Professional Documents

Culture Documents

CH 1

Uploaded by

Ken Premo0 ratings0% found this document useful (0 votes)

33 views17 pagesLearning Objectives 3 / 4 Learn about the three maior types oI 'risk attitudes' Learn how enterprise-wide risk approaches combine risk categories. Learn about causes of lossesperils and the hazards, which are the items increasing the chance of loss.

Original Description:

Original Title

Ch 1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLearning Objectives 3 / 4 Learn about the three maior types oI 'risk attitudes' Learn how enterprise-wide risk approaches combine risk categories. Learn about causes of lossesperils and the hazards, which are the items increasing the chance of loss.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views17 pagesCH 1

Uploaded by

Ken PremoLearning Objectives 3 / 4 Learn about the three maior types oI 'risk attitudes' Learn how enterprise-wide risk approaches combine risk categories. Learn about causes of lossesperils and the hazards, which are the items increasing the chance of loss.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

RISK MANAGE MENT F OR ENT ERPRISES

AND I NDI VI DUALS

Chapter 1

The Nature of Risk: Losses

and Opportunities

1 - 2

2010 Flat World Knowledge, Inc.

1 - 2

2010 Flat World Knowledge, Inc.

Learning Objectives

Build the definition of risk as a consequence of

uncertainty and within a continuum of decision-

making roles.

Learn about the three maior types oI 'risk

attitudes.

Learn what a risk professional means by exposure.

Learn several different ways to split risk exposures

according to the risk types involved.

1 - 3

2010 Flat World Knowledge, Inc.

1 - 3

2010 Flat World Knowledge, Inc.

Learning Objectives

Learn how enterprise-wide risk approaches

combine risk categories.

Learn the terminology used by risk professionals

to note different risk concepts.

Learn about causes of lossesperils and the

hazards, which are the items increasing the chance

of loss.

1 - 4

2010 Flat World Knowledge, Inc.

1 - 4

2010 Flat World Knowledge, Inc.

The Notion and Definition of Risk

The notion of risk is inextricably linked to the

notion of uncertainty.

Uncertainty is having two potential outcomes for

an event or situation.

Uncertainty about which of several possible

outcomes will occur circumscribes the meaning of

risk.

1 - 5

2010 Flat World Knowledge, Inc.

1 - 5

2010 Flat World Knowledge, Inc.

The Notion and Definition of Risk

Risk is the uncertainty about a future outcome,

particularly the consequences of a negative

outcome.

Our perception of risk arises from our perception

of and quantification of uncertainty.

1 - 6

2010 Flat World Knowledge, Inc.

1 - 6

2010 Flat World Knowledge, Inc.

Table 1.1 - Examples of Consequences

That Represent Risks

1 - 7

2010 Flat World Knowledge, Inc.

1 - 7

2010 Flat World Knowledge, Inc.

The Role of Risk in Decision Making

Risk encompasses the potential provision of both

an opportunity for gains as well as the negative

prospect for losses.

Risk permeates the spectrum of decision making

from goals of value maximization to goals of

insolvency minimization.

1 - 8

2010 Flat World Knowledge, Inc.

1 - 8

2010 Flat World Knowledge, Inc.

Attitudes Toward Risks

Risk averse refers to shying away from risks and

preferring to have as much security and certainty

as is reasonably affordable.

Risk seeker is someone who will enter into an

endeavor as long as a positive long run return on

the money is possible, however unlikely.

Risk neutral attitude is seen when one`s risk

preference lies between the extremes of risk averse

and risk seeking.

1 - 9

2010 Flat World Knowledge, Inc.

1 - 9

2010 Flat World Knowledge, Inc.

Types of RisksRisk Exposures

Pure versus speculative risk exposures

Pure risk: Risk that features some chance of loss and

no chance of gain.

Speculative risk: Risk that features a chance to either

gain or lose.

Some risks can be transferred to a third party, while

some require risk transfers that use capital markets,

known as hedging or securitizations.

1 - 10

2010 Flat World Knowledge, Inc.

1 - 10

2010 Flat World Knowledge, Inc.

Personal loss exposures (personal pure risk)

Property loss exposures (property pure risk)

Liability loss exposures (liability pure risk)

Liability loss is loss caused by a third party who is

considered at fault.

Types of RisksRisk Exposures

1 - 11

2010 Flat World Knowledge, Inc.

1 - 11

2010 Flat World Knowledge, Inc.

Catastrophic loss exposure and fundamental or

systemic pure risk

Fundamental risk or systemic risk are risks that are

pervasive to and affect the whole economy, as opposed

to accidental risk for an individual.

