Professional Documents

Culture Documents

Ackground and Rocedural Istory: (33423/1/DT255256.DOC 2)

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ackground and Rocedural Istory: (33423/1/DT255256.DOC 2)

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION

In re: COLLINS & AIKMAN CORPORATION. et al.,

Chapter 11 Case No. 05-55927-SWR Jointly Administered Hon. Steven W. Rhodes /

Debtors.

OBJECTION OF VALIANT TOOL & MOLD, INC., TO THE DEBTORS MOTION FOR ENTRY OF ORDERS APPROVING SALE OF CERTAIN OF THE ASSETS OF THE DEBTORS INTERIORS PLASCTICS GROUP FREE AND CLEAR OF LIENS, CLAIMS, ENCUMBRANCES AND INTERESTS, AND RELATED RELIEF Valiant Tool & Mold, Inc., (Valiant) hereby objects to entry of an order approving sale of certain of the assets of the Debtors Interiors Plastics Group Free and Clear of Liens, Claims, Encumbrances and Interests, and Related Relief (the Sale Motion), and in support of its objection states as follows: BACKGROUND AND PROCEDURAL HISTORY 1. On May 17, 2005 (Petition Date), Collins & Aikman Corporation and its debtor

subsidiaries (Debtors) filed their voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code 1101, et. seq. (Bankruptcy Code). 2. Debtors are operating their businesses and managing their properties as debtors-

in-possession pursuant to 1107(a) and 1108 of the Bankruptcy Code. No trustee or examiner has been appointed in these Chapter 11 cases. 3. This Court has jurisdiction pursuant to 28 U.S.C. 157 and 1334. This is a core

proceeding pursuant to 28 U.S.C. 157(b)(2).

{33423\1\DT255256.DOC;2}

0W[;'%.

0555927070514000000000017

1L

4.

On or about April 2, 2007, the Debtors submitted the Sale Motion. The deadline

to object to the Sale Motion was extended to May 11, 2007. 5. Valiant is a party to purchase orders with certain of the Debtors in the above-

captioned case, for the ongoing production of tooling for Debtors. 6. subsidiaries. 7. Currently pending in the Superior Court of Justice, in Windsor, Ontario, Canada, Valiant is not only a creditor of Debtors but also of certain of Debtors Canadian

is an action by Valiant against Collins & Aikman Automotive Canada Company (C&A Canada), a non-debtor entity, with court file number 06 CV 8313 CM (the Canadian Proceeding). In the Canadian Proceeding, Valiant is seeking damages in the amount of $1,527,566.23 plus interest (the C&A Indebtedness). 8. Because neither the Debtors nor C&A Canada would admit liability for the C&A

Indebtedness, Valiant also filed a secured claim in the Debtors chapter 11 bankruptcy for the C&A Indebtedness. The C&A Indebtedness is secured by certain tools and equipment (the Valiant Assets) by the Michigan Moldbuilders Lien Act and/or Canadian law. The ultimate customer for the tools and equipment was Honda Of America Mfg., Inc. (Honda) 9. On or about December 12, 2006, Debtors filed a Notice of Sale of de Minimis

Assets to Honda (the Notice). The equipment and/or tooling subject to the Notice appeared to be assets in which Valiant claimed a lien. As such, Valiant objected to the sale of its collateral until any lien issues could be resolved. Based on that objection, Debtors withdrew the Notice. See attached Exhibit A. Valiant was advised that Debtors would not sell the tools and equipment subject to the notice to Honda absent Valiants consent or further court order. See attached email, Exhibit B.

{33423\1\DT255256.DOC;2}

10.

