Professional Documents

Culture Documents

Disclosure Statement

Uploaded by

beckijoemailOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disclosure Statement

Uploaded by

beckijoemailCopyright:

Available Formats

U.S. Department of Education P.O.

Box 9003 Niagara Falls, NY14302-9003

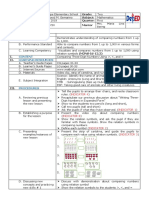

Disclosure Statement William D. Ford Federal Direct Loan Program Direct Subsidized Loan Direct Unsubsidized Loan

Borrower Information

1. Name and Address Baranski, Rebecca J 6201 W Olive Ave #3073 3073 Glendale, AZ 85302 2.Date of Disclosure Statement 11/07/2012 3.Area Code/Telephone Number (480) 244-4969

School Information

4. School Name and Address Rio Salado Community College 2323 West 14th Street Tempe, AZ 852816948 5. School Code/Branch G21775

Loan Information

6. Loan Identification Number(s) XXXXX7025S13G21775001 7. Loan Period(s) 07/02/2012 04/27/2013 8. Loan Fee % 1.000%

9. Information about the loan(s) that your school plans to disburse (pay out) follows. This information is explained in detail on the back. The actual disbursement dates and amounts may be different than the dates and amounts shown below. The school and your servicer will notify you of the actual disbursement dates and amounts. Direct Subsidized Loan Gross Loan Amount $3,500.00 Loan Fee Amount $34.00 + + Interest Rebate Amount $0.00 = = Net Loan Amount $3,466.00

Your school plans to disburse the Net Loan Amount as follows: Date Net Disbursement Amount Date 08/30/2012 $ 1,733.00 01/25/2013 $ 1,733.00

Net Disbursement Amount

Direct Unsubsidized Loan

Gross Loan Amount $0.00

Loan Fee Amount $0.00

+ +

Interest Rebate Amount $0.00

= =

Net Loan Amount $0.00

Your school plans to disburse the Net Loan Amount as follows: Date Net Disbursement Amount Date

Net Disbursement Amount

If there are further disbursements to be made on the loan(s) the school will inform you.

Disclosure Statement (continued) This Disclosure Statement provides information about the Direct Subsidized Loan and/or Direct Unsubsidized Loan that your school plans to disburse (pay out) by crediting your account at the school, paying you directly, or both. It replaces any Disclosure Statements that you may have received previously for the same loan(s). Keep this Disclosure statement for your records. Before any money is disbursed, you must have a signed Direct Subsidized Loan/Direct Unsubsidized Loan Master Promissory Note (MPN) on file. The MPN, the Borrower's Rights and Responsibilities statement, and the Plain Language Disclosure explain the terms of your loan(s). If you have any questions about your MPN or this Disclosure Statement, contact your school. Item 9 on the front of this Disclosure Statement provides the following information about the amount of each loan that your school plans to disburse to you:

Gross Loan Amount - This is the total amount of the loan that you are borrowing. You will be responsible for repaying this amount. Loan Fee Amount - This is the amount of the fee that we charge on your loan. It is based on a percentage of your Gross Loan Amount. The percentage is shown in item 8. The Loan Fee Amount will be subtracted from your Gross Loan Amount. Interest Rebate Amount - This is the amount of an up-front interest rebate that you may receive as part of a program to encourage the timely repayment of Direct Loans. If you receive a rebate, the Interest Rebate Amount will be added back after the Loan Fee Amount is subtracted. To keep an up-front interest rebate that you receive on your loan, you must make all of your first 12 required monthly payments on time (we must receive each payment no later than 6 days after the due date) when your loan enters repayment. You will lose the rebate if you do not make all of your first 12 required monthly payments on time. This will increase the amount that you must repay.

Net Loan Amount - This is the amount of your loan money that remains after the Loan Fee Amount is subtracted and the Interest Rebate Amount is added. The school will disburse the Net Loan Amount to you by crediting your account at the school, paying you directly, or both. Item 9 shows the school's plan for disbursing your Net Loan Amount to you. The actual disbursement dates and amounts may be different than the dates and amounts that are shown. The school and your servicer will notify you of the actual disbursement dates and amounts.

Before your loan money is disbursed, you may cancel all or part of your loan(s) at any time by notifying the school. After your loan money is disbursed, there are two ways to cancel all or part of your loan(s):

If the school obtains your written confirmation of the types and amounts of Title IV loans that you want to receive for an award year before crediting loan money to your account at the school, you may tell the school that you want to cancel all or part of the loan within 14 days after the date the school notifies you of your right to cancel all or part of the loan, or by the first day of the school's payment period, whichever is later (the school can tell you the first day of the payment period). If the school does not obtain your written confirmation of the types and amounts of loans you want to receive before crediting the loan money to your account, you may cancel all or part of the loan by informing the school within 30 days of the date the school notifies you of your right to cancel all or part of the loan. In either case, the school will return the cancelled loan amount to us. If you ask the school to cancel all or part of your loan(s) outside the timeframes described above, the school may process your cancellation request, but it is not required to do so.

Within 120 days of the date the school disburses your loan money (by crediting the loan money to your account at the school, by paying it directly to you, or both), you may return all or part of your loan(s) to us. Contact your servicer for guidance on how and where to return your loan money.

You do not have to pay interest or the loan fee on the part of your loan that is cancelled or returned within the timeframes described above, and if you received an up-front interest rebate, the rebate does not apply. Your loan will be adjusted to eliminate any interest, loan fee, and rebate amount that applies to the amount of the loan that is cancelled or returned. If you have questions regarding the next steps in the processing of your loan, contact your school. After the first disbursement of your loan has been made, your loan will be assigned to a loan servicer and you will be provided with the servicer's name, address and contact information. Your servicer will service, answer questions about, and process payments on your loan after you enter repayment.

