Professional Documents

Culture Documents

Contrct Labour & Workmen Compensation Act

Uploaded by

Atish KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contrct Labour & Workmen Compensation Act

Uploaded by

Atish KumarCopyright:

Available Formats

E5-E6 Telecom

Rev date: 18-03-11

Chapter -15

CONTRACT LABOUR ACT & WORKMEN COMPENSATION ACT

Shobhit Kumar, DGM (BS-C), 9412739212 (M) E-mail ID: shobhitkr@sify.com

BSNL, India For Internal Circulation Only

Page: 1

E5-E6 Telecom

Rev date: 18-03-11

Contract Labour (Regulation & Abolition) Act An Overview

Contract Labour (Regulation & Abolition) Act, 1970 (Amended in 2004) 1.0 Objective: The Act aims at regulating employment of contract labour so as to place it at par with working conditions. The Act empowers the Govt. to prohibit employment of contract labour in any process, operation or other work in any establishment if the working conditions and benefits provided to them are discriminatory. 2.0 Scope & Coverage: Sec. 1: The Act extends to the whole of India. It applied to:(a) Every establishment in which 20 or more workmen are employed or were employed on any day of the preceding 12 months as contract labour, and (b) Every contractor who employs or who employed on any day of the preceding 12 months, 20 or more workmen. (c) The Act, however, does not apply to any establishment working casually or intermittently. Work performed in an establishment shall not be deemed to be of an intermittent nature:(i) If it was performed for more than 120 days in the preceding 12 months, or (ii) If it is of seasonal character and is performed for more than 60 days in a year. 3.0 3.1 Definitions:Workman:- A workman is said to be employed as CONTRACT LABOUR in or in connection with the works of an establishment when he is hired for the work by or through a contractor with or without the knowledge of principle employer. [Sec. 2 (b)]. Contractor: - Contractor (including sub-contractor) means a person who undertakes to produce a given result for an establishment through contract labour or who supplies contract labour for any work in an establishment. Persons who merely supply goods or articles of manufacture [Sec. 2(1) (c)] for an establishment are not contractor. The contractor is employed to produce the given result for the benefit of the Principal Employer in the fulfillment of the undertaking given to him by the contractor. [M/S Gammon India Ltd. Etc. Vs. U.O.I. & Ors. (1974)1 SCC 596]. Workman hired through a contractor without a valid license and being paid

For Internal Circulation Only

Page: 2

3.2

BSNL, India

E5-E6 Telecom

Rev date: 18-03-11

by the management through that contractor, are workmen employed by the establishment and not contract labour. Workman engaged through a contractor in excess of the maximum number permitted under the license are not contract labour [Workman vs. Best & Crompton Engg. Ltd. (1985)2 LLN 169 {Mad) (D.B.) : (1985) 1 LLJ 492]. 3.3 Establishment:- Establishment, for this purpose, means any place where any industry, business trade, manufacture or occupation is carried on or any office of the Govt. or a local authority [Sec. 2(1) (e)]. Employees Entitled: The Act covers every workmen employed in or in connection with any of the establishment, by or through a contractor, with or without the knowledge of the principal employer [Sec. 2(1) (b)] but excludes: (i) persons employed in managerial or administrative capacity, (ii) persons employed as supervisors and receiving wages exceeding Rs.500/per Mensem (Month), and (iii) out workers to whom materials are given for manufacturing or processing at his own premises [Sec. 2(1) (i)].

4.0

5.0

Administrative Authority: The act is administered by the Central and the State Governments in their respective jurisdiction. The central/state Govts. have set up advisory Boards constituted by representatives of industry, contractor, workers and government nominees [Secs 2(1) (a), 3 and 4]. The Govt. also appoints registration offices, Licensing officer and inspectors for carrying out the provisions of the Act [Secs. 6, 11 and 28]. The Central and the State govts. Shall make their rules for enforcement of the Act [Sec. 35].

6.0

Prohibition on Employment of Contract Labour: The appropriate Govt. can prohibit employment of contract labour in any process, operation or other work in any establishment after considering the conditions of work and benefits provided for the contract labour in that establishment and other relevant factors [Sec. 10]. Employment of contract labour may not be permitted for any process operation and other work if: (a) It is incidental to , or necessary for the industry, trade business, manufacture or occupation that is carried on in the establishment;

BSNL, India

For Internal Circulation Only

Page: 3

E5-E6 Telecom

Rev date: 18-03-11

(b) It is of perennial or perpetual nature of sufficient duration; (c) It is done ordinarily through regular workmen in that establishment or an establishment similar thereto; and (d) It is sufficient to employ considerable of whole time workmen. 7.0 Obligations of Principal Employers/Contractors The obligations of the Principal Employer of an establishment and /or the contractor are as under:Registration of Establishment (Principal Employer): The principal employer should apply for registration of his establishment with the registering officer, in the prescribed form I along with the prescribed fee. On being satisfied with the application the registering officer shall issue a registration certificate [Sec. 7]. The certificate is liable to be cancelled if it has been obtained by misrepresentative of facts or if it has become useless [Sec. 8]. An establishment cannot employ contract labour if it does not hold a certificate of registration or if its certificate has been revoked [Sec.9]. Failure to obtain registration by the principal employer entails penal provisions of Sec. 23 but does not give a right to the workers engaged by the contractor to claim employment from the principal employer. [Dena Nath & Ors. Vs. National Fertilisers Ltd. & Ors. (1992)1 LLJ 289 (S.C.)]. Licensing of Contractors: A contractor should apply for license for employing contractor labout, to the LICENSING OFFICER, in the prescribed from containing particulars such as location of the establishment, operation of work, nature of process, particulars of contract labour, etc. On being satisfied with the application and after making necessary investigation the licensing officer grant the license on payment of the prescribed fee and security deposit. A copy of the license has to be displayed prominently at the premises where the contract work is being carried out. A contractor cannot undertake or execute any work through contract labour if it does not hold a valid license or its license has been revoked [Sec.12]. Failure to obtain a license by a contractor, entails penal provisions, but in no case shall the contract labour be deemed as workman of the Principal Employer [Dena Nath 7 Vs. National fertilizers Lts. & Ors. (1992) 1 LLJ 289 (S.C.)].

7.1

7.2

BSNL, India

For Internal Circulation Only

Page: 4

E5-E6 Telecom

Rev date: 18-03-11

No contractor can engage contract labour without obtaining a license or whose license has been revoked or in contradiction with the terms and conditions specified in the license [Sec.14]. No license can be revoked unless the licensing authority gives a fair hearing. 7.3 Welfare & Health Amenities for Contract Labour: The following amenities are required to be provided by the contractor for contract labour; One or more canteens where the number of contract labour ordinarily employed is 100 or more [Sec. 16]. Sufficiently lighted, well ventilated, clean and comfortable rest rooms, where contract labours are required to halt at night in connection with their work [Sec. 17]. Supply of wholesome drinking water at convenient places, provisions for latrines, urinals and working facilities [Sec. 18]; and Fully equipped First-Aid Boxes readily accessible during all working hours [Sec. 19]. Payment of Wages: The contractor is liable to make regular and timely payment of wages to the contract labour, in presence of an authorized representative of the principle employer. If however, the contractor fails to make the payment in time or makes short payment, the Principal Employer should make payment of wages in full or the unpaid balance due to the contract labour, and recover the same from the contactor. [Sec. 21]. However, gratuity and bonus will not be payable by the Principal Employer since these do not come within the definition of wages. [Cominco Niani Zinc. Ltd. Vs. Pappachan 1989 LLR 12,3; (1989) 1 LLJ 452 (Ker. HC)]. Registers, Returns & Notice The principal employer and the contractor should maintain such registers and records containing particulars of contract labour, nature of work performed rates of wages paid and other prescribed particulars. The employer and contractor should also send the prescribed returns to the registering officer or licensing officer. The employer and the contractor should exhibit in the premises of the establishment, notices containing hours of work, wage period, nature, of duty and other prescribed particulars [Sec. 29].

(i) (ii)

(iii) (iv)

7.4

7.5

BSNL, India

For Internal Circulation Only

Page: 5

E5-E6 Telecom

Rev date: 18-03-11

8.0

Coverage Of Contractor`s Employees Under EPF Act & ESI Act: Contractors employees are eligible for Provident Fund benefits. If the establishment is covered under ESI, the employees engaged by a contractor have to be enrolled as members of ESI. Direct Absorption of Contract Labour: Persons who get displaced, on the expiry of the contract/license period, do not get any statutory right for absorption in regular service under the employer [P. Karunakaran Vs. Chief Commercial Superintendent, southern Railway and Ors. 1989 1, LIN 898; LLJ 8 (Ker H.C.)]. Rights of Employers/Contractor: Te principal employers and the contractors have the following rights: Right to appeal against an order of the registering officer or the Licensing officer refusing or revoking registration or license. The appeal should be filed to the appellate officer on the prescribed manner, within 30 days from the date on which the order is communicated to him [Sec. 15]. Right to be represented on the Central and State advisory Boards [Sec. 4]. Rights of Contract Labour: The obligations of the contractor and the principal employer are, practically, the rights of the contract labour. Besides, the contract workmen have also the right to be represented on the Central and State Advisory Boards.

9.0

10.0 (i)

(ii) 11.0

12.0

Offence & Penalties:

OFFENCE

BSNL, India For Internal Circulation Only

PENALTIES

Page: 6

E5-E6 Telecom

Rev date: 18-03-11

(i)

(i)

Obstructing an inspector while making Imprisonment upto 3 months, or fine upto inspection, inquiry or investigation, or Rs. 500/- or Both. failure to produce registers or documents before an inspector for inspection [Sec. 22]. Employing contract labour in Imprisonment upto 3 months or fine upto contravention of the provisions of the Rs. 1000/- or Both. In case of a Act. Or violating any condition of the continuing offence, additional fine upto registration certificate or license Rs. 100/- per day [Padam pd. Jain Vs. state of Bihar (1978) Lab.IC 147)]. [Sec. 23].

