Professional Documents

Culture Documents

Muhammad Umar Internee of ZTBL: Rlending Procedure in ZTBL

Uploaded by

M Umar AshrafOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Muhammad Umar Internee of ZTBL: Rlending Procedure in ZTBL

Uploaded by

M Umar AshrafCopyright:

Available Formats

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 1

M.umar

Rlending procedure in ztbl

Muhammad Umar Internee of ZTBL

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 2

M.umar

Name Page No

Executive Summary

03

Agriculture plays an important role in Pakistan economy

04

Objective of agriculture

05

Product lines of ZTBL

06

Lending procedure of ZTBL

10

Critical Analysis

16

Conclusions and suggestions

18

Reference

21

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 3

M.umar

Executive Summary

Agriculture plays an important role in the national economy of Pakistan, where most of the

rapidly increasing population resides in rural areas and depends on agriculture for subsistence.

Biotechnology has considerable potential for promoting the efficiency of crop improvement,

food production, and poverty reduction. Use of modern biotechnology started in Pakistan since

1985. Currently, there are 29 biotech centers/institutes in the country.

The object of Agriculture has changed form self-reliance to Commercialization and this is

called Economic operation in Agriculture. This research comprising the several variables having

some predictors and self-sufficient. Gross Domestic product is one of the well-built indicators to

measure the growth pattern of the economy. It notifies the Aggregate value of all final goods and

services produced within a country over the specific time period. According to the World Bank

the GDP of Pakistan was $161.99 Billion or 5,475,716 Million in PKR in the year 2009.

Banking is one of the most sensitive businesses all over the world. Banks play very important

role in the economy of every country all over the world and Pakistan is no exemption. ZTBL is

playing its one of the most important role in the development of the Agriculture Sector of the

Pakistan. On 14th December 2002, under the ordinance of the Agricultural Development of the

Pakistan 1961, ZTBL was incorporated as Public Limited Company. This Bank severs its

venerated customers in the form of different customized products. It is providing both type of

severs financial and non-financials mostly to its clients of the rural areas of the Pakistan, which

comprises of 68% of the Pakistans total population.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 4

M.umar

Agriculture Plays an Important Role in

Pakistan Economy

Agriculture plays an important role in the national economy of Pakistan, where most of the

rapidly increasing population resides in rural areas and depends on agriculture for subsistence.

Biotechnology has considerable potential for promoting the efficiency of crop improvement,

food production, and poverty reduction. Use of modern biotechnology started in Pakistan since

1985. Currently, there are 29 biotech centers/institutes in the country. However, few centers have

appropriate physical facilities and trained manpower to develop genetically modified crops. Most

of the activities have been on rice and cotton, which are among the top 5 crops of Pakistan.

Biotic (virus/bacterial/insect) and a-biotic (salt) resistant and quality (male sterility) genes have

already been incorporated in some crop plants. Despite acquiring capacity to produce transgenic

plants, no genetically modified crops, either produced locally or imported, have been released in

the country. Pakistan is signatory to the World Trade Organization, Convention on Biological

Diversity, and Cartagena protocols. Concerted and coordinated efforts are needed among various

ministries for implementation of regulation and capacity building for import-export and local

handling of GM crops. Pakistan could easily benefit from the experience of Asian countries;

especially China and India, where conditions are similar and the agriculture sector is almost like

that of Pakistan. Thus, the exchange of information and experiences is important among these

nations.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 5

M.umar

Objective of agriculture:

The object of Agriculture has changed form self-reliance to Commercialization and this is

called Economic operation in Agriculture. Farming supplies is now being changed instead to

individual benefits but as exchange commercial business. The aim of production converted into

maximization the profitable level. Similarly the concept of self-sufficiency has become changed

into profit maximization. This research comprising the several variables having some predictors

and self-sufficient. Gross Domestic product is one of the well-built indicators to measure the

growth pattern of the economy. It notifies the Aggregate value of all final goods and services

produced within a country over the specific time period. According to the World Bank the GDP

of Pakistan was $161.99 Billion or 5,475,716 Million in PKR in the year 2009.

.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 6

M.umar

PRODUCT LINES OF ZTBL

Product lines of ZTBL

The ZTBL provides various products and services to its customers. The products and

services offered by ZTBL can increase the living standards of farmers in rural areas and also the

agriculture sector is developing. The people of Pakistan mostly depend on agriculture and the

products and services of ZTBL are performing a major role in increasing the GDP of the country

and in promoting the economic growth. So the ZTBL provides different facilities to its customers

such as various schemes and loans to invest in their business in order to earn more profit and to

pay low interest rate. The schemes and loan of ZTBL are given below.

Schemes of ZTBL

The ZTBL provides various schemes for its customers. The purposes of these schemes

are to develop the agriculture sector, reduce the poverty and increase the economic growth.

