Professional Documents

Culture Documents

Affidavit of Daniel Hayes

Uploaded by

shaprioliar666Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affidavit of Daniel Hayes

Uploaded by

shaprioliar666Copyright:

Available Formats

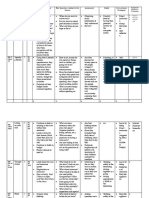

SUPREME COURT: NEW YORK COUNTY In The Matter Of An Article 75 Proceeding DANIEL B.

HAYES, Petitioner, - against DAVIS, SHAPIRO, LEWIT & HAYES, LLP, STEVEN G. SHAPIRO AND PETER LEWIT, Respondents. STATE OF CALIFORNIA COUNTY OF LOS ANGELES DANIEL B. HAYES, being duly sworn deposes and says: 1. I am a named equity partner in the law firm of Davis Shapiro AFFIDAVIT Index No.:

Lewit & Hayes LLP ("DSLH") and make this affidavit in support of Petitioners Motion for an Order of Attachment, pursuant to NY CPLR Order, pursuant to NY CPLR 6301. 6201, and Temporary Restraining

2.

I make this affidavit based upon my personal knowledge of the

facts set forth herein, and my review of DSLHs books and records kept in the ordinary course of business.

3. and

I am entitled to an order, pursuant to NY CPLR

6201 et seq.

6301 et seq. against Respondents Davis, Shapiro, Lewit & Hayes, LLP ("DSLH or

Partnership Respondent"), Steven G. Shapiro ("Shapiro") and Peter Lewit ("Lewit")

(jointly, the "Individual Respondents"), attaching and returning certain monies in the amount of $500,000 (the "Funds") which were improperly disbursed from the DSLH operating account at Chase Manhattan Bank on or about October 18, 2012, and entry of a Temporary Restraining Order and Injunction restraining Respondents from disbursing the Funds or any other monies in DSLH's operating account for partnership distributions until DSLH's line of credit has been paid and the arbitration between myself and the Individual Respondents has been completed. This amount exceeds all counterclaims of which I have any knowledge.

4.

Respondent DSLH is a law firm established as a New York

limited liability partnership with offices in New York and California. The firm specializes in entertainment law.

5. in DSLH.

Respondents Shapiro and Lewit are the other two equity partners

6.

In violation of our partnership agreement and their fiduciary

duties as partners, Shapiro and Lewit have improperly taken $500,000 from DSLH's operating account as purported partnership distributions. This leaves only $100,000 in the operating account, which is not enough to cover DSLH's monthly expenses of approximately $366,000, and a $400,000 current outstanding balance, on the firm's $1,000,000 line of credit, that must be paid by no later than November 13, 2012.

Shapiro and Lewit have done so knowing that their own assets will be insufficient to cover their share of DSLHs liabilities, and that, not only will DSLH no longer be able to function, but that I will be left holding the bag, as many of DSLHs liabilities, including the line of credit, have been personally guaranteed by me. The Management and OperationDSLH of 7. In April 2002, I became a named partner at DSLH, which was

2005, then known as Davis Shapiro Lewit Montone and Hayes. In or about January 1, all of the partners except Montone, who had previously left the firm, entered into a written partnership agreement (the "Partnership Agreement"). A copy of the Partnership Agreement is attached hereto as Exhibit A.

8.

Sections 6.01 and 6.02 of the Partnership Agreement provide that

"all of the Partners" would be responsible for managing DSLH and any determination affecting the Partnership would be "made by unanimous consent of the Partners." ( Partnership Agreement,4) (emphasis added). p.

9.

Regarding net cash flow, the Partnership Agreement further

provides that the Partnership "shall distribute Net Cash Flow (to the extent cash is available for distribution) to the Partners from time to time (but no less frequently than annually) in such amounts as shall be determined in the discretion of the Partners." ( Partnership Agreement 3.03) (emphasis added).

DSLII and Its Recent Financial Problems 10. For many years, DSLH operated successfully, with 2008 being

50-60% the firm's best year when its revenues reached $13.6 million, with profit margins. DSLH's success was due in large part to the firm's billing model; charging clients a percentage of the client's gross revenue rather than an hourly rate. However, conditions in the music industry were changing due to a decline in CD sales and the growth of the Internet.

11.

In November 2009, Fred Davis, the firm's founder and managing

partner, left DSLH to join an investment bank. I then became the firm's managing partner,

12.