Upon information and belief, either the Debtors or C&A Canada subsequently

transferred the assets subject to the Notice to Honda without seeking further court approval. In addition, upon information and belief, either Debtors and/or C&A Canada transferred all other Valiant Assets to Honda. To date, Valiant has been unable to confirm this transfer, including who made the transfer and on what terms. 11. The Sale Motion contemplates approval of an Asset Purchase Agreement (the

APA) by and among Cadence Innovation LLC as purchaser (the Purchaser), and certain of the Debtors. The APA contemplates a sale of certain of the assets of the Debtors interior plastics division (the Sale) and an assumption of certain of the Debtors contracts associated with the interiors plastics division. 12. In addition, upon information and belief, the Sale Motion contemplates that the

Debtors will cause their non-debtor Canadian subsidiaries to sell certain of the Canadian assets without paying the creditors of the Canadian subsidiaries. 13. Furthermore, the Canadian assets are included in the definition of Purchased

Assets under the APA. The proposed sale order (the Sale Order) contemplates that all entities will be enjoined from pursuing the Purchaser or the Purchased Assets in connection with their claims against the Canadian subsidiaries. 14. Upon information and belief, the ongoing purchase orders between Valiant and

the Debtors are intended to be transferred to Purchaser in connection with the Sale. Valiant, however, has received conflicting notices in connection with the sale. 15. Attached as Exhibit C is a notice that Valiant received regarding purchase orders

that Debtors seek to assume and assign to Purchaser. That notice does not include the following purchase orders which are currently in process: 66477, 66510, 66569, 66568, 66567, 66582,

{33423\1\DT255256.DOC;2}

66584, 65593, 64979, 65934, 66151, 64331, 65934, 62001, 62285, 61299, 85466, 403540, 401490, 404332, 404723 and 402485. The notice lists all the cure amounts as $0, despite that some of these contracts have past due amounts currently owing.. 16. Valiant also received a conflicting notice of clerical error attached as Exhibit D.

That notice lists some of the same contracts that are in Exhibit C, but instead notes that those contracts had been mistakenly listed as executory contracts that could be assumed. 17. Finally, Valiant received a notice of clerical error regarding a confidentiality and

non-disclosure agreement that Valiant is unaware of. OBJECTIONS TO THE PLAN 18. With respect to ongoing tooling purchase orders with the Debtors, Valiant

conditionally objects to the Sale Motion because it is currently unclear under the Sale Motion and subsequent notices which of the ongoing purchase orders are being transferred to the Purchaser in connection with the Sale. It is also unclear whether Valiant deems such contracts to be executory contracts. As such, Valiant reserves its rights to object to the Sale pending further information regarding what contracts are being transferred. 19. Valiant further objects to the transfer of the open tooling orders to the extent the

Purchaser is not assuming the obligations under the purchase orders, including the past due cure amounts. In addition, Valiant reserves the right to amend this objection once Valiant determines the actual cure amounts under the contracts that Debtors ultimately determine to assume. 20. Valiant further objects to the Sale Motion because Valiant has not been provided

with adequate assurance of future performance by Cadence or the Debtor as required by U.S.C. 365(f)(2)(B). Valiant is entitled to determine whether an assignee to the purchase orders is in fact credit worthy.

{33423\1\DT255256.DOC;2}

21.

With respect to Valiants claim against C&A Canada, Valiant objects to the Sale

to the extent the Sale Order seeks to enjoin Valiant from taking an action against the Purchased Assets or the Purchaser. The relief that Debtors seek in the Sale Order affecting Canadian assets, is beyond the scope of jurisdiction of a United States bankruptcy court. 22. Valiant further objects to the sale of the C&A Canada assets to the extent that the

sale proceeds are not being utilized to pay C&A Canada creditors, but rather will be distributed to C&A Canadas parent corporation, the Debtors in these proceedings. If in fact the sale proceeds will be transferred directly to C&A Canada, the proceeds should be frozen for the benefit of C&A Canada creditors. 23. Finally, it is unclear whether the Valiant Assets are subject to this Sale. Upon

information and belief, Debtors and/or C&A Canada may have already sold the assets subject to Valiants liens to a third-party. Given the uncertainty regarding what is being sold in this case, Valiant would like documentation regarding the status of the Valiant Assets, including, without limitation, who held title to the assets, whether and in what manner they were transferred to Honda, and what the consideration was for the transfer. Valiant further reserves its right to object to the Sale Motion if in fact the Valiant Assets will be included in the Sale. WHEREFORE, for the reasons stated above, Valiant respectfully requests that this Court deny the Sale Motion, require that the Debtors make more specific disclosures regarding what is being sold, and grant such further relief as is equitable and just.

