Professional Documents

Culture Documents

10000019670

Uploaded by

Chapter 11 DocketsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10000019670

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 1 of 7

Main Document

TARTER KRINSKY & DROGIN LLP Attorneys for The Christian Brothers Institute, et al. Debtors and Debtors-in-Possession 1350 Broadway, 11th Floor New York, New York 10018 (212) 216-8000 Scott S. Markowitz, Esq. Eric H. Horn, Esq. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

DEBTORS APPLICATION FOR RETENTION OF FOUR SEASONS REAL ESTATE CENTER AS DEBTORS REAL ESTATE BROKER TO: THE HONORABLE ROBERT D. DRAIN UNITED STATES BANKRUPTCY JUDGE The Christian Brothers Institute (CBI)1, one of the above-captioned debtors and debtors-in-possession (the Debtor), hereby files this application (the Application) to retain Four Seasons Real Estate Center (Four Seasons) as its real estate broker with respect to the marketing and sale of a certain piece of real property located at 117 North 10th Avenue, Mount Vernon, New York 10550. In support of this Application, the Debtor relies upon and

incorporates by reference the Affidavit of Darryl R. Selsey (the Selsey Affidavit) attached hereto as Exhibit A. In further support of the Application, the Debtor respectfully represents as follows:

The last four digits of CBIs employer identification number are 0153 and its mailing address is 21 Pryer Terrace, New Rochelle, New York 10804.

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 2 of 7

Main Document

JURISDICTION 1. This Court has jurisdiction to consider this matter pursuant to 28 U.S.C. 157

and 1334 and the Order of Reference, dated July 10, 1984 (Ward, C.P.J.). This is a core proceeding pursuant to 28 U.S.C. 157(b). Venue is proper before this Court pursuant to 28 U.S.C. 1408 and 1409. The statutory bases for the relief requested herein are 11 U.S.C. 101(14), 327(a) and 328, Rule 2014 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules) and Rule 2014-1 of the Local Bankruptcy Rules for the Southern District of New York (the Local Rules). BACKGROUND 2. On April 28, 2011 (the Petition Date), each of the above-captioned debtors

(collectively, the Debtors) filed their respective Chapter 11 cases by filing a voluntary petition for relief under Chapter 11 of Title 11 of the United States Code (the Bankruptcy Code). Pursuant to 1107(a) and 1108 of the Bankruptcy Code, the Debtors continue to operate as debtors-in-possession. No trustee has been appointed. 3. The Debtors cases were consolidated for administrative purposes only, by order

dated May 2, 2011. Thereafter, by order dated May 18, 2011, the Debtors were authorized to retain Tarter Krinsky & Drogin LLP as bankruptcy counsel. 4. On May 11, 2011, the United States Trustee appointed an Official Committee of

Unsecured Creditors (the Committee). The Committee retained Pachulski Stang Ziehl & Jones LLP as its counsel which was approved by an order of this Court dated July 14, 2011. 5. CBI is a domestic not-for-profit 501(c)(3) corporation organized under

102(a)(5) of the New York Not-for-Profit Corporation Law. CBI was formed in 1906 pursuant to Section 57 of the then existing New York Membership Law. The Not-for-Profit Corporation Law replaced the Membership Law effective September 1, 1970. The purpose for which CBI

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 3 of 7

Main Document

was, and continues to be, formed was to establish, conduct and support Catholic elementary and secondary schools principally throughout New York State. As a not-for-profit corporation, the assets, and/or income are not distributable to, and do not inure to, the benefit of its directors or officers. CBI depends upon grants and donations to fund a portion of its operating expenses. 6. The Christian Brothers of Ireland, Inc. (CBOI) is a domestic not-for-profit

