Professional Documents

Culture Documents

EXCEL

Uploaded by

Taxation TaxCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EXCEL

Uploaded by

Taxation TaxCopyright:

Available Formats

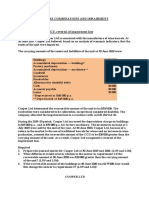

Choice of Model = Cost model Vs.

Revaluation Model Year 1 Revalued at 20000 15000 10000 Year 2 Revalued at 12000 20000 20000

Class M Asset 1 Asset 2 Asset 3 Note :-

Cost 20000 20000 20000

Acc. Dep 5000 5000 5000

C.V 15000 15000 15000

Rev. Gain/ (Loss) 5000 0 -5000

Rev. Gain/ (Loss) -8000 5000 10000

Rule :-

1 Revaluation is triggered = at assets level. 2 Revaluation is done at = class level. 3 Accounting of revalutaion gain / loss = asset wise. 1st Knock off Accumulated Dep. First then reduce the cost of the asset.

Journal Entry year 1 Asset 1 Accum. Dep A/c To Rev. Res A/c (being increase in the value of the assets) P & L A/c Dr. To Asset A/c 5000 5000

Asset 3

5000 5000

Journal Entry year 2 Asset 1 P & L A/c Dr. Rev. Res. A/c Dr. To Assets A/c Asset A/c Dr. To Rev. Reserves A/c Asset a/c Dr. To Rev. Reserve A/c To P&L A/c 3000 5000 8000 5000 5000 10000 10000 10000

Asset 2

Asset 3

Carrying Value Residual Value Life (in years) Dep. As per IAS 16 New Cost of Asset Less : Dep. Less : Dep. Less : Dep. Less : Dep. Less : Dep. Carrying Value

Asset 50000 0 10 5000 75000 10000 65000 10000 55000 10000 45000 10000 35000 10000 25000

Subsequent costs Overhaul Remarks 25000 To be Expensed 0 Treat this overhaul component as separate 5 5000 10000

Other Overhaul Cost Life

30000 5 Years

New Value

55000

Now if overhaul is scheduled in 3rd year Carrying Value Add : O/H Cost Less : Trf. Of old O/H Cost 55000 30000 15000 70000

To P&L A/c

IAS 16 Note :-

PROPERTY, PLANT AND EQUIPMENTS

By - CA Nalin Sharma

From exam point of view IAS 16 very important. 2006 1 Question 2007 1 Question 2008 1 Question 2009 2 Question 2010 1 Question In IFRS base financial statements they call it as PPE In IND-As based financial statements they call it as FA Topics to be covered in the compiled video IAS 16 IAS 23 IAS 36 Prpoerty Plant and Equipment Borrowings Impairment of Assets Session 1 Session 2 Session 3

Session 1 1

Non Current Assets Define the initial cost of NCA (+Self const. Assets) Apply various examples of expenditure distinguishing capital or revenue Identify the Pre Conditions for capitalising Borrowing Cost. Describe and idntify subsequent exp that may be capitalized. Rules for Revaluations. Gains/Loss on accounting of revalued assets. Depreciation Scope of IAS 16 Applies for accounting of PPE except when other IAS permits different treatment.

2 3 4 5 6

Covererd in respective Standards

Exception IFRS 5 IFRS 6 IAS 41 -

Items classified as HFS R & M of exploration and evaluation assets Biological Assets Mineral rights and mineral reserves

Key Definitions 1 2 3 4 5 6 7 8 9 Tangible Assets (PPE) Depreciation Depr. Amount Cost Fair Value Residual Value Useful Life Carrying Amount Imparment Loss

Held for Production or Supply of goods or admin purpose + exp to be used more than one year Systematic allocation of DA over an asset's useful life. Amt on which we provide depreciation = Cost - Residual Value Amt of C+CE paid initially + Fair Value of other considerations given (in case of exchange of asset) Arm's Length Price = Moderate Price = Not a favourable price of relative transaactions Scrap Value - upon buying we estimate the amount we exp. To realize upoin disposal period of time of expected usage of asset OR productions units expected to be obtained. Amt recognized in FS - Acc. Dep - Acc. Imparment Losses Reduction in value of the asset because of market condition or break out = CV less than Recoverable Value

Example of Tangible Non Current Asset as per IAS-16 Meaning of TNCA

Tangible (Physical/Touchable) + Other than Current Assets Current Assets

1 2 3 4 Realised in the companies Normal Operating Cycle (RM/WIP/FG/Debtors) Cash and Cash Equivalents Held for Trading ( Inventory) Exp to realised after 12 months

