Professional Documents

Culture Documents

Perfect Competition

Uploaded by

Abhijit RayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perfect Competition

Uploaded by

Abhijit RayCopyright:

Available Formats

THE PERFECTLY COMPETITIVE MARKET OUTLINE: I. Introduction to Market Structure II. Characteristics of Perfect Competition III.

Perfect Competition Graphically IV. Revenue for the Firm V. Short Run Equilibrium Profit Maximization VI. Graphically A. A Profit B. A Loss C. Breaking even VII. The Shutdown Rule VIII. The Firms Short Run Supply Curve IX. Long-Run Equilibrium in a Perfectly Competitive Market X. Permanent Changes in Market Demand 1) An Increase in Market Demand 2) A Decrease in Market Demand

Productivity

Product Curves Short run

Firms (Choice of Q)

Costs Long run

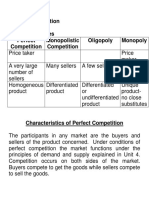

Customer Demand (Market Conditions) INTRODUCTION TO MARKET STRUCTURE Market Spectrum (Ch.11) Perfect Competition (Ch.13) Monopolistic Competition (Ch.13) Oligopoly

Market Structures (4)

(Ch.12) Pure Monopoly

I. Perfect Competition Characteristics:

(Market forces to operate unimpeded) 1) 2) 3) 4) all firms sell an identical (homogeneous) product So consumers are indifferent to different sellers Many sellers or firms (LRATC hits low point at relatively small level of output) Firms are price takers Their market share isnt large enough to affect the market price NO MARKET POWER Free entry and exit no barriers to entry or exit such as - exclusive control of a resource - unusually high start up costs Instantaneous entry and exit Complete information Firms maximize profits no firms operating charitably

5)

6) 7) 8)

II. Perfect Competition Graphically

Total revenue (dollars per day)

Demand, Price, and Revenue in Perfect Competition

Price (dollars per sweater) Price (dollars per sweater)

TR

50

S

Market demand curve

50

demand curve MR

25

25

225

D

0

9 20 Quantity (thousands of sweaters per day)

9 20 Quantity (sweaters per day)

10 20 Quantity (sweaters per day)

market

Copyright 2000 Pearson Education Canada Inc.

Demand and marginal revenue

total revenue

Slide 12-10

Each firms demand curve is perfectly elastic A change in q of any firm is not significant enough to change the market demand, D, so one firm can not impact the market price. If a firm tries to increase its price, it will lose all of its customers

III. Revenue for the firm Total Revenue = TR = Pe q

Marginal Revenue: Revenue from selling one more unit of the good MR = Pe IV. Short-Run Equilibrium - Profit Maximizing Output levels Profit = TR TC

Total Revenue, Total Cost, and Economic Profit

Total revenue and total cost (dollars per day)

TC TR

300 225 183 100 Economic loss 0 4 9 12

Slide 12-15

Economic loss Economic profit = TR TC

Quantity (sweaters per day)

Copyright 2000 Pearson Education Canada Inc.

Total Revenue, Total Cost, and Economic Profit

Total revenue and total cost (dollars per day)

TC

300 225 183 100 0 4 9 12

TR

Quantity (sweaters per day)

Profit/loss (dollars per day)

42 20 0 -20 -40

Economic loss Economic profit

12

Quantity (sweaters per day)

Profitmaximizing quantity

Profit/ loss

Slide 12-16

Copyright 2000 Pearson Education Canada Inc.

MR=MC The Profit Maximizing Condition V. Graphically looking at profit A) A firm earning a positive economic profit As long as Pe > ATC where MR=MC, the firm is earning a positive economic profit

Economic Profit

Price and cost (dollars per sweater)

30.00

MC

ATC MR

25.00

Economic profit

20.33

15.00

0

Copyright 2000 Pearson Education Canada Inc.

