Professional Documents

Culture Documents

Accounts Amalgamation

Uploaded by

scarunamarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Amalgamation

Uploaded by

scarunamarCopyright:

Available Formats

SCAA Academy Problems on Amalgamation Problem 1 The following were the Balance Sheet of P Ltd and V Ltd as at 31st

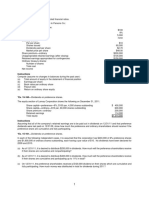

March, 2011 Liabilities Equity Share Capital (Fully paid shares of Rs.10 each) Securities Premium Foreign Project Reserve General Reserve Profit & Loss Account 12% Debentures Bills Payable Sundry Creditors Sundry Provisions Assets Land and Buildings Plant and Machinery Furniture, Fixtures and Fittings Stock Debtors Cash at Bank Bills Receivable Cost of issue of Debentures P Ltd V Ltd (Rs in (Rs in Lakhs) Lakhs) 15,000 6,000 3,000 9,500 2,870 120 1,080 1,830 33,400 6,000 14,000 2,304 7,862 2,120 1,114 33,400 310 3,200 825 1,000 463 702 12,500 5,000 1,700 4,041 1,020 609 80 50 12,500

All the bills receivable held by V Ltd were P Ltds acceptance On 01st April, 2011 P Ltd., took over V Ltd., in an amalgamation in the nature of merger. It was agreed that in discharge of consideration for the business P Ltd., would allot 3 fully paid Equity Shares of Rs.10 each at par for every 2 shares held in V Ltd. It was also agreed that 12% Debentures in V Ltd., would be converted into 13% Debentures in P Ltd. of the same amount of denomination. Expenses of amalgamation amounting to Rs.1,00,000 were borne by P Ltd. You are required to : i) Pass journal entries in the books of P Ltd., and ii) Prepare P Ltds Balance Sheet immediately after the merger

1

Problem 2 The financial position of two companies Hari Ltd., and Vayu Ltd., as on 31st March, 2011 was as under Assets Goodwill Building Machinery Stock Debtors Cash at Bank Preliminary Expenses Hari Ltd (Rs) 50,000 3,00,000 5,00,000 2,50,000 2,00,000 50,000 30,000 13,80,000 Liabilities Share Capital: Equity Share of Rs. 10 each 9% Preference Share of Rs.100 each 10% Preference Share of Rs.100 each General Reserve Retirement Gratuity Fund Sundry Creditors 10,00,000 1,00,000 1,00,00 50,000 1,30,000 13,80,000 3,00,000 1,00,000 80,000 20,000 80,000 5,80,000 Vayu Ltd (Rs) 25,000 1,00,000 1,50,000 1,75,000 1,00,000 20,000 10,000 5,80,000

Hari Ltd., absorbs Vayu Ltd., on the following terms : a) 10% Preference Share Holders are to be paid at 10% Premium by issue of 9% Preference Share of Hari Ltd., b) Goodwill of Vayu Ltd., is valued at Rs.50,000, Buildings are valued at Rs.1,50,000 and the machinery at Rs.1,60,000. c) Stock to be taken over at 10% less value and reserve for bad and doubtful debts to be created @ 7.5% d) Equity Shareholders of Vayu Ltd., will be issued Equity Shares @ 5% Premium Prepare necessary ledger accounts to close the books of Vayu Ltd., and show the acquisition entries in the books of Hari Ltd., Also draft the Balance sheet after absorbtion as at 31st March, 2011 Problem 3

2

The following is the balance sheet of A Ltd., as at 31st March, 2011 Liabilities 8,000 equity shares of Rs.100 each General Reserve 10% Debentures Loan from A Creditors Rs. 8,00,00 0 80,000 4,00,00 0 1,60,00 0 3,20,00 0 Assets Building Machinery Stock Debtors Bank Goodwill Misc Expenses 17,60,0 00 Rs. 3,40,000 6,40,000 2,20,000 2,60,000 1,36,000 1,30,000 34,000 17,60,00 0

B Ltd., agreed to absorb A Ltd., on the following terms and conditions: 1) B Ltd., would take over all assets, except bank balance at their book values less 10%. Goodwill is to be valued at 4 years purchase of super profits, assuming that the normal rate of return be 8% on the combined amount of share capital and general reserve 2) B Ltd., is to take over creditors at book value 3) The purchase consideration is to be paid in cash to the extent of Rs.6,00,000 and the balance in fully paid equity shares of Rs.100 each at Rs.125 per share The average profit is Rs.1,24,000. The liquidation expenses amounted to Rs.16,000. B Ltd., sold prior to 31st March, 2011 goods costing Rs.1,20,000 to A Ltd., for Rs.1,60,000. Rs.1,00,000 worth of goods are still in stock of A Ltd., on 31st March, 2011. Creditor of A Ltd include Rs.40,000 still due to B Ltd., Show the necessary ledger accounts to close the books of A Ltd and prepare the balance sheet of B Ltd as at 01st April, 2011 after the takeover.

Problem 4 The following are the balance sheet of Strong Limited and Small Limited as at 31stMarch, 2011 Liabilities Equity Shares of Rs.10 each Reserves 10% Debentures Trade Creditors Strong Ltd 1,50,000 95,000 47,000 2,92,000 Small Assets Ltd 1,20,00 Fixed Assets 0 (Net Depreciation) 10,000 Stock 20,000 Sundry Debtors 32,000 Cash at Bank Strong Ltd 1,40,000 42,000 30,000 80,000 Small Ltd 75,000 47,000 50,000 10,000

1,82,00 2,92,000 1,82,00 0 0 st Strong Limited agreed to absorb Small Limited as on 31 March 2011 on the following terms: (1) Strong Limited agreed to repay 10% Debentures of Small Limited (2) Strong Limited to revalue its Fixed Assets at Rs 1,95,000 to be incorporated in the books (3) Shares of both companies to be valued on net Assets Basis after considering Rs 50,000 towards value of goodwill of Small Limited. (4) The cost of absorption of Rs 3,000 are met by Strong Limited. You are required to : (a)Calculate the ratio of exchange of shares (b)Give Journal Entries in the books of Strong Limited and, (c)Construct the Bank Account to arrive at the balance on absorption

Problem 5 The following are the balance sheets of RS Ltd and XY Ltd as on 31st March, 2011 Liabilities Equity Shares of Rs.100 each Reserves & Surplus 10% Debenture s Loan from Financial Institutions Bank Overdraft Sundry Creditors Proposed Dividend RS Ltd 2,000 XY Ltd Assets RS Ltd Fixed Assets net 1,000 of 2,700 Depreciati on Investment 700 s Sundry - Debtors 400 Cash and 400 Bank Profit and 100 Loss Account 300 1800 4,050 1,800 250 Rs.in 000s XY Ltd 850

800 500 250 300 200 4050

150 800

It was decided that XY Ltd. will acquire the business of RS Ltd. for enjoying the benefit of carry forward of business loss. After acquisition, XY Ltd. will be renamed as XYZ Ltd The following scheme has been approved for the merger: (i) XY Ltd. will reduce its shares to Rs. 10 and then consolidate 10 such shares into one share of Rs. 100 each (New Share). (ii) Financial institutions agreed to waive 15% of the loan of XY Ltd. (iii) Shareholders of RS Ltd. will be given one new share of XY Ltd. in exchange of every share held in RS Ltd. (iv) RS Ltd. will cancel 20% holding of XY Ltd. Investments were held at Rs. 250 thousands. (v) After merger the proposed dividend of RS Ltd. will be paid to the shareholders of RS Ltd. (vi) Authorised Capital of XY Ltd. will be raised accordingly to carry out the scheme. (vii) Sundry creditors of XY Ltd. includes payable to RS Ltd. Rs. 1,00,000.

5

Pass the necessary entries to implement the scheme in the books of RS Ltd. and XY Ltd. and prepare a Balance Sheet of XYZ Ltd.

You might also like

- AcctsDocument63 pagesAcctskanchanthebest100% (1)

- Balance Sheet AmalgamationDocument7 pagesBalance Sheet AmalgamationAkki GalaNo ratings yet

- Amagamation QnsDocument5 pagesAmagamation Qnsmohanraokp2279No ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Document52 pagesPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- 12 Amalgamation NotesDocument12 pages12 Amalgamation NoteskautiNo ratings yet

- Holding Book QuestionsDocument9 pagesHolding Book QuestionskartikNo ratings yet

- C.A. Final Financial Reporting Consolidated BSDocument7 pagesC.A. Final Financial Reporting Consolidated BSDivyesh TrivediNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Accounting For Amalgamation - ProblemsDocument8 pagesAccounting For Amalgamation - ProblemsBrowse Purpose100% (1)

- X LTD: 1) XY LTD To Issue 600-10% Debentures of Rs 100 Each To Debenture Holders of X LTDDocument1 pageX LTD: 1) XY LTD To Issue 600-10% Debentures of Rs 100 Each To Debenture Holders of X LTDVishwas KrishnaNo ratings yet

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- CHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERDocument21 pagesCHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERbinu100% (1)

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- AmalgamationDocument6 pagesAmalgamationSnehal ShahNo ratings yet

- Financial Statement Analysis: Consolidated Balance SheetDocument6 pagesFinancial Statement Analysis: Consolidated Balance SheetUdit RajNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Alpha Arts College Corporate Accounting ExamDocument3 pagesAlpha Arts College Corporate Accounting Exammahabalu123456789No ratings yet

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet

- Holding Company ProblemsDocument22 pagesHolding Company ProblemsYashodhan MithareNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Question SheetDocument2 pagesQuestion SheetHarsh DubeNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingskirubaarunNo ratings yet

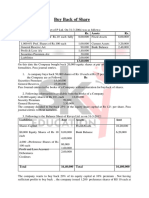

- Buy Back of ShareDocument2 pagesBuy Back of ShareRajesh ChedaNo ratings yet

- Final Ca: MAY '19 Financial ReportingDocument13 pagesFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNo ratings yet

- CALCULATING PURCHASE CONSIDERATIONDocument11 pagesCALCULATING PURCHASE CONSIDERATIONJoel VargheseNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- BuybackDocument6 pagesBuybacksmit9993No ratings yet

- The Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentDocument4 pagesThe Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentravirrkNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Problem No. 1: ST STDocument2 pagesProblem No. 1: ST STaditic000No ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- COA Unit 4 Amalgamation ProblemsDocument7 pagesCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNo ratings yet

- Debentures & Financial StatementsDocument11 pagesDebentures & Financial StatementsShreyas PremiumNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77No ratings yet

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasNo ratings yet

- Calculating ratios, journal entries for share forfeiture and reissueDocument7 pagesCalculating ratios, journal entries for share forfeiture and reissuejayeshNo ratings yet

- Mergers and Acquisitions DocDocument3 pagesMergers and Acquisitions DocRuchita JanakiramNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Financial Accounting & AuditingDocument13 pagesFinancial Accounting & Auditingkashish mehtaNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDocument12 pagesNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyNo ratings yet

- QB IiiDocument33 pagesQB IiisaketramaNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- CA IPCC Nov 13 Suggested AnswersDocument1 pageCA IPCC Nov 13 Suggested AnswersscarunamarNo ratings yet

- Case Laws in Companies ActDocument7 pagesCase Laws in Companies ActscarunamarNo ratings yet

- CA IPCC May 2014 Crash CourseDocument1 pageCA IPCC May 2014 Crash CoursescarunamarNo ratings yet

- CPT Dec 2013 Quantitative AptitudeDocument6 pagesCPT Dec 2013 Quantitative AptitudescarunamarNo ratings yet

- CPT Dec 2013 EconomicsDocument6 pagesCPT Dec 2013 EconomicsscarunamarNo ratings yet

- CPT Dec 2013 Law Question & AnswerDocument5 pagesCPT Dec 2013 Law Question & AnswerscarunamarNo ratings yet

- CPT Dec 2013 EconomicsDocument6 pagesCPT Dec 2013 EconomicsscarunamarNo ratings yet

- CPT Dec 2013 Law Question & AnswerDocument5 pagesCPT Dec 2013 Law Question & AnswerscarunamarNo ratings yet

- CPT Dec 2013 AccountsDocument7 pagesCPT Dec 2013 AccountsscarunamarNo ratings yet

- CA Rules and RegulationsDocument4 pagesCA Rules and RegulationsINDUJA235No ratings yet

- Institute LocationDocument1 pageInstitute LocationscarunamarNo ratings yet

- Final Accounts of Sole ProprietorsDocument9 pagesFinal Accounts of Sole ProprietorsscarunamarNo ratings yet

- Brenner West - 2010 Fourth Quarter LetterDocument4 pagesBrenner West - 2010 Fourth Quarter LettergatzbpNo ratings yet

- Financial Structure of a BusinessDocument4 pagesFinancial Structure of a BusinessGwen Ashley Dela PenaNo ratings yet

- Advanced Corporate Finance Policies and Strategies Download LinksDocument29 pagesAdvanced Corporate Finance Policies and Strategies Download Linksmusicshiva0% (1)

- FSA Chapter 01Document40 pagesFSA Chapter 01Oktaviani Ari WardhaningrumNo ratings yet

- Sample Paper Accountancy 12, Set-1, 2022-23Document9 pagesSample Paper Accountancy 12, Set-1, 2022-23Atharva GhugeNo ratings yet

- Assignment On Financial and Management AccountingDocument15 pagesAssignment On Financial and Management Accountingdiplococcous83% (12)

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Acctg. QuizzesuntitledDocument78 pagesAcctg. QuizzesuntitledJulie Velasquez0% (2)

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- Capital Structure and Leverage Quiz # 3Document4 pagesCapital Structure and Leverage Quiz # 3Maurice Hanellete EspirituNo ratings yet

- 2 Corinthians 1: 20 - 22 Explains God's Promises in ChristDocument39 pages2 Corinthians 1: 20 - 22 Explains God's Promises in ChristYu BabylanNo ratings yet

- 2021 San Miguel Corporation Parent Audited Financial Statement (04.25.2022)Document109 pages2021 San Miguel Corporation Parent Audited Financial Statement (04.25.2022)Gemmalyn BautistaNo ratings yet

- Latest Development of IFRS (and HKFRS) : Nelson Lam Nelson Lam 林智遠 林智遠Document32 pagesLatest Development of IFRS (and HKFRS) : Nelson Lam Nelson Lam 林智遠 林智遠ChanNo ratings yet

- Ratio Analysis Memo and Presentation: ACCA 500Document8 pagesRatio Analysis Memo and Presentation: ACCA 500Awrangzeb AwrangNo ratings yet

- Public Ittikal Sequel FundDocument10 pagesPublic Ittikal Sequel FundFayZ ZabidyNo ratings yet

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocument69 pagesFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- Preview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Document91 pagesPreview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Chi IuvianamoNo ratings yet

- IPSAS in Your Pocket August 2015Document59 pagesIPSAS in Your Pocket August 2015Yohana MonicaNo ratings yet

- Fundamentals of Financial AccountingDocument40 pagesFundamentals of Financial AccountingEYENNo ratings yet

- MFRS 108 & 110 Class ExerciseDocument2 pagesMFRS 108 & 110 Class ExerciseRubiatul AdawiyahNo ratings yet

- Textile Project ReportDocument116 pagesTextile Project ReportVikash Singh Gautam100% (1)

- Interview Preparation PresentationDocument42 pagesInterview Preparation PresentationAlaksh ParmarNo ratings yet

- NEDFi Project Financing GuideDocument3 pagesNEDFi Project Financing GuideangelsrivastavaNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Chapter Two Part TwoDocument175 pagesChapter Two Part TwoWelday GebremichaelNo ratings yet

- Emrm5103 (Project Risk Management)Document54 pagesEmrm5103 (Project Risk Management)syahrifendi100% (3)

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- Debentures and Debt MarketsDocument31 pagesDebentures and Debt MarketsVimal Singh100% (1)

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayNo ratings yet

- A STUDY ON RATIO ANALYSIS OF SundaramDocument64 pagesA STUDY ON RATIO ANALYSIS OF SundaramDivyansh VermaNo ratings yet