{33423\1\DT255256.DOC;2}

Dated: May 11, 2007

KERR, RUSSELL AND WEBER, PLC

/s/ Laura J. Eisele Laura J. Eisele (P42949) Attys. for Valiant Tool & Mold, Inc. 500 Woodward Avenue, Suite 2500 Detroit, MI 48226 (313) 961-0200

By:

{33423\1\DT255256.DOC;2}

You might also like

- Et Af.,iDocument22 pagesEt Af.,iChapter 11 DocketsNo ratings yet

- Brief in Support of Motion of Collins & Aikman Floorcoverings, Inc. For Entry of An Order Deeming Proof of Claim Timely FiledDocument11 pagesBrief in Support of Motion of Collins & Aikman Floorcoverings, Inc. For Entry of An Order Deeming Proof of Claim Timely FiledChapter 11 DocketsNo ratings yet

- What Constitutes Sufficient Notification of A Security InterestDocument3 pagesWhat Constitutes Sufficient Notification of A Security InterestYolanda LewisNo ratings yet

- Answer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefDocument11 pagesAnswer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefChapter 11 DocketsNo ratings yet

- Original: Et Al,'Document3 pagesOriginal: Et Al,'Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument13 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Metropark Usa, Inc.Document20 pagesMetropark Usa, Inc.Chapter 11 DocketsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument47 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationDocument19 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court For The Eastern District of MichiganDocument4 pagesUnited States Bankruptcy Court For The Eastern District of MichiganChapter 11 DocketsNo ratings yet

- Eastman Kodak Co. v. Atlanta Retail, Inc., 456 F.3d 1277, 11th Cir. (2006)Document17 pagesEastman Kodak Co. v. Atlanta Retail, Inc., 456 F.3d 1277, 11th Cir. (2006)Scribd Government DocsNo ratings yet

- Objection of Visteon Corporation To Debtors' Motion For Order Deeming Reclamation Claims To Be General Unsecured Claims Against The DebtorsDocument8 pagesObjection of Visteon Corporation To Debtors' Motion For Order Deeming Reclamation Claims To Be General Unsecured Claims Against The DebtorsChapter 11 DocketsNo ratings yet

- Et AlDocument27 pagesEt AlChapter 11 DocketsNo ratings yet

- Letters of Credit and Trust Receipt Digests Under Atty Zarah Castro VillanuevaDocument20 pagesLetters of Credit and Trust Receipt Digests Under Atty Zarah Castro VillanuevaJun TabuNo ratings yet

- Colorado Attorney General Suit United Credit RecoveryDocument19 pagesColorado Attorney General Suit United Credit Recoveryconsumadvocat41576No ratings yet

- Sale Procedures Hearing Date: October 23, 2008 at 1:30 P.M. Sale Procedures Objection Deadline: October 22, 2008 at 4:00 P.M. Related Docket Nos. 620, 621Document20 pagesSale Procedures Hearing Date: October 23, 2008 at 1:30 P.M. Sale Procedures Objection Deadline: October 22, 2008 at 4:00 P.M. Related Docket Nos. 620, 621Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument41 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Pro Se Movant - Motion For Appointment of Ch. 11 TrusteeDocument120 pagesPro Se Movant - Motion For Appointment of Ch. 11 TrusteeSNo ratings yet

- Colfax Federal ComplaintDocument35 pagesColfax Federal ComplaintStatesman JournalNo ratings yet

- Allied Banking Corporation vs. Court of AppealsDocument5 pagesAllied Banking Corporation vs. Court of AppealsbittersweetlemonsNo ratings yet

- Attorneys For Flextronics Industrial, LTD.: United States Bankruptcy Court For The District of DelawareDocument9 pagesAttorneys For Flextronics Industrial, LTD.: United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000025381Document124 pages10000025381Chapter 11 DocketsNo ratings yet

- Velasquez v. Solidbank Corp. (2006)Document4 pagesVelasquez v. Solidbank Corp. (2006)Prin CessNo ratings yet

