Professional Documents

Culture Documents

10000021387

Uploaded by

Chapter 11 DocketsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10000021387

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 1 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Jeffrey K. Garfinkle, Cal. Bar No. 153496 Joseph M. Welch, Cal. Bar No. 259308 BUCHALTER NEMER, PC 18400 Von Karman Avenue, Suite 800 Irvine, California 92612-0514 Telephone: (949) 760-1121 Facsimile: (949) 720-0182 Email: jgarfinkle@buchalter.com jwelch@buchalter.com Proposed Counsel to the Official Committee of Unsecured Creditors UNITED STATES BANKRUPTCY COURT CENTRAL DISTRICT OF CALIFORNIA SANTA ANA DIVISION In re: WESTCLIFF MEDICAL LABORATORIES, INC., Debtor. Lead Case No.: 8:10-bk-16743-TA Jointly Administered with Case No. 8:10-bk-16746-TA CREDITORS COMMITTEES OPPOSITION TO DEBTORS MOTIONS FOR ORDERS: (1) APPROVING SALE OF SUBSTANTIALLY ALL OF THE DEBTORS ASSETS (EXCLUDING CASH AND ACCOUNTS RECEIVABLE) FREE AND CLEAR OF ALL LIENS, CLAIMS AND INTERESTS; (2) APPROVING OF DEBTORS ASSUMPTION AND ASSIGNMENT OF UNEXPIRED LEASES AND EXECUTORY CONTRACTS AND DETERMINING CURE AMOUNTS; (3) WAIVING THE 14-DAY STAY PERIODS SET FORTH IN BANKRUPTCY RULES 6004(H) AND 6006(D); (4) GRANTING RELATED RELIEF; AND (5) APPROVING QUI TAM SETTLEMENT Date: June 3, 2010 Time: 2:00 p.m. Place: Courtroom 5B 411 West Fourth Street Santa Ana, CA 92701

BN 6320243v2

BIOLABS, INC., 17 18 19 20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

Debtor.

Affects Both Debtors Affects WESTCLIFF MEDICAL LABORATORIES, INC. only Affects BIOLABS, INC. only

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 2 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

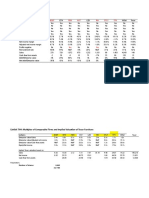

The Official Committee of Unsecured Creditors (Committee), by and through its proposed counsel, hereby objects to Debtors (1) Motion to Approve Sale of Substantially All of its Assets and related relief (the Sale Motion); and (2) Motion to Approve Settlement of Qui Tam Litigation (Qui Tam Settlement Motion). I. INTRODUCTION Last week, shortly after the Committee was formed and Committee counsel was engaged, the Committee and the Court (at the May 27 hearings) were assured the Lenders would not be the sole or primary beneficiaries of this liquidation. Unfortunately, that is exactly what appears to be the outcome. Without the benefit of bankruptcy schedules, statement of financial affairs and a claims bar date, the Committee has been left to rely upon preliminary information provided by the Debtors regarding their current financial condition and the potential claims against these estates. The Committees preliminary investigation reveals significant administrative claims. They include the following:: MTS Health (Debtors investment bankers): Qui Tam Settlement: Cure Obligations: Employee Wage Claims (including vacation): $1,350,000 $5,190,000 $2,510,000 $650,000 $9,740,000

Total:

All of these claims are required to be paid before there can be any distribution to unsecured creditors. And, in addition to these claims, there will be additional administrative claims such as the Debtors wind-down costs (estimated at $1,225,000), Section 503(b)(9) claims (estimated at $1,146,000) and professional fees (estimated at $1,160,000). In any disposition of the Debtors assets, the Lenders would be required to pay almost all of the non-bankruptcy administrative claims (MTS Health, Qui Tam Settlement, Cure Obligations and Employee Wage Claims) from any sale proceeds. As a consequence, the Committee does not view these items as benefiting the unsecured creditors or the Debtors estates. Rather, they represent costs of sale, all required to be paid, regardless of the forum or manner in which that BN 6320243v2 1