Schemes of ZTBL are explained below;

Sairab Pakistan Scheme

The purpose of this scheme is to increase the irrigated area in the country to promote the

economic growth and assist the farmers for cultivation. The water plays an important role to

increase the yield per acre. The total area of Pakistan is 31 million hectors of which 22million

hectors is cultivated but the remaining 9 million hectors is notable for cultivation because of non

supply of water. For this purpose the ZTBL has signed an agreement with KSB pumps company

Limited under Sairab Pakistan scheme. The ZTBL will provide loan to the farmers for the

installation of tube wells and turbines while KSB Pumps Company will provide pumps, turbines

and other equipments for pumping of waters. The ZTBL has financed about 143000 Tube wells

which amount to Rs: 15billions. The company will also provide after sale services to the farmers

which include the spare parts and replacement of damaged parts to develop the agriculture.

Because Agriculture is the life blood of the countrys economy and it contributes 22% of GDP

and employs about 45% of country workforce. It has also an impact on industrial sector because

it provides raw material to industries. So it has a huge effect on economy.

Supervised Agriculture Credit Scheme

Under supervised agriculture credit scheme short term medium and long term

loans are given to farmers. The limit of these loans is up to 1 million per borrower. These loans

are given for tractors, agriculture machinery, livestock, tube wells and other facilities. Besides

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 7

M.umar

the loan information is also provided to the farmers for planning the agriculture, increase in

production, provision of the scheme and also how to repay the loans to the bank.

White Revolution Scheme

The purpose of this scheme is to increase the supply of milk by improving dairy farming,

reduce the poverty in Pakistan and raise the living standards of people in rural areas in order to

achieve growth and development in agriculture sector. For this purpose the ZTBL has made an

agreement with Pakistan Dairy Development Company (PDDC) and Nestle Pakistan Limited

(NPL) under white revolution scheme. By this approach the dairy sector will be improved in

order to increase supply of milk, reduce the poverty and raise the living standards in rural areas.

To improve the dairy production ZTBL has sanctioned RS: 5000 million for financing 50,000

animals during the year 2007-2011. The PDDC will help ZTBL to select clients and in the

process of loaning. This scheme is for 5 years and 5000 farmers will receive the loans. 1000

farmers will receive the loans per year. This scheme include financing of milk cooling tanks,

generator, Voltage stabilizer, water geezer, water pumps, cooling pad and other dairy

equipments. The limit of loan in this scheme is Rs: 1 million per borrower. The PDDC will bear

the total markup charged on the loan. 50% of the total amount of loan will be repaid in time by

borrower while the 50% amount with markup will be paid by PDDC.

The Nestle Pakistan Limited will help ZTBL to improve the quality breed of foreign and

local dairy animals. NPL will also help the farmers through Veterinary doctors. The NPL will

purchase milk and make weekly payment to ZTBL for adjustment of loan.

Micro Credit Scheme

This scheme was introduced on 15th July, 2000 and the purpose of this scheme is to

reduce the poverty in rural areas. Those people who have small lands not more than 2 acres they

can get loan from ZTBL under micro credit scheme. This scheme is operational in all branches

of ZTBL. Men and women both can get loan under this scheme. The minimum limit in this

scheme is Rs.5000 while the maximum limit is Rs.25000. the loan under this scheme is given by

taking a surety or security of tangible property or 50% of solvency of the property. These loans

have high mark-up rate of 18% per year because of its small size while 2% rebate is given on

timely payment. The loans under this scheme are recoverable within 18 months.

Zarkhaiz Scheme (one window operation)

For purchasing the inputs timely and conveniently the farmers are provided loans twice a

week in Rabi and Kharif seasons under this scheme. The farmer receives their pass books which

are prepared and also the loan application on the same day while the loan is paid within three

days to the farmers at the branch. This scheme for Rabi crops is from October to January while

for Kharif it is from April to September each year which may be extended according to

requirement of certain area.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 8

M.umar

Sada Bahar Scheme

To provide loans for crops and working capital for poultry and fisheries on time the ZTBL has

introduced this scheme. This scheme is also called revolving finance scheme. The amount

required is assessed for the whole year at the time of first application. The amount is paid with in

the security limit. The loan limit in this scheme is up to 5 Lacks.

This scheme has some features which are;

The amount of credit limit is fixed according to the requirement of the farmers during one

year.

The borrower can draw the amount in a lump sum or in installment according to his

requirements

The borrower can repay the amount in lump sum or in installment during the year

depending upon the financial position.

The pass Book which contains the transaction of the borrower in his account be supplied

to all borrowers without cost.

Tea Financing Scheme

The maximum limit of loan per acre is Rs: 60,000 which have been fixed.

The farmer who land up to 5 acre can get the loan.

The amount of loan is given in three installments. The installment for first year is Rs:

30,000. The installment for 2nd year is RS: 15,000. And for 3rd year is Rs: 15000.

The amount is repayable within 11 years with 9% markup per year.

Loans of ZTBL

The ZTBL provides loans for the growth and development of agriculture to raise the

living standards and income of the farmers and also to make this country prosperous.