Today, DSLH's partner compensation model operates on "what

feels fair" to the three equity partners after taking into account four variables: (1) available cash to distribute, (2) each partner's collections, (3) each partner's contribution to overhead and (4) each partner's resulting percentage compensation. For example, in 2010, my collections were $1.6 million and my compensation was $885,000 (55%) whereas Shapiro's collections were $1.9 million and his compensation was $1.1 million (59%). The difference in our percentage compensation was due to the partners' belief it was fair to have Shapiro contribute $783,000 to overhead, compared to my $717,000 in overhead (in contrast to the $800,000 and $950,000 we would have 50% contributed respectively to overhead under the Davis model). The partner

compensation model is applied pursuant to an end-of-the-year conversation among the three equity partners and requires unanimous consent prior to distribution.

13.

With Davis' departure, DSLH lost Davis' $2 million in business.

From 2010 through 2011, the firm's revenue decreased by an additional $1.5 million because of the loss of significant clients and the departure of contract partner Laurie $6.5 to Soriano. By the end of 2011, the firm's revenues had dropped million.

14.

For 2011, the firm had a net operating loss of approximately

$437,000. This loss led DSLH to use approximately $700,000 of its $1,000,000 line of credit with JPMorgan Chase Bank, N.A. (the "Credit Line") in order to make the agreed upon partner distributions.

15.

Although DSLH had used its Credit Line previously to cover cash

flow and make partner payments, it was unprecedented for the finn to start, as it did in 2012, with $700,000 already drawn on its Credit Line. Reiuirements Of The Credit Line 16. It is a requirement of the Credit Line that its balance be paid in

full, and maintained at a zero balance for thirty consecutive days during its term. As the line of credit is scheduled to mature on December 13, 2012, DSLH must pay $400,000

currently due on the Credit Line' and maintain a zero balance for thirty (30) days. Thus, to avoid a default, repayment to zero must occur by no later than November 13, 2012. SeeExhibit B.

17.

Payment of the Credit Line is jointly, severally, and personally.

guaranteed by me, Shapiro and Lewit pursuant to a written guaranty of payment (the "Guaranty"). A copy of the Guaranty is attached hereto Exhibit C. as The Underlying Dispute and Respondents' Action That Threatens DSLH's Continued Existence and Operation 18. In January 2012, I became very concerned about the firm's

finances and its ability to survive. 2012 firm revenues were initially projected at approximately $6.3 million, and subsequently lowered to $5.3 million; monthly expenses were projected at approximately $366,000. This left a slim projected profit 45-55% profit margin of prior years. margin of around 17%, far below the historic Through a series of emails and telephone conversations, I expressed my concerns to Shapiro and Lewit, the Individual Respondents.

19.

Despite the firm's financial condition and likely prospect of little

$865,000,reflecting to no profit, in August, Lewit and Shapiro demanded to be paid 40% of their actual collections to date. Because the firm only had approximately

1 Over the course of 2012, DSLH reduced the amount owed on the Credit Line from $700,000 to $400,000.

n.

$600,000 inits operating account, I suggested that any partnership distribution be considered only after DSLH paid the Credit Linefor the required 30 days. Shapiro off and Lewit disagreed, and blocked me from paying down the Credit Line.

20,

On October 2, 2012 (and again on October 10), Shapiro and

Lewit proposed that an additional $350,000 be drawn on the Credit Line, (in addition to the then-balance owed of $400,000), so Shapiro and Lewit's desired partnership distributions of $865,000 could be made. I withheld my consent to this proposal and instead requested that each partner post collateral before the line of credit was drawn down any further, or any partner distributions be made to any of the partners, especially given the Credit Line had to be repaid by no later than November 13, 2012, one month before the end of the term.

21.

My concern was understandable. As of October 2, DSLH (i) had

only about $600,000.00 in cash in the operating account; (ii) had collected $4,300,000 of the $5,300,000 revenue projected for 2012, while still owing over $1,000,000 in projected 2012 expenses; (iii) still owed $400,000 on the Credit Line; and (v) has additional unbudgeted moving costs, bonuses, and equipment and furniture expenses of $100,000 to $300,000 for 2012. Clinching the matter, I was jointly and severally liable to pay back the Credit Line (and many of DSLH's other debts and obligations), and understood that neither Lewit or Shapiro had the financial wherewithal to be able to pay back their share of the Credit Line on or before November 13, 2012, if the money in the

operating account was first distributed to them.

22.

On October 17, 2012, when Lewit and Shapiro continued their

refusal to post collateral and continued insisting on an immediate draw that threatened DSLHs future, I demanded arbitration, as provided for by Exhibit D (Demand for Arbitration). Agreement. See 9.07 of the Partnership

23.

