Professional Documents

Culture Documents

Business Strategy Notes VRIO Framework The VRIO Framework and The Resource-Based View

Uploaded by

Sandeep Sandeep SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Strategy Notes VRIO Framework The VRIO Framework and The Resource-Based View

Uploaded by

Sandeep Sandeep SinghCopyright:

Available Formats

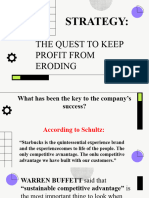

Business Strategy Notes VRIO Framework1 The VRIO Framework and the Resource-Based View2 In the last three

weeks we have looked at how firms can get a competitive advantage. Today we focus primarily on the sustainability of a firms competitive advantage. That is, what determines whether a firms competitive advantage will be short-lived or whether it will endure a long time? We will consider this question within Barneys VRIO framework (outlined below) within the resource-based view. Under the resourced-based view, a firms competitive advantage is based on the resources and capabilities it has.

Categories of Resources and Capabilities Financial Resources - Virtually all firms require some capital. Firms vary in how much capital they have, and how much they can raise. Firms with limited financial resources face limitations on what projects they can undertake. Physical Resources - For the purposes of our categorization the term physical resources is broad, capturing items such as: o physical assets (buildings, equipment, etc.), o geographic location, and o computer hardware and software. - Consider UPEIs physical assets. Which of its physical assets are most important to UPEIs competitive advantage? - One of Wal-Marts most important resources is the location of its stores. Wal-Mart started out by setting up large stores in small rural towns towns that are large enough for one large store but too small for a second store. Wal-Mart earns its most attractive profits in towns where it faces little competition. Human Resources - Human resources refers to the benefits that the firms employees bring to the firm. - Here we mean employees at all levels, including the CEO. - The term benefits refers to anything that the individual contributes towards the firm, whether it is knowledge, people-skills, relationships, etc. - Many CEOs and presidents (e.g. UPEIs Wade MacLauchlan) contend that one of their most important jobs is attracting and hiring great people.

1 2

By Don Wagner, UPEI, February 12, 2007. The material in this section is heavily based on Jay B. Barney and William S. Hesterly, Strategic Management and Competitive Advantage (Upper Saddle River, NJ: Pearson Prentice-Hall, 2006), chapter 3.

-1-

Organizational Resources - While human resources refers to the abilities of individuals, organizational resources refers to the ability of a group of people. - The term refers to the organizations ability to get things done. - Suppose Company A and Company B are equal in the quality of their human resources, yet company A beats company B in: o the quality of the products it introduces, o the speed at which it introduces new products, o the friendliness of its customer service, or o the efficiency at which its employees work. Possible reasons that Company A outperforms Company B include: o better organizational structure, o better decision making methods, o better coordinating systems, o a more cooperative culture, o a more competitive culture, and/or o informal relationships within the company. What is the VRIO Framework? Barneys VRIO framework considers the competitive implications of a resource with the following questions: o Is the resource or capability Valuable? o o Is the resource or capability Rare? Is the resource or capability costly to Imitate?

o Is the resource or capability one that exploited by the Organization? The competitive implications are as listed in the chart below. Is a resource or capability Costly to Exploited by Valuable? Rare? Imitate? Organization Competitive implications No --No Competitive disadvantage Yes No -Competitive parity Yes Yes No Temporary competitive advantage Yes Yes Yes Yes Sustained competitive advantage

Below we address what is meant by each of these questions.

Is the Resource or Capability VALUABLE? Does the resource or capability enable the organization to exploit an opportunity or neutralize a threat?

-2-

Can you think of some examples? o Identify a firm and a specific physical resource that enables that firm to exploit an opportunity. o Identify a physical resource that enables its owner to neutralize a threat. o Can you think of physical resources that are not valuable? o Identify an example in which the firms location is valuable. o Identify an example in which the firms location is not valuable. o Identify a specific example in which human resources enable an organization to exploit an opportunity or to neutralize a threat. o Can you think of examples in which human resources are not valuable? o How about organizational resources?

Is the Resource or Capability RARE? How many competing firms possess this resource or capability? An example of a non-rare resource is the computer. Computers make a firm more efficient than it would otherwise be, but if all the firms competitors also have computers, the resource is not rare. The fact that the firm has computers does not give the firm a competitive advantage; it only ensures that the firm is not at a disadvantage in that respect. Most resources that firms have are valuable but not rare. Since most such resources (e.g. equipment, buildings and even human resources) can simply be purchased, competitors have access to the same resources and will in fact buy them if they are valuable. Managers often mistakenly think their assets are rare when they actually are not. Resources that managers often claim as a source of competitive advantage include: o their people, o their technology, o their philosophy of management, and o their management systems. Why do you think that managers often fail to see that their resources are not rare? A firm does not necessarily need to be the only firm to have a particular resource for it to be rare. For example, suppose an industry has many competitors, but only two enjoy a reputation for quality. As long as those two firms are not forced to compete away this advantage, those two firms have a valuable and rare resource.

Is the Resource or Capability IMITATABLE (or substitutable)? Can (or will) competitors obtain the same or similar resource? Suppose a firm has a resource that is both valuable and rare. When competitors see the firms additional profitability from that resource, they will want to imitate in order to cash in on the profit opportunities. Examples include the following: o After the enormous popularity of CBSs Survivor in 2000, the other networks introduced their own reality TV shows.

-3-

o Coca-Cola and Pepsi continue to copy one another whenever a new product is introduced. Examples include Diet Coke and Diet Pepsi, and Cherry Coke and Wild Cherry Pepsi. o When Apple introduced the Apple II personal computer in the late 1970s, IBM and other firms quickly introduced their versions, and soon outsold Apple. More recently, Apples iPod has spawned numerous imitations, though Apple has this time retained its sales leadership (so far). o Can you think of other examples? In fact, imitation is pervasive. Virtually every company is affected by imitation. It is not easy to protect innovations. New products can be reverse engineered. Even patented products are not safe from imitation; frequently copycats can make small modifications to another firms product to place their own products just outside the scope of the patent. In some cases, competitors might not necessarily imitate a firms innovations, but may instead introduce a substitute innovation that achieves a similar or greater advantage. For example, Barnes & Noble and Borders enjoyed dominant positions in book retailing in the US, because they had strong brand recognition, efficient warehousing systems and strategically located stores. However, Barnes & Nobles and Borders advantages were significantly reduced when Amazon.com emerged with its on-line method of selling. The threat of imitation comes from both existing rivals and potential entrants. There are two main disadvantages to having your technology imitated. First, successful imitators take away some of your market share. Second, imitators increase the level of price competition in your market, creating downward pressure on your prices. These disadvantages apply not only when imitators are new entrants, but also when imitators are existing competitors. When UPS imitates FedEx, it moves its product position closer to that of FedEx and probably takes away some of the market share FedEx would otherwise enjoy. Moreover, the more UPS imitates FedEx, the less differentiated FedExs product becomes, which limits FedExs ability to charge a premium. It is sometimes observed that competitors imitate each other excessively. Two phenomena that can lead to excessive imitation are information cascading and riding the herd: o Information cascading: When making decisions, we draw information from whatever sources we can, including inferences from other peoples actions. For example, suppose an employer considering a job applicant finds out that numerous other employers have turned down the applicant. The rejection by other employers makes the applicant less attractive in the current interviewers eyes. This happens because the employer infers that there must be some reason that everyone else was unwilling to hire the person. Consequently, the decisions of the first few employers can have a lingering effect on everyone elses decisions, even if the first employers were wrong. o Riding the herd: Riding the herd can occur when managers are afraid to take risks. The manager who does what everyone else does is less likely

-4-

to face blame for wrong decisions if everyone else in the industry made the same wrong decisions. The copycat tendencies amongst the three traditional TV networks (ABC, CBS and NBC) are likely excessive for this reason. Nevertheless, imitation is not always inevitable. Barriers to imitation may prevent copycats from intruding into your market. Some barriers are natural, and some can be arranged. Below we examine numerous types of barriers to imitation. Most of them are connected to first-mover advantages. Barriers exist when potential imitators face higher costs to acquire the necessary resources than the first movers had to face.