- Attorneys For Cwcapital Asset Management, LLC: TH THDocument7 pagesAttorneys For Cwcapital Asset Management, LLC: TH THChapter 11 DocketsNo ratings yet

- Corpo Prelim WeekDocument22 pagesCorpo Prelim WeekEmman KailanganNo ratings yet

- WMI V FDIC ComplaintDocument39 pagesWMI V FDIC Complainti8wamuNo ratings yet

- BKBorders11 06-09StoreListDocument92 pagesBKBorders11 06-09StoreListHonolulu Star-AdvertiserNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- Original: Et AlDocument3 pagesOriginal: Et AlChapter 11 DocketsNo ratings yet

- Prudential Bank Vs AlviarDocument3 pagesPrudential Bank Vs AlviarNicky GalangNo ratings yet

- SC upholds liability of guarantorsDocument161 pagesSC upholds liability of guarantorsLi MaeNo ratings yet

- Mortgage VODDocument6 pagesMortgage VODmanitobamktg67% (3)

- Letters of Credit and Trust Receipt Digests Under Atty Zarah Castro-VillanuevaDocument16 pagesLetters of Credit and Trust Receipt Digests Under Atty Zarah Castro-VillanuevaBAMFNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 10000026887Document4 pages10000026887Chapter 11 DocketsNo ratings yet

- 10000001721Document4 pages10000001721Chapter 11 DocketsNo ratings yet

- Letter of Credit Bank of The Phil. Islands vs. de Remy Fabric Industries, Inc. FactsDocument16 pagesLetter of Credit Bank of The Phil. Islands vs. de Remy Fabric Industries, Inc. FactsLea SudioNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument18 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Prudential Bank Vs AlviarDocument3 pagesPrudential Bank Vs Alviarcmv mendozaNo ratings yet

- United States Court of Appeals: PublishedDocument55 pagesUnited States Court of Appeals: PublishedScribd Government DocsNo ratings yet

- United States Bankruptcy Court For The Eastern District of Michigan Southern DivisionDocument20 pagesUnited States Bankruptcy Court For The Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Corpo Digested Cases 1st WeekDocument4 pagesCorpo Digested Cases 1st WeekHuey CalabinesNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument7 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument538 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- 058 Stone v. EachoDocument3 pages058 Stone v. EachojoyceNo ratings yet

- Abi Kalimian, Elias Kalimian and Morad Kalimian, Doing Business As Kalimko Buying Service v. Liberty Mutual Fire Insurance Company, and Cross-Appellant, 300 F.2d 547, 2d Cir. (1962)Document4 pagesAbi Kalimian, Elias Kalimian and Morad Kalimian, Doing Business As Kalimko Buying Service v. Liberty Mutual Fire Insurance Company, and Cross-Appellant, 300 F.2d 547, 2d Cir. (1962)Scribd Government DocsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Ackground and Rocedural IstoryDocument28 pagesAckground and Rocedural IstoryChapter 11 DocketsNo ratings yet

- In Re Cross Baking Co., Inc., Debtor. New Hampshire Business Development Corporation v. Cross Baking Company, Inc., 818 F.2d 1027, 1st Cir. (1987)Document11 pagesIn Re Cross Baking Co., Inc., Debtor. New Hampshire Business Development Corporation v. Cross Baking Company, Inc., 818 F.2d 1027, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- Consent Order Encore Capital Group, Inc., Midland Funding, LLC, Midland Credit Management, Inc. and Asset Acceptance Capital Corp.Document63 pagesConsent Order Encore Capital Group, Inc., Midland Funding, LLC, Midland Credit Management, Inc. and Asset Acceptance Capital Corp.Juan Viche100% (1)

- Et Al.,t: Re: Docket Nos. 74, 106, 122, 149, 154 &Document3 pagesEt Al.,t: Re: Docket Nos. 74, 106, 122, 149, 154 &Chapter 11 DocketsNo ratings yet

- Capital Ventures International v. Republic of Argentina, No. 05-2591-Cv, 443 F.3d 214, 2d Cir. (2006)Document12 pagesCapital Ventures International v. Republic of Argentina, No. 05-2591-Cv, 443 F.3d 214, 2d Cir. (2006)Scribd Government DocsNo ratings yet

