Professional Documents

Culture Documents

Fee Auditor'S Final Report - Page 1: Pac FR Schully 5th Int 3-5.10 v2.wpd

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fee Auditor'S Final Report - Page 1: Pac FR Schully 5th Int 3-5.10 v2.wpd

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE

In Re: PACIFIC ENERGY RESOURCES, LTD., et al., Debtors.

) ) ) ) ) )

Chapter 11 Case No. 09-10785 (KJC) (Jointly Administered)

FEE AUDITORS FINAL REPORT REGARDING INTERIM FEE APPLICATION OF SCHULLY, ROBERTS, SLATTERY & MARINO PLC FOR THE FIFTH INTERIM PERIOD This is the final report of Warren H. Smith & Associates, P.C., acting in its capacity as fee auditor in the above-captioned bankruptcy proceedings, regarding the Fee Application of Schully, Roberts, Slattery & Marino PLC for the Fifth Interim Period (the Application). BACKGROUND 1. Schully, Roberts, Slattery & Marino PLC (SRSM) was retained as special oil-and-

gas and transactional counsel to the debtors-in-possession. In the Application, SRSM seeks approval of fees totaling $36,870.00 and costs totaling $1,507.07 for its services from March 1, 2010, through May 31, 2010 (the Application Period). 2. In conducting this audit and reaching the conclusions and recommendations

contained herein, we reviewed in detail the Application in its entirety, including each of the time and expense entries included in the exhibits to the Application, for compliance with Local Rule 2016-2 of the Local Rules of the United States Bankruptcy Court for the District of Delaware, Amended Effective February 1, 2010, and the United States Trustee Guidelines for Reviewing Applications for Compensation and Reimbursement of Expenses Filed Under 11 U.S.C. 330, Issued January 30, 1996 (the Guidelines), as well as for consistency with precedent established in the United States

FEE AUDITORS FINAL REPORT - Page 1 pac FR Schully 5th int 3-5.10 v2.wpd

Bankruptcy Court for the District of Delaware, the United States District Court for the District of Delaware, and the Third Circuit Court of Appeals. We served on SRSM an initial report based on our review, and received a response from SRSM, portions of which response are quoted herein. DISCUSSION 3. Guideline II.C.1 provides that fee applications shall include a summary sheet

indicating all amounts previously requested. The monthly invoices include this information only through November 2009. We asked SRSM to forward an updated chart, and include fully updated charts in all future applications. SRSM subsequently filed an amended application containing this information. 4. Of the $36,870 in fees requested, $6,270 relates to SRSMs preparation and

prosecution of its fee applications, and the balance ($30,600) relates to substantive work. Thus, the fee application fees amount to 20.49% of the fees for substantive work. We asked SRSM to explain why this should be considered reasonable. SRSM provided the following response: As discussed in our conversation last week, the time spent reviewing and recalculating fee applications was occasioned by requests from bankruptcy counsel, the Debtor, and the fee auditor. We appreciate this response and have no objection to the fees billed in March and April 2010 for fee application preparation. The May fee detail, however, reflects an inordinate amount of time spent on the preparation of the March 2010 invoice, which covered $19,665.00 in fees and $1,303.86 in expenses: 5/5/2010 5/10/2010 LGW 3.00 LGW 2.50 900.00 750.00 Prepare interim fee application for March 2010 and submit. Continued work on March fee application per Mr. Tywoniuk and Ms. McFarland; prepare and transmit for filing; receive email requesting objections and verify to Ms. McFarland that there are none;

FEE AUDITORS FINAL REPORT - Page 2 pac FR Schully 5th int 3-5.10 v2.wpd

5/11/2010

LGW 1.20

360.00

Re-work March fee application per Mr. Tywoniuk and resubmit to Ms. McFarland; move certain activities to Rise offshore account.