Economies of Scale - Large economies of scale combined with a small market size, can limit entry (and thus can limit imitation). This can occur at the global level, the national level, the regional level or the local level. An example of a limited global market is the airplane manufacturing industry. There are only two manufacturers of large passenger airplanes Boeing and Airbus. The global market for large airplanes is too small to support another manufacturer. At the other end of the spectrum at the local level we can consider gas stations. A small town may only be large enough for a few gas stations. - We have already mentioned Wal-Mart. Wal-Marts most profitable stores operate in towns that cannot support a second large discount store. - The number of firms that an industry can handle depends on the size of the fixed costs, and on the profits available in the industry. For example, suppose there are two firms in a particular industry. Each firms annual income statement is as follows: Sales $300,000 Variable costs 180,000 Gross margin $120,000 Fixed Costs 100,000 Net income $ 20,000 - Can the industry support another firm if it too will need to incur annual fixed costs of $100,000 in order to operate? Why or why not? (Assume that the total output for the industry is fixed.) - Some industries require large fixed cost investments to operate at a competitive level. An example is the express mail industry, which is dominated by FedEx and UPS. In other industries, such as the barbershop industry, firms can be competitive at small sizes. In many industries, we find that there is a range of sizes in which the firms costs per unit decrease as volume rises, followed by a range where the costs per unit hold steady, followed again by a range where costs per unit increase as volume rises. The volume at which the lowest per-unit costs begin is known as the minimum efficient scale. (Ill draw a diagram in class.) - Where the minimum efficient scale is large, the entrant faces a dilemma. Should it begin operations at the minimum efficient scale? If it does so, the market may become too crowded, and the industry will tend to fight a price war as all the firms struggle to make enough sales to cover their fixed costs. Alternatively, should the entrant start small? What is the disadvantage of starting small?

-5-

In some cases, a firm might enter an industry even though the industry cannot support one more player, if it thinks it can dislodge one of the incumbents. For example, an innovative soap company named Minnetonka was the first company to introduce fruit shampoos. However, the big companies soon copied the idea and displaced Minnetonkas product on retailers shelves. Here is a more challenging question3: Suppose a town is barely large enough to support one car dealership. At this point, the car dealership would just be breaking even. If the town were to grow by 50%, the town would still only be large enough to support one car dealership, though that dealership would become quite profitable. If the town continued to grow so that it became twice the original size, would you expect a new entrant? Why or why not? Some researchers, Timothy Bresnahan and Peter Reiss, have compared the populations of one-dealership towns to two-dealership towns and found the following (to be completed in class): Auto Drug Movie Dealers stores Theatres Population at which 1st firm enters 664 583 1985 Population at which 2nd firm enters

Learning Curve / Private Information: - A barrier to entry can also exist when the incumbents/first-movers possess know-how that entrants cannot easily acquire. - As a person or firm does something repeatedly, that person or firm becomes more efficient at it. The person or firm learns which mistakes to avoid, and devises more efficient procedures. - The effects of learning can be powerful. For example, studies on the aircraft industry have found that costs drop 20% as output doubles. That is, the manufacturing cost of a firms second airplane is 80% of the cost of the first airplane. The manufacturing cost of the fourth airplane is 80% of the cost of the second airplane, and so on. - Naturally, the size of the barrier will depend on the cost of learning and on how big an advantage that knowledge provides. - As stated above, copycats often can obtain a firms technology through reverse engineering, patent documents, hiring away the firms employees or other means. Know-how that cannot easily be documented is harder for copycats to obtain. In addition, know-how that is spread out amongst many employees (i.e. not concentrated to only a few employees) is also harder to obtain. - If imitation is easy, the advantage may not necessarily go to the first-mover. o The advantage to second-movers is that they can observe the first-movers experience and see what works and what does not work. Consequently, the second-movers can usually acquiring the learning at a lower cost than the first-mover can. They avoid the pioneering costs that the first mover inevitably incurs. o However, the first mover might nevertheless have the advantage despite incurring higher learning costs than second movers. The reason is that the first mover did its learning in a non-competitive environment and usually

3

This example is taken from Saloner, Shepard and Podolny.

-6-

was able to pass its learning costs on to its buyers. Second movers have to incur learning costs in a competitive environment and cannot pass those costs on to buyers. Brand Loyalty - As we noted in the Coke and Pepsi case, the cumulative effect of advertising and promotion can give incumbents an advantage. It often takes time to build up loyalty, making it difficult for newcomers to break into a market. - Indeed, marketers claim that it is much more costly to steal a customer from the competition than to keep an existing customer. - Goods that are particularly subject to consumer loyalty are those that must be experienced to evaluate. Once a consumer finds a product that he/she is happy with, he/she will likely not try another product since the upside of experimenting is small (he/she might like the new product slightly better) and the downside is large (he/she might not like the product at all). Contracts / Relationships - In some cases, contracts and relationships can act as barriers to imitation. Examples include the following: o A retail outlet may occupy the best location in town. If there is only one best location, nobody can imitate that. o Companies entering new markets may be able to create a barrier to imitation by securing the best distributors, leaving latecomers no attractive means of distributing their products. o Minnetonka, after getting burned by the big boys in the past, fared much better when it introduced Softsoap. (Softsoap comes in a container with a pump. One of the main advantages of Softsoap is that it doesnt leave soap scum wherever it is placed in the bathroom.) Once the product started to look promising, Minnetonkas management decided to pre-empt imitation by taking control of the supply of pumps. There were only two suppliers of pumps, with a combined annual output of 100 million pumps. Softsoap secured contracts for the full 100 million pumps, which substantially delayed the entry of imitations. With that extra time, Softsoap was able to establish its brand name. o If Minnetonkas action had occurred in Canada, do you think its maneuver would have violated Canadas Competition Act? (Refer to the legislation provided in the appendix to these lecture notes.) Network Externalities - Some products become more valuable to customers as the number of other customers increases. For example, fax machines became more valuable as the number of people with fax machines increased. (Whats the point of having a fax machine if no-one else has one?) - Microsoft benefits enormously from network externalities. People tend to choose Windows and Microsoft Word because almost everybody else uses that software.

-7-

Nintendo also benefits from network externalities. The greater the number of people with a Nintendo Gamecube, the more game developers will develop games that work with that hardware. Can you think of other industries in which network externalities exist?

Threats of Retaliation - Credibility: o We have already examined the issue of retaliation in our discussion on game theory. Incumbents would like entrants to believe that they face retaliation if they enter, but such threats may not be credible if retaliation would also hurt the incumbent. o To make the threat of retaliation believable, the incumbent must persuade the entrant that it has both the ability and the willingness to retaliate. o Three ways a firm can increase its ability to retaliate are the following: maintaining buffer stocks, maintaining extra capacity, and remaining highly liquid. Why do these steps increase a firms ability to retaliate? o A firm can also position itself for retaliation by maintaining a presence in the main markets of potential rivals. For example, years ago Michelin decided to aggressively enter the U.S. market with relatively low prices. Since Michelin had little presence in the US market, it reckoned that it had little to lose by pricing low. Goodyear responded by aggressively selling in France Michelins home base. This response prompted Michelin to back off. o A firm can indicate a willingness to retaliate in various ways as well. One way is to acquire a reputation for fighting. Once an incumbent fights off the first few entrants, other entrants will likely believe that the incumbent is willing to fight. o In some cases, a firm can demonstrate a willingness to fight without bearing the full cost of a fight by first fighting only in certain targeted areas. - Laws Prohibiting Predatory Pricing o As noted in the appendix to these notes, Canadas Competition Act prohibits predatory pricing. o When the Competition Bureau reviews a companys activities, it considers some of the following issues: Does the company (or person) already have considerable market power? If not, it would not be reasonable to believe that aggressively low prices lessen competition. Are there high barriers to entry? For example, if the industry has low exit costs, so that firms can enter the industry with little risk, then attempts to employ predatory pricing are unlikely to be effective. Would the company be able to recoup its losses after eliminating its competition?

-8-

Was the company selling below marginal cost? (If not, the price cannot be considered unreasonably low.) If the company is selling below marginal cost, is the low price attributable to non-predatory business reasons? Can you think of any valid business reasons why a firm might sell below cost? o Why do you think it would be hard to prove predatory pricing in the airline industry? What are some of the valid arguments that Air Canada could put forward when it is accused of predatory pricing in the Canadian airline industry? Causal Ambiguity - Another reason that a firms competitive advantage can be difficult to imitate is causal ambiguity. - It is often difficult to pinpoint exactly which combination of resources creates the competitive advantage. In fact, even the managers of the firm with the competitive advantage might not really understand which of their own firms resources create its competitive advantage. - For example, Wal-Marts founder, Sam Walton, contended that Wal-Marts success was attributable to how the company treated its employees (or associates as WalMart calls them), but it is doubtful that this resource is truly the reason for WalMarts success. Strategists tend to point to factors such as Wal-Marts entrenched position in rural towns, its extraordinary information systems, and its culture of cheapness. - Competitive advantage is often the result of a complex system of resources and capabilities, rather than only one or two of them. These business methods are harder to duplicate, because an imitator must get the whole system working to compete effectively. Social Complexity - Social complexity is another reason that a firms resources may be difficult to imitate. In many cases a competitive advantage exists due to strong relationships between managers, due to an effective corporate culture, and/or due to a positive reputation. Duplicating this advantage is difficult, because it involves the attitudes, beliefs and priorities of free-thinking people. Relationships, culture and reputations take on a life of their own and can evolve in ways that the managers did not intend. At most, managers can influence interpersonal relationships, corporate culture and reputations, but managers cannot social-engineer them exactly as desired. Patents - Patents can also form a barrier to imitation. Governments provide 20-year patent protection to inventors as an incentive to innovation precisely because of the threat of imitation. The logic is that if imitators can copy inventions easily, competition will often reduce the profitability of the invention to the point where inventors get inadequate reward to make their efforts worthwhile. This principle is particularly true in the pharmaceutical industry, where it now costs about $1 billion to introduce a new drug. Without patent protection, pharmaceutical companies would have little

-9-

incentive to incur this cost if they knew that imitators without this cost burden could immediately enter. Some companies, however, choose not to obtain patent protection. A disadvantage of filing for patent protection is that the technology must be disclosed. This disclosure can make it easier for imitators to develop a technology that achieves the same function but falls just outside the boundary of the patent protection. Some firms therefore prefer to rely on secrecy instead of patents especially if they expect the technology to have a short life-span. Suppose a firm has the ability to introduce an innovation, but foresees that other firms will imitate. Under what conditions is it still worthwhile to innovate? A firm that continually innovates is harder to imitate than one that remains stagnant. The innovative firm becomes a moving target. By the time copycats imitate such a firm, that firm has already moved ahead.

Is the Firms ORGANIZATION Capable of Exploiting the Resource or Capability? Some firms may have resources or capabilities that are valuable, rare and difficult to imitate, and yet they are unable to take full advantage of those resources or capabilities because their own firm is not organized to do so. In some cases, the firms inability to exploit a particular resource exists because the organization is designed to exploit different strengths. For example, a firm whose main strength is developing new products and technology is usually managed and staffed by researchers who thrive upon working in an environment that is in flux and who prefer creativity and risk-taking. Moreover, the organization needs to tolerate failures. In contrast, other firms operate in a competitive environment in which efficiency and cost-control are critical. The organization and the people within it will therefore be oriented towards managing costs carefully. One example is Ballard Power Systems Inc, which is working on developing fuel cell technology to power vehicles. Eventually the corporation would like to mass-produce fuel cells. The company is well aware that the transition from a research and development company towards a mass-production company will be difficult. In other cases, the firms inability to exploit a particular resource exists because of organizational failure. There may be slack within the organization that prevents the firm from achieving what it ought. An example is Xerox. As discussed previously, Xerox invented the mouse, graphical user interface and Ethernet, yet it failed to commercialize those inventions. Some senior managers were actually unaware of these inventions, and the commercialization process involved so many review steps that the inventions got bogged down in bureaucracy.

- 10 -

APPENDIX ANTI-PREDATORY-PRICING PROVISIONS IN CANADAS COMPETITION ACT There are two main provisions in the Canadian Competition Act that deal with predatory pricing the criminal provision and the civil provision.

Criminal Provision - Below is subsection 50(1) of Canadas Competition Act. Every one engaged in a business who (a) . . . ., (b) engages in a policy of selling products in any area of Canada at prices lower than those exacted by him elsewhere in Canada, having the effect or tendency of substantially lessening competition or eliminating a competitor in that part of Canada, or designed to have that effect, or (c) engages in a policy of selling products at prices unreasonably low, having the effect or tendency of substantially lessening competition or eliminating a competitor, or designed to have that effect, is guilty of an indictable offence and liable to imprisonment for a term not exceeding two years. - To summarize, this law prohibits predatory pricing using geographic price discrimination or using unreasonably low prices.

Civil Provisions - Below are section 79 and part of section 78 of the Competition Act. 79. (1) Where, on application by the Commissioner, the Tribunal finds that (a) one or more persons substantially or completely control, throughout Canada or any area thereof, a class or species of business, (b) that person or those persons have engaged in or are engaging in a practice of anticompetitive acts, and (c) the practice has had, is having or is likely to have the effect of preventing or lessening competition substantially in a market, the Tribunal may make an order prohibiting all or any of those persons from engaging in that practice. 8.. 78. . . . "anti-competitive act", without restricting the generality of the term, includes any of the following acts: (a) squeezing, by a vertically integrated supplier, of the margin available to an unintegrated customer who competes with the supplier, for the purpose of impeding or preventing the customer's entry into, or expansion in, a market; (b) acquisition by a supplier of a customer who would otherwise be available to a competitor of the supplier, or acquisition by a customer of a supplier who would otherwise be available to a competitor of the customer, for the purpose of impeding or preventing the competitor's entry into, or eliminating the competitor from, a market; (c) freight equalization on the plant of a competitor for the purpose of impeding or preventing the competitor's entry into, or eliminating the competitor from, a market;

- 11 -

(d) use of fighting brands introduced selectively on a temporary basis to discipline or eliminate a competitor; (e) pre-emption of scarce facilities or resources required by a competitor for the operation of a business, with the object of withholding the facilities or resources from a market; (f) buying up of products to prevent the erosion of existing price levels; (g) adoption of product specifications that are incompatible with products produced by any other person and are designed to prevent his entry into, or to eliminate him from, a market; (h) requiring or inducing a supplier to sell only or primarily to certain customers, or to refrain from selling to a competitor, with the object of preventing a competitor's entry into, or expansion in, a market; (i) selling articles at a price lower than the acquisition cost for the purpose of disciplining or eliminating a competitor; (j) acts or conduct of a person operating a domestic service, as defined in subsection 55(1) of the Canada Transportation Act, that are specified under paragraph (2)(a); and (k) the denial by a person operating a domestic service, as defined in subsection 55(1) of the Canada Transportation Act, of access on reasonable commercial terms to facilities or services that are essential to the operation in a market of an air service, as defined in that subsection, or refusal by such a person to supply such facilities or services on such terms.

- 12 -

You might also like

- Consulting Interview Case Preparation: Frameworks and Practice CasesFrom EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNo ratings yet

- RBVDocument7 pagesRBVNaoman Ch100% (1)

- VROIDocument5 pagesVROIpawanroad24612No ratings yet

- Porter S 5 Forces PEST Analysis Value Chain Analysis BCG MatrixDocument10 pagesPorter S 5 Forces PEST Analysis Value Chain Analysis BCG MatrixPrajakta GokhaleNo ratings yet

- VRIODocument3 pagesVRIOPrajakta GokhaleNo ratings yet

- Value Resources Immitate Order AnalysisDocument10 pagesValue Resources Immitate Order Analysisshivani0% (1)

- VRIODocument3 pagesVRIOSadia AnumNo ratings yet

- MBA AssignmentDocument17 pagesMBA AssignmentKomal75% (4)

- Summary - Looking Inside For Competitive AdvantageDocument2 pagesSummary - Looking Inside For Competitive AdvantageShabrina Wulan NursitaNo ratings yet

- Resource Based ViewDocument6 pagesResource Based ViewLaurice MelepyanoNo ratings yet

- RBV ApproachDocument4 pagesRBV ApproachTarun KumarNo ratings yet

- Resource Based ViewDocument15 pagesResource Based Viewpankaj TelangNo ratings yet

- Understanding The Tool: VRIO FrameworkDocument21 pagesUnderstanding The Tool: VRIO Frameworksajeet sahNo ratings yet

- Viro FameworkDocument3 pagesViro FameworkMayank GoelNo ratings yet

- SWOT Analysis PDFDocument4 pagesSWOT Analysis PDFGhady HannaNo ratings yet

- Strategy - Chapter 8 "Looking Inside For Competitive Advantage "Document14 pagesStrategy - Chapter 8 "Looking Inside For Competitive Advantage "AsharNo ratings yet

- The VRIO FrameworkDocument4 pagesThe VRIO FrameworkAbhineetSrivastavaNo ratings yet

- Business Strategy Notes Competitive Advantage III: Examples?Document11 pagesBusiness Strategy Notes Competitive Advantage III: Examples?Saumyadeepa DharNo ratings yet

- VRIODocument5 pagesVRIOSaraTouiraNo ratings yet

- Internal CapabilitiesDocument15 pagesInternal CapabilitiesDee NaNo ratings yet

- VRIO Framework Explained - SMIDocument7 pagesVRIO Framework Explained - SMIgraceNo ratings yet

- VRIO AnalysisDocument2 pagesVRIO AnalysisrenjuannNo ratings yet

- Acronym: VRIO (From Wikipedia)Document5 pagesAcronym: VRIO (From Wikipedia)Kelly TorresNo ratings yet

- Strategy - Chapter 5: Basing Strategy On Resources and CapabilitiesDocument8 pagesStrategy - Chapter 5: Basing Strategy On Resources and CapabilitiesTang WillyNo ratings yet

- The Content Pool: Leveraging Your Company's Largest Hidden AssetFrom EverandThe Content Pool: Leveraging Your Company's Largest Hidden AssetNo ratings yet