501(c)(3) corporation organized under the Not-for-Profit Corporation Law of the State of Illinois. The purpose for which CBOI was, and continues to be, formed was to establish, conduct and support Catholic elementary and secondary schools principally throughout the State of Illinois, as well as other spiritual and temporal affairs of the former Brother Rice Province of the Congregation of Christian Brothers. As a not-for-profit corporation, the assets, and/or income are not distributable to, and do not inure to the benefit of its members, or officers. CBOI depends upon grants and donations to fund a portion of its operating expenses. 7. The cause for the filing of these cases has been extensively detailed in the

affidavit pursuant to Local Bankruptcy Rule 1007-2 filed with the original petitions, and is referred to as if fully set forth herein. In short, the Debtors Chapter 11 cases were filed in an effort to resolve in one forum, an onslaught of litigation and claims asserted by alleged sexual abuse plaintiffs against the Debtors in several jurisdictions in North America. 8. By order dated June 28, 2011, CBI was authorized to retain Newmark &

Company Real Estate, Inc. d/b/a Newmark Knight Frank as its exclusive real estate broker with respect to the marketing and sale of real property located at 74 W. 124th Street, New York, NY 10027. Additionally, by order dated September 29, 2011, CBOI was authorized to retain

Re/Max 10 as its real estate broker with respect to the marketing and sale of real property located at 9757 S. Seeley Avenue, Chicago, Illinois.

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 4 of 7

Main Document

9.

The Debtors are continuing to review their real estate portfolio to determine

which properties may be sold as part of their efforts to reorganize and propose a plan to creditors in these cases. In that regard, CBI is filing this Motion to retain Four Seasons to market and sell the property located at 117 North 10th Avenue, Mount Vernon, New York 10550 (the Property). The Property is a single family house which was formerly utilized as a residence to house Brothers. Currently, the Property is vacant and CBI had listed the Property for sale months before the Chapter 11 filing. A copy of the Exclusive Right to Sell Agreement, dated September 30, 2011 (the Agreement) is annexed hereto as Exhibit B. The Agreement grants Four Seasons an exclusive period to through and including March 31, 2012 to market and sell the Property. RELIEF REQUESTED 10. By this Application, the Debtor seeks entry of an order pursuant to Bankruptcy

Code 327(a) and Bankruptcy Rule 2014(a) authorizing the retention and employment of Four Seasons with respect to the marketing and sale of the Property. BASIS FOR RELIEF 11. Bankruptcy Code 327(a) provides that a debtor, subject to Court approval may employ one or more attorneys, accountants, appraisers, auctioneers, or other professional persons, that do not hold or represent an interest adverse to the estate, and that are disinterested persons, to represent or assist the [debtor] in carrying out the [debtor]s duties under this title. 11 U.S.C. 327(a). 12. Bankruptcy Rule 2014(a) requires that an application for retention include specific facts showing the necessity for the employment, the name of the [firm] to be employed, the reasons for the selection, the professional services to be rendered, and proposed arrangement for compensation, and, to the best of the applicants knowledge, all of the [firms] connections

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 5 of 7

Main Document

with the debtor, creditors, any other party in interest, their respective attorneys and accountants, the United States trustee, or any person employed in the office of the United States trustee. Fed. R. Bankr. P. 2014. 13. The Debtor submits that the retention of Four Seasons is warranted under

Bankruptcy Code 327 and Bankruptcy Rule 2014(a). Indeed, in order to achieve the highest and best value for the Property, the Debtor submits that the assistance of highly qualified brokers is necessary. QUALIFICATIONS 14. The Debtor has selected Four Seasons because of its considerable experience in

representing sellers of homes. Indeed, Darryl Selsey, the broker primarily responsible for the marketing and sale of the Property, has considerable experience in selling and marketing homes of this type and is licensed in the State of New York to do so. Additionally, Four Seasons has worked with the Debtor prior to the Petition Date with respect to marketing the Property for sale and is familiar with the details of the Property and surrounding area. 15. The Debtor believes, and respectfully submits, that Four Seasons is experienced

and qualified to market the Property. Four Seasons has indicated its willingness to serve as the Debtors exclusive real estate broker under the Agreement and in accordance with the terms of the Agreement, as modified by the rider attached thereto. SCOPE OF SERVICES & COMPENSATION 16. The professional services that Four Seasons will provide are specifically set forth

in the Agreement,2 but in general include marketing the Property to obtain prospective, well

This summary of the Agreement is descriptive only and is qualified in its entirety by the provisions of the Agreement. The terms of the Agreement will control in the event of any inconsistency between this Application and the Agreement.

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 6 of 7

Main Document

qualified purchasers that are ready, willing and able to purchase the Property.

All costs

associated with the marketing of the Property including, but not limited to, advertisements, public relations, marketing brochures, etc. will be borne by Four Seasons. 17. Upon sale of the Property, Four Seasons will be paid a commission of five (5%)

percent of the sales price (the Commission).3 In no event shall the fee for services paid by the Debtor exceed the Commission. 18. Since they are acting merely as real estate brokers and will be paid a commission,

only, it will be burdensome for Four Seasons to comply with the requirements of the Bankruptcy Code with respect to maintenance of time records. Four Seasons sale efforts will not affect the Debtors cash flow. Based upon these factors, the Debtor respectfully requests that Four Seasons (i) be exempted from the requirements to maintain time records; and (ii) be exempted from the monthly record keeping and notice requirements set forth in this Courts Order Establishing Procedures for Monthly Compensation and Reimbursement of Expenses of Professionals (the Interim Compensation Order) (Docket No. 64). DISINTERESTEDNESS 19. To the best of the Debtors knowledge, and except as otherwise as disclosed in the

Selsey Affidavit, the members and employees of Four Seasons do not hold or represent an interest materially adverse to the Debtors estate with respect to any matter upon which it is to be engaged. 20. To the best of the Debtors knowledge, Four Seasons is a disinterested person

as that term is defined in 101(14) of the Bankruptcy Code, as modified by 1107(b) of the Bankruptcy Code, in that their members and employees

In the event that a buyer is represented by a broker, such broker may receive up to two percent (2%) of the Commission and the remainder of the Commission will be paid to Four Seasons.

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104

Filed 10/07/11

Entered 10/07/11 16:43:47 Pg 7 of 7

Main Document

a. b. 21.

are not creditors, equity security holders or insiders of the Debtors; and are not and were not, within 2 years before the date of the filing of the petition, a director, officer, or employee of the Debtors.

Four Seasons has not entered into any agreement prohibited by 155 of Title 18

of the United States Code. NOTICE 22. The Debtor respectfully submits that no notice of this Application is necessary

inasmuch as the requested relief does not affect the substantive rights of any party. A copy of this Application, the Selsey Affidavit, and the proposed order of retention has been submitted to the United States Trustee and counsel for the Committee for review and approval. NO PRIOR REQUEST 23. other court. WHEREFORE, the Debtor respectfully requests that the prefixed order be entered pursuant to 327(a) and 328 of the Bankruptcy Code, Bankruptcy Rule 2014 and Local Bankruptcy Rule 2014-1(a), authorizing the Debtor to employ and retain Four Seasons as its exclusive real estate agent to market the Property on the terms set forth in the Agreement, and that it have such other and further relief as is just and proper. Dated: New York, New York October 3, 2011 By: /s/ Brother Kevin Griffith Brother Kevin Griffith Vice-President No prior application for the relief requested herein has been made to this or any

{Client/001718/BANK376/00408969.DOC;1}

11-22820-rdd

Doc 104-1

Filed 10/07/11 Entered 10/07/11 16:43:47 Affidavit in Support Pg 1 of 4

Exhibit A -

EXHIBIT A

11-22820-rdd

Doc 104-1

Filed 10/07/11 Entered 10/07/11 16:43:47 Affidavit in Support Pg 2 of 4

Exhibit A -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

AFFIDAVIT OF DARRYL R. SELSEY IN SUPPORT OF DEBTORS APPLICATION FOR RETENTION OF FOUR SEASONS REAL ESTATE CENTER AS DEBTORS REAL ESTATE BROKER STATE OF NEW YORK COUNTY OF WESTCHESTER ) ss.: )

Darryl R. Selsey being duly sworn, states as follows: 1. I am a co-owner and co-founder of Four Seasons Real Estate Center (Four

Seasons) which maintains an office at 557 Gramatan Avenue, Mount Vernon, New York. Four Seasons is a licensed real estate brokerage firm. 2. I submit this affidavit in support of the application (the Application) of The

Christian Brothers Institute, one of the above-captioned debtors (the Debtor), for an order authorizing it to retain Four Seasons as its exclusive real estate agent to market and sell a residence located at 117 North 10th Avenue, Mount Vernon, New York (the Property) under the terms of an Exclusive Right to Sell Agreement, dated September 30, 2011 (the Agreement), annexed as Exhibit B to the Application. 3. Four Seasons is experienced and qualified to represent the Debtor in its effort to The services to be rendered include all of those services

sell the Property in this case.

summarized in the Application and set forth in the Agreement.1

Capitalized terms otherwise undefined herein shall have the meaning set forth in the Application.