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

IRVINE

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 3 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12

sale takes place. Thus, the issue for the Court and the Committee is whether the bankruptcy sale process may be used where the secured creditor is the primary beneficiary of such a sale. There is no dispute the Debtors assets that are the subject of the pending sale are fully encumbered: first, by a lien in favor of the Debtors employees under California Code of Civil Procedure (CCP) Section 1205 for wages earned within 90 days of a sale of substantially all of the Debtors assets (estimated at $300,000);1 and second, by liens securing in excess of $58 million owed to the Lenders.2 The gross sale proceeds under the proposed sale are $57,500,000 before any downward adjustments and before the administrative sales costs outlined above (including MTS Health, cure costs, and the Qui Tam Settlement). II. THE PROPOSED SALE WILL NOT PROVIDE THE REQUISITE BENEFIT TO THE ESTATES Obviously, the primary beneficiaries of the proposed sale are the Lenders, not the Debtors or their estates. Under these circumstances, the proposed sale is impermissible. See e.g., In re

13 Feinstein Family Partnership, 247 B.R. 502 (Bankr. M.D. Fla. 2000). As the Feinstein court 14 aptly noted in denying a sale motion where the assets to be sold were fully encumbered: 15 16 17 18 19 Id. at 508-09. 20 The simple reality is that bankruptcy should not be used as an express foreclosure court. 21 It should not be used as a tool for senior, secured creditors to liquidate collateral at the cost of 22 junior creditors, and at the expense of those interests. 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

It is now almost universally recognized that where the estate has no equity in a property, abandonment is virtually always appropriate because no unsecured creditor could benefit from the administration. . . . [[A] a general rule the bankruptcy court should not authorize the sale free and clear of liens unless the sale proceeds will fully compensate secured lien holders and produce some equity for the benefit of the estate.

In the Sale Motion, the Debtors state that only the Lenders hold liens against the Debtors assets and that those liens are first priority liens. Sale Motion, p. 41, lines 15-18. The Debtors are incorrect. Under Cal. Code Civ. Pro. Section 1205, the Debtors employees have a springing first priority liens for their wages earned within 90 days of a sale of substantially all of the Debtors assets. Under California labor law, the term wages includes accrued vacation and sick leave. As a result, the employees liens secure approximately $300,000 owed to the Debtors employees.

The Committee has not scrutinized the Lenders claims. Nevertheless, the Committee understands that a portion of the Lenders claim includes default interest, which may be avoidable under controlling Ninth Circuit law.

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 4 of 8

Desc

1 2 3 4 5 6 7 8 9 10 E.D. Va. 2004) (Chapter 7 trustees proposed sale denied because unsecured creditors would 11 receive nothing or next to nothing). 12 The concepts of non-bankruptcy, foreclosure, good faith in bankruptcy, and Section 554 13 abandonment come into play when there is no benefit to unsecured creditors. See Barber v. 14 Westbay (In re Integrated Agri, Inc.), 313 B.R. 419, 425 (Bankr. C.D. Ill. 2004). (It is improper 15 for a bankruptcy trustee to liquidate property solely for the benefit of secured creditors); In re 16 FJD, Inc., 24 B.R. 138, 141 (Bankr. D. Nev. 1982) (If virtually all the indebtedness runs to 17 secured creditors, and there is no equity in the property which would benefit unsecured creditors, 18 the invocation of Chapter 11 proceedings is an abuse of the Bankruptcy Court's jurisdiction); See 19 also In re Feinstein Family P 'ship, 247 B.R. 502, 507 (Clearly, the Code never contemplated 20 that a Chapter 7 trustee should act as a liquidating agent for secured creditors who should 21 liquidate their own collateral); In re HBA E., Inc., 87 B.R. 248, 260 (Bankr. E.D.N.Y. 1988) 22 (These Chapter 11 cases do not represent efforts pitched to a business reorganization or to 23 restructure a business's finances. They are essentially a two-party civil lawsuit involving non24 bankruptcy law brought in the bankruptcy court in the guise of being a reorganization of some 25 sort under Chapter 11. Chapter 11 was never intended to be used as a fist in a two party bout. 26 The Chapter is entitled reorganization and not litigation). 27 For all of these reasons, the Sale Motion must be denied. 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