In retaliation, Shapiro and Lewit terminated me on October 18,

2 See 2012, and then unilaterally distributed $500,000.00 to themselves. Exhibit E (Termination Notice).

24.

Shapiro and Lewits unilateral actions violated the Partnership

Agreement in a number of independent ways. First, I was terminated without the required 30-day prior notice provided under 8.02 of the Partnership Agreement.

Second, Shapiro and Lewit unilaterally disbursed $500,000 to themselves without my consent, in violation of 6.02 of the Partnership Agreement. Third, they disbursed 3.03 of the Partnership

$500,000 when cash was unavailable to do so, in violation of

Agreement. Further, as Shapiro and Lewit did this to benefit themselves at my expense and that of DSLFI, they have breached their fiduciary duties as partners to me and to the firm.

2 They also sent me a check in the amount of $96,138.83, reflecting a distribution weighted in favor of Shapiro and Lewit, and which does not reflect the sum to which I am entitled. I have not cashed the check, so that part of the Funds remains with Shapiro and Lewit. This and other issues will be addressed in the arbitration I commenced on October 17, 2012. See Exhibit D (Demand for Arbitration).

[J

25.

Shapiro and Lewits conduct shows an unmistakable intent to

dissipate assets and deprive me of any ability to recover anything in arbitration. If the requested relief is not granted, any arbitration award to me will be illusory.

26.

Further, if the TRO does not issue and Attachment is not granted,

I will be irreparably harmed. Bluntly put, without the money Shapiro and Lewit unilaterally and improperly removed from DSLHs operating account, DSLH will not have enough money to continue operating, or to meet the November 13, 2012 Credit Line deadline. One cannot put a price on the deliberate and unnecessary destruction of the law firm I helped build over many years and much effort. Likewise, the failure of DSLH, where I am a named partner, will negatively and irreparably harm my reputation, my ability to find other work, continue at DSLH, or join or start another firm, and my ability to maintain existing clients and develop new clients. Depending on the circumstances, I may even be forced into personal bankruptcy should I be forced to pay all the firms debts on my own.

27. 7502(c) and warranted.

Under these circumstances, an order of attachment under CPLR 7502(c) 6201(3), and a restraining order under CPLR and 6201 is

28. action.

No other provisional remedy has been secured or sought in this

29.

No prior application has been made for the relief

herein.

MM

Sworn to before me this day of October, 2012

ko

4. f

imp

Notary P bIle

j'..:.j:.

ELAINE E. LOVE Commission # 1878064 Notary Public California My Comm. Angeles County mm. xpires Feb 21, 2014

.

#68648 1v2/TD/1 1201.001

IC

You might also like

- Attorney StatementDocument15 pagesAttorney Statementshaprioliar666No ratings yet

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActFrom EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActNo ratings yet

- Filed: Patrick FisherDocument23 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- A Corrected Message From The SIPA Trustee's Chief Counsel, David J. SheehanDocument2 pagesA Corrected Message From The SIPA Trustee's Chief Counsel, David J. SheehanInvestor ProtectionNo ratings yet

- Questions Chapter 2Document4 pagesQuestions Chapter 2Minh Thư Phạm HuỳnhNo ratings yet

- First Data Annual Report 2008Document417 pagesFirst Data Annual Report 2008SteveMastersNo ratings yet

- Why Do Companies Issue Debt When They Don't Seem To Need The MoneyDocument3 pagesWhy Do Companies Issue Debt When They Don't Seem To Need The MoneythebigpicturecoilNo ratings yet

- Binder - LL - SecDocument23 pagesBinder - LL - SecMy-Acts Of-SeditionNo ratings yet

- Adelphia Case StudyDocument5 pagesAdelphia Case StudySuprabhat Tiwari50% (2)

- UntitledDocument14 pagesUntitledapi-227433089No ratings yet

- Exhibit #41Document52 pagesExhibit #41Jeremy W. GrayNo ratings yet

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- Partnership Accounting Question & Answer As Mention in This FileDocument7 pagesPartnership Accounting Question & Answer As Mention in This FileSadraShahidNo ratings yet

- New York v. Davis, Et AlDocument60 pagesNew York v. Davis, Et AlDealBookNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Equity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsFrom EverandEquity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsNo ratings yet

- TheMacroeconomicsOfFirmsSavings Preview PDFDocument48 pagesTheMacroeconomicsOfFirmsSavings Preview PDFDon JulioNo ratings yet

- Accounting For Liabilities: Learning ObjectivesDocument39 pagesAccounting For Liabilities: Learning ObjectivesJune KooNo ratings yet