We employ a general guideline that holds that fee-application fees should not exceed more than 5% of the amount requested. The figure is flexible to accommodate applicants whose fees are minimal, as the time attributable to certain aspects of the fee application process is not necessarily proportional to the size of the application. We also not that the 5% figure is an aggregate figure intended to account for fees associated with the monthly invoice and the quarterly interim application. Here, we see $2,010 in fees associated with preparation of the monthly invoice alone, where the figure represents 9.59% of the fees and expenses requested for the month. Moreover, it appears that more than half of this amount is due to problems with the original invoice that required correction and additional fees totaling $1,110.00. Under the circumstances, we do not believe SRSM has met its burden of showing that this amount is reasonably charged to the estate, and we accordingly recommend a reduction of $1,110.00 in fees. 5. In our initial report for the second interim period, we noted that SRSM had

substantially increased the billing rates of several of its timekeepers during July 2009. These increases included a 22% increase (from $450 to $550) for an attorney (Anthony Marino) who has been a partner at SRSM since 1996 and has been licensed in Louisiana since 1985. The firm also included a 25% increase for an associate (Lynn Wolf) who has been licensed in Louisiana since 1987. Guideline II.A.3 calls for disclosure of the [n]ames and hourly rates of all applicants professionals and paraprofessionals who billed time and for an explanation of any changes in hourly rates from those previously charged. We accordingly asked SRSM to explain these increases. After considering SRSMs response, we concluded that an ad-hoc rate increase cannot

FEE AUDITORS FINAL REPORT - Page 3 pac FR Schully 5th int 3-5.10 v2.wpd

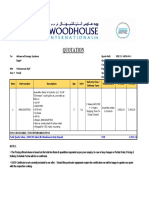

be justified by the work entailed by an engagement after the firm is retained with a different fee structure.1 For the current Application, we asked SRSM to comment on this issue, and SRSM provided the following response: All fees for this reporting period are based on the lower rates originally filed with the court. I have attached the back-up necessary to demonstrate this point. We appreciate this response and note that the Application reflects the earlier, lower rates. 6. The April 2010 invoice includes a $154.87 expense item for Edgar research charges.

This expense, however, appears to represent an allocation rather than an actual attribution of specific out-of-pocket charges to the client. We asked SRSM to explain how this expense was calculated. SRSM provided the following response: The April 2010 invoice of $154.87 for EDGAR Online research relative to the adversary actions brought against the Debtor by Chevron and Marathon Oil were paid for by credit card by Ms. Wolf and were submitted for reimbursement to the Firm. The research into transactions on these publicly traded entities was employed to locate documents that were filed with the SEC and provided a considerably less expensive alternative to filing discovery motions in the bankruptcy court. We appreciate this response, but it does not address the issue we raised. The expense detail shows a $309.75 charge that was split 50-50 between this and another matter. This rough allocation suggests that the amount allocated to this matter is not based on the amount of usage attributable to this matter. In the absence of a further explanation, we recommend a reduction of $154.87 in expenses.

The ad-hoc nature of the rate increase is further underscored by the fact that the new rates were not consistently applied during the month of July 2009. Time entries reflecting the increased rates were sometimes followed by entries reflecting the original lower rates.

FEE AUDITORS FINAL REPORT - Page 4 pac FR Schully 5th int 3-5.10 v2.wpd

CONCLUSION 7. Thus, we recommend approval of fees in the amount of $35,760.00 ($36,870.00

minus $1,110.00) and expenses in the amount of $1,352.20 ($1,507.07 minus $154.87) for SRSMs services for the Application Period.

Respectfully submitted, WARREN H. SMITH & ASSOCIATES, P.C.

By: Warren H. Smith Texas State Bar No. 18757050 325 N. St. Paul Street, Suite 1250 Republic Center Dallas, Texas 75201 214-698-3868 214-722-0081 (fax) whsmith@whsmithlaw.com FEE AUDITOR

CERTIFICATE OF SERVICE I hereby certify that a true and correct copy of the foregoing document has been served via First-Class United States mail to the attached service list on this 22nd day of December 2010.