DISSU7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working Backwards StrategyDocument10 pagesWorking Backwards StrategyGANDI LEXTER LUPIANNo ratings yet

- Position PaperDocument7 pagesPosition Papercocopitlabmix100% (3)

- Katsura PDP ResumeDocument1 pageKatsura PDP Resumeapi-353388304No ratings yet

- Pooja Raut Resume - Java DeveloperDocument3 pagesPooja Raut Resume - Java DeveloperVaibhav PahuneNo ratings yet

- DLL-First Summative Test-2nd QuarterDocument2 pagesDLL-First Summative Test-2nd QuarterJesusa Jane Labrador RolloqueNo ratings yet

- 10-15'-ĐỀ CHẴNDocument2 pages10-15'-ĐỀ CHẴNSơn HoàngNo ratings yet

- EE2001 Circuit Analysis - OBTLDocument7 pagesEE2001 Circuit Analysis - OBTLAaron TanNo ratings yet

- Beginners Guide Psychometric Test JobtestprepDocument20 pagesBeginners Guide Psychometric Test JobtestprepOlivia Eka PrasetiawatiNo ratings yet

- Tugas ATDocument20 pagesTugas ATKhoirunnisa OktarianiNo ratings yet

- What Is Potency - Exploring Phenomenon of Potency in Osteopathy in The Cranial Field - Helen Harrison - Research ProjectDocument105 pagesWhat Is Potency - Exploring Phenomenon of Potency in Osteopathy in The Cranial Field - Helen Harrison - Research ProjectTito Alho100% (1)

- Tracer Study of Bachelor of Science in Criminology Graduates Batch 2016 - 2019 at Laguna State Polytechnic University-Lopez Satellite CampusDocument28 pagesTracer Study of Bachelor of Science in Criminology Graduates Batch 2016 - 2019 at Laguna State Polytechnic University-Lopez Satellite CampusJayson AurellanaNo ratings yet

- Why Should A Researcher Conduct Literature ReviewDocument7 pagesWhy Should A Researcher Conduct Literature Reviewc5p4r60cNo ratings yet

- Choose ONE Answer For Each Question by Highlighting It in YELLOWDocument5 pagesChoose ONE Answer For Each Question by Highlighting It in YELLOWKhánh NgọcNo ratings yet

- Health Education's Progression To The Forefront of Health PromotionDocument18 pagesHealth Education's Progression To The Forefront of Health Promotionbernadette_olaveNo ratings yet

- Assesing Learning Thriugh Passion and Compassion Thru DepED Order 31 2020Document70 pagesAssesing Learning Thriugh Passion and Compassion Thru DepED Order 31 2020myline estebanNo ratings yet

- BSC6900 RNC Step CommissionDocument6 pagesBSC6900 RNC Step CommissionFrancisco Salvador MondlaneNo ratings yet

- Triangle Angle Sum Theorem Lesson Plan 11 12Document5 pagesTriangle Angle Sum Theorem Lesson Plan 11 12api-500312718No ratings yet

- Comparing Numbers (2021 - 06 - 19 01 - 35 - 12 UTC) (2021 - 08 - 06 04 - 51 - 25 UTC)Document3 pagesComparing Numbers (2021 - 06 - 19 01 - 35 - 12 UTC) (2021 - 08 - 06 04 - 51 - 25 UTC)ALLinOne BlogNo ratings yet

- Cot - English 4-Q4-WK 10-Gary C. RodriguezDocument5 pagesCot - English 4-Q4-WK 10-Gary C. Rodriguezjerick de la cruzNo ratings yet

- 10thanniversary - Leafletfore MailDocument2 pages10thanniversary - Leafletfore MailredmondptNo ratings yet

- Machine Learning: Mona Leeza Email: Monaleeza - Bukc@bahria - Edu.pkDocument60 pagesMachine Learning: Mona Leeza Email: Monaleeza - Bukc@bahria - Edu.pkzombiee hookNo ratings yet

- Inquiries, Investigation S and Immersion: Dr. Amelita J. DrizDocument26 pagesInquiries, Investigation S and Immersion: Dr. Amelita J. DrizAjilNo ratings yet

- Accomplishment Teachers BoothDocument3 pagesAccomplishment Teachers Boothjosephine paulinoNo ratings yet

- International Conservation Project Funders: Institution Award/Scholarship Description Award Amount WebsiteDocument22 pagesInternational Conservation Project Funders: Institution Award/Scholarship Description Award Amount WebsitenicdonatiNo ratings yet

- Math 5 - 2ND QUARTER - UBDDocument21 pagesMath 5 - 2ND QUARTER - UBDMark Anthony EspañolaNo ratings yet

- Narrative-Descriptive Essay Marking SchemeDocument1 pageNarrative-Descriptive Essay Marking SchemeAlecsandra Andrei100% (1)

- Asafa Book Oromuma PDFDocument183 pagesAsafa Book Oromuma PDFgemechuNo ratings yet

- Engineering Drawing IPreDocument9 pagesEngineering Drawing IPregopal rao sirNo ratings yet

- DLL Social ScienceDocument15 pagesDLL Social ScienceMark Andris GempisawNo ratings yet

- Media and Information Literacy - Lesson 2Document1 pageMedia and Information Literacy - Lesson 2Mary Chloe JaucianNo ratings yet