- In Re) Chapter 11: in The United States Banuptcy CourtDocument14 pagesIn Re) Chapter 11: in The United States Banuptcy CourtChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument9 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- M&A Disputes: A Professional Guide to Accounting ArbitrationsFrom EverandM&A Disputes: A Professional Guide to Accounting ArbitrationsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Anglais 1Document3 pagesAnglais 1idilmiNo ratings yet

- CV QU Contoh CVDocument2 pagesCV QU Contoh CVroonzNo ratings yet

- Chapter 5 Practice QuestionsDocument5 pagesChapter 5 Practice QuestionsFarah YasserNo ratings yet

- Lesson 6 - Price LevelDocument17 pagesLesson 6 - Price LevelMuktesh SinghNo ratings yet

- Shareholders' Equity: Question 45-1Document18 pagesShareholders' Equity: Question 45-1debate ddNo ratings yet

- Statement of Account: Locked Bag 980 Milsons Point NSW 1565Document9 pagesStatement of Account: Locked Bag 980 Milsons Point NSW 1565Tyler LindsayNo ratings yet

- Principles of Corporate PersonalityDocument27 pagesPrinciples of Corporate PersonalityLusajo Mwakibinga100% (1)

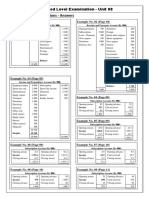

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Document12 pagesNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaNo ratings yet

- Product and Brand ManagementDocument57 pagesProduct and Brand ManagementAshish Adholiya100% (1)

- 5 Navarra Vs Planters BankDocument15 pages5 Navarra Vs Planters BankJerric CristobalNo ratings yet

- Quiz BowlDocument3 pagesQuiz BowljayrjoshuavillapandoNo ratings yet

- Children Education Allowance Claim FormDocument3 pagesChildren Education Allowance Claim FormSUSHIL KUMARNo ratings yet

- Irrevocable Power of AttorneyDocument6 pagesIrrevocable Power of AttorneyAlpesh ThakkarNo ratings yet

- PB1.3 CH1 Using NumbersDocument22 pagesPB1.3 CH1 Using NumbersGadgetGlitchKillNo ratings yet

- Module 2 Study GuideDocument6 pagesModule 2 Study Guidemarkesa.smithNo ratings yet

- Philippine Steel Industry CompetitivenessDocument49 pagesPhilippine Steel Industry CompetitivenessEricka CabreraNo ratings yet

- DIfference Between Indian and US GAAPDocument2 pagesDIfference Between Indian and US GAAPMark Dela CruzNo ratings yet

- The Tyler Group Wealth ManagementDocument16 pagesThe Tyler Group Wealth ManagementhuberthvargasNo ratings yet

- Ali Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillDocument1 pageAli Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillMuhammad Irfan ButtNo ratings yet

- General Principles of TaxationDocument25 pagesGeneral Principles of TaxationJephraimBaguyo100% (1)

- Conceptual Frameworks of Accounting From An Information PerspectiveDocument14 pagesConceptual Frameworks of Accounting From An Information PerspectivePhilip VoNo ratings yet

- Chap 9Document7 pagesChap 9GinanjarSaputra0% (1)

- Forbes 12 Best Stocks To Buy For 2024Document29 pagesForbes 12 Best Stocks To Buy For 2024amosph777No ratings yet

- 2012-2013 PNHA Tables - 2Document9 pages2012-2013 PNHA Tables - 2Juan CarlosNo ratings yet

- Master Direction Risk ManagementDocument94 pagesMaster Direction Risk ManagementRajeev CHATTERJEENo ratings yet

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- Assignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessDocument7 pagesAssignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessTuong Tran Gia LyNo ratings yet

- Car Loan Application FormDocument6 pagesCar Loan Application FormSuhail AhmedNo ratings yet

- Excess and Surplus Lines Laws in The United States - 2018 PDFDocument154 pagesExcess and Surplus Lines Laws in The United States - 2018 PDFJosué Chávez CastellanosNo ratings yet

- 2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Document116 pages2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Maha8888No ratings yet