9 10

Quantity (sweaters per day)

Slide 12-24

Profit = TR TC Profit = Pe*q (ATC)q

B) A firm earning zero economic profit (normal rate of return) may still be earning a positive accounting profit As long as Pe = ATC where MR=MC, the firm is earning zero economic profit

Normal Profit

Price and cost (dollars per sweater)

30.00 Break-even Breakpoint

MC

ATC

25.00

20.00

MR

15.00

0

Copyright 2000 Pearson Education Canada Inc.

10 Quantity (sweaters per day)

Slide 12-23

Profit = TR TC Profit = Pe*q (ATC)q Normal rate of Return C) A firm earning a negative economic profit (economic loss) If Pe < ATC where MR = MC, the firm is suffering an economic loss GRAPH Profit = TR TC Profit = Pe*q (ATC)q VI. The Shutdown Rule How do you know when to shut down and when to keep producing? When Pe < ATC (LOSS) If Pe > AVC the firm will keep operating Even though suffering a loss, still paying some fixed costs If Pe < AVC the firm will shut down The firm shuts down because it is not covering its fixed costs of production

Shut down is a temporary decision close down operation until market conditions look better If we expect P < ATC indefinitely we get out of business this is a long run decision getting out of business for good Maximizing profit also means minimizing loss VII. The firms short-run supply curve If D shifts in the market, Pe changes causing MR or d to shift. New output determined where MR1 = MC The part of MC curve above AVC is the firms short-run supply curve Shows relationship between P and q for the producer

A Firms Supply Curve

Price and cost (dollars per sweater)

MC 31 MR2

25

Shutdown point

MR1 AVC MR0

s 17

0

Copyright 2000 Pearson Education Canada Inc.

9 10

Slide 12-28

Quantity (sweaters per day)

The industry supply curve is the horizontal summation of the supply curves of individual firms. VIII. Review of the Perfect Competition and Long-Run Equilibrium in a Perfectly Competitive Market 1) QD = QS in the market no P 2) Firms are breaking even or earning a normal rate of return no # firms a) Existing firms cannot be suffering losses (This would include exit from the market) b) Existing firms cannot be earning an economic profit (This would induce new entry into the market) This is called the zero profit condition 3) Allocative efficiency: (Pe = MC) (this implies that the firm is putting their resources into best paying use)

for perfect competition this is also true in the short run no resource allocation 4) Productive efficiency: (Pe = min ATC) Must be at minimum of LRATC so that expansion of plant size will not lower costs Low point of LRATC is called minimum efficient scale So no incentive to change plant size. no plant size Economic or productive efficiency IX. Permanent changes in Market Demand 1) An increase in market demand

GRAPHS Suppose D shifts from D0 to D1. a) In the short-run (a to b) As demand increases, (D0 to D1), the firms demand curve increases due to the higher equilibrium price, (d0 to d1) or (MR0 to MR1). The profit maximizing output increases from q0 to q1 as existing firms increase output and respond to the higher price level and the ability to earn greater profits. (by running factories overtime) Existing firms increase output by moving along up their supply curve (i.e. the marginal cost curve). As existing firms increase production, this is a short run response. Market output increases as we move along S0 from point a to point b. Is point b a long run equilibrium? No P > min ATC b) In the short-run (a to c) In the long run the profits of existing firms send a signal to new firms to enter the market. As new firms enter what happens to the market supply curve? It shifts out to the right As S0 shifts to S1, the market price falls hence pushing the firms demand curve back to its original level. The lower price encourages firms to cut production back to q0. So now we have more firms, but all producing at the old equilibrium output level. Point c is along run equilibrium. The long run market supply curve connects the dots representing the long run equilibrium. In this case it is perfectly flat. This shows that the industry has constant costs. There are also industries where the cost of inputs change when firms enter and exit the markets, however, we will not focus on such cases.