Tangible Non - Current Assets

Detais Covered By

1. Property, Plant and Equipment a Building b Machineries c Computers Traditionally called Fixed Assets. 2. Investment Property a Bulding given on rent b Plot of Land given for Capital Appreciation 3. Property constructed on behalf of third party 4. PPE classified as Held for Sale

Covered by IAS 16 PPE

Covered by IAS 40 Investment Property

Covered by IAS 11 Construction Contracts Covered by IFRS 5 NCA-HFS + Discontinued Operations

Recognition of NCA 1. When future economic benefit will flow to entity. 2. When cost is measured reliably Capital Expenditure vs. Revenue Expenditure Cap Ex. Rev. Ex. Incurred to acquier PPE intended for long term use + increase rev. earning capacity N.C.A. ( SOFP) Incurred to run day to day operations like buy-sell / admin exps / reparing (P&L)

Quiz Time 1 2 3 4 5

Rs 50000 Speant on acquiring new asset. Road Tax of Rs 1500 included in this? Rs 10000 on purchse of Second hand vehicle? Rs 12000 spent on refurbishment? Rs 1000 monthly rental for hire of vehilce? Component of cost - Restoring the Site Purchase Price+import duties+non-refundable taxes after discounts/rebate Direct attributable cost of bringing the asset to the present condition and Location (Employees Cost+Site Prep Cost+Delivery & handling Cost+Installation assembly cost+borrowing cost IAS 23+Testing Cost+Professional Fees) Estimated cost of dismanteling and removing the asset and restoring the site (= Decommissioning) the asset and restoring the site Purchase Price in exchange of Transactions (car is exchanged for another car) When the assets are acquired not in money then it may be neceesary to measure the value. FAIR VALUR OR CARRYING AMOUNT Type 1 F.V. Basis (a) When transaction lacks commercial substance. (b) When F.V. of neither of the two assets is measured reliably. Type 2 If F.V. fails then on the basis of C.V.

Cap Ex Rev Ex Cap Ex Cap Ex Rev Ex

1 2

Quiz Time 1

Mr. X buys bike of Rs 100000 and pays cash of Rs 80000 and trade is activa. Bike A/C Dr. 80000 To Cash A/c Bike A/C Dr. 20000 To Disposal A/c

80000 20000

(Profit) A machinery is acquired in exchange of the plot of land. The Fair Value of the machinery agreed at $ 200000 and the Fair Value of the Plot of Lanf agreed at $ 250000 and The Book Value of the Land is $ 225000 The difference of $ 50000 will be settled by the cash. The Machinery acquired will be recoreded at the $ 200000 Machinery A/C Dr Cash A/c Dr Plot of Land A/C Profit on Plot A/C Self Constructed Assets Principles of Measurement are similar to that of TNCA Indicative Cost = Cost of other similar asset const. 4 Sale Capitalised Cost =as per IAS 23 Boroowing Costs Non Capit. Cost = Cost of abnormal wastage 200000 50000 225000 25000

Acquiring Disposing

1 2 3 4 1 2

Component Accounting IAS 16 requires separate recognition of each significant item of PPE Item of PPE means a part that is having significant cost in relation to total cost of an asset. 3 Not necessary that the part has different useful life. 4 IAS 16 New Requirement The Parts of PPE has to be identified seperately. So that cost of replacing part recognised seperately. Example of Component Accounting

A New Furnace is installed in the Heater Plant. The Total Expense for the furncae is Rs 50Lac Expected useful life - 20 years Sr. No. 1 2 3 4 5 Various Component identifed at the time of Cap. Ex. Request made are :Particulars Heat Vault Heat system,burner,pipes Control Mechanism Visits and Overhaul Exps Furnace (Main Element) Total Cap. Ex. Useful Life 4 Years 10 Years 5 Year 2 years 20 Years Amount (in Rs.) 1500000 600000 200000 200000 2400000 4900000

That means various component of PPE is break up into number of different parts having diff. useful life.

NEW CONCEPT - NOT IN OLD AS 10 of INDIAN ACCOUNTING STANDARDS. Mainly used in Power or Infra Co. Subsequent Costs Accounting Treatment 1 C.V. of PPE doesnt include day-to-day servicing of the item. 2 Servicing Cost (Labour+Consumables - Tr to P&L A/c) Part Replacement 1 C.V. of PPE recognize the Cost of replacing a Part when the cost is incurred if the recognition criteria are met. 2 CV of Replaced Part = Derecognized. Major Inspection or Overhaul costs are capitalised. How to measure after recognition Select the Accounting Policy

Less Less

Cost Model Cost Acc. Dep. Impaitment Loss

Revaluation Model Revalued Amount Acc. Dep. Impaitment Loss

1 2 3

Revalued amount = Fair Value (F.V.) of asset at the revaluation date. F.V. has to be derived from Market Values. When F.V. is not available we use replacement cost approach.

