Professional Documents

Culture Documents

Daily Agri Report Nov 29

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report Nov 29

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Vaishali Sheth - Research Associate vaishalij.sheth@angelbroking.com (022) 2921 2000 Extn. 6133

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

News in brief

Maharashtras irrigation potential up 28% in past decade

Maharashtras water resources department has said the states irrigation potential has risen 28 per cent in the past decade from 3.7 million hectares in 2001 to 4.75 million hectares in 2010. During this period, irrigated area in the state increased from 1.75 million hectares to 2.9 million hectares, arecord 72 per cent rise. It is expected the state Cabinet would take up a white paper on irrigation in the state at its meeting slated for tomorrow. If approved, the paper would later be tabled in the legislature for debate in the winter session starting December 10. The state government is yet to complete the inquiry against 45 officials of the Vidarbha Irrigation Development Corporation for alleged irregularities in the implementation of 38 projects. (Source: Business Standard)

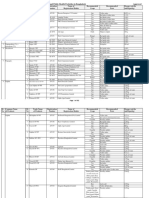

Market Highlights (% change)

Last Prev. day

as on Nov 28, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

18842 5727 55.46 86.49 1717

1.65 1.62 -0.34 -0.79 -1.48

2.80 2.80 0.64 -1.02 -0.66

1.11 1.09 2.53 1.11 0.52

17.70 19.20 6.83 -13.33 0.18

.Source: Reuters

Wheat exports stepped up to cash in on high global prices

A big spike in global wheat prices since June has encouraged the government to aggressively step up exports from its overflowing reserves. State-run trading agencies such as STC, MMTC and PEC have been asked to seize the export opportunity by floating bids regularly. The government has opened talks with potential buyers like Iran for longterm deals, according to sources. The government would soon consider allowing exports of 1.5 million tonnes of more wheat from the official pool, on top of the 2 million tonnes approved in July, so that the process of offloading stocks will not be halted, these sources said. (Source: Financial

Express)

Paddy procurement at 17 mt, up 9% so far

So far in 2012- 13, paddy procurement is nine per cent more than in 2011- 12, according to sources in the Food Corporation of India ( FCI). If the trend continues, the rise in pan- India procurement in 2012- 13 might be about 14 per cent. On the basis of paddy arrivals in different states, FCI expects rice procurement of 40 million tonnes ( mt) in 2012- 13, compared with 35 mt in 201112. Punjab is likely to contribute about a quarter to the central pool, retaining the top position among states. Andhra Pradesh is expected to be second in the list. State agencies procure paddy and supply this to rice millers. FCI lifts the rice from these mills for public distribution. So far in 2012- 13, an estimated 17 mt of paddy has been procured, of which FCIs procurement stands at only 6,00,000 tonnes. In Punjab and Haryana, paddy procurement is in its final stage. In Andhra Pradesh and Chhattisgarh, procurement has already commenced. Unlike wheat (for which procurement is completed in a month), the procurement of paddy is staggered over four months ( October to December). Harvest periods vary across states. Storing such stocks may pose a challenge to agencies. FCI sources said the Centre had approved 18.1 mt of additional storage space. (Source: Business Standard)

India's 2013 wheat exports seen at 3 mn T - state firm official

Exports of wheat by India, the world's second-largest producer, could reach 3 million tonnes from government stocks in 2013, an official of a state-run trading firm said on Wednesday, adding that the country had sold 1 million tonnes since April. Traders expect wheat shipments from India to rise on a potent combination of dry weather in the United States and drought in the Black Sea region. Initially the government has set a limit of 2 million tonnes for wheat exports, but I think the exports will continue to go much higher, an official of a state-run trading company told reporters at an industry conference in Singapore. (Source: Financial

Express)

Centre defers decision to raise ration sugar prices

The food ministry has withdrawn its proposal to almost double the price of sugar sold in ration shops, fearing severe criticism from opposition parties in Parliament and likely voter backlash in Gujarat. The proposal to raise levy sugar prices for the first time in a decade was on the agenda of the CCEA this week. The proposal of raising levy sugar prices was sent to the CCEA for consideration. But since the food ministry is examining the implementation of some of the Rangarajan committees recommendations which include directions on levy sugar, food minister KV Thomas decided to withdraw the proposal, said a senior food ministry official. This is the second time such a proposal has been put on hold by the government. Earlier in September, when the proposal was scheduled to be placed before the CCEA, UPA chairperson Sonia Gandhi and other senior ministers opposed it. The food minister skipped that meeting to defer the proposal. (Source: Economic Times)

CME says no plans to shut grains floor trading

The CME Group CME.O, the biggest operator of U.S. futures exchanges, has no plans to shut open-outcry trading pits but will not change new price settlement rules for grains despite a lawsuit by a group of traders, its CEO said on Wednesday. "Their lawsuit has zero merit," Phupinder Gill, chief executive of CME, told Reuters. Gill said the company "fully expected" the ruling by a Chicago judge on Monday allowing the grain traders to go ahead with a lawsuit to overturn the CME's new end-of-day settlement rules that they say are killing business in the trading pits. The CME has no plans to withdraw the new settlement rules that include transactions done electronically, where the bulk of the volume comes from. "It has to make sense to our client base not just to a small group of traders who somehow feel that they have been displaced," said Gill, who is in Singapore for a derivatives industry conference. Prior to the change, CME had a century-old tradition of settling futures prices for crops like corn and soybeans based on transactions executed in the pits.Gill said the bourse has no plans to close floor trading as long as liquidity was there. (Source: Reuters)

Maha sugar mills get I-T notice for paying cane prices above FRP

The income-tax department has served notices on Maharashtra sugar mills for paying cane price over and above the fair and remunerative price (FRP) fixed by the government. According to the state cooperation minister, the I-T department has assessed the dues of the sugar industry at . 5,000 crore for the period from 1984 to 2011. Most of the sugar mills in top sugar producer Maharashtra are concentrated in the co-operative sector. Co-operatives do not pay any income tax because they say the profit generated is distributed among member farmers. However, according to the I-T department, the money paid to farmers above the FRP is profit and hence attracts income tax (Source: Economic Times)

India oilseed industry pushes for hike in import taxes

India's oilseed industry has submitted a proposal to the government to raise import taxes on palm oil and other edible oils, arguing demand for local output is being hurt after a sharp fall in prices, two trading sources told Reuters. India's oilseed crushing industry gave the proposal to Farm Minister Sharad Pawar last week seeking a raise in crude edible oil import taxes to 10 percent from zero duty currently, said the Indian sources with direct knowledge of the plan. They asked not to be identified due to the sensitivity of the issue. (Source: Reuters)

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Chana

Chana spot continued to decline on account of improved sowing, while futures witnessed short coverings and settled 0.6% higher on Tuesday. Total pulses acreage as on 23rd November is down by 8% to 85.1 lakh ha from 92.49 lakh ha last season. Acreage was down by almost 17% till the previous week and thus shown some recovery in the sowing. In Maharashtra Chana acreage is up by 39% at 6.8 lakh ha as on 23rd Nov. While in AP it is up by 35% at 4.93 lakh ha. However, in Rajasthan, sowing is down by 11% at 11.36 lakh ha. Except for Wheat, minimum support price of all other Rabi crops has been increased by CCEA for 2012-13 season. MSP of Chana/Gram is raised by Rs 400 per qtl for 2012-13 season to Rs 3200. Higher returns and favorable soil condition will definitely boost acreage in the coming season. The Commission for Agriculture Costs and Prices (CACP) has suggested 10 per cent import duty on pulses to encourage domestic production. in the first six months of the new fiscal that is from April to September this year, imports were an estimated 12 lakh tonnes.

Market Highlights

Unit Rs/qtl Rs/qtl Last 4414 4274 Prev day -0.24 0.59

as on Nov 27, 2012 % change WoW MoM -3.07 -7.07 -7.67 -10.38 YoY 32.76 29.87

Chana Spot - NCDEX (Delhi) Chana- NCDEX Nov'12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Dec contract

Sowing progress and demand supply fundamentals

Improved rains towards the end of monsoon season coupled with hike in MSP have raised prospects of Chana sowing in the 2012-13 season. Also, farm ministry has targeted 7.9 mn tn chana output for 2012-13 season, higher compared to 7.58 mn tn in 2011-12.

Source: Telequote

According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses in 2012-13 compared to 108.28 lakh hectare (ha) in the previous year. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

Technical Outlook

Contract Chana Dec Futures Unit Rs./qtl Support

valid for Nov 29, 2012 Resistance 4300-4335

4210-4250

Outlook

Chana futures may open higher initially amid short coverings; however, selling at higher levels is advisable as fundamentals remain supportive for the downside. Expectations of ease in supplies amid higher shipments coupled with subdued demand will keep bearishness intact. Going forward, prices may also take cues from sowing progress of Rabi pulses which is expected to gain momentum in the coming days.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Sugar

Market Highlights

Sugar spot settled lower by 0.24% on Tuesday as government released higher quota for the next four months to restrict any sharp rise in prices. However, downside was limited on the futures which settled flat on Tuesday as traders are watching crushing progress and government policies with respect to tax structure on raw and white sugar imports. In a move to curb any further spike in sugar prices considering lower sugar production for the marketing year 2012-13, Government has allocated total 70 lac tons of non-levy sugar quota for Dec-March 201213 period which is higher from 59.5 lac tons sugar quota allocated by government last year same period . Out of total 70 lac tons, Government released 66 lac tons non-levy sugar quota and 2 lac tons levy conversion sugar quota. Also, there is an extension of around 2 lac tons from October, 2012 - November, 2012 which the millers have to release upto 10th December, 2012. Liffe white sugar settled lower by 0.22% on account of higher pace of crushing in Brazil coupled with higher sugar surplus forecast for fourth straight year has led to a sharp decline in international sugar prices.

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX Nov '12 Futures Rs/qtl Last 3418 as on Nov 27, 2012 % Change Prev. day WoW -0.24 -1.56 MoM -1.55 YoY 10.06

Rs/qtl

3290

0.00

-6.96

-1.56

8.15

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMar'13 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 509.6 425.78

as on Nov 28, 2012 % Change Prev day WoW -0.22 -0.36 -1.62 -2.44 MoM -6.29 -1.29 YoY -16.95 -19.12

.Source: Reuters

Domestic Production and Exports

According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. 9.84 lakh tons of sugar has been produced in the current sugar season 2012-13 upto 15th November, 2012 that is 2 lakh tons higher to the production in the same period last year of 7.76 lakh tons. (Source: PIB) Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13.

Technical Chart - Sugar

NCDEX Dec contract

Source: Telequote

Technical Outlook

Contract Sugar Dec NCDEX Futures Unit Rs./qtl Support

valid for Nov 29, 2012 Resistance 3310-3330

Global Sugar Updates

The center-south region, the world's largest producer of sugar, churned out 1.74 mn tn in the first two weeks of November, up 37%from the same fortnight last year when drought had caused the first drop in output in a decade. Thus, sugar output in brazil which was lower compared to last year since the beginning of the crushing season in May, is now up marginally by 0.1% at 29.3 mn tn. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters)

3250-3275

Outlook

Sugar prices may remain under downside pressure as government has allocated higher quota for the next four months to curb any sharp rise in the prices. However, further delay in cane crushing in Maharashtra and UP may provide support to the prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Oilseeds

Soybean: Soybean Dec futures which extended the gains of the

previous day during the early part of the session on Tuesday, declined towards the on profit taking ahead of 2 day palm oil conference in Indonesia where analyst will present their 2013 price forecasts for the tropical oil. Arrivals remained around 3-3.5 lakh bags on Monday while, demand from solvent extractors is robust to meet the soy meal export commitment. Soy meal exports during October are down 49,840 tn in October, the seventh consecutive month of fall in the current fiscal year, from 223,594 tn a year ago. This is because; most export commitments were done for forward trade like Nov-Dec amid uncertainty over supplies in October. According to first advance estimates, Soybean output is pegged at 126.2 lakh tn for 2012-13.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Dec '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3291 3259 744.7 725.9

as on Nov 27, 2012 % Change Prev day 0.12 -0.05 0.15 -0.51 WoW -0.60 -0.44 3.63 1.67 MoM -0.66 -2.57 3.84 3.21 YoY 47.51 44.89 17.25 13.17

Source: Reuters

as on Nov 28, 2012 International Prices Soybean- CBOTNov'12 Futures Soybean Oil - CBOTDec'12 Futures Unit USc/ Bushel USc/lbs Last 1446 50.11 Prev day -0.21 -0.02 WoW 2.70 3.26 MoM -5.30 -0.14

Source: Reuters

International Markets

CBOT soybean prices closed marginally lower by 0.21% on Tuesday on account of profit booking. Prices have risen earlier this week taking cues from the dwindling supplies from South American nations coupled wih increasing demand for crushing in US. South American exports of soybeans to China are now dwindling, probably falling to only 0.3-0.4 Mn T in November. As per Argentina's Agriculture Ministry weekly crop progress report, farmers have planted 31% of the estimated acreage for soybean to 5.921 mn ha , down 13% from the previous year. The National Oilseed Processors Association (NOPA) reported the U.S. soybean crush for October at 153.536 million bushels, the largest monthly figure since January 2010 and the highest for October since 2009. According to the USDA November monthly report, The U.S. Department of Agriculture on Friday raised its estimate for soybean production by 4% from its forecast last month, saying that rainfall late in the growing season softened the impact of the U.S. drought. th Brazil's government on 8 Nov 2012 edged up its forecast for a record 2012/13 soybean crop to between 80.1 and 83 mn tn.

YoY 28.56 1.89

Crude Palm Oil

as on Nov 28, 2012 % Change Prev day WoW -0.83 -1.11 -7.69 -1.49

Unit

CPO-Bursa Malaysia Dec '12 Contract CPO-MCX- Nov '12 Futures

Last 2160 428.5

MoM -12.48 -1.34

YoY -29.37 -16.18

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Dec'12 Futures Rs/100 kgs Rs/100 kgs Last 4195 4137 Prev day -0.12 0.80

as on Nov 27, 2012 WoW -2.44 -1.48 MoM 3.07 -4.35

Source: Reuters

YoY 35.10 29.81

Refined Soy Oil: Ref soy oil spot traded on a positive note due to

increasing demand for the edible oil amid winter season. However, CPO continues to remain weak on account of lower exports of Malaysian palm oil and fears of further stocks rise. Malaysian palm oil products export figures for 1-25 Nov. fell 1.9% to 12.56 lakh tn compared to 12.8 lakh tons in the Oct. 1-25.

Technical Chart Soybean

NCDEX Dec contract

Rape/mustard Seed: Rm seed futures recovered and settled

higher by 0.8% account of short coverings. Prices have corrected on prospects of better sowing. Indias rapeseed output is expected to rise by 5% to 6.5 mn tn from 6 mn tn last year. Higher prices have urged farmers to increase plantation as total acreage this year is seen at 6.8 mn ha compared with previous years 6.5 mn ha. So far, mustard has been covered on 52.2 lakh ha up from last seasons 50.7. MSP for Mustard seed is increased to Rs 3000/qtl.

Outlook

Edible oil prices will take cues analyst view covering the palm oil sector 2013 price forecasts for the tropical oil at the Indonesias two-day conference. Fundamentally, prices are expected to trade on a positive note during the intraday on account of good demand from solvent extractors for soybean and strong demand soy oil amid lower availability of mustard oil to meet the winter season demand. Mustard prices may remain under downside pressure on prospects of higher sowing and thereby better output next year.

Source: Telequote

Technical Outlook

Contract Soy Oil Dec NCDEX Futures Soybean NCDEX Dec Futures RM Seed NCDEX Dec Futures CPO MCX Dec Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Nov 29, 2012 Support 716-720 3200-3240 4060-4090 429-432 Resistance 732-739 3280-3320 4160-4200 441-445

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Black Pepper

Pepper spot as well as futures continued to trade on a negative note on Tuesday over reports that FMC has launched probe into complaints against pepper market movement. Prices have also corrected on expectations of better output in the domestic as well as the international markets. Farmers are trying to liquidate their stocks ahead of the commencement of arrivals of the fresh crop. Exports demand for Indian pepper in the international markets remains weak due to price parity. However, low stocks and winter demand have supported the prices in the spot. The Spot as well as the Futures settled 1.43% and 1.57% lower on Tuesday. Pepper prices in the international market are being quoted at $7,400/tn(C&F) while Vietnam was offering Austa at $7,000/tn, Brazil Austa at $6,700/tn, and Indonesia Austa at $6,500/tn (FOB).

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 38085 37275 % Change Prev day -1.43 -1.57

as on Nov 27, 2012 WoW -3.99 -5.21 MoM -10.93 -15.32 YoY 10.02 6.61

Source: Reuters

Technical Chart Black Pepper

NCDEX Dec contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till September 2012 is estimated around 80,433 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Dec Futures Unit Rs/qtl

valid for Nov 29, 2012 Support 36000-36640 Resistance 38020-38750

Production and Arrivals

The arrivals in the spot market were reported at 20 tonnes while no offtakes were reported on Monday. As per IPC, Global pepper production in 2012 is projected at 3.27 lk tn, up by 12.7% compared with 2.98 lk tn in 2011. Indonesian pepper output Is expected to rise by 24% and in Vietnam by 10%. According to previous estimates, report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) Pepper production in 2012-13 is expected around 60,000-63,000 tonnes. Currently, pepper is in the fruit formation stage in Kerala.

Outlook

Pepper is expected to trade on a negative note today. Reports that FMC is probing into complaints against price movement may pressurize prices. Liquidation pressure from farmers as well as low export demand may pressurize prices. However, festive season as well as winter demand may arrest a sharp downside in the prices.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Jeera

Jeera Futures recovered from lower levels on account of short covering as the prices have corrected over the last couple of sessions. Currently, sowing in Gujarat is currently lower by 25-30% but it is expected to gain momentum in the coming days. Sluggish demand coupled with higher stocks for delivery on the exchange warehouses has pressurized prices. However, export as well as demand has supported prices in the spot markets. Exporters are buying due to tensions between Syria and Turkey. The spot settled 0.35%lower while the Futures settled 0.56% higher on Tuesday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,825 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 4-5 lakh bags lower by around 3 lakh bags last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 14948 14425 Prev day -0.35 0.56

as on Nov 27, 2012 % Change WoW -0.77 -0.33 MoM -0.31 0.00 YoY 3.59 4.00

Source: Reuters

Technical Chart Jeera

NCDEX Dec contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 6,000 bags, while off-takes stood at 6,000 bags on Tuesday. Production of Jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.06 1.28

as on Nov 27, 2012 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Dec '12 Futures Rs/qtl Rs/qtl

Last 5048 5080

WoW 0.31 -1.51

MoM 0.54 1.15

YoY -8.61 6.59

Outlook

Jeera futures are expected to continue to trade downwards d. Prices may correct tracking higher stocks for delivery on the exchange warehouse. However, sharp downside may be capped due to export demand. In the medium term (November-December 2012), prices are likely to stay firm as there are limited stocks with Syria and Turkey.

Technical Chart Turmeric

NCDEX Dec contract

Turmeric

Turmeric Futures recovered from lower levels on Tuesday on account of short coverings after the prices corrected sharply over the preceding three sessions. The market participants have revised the production estimates due to improved weather conditions in Andhra Pradesh and Karnataka. Also, the upcountry demand has dried up. Overseas demand is also reported to be weak. Stockists also have good carryover stocks with them. There are reports that Turmeric Farmers Association of India have decided to fix their own Minimum Sowing is also reported 30-35% lower during the sowing period. The Spot as well as the Futures settled 0.06% & 1.28% higher on Tuesday. Production, Arrivals and Exports Arrivals in Erode and Nizamabad mandi stood at 3,000 bags and 1,000 bags respectively on Tuesday. Turmeric production in 2012-13 is expected around 50-60% lower compared to last year. Production in 2011-12 is projected at historical high of 10.62 lakh tonnes. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric prices are expected to trade sideways today. Higher production estimates coupled with weak upcountry demand may pressurize prices. However, prices may find support at lower levels as farmers may be unwilling to sell their stocks at lower prices.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Dec Futures Turmeric NCDEX Dec Futures Rs/qtl Rs/qtl

Valid for Nov 29, 2012

Support 14230-14330 4970-5020 Resistance 14510-14600 5130-5170

www.angelcommodities.com

Commodities Daily Report

Thursday| November 29, 2012

Agricultural Commodities

Kapas

NCDEX Kapas settled marginally higher on short coverings. Sentiments remain weak on account of increasing arrival pressure. As on 18th November 2012, 22.66 lakh bales of Cotton has arrived so far, down by 29% compared to last year 31.97 lakh bales during the same period. Cotton export registrations for the 2012-13 season stood at 4.5 lakh bales as of November 5, 2012. Cotton exports are currently on Open General License subject to a prescribed procedure of registration. ICE cotton markets settled higher 0.27% on account of long liquidation by the market participants. Cotton harvesting 84% is harvested completed, versus 85% same period a year ago. Cotton crop condition is 43% in Good/Excellent state th compared to 29% same period a year ago as on 20 Nov 2012.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 962 16300

as on Nov 27, 2012 % Change Prev. day WoW 0.37 -1.89 0.62 0.18 MoM -3.32 0.18 YoY #N/A -1.57

NCDEX Kapas Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 71.23 81.35

as on Nov 28, 2012 % Change Prev day WoW 0.27 -1.59 0.00 0.00 MoM -1.90 0.00 YoY -21.13 -29.20

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) latest estimates for 2012-13 season that commenced in October, domestic cotton production is pegged 334 lakh bales, down 5.6% from the previous years estimates of 353 lakh bales. Lower opening stocks coupled with estimated lower output will result in lower supplies this season at 374 lakh bales, a decline of 8.7% compared with last years 410.77 lakh bales. On the consumption front, domestic consumption is estimated higher at 270 lakh bales on the back of higher mill consumption. However, after witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 70 lakh bales this season, compared with 128.8 lakh bales last year.

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

The U.S. government has raised its 2012/13 forecast for global cotton inventory to above 80 million 480-pound bales for the first time due to larger-than-expected output in the United States, the world's third largest producer, and falling demand from China, the world's largest consumer. In its monthly crop report, the U.S. Department of Agriculture increased its estimate for 2012/13 ending stocks for a fourth straight month to a new all-time high of 80.27 million bales. Higher global ending stocks are seen capping the upside in the cotton prices this year too. However, downside is also limited as prices are again nearing its 12 year average price of 65 cents per pound. Markets will now take cues from the Chinese demand for cotton and trade policies of India with respect to cotton exports. In its November monthly demand supply report, the Agriculture Department (USDA) raised its cotton crop for 2012/13 cotton crop season to 17.45 mln bales (Prev 17.29) along with upward revision in end stocks 5.80 mln 480 pounds/bales (Prev 5.60). Exports were unchanged at 11.60 mln 480 pounds/bales.

Source: Telequote

Technical Chart - Cotton

MCX Dec contract

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Kapas MCX April Cotton MCX December Unit Rs/20 kgs Rs/20 kgs Rs/bale

valid for Nov 29, 2012 Support 940-950 950-958 15950-16080 Resistance 970-980 975-985 16350-16480

Outlook

Cotton prices might trade sideways with negative bias as arrival pressure is weighing on the prices. However, no major downside is expected in the domestic markets as farmers will not sell their stocks at very low prices. Also, CCI procurement at MSP levels may support prices from falling sharply.

www.angelcommodities.com

You might also like

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 10 Terrestrial BiodiversityDocument76 pagesChapter 10 Terrestrial BiodiversityVedant KarnatakNo ratings yet

- Global Cassava End-Uses and Markets Report Highlights Food, Feed and Industrial ApplicationsDocument58 pagesGlobal Cassava End-Uses and Markets Report Highlights Food, Feed and Industrial ApplicationsabdouzadNo ratings yet

- Zenag Farming GuideDocument32 pagesZenag Farming GuideChandan PatilNo ratings yet

- In House ReviewsDocument2 pagesIn House ReviewsGrignionNo ratings yet

- Form 1 Agriculture NotesDocument47 pagesForm 1 Agriculture NotesGodfrey Muchai100% (3)

- Business ListingDocument16 pagesBusiness ListingPassionate_to_LearnNo ratings yet

- Effect of Gypsum and Calcium Carbonate On PlantsDocument32 pagesEffect of Gypsum and Calcium Carbonate On Plantsmohammed_seid67910No ratings yet

- Evaluation of Punjab Land Reforms: Army Institute of LawDocument17 pagesEvaluation of Punjab Land Reforms: Army Institute of LawTulip Joshi0% (2)

- Bardot Brasserie Dinner MenuDocument2 pagesBardot Brasserie Dinner Menususan6215No ratings yet

- Alexandria, Giurgiu, OltenitaDocument1 pageAlexandria, Giurgiu, OltenitaBogdan DraghiciNo ratings yet

- Registered Pesticides ListDocument182 pagesRegistered Pesticides ListBaeyzid Khan100% (3)

- History NotesDocument28 pagesHistory Notesano mlamboNo ratings yet

- Unit5 PDFDocument2 pagesUnit5 PDFDAYELIS DUPERLY MADURO RODRIGUEZ0% (1)

- Concentrated Animal Feedings Operations PDFDocument4 pagesConcentrated Animal Feedings Operations PDFANGIE TATIANA VELÁSQUEZ TATISNo ratings yet

- IITA Bulletin No. 2201Document6 pagesIITA Bulletin No. 2201International Institute of Tropical AgricultureNo ratings yet

- Sustainable Development of An Agricultural Region - The Case of The Allgäu, Southern GermanyDocument28 pagesSustainable Development of An Agricultural Region - The Case of The Allgäu, Southern Germanyjjwy2No ratings yet

- Cocoa Training Manual PDFDocument122 pagesCocoa Training Manual PDFOlukunle AlabetutuNo ratings yet

- Meaning of Terms Used in Karnataka Land Records: Posts: JoinedDocument12 pagesMeaning of Terms Used in Karnataka Land Records: Posts: JoinedChetan SharmaNo ratings yet

- Intra Clean Quick-Scan BookletDocument8 pagesIntra Clean Quick-Scan BookletIntracareNo ratings yet

- 100 Medicinas de PopoolaDocument122 pages100 Medicinas de Popoolajaime92% (48)

- Ziimart Business PlanDocument18 pagesZiimart Business PlanNsereko Ssekamatte100% (1)

- Oprah: "Feel Everything With Love": Broke and HappyDocument20 pagesOprah: "Feel Everything With Love": Broke and HappyDonna S. SeayNo ratings yet

- Dairy Farm Project Report - Buffalo (Large Scale)Document2 pagesDairy Farm Project Report - Buffalo (Large Scale)VIJAYJKNo ratings yet

- John D. Smith - The Butchers' Manual - 1890Document32 pagesJohn D. Smith - The Butchers' Manual - 1890МихаилNo ratings yet

- Poultry Antemortem Inspection ProceduresDocument17 pagesPoultry Antemortem Inspection ProceduresFaradiila CharitasNo ratings yet

- Engish 1st Language MCQ's Question BankDocument77 pagesEngish 1st Language MCQ's Question BankShivalingappa Sampaganvi67% (3)

- Maya Mountain Research Farm Intern ProgramDocument5 pagesMaya Mountain Research Farm Intern ProgramSarah McHughNo ratings yet

- Food SecurityDocument2 pagesFood SecurityChris LowNo ratings yet

- Specific HeatDocument4 pagesSpecific HeatMikee CorpuzNo ratings yet

- India's Amul: Keeping Up With The TimesDocument16 pagesIndia's Amul: Keeping Up With The TimesAmbika AgrawalNo ratings yet