A court of bankruptcy should not assume charge of encumbered property and liquidate the liens on it, unless there are reasonable grounds for believing some advantage will accrue to the bankrupts estate. If the validity of the liens is unquestioned, and their amount is such that there is probably no excess of value in the property, it should be surrendered to the lienholders or others entitled, unless some other reason appears for retaining control. A court of bankruptcy is not a court of general jurisdiction for the adjudication of controversies or the administration of assets in which the bankrupt's estate is in no wise interested. If, however, cognizance is taken, it should be assumed some benefit or advantage was expected to accrue to the general creditors, and if it results otherwise it is equitable to make the general estate bear the cost of the proceeding. In re Harralson, 179 F. 490, 492 (8th Cir. 1910); see also In re Silver, 338 B.R. 277, 282 (Bankr.

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 5 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

III.

SECTION 363(F) DOES NOT PERMIT THE SALE OF FULLY ENCUMBERED ASSETS UNLESS ALL SECURED CREDITORS CONSENT Two years ago, the Ninth Circuit Bankruptcy Appellate Panel issued its seminal decision

regarding Bankruptcy Code Section 363(f). Clear Channel Outdoor Channel, Inc. v. Knupfer (In re PW, Inc.), 391 B.R. 25(9th Cir. BAP 2009). In Clear Channel, the Ninth Circuit BAP ruled that Section 363(f)(3) does not permit the sale of fully encumbered property. Id., at 32-33 ([W]e join those courts cited above that hold that 363(f)(3) does not authorize the sale free and clear of a lienholders interest if the price of the estate property is equal to or less than the aggregate amount of all claims held by creditors who hold a lien or security interest in the property being sold). Without the ability to rely on Section 363(f)(3), the Debtors must rely on another provision of Section 363(f) in order to sell the Debtors assets. Section 363(f)(2) presently is unavailable to the Debtors. The Debtors have not obtained the consent of each of its employees who hold liens under CCP 1205.3 Likewise, the Debtors have not made any showing that California law permits the sale of the Debtors assets free and clear of the employees lien rights under CCP 1205. The Debtors likewise have not made the requisite showing under Section 363(f)(5). For all of these reasons, the Debtors are unable to sell theirs assets under Section 363(f) at this time. IV. THE QUI TAM SETTLEMENT MOTION IMPERMISSIBLY PREFERS ONE SMALL SUBSET OF UNSECURED CREDITORS For many years, the Debtors were defendants in a lawsuit brought by two relators under Californias False Claims Act. The State of California is an intervenor in that action. The Debtors suggest that claims arising from that lawsuit could total $56 million, with additional fines

20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

While the Debtors may be able to obtain such consent, they have not yet done so. Without question, these employees hold liens senior to liens of the Lenders and their Agent. See Myzer v. Emark Corp., 45 Cal. App. 4th 884, 890 (4th DCA 1996). In the Sale Motion, the Debtors argue that there can be implied consent under Bankruptcy Code Section 363(f)(2). Implied consent under section 363(f)(2) has never been recognized in the Ninth Circuit. Silence does not qualify as implied consent. See e.g., In re DeCelis, 349 B.R. 465, 473 (Bankr. E.D. Va. 2008).

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 6 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