How to determine Fair Value (F.V.)

Land & Buildings

Derived from market based values as evidenced by an appraisal that is normally undertaken by professionally qualified valuers. Derived from market based values as evidenced by an appraisal performed by experts.

Plant & Equipment

Quiz Time (If there is market based evidence)

Zodaic Ltd purchase a building at the cost of Rs. 5,00,000 on 1/1/2008. Experts value them at Rs. 7,00,000 on 31/12/2009. Ignore Depreciation. How will you revalued amounts be recognised?

Accounting Entry :Quiz Time (If there is NO market based evidence)

Revalution Res shown in SOCE and not to P&L A/c. Find the Fair Value if, equipment which is purchased 4 years ago, Cost Rs. 80,000 today. SLM Based Depreciation rate = 10%. Ans - Rs. 48000 Frequency of Revaluation Ravaluations must be made sufficiently regularly. Frequency depends on movements in fair value.

Increase / Decrease of Revaluation Amount 1 2 3 4 Recognise on Asset by Asset Basis. Increase = recognised as gains in SOCI and accumulated in Equity under the head "Rev. Surplus." Decrease = recognised in P&L Unless reversing a gain previously recognised in SOCI Decrease = recognised in OCI to the extent of any suplus prev. recognised and still remaining in respect of same asset. Accounting for Revaluations

P&L Dr To Asset

2K Rs. 8000

Cost of Asset C.V. - Rs. 10000 First Time Rs. 12000

Rs. 5000

Rs. 11000

Rs. 9000

Rs. 15000

P&L Dr To Asset

3K

Asset A/c Dr 3K To P&L 2K To Rev. Res 1K Accumulated Depreciation At the date of revaluation accumulated depreciation is either RESTATED PROPORTIONATELY (Method 1) ELIMINATED (Method 2)

with the change in Gross C.V. so that C.V. after revaluation equals at revalued amount.

against Gross C.V. and Net amount is restated to the revalued amt. Most popular in use for buildings.

Quiz TimeX Co. bought item of plant for $10000. The palnt has 10 years of life. R.V.=Nil The X Co. follows a policy to revalue its such items every two years. The assets were revalued at the year end for Rs. $8800 Required. What will be the entry under Proportionate Restatement Method and under Elimination Method? Method 1 Assets A/C Dr To Acc. Dep. To SOCI (Rev. Gain) PRM 1000 200 800 2000 1200 800

8000

Method 2 Acc. Dep. A/C Dr. To Asset A/C To SOCI (Rev. Gain) Subsequent Accounting IAS 16 ALLOWS, but does not requier and entity to transfer from revaluation reserve to retained earnings as the assets.

The transfer is the difference between the annual depreciation expense based on the revalued amount and the anuual depreciation expense based on historical cost.

Quiz Time

An item of PPE acquired on 1/1/2009 for $ 100000. Estimated Useful life - 10 years+SLM R.V. - Nil Revalued at $ 104000 on 31/12/2010 Calculate the depreciation charge for the year 3 to 10 and the amount of the revaluation surplus that can be transferred to retained earnings annually.

Required

13000 Rev Surplus TO R.E Deferred Taxation

3000 3000

When an asset is revalue, the amount of revaluation is adjusted to reflect the impact of Deferred Taxation on revaluation The Tax Base will not change when compan revalue its assets. Thus resulting in Taxable Temporary Difference. The credit recognised in OCI will be net of taxation and subsequent transfer from revaluation resereve will also be net of taxation. Example C.V. of Asset - $ 500000 Life 10 years Revalued $ 600000 IT Rate 30%