Warren H. Smith

FEE AUDITORS FINAL REPORT - Page 5 pac FR Schully 5th int 3-5.10 v2.wpd

SERVICE LIST Notice Parties The Applicant Anthony C. Marino, Esq. Lynn G. Wolf, Esq. Schully, Roberts, Slattery & Marino PLC 1100 Poydras Street, Suite 1800 New Orleans, LA 70163-1800 United States Trustee Office of the United States Trustee 844 N. King Street, Room 2207 Lock Box 35 Wilmington, DE 19801 Counsel to the Debtors Laura Davis Jones, Esq. Ira D. Kharasch, Esq. Scotta E. McFarland, Esq. Robert M. Saunders, Esq. James E. ONeill, Esq. Kathleen P. Makowski, Esq. Pachulski Stang Ziehl & LLP 919 North Market Street, 17th Floor P.O. Box 8705 Wilmington DE 19899-8705 Counsel to the Debtors Ian S. Fredericks, Esq. Skadden Arps, Slate, Meagher & Flom LLP One Rodney Square P.O. Box 636 Wilmington, DE 19899 Special Counsel to the Debtors Penelope Parmes, Esq. Rutan & Tucker, LLP 611 Anton Boulevard 14th Floor Costa Mesa, CA 92626 Canadian Counsel to the Debtors Jensen Lunny MacInnes Law Corp. H.C. Ritchie Clark, Q.C. P.O. Box 12077 Suite 2550 555 West Hastings Street Vancouver, BC V6B 4N5 Engineering Consultant to the Debtors Mark A. Clemans Millstream Energy, LLC 4918 Menlo Park Drive Sugarland, TX 77479 Special Oil and Gas Transactional Counsel to the Debtors Anthony C. Marino, Esq. Schully, Roberts, Slattery & Marino PLC Energy Centre 1100 Poydras Street, Suite 1800, New Orleans, LA 70163 Financial Advisor to the Debtors Curtis A. McClam Deloitte Financial Advisory Services LLP 350 South Grand Ave, Ste. 200 Los Angeles, CA 90071 Financial Advisor to the Debtors John Rutherford Lazard Freres & Co. LLC 30 Rockefeller Plaza, 61st Floor New York, NY 10020

FEE AUDITORS FINAL REPORT - Page 6 pac FR Schully 5th int 3-5.10 v2.wpd

Co-Counsel to the Official Committee of Unsecured Creditors David B. Stratton, Esq. James C. Carignan, Esq. Pepper Hamilton LLP Hercules Plaza, Suite 1500 1313 Market Street Wilmington, DE 19899 Co-Counsel to the Official Committee of Unsecured Creditors Filiberto Agusti, Esq. Steven Reed, Esq. Joshua Taylor, Esq. Steptoe & Johnson LLP 1330 Connecticut Avenue NW Washington, DC 20036

FEE AUDITORS FINAL REPORT - Page 7 pac FR Schully 5th int 3-5.10 v2.wpd

You might also like

- Affidavit of Redeem MortgageDocument4 pagesAffidavit of Redeem MortgageDan Just DumoNo ratings yet

- Petition Notarial Commission Renewal - 2017 FormDocument4 pagesPetition Notarial Commission Renewal - 2017 FormMarie SerranoNo ratings yet

- Ei 1529Document43 pagesEi 1529milecsa100% (1)