Loans of ZTBL are given below

Production Loans

Production loans are provided to farmers for seeds , fertilizers, pesticides, labor charges etc in

order to grow crops and vegetables which include the day to day capital requirement for fisheries

, dairy and poultry. These loans are recoverable during one and a half year. The amount of

production loans given to farmers at the end of Dec, 31, 2010 is 51,323 million in all provinces.

Examples of production loans items are bellow.

Pesticides, herbicides, insecticides, manual sprayer.

Seeds, fertilizers and fuel.

Poultry foods, chicks and medicense.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 9

M.umar

Charges of labor, power and water.

Development Loans

These loans are given to farmers for purchase of different items like farm machinery, tractors,

irrigation, green houses, dairy, poultry, fishery, livestock and farming. These loans are

recoverable from one to eight years. The total amount of development loan given is Rs: 6690

million at the end of 2010.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 10

M.umar

LENDING PROCEDURE OF ZTBL

Lending of Loan

ZTBL provide loans for various agriculture sectors. It provides loans for irrigation of land,

fertilizers, pesticides, tractors, fisheries, dairy production and so on. ZTBL may provide short

term, medium and long term.

Short Term

The duration of short term loan is one year. These loans are provided to farmers for seed,

fertilizers, pesticides, labor charges in order to grow vegetables and crops. These loans are also

called production loans and these loans are recovered in a lump sum after the harvesting of the

crops.

Medium Term

These loans are for the purpose of development. These loans are given for dairy farming

and livestock. These loans are paid in installments of monthly, biannually and annually basis and

recovery period is 5years.

Long Term

These loans are given to farmers for tractors, agricultural machinery and poultry farming.

These loans are paid in installments of monthly, biannually and annually basis. The recovery

period of these loans is 8 years and above.

Steps in Lending Procedure

In order to get the loan from the bank, the farmers have to pass through many steps which

are;

Loan Application

The loans applications are available at each branch of the bank. Each branch will assess their

annual requirements and will ensure the availability of application forms in sufficient quantity at

each branch. The price of one application form is Rs: 20 and these are issued in their serial

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 11

M.umar

numbers. These loan applications are not allowed on simple papers. For one window operation

these forms are available free of cost. The loan application forms are available at each branch for

sale to the public during working hours of the bank. The loan application forms can also be sent

to the farmers by post, bearing the postal charges. If the loans is sanctioned by the branch one

copy of loan application may be submitted. If the loan is sanctioned by the regional manager,

two copies of loan application may be obtained and if the loan is sanctioned by the head office

the borrower may be asked to submit three copies of the form.

Appraisal of Loan Applications

For appraisals of the loan proposal the following documents are used.

Index sheet.

Loan application form.

Credit investigation report.

Opinion of legal advisor.

Sanction orders in secured cases.

Sanction orders in surety cases.

Acceptable Securities and Assessment of Valuation of a Security

The ZTBL take securities in the form of property in order to advance the loans to the farmers.

The securities may be agriculture land, residential/commercial plots and buildings. The bank

may also take personal surety from the borrower. The purpose of taking security is to secure the

repayment of loans from borrower. If the borrower defaults in the repayment of loans, the bank

can lay direct claim on the property of the borrower and the property like agricultural land lay in

the custody of the bank. The securities in which the bank takes may be movable and immovable

property. Immovable property include agricultural land, plots, commercial buildings etc while

moveable property include bank guarantee or guarantee of central and provisional government.

Assessment of Valuation of Security

To assess the value of the property which is offered as security, the appraisal staff will

valuate the property in order to do justice with the borrower and also to protect the interests of

the bank. The elements of speculation are avoided. The staff will assess the value so that it does

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 12

M.umar

not seriously affect the borrower and also keeping in view the interests of the bank. The value of

land is assessed under pass book system the agricultural land is valuated according to the market

price or index units (P.I.Us) at maximum rate of Rs: 400/ produce index unit at the option of the

borrower. Market price means the average sale price of land during 3years. In order to provide

valuation facility, the branches will obtain for record and references, the booklet of product

index which is published under the authority of Pakistan land commission.

ZTBL give loans to the farmers on agricultural passbook system for the purpose of

developing the agricultural sector of economy. This system was introduced by the Federal

Government in order to make the loan process easier. In 1987 some amendments were made in

the passbook system. It can also be issued to companies now.

Advantage of Agricultural Pass Book System

There are some rules under which the pass book is provided to land owner.

It includes his identity card.

A certified copy lf his title to the land given.

It includes a guide of the valuation of his land and his loan limits.

It includes his complete transactions record with the ZTBL and other Banks.

Loaning Scheme

The bank provides loans for all schemes in order to maximize cultivation of lands and

increase the yield of production. The bank provides finances for various facilities such as dairy

farming, irrigation of land, fisheries, poultry and fruit farming etc. and also the agro-based

industries. Each scheme should be properly planned and reliable in order to get maximum

benefits at low cost. If the scheme is properly planned and finances are utilized effectively by the

farmers they will not only be able to repay their loans easily but also cover their expenses on

implementation of the scheme but also get surplus.