2) A decrease in the market demand

Suppose D shifts from D0 to D1. c) In the short-run As demand decreases, (D0 to D1), the firms demand curve decreases due to the lower equilibrium price, (d0 to d1) or (MR0 to MR1). The profit maximizing output decreases from q0 to q1 as existing firms decrease output and respond to the lower price level and the ability to suffer greater losses. Existing firms decrease output by moving down their supply curve (i.e. the marginal cost curve). As existing firms decrease production, this is a short run response. Market output decreases as we move along S0 from point a to point b. Is point b a long run equilibrium? No P > min ATC d) In the long run the losses of existing firms send a signal to new firms to exit the market. As some firms exit the market supply curve shifts back to the left As S0 shifts to S1, the market price rises hence pushing the firms demand curve back to its original level. The higher price encourages firms to increase production back to q0. So now we have fewer firms, but all producing at the old equilibrium output level. Point c is a long run equilibrium. The long run market supply curve connects the dots representing the long run equilibrium. In this case it is perfectly flat. This shows that the industry has constant costs. There are also industries where the cost of inputs change when firms enter and exit the markets, however, we will not focus on such cases.

You might also like

- CompTIA Network+Document3 pagesCompTIA Network+homsom100% (1)

- Coursework Assignment: Graduate Job ImpactDocument13 pagesCoursework Assignment: Graduate Job ImpactmirwaisNo ratings yet

- Microeconomics-Perfect CompetitionDocument33 pagesMicroeconomics-Perfect CompetitionSow Kuan LiNo ratings yet

- Competitive Markets: B 2 B MarketingDocument46 pagesCompetitive Markets: B 2 B MarketingShikha TiwaryNo ratings yet

- Perfect CompititionDocument35 pagesPerfect CompititionAheli Mukerjee RoyNo ratings yet

- Perfectly Competitive Market: ETP Economics 101Document37 pagesPerfectly Competitive Market: ETP Economics 101d-fbuser-65596417100% (1)

- Microeconomics: Lecture 10: Profit Maximization and Competitive SupplyDocument42 pagesMicroeconomics: Lecture 10: Profit Maximization and Competitive Supplyblackhawk31No ratings yet

- Topic 8 - Firms in Competitive Markets PDFDocument32 pagesTopic 8 - Firms in Competitive Markets PDF郑伟权No ratings yet

- Perfect CompetitionDocument41 pagesPerfect CompetitionPrashantNo ratings yet

- Micro Ch14 PresentationDocument36 pagesMicro Ch14 PresentationGayle AbayaNo ratings yet

- Perfect Competition: To Determine Structure of Any Particular Market, We Begin by AskingDocument26 pagesPerfect Competition: To Determine Structure of Any Particular Market, We Begin by AskingRavi SharmaNo ratings yet

- Hul211 Unit2e MKT PCDocument25 pagesHul211 Unit2e MKT PCTanayJohariNo ratings yet

- Ch06 - Perfectly Competitive MarketsDocument43 pagesCh06 - Perfectly Competitive MarketsToshi ParmarNo ratings yet

- Eco101 Lec 14Document16 pagesEco101 Lec 14Lulu LemonNo ratings yet

- Chapter 8 Profit Maximization &cmptitive SupplyDocument92 pagesChapter 8 Profit Maximization &cmptitive Supplysridhar7892No ratings yet

- 212 f09 NotesB Ch9Document20 pages212 f09 NotesB Ch9RIchard RobertsNo ratings yet

- Tutorial 7 - SchemeDocument6 pagesTutorial 7 - SchemeTeo ShengNo ratings yet

- Eco415 MKT StructureDocument105 pagesEco415 MKT StructureappyluvtaeminNo ratings yet

- Lecture 16 Market Structures-Perfect CompetitionDocument41 pagesLecture 16 Market Structures-Perfect CompetitionDevyansh GuptaNo ratings yet

- Ch05.1Perfect Comp.Document52 pagesCh05.1Perfect Comp.Andualem Begashaw100% (1)

- Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument46 pagesManaging in Competitive, Monopolistic, and Monopolistically Competitive MarketsPratama YaasyfahNo ratings yet

- Chap 008Document26 pagesChap 008Citra Dewi WulansariNo ratings yet

- ME Problems PC MonopolyDocument7 pagesME Problems PC MonopolyDevan BhallaNo ratings yet

- Chapter 5Document53 pagesChapter 5abdi geremewNo ratings yet

- Lesson 5 MarketsDocument39 pagesLesson 5 MarketsiitNo ratings yet

- Competition & Pure MonopolyDocument36 pagesCompetition & Pure MonopolyChadi AboukrrroumNo ratings yet