Required JV of Revaluations, Annual Dep. And RE Assets A/C Dr. Deff. Tax Cr. Rev. Res 100000 30000 70000 60000 To Acc Dep Excess Dep because of Revaluation 60000 50000 Related tr. From RR to RE RR A/C Dr To RE A/C ConclusionNo adjustment to deferred tax is required as a result of transfer of excess dep.This is because the deferred tax balance is adjusted as a result of Dep. Charge($60000) which reduces the temporary diff. IAS 16 does not specify any method of depreciation Depreciation of non-current tangible asset 1 2 3 Depreciation is systematic allocation of depreciable amount of an asset over useful life. Useful life and residual value must be reviewed at each financial year end. If expectation differs from previous estimates the changes are accounted for change in accounting estimates. Depreciation calculation after revaluation 1 2 3 Deprecaition will be based on revalued amount. Full depreciation amount charged off as as expense in SOCI. Difference between depreciation on revalued amount & original cost may be transferred from Revalued Reserve to Retained Earnings Depreciable Amount Useful Life Factors to be considered Expected usage assessed by reference to capacity / physical output. Expected physical wear and tear. (Depends upon operational factor - No. of Shifts) Technical obsolscene srising from change in the production or market demand for the product. Legal or similar limits on the use. (e.g. expiry dates of related leases) Asset Management Policy may involve diposal of the assets after specific time therfore useful life may be shorter than the economic life. Repairs and Maintenance Policy may also affect useful life but do not negate the need for depreciation Residual Value Often insignificant and immaterial as compard to depreciable amount. Dep. Is always recognised even if F.V. exceeds C.V. except where residual value is greater than carrying value in which case depreciation will be zero. Depreciaiton Period Depreciaiton is the date when asset is available for use. Begin from Ceases at the earlier of the date the asset is 1 Classified as HFS as per IFRS 5 2 Derecognised. (as scraped or sold) DPERECIATION DOES NOT CEASE WHEN ASSET IS IDLE OR RETIRED FROM USE FOR SALE. 60000

Dep

10000

7000 7000

1 2 3 4 5 6

1 2

1 2 3

Land and Building These are the separate assets and are seperately accounted for even they are acquired togather. Land is not depreciated. Building is depreciated. However if the land has limited useful life e.g. landfill, mining site, Quarry then land is depreciated. Depreciaiton Method SLM Constant charge over useful life. WDV A decreasing charge over useful life. Sum of units chrged based on expected use / units. Method IAS 16 PARA 43 INSIGNIFICANT PARTS ARE DEPRECIATED TOGATHER. Derecognizing - Removing Assets SOFP Eliminate on disposal or when no future economic benefits are expected from use or disposal. Recognise gain or loss in Profit and Loss Gains are not classified as revenue as per IAS 18 but are income.

1 2 3

SOCI Note

1 2 3 4 5 6 a b c d e f g

Disclosures Measurement basis used for determining Gross Carrying Amount. Depreciation method used. Useful life or Dep. Rates. Gross CV Less Acc. Dep. From Beginning and End of the Period. Accumulated imparment Loss are aggregated with acc. Dep. A reconciliation of the carrying amount at the beginning and end of the period showing Additions IFRS 5 clssified items Acquisition throgh business combinations Increase or decrease through revaluations Impairment Losses Reversal of Impairment Losses. Depreciation.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Wave Principle Improve TradingDocument6 pagesWave Principle Improve TradingThomas Tan100% (1)

- Damodaran, A. - Capital Structure and Financing DecisionsDocument107 pagesDamodaran, A. - Capital Structure and Financing DecisionsJohnathan Fitz KennedyNo ratings yet

- VolatilityDocument5 pagesVolatilityTaxation Tax100% (1)

- Financial Analysis of Garrison CorporationDocument39 pagesFinancial Analysis of Garrison CorporationGeraldo Mejillano100% (1)

- 3CD Ready ReckonerDocument39 pages3CD Ready ReckonerTaxation TaxNo ratings yet

- HR Mis FormatsDocument25 pagesHR Mis FormatsTaxation TaxNo ratings yet

- Rasoya Proteins LTD SHP M14Document9 pagesRasoya Proteins LTD SHP M14Taxation TaxNo ratings yet

- 1daily Work ScheduleDocument2 pages1daily Work ScheduleTaxation TaxNo ratings yet

- Attendance Register From 25Document7 pagesAttendance Register From 25Taxation TaxNo ratings yet

- Maximum Number of Members Restricted To 50. Maximum Number of MembersDocument3 pagesMaximum Number of Members Restricted To 50. Maximum Number of MembersTaxation TaxNo ratings yet

- Income Tax Declaration Form For Financial Year 2012-13Document1 pageIncome Tax Declaration Form For Financial Year 2012-13Taxation TaxNo ratings yet

- SupDocument2 pagesSupTaxation TaxNo ratings yet

- VedicReport12 22 201310 32 11AMDocument34 pagesVedicReport12 22 201310 32 11AMTaxation TaxNo ratings yet