Types of RisksRisk Exposures

1 - 12

2010 Flat World Knowledge, Inc.

1 - 12

2010 Flat World Knowledge, Inc.

Table 1.3 - Examples of Risk Exposures by the

Diversifiable and Nondiversifiable Categories

1 - 13

2010 Flat World Knowledge, Inc.

1 - 13

2010 Flat World Knowledge, Inc.

Enterprise Risks

The opportunities in the risks and the fear of losses

encompass the holistic risk or the enterprise risk of

an entity.

Enterprise risk management (ERM) is one of

today`s key risk management approaches.

1 - 14

2010 Flat World Knowledge, Inc.

1 - 14

2010 Flat World Knowledge, Inc.

Perils and Hazards

Perils: The causes of loss.

Natural perils: Causes of losses over which people

have little control.

Human perils: Causes of losses that lie within

individuals` control.

Economic perils: Causes of losses resulting from the

state of the economy.

1 - 15

2010 Flat World Knowledge, Inc.

1 - 15

2010 Flat World Knowledge, Inc.

Table 1.4 - Types of Perils by Ability to

Insure

1 - 16

2010 Flat World Knowledge, Inc.

1 - 16

2010 Flat World Knowledge, Inc.

Hazards: Conditions that increase the cause of

loss; they may increase the probability of losses,

their frequency, their severity, or both.

Physical hazards: Tangible environmental conditions

that affect the frequency and/or severity of loss.

I ntangible hazards: Attitudes and nonphysical

cultural conditions can affect loss probabilities and

severities of loss.

Hazards are critical as our ability to reduce their

effects will reduce both overall costs and

variability.

Perils and Hazards

1 - 17

2010 Flat World Knowledge, Inc.

1 - 17

2010 Flat World Knowledge, Inc.

Summary

Risk is a consequence of uncertainty, and can be

emotional, financial, or reputational.

The three risk attitudes include being risk averse,

risk neutral, and a risk seeker.

The main categories of risks include pure versus

speculative, diversifiable versus nondiversifiable,

and idiosyncratic versus systemic risk.

Perils are the causes of loss while hazards are

conditions that increase the cause of loss.

You might also like

- Risk ManagementDocument22 pagesRisk ManagementLalit SukhijaNo ratings yet

- Principles of Insurance (Notes)Document68 pagesPrinciples of Insurance (Notes)Prince PrinceNo ratings yet

- Lab Report Physics (Measurement and Uncertainty)Document3 pagesLab Report Physics (Measurement and Uncertainty)Izzat Shafiq57% (23)

- Proof Load Testing For Bridge Assessment and Upgrading PDFDocument13 pagesProof Load Testing For Bridge Assessment and Upgrading PDFDhimas Surya NegaraNo ratings yet

- Risk Management - Module 1Document44 pagesRisk Management - Module 1hannah villanosaNo ratings yet

- Solution Manual For Principles of Risk Management and Insurance 13th Edition by RejdaDocument7 pagesSolution Manual For Principles of Risk Management and Insurance 13th Edition by Rejdaa23592989567% (3)

- PTC12.2-Steam Surface CondenserDocument86 pagesPTC12.2-Steam Surface Condenserlibid_raj100% (3)

- IC-86 Risk ManagementDocument240 pagesIC-86 Risk ManagementRishi RajNo ratings yet

- RISK Management and InsuranceDocument10 pagesRISK Management and InsuranceWonde Biru100% (1)

- Insurance and Risk ManagementDocument17 pagesInsurance and Risk ManagementFardus Mahmud92% (24)

- Risks CH 1 AnswerDocument2 pagesRisks CH 1 AnswerAbdulkadir Hassan mohamedNo ratings yet

- Hofstede ValuesDocument19 pagesHofstede ValuesCiocan ClarisaNo ratings yet

- Chapter 1 Introduction To RiskDocument17 pagesChapter 1 Introduction To RiskBrenden KapoNo ratings yet

- Asiedu+ ProductLifeCycleCostAnalysis - 201412102295156Document27 pagesAsiedu+ ProductLifeCycleCostAnalysis - 201412102295156MenaNo ratings yet

- BTJ 2009 FullDocument228 pagesBTJ 2009 Fullclarence deadaNo ratings yet

- Chapter 03 Radiation Dosimeters PDFDocument113 pagesChapter 03 Radiation Dosimeters PDFJose Ivan MejiaNo ratings yet

- Risk Management Full NotesDocument40 pagesRisk Management Full NotesKelvin Namaona NgondoNo ratings yet

- FM 11-9 Gbs For Week 02 03 PDFDocument11 pagesFM 11-9 Gbs For Week 02 03 PDFShugi YenNo ratings yet

- RM Tutorial CourseheroDocument46 pagesRM Tutorial CourseheroEileen WongNo ratings yet

- Risk Management and Insurance Chapter 1-1Document10 pagesRisk Management and Insurance Chapter 1-1bayrashowNo ratings yet

