Professional Documents

Culture Documents

Recent Developments and Business Opportunities in Indian Financial Markets

Uploaded by

Jakki KhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recent Developments and Business Opportunities in Indian Financial Markets

Uploaded by

Jakki KhanCopyright:

Available Formats

Recent Developments and Business Opportunities in Indian Financial Markets The Indian financial markets are undergoing major

transformation since the last 2 years. We are witnessing lot of new developments in Indian financial markets. This article attempts to cover some of the recent developments in Indian financial markets and the possible business opportunities that one can avail. To begin with, recently [Apr 2011], NSE, National Stock Exchange of India introduced the Smart order routing [SOR] which would allow the orders to pass from NSE to various other stock exchanges. What SOR does is that it looks for the best possible price across various exchanges. So if Reliance is trading at 995 in NSE and at 1000 in BSE, this SOR system would execute your order on NSE and thus save you Rs 5 per share Smart order routing is a new phenomenon in our markets, though this concept is already in existence in US, UK and Saudi markets. The SOR would further do is that it will bring in more algorithmic trading. Algorithmic or Program trading is again a new concept in Indian financial markets. NSE bought it in early 2009 and BSE too started algorithmic trading in early 2010. What Algorithmic trading means is that instead of manual orders, the control would be given to the algorithms which will decide when to take position in the market and when to square off the positions. So with these algorithms various strategies can be developed, and without manual intervention, these algorithms can generate huge profits for the traders. In India, some algorithms which became very popular were arbitrage algorithms. Arbitrage refers to taking advantage of price differential between 2 exchanges or between 2 calendar months on same exchange. These algorithms would bring in more liquidity and thus more efficiency in our markets.

In mid-2008, SEBI [Securities and Exchange board of India] gave approval for DMA [Direct market access]. The DMA means is that it allows the broker to give direct access to its clients. So a client can use the infrastructure of the broker and place orders directly in the stock market, instead of calling up the broker on phone and asking him to place an order. DMA has potential advantages - in that it would speed up execution of orders and would give more control to clients. Also DMA will help reduce errors because now the clients would place orders themselves and so the chances of manual errors are less compared to the previous scenario when clients had to call up broker on phone and the broker used to place orders for them.

Also, the coming up of financial instruments like currency futures and currency options is pretty new in our markets. Currency trading started in mid- 2008 and has witnessed huge volumes. In fact, recently the volumes in currency options have broken all records. There is huge business opportunity in this segment too as the currency markets are worth more than 2 trillion dollars! So currency trading offers a huge business opportunity.

Another recent development in Indian financial markets is the coming up of various electronic trading conferences- namely FixGlobal Face2Face and TradeTech events. These events provide tremendous opportunity for interaction of various stakeholders in financial markets. For example- the FixGlobal event in Mumbai saw participation by stock exchanges, buy side and sell side firms, Technology companies providing financial markets solutions, investment banks, financial markets news agencies, etc. Such events have started in Indian markets since last 3 years and provide a great networking as well as learning opportunity for everyone.

Business opportunities to enter financial markets There are innumerable business opportunities in financial markets for budding entrepreneurs. As of now, the Indian financial markets are evolving and there are opportunities in various sectors viz. financial market education, retail investor participation, exploring opportunities in stock broking etc. So this gives us tremendous scope of innovation and growth potential. There are various ways one can enter the financial markets in India: 1. As an IT company developing financial products - you can start your own IT company and get in touch with various brokerage houses and work with them in developing IT solutions catering to financial markets 2. Franchise route - you can take a franchise of a brokerage house and become a sub broker yourself. This way you can bring more clients for the brokerage house and you can earn money 3. Education in financial services: Well, you are well acquainted with financial services industry, but wealth management is not your cup of tea, right? In that case, why not explore the opportunity to create a capital markets school? Education is a huge industry in India and you can get a pie of it by creating courses that offer learning opportunity to students, professionals, traders, etc. In India, CFA, FRM and other educational courses are getting popular and so there is also a demand for faculty, institutes that can help the students clear these international certifications. In the end, I have 2 tips for you, each worth a million dollar.