- CH 08Document36 pagesCH 08Xiaojie CaiNo ratings yet

- Answers To Summer 2010 Perfect Competition QuestionsDocument7 pagesAnswers To Summer 2010 Perfect Competition QuestionsNikhil Darak100% (1)

- BIE201 Handout05Document14 pagesBIE201 Handout05andersonmapfirakupaNo ratings yet

- Econ203 Lab 081Document36 pagesEcon203 Lab 081api-235832666No ratings yet

- CH 8Document21 pagesCH 8SarthakNo ratings yet

- Market PerfectDocument35 pagesMarket PerfectLoretta D'SouzaNo ratings yet

- Perfect Competition MarketDocument17 pagesPerfect Competition MarketMaide HamasesNo ratings yet

- ECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkDocument20 pagesECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkranashair9919No ratings yet

- Perfect CompetitionDocument31 pagesPerfect CompetitionAnand ShindeNo ratings yet

- Chapter FiveDocument39 pagesChapter FiveBikila DessalegnNo ratings yet

- Assgnmt 5Document4 pagesAssgnmt 5Heap Ke XinNo ratings yet

- Chapter Five: Market Structure 5.1 Perfectly Competition Market StructureDocument27 pagesChapter Five: Market Structure 5.1 Perfectly Competition Market StructureBlack boxNo ratings yet

- 7 Perfectly Competitive MarketsDocument8 pages7 Perfectly Competitive MarketsChristian Cedrick OlmonNo ratings yet

- Key Diagrams A2 Business EconomicsDocument16 pagesKey Diagrams A2 Business EconomicsEl Niño SajidNo ratings yet

- Market and Pricing - Perfect Competition and MonopolyDocument35 pagesMarket and Pricing - Perfect Competition and Monopolychandel08No ratings yet

- Micro Eco Chapter 6Document22 pagesMicro Eco Chapter 6MkhululiNo ratings yet

- Lecture11 12 13Document91 pagesLecture11 12 13Victor NguyenNo ratings yet

- Answerstosummer2010perfectcompetitionquestions PDFDocument7 pagesAnswerstosummer2010perfectcompetitionquestions PDFMohammad Javed QuraishiNo ratings yet

- Analysis of Perfectly Competitive Market by Meinrad C. BautistaDocument22 pagesAnalysis of Perfectly Competitive Market by Meinrad C. BautistaRad BautistaNo ratings yet

- Market Structures - Competitive Supply (Sec E)Document35 pagesMarket Structures - Competitive Supply (Sec E)Amandeep GroverNo ratings yet

- Youtube Channel-Grooming Education Academy by Chandan PoddarDocument3 pagesYoutube Channel-Grooming Education Academy by Chandan Poddargagan vermaNo ratings yet

- Chapter 8 Powerpoint Slides-2Document33 pagesChapter 8 Powerpoint Slides-2Goitsemodimo Senna100% (1)

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- Market Structures HandoutDocument10 pagesMarket Structures HandoutSuzanne HolmesNo ratings yet

- Econ 2001 Midsemester Marathon: EquationsDocument3 pagesEcon 2001 Midsemester Marathon: Equationssandrae brownNo ratings yet

- Market Structure in EconomicsDocument11 pagesMarket Structure in EconomicsOh ok SodryNo ratings yet

- Chapter Four: Price and Out Put Determination Under Perfect CompetitionDocument49 pagesChapter Four: Price and Out Put Determination Under Perfect Competitioneyob yohannesNo ratings yet

- Msci 607: Applied Economics For Management: Q 15 UnitsDocument5 pagesMsci 607: Applied Economics For Management: Q 15 UnitsRonak PatelNo ratings yet

- Chapter 14Document29 pagesChapter 14Syed Ahmad Ali LCM-3808No ratings yet

- CH 20 Perfect CompetitionDocument12 pagesCH 20 Perfect CompetitionAsad Uz JamanNo ratings yet