- Risk & Insurance in International TradeDocument62 pagesRisk & Insurance in International TradeasifanisNo ratings yet

- Ch1. Risk and Its TreatmentDocument7 pagesCh1. Risk and Its TreatmentRaghda HussienNo ratings yet

- Chapter 1 Risk and Its Treatment SummaryDocument5 pagesChapter 1 Risk and Its Treatment SummaryIbrahim Nur Sufi100% (1)

- Chapter 1 - Introduction To Risk and Risk ManagementDocument39 pagesChapter 1 - Introduction To Risk and Risk ManagementAisyah AnuarNo ratings yet

- CH 01Document23 pagesCH 01dxbuae384No ratings yet

- Report Res558 (PM, Sem2) PDFDocument10 pagesReport Res558 (PM, Sem2) PDFItsme MariaNo ratings yet

- Unit 1Document77 pagesUnit 1Vanshika SharmaNo ratings yet

- FIN320 Tutorial W2Document4 pagesFIN320 Tutorial W2Sally OngNo ratings yet

- Risk - WikipediaDocument76 pagesRisk - WikipediaMwawiNo ratings yet

- Risk PreDocument86 pagesRisk PreDawit AshenafiNo ratings yet

- RiskDocument4 pagesRiskJef PerezNo ratings yet

- Intro To RiskDocument9 pagesIntro To RiskAbubaker SaddiqueNo ratings yet

- Module 1 - IrmDocument9 pagesModule 1 - Irmrajitasharma17No ratings yet

- Risk AllDocument108 pagesRisk AllGabi MamushetNo ratings yet

- Risk Management and InsuranceDocument71 pagesRisk Management and Insurance0913314630No ratings yet

- Explicacion Buena Aceptabilidad RiesgoDocument17 pagesExplicacion Buena Aceptabilidad Riesgolichigo_perezNo ratings yet

- Risk Management HandoutDocument114 pagesRisk Management HandoutGebrewahd HagosNo ratings yet

- Principles of InsurenceDocument257 pagesPrinciples of InsurenceKomal PanditNo ratings yet

- Lesson 1: Basic Concepts of Risk Management: Week 1Document73 pagesLesson 1: Basic Concepts of Risk Management: Week 1Anna DerNo ratings yet

- Chapter 1Document15 pagesChapter 1Ramez RedaNo ratings yet

- Ramins 1&2Document24 pagesRamins 1&2bayisabirhanu567No ratings yet

- Concept of Risk and Insurance at Chap1Document22 pagesConcept of Risk and Insurance at Chap1Yuba Raj DahalNo ratings yet

- WM Insurance Set 1 Risk Mangement ProcessDocument17 pagesWM Insurance Set 1 Risk Mangement ProcessRohit GhaiNo ratings yet

- NAME: Anne Marielle Pla Uy I. True or False. Justify Your Answer. Answer: TrueDocument5 pagesNAME: Anne Marielle Pla Uy I. True or False. Justify Your Answer. Answer: TrueMarielle UyNo ratings yet

- Insurance Q@ADocument148 pagesInsurance Q@AAnonymous y3E7iaNo ratings yet

- Risk Analysis: Absolute vs. Relative RiskDocument2 pagesRisk Analysis: Absolute vs. Relative RiskAsmara NoorNo ratings yet

- 28 Bartlett Risk ManagemnetDocument10 pages28 Bartlett Risk ManagemnettatekNo ratings yet

- Assignment # 02 Submitted To: Sir Khurram Shehzad Submitted byDocument5 pagesAssignment # 02 Submitted To: Sir Khurram Shehzad Submitted bySabaNo ratings yet

- Chapter 01 RiskDocument23 pagesChapter 01 Riskwww.rithik10No ratings yet

- Financial RiskDocument10 pagesFinancial RiskTrifan_DumitruNo ratings yet

- RM&IDocument11 pagesRM&IShahab AhmedNo ratings yet

- Master of Business Administration - MBA Semester 4Document8 pagesMaster of Business Administration - MBA Semester 4Chandan KishoreNo ratings yet

- Risk Managemennt Chapter 1Document35 pagesRisk Managemennt Chapter 1Tilahun GirmaNo ratings yet

- Topic 2 Insurance Risk and Uncertainty in Human LifeDocument35 pagesTopic 2 Insurance Risk and Uncertainty in Human LifeNabila AfandiNo ratings yet

- Basic Concepts in Risk Management and InsuranceDocument12 pagesBasic Concepts in Risk Management and InsuranceSuzan khanNo ratings yet

- Insurance and Insurance Risk ManatDocument18 pagesInsurance and Insurance Risk Manat679shrishti SinghNo ratings yet

- FDRM Unit IVDocument104 pagesFDRM Unit IVAnonymous kwi5IqtWJNo ratings yet

- CHAPTER 1-Introduction To RiskDocument8 pagesCHAPTER 1-Introduction To RiskgozaloiNo ratings yet

- Applied Ethics RiskDocument3 pagesApplied Ethics RiskDonn Jeremi CastilloNo ratings yet

- Risk ManagementDocument9 pagesRisk ManagementSoleil Sierra ReigoNo ratings yet

- Business Risk HND-1Document10 pagesBusiness Risk HND-1josephfaith711100% (1)

- Introduction To Risk Management Chapter One Basic Concepts of RiskDocument32 pagesIntroduction To Risk Management Chapter One Basic Concepts of RiskYehualashet MekonninNo ratings yet

- What Is Pure RiskDocument2 pagesWhat Is Pure RiskJaveed A. KhanNo ratings yet

- Lecture 1 Insurance RiskDocument43 pagesLecture 1 Insurance RiskKazi SaifulNo ratings yet

- Tools For Decision AnalysisDocument16 pagesTools For Decision AnalysisPaul De AsisNo ratings yet

- Professional Ethics - Module 4Document62 pagesProfessional Ethics - Module 4VINAYAKUMAR B AEINo ratings yet

- EURAMET cg-18 v.02.1Document84 pagesEURAMET cg-18 v.02.1Renato LameraNo ratings yet

- Chapter 12 Decision-Making Under Conditions of Risk and UncertaintyDocument5 pagesChapter 12 Decision-Making Under Conditions of Risk and UncertaintykellyNo ratings yet

- Mod 2 1 Concepts of Individual Decision MakingDocument23 pagesMod 2 1 Concepts of Individual Decision MakingStevenSeilmontNo ratings yet

- Physics - Annotated Exemplars Level 3 AS90774Document8 pagesPhysics - Annotated Exemplars Level 3 AS90774Niharika MadaNo ratings yet

- MBF Thesis - Hoefman, BerreDocument57 pagesMBF Thesis - Hoefman, BerreMax BerreNo ratings yet

- Phy 101 Lecture1 (Introduction, Measurement and Estimation)Document40 pagesPhy 101 Lecture1 (Introduction, Measurement and Estimation)ChinyamaNo ratings yet

- FD X07 021 Métrologie Et Application de La StatistiqueDocument58 pagesFD X07 021 Métrologie Et Application de La StatistiqueMohannad qutubNo ratings yet

- JTM K 08 Estimation Temperature Uncertainty Temperature Chambers PDFDocument14 pagesJTM K 08 Estimation Temperature Uncertainty Temperature Chambers PDFStiven Giraldo NuñezNo ratings yet

- Albici ArticoleDocument327 pagesAlbici ArticoleAlbici MihaelaNo ratings yet

- Elective Midterm NotesDocument38 pagesElective Midterm NotesMJ NuarinNo ratings yet

- Insurance and Risk ManagementDocument53 pagesInsurance and Risk ManagementAbdulAzeemNo ratings yet

- Units, Physical Quantities, Measurement, Errors and Uncertainties, Graphical Presentation, and Linear Fitting of DataDocument87 pagesUnits, Physical Quantities, Measurement, Errors and Uncertainties, Graphical Presentation, and Linear Fitting of DataAlbert Jade Pontimayor LegariaNo ratings yet

- IA - Rubric - With - Student - Checklist - 2025 BioDocument4 pagesIA - Rubric - With - Student - Checklist - 2025 Bioliziabramishvili14No ratings yet

- Operations Research: Introduction, Historical Background: Notes of KMBN 206 Unit-1Document7 pagesOperations Research: Introduction, Historical Background: Notes of KMBN 206 Unit-1Ramesh ChandraNo ratings yet

- GMP 3 Pembacaan MeniskusDocument8 pagesGMP 3 Pembacaan Meniskushidayah cahyaNo ratings yet

- ULM User Information No. 8Document5 pagesULM User Information No. 8khemedra patleNo ratings yet

- 920 vpm2Document54 pages920 vpm2Wasim ShahzadNo ratings yet

- SHM Pendulum Required PracticalDocument3 pagesSHM Pendulum Required PracticalSagar AgrawalNo ratings yet

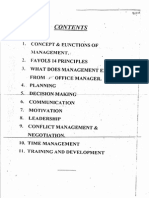

- Concept and Functions of ManagementDocument55 pagesConcept and Functions of Managementrony_phNo ratings yet

- Seismic Reliability and Risk Assessment of Structures Based On Fragilitu AnalysisDocument18 pagesSeismic Reliability and Risk Assessment of Structures Based On Fragilitu AnalysisMariliaLara7No ratings yet

- Insurance and Risk Management PDFDocument340 pagesInsurance and Risk Management PDFShahriar HaqueNo ratings yet