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 4th Int 12.09-2.10.wpdDocument11 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 4th Int 12.09-2.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document8 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 3rd Int 9-11.09.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 3rd Int 9-11.09.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 6th Int 6-8.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 6th Int 6-8.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 2nd Int 6-8.09.wpdDocument22 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 2nd Int 6-8.09.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Meyers 1st Int 3-5.09 v2.wpdDocument16 pagesFee Auditor'S Final Report - Page 1: Pac FR Meyers 1st Int 3-5.09 v2.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document141 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pachulski 7th 8th Final 3.09-12.10.wpdDocument13 pagesFee Auditor'S Final Report - Page 1: Pac FR Pachulski 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document6 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 7th 8th Final 3.09-12.10.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 7th 8th Final 3.09-12.10.wpdDocument19 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen 5th Int 10.09-6.10 v2.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen 5th Int 10.09-6.10 v2.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document17 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Millstream Final 3-12.09.wpdDocument8 pagesFee Auditor'S Final Report - Page 1: Pac FR Millstream Final 3-12.09.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Meyers Final 3.09-12.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Meyers Final 3.09-12.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen 2nd Int 6-9.09.wpdDocument9 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen 2nd Int 6-9.09.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Loeb Final 6.09-1.10.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Loeb Final 6.09-1.10.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 1st Int 3-5.09.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 1st Int 3-5.09.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdDocument5 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdChapter 11 DocketsNo ratings yet

- See Paragraph 5 For Further Discussion.: Fee Auditor'S Final Report - Page 1Document10 pagesSee Paragraph 5 For Further Discussion.: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 4th Int 12.09-2.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 4th Int 12.09-2.10.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document8 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument13 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument11 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsNo ratings yet

- Et Ai.,: Objection Deadline: 11112/10 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument41 pagesEt Ai.,: Objection Deadline: 11112/10 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsNo ratings yet

- 10000016738Document16 pages10000016738Chapter 11 DocketsNo ratings yet

- Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument43 pagesObjection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsNo ratings yet

- Et Ai.,: Nunc Pro Tunc March 19,2009Document40 pagesEt Ai.,: Nunc Pro Tunc March 19,2009Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pachulski 5th Int 3-5.10.wpdDocument9 pagesFee Auditor'S Final Report - Page 1: Pac FR Pachulski 5th Int 3-5.10.wpdChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document5 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Millstream Termination Fee - WPDDocument5 pagesFee Auditor'S Final Report - Page 1: Pac FR Millstream Termination Fee - WPDChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 7th 8th Final 3.09-12.10.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument15 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 2nd Int 6-8.09.wpdDocument18 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 2nd Int 6-8.09.wpdChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument7 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- In Re:: Fee Auditor'S Final Report - Page 1Document5 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument16 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 3rd Int 9-11.09.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 3rd Int 9-11.09.wpdChapter 11 DocketsNo ratings yet

- Et Ai.,: Objection Deadline: 12/7/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument42 pagesEt Ai.,: Objection Deadline: 12/7/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument12 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Lazard 3rd Final 3-12.09 v2.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Lazard 3rd Final 3-12.09 v2.wpdChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Pachulski 4th Int 12.09-2.10.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Pachulski 4th Int 12.09-2.10.wpdChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: in ReDocument33 pagesUnited States Bankruptcy Court District of Delaware: in ReChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen Final 3.09-6.10.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen Final 3.09-6.10.wpdChapter 11 DocketsNo ratings yet

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReDocument70 pages1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument11 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of DelawareDocument27 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- LTD., Et At.,'Document19 pagesLTD., Et At.,'Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: in ReDocument24 pagesUnited States Bankruptcy Court District of Delaware: in ReChapter 11 DocketsNo ratings yet

- Fee Auditor'S Final Report - Page 1: Pac FR Lazard 2nd Int 6-8 09.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Lazard 2nd Int 6-8 09.wpdChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: in ReDocument29 pagesUnited States Bankruptcy Court District of Delaware: in ReChapter 11 DocketsNo ratings yet

- Objection Deadline: March 17, 2010 Hearing Date: Only If Objections Are Timely FiledDocument27 pagesObjection Deadline: March 17, 2010 Hearing Date: Only If Objections Are Timely FiledChapter 11 DocketsNo ratings yet