- Bos 21769Document104 pagesBos 21769Shailesh KamathNo ratings yet

- Care Technical Analysis Workshop ScheduleDocument2 pagesCare Technical Analysis Workshop ScheduleTaxation TaxNo ratings yet

- Elliott Wave-Rules & GuidelinesDocument9 pagesElliott Wave-Rules & GuidelinesTaxation TaxNo ratings yet

- VedicReport12 29 201311 42 19AMDocument42 pagesVedicReport12 29 201311 42 19AMTaxation TaxNo ratings yet

- Loans Against Shares and DebenturesDocument3 pagesLoans Against Shares and Debenturessaumitra2No ratings yet

- IEC OnlineDocument37 pagesIEC OnlinespotdealNo ratings yet

- Centrum Wealth - Take It or Leave It - Voltas LTDDocument3 pagesCentrum Wealth - Take It or Leave It - Voltas LTDTaxation TaxNo ratings yet

- Application For Applied Value Investing 2009-2Document4 pagesApplication For Applied Value Investing 2009-2Taxation TaxNo ratings yet

- Jagran Prakashan 194H TDSDocument91 pagesJagran Prakashan 194H TDSTaxation TaxNo ratings yet

- MF Tracker 28012013Document103 pagesMF Tracker 28012013Taxation TaxNo ratings yet

- Election - What'S in It For Me?Document5 pagesElection - What'S in It For Me?Taxation TaxNo ratings yet

- Section 206AADocument8 pagesSection 206AATaxation TaxNo ratings yet

- Galaxy NexusDocument1 pageGalaxy NexusTaxation TaxNo ratings yet

- Complete Overview: The Value Line 600Document20 pagesComplete Overview: The Value Line 600janeNo ratings yet

- Analyze Capital Structure With Ratios And RiskDocument35 pagesAnalyze Capital Structure With Ratios And RiskArly Kurt TorresNo ratings yet

- BPS - Value Chain AnalysisDocument39 pagesBPS - Value Chain AnalysisMb88No ratings yet

- Chapter Six Audit of Equity Dear Learners! Equity Refers To The Net Worth of The Business, I.E. The Amount Remaining AfterDocument12 pagesChapter Six Audit of Equity Dear Learners! Equity Refers To The Net Worth of The Business, I.E. The Amount Remaining Aftermubarek oumerNo ratings yet

- Chapter 3 Quiz KeyDocument2 pagesChapter 3 Quiz KeyAmna MalikNo ratings yet

- Risk and Refinement in Capital BudgetingDocument51 pagesRisk and Refinement in Capital BudgetingRitesh Lashkery0% (1)

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Retrospective 2008-2009 MasterDocument65 pagesRetrospective 2008-2009 MasterbichgatiNo ratings yet

- Section 1 - Introduction To Investing Strategies: Download This in PDF FormatDocument13 pagesSection 1 - Introduction To Investing Strategies: Download This in PDF FormatpkkothariNo ratings yet

- Cost & RevenueDocument13 pagesCost & RevenueDeepikaa PoobalarajaNo ratings yet

- CLSA Microstrategy Dividend 2013-3-01Document191 pagesCLSA Microstrategy Dividend 2013-3-01kennethtslee100% (1)

- Elements of Financial StatementsDocument2 pagesElements of Financial StatementsJonathan NavalloNo ratings yet

- Annex W (Cir 818)Document3 pagesAnnex W (Cir 818)Diana FernandezNo ratings yet

- Takeover and Defence TacticsDocument31 pagesTakeover and Defence TacticsSachinGoelNo ratings yet

- Bringing industry, finance & people togetherDocument33 pagesBringing industry, finance & people togetherabhi4789No ratings yet

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisRAKESH SINGHNo ratings yet

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323No ratings yet

- Driving Sustainabile and Repeatable Growth in Enterprise SaasDocument18 pagesDriving Sustainabile and Repeatable Growth in Enterprise SaasFoton y JacNo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Tybaf Sem6 Fm-Iii Apr19Document6 pagesTybaf Sem6 Fm-Iii Apr19rizwan hasmiNo ratings yet

- DuPont Analysis - Wikipedia, The Free EncyclopediaDocument3 pagesDuPont Analysis - Wikipedia, The Free EncyclopediaidradjatNo ratings yet

- Coffee Futures 101Document6 pagesCoffee Futures 101Jeny EcheverriaNo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Preguntas Nivel 2Document33 pagesPreguntas Nivel 2Luis AENo ratings yet

- Ar EdfhcfDocument45 pagesAr EdfhcfPrasen RajNo ratings yet