{Client/001718/BANK376/00408989.DOCX;2}

11-22820-rdd

Doc 104-1

Filed 10/07/11 Entered 10/07/11 16:43:47 Affidavit in Support Pg 3 of 4

Exhibit A -

4.

Neither I, Four Seasons, nor any officer, director, shareholder or employee of

Four Seasons, insofar as I have been able to ascertain, has any connection with the Debtor, its creditors or any other interested party or their respective attorneys and accountants, except that Four Seasons, its officers, directors, shareholders and employees: (a) represented the Debtor prior to the Petition Date with respect to marketing the Property for sale; (b) may have represented in the past, and may represent in the future, entities in matters wholly unrelated to the Debtors case, where one or more of the said parties may have been, or may be or become involved in this case; and (c) may represent, or may have represented, certain of the Debtors creditors in matters wholly unrelated to its case. 5. Neither I, Four Seasons, nor any officer, director, shareholder or employee of

Four Seasons, insofar as I have been able to ascertain, holds or represents any interest adverse to that of the estate in the matters upon which Four Seasons is to be engaged and I believe Four Seasons to be a disinterested person within the meaning of 101(14) of the Bankruptcy Code. 6. I have advised the Debtor of Four Seasons willingness to serve as its exclusive

real estate agent under the Agreement, consistent with the provisions of the Bankruptcy Code and Rules for professional services rendered and expenses incurred in accordance with the provisions of 328, 330 and 331 of the Bankruptcy Code. 7. The five (5%) percent commission rate to be paid upon the closing of the sale of

the Property is competitive with the rates charged by other firms and the services to be rendered are also comparable to those provided by other brokerage firms. 8. While employed by the Debtor, Four Seasons will not represent any other entity

having an adverse interest in connection with this case.

{Client/001718/BANK376/00408989.DOCX;2}

11-22820-rdd

Doc 104-1

Filed 10/07/11 Entered 10/07/11 16:43:47 Affidavit in Support Pg 4 of 4

Exhibit A -

9.

To the best of my knowledge, information and belief, Four Seasons has not

entered into any agreement prohibited by 155 of Title 18 of the United States Code or 504 of the Bankruptcy Code. 10. I have read the Application for an order approving the retention of Four Seasons

as the Debtors exclusive real estate agent to sell the Property and, to the best of my knowledge, information and belief, the contents of said Application are true and correct.

/s/ Daryl R. Selsey Daryl R. Selsey Sworn to before me this 3rd day of October, 2011 /s/ Carol R. Mark Carol R. Mark Notary Public, State of New York No. 02MA4925080 Qualified in Westchester County Commission Expires February 28, 2014

{Client/001718/BANK376/00408989.DOCX;2}

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 1 of 6

Exhibit B -

EXHIBIT B

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 2 of 6

Exhibit B -

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 3 of 6

Exhibit B -

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 4 of 6

Exhibit B -

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 5 of 6

Exhibit B -

11-22820-rdd

Doc 104-2

Filed 10/07/11 Entered 10/07/11 16:43:47 Broker Agreement Pg 6 of 6

Exhibit B -

You might also like

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Art 36 FC (G.R. No. 196359. May 11, 2021)Document183 pagesArt 36 FC (G.R. No. 196359. May 11, 2021)tin_m_sNo ratings yet

- General PHYSICS 2 Week 1Document24 pagesGeneral PHYSICS 2 Week 1senpai notice me0% (1)

- Design of Road Overbridges: S C T RDocument7 pagesDesign of Road Overbridges: S C T RHe WeiNo ratings yet

- A Proposal Made By: Shashwat Pratyush Roll No: 1761 Class: B.A.LL.B. (Hons.) Semester: 5Document30 pagesA Proposal Made By: Shashwat Pratyush Roll No: 1761 Class: B.A.LL.B. (Hons.) Semester: 5Shashwat PratyushNo ratings yet

- Checklist For Appointment Provisional To PermanentDocument4 pagesChecklist For Appointment Provisional To PermanentUniversal CollabNo ratings yet

- GE122-HIST Readings in Philippine History: Rosalejos, Mary Ann Allyn BDocument4 pagesGE122-HIST Readings in Philippine History: Rosalejos, Mary Ann Allyn BMary Ann RosalejosNo ratings yet

- Awe SampleDocument12 pagesAwe SamplerichmondNo ratings yet

- GNS430W Pilots Guide and ReferenceDocument218 pagesGNS430W Pilots Guide and Referenceniben16No ratings yet

- NLRC Affirms Manager's Suspension for Sexual HarassmentDocument3 pagesNLRC Affirms Manager's Suspension for Sexual HarassmentSylina AlcazarNo ratings yet

- Trade and Investment PoliciesDocument24 pagesTrade and Investment PoliciesSarsal6067No ratings yet

- Thailand 6N7D Phuket - Krabi 2 Adults Dec 23Document4 pagesThailand 6N7D Phuket - Krabi 2 Adults Dec 23DenishaNo ratings yet

- Form 1. Application For Travel and Accommodation Assistance - April 2019Document4 pagesForm 1. Application For Travel and Accommodation Assistance - April 2019chris tNo ratings yet

- TDS-466 Chembetaine CGFDocument1 pageTDS-466 Chembetaine CGFFabianoNo ratings yet

- News You Can Use: 5-Star Resort 5-Star ResortDocument56 pagesNews You Can Use: 5-Star Resort 5-Star ResortCoolerAds100% (5)

- Poe's "The Cask of AmontilladoDocument5 pagesPoe's "The Cask of AmontilladoSherrie Lyn100% (1)

- Banez vs. ValdevillaDocument2 pagesBanez vs. Valdevillahmn_scribdNo ratings yet

- Answer To Exercises-Capital BudgetingDocument18 pagesAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)

- TIK Single Touch Payroll Processing GuideDocument23 pagesTIK Single Touch Payroll Processing GuideMargaret MationgNo ratings yet

- In The Supreme Court of India: Appellants: RespondentDocument31 pagesIn The Supreme Court of India: Appellants: Respondentaridaman raghuvanshiNo ratings yet

- Nazi Germany - Color Photos From LIFE ArchiveDocument197 pagesNazi Germany - Color Photos From LIFE Archiveabhii97% (69)

- Affirmative Second SpeakerDocument2 pagesAffirmative Second SpeakerAnonymous B0hmWBT82% (11)

- ME 1102 Electric Circuits: Analysis of Resistive CircuitsDocument12 pagesME 1102 Electric Circuits: Analysis of Resistive CircuitsTalha KhanzadaNo ratings yet

- GR No. 75042 (Republic v. IAC)Document3 pagesGR No. 75042 (Republic v. IAC)Jillian AsdalaNo ratings yet

- E-TICKET DETAILSDocument3 pagesE-TICKET DETAILSKrishna TelgaveNo ratings yet

- Preliminary Offering Memorandum - Offering 2117Document290 pagesPreliminary Offering Memorandum - Offering 2117ElDisenso.com100% (1)

- St. Aviation v. Grand International Air DigestDocument3 pagesSt. Aviation v. Grand International Air DigestkathrynmaydevezaNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- 4 in Re of The Admission To The Bar and OathDocument2 pages4 in Re of The Admission To The Bar and OathGenevieve BermudoNo ratings yet

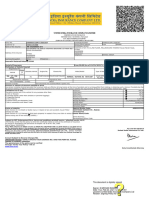

- United India Insurance Company Limited: This Document Is Digitally SignedDocument2 pagesUnited India Insurance Company Limited: This Document Is Digitally SignedjagaenatorNo ratings yet

- Journal Reading 2 - Dr. Citra Manela, SP.F PDFDocument15 pagesJournal Reading 2 - Dr. Citra Manela, SP.F PDFSebrin FathiaNo ratings yet