The limit of loans for each scheme is fixed by the head officer and revises it from time to

time. All branches should implement these limits while advancing the loans. No loan should be

given beyond the rate fixed by the Head Office.

Sanctions of Loans

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 13

M.umar

When the mobile credit officer submits a complete loan case with all the relevant documents,

the Branch manager thoroughly and closely examines the case by focusing on the following

points

The Branch manager examines the loan proposal of borrower, the items included for

loans and suggestions for payments are according to the instructions of the Bank.

The project for which the loan is granting is economically feasible and that the scheme is

right for financing.

The amount of loan recommended for different items is fair and appropriate and also the

market rates and given rates are according to guidelines of Bank.

The borrower is an active farmer. He has sufficient resources to invest in the project and

he has knowledge, experience to manage the project by himself or make arrangements for

it.

The branch manager also examines that the MCO has thoroughly verified and examined

the documents of the property. The property which is offered as security is legally owned

and is free from any lawful disputes. The manager has also to ensure that the value of the

property is correctly assessed according to the procedure of the Bank.

If the manager is in doubt he may refer the loan case to the Regional Manager for guidance. The

Regional Manager records his opinion after consulting the legal advisor if needed.

Documentation

When the branch manager is satisfied with the loan case the following documents are required

before disbursement of loan.

Mortgage deed.

Charge creation deed.

Hypothecation deeds.

Pledge deed.

Disbursement of Loans

When the loan is sanctioned, efforts are made to disburse the loan to the borrower as soon as

possible. Sometimes, there is delay in disbursement of loan due to non presence of mortgage

deed, charge creation certificate etc. In such cases the sanction may be maintained for 6months

to complete the documentation. It may be renewed for further six months by the borrower on his

written request. In some cases the borrower cannot get the loan after documentation due to some

reasons. In such cases the loans should not be cancelled by one year. However it can be extended

for further six months on the request of the borrower. In certain cases, after completing the

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 14

M.umar

documentation and before disbursement the borrower defaults in some other cases. In such cases

the disbursement of the sanctioned loan should not be started and if partial disbursement has

been made further disbursement should be stopped before getting clearance of the default. If the

borrower fails to fulfill the requirements of the bank before the stipulated time, the sanction

becomes, the sanction becomes invalid. If no action is taken on the lapsed sanction, the sanction

letter is crossed by the word cancelled written in capital letters and signed by Branch Manager.

A note is also recorded in the loan file with red ink that sanction cancelled and the case closed.

The Bank pays the loan in lump sum or in installments according to the requirement of the

project. The borrower will invest the finances according to the prescription of the bank.

Subsequent installments are paid before verification of utilization to earliest installment.

Utilization of Loan

The bank has to ensure as much a possible that the loan has been spent for the purpose for

which it was granted. If the borrower is not spending the loan for the purpose, the bank can

recall the entire loan back.

The branch has to make sure that the subsequent installments should be paid before

verification of earlier installments been properly utilized.

The MCO is responsible for checking the 100% utilization of loans in his area. The MCO

copy the utilization reports and file it with files of the loans signed by MCO and counter-signed

by the manager. The MCO has to visit the farms of the borrowers in his circles to verify that the

loans are being utilized for the purpose provided by the bank and submits his utilization report

to the bank. During his visit he should also work on the recovery of default loans.

Repayment of Loan

Repayments of loans are fixed on certain basic principles. The installments will be repaid

after the surplus income left with the borrower after covering the cost of production. The

recovery of loans for seeds, fertilizers and other seasonal requirement starts after harvesting the

crops for which the loan was given.

As a rule of the banks 50%of the surplus income is left with the farmer to cover his cost

of production and his own expenses while the remaining 50% of the surplus income of the

borrower is to be repaid in installments to the bank.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 15

M.umar

The recovery time period or loan depends on the type of loan whether the loan is short

term, medium or long term.

Recovery of Loan

There are three steps in the recovery procedure of loan of ZTBL. These steps are

recovery schedule, issuance of notice and legal action which are explained below.

Recovery Schedule

The recovery schedule is fixed according to the terms of sanction of each loan case and it

is communicated to the borrower after disbursement of loan. If the borrower defaults in the

repayments of any installments on its due date the mark-up will be charged continuously and the

amount of last installment may differ from the amount of installment which was fixed at the time

of disbursement.

Issuance of Notice

The bank can issue a notice before the due date of each installment in order to recover the

loans which is called Demand Notice. The bank issue a legal notice to the borrower after one

month of the due date to repay the amount within one month , otherwise the loan can be

recovered by taking legal action.

Legal Action

If the borrower does not repay the amount after expiry of legal notice then legal actions

are taken to recover the loan. The court declares the case in banks favor and the bank recovers

the amount by auctioning the mortgage property. The bank may purchase the mortgage property

and sell in through auction to get the best price.