- Application For DFC-DPA Loan Program (DFC-014) : Omb NoDocument17 pagesApplication For DFC-DPA Loan Program (DFC-014) : Omb NoSam KnightNo ratings yet

- Jeter AA 4e SolutionsManual Ch16Document22 pagesJeter AA 4e SolutionsManual Ch16Dian Ayu Permatasari100% (1)

- Using Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityFrom EverandUsing Successful and Proven Strategies of Credit and Finance, Grants, and Taxation Principles to Obtain Multiple Lines of Credit to Build Your Home-Based Business OpportunityRating: 1 out of 5 stars1/5 (1)

- Tugas FM-High Rock IndustryDocument5 pagesTugas FM-High Rock IndustryAnggit Tut PinilihNo ratings yet

- Partnerships Made And: Promises KeptDocument40 pagesPartnerships Made And: Promises Keptblueprint3dNo ratings yet

- Business Loans and Pricing FundamentalsDocument2 pagesBusiness Loans and Pricing FundamentalsAn DoNo ratings yet

- US Consumer Debt Relief: Industry, Overview, Laws & RegulationsFrom EverandUS Consumer Debt Relief: Industry, Overview, Laws & RegulationsNo ratings yet

- A Case Study of D'Leon IncDocument13 pagesA Case Study of D'Leon IncTimNo ratings yet

- Bam q1 2016 LTR To ShareholdersDocument7 pagesBam q1 2016 LTR To ShareholdersDan-S. ErmicioiNo ratings yet

- Harbeck Responds To Letter From Cong. GarrettDocument28 pagesHarbeck Responds To Letter From Cong. GarrettIlene KentNo ratings yet

- Discussion Unit 1 - Financial ManagementDocument2 pagesDiscussion Unit 1 - Financial ManagementRenatus MalimbeNo ratings yet

- 10000003728Document32 pages10000003728Chapter 11 DocketsNo ratings yet

- Kenneth Trent Draft Complaint V JPMC and TTC, Pierrevil Complaint 9Document17 pagesKenneth Trent Draft Complaint V JPMC and TTC, Pierrevil Complaint 9larry-612445No ratings yet

- Corporations Outline Provides Overview of Key ConceptsDocument48 pagesCorporations Outline Provides Overview of Key ConceptsNegotiator101No ratings yet

- Data Center College of The PhilippinesDocument2 pagesData Center College of The PhilippinesCjhay MarcosNo ratings yet

- Ziff Davis Bankruptcy Filing 2Document75 pagesZiff Davis Bankruptcy Filing 2Rafat AliNo ratings yet

- Ch16 Beams10e TBDocument23 pagesCh16 Beams10e TBLouie De La TorreNo ratings yet

- Account Receivable and Goodwill ValuationDocument3 pagesAccount Receivable and Goodwill ValuationYimeng ChengNo ratings yet

- Chapter 8-1 Group Report - NormanDocument6 pagesChapter 8-1 Group Report - Normanvp_zarate100% (1)

- Proof Steve Shapiro and Peter Lewit Are Liars.Document7 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Saintvil IndictmentDocument22 pagesSaintvil IndictmentNick SchwellenbachNo ratings yet

- SolutionForCh3 5 6 8 9Document9 pagesSolutionForCh3 5 6 8 9Wang Ka YuNo ratings yet

- Hutchison Whampoa SolutionDocument6 pagesHutchison Whampoa SolutionIvan Baranov100% (1)

- Other Financing Alternatives Focus: 1. What Are The Five C's of Credit Analysis?Document10 pagesOther Financing Alternatives Focus: 1. What Are The Five C's of Credit Analysis?Muhammad Qasim A20D047FNo ratings yet

- Brookfield Asset Management q2 2013 Letter To ShareholdersDocument6 pagesBrookfield Asset Management q2 2013 Letter To ShareholdersCanadianValueNo ratings yet

- How to Win the Property War in Your Bankruptcy: Winning at Law, #4From EverandHow to Win the Property War in Your Bankruptcy: Winning at Law, #4No ratings yet

- 7Document24 pages7JDNo ratings yet

- Chap 01 - Introduction To Financial Statements (ICA)Document8 pagesChap 01 - Introduction To Financial Statements (ICA)Wayne Andrea TualaNo ratings yet

- Notes Payable vs Accounts Payable: Key DifferencesDocument3 pagesNotes Payable vs Accounts Payable: Key DifferencesEllaine Pearl AlmillaNo ratings yet

- How Are Notes Payable Different From Accounts Payable?Document3 pagesHow Are Notes Payable Different From Accounts Payable?Ellaine Pearl AlmillaNo ratings yet