Here is the first one- For getting into any business, it is essential that you know the theoretical part before getting practical. To build the theory, you need to do your homework and build knowledge. To build your knowledge in this area, you can pursue various certifications which will help you get an overview of various stakeholders involved in this industry. So if you feel that you need to learn about financial markets, you can begin by taking certifications from NSE [National Stock Exchange], BSE [Bombay Stock Exchange] or NISM [National Institute of Securities Management, promoted by SEBI]. If you feel confident to learn the depth about

financial markets, you may go for CFA [Certified Financial Analyst] or for FRM [Financial Risk Management - which will help you learn about various kinds of risks]. Alternatively, you may also go for an MBA in finance and get holistic learning not only in finance related subjects, but also in various other subjects and how they relate to each other.

And here's the 2nd million dollar tip - 'Networking'. I strongly advocate networking- both offline and online. When you are networked well, you know whom to seek advice from. My advice to entrepreneurs is, 'Put consistent effort in networking'. In business, what you know is just 50%; and who you know is the remaining 50%! To network, I would share the techniques that I use and how they have helped me. First, never hesitate to meet a new person. Once you meet someone, remember their name and use it often during the conversation. Also, carry your business cards with you and always exchange with the people you meet in any events. To learn where such events are happening, read newspapers regularly and publications that interest you. Ask lot of questions. I never hesitate to ask questions and also appreciate questions from other party. This way you can come up as an individual who is open to new ideas and at the same time, you can also increase your knowledge about the subject. Also, ask the person if they are on various social/ professional networking sites like LinkedIn and you can request them for connecting with your network. The most important tip for networking is- while getting introduced to a new person, seek their advice and knowledge and keep the meeting informational; and do not try to directly talk about the purpose. First, understand and learn the needs of that person and later on, you can talk about business. Also, maintain a dairy or notes and keep track of your contacts. This way you can access your contacts whenever necessary.

"What are recent developments in the Indian Capital Market?" is not only important question for finance students but there are large number of investors, researchers and companies may also be interested in this topic. Even, I am not personally interested in this market but as a teacher and being an Indian, I want to know its recent developments and its effect on our economy. So, I will cover new things which shows the latest development of Indian capital market. 1. New Measures of Risk Management System in Indian Capital Market Every shareholder or investor wants to protect his investment and promote it as his source of earning. So, my always concentration is on new measures the Risk management system of SEBI which is the controller of Indian Capital Market. SEBI did several steps in this regards. { A } Measures for Reducing Price Volatility

Price volatility is the relative rate at which the price of a security moves up and down. But this technique of profit maximization which is used by bad guys for wrong purposes. They buys shares at very cheap rates and sell when overpriced. Because, they get idea of trend of next price of shares with invalid source instead of using mathematical formula which is given below

Using a simplification of the formulas above it is possible to estimate annualized volatility based solely on approximate observations. Suppose you notice that a market price index, which has a current value near 10,000, has moved about 100 points a day, on average, for many days. This would constitute a 1% daily movement, up or down. Volatility is often viewed as a negative term in the market that represents uncertainty and risk. Higher volatility brings worry to the investors as they watch the value of their portfolios move wildly and decrease in value. To reduce price volatility and stability in the prices of stock market, A major reform undertaken by SEBI was the introduction of derivatives products: Index futures, Index options, stock options and stock futures. {B} Place Circuit Breakers This is another recent development in Indian Capital Market. We all know an excessive speculation is always risky for every investor. For reducing it, SEBI has introduced place circuit breakers. A circuit breaker is the system which stops to trade in stock market when prices move after a specific level. For example, if a stock is at Rs. 100 and circuit breaker is fixed at 5%, then stock trading will stop if it hit of Rs. 95 or Rs. 105. There are mainly two types of circuit breakers. One is index wise circuit breakers and other is stock wise circuit breakers. {C} Intraday Trading Limit Intraday Trading, also known as Day Trading, is the system where you take a position on a stock and release that position before the end of that day's trading session. Thereby making a profit for yourself in that buy-sell or sell-buy exercise. All in one day. {D} Mark to Market Margin MTM margin is imposed to cover loss that a member may incur, in case the transaction is closed out at a closing price different from a price at which the transaction has been entered. It is just collection in cash for all futures contracts and adjusted against the available Liquid Networth for option positions. In the case of futures Contracts MTM may be considered as Mark to Market Settlement.

2. Investigations If any company law or SEBI Act's rules regarding indian capital market are voilated, its investigation is done by SEBI. This is the list of cases resulted in compounding in the prosecution filed by SEBI (As on 30th June 2010). See PDF 3. Investor Awareness Campaign For making Indian capital market more secure for indian and foreign investors, SEBI has started investors awareness campaign. For this, SEBI has made his official site's sub domain at http://investor.sebi.gov.in/ Under this campaign, Workshops/ Seminars Conducted by Investor Associations recognised by SEBI. There are following things are included :

Caution to Investors

Do not enter into securities transactions with unregistered intermediaries. Do not get carried away by advertisements promising unrealistic gains and windfall profits. Do not invest based on market rumours or unconfirmed or unauthentic news. Be aware that advice through television or print media does not mean that it is the opinion of the channel or publisher. 4. Ban on Inside Trading Insider trading is the trading of a corporation's stock or other securities (e.g. bonds or stock options) by individuals with potential access to non-public information about the company. In most countries, trading by corporate insiders such as officers, key employees, directors. To ban on inside trading, SEBI has made ( Prohibition of Insider Trading) Regulations, 1992.

4. Trading Cycle Under T + 2

T' represents the trade day. 'T + 2' implies the settlement on the 2th trading day. SEBI has reduced the settlement cycle upto T +2 and in future, it may be T + 1 settlement cycle. But SEBI accepted shorter settlement cycles will mean more pressure on trade processing systems so that funds/securities are ready for payin/pay-out on the next day.

A stock is said to be growth stock when it appreciates more than the market average. In most cases companies that reinvest major share of its earnings have stocks that rise above the overall industry trend of appreciation in the market. Therefore, the growth stocks hardly pay any dividends to the investors but bring high returns for them. Remember that not all the growth companies stocks are not growth stocks. In reality the stocks of the growth companies are in most cases overvalued in the market rather than being growth stocks. Technically speaking, a stock can be termed as growth stock when it has the return on equity or ROE of 15% or above. ROE is a measurement that is used by the experts to determine the growth stocks. It is calculated by dividing the net income of the company with the number of equity it has. Growth stocks have high ROE and give high returns to its investors compared to the other stocks in that particular sector and in comparison to the overall average in which the stock market appreciates at that particular time. Growth stocks are excellent investment if as an investor you want to see your investment rise at a faster rate than the market average. But while investing in growth stocks you must be prepared for a long term investment to get the maximum benefit of the investment. While buying the growth stocks and holding the stocks for significant period of time you must always remember that growth stocks will not pay you dividends even if the companies post a good profit at the end of the year. So, if you are looking forward to have a good profit from the stock market investment, growth stocks are really a viable investment opportunity for you. But as with any other stock market investment, while investing in the growth stock you must always remember that the basic for gaining form stock market investment remains the same for the growth stocks as well. That is, you have to pick the right stocks for gaining from your investment.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Document7 pagesBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)WM Iskandar100% (1)

- Answer Legal FormsDocument10 pagesAnswer Legal FormsLean-Klair Jan GamateroNo ratings yet

- Csec Poa January 2018 p2Document21 pagesCsec Poa January 2018 p2Joshua Melville100% (2)

- IJEF - 1001-0207 - DUONG - VONG - 278452 - Revisting BankDocument15 pagesIJEF - 1001-0207 - DUONG - VONG - 278452 - Revisting BankPham Cong MinhNo ratings yet