The bank may also dispose off the mortgage property to recover its dues without

intervention of courts and FINANCIAL INSTITUTIONS ORDINANCE 2001

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 16

M.umar

CRITICAL ANALYSIS

An internship is an activity which allows the student to know about both the positive and

negative aspects of the organization. The ZTBL have many positive aspects but it also have some

drawbacks and problems which should be improved and fixed with the passage of time. Some of

the problems are;

Deficiencies in Disbursement of Loans

Firstly the ZTBL give loans to the farmers for agriculture purpose. The farmers face

difficulties in order to get the loan which are required for their needs, for example Seeds,

fertilizers, poultry etc. the farmers have to go through a long process in order to get the loan. He

has to prepare various documents which usually cause delay in the payment of loan, and so the

farmer is deprived of getting the loan on time. The ZTBL should make it easy for the farmers to

get the loan on time.

Secondly there is no proper check and balance on the loan provided by the ZTBL to the

farmers for agriculture. The farmers sometime do not utilize the loan for the purpose for which it

is taken. So the bank has to make sure that the amount is used for the purpose for which it is

taken. The bank has to make sure that the amount is using for the purpose for which it was taken.

Thirdly, the mark-up charged on the loan in very low. The mark-up rate is 9% while the

state bank provide loan to ZTBL at 8% which is not good for the bank , Because the bank cannot

covers its cost and other expenses on such a lower rate and thats why the bank often suffer the

loss.

Some time the borrower fails to repay the loan so the bank recovers the amount by

auctioning his whole property which is not a justice on the borrower side. So the bank should do

justice on both sides.

Deficiencies in Recovery of Loan

The recovery system of bank is not good. In certain cases the borrowers do not repay the

loan on its due date or do not repay it at all which badly affect the performance of the bank. So

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 17

M.umar

the bank should improve its recovery system in order to meet its future credit requirement. The

bank particularly failed in the last three years to recover its total amount from the borrower

which was paid to them.

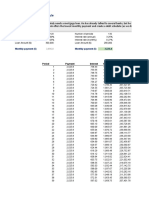

For example; in 2008 the bank had to recover Rs: 196,807 millions but the total amount

recovered was Rs; 16, 2507 millions which is 83% of the total amount recoverable.

Similarly, in 2009 the total recoverable amount was Rs; 19,297 millions but but the

amount recovered was Rs: 178650millions which is 93% of the total amount. In the same way in

2010 the total recoverable amount was Rs; 16, 4943 millions but the bank recovered only Rs;

16,217 million, which is 10% of the total amount recoverable amount. So it means that the bank

has not recovered a lump sum amount in these years so it can affect the performance and

reputation of the bank. So the bank should make its recovery system efficient and reliable to

meet its future requirement.

Management and Employees

There are some problem in management and employees of the bank which should be fixed

and corrected. Some of them are;

Lack of Cooperation

There is lack of cooperation among the employees, management, customers and share

holders. The employees are not fully cooperated with each other during the work environment so

there should be full cooperation among all the members of bank.

Job Rotation and Motivation

There is no job rotation of employees in the bank which deprived them to know about

various functions of the department and to improve their skills and knowledge. It affects the

performance of employees because they get bored doing the same job all the time. So there

should be proper job rotation among the employees to enhance their skills and abilities.

The employees are not fully motivated which also effect their performance so the

motivation level of employees should be improved by giving them more benefits, increasing

their salaries, providing good working condition to them and giving them proper promotion.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 18

M.umar

Employees selection and promotions

The selection and promotion of employees is based on favoritism and seniority thats

why the organization lacks professional employees in different departments. There is lack of

qualified staff in the bank and most of the employees are of old. So the organization should

select new and young employees who must have knowledge and are well qualified. The

employees should be promoted on the basis of performance and not on the basis of seniority or

favoritism.

Employees Training

There is no training facility for employees in the bank and that is why the employees of

the bank lack professionalism so the employees should be regularly trained to get more

knowledge and experience about new tasks in order to show good performance.

Management Information System

There is no proper information system in the bank. All the data are recorded in register

which may be lost with the passage of time or due to some other reasons. So there should be a

proper computerized system in order to store all the data and information in it which can be

retrieved easily and also saves time.

New Products and Services

The bank is offering the same loaning schemes and services to its customers from a long

time, which is affecting the reputation of the bank. The bank should introduce new products and

services for its customers in order to attract them more and also to compete in the market with

other banks because business is very competitive now days.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 19

M.umar

CONCLUSIONS AND SUGGESTIONS

Since the duration of internship is very less so it is difficult to find all the problems and

give suggestions so only few problems have been identified and suggestions are given for them.

Conclusions

To conclude my report I would like to say that my internship at ZTBL was a positive

experience. It provide me the opportionity to work with the experience employees of ZTBL

because ZTBL is one of the best financial institution in the country. The bank is performing a

major role in the economic growth of the country. As we know that Pakistan as an Agricultural

and its people mostly depend on Agriculture so the Bank is doing a good job by providing loans

for various Agricultural purposes to the farmers inorder to develop the Agriculture sector. The

ZTBL is offering various schemes and different loans for the development of Agriculture. Its

loans include short term, medium and long term loans. The short term and medium term include

production loans while the long term loans include development loans.