- Analytical Tools: 1. Swot 2. Michael Porters Five Forces Analysis 3. Value Chain Analysis 4. GE ModelDocument16 pagesAnalytical Tools: 1. Swot 2. Michael Porters Five Forces Analysis 3. Value Chain Analysis 4. GE ModelchinchangeNo ratings yet

- Session 2 Reasons of Wins On Losses in SalesDocument5 pagesSession 2 Reasons of Wins On Losses in SalesAritra BanerjeeNo ratings yet

- Solve Only Questions 1,2,3 and 4Document4 pagesSolve Only Questions 1,2,3 and 4Secret LoveNo ratings yet

- VRIO Framework Explained - SMIDocument10 pagesVRIO Framework Explained - SMITanisha AgrawalNo ratings yet

- Question of Value: Jump To Navigationjump To SearchDocument6 pagesQuestion of Value: Jump To Navigationjump To SearchMarco NunNo ratings yet

- Five Future Strategies You Need Right NowFrom EverandFive Future Strategies You Need Right NowRating: 2.5 out of 5 stars2.5/5 (1)

- Ibs - BS - Mba - S8 & 9Document34 pagesIbs - BS - Mba - S8 & 9Muskan KhanNo ratings yet

- RBVDocument22 pagesRBVDaliya ManuelNo ratings yet

- The Strategic Planning ProcessDocument25 pagesThe Strategic Planning ProcessraaazsNo ratings yet

- Chapter 4Document10 pagesChapter 4akeila3No ratings yet

- Reinventing Talent Management: How to Maximize Performance in the New MarketplaceFrom EverandReinventing Talent Management: How to Maximize Performance in the New MarketplaceNo ratings yet

- Chapter 10 ReportDocument29 pagesChapter 10 ReportMay Jude Dela CruzNo ratings yet

- Internal Analysis: Resources, Capabilities, and Core CompetenciesDocument8 pagesInternal Analysis: Resources, Capabilities, and Core CompetenciesNadineNo ratings yet

- Confronting Reality (Review and Analysis of Bossidy and Charan's Book)From EverandConfronting Reality (Review and Analysis of Bossidy and Charan's Book)No ratings yet

- 282accenture Core Competency 20 The Case For Outsourcing Supply Chain ManagementDocument24 pages282accenture Core Competency 20 The Case For Outsourcing Supply Chain ManagementLincon SinghNo ratings yet

- Underdog StrategyDocument24 pagesUnderdog StrategyVũ HiềnNo ratings yet

- Day 4Document16 pagesDay 4mijjinNo ratings yet

- ch01 Keat6eDocument4 pagesch01 Keat6eEssam QuzaNo ratings yet

- Final Exam IIDocument10 pagesFinal Exam IIBenevolent LadNo ratings yet

- Strategy - NotesDocument14 pagesStrategy - NotesSalvatoreNo ratings yet

- DR - Kismat Kaur Associate Professor Cbsa, CGCDocument17 pagesDR - Kismat Kaur Associate Professor Cbsa, CGCAdil Bin KhalidNo ratings yet

- Strategic Management MidtermDocument5 pagesStrategic Management MidtermBrady Shiplet67% (3)

- Internal Analysis - Resources and CompetencesDocument5 pagesInternal Analysis - Resources and CompetencesJoana ToméNo ratings yet

- Aaron de Smet, Et Al.-Performance and HealthDocument12 pagesAaron de Smet, Et Al.-Performance and HealthboonikutzaNo ratings yet

- The Success and Failure of Global Firms Based On Institution - and Resource-Based ViewsDocument14 pagesThe Success and Failure of Global Firms Based On Institution - and Resource-Based ViewsPyae Phyo AungNo ratings yet

- HBR'S 10 Must Reads: The EssentialsFrom EverandHBR'S 10 Must Reads: The EssentialsRating: 4.5 out of 5 stars4.5/5 (15)

- VRIO FrameworkDocument9 pagesVRIO FrameworkndarumadritoNo ratings yet

- Fighting The War For Talent Is Hazardous To Your Organization's HealthDocument12 pagesFighting The War For Talent Is Hazardous To Your Organization's Healthdt417No ratings yet

- Goliath Strikes Back: How Traditional Retailers Are Winning Back Customers from Ecommerce StartupsFrom EverandGoliath Strikes Back: How Traditional Retailers Are Winning Back Customers from Ecommerce StartupsNo ratings yet

- Assignment-3 Fastrock Swot AnalysisDocument5 pagesAssignment-3 Fastrock Swot AnalysisKRS SunilNo ratings yet