- Global FinanceDocument49 pagesGlobal FinanceAnisha JhawarNo ratings yet

- Job Analysis:: There Are Two Major Aspects of Job AnalysisDocument4 pagesJob Analysis:: There Are Two Major Aspects of Job AnalysisJakki KhanNo ratings yet

- Corporate Governance of Insurance Companies in IndiaDocument15 pagesCorporate Governance of Insurance Companies in IndiaJakki KhanNo ratings yet

- Corporate Governance in Insurance CompaniesDocument24 pagesCorporate Governance in Insurance CompaniesJakki KhanNo ratings yet

- Short Notes On:: IV-MBA (FM-422) - FDDocument3 pagesShort Notes On:: IV-MBA (FM-422) - FDJakki KhanNo ratings yet

- Jose Antonio Maravall - Estado Moderno y Mental Id Ad Social (Summary)Document7 pagesJose Antonio Maravall - Estado Moderno y Mental Id Ad Social (Summary)Curran O'ConnellNo ratings yet

- Section 4 ADocument88 pagesSection 4 ANg Kah HoeNo ratings yet

- Credit Manual: United Bank LimitedDocument120 pagesCredit Manual: United Bank LimitedAsif RafiNo ratings yet

- Application of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsDocument6 pagesApplication of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsmizaelledNo ratings yet

- Summary of ChargesDocument12 pagesSummary of ChargesVinayNo ratings yet

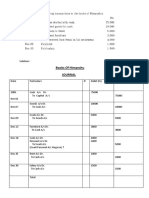

- Books of Himanshu JournalDocument4 pagesBooks of Himanshu Journalrakesh19865No ratings yet

- Vodafone BillDocument3 pagesVodafone BillSatnam Singh SagguNo ratings yet

- Customer Relationship ManagementDocument1 pageCustomer Relationship ManagementYamini Katakam0% (1)

- Al-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VDocument2 pagesAl-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VRaju AhamedNo ratings yet

- Punjab and Sind Bank Services of Risk ManagementDocument12 pagesPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- Company Profile of HDFC BankDocument3 pagesCompany Profile of HDFC BankAkash Ðaya Sinha50% (4)

- Clarical New ClarificationDocument2 pagesClarical New Clarificationmevrick_guyNo ratings yet

- Risk Spectrum For BanksDocument5 pagesRisk Spectrum For BanksLý Minh TânNo ratings yet

- The Rise and Plummet of APP's Widjaja Family - WSJDocument10 pagesThe Rise and Plummet of APP's Widjaja Family - WSJEdgar BrownNo ratings yet

- (2018) US-China Trade War WFR: December 2018Document7 pages(2018) US-China Trade War WFR: December 2018Mario Roger HernándezNo ratings yet

- FIN 464 Course OutlineDocument3 pagesFIN 464 Course OutlineShahriar HasnaineNo ratings yet

- B 2Document35 pagesB 2Anonymous Ei6ZuOhDoFNo ratings yet

- Cash and Cash EquivalentDocument11 pagesCash and Cash EquivalentWilsonNo ratings yet

- When Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations That Print Money (PDFDrive)Document190 pagesWhen Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations That Print Money (PDFDrive)Délcio CostaNo ratings yet

- Priya KapilDocument93 pagesPriya KapilaamritaaNo ratings yet

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsVanessa DozonNo ratings yet

- MDP Nomination FormDocument2 pagesMDP Nomination FormShivam ChaudharyNo ratings yet

- Essay Fintech Vs Traditional Tech - Angela Putri KeziaDocument4 pagesEssay Fintech Vs Traditional Tech - Angela Putri KeziaAngela KeziaNo ratings yet

- Honda FinanceDocument90 pagesHonda FinanceHarish MauryaNo ratings yet

- Kartik - Double EnteryDocument17 pagesKartik - Double EnterySathya SeelanNo ratings yet