The ZTBL has a specialized lending process to provide loans to its customers and has a

recovery system in order to recover its loans from the farmers. The lending process include

different steps in order to disburse the loans to the farmers. The Bank plays a vital role in order

to raise the living standards of people in rural areas.

The Bank has a friendly and challenging environment which is a good sign for the the

bank. The bank has a strong supervision and management staff which can lead the bank to the

success.

The ZTBL is one of the specialized banks but still there are some areas which need to be

improved especially its lending process, its recovery system and cooperation among all the

members of the bank.

In conclusion , the ZTBL has the full potential to become a market leader, if the suggestions

given are followed and bank avail all the available opportionities and cover its weaknesses.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 20

M.umar

Suggestions

The ZTBL is one of specialized banks having a cooperative environment but still there

are some areas which need to be improved. Firstly there is lack of cooperation and coordination

among the staff members, management, customers and stockholders. So there must be

cooperation among the staff members, customers, management and shareholders. There should

be job rotation among the duties and responsibilities of employees in different departments in

order to improve their skill and performance and to know the functions of different departments.

The employees should be motivated by increasing their salaries and giving other benefits, this

will increase their performance. The products and services of ZTBL should be advertised in a

proper way in order to attract more customers. The bank should select and hire the employees on

the basis of their relative experience. The bank should have proper check and balance system on

the whole loaning process, keeping of large files waste a lot of time in searching the records

moreover the record of documentary of the bank should be complete and correct. More fringe

benefits and allownces should be given to employees and management to improve the overall

performance of the bank.

The employee should be promoted in order to motivate them and improve thier

performance. The employees abscentism and turnover should be reduced in order to aviod

conflicts and misunderrstanding. The bank should develop its management information system

so that employees and customers can get benefits from it. The Bank should make its website

attractive for people. The relations and attitudes of employees should be positive and polite

towards its customers. The motivation of employees can be increased through job satisfaction

and job promotion so that they can increase their performance. The employees should be given

training regularly to know about new information system because the business is quite

competitive now days. The bank should improve its lending procedure of loan especially the loan

sanctions and recovery of the loan at proper time in order to meet its future credit requirements.

The loan procedure of the Bank should be made simple for the farmers. The mark-up rate on the

loan should be increased in order to meet its credit requirement and other expenses. More efforts

should be made on recovery of the loan to recover the amount from the borrowers. Finally, the

bank can reduce its cost and expenses through its operation and make its reovery system

effecient.

POAE Ou AIPIXYATYPE IN HAKIETAN EXONOM+

Page | 21

M.umar

REFERENCES

Horne C.Vane Jame. 2003. Fundamentals of Financial Management, 12

th

Edition.

Internship report by Muhammad Umar, M.Com, 2012, Islamia University of

bhawalpur

www.ztbl.com.pk

You might also like

- Directors' Report: Zarai Taraqiati Bank LimitedDocument13 pagesDirectors' Report: Zarai Taraqiati Bank LimitedZia KhanNo ratings yet

- PPP in Indian Dairy Industry - Technopak - CII - Background Paper - May08,2010 PDF VerDocument37 pagesPPP in Indian Dairy Industry - Technopak - CII - Background Paper - May08,2010 PDF VersuryaprasadmvnNo ratings yet

- Agriculture - BR News ArticleDocument10 pagesAgriculture - BR News ArticleXainab AmirNo ratings yet

- Agriculture Budget 2013-14Document33 pagesAgriculture Budget 2013-14Ajay LimbasiyaNo ratings yet

- Agricultural Sector of Pakistan: BBA-V (Hons)Document8 pagesAgricultural Sector of Pakistan: BBA-V (Hons)IqraarifNo ratings yet

- Higher Allocation Under RKVY SchemeDocument5 pagesHigher Allocation Under RKVY SchemeAjeet SinghNo ratings yet

- Apeda SchemesDocument8 pagesApeda SchemesPragya MishraNo ratings yet

- Anchor Borrowers in NigeriaDocument18 pagesAnchor Borrowers in NigeriaAbdullahi MuhammadNo ratings yet

- Z T B L - (ZTBL) : Ompany AMEDocument21 pagesZ T B L - (ZTBL) : Ompany AMEYounis_Mohamma_280No ratings yet

- 26 (A) Agriculture 0Document29 pages26 (A) Agriculture 0ankitjss2007No ratings yet

- Budget Agriculture: Group C Presented by Amrit Neupane Susmita Timilsina Maya GatarajDocument18 pagesBudget Agriculture: Group C Presented by Amrit Neupane Susmita Timilsina Maya GatarajAmrit NeupaneNo ratings yet

- Marketing Anlysis and Developmental Strategy of Mother DairyDocument58 pagesMarketing Anlysis and Developmental Strategy of Mother DairySambit BanerjeeNo ratings yet