- ECON203Document67 pagesECON203CharlotteNo ratings yet

- CH 9Document9 pagesCH 9ceoji100% (1)

- Perfect CompetitionDocument12 pagesPerfect CompetitionMikail Lee BelloNo ratings yet

- Multiple Choice: This Activity Contains 20 QuestionsDocument4 pagesMultiple Choice: This Activity Contains 20 Questionsmas_999No ratings yet

- UAS English For Acc - Ira MisrawatiDocument3 pagesUAS English For Acc - Ira MisrawatiIra MisraNo ratings yet

- Beowulf Essay 1Document6 pagesBeowulf Essay 1api-496952332No ratings yet

- rp200 Article Mbembe Society of Enmity PDFDocument14 pagesrp200 Article Mbembe Society of Enmity PDFIdrilNo ratings yet

- 10th Grade SAT Vocabulary ListDocument20 pages10th Grade SAT Vocabulary ListMelissa HuiNo ratings yet

- API1 2019 Broken Object Level AuthorizationDocument7 pagesAPI1 2019 Broken Object Level AuthorizationShamsher KhanNo ratings yet

- Coorg Chicken CurryDocument1 pageCoorg Chicken CurryAnitha VinukumarNo ratings yet

- CKA CKAD Candidate Handbook v1.10Document28 pagesCKA CKAD Candidate Handbook v1.10Chiran RavaniNo ratings yet

- Kaalabhiravashtakam With English ExplainationDocument2 pagesKaalabhiravashtakam With English ExplainationShashanka KshetrapalasharmaNo ratings yet

- Marking SchemeDocument57 pagesMarking SchemeBurhanNo ratings yet

- Adobe Scan 03-May-2021Document22 pagesAdobe Scan 03-May-2021Mohit RanaNo ratings yet

- The Approach of Nigerian Courts To InterDocument19 pagesThe Approach of Nigerian Courts To InterMak YabuNo ratings yet

- Philippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Document2 pagesPhilippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Christian LeijNo ratings yet

- The Department of Education On Academic DishonestyDocument3 pagesThe Department of Education On Academic DishonestyNathaniel VenusNo ratings yet

- Trifles Summary and Analysis of Part IDocument11 pagesTrifles Summary and Analysis of Part IJohn SmytheNo ratings yet

- Form Audit QAV 1&2 Supplier 2020 PDFDocument1 pageForm Audit QAV 1&2 Supplier 2020 PDFovanNo ratings yet

- Tecson VS Glaxo LaborDocument2 pagesTecson VS Glaxo LaborDanyNo ratings yet

- Salesforce Salesforce AssociateDocument6 pagesSalesforce Salesforce Associatemariana992011No ratings yet

- CHAPTER 1 - 3 Q Flashcards - QuizletDocument17 pagesCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Day Wise ScheduleDocument4 pagesDay Wise ScheduleadiNo ratings yet

- Students Wants and NeedsDocument1 pageStudents Wants and Needsapi-262256506No ratings yet

- 5 15 19 Figaro V Our Revolution ComplaintDocument12 pages5 15 19 Figaro V Our Revolution ComplaintBeth BaumannNo ratings yet

- Final Seniority List of HM (High), I.s., 2013Document18 pagesFinal Seniority List of HM (High), I.s., 2013aproditiNo ratings yet

- José Mourinho - Defensive Organization PDFDocument3 pagesJosé Mourinho - Defensive Organization PDFIvo Leite100% (1)

- 2015 3d Secure WhitepaperDocument7 pages2015 3d Secure WhitepapersafsdfNo ratings yet

- TRB - HSK NC IiiDocument7 pagesTRB - HSK NC IiiBlessy AlinaNo ratings yet

- GOUP GO of 8 May 2013 For EM SchoolsDocument8 pagesGOUP GO of 8 May 2013 For EM SchoolsDevendra DamleNo ratings yet

- Medieval Societies The Central Islamic LDocument2 pagesMedieval Societies The Central Islamic LSk sahidulNo ratings yet

- Pre-Qualification Document - Addendum 04Document4 pagesPre-Qualification Document - Addendum 04REHAZNo ratings yet