Professional Documents

Culture Documents

Module 8 Control Lecture Notes

Uploaded by

DheerajOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 8 Control Lecture Notes

Uploaded by

DheerajCopyright:

Available Formats

Management Science I Prof. M.

Thenmozhi

CONTROLLING

Dr.M. Thenmozhi

Professor

Department of Management Studies

Indian Institute of Technology Madras

Chennai 600 036

E-mail: mtm@iitm.ac.in

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

EFFECTIVE CONTROL

THE MEANING OF CONTROL

• By one definition, management control is the process of ensuring that actual

activities conform to planned activities. In fact, control is more pervasive than

planning.

• Control helps managers monitor the effectiveness of their planning, their

organizing, and their leading activities .An essential part of the control process is

taking corrective actions as needed.

Steps in the control process

Robert j.Mockler’s definition of control points out the essential element of the control

process:

• Management control is the systematic effort to set performance standards with

planning objectives, to design information feedback systems, to compare actual

performance with these predetermined standards, to determine whether there are

any deviations and to measure their significance, and to take any actions

required to assure that all corporate

• Resources are being used in the most effective way possible in achieving

corporate objectives.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

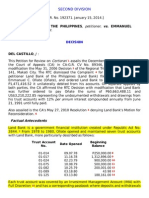

BUDGETING SYSTEM FOR CONTROLLING

FUNCTION

OUTPUTS MINUS

OUTPUTS INPU INPUTS

TS

REVENUE EXPENSE PROFIT INVESTMENT

CENTERS CENTERS CENTERS CENTER

OUTPUTS COMPARED

WITH ASSETS

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

ESTABLISH STANDARDS AND METHODS FOR MEASURING PERFORMANCE:

• Ideally, the goals and objectives established during the planning process will

already be stated clear, measurable terms that include specific dead lines. This

is important for a number of reasons.

• First, vaguely worded goals, such as “To improve employee skills”, are just

empty slogans until managers begin to specify what they mean by “Improve”

and what they indent to do reach this goal-and when.

• Second precisely worded goals are easier to evaluate for accuracy and

usefulness than empty slogans.

• Finally, Precisely Measurable objectives are easy to communicate and to

translate into standards and methods that can be used to measure

performance.

• This ease of communicating precisely worded goals and objectives is especially

important for control, since some people usually fulfill the planning roles and

other people are assigned to control roles.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• In service industries standards and measurements might include the amount of

customer have to wait in line at a bank, the amount of time they have to wait near

the telephone is answered or the number of new clients attracted and

measurement can include sales and production targets, work attendance goals,

waste product produced and recycled and safety records.

MEASURE THE PERFORMANCE

• Like all aspects of control, measurement is an ongoing repetitive progress. The

frequency of measurements depends on the type of activity being measured.

• In a manufacturing plant, levels of gas particles in the air for example could be

continuously monitored for safety, whereas progress on long term expansion

objection might be reviewed by top management only once or twice year.

DETERMINE WHETHER THE PERFORMANCE MATCHES THE STANDARDS

• It’s an easiest step in the control process .

• Now it’s a matter of comparing measured results with the established targets are

standard previously set. If performance matches the standards the managers can

assume that everything is under control.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• The figure shows that they don’t have to intervene actively in the organizations

operations. The figure illustrates another important point –namely that control is

a dynamic process.

WHY CONTROL IS NEEDED

• One reason that control is needed is that the best of plans go away. But

controls also help managers monitor environmental changes and their effects

on the organization progress.

• To create better quality

– Total quality management leads to dramatic improvements in control.

– Process flaws are spotted and the process is corrected to drive out

mistakes. Employees are empowered to inspect and improve their own

work.

• To cope with changes

– Changes are an inevitable part of any organization environment. Markets

shift.

– Competitors often from around the world-offers new products and services

that capture the public imagination. New materials and technology’s

emerge .

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

– Government regulations are enacted or amend.

– The control function aid managers in responding to the resulting threats, or

opportunities by helping managers detect changes that are affecting the

organization product and service.

• To create faster cycles:

– It is one thing to recognize that the customer demand for improved,

design, quality or delivery time. It is another to speed up the cycles

involved in creating and delivering new products and services to

customers.

• To facilitate elegation and team work:

– Key performance and key result areas (KRA) are those aspects of unit or

organization that must function effectively for the entire unit or organization

should get succeed.

– These areas usually involves major organization activities or group of

activities that occur throughout the organization or unit.

– This figure shows some of key performance areas for production,

marketing, personnel Management, and finanace, and accounting.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

– These key performance areas, in turn help define the more detailed control

systems and standards.

– In today’s organization, many KRAS are cross functional an organization

might define KRAs for a team focused on customer service in terms of

customer response to a satisfaction survey.

IDENTIFYING STRATEGIC CONTROL POINTS:

• In addition to key performance area it is also important to determine the critical

points in the system where monitoring or information collecting should occur

• once such strategic control point should be located; the amount of information

that has to be gathered and evaluated can be reduced considerably.

• The most important in selecting strategic control point is to focus on most

significant element in the given operation.

• Usually small portion of objects, individuals causes large expense and problem

for the managers to face.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• Examples:

– For example 10 manufactured products may well yield 60 percent of its

sales. 2 percent of an organization’s employee may account 80 percent of

its employee grievances and 20 percent of the police precincts in city may

account for 70 percent of the city’s violence and crimes.

– Another useful consideration is the identification of places where change

occurs in a productive process. For Example in an organizations system

for filling customer’s orders

• Examples:

– A change occurs when a purchase order become a invoice, when an

inventory items becomes an item to be shipped, or when the item to be

shipped becomes part of truckload. Since errors are more likely to be

made when such change occur, monitoring change points is usually a

highly effective way to control an operation.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

FINANCIAL CONTROLS

• Manager’s uses a series of controls and systems to deal with differing problems

and element of their organization.

• The method and systems can take many forms and can be intend for various

groups.

• However finance control have special prominence since money is easy to

measure and tally.

FINANCIAL STATEMENTS

• Financial statements are used to track the monetary value of goods and services

into and out of the organization .

They provide a means for monitoring three major financial condition of an

organization:

1. Liquidity: The ability to convert assets into cash in order to meet current

financial Needs and obligations.

2. General financial condition: The long Term between balance between debt

and equity.

3. Profitability: The ability to earn a profit over an extended period of time.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• Financial statements are widely used by managers, shareholders, financial

institutions, investment analysts, union, and other stake holders to increase

the performance.

• Managers, for example, could compare company’s current performance with a

past performance and to those of competitors of how well the organization is

doing the overtime.

• Given enough information they might be able to see trends that require

corrective action.

• Bankers and financial analysts on the other hand they will use the statements

to decide whether they should invest in the firm.

• It’s important to remember that the financial statement do not show all the

relevant information.

• Recent Technological or scientific break through shows up on financial

statements For example nor changes in environment of the organization for

example shifts changes as per the consumer taste even though these could

be more crucial than a financial Performance.

• Depending on the company financial statements could cover the previous

year, previous quarter or previous month.

• The most common financial statements used by large, small organization alike

are income statement, balance sheet, cash flow statement.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

BALANCE SHEET

• In its simple form balance sheet describes the company in terms of Asset

Liabilities, and worth.

A company asset will ranges from the money in the bank to the Good will value of

its name in the market place.

• The left side of the balance sheets lists these order in the descending order of

liquidity.

• A distinction is made between current asset and fixed asset.

• Current Assets: covers items such as cash, account receivable, marketable

securities

• And inventories assets that could be turned in to cash reasonably predictable

value with in a relatively short period of time.

• Fixed Assets: show the monetary value of company’s plant, equipment,

property, plants, and other item used on a continuing basis to produce its goods

or services.

• Liabilities :are also made up two groups: current liabilities and long term

liabilities

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• Current liabilities: are debts, account payable short-term loans and unpaid

taxes that will have to be paid off during the current fiscal period.

• Long term liabilities include mortgages, bonds, and other debts that are being

paid off gradually.

• The company’s net worth value remains as residual value remaining after total

liabilities have been subtracted from total assets.

• The Electronic spread sheet has made balance sheet much easier .

• In addition to that computer packages have been developed specifically to

process accounting transaction and prepare the resulting balance sheets and

other financial statements.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

INCOME STATEMENT

It summaries the companies financial statement at the given interval of time.

• The income statement then says “Heres how much money I have made over a

given period instead of “hears how much money we are worth now.

• Income statements starts with a figure for gross receipts or sales and then

subtract all cost the costs involved in realizing those sales, such as the cost of

goods sold, administrative expenses taxes, interest, and other operating

expenses.

• What is left is the net income available for stockholders dividends or

reinvestment in the business.

CASH FLOW

• In addition to the standard balance sheet and income statement, many

companies report financial data in the form of a statement of cash flow or a

statement of sources and uses of funds.

• Theses statements show where cash or funds came during the year and where

they are applied they should not confused with the income statement.

Cash flow statements show how cash or funds were used rather than how much profit

or loss was achieved.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

BUDGEDERY CONTROL METHODS

• Budget are formal quantitative statements of the resources set outside for

carrying out planned activities over give period of time.

• As such they are widely used for carrying out planned activities over given

period of time.

• As such they are widely used means for planning and controlling activities at

every level of the organization.

• Thier are number of reason for their wide usage.

• First budget: are stated in momentary terms, which are easily used as a

common denominator for a wide variety of organizational activities-hiring and

training personnel, purchasing equipment, manufacturing, advertising and

selling.

• Second: the monetary aspect of budgets means that they can directly convey

information on key organizational recourses-capital-and on a key organizational

goal-profit. They are therefore heavily favored by a profit oriented companies.

• Third budget: establish clear and unambiguous standards of performance for a

set time period.-usually year.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• At stated intervals during that time period ,actual performance will be compared

directly with the budget.

• Deviation can detect quickly and acted upon.

• In addition to being major control devices, budgets are one of the major means

of coordinating the activities of the organization.

• The interaction between managers and subordinate that take place during the

budget development process will help define and integrate the activities of

organization members.

RESPONSIBILITY CENTERS:

Any organizational or functional unit headed by a manager who is

responsible for the activities of that unit is called a responsibility center.

All responsibility center uses the resources for something.

Typically responsibility is assigned to a revenue, expense ,profit and or invest

center.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• Control systems can be devised to monitor organizational functions or

organizational projects. Controlling a function involves making sure that a

specified activity (such as production or sales) is properly carried out.

• Controlling a project involves making sure that a specified end result is achieved

(such as the development of a new product or the completion of a building).

• Budgets can be used for both types of systems;

• Any organizational or functional unit headed by a manager who is responsible for

the activities of that unit is called a responsibility center.

• All responsibility centers use resources (inputs or costs) to produce something

(outputs or revenues).

• Typically, responsibility is assigned to a revenue, expense, profit, and/or

investment center are 20-4).

• The decision usually depends on the activity performed by the organizational unit

and on the manner in which inputs and outputs are measured by the control

system.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

We will describe such centers briefly here.

• REVENUE CENTERS: Revenue centers are those organizational units in which

outh puts are measured in monetary terms but are not directly compared to

input costs.

– A sales department is an example of such a unit. The effectiveness of the

center is t not judged by the extent to which revenue (in the form of sales)

exceeds the cost of

– The center (in salaries or rent, for example). Rather, budgets (in the form

of sales quotas) are prepared for the revenue center and the figures are

compared with sales orders or actual sales.

– In this way, a useful picture of the effectiveness of individual salespeople

or of the center itself can be determined.

• EXPENSE CENTERS: In expense centers or cost centers, inputs are

measured by In re the control system In monetary terms, but outputs are not.

The reason is that

– These centers are not expected to produce revenues. Examples are

maintenance, administration, service, and research departments.

– Budgets will be devised only for the input portion of these centers'

operations.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• PROFIT CENTERS: In a profit center, performance is measured by the

numerical difference between revenues (outputs) and expenditures (inputs).

– Such a measure is do used to determine how well the center is doing

economically and how well the manager in charge of the center is

performing.

– A profit center is created when- ever an organizational unit is given

responsibility for earning a profit.

– In a divisionalized organization, in which each of a number of divisions is

completely responsible for its own product line, the separate divisions are

considered profits.

• INVESTMENT CENTERS: In an investment center, the control system again

measures the monetary value of inputs and outputs, but it also assets how

– those outputs compare with the assets employed in producing

them./Assume, for X

– It example, that a new hospital requires a capital investment of $20 million

in property, buildings, equipment, and working capital.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

– In its first year, the hospital has $2 million in labor and other input

expenses and $4 million in revenue.

– For two reasons the hospital would not be considered to have earned a $2

million profit.

– First, an allowance must be made for the depreciation of building and

equipment.

– Second, management must account for the interest that could have been

earned from alternative investments.

– By assessing these factors as well, the company obtains a much more

accurate picture of profitability.

– Managers can identify the return on an investment, not merely the actual

inflow and outflow or, and submitted to the budget committee for further

review.

– Finally, the master budget is sent to top magement (the president, chief

executive officer, or board of directors) for approval.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

THE BUDGETING PROCESS

• The budgeting process usually being when the managers receive top

management economic forecasts and sales and profit objectives for the coming

year along with the time table stating when budget must be completed.

• The forecasts and objectives provided by top management with in which other

managers budget will be developed.

• In a few organizations the presence is for “top-down” budgeting. Budget are

imposed by top managers but little or no consultation with lower level managers

.

• Most companies, however most companies how ever prefer the process of

bottom up budgeting; budgets are prepared at least initially by those who

implemented by them.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

(ii). THE ROLE OF BUDGET Personnel.

• Although developing is the responsibility of managers, they may receive

information and technical assistance from the staff of a planning group or from a

formal budget department or committee.

• These groups are likely to exist in large, divisionalized organizations in which

the division budget plays a key role in planning, coordinating, and controlling

activities.

• 17 The budget department, which generally reports to the corporate controller,

pro-vides budget information and assistance to organizational units, designs

budget systems and forms, integrates the various departmental proposals into a

master budget for the organization as a whole, and reports on actual

performance relative to the budget

• The budget committee, made up of senior executives from all functional areas,

reviews the individual budgets, reconciles divergent views, alerts or approves

the budget proposals, and then refers the integrated package to the board of

directors.

• Later, when the plans have been put into practice, the committee reviews the

control reports that monitor progress.

• In most cases, the budget committee must approve any revisions made during

the budget period.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

SOME PROBLEMS IN BUDGET DEVELOPMENT

• During the budget-development process. when the organization's limited

resources are allocated, managers could fear that , they will not be given their

fair share.

• Tension can grow as competition with other. Managers increases.

• Anxieties might also arise because managers know they will J be judged by

their ability to meet or beat budgeted standards.

• Hence, they are concerned about what those standards will be and may

overstate their needs to create some slack.

• Conversely, their senior managers are concerned with establishing aggressive

budget objectives.

• As a result, the senior managers will often try to trim ADITING

• To much of the general public, the-term auditing is associated with detecting

fraud.

• Although the discovery of fraud is, in fact, one important facet of auditing, it is

from the only one.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• Auditing has many important uses, from validating the honesty and irness of

financial tamnts.

• To providing a critical sis for man- agreement decisions.

• Will discuss two types put; audit external c auditing and internal auditing.2O

EXTERNAL AUDITING

• The traditional external audit is largely a verification process involving the in-

dependent appraisal of the organization's financial accounts and statements.

• Assets and liabilities verified, and financial reports are checked for

completeness and accuracy.

• The audit is conducted by accounting personnel employed by chartered

accountants.

• The auditors' purpose is not to pre- pare the company's financial reports.

• Their job is to verify that the company, in preparing its own financial statements

and valuing its assets and liabilities, has followed generally accepted

accounting principle’s and applied them correctly.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• The external audit plays a significant role in encouraging honesty, not only in

the preparation of statements, but also in the actual operation of the

organization.

• It is, in fact, a major systematic check against fraud within the organization.

• For people outside the organization, such as bankers and potential investors,

the ex- ternal audit provides the major assurance that publicly available

statements are accurate.

EXTERNAL AUDIT

• The external audit takes place after the organization’s operating period is

finished and its financial statements are completed.

• For this reason, and also because it generally focuses on a comparatively

limited set of financial statements and transactions, the external audit does not

usually make a major contribution to control of the ongoing operations of the

organization.

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

INTERNAL AUDIT

• However, knowing that the audit will inevitably occur is a strong deterrent

against actions that may lead to embarrassment if they are discovered during or

after the audit.

• The internal audit is carried out by members of the organizations .

• Its objectives are to Provide reasonable assurance that the assets of the

organization are being properly Safe guarded and that financial records are

being kept reliably and accurately enough For the preparation of financial

statements.

• Internal auditing also assists managers in evaluating the organization s

operational efficiency and performance of its control system.

• Because it concentrates on the operation of the organization this process is

also known as operational auditing

Indian Institute of Technology Madras

Management Science I Prof. M.Thenmozhi

• In this role the we can see the management process is a self correcting.

• The internal audit may be carried out as a separate project by assigned

members of the financial department or in large organizations, by full time

internal auditing staff.

• The range and depth of audit will also vary, depending on company size and

policy.

• It can range from a relatively narrow survey to a board comprehensive analysis

that gone beyond appraising the control system to look at policies, procedures,

the use of authority, and the overall quality and effectiveness of the managerial

methods being used .

Indian Institute of Technology Madras

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- NPDQuotesDocument55 pagesNPDQuotesDheerajNo ratings yet

- Cold Calling Process-TMDocument1 pageCold Calling Process-TMDheerajNo ratings yet

- How To Learn JapaneseDocument31 pagesHow To Learn JapanesebmonaandaNo ratings yet

- Introduction To Acceptance SamplingDocument16 pagesIntroduction To Acceptance Samplingjsalu_khanNo ratings yet

- Human Resources in Balance SheetDocument15 pagesHuman Resources in Balance SheetDheerajNo ratings yet

- Training, Development, SocializationDocument16 pagesTraining, Development, SocializationDheeraj100% (3)

- Human Resources Management in 2020.Document11 pagesHuman Resources Management in 2020.DheerajNo ratings yet

- 500 Mcqs For Amfi TestDocument34 pages500 Mcqs For Amfi TestNidhin G NairNo ratings yet

- Presentation On AIGDocument27 pagesPresentation On AIGDheeraj80% (5)

- HR's Scenario in 2020Document4 pagesHR's Scenario in 2020Dheeraj100% (1)

- Human Resources Management in 2020Document12 pagesHuman Resources Management in 2020DheerajNo ratings yet

- Services - 4 PS: Service?Document5 pagesServices - 4 PS: Service?DheerajNo ratings yet

- 1169002953-Chapter 29 Section 29.1Document28 pages1169002953-Chapter 29 Section 29.1DheerajNo ratings yet

- Fact Sheet 082008Document8 pagesFact Sheet 082008DheerajNo ratings yet

- AdvantagesDocument7 pagesAdvantagesDheerajNo ratings yet

- AIG India Equity Fund: April 2007Document55 pagesAIG India Equity Fund: April 2007DheerajNo ratings yet

- 6 Sampling VaDocument19 pages6 Sampling Vaapi-3825778No ratings yet

- Unit 5 Pom PDFDocument20 pagesUnit 5 Pom PDFpit mechNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- How To Become A Certified Finance Planner (CFP) in India - QuoraDocument11 pagesHow To Become A Certified Finance Planner (CFP) in India - QuorarkNo ratings yet

- Unit 6 Ratios AnalysisDocument28 pagesUnit 6 Ratios AnalysisLe TanNo ratings yet

- Chapter 07Document3 pagesChapter 07Suzanna RamizovaNo ratings yet

- CARO 2020 PresentationDocument47 pagesCARO 2020 PresentationMuralidharan SNo ratings yet

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Notice For MemberDocument5 pagesNotice For MemberDEEPAK KUMARNo ratings yet

- Acknowledgement To ContentsDocument4 pagesAcknowledgement To Contentsvandv printsNo ratings yet

- Patels Airtemp (India) LimitedDocument5 pagesPatels Airtemp (India) LimitedAnkit LohiyaNo ratings yet

- Authorization For Salary ChangeDocument2 pagesAuthorization For Salary ChangeKhan Mohammad Mahmud HasanNo ratings yet

- Topic 6 Financial Management in The WorkshopDocument27 pagesTopic 6 Financial Management in The Workshopjohn nderitu100% (1)

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- 2021 BEA1101 Study Unit 5 SolutionsDocument13 pages2021 BEA1101 Study Unit 5 SolutionsKhanyisileNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument25 pagesGeneral Comments: The Chartered Institute of Management AccountantsSritijhaaNo ratings yet

- Using The Following Instructions, Perform Accuracy Check of Lecture SlideDocument3 pagesUsing The Following Instructions, Perform Accuracy Check of Lecture SlideAshish BhallaNo ratings yet

- Standard Chartered Bank PakistanDocument19 pagesStandard Chartered Bank PakistanMuhammad Mubasher Rafique100% (1)

- Outstanding Investor DigestDocument6 pagesOutstanding Investor Digestapi-26172897No ratings yet

- Mortgage (CH 9)Document37 pagesMortgage (CH 9)widya nandaNo ratings yet

- Hedge Funds-Case StudyDocument20 pagesHedge Funds-Case StudyRohan BurmanNo ratings yet

- Duxbury Clipper 2010-30-06Document40 pagesDuxbury Clipper 2010-30-06Duxbury ClipperNo ratings yet

- Group Assignment FIN533 - Group 4Document22 pagesGroup Assignment FIN533 - Group 4Muhammad Atiq100% (1)

- Bloomberg Top Hedge Funds 2010Document14 pagesBloomberg Top Hedge Funds 2010jackefeller100% (1)

- Question 591541Document7 pagesQuestion 591541sehajleen randhawaNo ratings yet

- Dissolution Deed FormatDocument2 pagesDissolution Deed FormatMuslim QureshiNo ratings yet

- Business Risk Measurement MethodsDocument2 pagesBusiness Risk Measurement MethodsSahaa NandhuNo ratings yet

- Immovable Sale-Purchase (Land) ContractDocument6 pagesImmovable Sale-Purchase (Land) ContractMeta GoNo ratings yet

- Assignment Banking ShivaniDocument25 pagesAssignment Banking ShivaniAnil RajNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Land Bank of The PhilippinesDocument30 pagesLand Bank of The PhilippinesAdam WoodNo ratings yet

- Arielle Martin - IRS LetterDocument2 pagesArielle Martin - IRS LetterArielle MartinNo ratings yet

- Investments Bodie Kane Marcus 9th Edition Solutions ManualDocument6 pagesInvestments Bodie Kane Marcus 9th Edition Solutions ManualDouglas Thompson100% (27)