- Agribusiness in Pakistan: Department of Marketing & AgribusinessDocument16 pagesAgribusiness in Pakistan: Department of Marketing & AgribusinessZahid AliNo ratings yet

- Quick FactsDocument3 pagesQuick Factsdua fatimaNo ratings yet

- Working Capital Management in Dairy Co-OperativeDocument52 pagesWorking Capital Management in Dairy Co-Operativeragvendra04No ratings yet

- MINFALYearbookBook2005 06Document146 pagesMINFALYearbookBook2005 06Farhat Abbas DurraniNo ratings yet

- 4210-Article Text-7875-1-10-20210426Document19 pages4210-Article Text-7875-1-10-20210426livgreencatlitterNo ratings yet

- Agro Processing Sector in IndiaDocument20 pagesAgro Processing Sector in IndiaKavita Baeet88% (8)

- ZTBL ReportDocument30 pagesZTBL ReportAbid Bilal100% (1)

- Rdaap AssignmentDocument30 pagesRdaap AssignmentFuNnY OnENo ratings yet

- AgricultureDocument15 pagesAgriculturemaheshwariNo ratings yet

- Micro Finance For Agro, Agriculture & Allied IndustryDocument10 pagesMicro Finance For Agro, Agriculture & Allied IndustryAmit SoniNo ratings yet

- Final Sustainable Analysis Report of ITCDocument19 pagesFinal Sustainable Analysis Report of ITCZany AlamNo ratings yet

- Internship Report On ZTBL by Mumtaz Ali HulioDocument48 pagesInternship Report On ZTBL by Mumtaz Ali Hulioasif_iqbal84No ratings yet

- Cooperative Business Plan in Alcala PhilDocument24 pagesCooperative Business Plan in Alcala Philmilesdeasis25No ratings yet

- Bangladesh 2000002356 RMTP PKSF Project Design Report July 2019Document428 pagesBangladesh 2000002356 RMTP PKSF Project Design Report July 2019Abdii BoruuNo ratings yet

- Functioning of Kscard Bank in The Economic Development of Farming CommunityDocument9 pagesFunctioning of Kscard Bank in The Economic Development of Farming CommunityarcherselevatorsNo ratings yet

- Case Study On The Repayment of LoansDocument48 pagesCase Study On The Repayment of LoansAmin ShahzadNo ratings yet

- Agricultural Development Planning and Resource MobilizationDocument18 pagesAgricultural Development Planning and Resource MobilizationReaderNo ratings yet

- AP CM Seeks Remunerative MSP, Confident of 10% Growth For A.P. at NDCDocument16 pagesAP CM Seeks Remunerative MSP, Confident of 10% Growth For A.P. at NDCmyfutureidentityNo ratings yet

- Chapter-1 Introduction and Design of The StudyDocument3 pagesChapter-1 Introduction and Design of The StudyRama ChandranNo ratings yet

- 11jjcma100 1Document87 pages11jjcma100 1anandkumar_269No ratings yet

- Doodh Ganga Yojana - EditedDocument10 pagesDoodh Ganga Yojana - EditedDheeraj VermaNo ratings yet

- Importance of Livestock in IndiaDocument21 pagesImportance of Livestock in IndiaAkhil MohananNo ratings yet

- 12 Food ProcessingDocument5 pages12 Food ProcessingTanay BansalNo ratings yet

- Agriculture Food ProcessingDocument4 pagesAgriculture Food ProcessingBappiSwargiaryNo ratings yet

- AgricultureDocument5 pagesAgricultureANJALI NAINNo ratings yet

- Tandin EditedDocument24 pagesTandin EditedTandin TsheringNo ratings yet

- Overview of Food Processing IndustryDocument9 pagesOverview of Food Processing Industry12RinkuNo ratings yet

- DPRDocument48 pagesDPRDanish JavedNo ratings yet

- IBF 3rd ModuleDocument11 pagesIBF 3rd ModuleMuhammad Azlan TehseenNo ratings yet

- Dairy Farming 1Document3 pagesDairy Farming 1Anonymous E7DMoINo ratings yet

- Uttarakhand Kamdhenu - GoshalaDocument19 pagesUttarakhand Kamdhenu - Goshalaabk00550% (2)

- Agric AssDocument5 pagesAgric AssFunbi MdNo ratings yet

- Eco Assignment 2052Document3 pagesEco Assignment 2052animesh singhNo ratings yet

- Internship Report On ZTBL by Mumtaz Ali HulioDocument48 pagesInternship Report On ZTBL by Mumtaz Ali Huliohulimumtaz93% (14)

- Final SMMDocument16 pagesFinal SMMSajad AslamNo ratings yet

- Schemes For Goat FarmingDocument19 pagesSchemes For Goat FarmingJYOTI SUNDAR ROUTNo ratings yet

- Diary Cattle FarmDocument8 pagesDiary Cattle FarmPeter GeorgeNo ratings yet

- Bhangar Vegetable Producer CompanyDocument13 pagesBhangar Vegetable Producer CompanySaikat GhoshNo ratings yet