of in the billions of dollars. (Of course, such fines would be subject to subordination to the claims of other unsecured creditors.) By virtue of a pre-petition settlement, of which the Committee had no involvement, the Debtors agreed as follows: (a) remit $400,000 of insurance funds into a trust account; (b) pay the qui tam plaintiffs 10% of the net sale proceeds (approximately $5.1 million). In short, the Debtors propose to pay one unsecured claimant $5.1 million outside of a Chapter 11 plan, in a manner which is grossly disparate to the treatment of the other unsecured creditors. Nothing in the Bankruptcy Code allows a debtor to take such actions. In deed, such actions are in direct violation of Ninth Circuit law. In re Air Beds, Inc., 92 B.R. 419 (9th Cir. BAP 1988), is the controlling case on this issue. In Air Beds, following a sale of a debtors assets but before confirmation of a plan of liquidation, the debtor proposed disbursing a portion of the sale proceeds to one creditor (in that case, the IRS). In overruling the bankruptcy courts authorization of that payment, the Ninth Circuit BAP ruled as follows: The general rule is that a distribution on pre-petition debt in a Chapter 11 case should not take place except pursuant to a confirmed plan of reorganization, absent extraordinary circumstances. See 11 U.S.C. 1123(a)(5) (plan must provide adequate means for implementation); Bankruptcy Rule 3021 (distribution shall be made to creditors whose claims have been allowed after confirmation of a plan.) . . . When a sale of all or substantial assets of the estate is proposed in a Chapter 11 case under the aegis of 363(b)(1), there is the potential for circumventing the requirements attendant to the confirmation of a Chapter 11 plan. . . . In a liquidating Chapter 11 where the debtor has ceased operations and the value of the collateral is not decreasing, ordinarily all property will be necessary for an effective reorganization. . . . If circumstances require confirmation of a sale before a liquidating plan has been confirmed, the proceeds, which will be earning interest, are necessary to the plan which presumably will provide for the sale of the rest of the debtors assets and the distribution of the proceeds. If distribution of assets occurs before confirmation, there will exist no means by which a plan may be implemented, in contravention of 11 U.S.C. 1123(a)(5). In addition, if distribution is made to creditors in a liquidating Chapter 11 before confirmation of a plan, there will be little incentive for parties in interest to prosecute the case in an expeditious manner, much less to perform 5

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 7 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

the work required to issue and obtain approval of a disclosure statement and plan. Id. at 424 (citations omitted). For all of these reasons, the Ninth Circuit BAP refused to allow pre-plan confirmation distributions to one creditor. Likewise, this Court cannot approve the Qui Tam Settlement as it requires immediate distribution of some of the sale proceeds in direct contravention of Air Beds. Beyond the distribution/timing issues involved in the Qui Tam Settlement Motion and the resulting problems under the Air Beds decision, that motion must be denied for another reason. It represents impermissible disparate treatment between two groups of similarly situated unsecured creditors. The Qui Tam plaintiffs are guaranteed to receive a 10% recovery on their general nonpriority unsecured claim. On the other hand, the other unsecured creditors may receive little if any recovery on their unsecured claims. This disparate treatment is impermissible. See Oxford Life Ins. Co. v. Tucson Self Storage. Inc., 166 B.R. 892, 898 (9th Cir. 1994) (plan cannot provide for disparate treatment of claims that have identical legal rights). Hoping to avoid the Air Beds and disparate treatment issues, the Debtors attempt to characterize the settlement agreement as an executory contractand thus not subject to court review or approval under Bankruptcy Rule 9019. The Debtors efforts to avoid having the settlement agreement scrutinized under Bankruptcy Rule 9019 are obvious. The Committee is unable to locate a single reported decision in which a bankruptcy court has ever approved a settlement agreement similar to what Debtors propose. Indeed, the settlement agreement was entered into just days before these cases commenced. In such instances, the Debtor still must meet the standards for approval of a settlement under Bankruptcy Rule 9019. Here, the Debtors cannot make the requisite showing under Bankruptcy Rule 9019. In the Qui Tam Settlement Motion, the Debtors reference the possibility of recoupment claims. Yet, the Debtors fail to mention that they are only owed approximately $500,000 from the State of California. Accordingly, there is no justification to pay the Qui Tam plaintiffs $5.1 million to preserve $500,000 in receivables.