- Staffing to Support Business StrategyFrom EverandStaffing to Support Business StrategyRating: 2.5 out of 5 stars2.5/5 (3)

- Source: Principles and Practices by Ricky W. Griffin, Published by South Western. 11th EditionDocument4 pagesSource: Principles and Practices by Ricky W. Griffin, Published by South Western. 11th EditionMoktasid HossainNo ratings yet

- Strategic Management ºA Case Study of AppleDocument8 pagesStrategic Management ºA Case Study of AppleDee MavreshkoNo ratings yet

- What Is NoSQLDocument4 pagesWhat Is NoSQLDulari Bosamiya BhattNo ratings yet

- Design Checklist-9 USACE AngineeringDocument15 pagesDesign Checklist-9 USACE AngineeringSankar CdmNo ratings yet

- PQ100 Data SheetDocument2 pagesPQ100 Data Sheethanif_perdanaNo ratings yet

- Tracer-AN Series: MPPT Solar Charge ControllerDocument4 pagesTracer-AN Series: MPPT Solar Charge ControllerNkosilozwelo SibandaNo ratings yet

- IEC 61439 - 2011 New Standard PDFDocument21 pagesIEC 61439 - 2011 New Standard PDFSamsung JosephNo ratings yet

- MT Company PresentationDocument30 pagesMT Company Presentationjose manuelNo ratings yet

- CMMIDocument23 pagesCMMIChaithanya KumarNo ratings yet

- G249 MXBDocument8 pagesG249 MXBAndres SorinNo ratings yet

- Multiquadrant Dynamics in The Speed-Torque PlaneDocument41 pagesMultiquadrant Dynamics in The Speed-Torque PlanethanvandhNo ratings yet

- Template Extended-AbstractDocument3 pagesTemplate Extended-AbstractGraita PurwitasariNo ratings yet

- Subject Orientation: Empowerment TechnologiesDocument10 pagesSubject Orientation: Empowerment TechnologiesJessa GuerraNo ratings yet

- Ds Lm5006 en Co 79839 Float Level SwitchDocument7 pagesDs Lm5006 en Co 79839 Float Level SwitchRiski AdiNo ratings yet

- BAERD GEN-007 Rev CDocument27 pagesBAERD GEN-007 Rev CPaulNo ratings yet

- Technical Report Route To IEng GuidanceDocument11 pagesTechnical Report Route To IEng GuidanceECCNo ratings yet

- Seminarski RadDocument32 pagesSeminarski RadAdmir KlinčevićNo ratings yet

- CM Line Catalog ENUDocument68 pagesCM Line Catalog ENUdmugalloyNo ratings yet

- BK3251 BekenDocument13 pagesBK3251 BekenDanny DurhamNo ratings yet

- Unit 49 Installing and Commissioning Engineering EquipmentDocument13 pagesUnit 49 Installing and Commissioning Engineering EquipmentSaifuddinHidayat100% (1)

- Remuz TreeDocument608 pagesRemuz TreeEdward JonesNo ratings yet

- Dutch Cone Penetrometer Test: Sondir NoDocument3 pagesDutch Cone Penetrometer Test: Sondir NoAngga ArifiantoNo ratings yet

- Genetic Algorithms - Principles and Perspectives - A Guide To GA TheoryDocument327 pagesGenetic Algorithms - Principles and Perspectives - A Guide To GA Theoryluis-barrios-941150% (4)

- STLD Website User GuideDocument9 pagesSTLD Website User GuidemrmarcoscruzNo ratings yet

- Oct 15 Action Research PLT AgendaDocument2 pagesOct 15 Action Research PLT Agendaapi-231962429No ratings yet

- Premier MDocument44 pagesPremier Mthebetterman0511No ratings yet

- TDS - Masterkure 106Document2 pagesTDS - Masterkure 106Venkata RaoNo ratings yet

- 334387bet777 - Everything About Bet777 CasinoDocument2 pages334387bet777 - Everything About Bet777 Casinoz7xsdpn047No ratings yet

- Lancaster LinksDocument3 pagesLancaster LinksTiago FerreiraNo ratings yet

- TemplateDocument17 pagesTemplatedaveNo ratings yet

- Differences Between Huawei ATCA-Based and CPCI-Based SoftSwitches ISSUE2.0Document46 pagesDifferences Between Huawei ATCA-Based and CPCI-Based SoftSwitches ISSUE2.0Syed Tassadaq100% (3)

- Impact of Computer On SocietyDocument4 pagesImpact of Computer On SocietyraheelNo ratings yet