- Et Ai.,: AndlorDocument42 pagesEt Ai.,: AndlorChapter 11 DocketsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Estate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesFrom EverandEstate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- MasteringPhysics - CH 31-KirchhoffsDocument19 pagesMasteringPhysics - CH 31-KirchhoffsBalanced100% (5)

- Youth Empowerment Grants ApplicationDocument5 pagesYouth Empowerment Grants ApplicationKishan TalawattaNo ratings yet

- Quinto Vs ComelecDocument3 pagesQuinto Vs ComelecEthan ZacharyNo ratings yet

- Rosa ParksDocument4 pagesRosa ParksTodd KoenigNo ratings yet

- M-Xii Corona vs. SenateDocument2 pagesM-Xii Corona vs. SenateFritzie G. PuctiyaoNo ratings yet

- Pando Whitepaper enDocument28 pagesPando Whitepaper enIsal AbiNo ratings yet

- E1 2 Patent Searches - Activity TemplateDocument21 pagesE1 2 Patent Searches - Activity Templateapi-248496741No ratings yet

- Armstrong BCE3 Install 507120-01Document18 pagesArmstrong BCE3 Install 507120-01manchuricoNo ratings yet

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocument9 pagesSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraNo ratings yet

- AMLA SingaporeDocument105 pagesAMLA SingaporeturkeypmNo ratings yet

- AmeriMex Blower MotorDocument3 pagesAmeriMex Blower MotorIon NitaNo ratings yet

- Alcoholic Drinks in India (Full Market Report)Document58 pagesAlcoholic Drinks in India (Full Market Report)Shriniket PatilNo ratings yet

- Sixteenth All India Moot Court Competition, 2016: T. S. Venkateswara Iyer Memorial Ever Rolling TrophyDocument3 pagesSixteenth All India Moot Court Competition, 2016: T. S. Venkateswara Iyer Memorial Ever Rolling TrophyVicky Kumar100% (1)

- Report PDFDocument3 pagesReport PDFHarsh PatelNo ratings yet

- Program From Ncip MaeDocument3 pagesProgram From Ncip Maeset netNo ratings yet

- Landlord/Tenant BasicsDocument48 pagesLandlord/Tenant BasicsAlva ApostolNo ratings yet

- CBLM Package - Rev 4Document58 pagesCBLM Package - Rev 4roy sumugatNo ratings yet

- 2019 Iesc 98 1Document28 pages2019 Iesc 98 1gherasimcosmina3014No ratings yet

- Text of CorrectionDocument3 pagesText of CorrectionKim Chung Trần Thị0% (1)

- Martin Centeno v. Villalon-PornillosDocument1 pageMartin Centeno v. Villalon-PornillosAnonymous TTHbufD7100% (1)

- Im 460.150afua P75 MicroDocument69 pagesIm 460.150afua P75 MicroAlejandro VerdugoNo ratings yet

- Intentional Torts TableDocument66 pagesIntentional Torts TableShannon LitvinNo ratings yet

- Braulio de Diego - Problemas Oposiciones Matemáticas Vol 2 (81-87)Document10 pagesBraulio de Diego - Problemas Oposiciones Matemáticas Vol 2 (81-87)laura caraconejo lopezNo ratings yet

- CarfaxDocument7 pagesCarfaxAnonymous wvAFftNGNSNo ratings yet

- Santos Ventura Hocorma Foundation Inc Vs Ernesto SantosDocument7 pagesSantos Ventura Hocorma Foundation Inc Vs Ernesto SantosJan BeulahNo ratings yet

- 22913/Shc Hamsafar Ex Third Ac (3A) : WL WLDocument2 pages22913/Shc Hamsafar Ex Third Ac (3A) : WL WLSayro Ki DuniyaNo ratings yet

- Direct Shear Test ReprtDocument4 pagesDirect Shear Test ReprtShivaraj SubramaniamNo ratings yet