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

Case 8:10-bk-16743-TA

Doc 96 Filed 06/03/10 Entered 06/03/10 10:13:29 Main Document Page 8 of 8

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

B UCHALTER N EMER

A PROFESSIONAL CORPORATION

In the Qui Tam Settlement Motion, the Debtors speak to the possibility that without the settlement the purchase price will substantially decline. Of course, those proceeds are the Lenders collateral. Accordingly, the Lenders are free to use their share of the proceeds on account of their allowed secured claim to pay directly to one group of unsecured creditors. On the other hand, the Debtors cannot prior to confirmation of a court approved plan. V. CONCLUSION Based on the foregoing, the Committee respectfully requests the Motions be denied in all respects and for such other and further relief and the Court deems just and proper. Dated: June 3, 2010 BUCHALTER NEMER

By: /s/ Jeffrey K. Garfinkle Jeffrey K. Garfinkle Proposed Counsel for Official Committee of Unsecured Creditors

BN 6320243v2

IRVINE

CREDITORS COMMITTEES OBJECTION TO SALE MOTION AND QUI TAM SETTLEMENT MOTION

You might also like

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 10Document8 pagesChapter 10Nguyên NguyễnNo ratings yet

- Case Study On Master BudgetDocument8 pagesCase Study On Master BudgetMusaib Ansari100% (1)

- Swing Trading MasteryDocument120 pagesSwing Trading MasterySandro Pinna100% (5)

- A Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsDocument45 pagesA Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsJustice PajarilloNo ratings yet

- 31.economic Contributions of Indian Film IndustryDocument3 pages31.economic Contributions of Indian Film IndustrymercatuzNo ratings yet

- Cfap 2 CLW PKDocument128 pagesCfap 2 CLW PKTeacher HaqqiNo ratings yet

- Response Letter - LOA - VAT 2021 - RAWDocument2 pagesResponse Letter - LOA - VAT 2021 - RAWGeralyn BulanNo ratings yet

- Issue 50Document24 pagesIssue 50The Indian NewsNo ratings yet

- Ci17 5Document11 pagesCi17 5robmeijerNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Modelo Proof of Claim MaestroDocument8 pagesModelo Proof of Claim MaestroMetro Puerto RicoNo ratings yet

- MSC Ariel ZadikovDocument119 pagesMSC Ariel ZadikovAkansha JadhavNo ratings yet

- Doj Ojp TFSC General Ledger and Chart of Accounts 508Document3 pagesDoj Ojp TFSC General Ledger and Chart of Accounts 508Wahyu JanokoNo ratings yet

- Final Prospectus - PIK LSE IPODocument333 pagesFinal Prospectus - PIK LSE IPObiblionat8373No ratings yet

- New Economic Policy of India: R.P.SinghDocument24 pagesNew Economic Policy of India: R.P.SinghrpsinghsikarwarNo ratings yet

- YTL Buys Rival Lafarge Malaysia: Corporate NewsDocument3 pagesYTL Buys Rival Lafarge Malaysia: Corporate NewsSatesh KalimuthuNo ratings yet

- Top 20 Grants For African American Women Business OwnersDocument3 pagesTop 20 Grants For African American Women Business OwnersKarinah MorrisNo ratings yet

- Stanley Black DeckerDocument9 pagesStanley Black Deckerarnabkp14_7995349110% (1)

- Franchise ConsignmentDocument2 pagesFranchise ConsignmentClarissa Atillano FababairNo ratings yet

- Petition For Issuance of Letter of AdministrationDocument4 pagesPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaNo ratings yet

- Chapter 6 KeyDocument44 pagesChapter 6 KeyNatasha Koninskaya100% (2)

- Biotech Valuation ModelDocument8 pagesBiotech Valuation ModelsachinmatpalNo ratings yet

- 32AEHPM9073L1Z3 Kottoor Mathew Jose MathewDocument5 pages32AEHPM9073L1Z3 Kottoor Mathew Jose MathewVVR &CoNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Final Exam Review 2 - LSM 1003 - HCT - ..Document12 pagesFinal Exam Review 2 - LSM 1003 - HCT - ..Roqaia AlwanNo ratings yet

- Audit of Non-Banking Financial Companies: After Studying This Chapter, You Will Be Able ToDocument40 pagesAudit of Non-Banking Financial Companies: After Studying This Chapter, You Will Be Able ToSaumya RanjanNo ratings yet

- Quant Interview PrepDocument25 pagesQuant Interview PrepShivgan Joshi67% (3)

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Document24 pagesKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- This Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Document4 pagesThis Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Ruhul AminNo ratings yet

- PaymentReceipt 22330358715495Document3 pagesPaymentReceipt 22330358715495nurgazymazhNo ratings yet