- Freddie Mac Scandal Report PDFDocument4 pagesFreddie Mac Scandal Report PDFaditikhasnisNo ratings yet

- Adecco Olesten Merger CaseDocument4 pagesAdecco Olesten Merger CaseAnonymous qbVaMYIIZ100% (1)

- Attorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Page 1 of 13 F-283364Document37 pagesAttorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Page 1 of 13 F-283364Chapter 11 DocketsNo ratings yet

- SBA Loan SecretsDocument3 pagesSBA Loan SecretsPNWBizBrokerNo ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document3 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document2 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document7 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document2 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document5 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document4 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document3 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document6 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- More Proof Steve Shapiro and Peter Lewit Are Liars.Document14 pagesMore Proof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Proof Steve Shapiro and Peter Lewit Are Liars.Document15 pagesProof Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- Affirmation of EmergencyDocument2 pagesAffirmation of Emergencyshaprioliar666No ratings yet

- Confirmation Notice Steve Shapiro and Peter Lewit Are Liars.Document2 pagesConfirmation Notice Steve Shapiro and Peter Lewit Are Liars.shaprioliar666No ratings yet

- IFC Promotes Private Sector Growth in Developing NationsDocument7 pagesIFC Promotes Private Sector Growth in Developing NationsJawad Ali RaiNo ratings yet

- XLSXDocument2 pagesXLSXchristiewijaya100% (1)

- Calm Finance Unit PlanDocument7 pagesCalm Finance Unit Planapi-331006019No ratings yet

- Hexaware TechnologiesDocument2 pagesHexaware Technologieshsolanke21No ratings yet

- L2 Certificate in Bookkeeping and Accounting PDFDocument26 pagesL2 Certificate in Bookkeeping and Accounting PDFKhin Zaw HtweNo ratings yet

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocument2 pagesThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNo ratings yet

- Exclusive Investment Cheat Sheet: The Ultimate Wealth Creation SummitDocument14 pagesExclusive Investment Cheat Sheet: The Ultimate Wealth Creation SummitMohammad Samiullah100% (1)

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- Yukitoshi Higashino MftaDocument29 pagesYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatNo ratings yet

- Christopher P. Mittleman's LetterDocument5 pagesChristopher P. Mittleman's LetterDealBook100% (2)

- Taxes Are Obsolete by Beardsley Ruml, Former FED ChairmanDocument5 pagesTaxes Are Obsolete by Beardsley Ruml, Former FED ChairmanPatrick O'SheaNo ratings yet

- Black Scholes Model ReportDocument6 pagesBlack Scholes Model ReportminhalNo ratings yet

- Principles and Methods for Improving CollectionsDocument7 pagesPrinciples and Methods for Improving Collectionsrosalyn mauricioNo ratings yet

- Total Compensation Framework Template (Annex A)Document2 pagesTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNo ratings yet

- 01 Basilan Estate V CIRDocument2 pages01 Basilan Estate V CIRBasil MaguigadNo ratings yet

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDocument27 pagesVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNo ratings yet

- Indian Institute of Banking & Finance: Certificate Course in Digital BankingDocument6 pagesIndian Institute of Banking & Finance: Certificate Course in Digital BankingKay Aar Vee RajaNo ratings yet

- NpoDocument30 pagesNpoSaurabh AdakNo ratings yet

- DR Stanisław Kubielas: International FinanceDocument4 pagesDR Stanisław Kubielas: International FinanceGorana Goga RadisicNo ratings yet

- AccountingDocument2 pagesAccountingMerielle Medrano100% (2)

- STTP - Icmd 2009 (B01)Document4 pagesSTTP - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Hsslive-XII-economics - Macro - EconomicsDocument3 pagesHsslive-XII-economics - Macro - Economicscsc kalluniraNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- FAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSDocument66 pagesFAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSAbdurrehman ShaheenNo ratings yet

- THE BARLOW CLOWES SCAMDocument6 pagesTHE BARLOW CLOWES SCAMBik Ly100% (1)

- C11 Principles and Practice of InsuranceDocument9 pagesC11 Principles and Practice of InsuranceAnonymous y3E7ia100% (2)

- Uno Minda RameezDocument139 pagesUno Minda RameezRameez TkNo ratings yet

- 50 Cent - Schedules A-JDocument38 pages50 Cent - Schedules A-JMike Huseman100% (1)

- Lesson 10 - Managing Projects With Uncertain OutcomesDocument27 pagesLesson 10 - Managing Projects With Uncertain OutcomesMarc Loui RiveroNo ratings yet

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet