thing under any Underlying Instrument without the consent of Purchaser.

If a Seller shall at any time request in writing Purchaser's consent or direction to any such matter

for which Purchaser's consent or direction is required and shall not receive a response to such

request within seven (7) business days after Purchaser has received such request (or within such

earlier period as a Seller may notify to Purchaser in connection with a specific request), Purchaser

shall be conclusively deemed to have refused to give such consent and that Seller shall be entitled

to thereafter act on the basis that Purchaser has denied such consent.

(b) Amendments of this Agreement. The Purchaser and the Sellers shall not

enter into any agreement amending, modifying or terminating this Master Participation Agreement

(other than in respect of amendments or modifications to cure any inconsistency, ambiguity or

manifest error) without the satisfaction of the Rating Agency Condition.

Section 14. Savings Clause. Notwithstanding any other prov1s1on of this

Agreement, with respect to each Participation Interest: (i) this Agreement shall be deemed to

incorporate any provisions required by any Credit Document to be incorporated in order to

transfer the related Participation Interest hereunder; and (ii) this Agreement ghall be deemed to

omit any provision which any Credit Document requires to be omitted in order to transfer the

related Participation Interest hereunder.

Section 15. Further Sale, Assignment and Repurchase.

(a) Transfer by the Purchaser. To the extent permitted under the related

Underlying Instruments; the Purchaser shall be only entitled to deal with the Transferred Interests

in the manner set out in the Indenture. Purchaser agrees that any sale or disposition of Purchaser's

Transferred Interest will be made in accordance with applicable securities laws.

(b) Transfer by the Seller. With respect to any Lehman Asset, none of the

Sellers may participate, sell, assign, transfer, mortgage, pledge, grant a lien on or otherwise deal

with or encumber any of its retained interest, if any, in or to such Lehman Assets if such transfer

would adversely affect the Transferred Interests or any other distributions or payments with

respect thereto or any of the Purchaser's rights or obligations under this Agreement or if such

transfer involves the transfer of title to the Lehman Asset, without the prior written consent of

Purchaser and the satisfaction of the Rating Agency Condition. None of the Sellers may sell,

assign, transfer pledge or grant a lien on any Retained Future Advance Obligation without

satisfaction of the Rating Agency Condition.

(c) Repurchase by the Seller. If any Seller receives written notice of (i) its

breach of a representation or a warranty made in Section 9(c) of this Agreement that materially

and adversely affects the ownership interests of the Purchaser in a Transferred Interest or the

value of a Transferred Interest, or (ii) a Material Document Defect, then such Seller shall not later

than 90 days from receipt of such notice cure such breach or Material Document Defect or, if such

breach or Material Document Defect cannot be cured in all material respects within such 90-day

period, repurchase the affected Transferred Interest not later than the end of such 90-day period at

the Transferred Interest Repurchase Price; provided, that if any such breach or Material Document

Defect, as the case may be, is capable of being cured in all material respects but not within the

USActive 12824081.13

13

initial 90-day period and such Seller has commenced and is diligently proceeding with the cure of

such breach or Material Document Defect, as the case may be, then such Seller shall have such

additional 90-day period to complete such cure or, failing such, to repurchase the affected

Transferred Interest. Such repurchase obligation by the related Seller shall be the Purchaser's sole

remedy for any Material Document Defect or the breach of any representation or warranty

pursuant to this Agreement with respect to any related Transferred Interest sold to the Purchaser

by such Seller; and provided, further, that, if any such Material Document Defect is still not cured

in all material respects after the initial 90-day period and any such additional 90-day period solely

due to the failure of such Seller to have received the recorded document, then such Seller shall be