- Cooperative Business Plan in Alcala PhilDocument24 pagesCooperative Business Plan in Alcala PhilHome Grown Digital AdvertisingNo ratings yet

- UntitledDocument12 pagesUntitledVijaychandra ReddyNo ratings yet

- Chapter IiDocument14 pagesChapter IiRevathy Saju Thyagarajan100% (1)

- Group 4 Credit and Finance New-2Document51 pagesGroup 4 Credit and Finance New-2Shekhar KushwahaNo ratings yet

- Economics ProjectDocument13 pagesEconomics ProjectAbhinav PrakashNo ratings yet

- Agriculture ReformsDocument6 pagesAgriculture ReformsMaking ChangeNo ratings yet

- Role of Government of IndiaDocument5 pagesRole of Government of IndiaJesal PorechaNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Non-Deposit Taking NBFIs Business RulesDocument24 pagesNon-Deposit Taking NBFIs Business RulesPrince McGershonNo ratings yet

- Mingo Spring - A Senior Living CommunityDocument21 pagesMingo Spring - A Senior Living CommunityRyan SloanNo ratings yet

- (2022) Financial Wellness of 1st-Gen College StudentsDocument16 pages(2022) Financial Wellness of 1st-Gen College StudentsEugene M. BijeNo ratings yet

- NCC Limited: Corporate PresentationDocument32 pagesNCC Limited: Corporate PresentationHARIKEERTHI NALLELLANo ratings yet

- Collateralized Loan Obligations (CLO) : 4.12.2017 Dr. Janne GustafssonDocument45 pagesCollateralized Loan Obligations (CLO) : 4.12.2017 Dr. Janne GustafssonSehgal Ankit100% (1)

- MERKLE Media Insights Report Q2 2021Document42 pagesMERKLE Media Insights Report Q2 2021Hà Thi100% (1)

- Commercial Applications of Company Law 2019 Ebook - (PART A - COMPANIES and COMPANY LAW)Document114 pagesCommercial Applications of Company Law 2019 Ebook - (PART A - COMPANIES and COMPANY LAW)Chenjie ShiNo ratings yet

- Comparative Business Systems: The Role of Financial Systems Sverre KnutsenDocument27 pagesComparative Business Systems: The Role of Financial Systems Sverre KnutsenVishveshwara SwaroopNo ratings yet

- Receivables Management NotesDocument25 pagesReceivables Management NotesBon Jovi0% (1)

- A New Approach To Business Fluctuations HeterogeneDocument36 pagesA New Approach To Business Fluctuations HeterogeneLeandro BarrosNo ratings yet

- Microfinance PDFDocument169 pagesMicrofinance PDFSudharani Yellapragada100% (4)

- SuretyDocument2 pagesSuretyNiño Rey LopezNo ratings yet

- Preface: Nothing More Than This Study Material Is Required To Score A+ GradeDocument166 pagesPreface: Nothing More Than This Study Material Is Required To Score A+ Gradevedanksingh78No ratings yet

- 2 Quick Success Series BPRDocument8 pages2 Quick Success Series BPRvvivek22No ratings yet

- Bret Broaddus Tips To Avoid Mistakes That Home Buyers MakeDocument3 pagesBret Broaddus Tips To Avoid Mistakes That Home Buyers MakeBret broaddusNo ratings yet

- 3.2 70. Exercise Loan Schedule SolvedDocument6 pages3.2 70. Exercise Loan Schedule SolvedAniket KarnNo ratings yet

- Chapter 8Document4 pagesChapter 8rcraw87No ratings yet

- Description: Tags: 0506Top100ConsolidatorspublicDocument3 pagesDescription: Tags: 0506Top100Consolidatorspublicanon-101724No ratings yet

- Letters of CreditDocument100 pagesLetters of CreditJai Delos Santos100% (1)

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- The Rise of African SIM RegistrationDocument23 pagesThe Rise of African SIM RegistrationThomasMcAllisterNo ratings yet

- K20404C Final-TestDocument34 pagesK20404C Final-TestNgọc Hoàng Thị BảoNo ratings yet

- Sales Homework 10-9-19Document7 pagesSales Homework 10-9-19licarl benitoNo ratings yet

- Localizing Agri Development Towards Equitable Growth in Northern MindanaoDocument113 pagesLocalizing Agri Development Towards Equitable Growth in Northern Mindanaoepra100% (1)

- Chapter 10 - FinanceDocument25 pagesChapter 10 - FinanceHershey BarcelonNo ratings yet

- International Credit Rating AgencyDocument4 pagesInternational Credit Rating AgencyDibesh PadiaNo ratings yet

- HW 5Document3 pagesHW 5Vũ Hải YếnNo ratings yet

- MY AIA Step by Step Guide Online Payment V3 11june PDFDocument47 pagesMY AIA Step by Step Guide Online Payment V3 11june PDFliza995cNo ratings yet

- 2009-08 BCG - Managing Working Capital-201Document12 pages2009-08 BCG - Managing Working Capital-201Anonymous iMq2HDvVqNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet