Professional Documents

Culture Documents

Tawarruq 1

Uploaded by

Raheel KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tawarruq 1

Uploaded by

Raheel KhanCopyright:

Available Formats

TAWARRUQ, ITS CONCEPTS, ITS PRACTICES AND ITS ECONOMICS IMPLICATION ON ITS PROMOTION BY ISLAMIC BANKS by Dr.

Abdul Aziz Khayat

Literal meaning of at-tawarruq Literally, it is derived from the word al-warq or al-wariqu or al-waraqa, which means darahim madrubah. Allah says in the Quran (Surah Al-Kahfi, verse 19), Now send one of you, with this, your silver coin unto the city. Wariqah means the Kitab or tree and trade for money and awraqa means much money or Dirham and the word of (at-tawarruq) is taken from this, which means lots of money.

Technical meaning of at-tawarruq According to the Hanafis, bai al-inah is characterized by a situation, where a man who needs money asks another person for a loan. However, the lender does not want to loan money to the first party. So, he says, I will not lend money to you, but I shall sell this cloth to you and the cost is twelve Dirham (its value in the market price is ten Dirham). Then, the mustaqrid agrees and sells it. Resultantly, the lender gets two Dirham (profit) and the buyer gets ten Dirham as loan.

Another practice is that there is a third party. The lender sells his cloth to the mustaqrid at the cost of twelve Dirham. Then, the mustaqrid sells the same cloth to a third party at the price of ten Dirham. Thus, the mustaqrid get tens Dirham and the lender gets two Dirham (profit).

According to Malikis, tawarruq means selling something on deferred basis, and then buying it back in cash, albeit at a lower price than the deferred price. For example, someone sells his commodity at a price that is already known to be paid by the deferred payment. He then buys it at a lesser price than the deferred price. It is known because of obtaining the money for sahib alinah. This is because al-ain is the present property from the money. This is one of the practices of the Hanafis.

According to the Shafiis, tawarruq means selling something on deferred payment, and then buy it back in cash, albeit at a lower price than the deferred price.

The Hanbalis said in kitab Syarh Muntaha Al-Iradat, known as Daqaiq Awla An-Nahyu Li syarhi Al-Muntaha that bai al-inah by the name of tawarruq is the need for cash, buying the equivalent of thousands and more to expand its price and there is nothing wrong with that and it is known as tawarruq. In Muntaha Al-Iradat Fi Jami Al-Muqni Maa At-Tanqih Wa ziadat, If someone bought something on credit or he did not pay the price, it then becomes forbidden and the sale is invalid to its buyer by cash purchase less than the first price, and it is a tool to the second, except change its feature and it is known as the problem of inah, because the commodity of the buyer in deferred is taken instead of it.

Hukm of at-tawarruq The scholars differed concerning the hukm of tawarruq (al-inah): According to Abu Yusof, bai al-inah is permissible, but not encouraged. According to Muhammad bin Al-Hassan, bai al-inah is impermissible. He said that, In my heart, this sale is like mountains invented by riba dealers. Some Hanafi scholars said that, Beware of al-inah because it is evil. Their evidence is based on what Prophet pbuh said, If you practice al-inah, then you follow the tails of cows, you becomes humiliated and your enemy becomes stronger than you. There is no repugnance to deal with it, but there is a contradiction from the good deed of loan.

According to the Malikis, tawarruq is impermissible and their evidence is based on what Ahmad said in az-zuhdi, narrated from Ibn Umar, There is a time that comes toward us and we find that none of us says that he has the right of Dinar and Dirham from his Muslim brother. Then, he said, I heard Rasulullah pbuh said, If people practice inah, then they follow the tails of cows and leave jihad in the way of Allah and Allah will punish them and not forgive them until they come back to their religion. Ibn Rashid said, Someone who sells a commodity on deferred basis and then buys it either with its specify or before or after and every each of three either buys it same with what he sold either

less or more which is different from the two. This involves buying a commodity in cash and selling it on credit, where the deferred price is less/equals to/more than the cash price. According to Malik and most ahl-madinah, this is impermissible. However, Shafii, Daud and Abu Thaur said that this is permissible. And to prevent it, as he drew prevented the second sale of first sale. Then, its accusation is to be paid in Dinar rather than to which riba is forbidden. So, this picture is connected with the forbidden. For instance, someone says to another, I borrow from you ten Dinar in one month and I pay back twenty Dinar and says this would not be allowed, but I sell camel from you at twenty in one month then, I buy it in cash at ten Dinar.

Another form is that there is no accusation on it if give more price at the lower deferred which is not accuse and if buy it at a price that is lower than the deferred price. Their evidence is based on a Hadith Aisha - may Allah have mercy upon her - from Aliyah bint Aifa, that she said, I , a maid and wife of Zaid ibn Arqom went to Aisha, the maid said, I sold a child of Zaid ibn Arqom at three hundred Dirham to the Ata. Then I bought it from him for six hundred Dirham. She (Aisha) said to her, shame to what you bought, tell Zaid ibn Arqom that he had spoilt his jihad with the Prophet until he repents. (Reported by Ahmad). Ibn Rashid said, Shafie and his scholars: Hadith of Aishah is not consistent with what is narrated like Shafii say from Ibn Umar. As-Syarani said in Al-Mizan that Shafii look upon this permissible aqad with repugnance, in order to fulfill its requirement, which is ijab and qabul.

The Hanbalis sees tawarruq as impermissible, according to what was explained by Al-Mardawi in kitab al-insof: If I need cash as buying rights to the equivalent of one hundred one hundred and fifty, then this is impermissible. This is known among the Hanbalis as tawarruq. And according to what has been mentioned by the appropriate Hadith on bai al-inah, the Islamic Sheikhdom at the end of the Uthmaniah Empire came out with an investment for the Islamic courts in order to invest money of the orphans by the establishment of the orphanage in each legitimate court according to the practice of Hanafis. The legitimate court used to practise the investment of the orphans money in both Jordan and Palestine until we revised the judge of judges on behalf of Mr.Basyir As-Sibagh in the last of 1960s, and he said that it is necessary to

stop practising al-inah, because it is a way of riba, according to the opinion of al-Imam Muhammad bin al-Hasan, and it is the priority to make the money of orphans is pure from this accusation and he responded to us after he asked the judges of the Appeals Court in Jordan.

Then, they came out with it is necessary to the guardian of orphans to stop this practice and not depend on it until we find the permissible way to invest the orphans money, but the Ministry which he was a member of it was resigned. Then, the judge of judges who came after him asked the same judges to back to practice with inah and they came out by the opinion of al-imam Abi Yusof from Hanafiah and the orphanage came in legitimate court to practice with it. Then, the Ministry of Awqaf in Jordan look upon the investment of orphans money and it continued to practise bai al-inah. Then, when Sheikh Abdullah Ghusyah became judge of judges and he was from the good scholars who protested a number of judges and scholars and he said that the orphanage should not become a part of the Ministry of Awqaf because of the responsibility of an orphan according to the fiqh (he is the present legitimate judge). We refer back to the Prime Minister Al-Lawzi, then he responded to us to find the solution:

Stop the conflict between the legitimate judgement and the Ministry of Awqaf upon who should take the responsibility of orphanage. Stop the accusation of riba in the investment of orphans money.

Then, he responded to that and had a meeting in the Prime Ministers office with the presence of the President, Sheikh Abdullah Ghusyah who is the judge of judges, the minister of Awqaf Dr.Ishak Al-Farhan and my presence as Dean of College of Shariah at that time, Mr. Abdil Rahman al-Khalifah who is a lawyer, Mr.al-Khalil and Abd Razak Al-Muflih and they had a discussion regarding the investment of the orphans money. I suggested to them for the establishment of an independent sector called establishment of development of orphans money to take care about the development of money by legitimate ways, such as compound murabahah, istisna, as-salam, agricultural projects and others, and the judge of judgement has to be the head of the management and he agreed to that. And I appointed committees to set up the laws for the institution and it is practised until today.

According to contemporary scholars, there are three different types of tawarruq, as follows: 1. Tawarruq fardi: What was defined by the past scholars that include its meanings, types, as well as the hukm shari; 2. Tawarruq munazzam: That the order of the seller to get cash to the buyer by selling a commodity on deferred payment, at the price of fifteen Dinar. Then, the seller who represents the buyer sells the commodity to another in cash, at a price of 10 Dinar, which is lower than the first price, and gives it to the buyer (mutawarriq). By this, the deferred price is held by the seller as debt, which is 15 Dinar. The difference in amount between both prices is five Dinar, and it is known as tawarruq munazzam, because this type of transaction is run among the different organizations. Sometimes, the seller and another party agree to buy the commodity in cash, i.e. at a lower price than the price that will be charged to the buyer. The expression from this transaction is a way to escape from giving the first party ten Dinar as a loan, with five Dinar as interest, which is a ploy to escape from riba, i.e. by using this type of sale, which is known as tawarruq. Consequently, this is impermissible; and 3. Tawarruq masrafi: The researchers said that there are various practices with respect to this type of tawarruq: a. Signs an agreement with a company (repurchase agreement), whereby the company buys all the present metal (palladium) at a price lower than the price paid by the customer, with fixed percentage (e.g. 1%); b. The customer signs as a representative of bank to sell the metal on behalf of this company; and c. The bank secures the metal (palladium) within one week.

Steps taken to grant funding 1. When a client needs to obtain the investment, he must fill up the specific form that shows the required amount, as well as the period of payment and guarantees available; 2. Agrees with the customer regarding the period of investment and its cost. For instance, if the required amount is ten thousand Dinar per year and the cost of investment will be

10% and the distribution as follow, 8% for the bank receive in deferred and 2% for the company that signed the buy-back agreement with the bank; 3. The bank cannot give the required amount of investment to the customer in cash. For example, the sale of one hundred grams of palladium, and the buyer does not need the metal and perhaps he does not know what the colour, shape or use of that metal, and the sale is run on deferred payment, at the price of eight thousand dollars per kilogram and its total costs is payable after one year; 4. Reassure the customer that the bank will receive the amount requested of ten thousand Dinar in two days, i.e. from the date of the agreement, and asking him to sign to sell the

palladium by the buyer on behalf of the company. For example, the company will get the proportion of 2% of the amount. If the market price of the metal is ten thousand per kilogram, then it will be paid eight thousand dinars per kilogram as part of a deal in exchange for cash purchase of the metal; 5. The transition of the operation of the transfer of ownership of the metal ownership from the ownership of the bank to the ownership of the company at the same moment by using the computer and the amount of funding required is eight thousand dinars in the customers account, i.e. within two days from the date of agreement. Sheikh Al-Mani sees that this type of arrangement is impermissible, because of its weakness and not measured by the tawarruq, which is allowed by some scholars.

Another type Someone who needs one hundred thousand Dinar comes to the bank. Then, the bank does not give the amount in cash, but it sells a commodity on deferred basis at the cost of one hundred and twenty thousand Dinar. Then, the bank acts as an agent of the customer and sells the commodity at the cost of one hundred Dinar on deferred basis and gives it to the debtor and known as (mutawarriq). Then, the profit for bank is twenty thousand Dinar.

This is known as tawarruk masrafi, because it was practised by the banks and it should be noted that the bank buys the commodity when the person who needs the money comes to make loan like ordered the purchase of the commodity. This type of arrangement is also a ploy to obtain cash.

Hukm Shari for tawarruq munazzam or tawarruq masrafi, according to some contemporary scholars: Among the past hukm of tawarruk fardi, according to our past fuqaha, as well as our present scholars who make research about tawarruq and its evidences, and after discussing their evidences, I prefer the following view: Among the contemporary scholars who allow tawarruq are As-Syaikh Abdullah bin Sulaiman Al-Mani, who is one of the scholars in Saudi, Dr. Muhammad Abdul Ghaffar As-Syarif, Dr. Musa Adam Isa, Dr. Ali Al-Qarah Daghi, who is the Head of the Shariah department in Qatar, Dr. Muhammad Taqi Al-Usmani who is Qadi of Pakistan, Syaikh Muhammad Ibrahim, organization of the Ulama in Saudi Arabia, Majma Fiqh in Makkah Al-Mukarramah, and the Encyclopedia of Fiqh in Kuwait. Their evidences are as follows: Allah said in the Quran, Allah permitteth trading and forbiddeth usury. The general meaning of this verse come from the word Alif and Lam, which means the absorption and all types of sale are permissible, except if there are any verses that make the sale impermissible. Allah said, O ye who believe! Squander not your wealth among yourselves in vanity, except it be a trade by mutual consent. This verse shows that it is prohibited to eat the property of others by using the incorrect ways, which are not in line with the Shariah, such as riba, qimar, ghisyh, either the trade is like selling the commodity to the buyer at a high price through debt, and the buyer sell the commodity at a lower price to the third party at the same price, in order to make the profit differ from the other price. This type of sale is permissible, because there is no riba. Tawarruq is a type of madainat. For example, Said sold the commodity to Ali by debt, which is twelve Dirham and Ali sold it to Khalid at the price of ten Dirham and then Khalid sold to Said, also at the price of ten Dirham. The difference between both is two Dirham, which is the profit for Said. This sale is permissible and there is no confusion on it because it is to pay the debt like Allah said in the Quran, O ye who believe! When ye contract a debt for a fixed term, record it in writing and another two sales are included in what Allah said, Allah permitteth trading and forbiddeth usury.

The 15th Session of the Majma Fiqh was held from Saturday, 11 Rajab, 1419 Hijrah, and this is the text this bai at-tawarruq is permissible according to the Shariah, like the opinion of most of the scholars. This is because the original ruling on sale is permissibility, like what was mentioned by Allah in the Quran, Allah permitteth trading and forbiddeth usury, and the riba does not exist, either by intention or feature, and this is because the need towards it is to pay the debt, marriage and so on. In the session of Majma Fiqh, this type of bai is in the line with the Shariah, because the buyer does not sell the commodity directly at a cheaper price than what he purchased from the first seller. If that were to happen, then it is bai al-inah, which is impermissible because it consists of the trick of riba and leads to the prohibited aqad.

The Fiqh Encyclopedia of Kuwait stated that most of scholars, except the Hanbalis said that tawarruq is permissible, either by using the name of tawarruq or without using that name. Their evidences are from the Quran, like when Allah said, Allah permitteth trading and forbiddeth usury and from the Hadith that was reported in Sahih Bukhari and Muslim that the Prophet pbuh appointed a man upon Khaibar. The man brought him a good date (janiib) (janiib is a good date, and jamma is a bad one). The Prophet pbuh asked the man, Are all dates of Khaibar like this? He said, O you the messenger of Allah, we take a sa of this with two sa and two sa with three, the Prophet replied, Do not do that, sell the juma (the bad dates). Then use the cash to buy janiib.

Among the contemporary scholars who said that tawarruq is impermissible are As-Syaikh Abdullah bin Muhammad bin Hassan As-said, no.274 in Muharram 1425 Hijrah, Asy-Syeikh Ali As-Salus in his research for the Majma Fiqh Al-Islami in year 1424 Hijrah on the title of Al-Inah wa At-Attawarruk wa At-Tawarruk Al-Masrofi, Dr Hussien Hamid, Sami bin Ibrahim As-Suwailim in his research which presented to the Majma Fiqhi Al-Islami in Makka, year 1424 Hijrah on the title At-Tawarruk wa At-Tawarruk Al-Munazzom, Professor Sodiq Muhammad Al-Amin Adh-Dharir in his research year 1423 Hijrah on the title At-Tawarruk wa AtTawarruk Al-Munazzom, and Dr. Rafiq Yunus Al-Misri in his research on the title Al-Jami Liusuli Ar-Riba.

Their evidences: 1. It is a force and does not take it except compelled by it and compelled to it and the Prophet pbuh had forbidden, as it was narrated by Abu Daud. The purpose of mustawriq is to obtain the money, with acceptance of the higher deferred price; 2. Its reality is riba, because the purpose of both parties is to obtain money, with the addition of deferred money and the commodity is only the medium, not the purpose of the transaction; 3. It is like bai al-inah, which is prohibited by most scholars; and 4. The objective of buying and selling does not exist in tawarruq, and everything is recognized with its objective and not with its sayings and the exact expenditure is only recognized with regard to its objective. The Prophet pbuh said, The reward of deeds depends upon the intentions and every person will get the reward according to what he has intended. The purpose of this transaction is to obtain money, instead of selling and it is the feature of riba, which is impermissible.

The banking applications of tawarruq 1. The mustawriq comes to the Islamic bank and demands a certain amount of money. Then, the bank sells a commodity to the customer at the price, according to the amount needed (on deferred basis). Then, the buyer sells the commodity to a third party at a lower price. Finally, the third party sells it to the bank at the same price; 2. The mustawriq comes to the bank and makes a loan. Then, the bank preferred to buy the commodity by debt at the amount requested. Then, the bank buys the commodity from the mustawriq in cash, at the lower price and the debt amount shall be paid by installments; and 3. The mustawriq comes to the bank to make a loan. Then, the bank, the mustawriq and the third party agree that the bank will sell the commodity to the mustawriq by debt installments. Then, the bank acts as an agent for the mustawriq, i.e. to sell the commodity to a third party, at a lower price. The amount of debt remains higher to be paid by installments, as agreed.

All of these are the evidences for those who support and those who reject, as well as their applications in tawarruq. When we see at this thing, we can see that there are differences between bai al-inah and tawarruq and bai al-inah is impermissible according to most scholars and there are also different opinions of the hukm of tawarruq among of them. I tend to say that tawarruq is impermissible, based on the evidences of those who reject it and because there is also suspicion of riba, as explained before in several types of tawarruq.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- CH 16Document54 pagesCH 16Raheel Khan100% (1)

- 1 - Six Steps To Successful Supply Chain CollaborationDocument7 pages1 - Six Steps To Successful Supply Chain CollaborationRaheel KhanNo ratings yet

- Project NetworkDocument41 pagesProject NetworkRaheel KhanNo ratings yet

- 2 - Rules of Engagement SupplierDocument7 pages2 - Rules of Engagement SupplierRaheel KhanNo ratings yet

- Report # 1: Impact of Advertising and Sales Promotion On Consumer Brand SwitchingDocument28 pagesReport # 1: Impact of Advertising and Sales Promotion On Consumer Brand SwitchingRaheel KhanNo ratings yet

- Human Resource Management: Iqra UniversityDocument1 pageHuman Resource Management: Iqra UniversityRaheel KhanNo ratings yet

- Racing Past The BarriersDocument12 pagesRacing Past The BarriersRaheel KhanNo ratings yet

- The High Performance Development ModelDocument26 pagesThe High Performance Development ModelRaheel Khan100% (1)

- Vendor Managed InventoryDocument16 pagesVendor Managed InventoryRaheel KhanNo ratings yet

- Organization Behavior Solved Subjective QuestionsDocument6 pagesOrganization Behavior Solved Subjective QuestionsRaheel KhanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Truth of MuawiyahDocument21 pagesThe Truth of MuawiyahhammadNo ratings yet

- Ishmael in Islam - WikipediaDocument8 pagesIshmael in Islam - WikipediaDominika ChodakowskaNo ratings yet

- Syed Muhammad Taqi Hakim Taking Inspiration From The Words of Imam Ali Translator Abu Zahra Muhammadi OCRDocument138 pagesSyed Muhammad Taqi Hakim Taking Inspiration From The Words of Imam Ali Translator Abu Zahra Muhammadi OCRjawadNo ratings yet

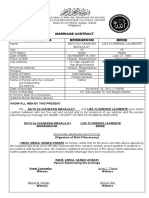

- Marriage Contract Personal Data Bridegroom BrideDocument1 pageMarriage Contract Personal Data Bridegroom Brideabdullah saripadaNo ratings yet

- Individual Report - How Is Takaful Different From Other Insurance - (Nor Khairiyatul Wafa Binti Rosdi)Document10 pagesIndividual Report - How Is Takaful Different From Other Insurance - (Nor Khairiyatul Wafa Binti Rosdi)Nor KhairiyatulNo ratings yet

- Abu SuhaibDocument8 pagesAbu SuhaibAbu BilaalNo ratings yet

- Al-Mahdi PDFDocument193 pagesAl-Mahdi PDFlolzNo ratings yet

- The True Face of Ayesha BintDocument62 pagesThe True Face of Ayesha BintSyed Jawad Ali Raza44% (9)

- Dalailuh KhayratDocument120 pagesDalailuh KhayratMujahid Asaadullah Abdullah100% (2)

- Imamate Divine Guide in IslamDocument381 pagesImamate Divine Guide in IslamSohaib KhanNo ratings yet

- Why Must We Study SeerahDocument3 pagesWhy Must We Study SeerahAdeeb HassannoorNo ratings yet

- Are Non-Theocratic Regimes Possible?Document10 pagesAre Non-Theocratic Regimes Possible?Christian E Ana BrittoNo ratings yet

- 17th Century CrisisDocument8 pages17th Century CrisisAbhinava GoswamiNo ratings yet

- Hazrat Abdul Quddus GangohiDocument301 pagesHazrat Abdul Quddus GangohiNishan-e-Rah100% (9)

- Mosques of Madinah - Madinah ZiaraatDocument34 pagesMosques of Madinah - Madinah ZiaraatTariq Maqsood KhanNo ratings yet

- The Interaction of Medicine, Philosophy and ReligionDocument289 pagesThe Interaction of Medicine, Philosophy and ReligionFeyzettin EkşiNo ratings yet

- A Call To Migrate - Abdul - Aziz Al-Jarbu'Document66 pagesA Call To Migrate - Abdul - Aziz Al-Jarbu'Fahim MuhammadNo ratings yet

- Turner, The Tradition of MufaddalDocument22 pagesTurner, The Tradition of MufaddalJean Yavayaru100% (1)

- UYUN AKHBAR AL REZA - VOL. 2 - Sheikh Sadooq - XKPDocument367 pagesUYUN AKHBAR AL REZA - VOL. 2 - Sheikh Sadooq - XKPIslamicMobilityNo ratings yet

- Pathways To An Inner IslamDocument221 pagesPathways To An Inner Islamzoran-888100% (2)

- Ubqari 7Document4 pagesUbqari 712MOHAMMED100% (3)

- Dalayil Al-Khairat Maa Dua Hizbul-Behr (Arabic/Urdu)Document146 pagesDalayil Al-Khairat Maa Dua Hizbul-Behr (Arabic/Urdu)Dar Haqq (Ahl'al-Sunnah Wa'l-Jama'ah)No ratings yet

- Islamic Political SystemDocument12 pagesIslamic Political SystemMusharafmushammadNo ratings yet

- Muslim and International LawDocument3 pagesMuslim and International LawRosario Arrozal LiongsonNo ratings yet

- 23 (2) Concept of Life Hereafter 27-2-24Document23 pages23 (2) Concept of Life Hereafter 27-2-24sarang23bhjNo ratings yet

- 8603 1 PDFDocument10 pages8603 1 PDFZebiButt100% (1)

- Last Sermon of Imam Hussain A S in Karbala EnglishDocument2 pagesLast Sermon of Imam Hussain A S in Karbala EnglishFaraz Haider100% (1)

- Benefits of Learning The Arabic LanguageDocument5 pagesBenefits of Learning The Arabic Languagesuresh100% (1)

- Memo Report On Faraid FirmDocument11 pagesMemo Report On Faraid FirmHazimah SairinNo ratings yet

- 1 Gr12 Surah Nur 32 34 Marriage Is The Path To ChastityDocument20 pages1 Gr12 Surah Nur 32 34 Marriage Is The Path To ChastityEmad bin ansaryNo ratings yet