Questions

1. Please discuss the scope & coverage of the Indian Contract Labour (Regulation & Abolition) Act, 1970? 2. Please indicate the employees entitled/covered as contract labour by the Contract Labour Act, 1970 along with exceptions, if any? 3. Elaborate the salient featured of prohibition on employment of contract labour in light of the scenario where it is not permitted? 4. Please discuss welfare & Health Amenities for Contract Labour in the light of relevant sections of the Contract Labour Act 1970? 5. Illustrate the essence of section 21 of the Contract Labour Act 1970 with reference to payment of wages? 6. What are the rights of Employees & Contractors envisaged in section 15 & section 4 of the Contract Labour Act 1970? 7. What are the rights of Contract Labour? 8. Enumerate various types of offence & penalties envisaged in the Contract Labour Act 1970? in the light of relevant sections? 9. Please discuss registration of Establishment (Principal Employer), quoting relevant sections of the Contract Labour Act 1970. 10. Please elaborate the process & significance of licensing of contractors along with implication in case of default, under the purview of the Contract Labour Act 1970?

The Workmens Compensation Act, 1923 (Amended in 2000)

BSNL, India

For Internal Circulation Only

Page: 7

E5-E6 Telecom

Rev date: 18-03-11

1.0 Objective: The Act aims to impose an obligation upon employers to pay compensation to workers and/or their dependents for accidents arising out of and in the course of employment, resulting in death or total or partial disablement for a period exceeding 3 days. Compensation is also payable for some occupational diseases contracted by workmen during the course of their occupation. 2.0 Scope & Coverage: The Act extends to the whole of India. It applies to Railways and other transport establishments, factories, establishments engaged in making, altering, repairing, adapting, transport or sale of any article, mines, docks, establishment engaged in constructions, fire brigade, plantations, oil fields and other establishment listed in schedules II & III the Act. It does not apply to casual workers, those employed in armed forces and workers covered by the Employees State Insurance Act. 1948. 3.0 Employees Entitled: Every employee (including contract labour), who is engaged for the purposes of employers business in any such accident. There are three tests to determine whether an accident arises out of and in course of employment viz. it has to be established that: (i) At the time of the accident the employees were in fact employed on the duties of their employment; (ii) That accident occurred at the place where he was performing his duties; and (iii) That the immediate act which led to the accident is so remote from the sphere of his duties that it is to be regarded as nothing but something foreign. Now, to find out as to whether a workmen is covered under the Act or not we have to see the following two points: (i) Whether his employment was a casual nature; and (ii) Whether his employment was otherwise for the purpose of employees trade or business and does not come under the purview of section 2(1) (n) of the Act. Nevertheless, where compensation has been claimed by a person, the relation between employer and the person who is claiming compensation has to be seen which can be determined on the basis of following principles: (a) Whether the workman is having contract of service; (b) Whether the master can only order or he can require workman what is to be done or he can also order as to how it is to be done; (c) Whether it is obligatory on the part of the workman to obey his order; (d) Whether workman is having any agreement to serve the employer only or employed for his trade or business. 4.0 Administrative Authority: It is administered by the state Govt. through commissioners for workmens compensation appointed by them. Govts. also makes rules for proper compliance of the Act. 5.0 Dependent: The following relations of a deceased workman shall be his dependents [Sec. 2(d)]:

BSNL, India For Internal Circulation Only

Page: 8

E5-E6 Telecom

Rev date: 18-03-11

(i) (ii) (iii) (iv)

A widow, a minor legitimate son, an unmarried legitimate daughter, a widowed mother, whether or not dependent on the workman; A son or daughter, who is aged 18 years or more, is infirm and wholly dependent on the workman; Any of the following persons partially or wholly dependent on the workman; and A widower, a parent other than a widowed mother, a minor illegitimate son, an unmarried illegitimate daughter or a daughter legitimate or illegitimate if married and a minor, or if widowed and a minor, a minor brother or unmarried sister or a widowed sister if minor, a widowed daughter in-law, a minor child of a pre-deceased daughter where no parent of the child is alive, or a paternal grand-parent if no parent of he workman is live.

6.0 Disablement: [Sec 2(g) & (l)]. Injury caused by an accident ordinarily results into less of the earning capacity, of the workman which is called disablement. Disablement can be either total or partial which can be further subdivided as temporary or permanent. Disablement, whether permanent or temporary is said to be total when it incapacitates a worker for all work he was capable of doing at time of the accident resulting in such disablement. Total disablement is specified in part I of schedule I or part II of schedule I (Permanent partial disablement). 7.0 Main Provisions: The employer covered under this Act is liable to pay compensation to workman for accidents arising out of and in course of employment, resulting in death or total or partial disablement for a period exceeding 3 days or who has contracted occupational disease during the course of their occupation (Specified in schedule III). 8.0 Accident Arising Out of & in Course of Employment: If an occurrence is unexpected and without design on the part of the workman, it is accident [Devshi Bhanji Khona Vs. Smt. Mary Burno, (1985) 1 LLN 362 (Ker)]. An accident arising out of employment implies a casual connection between the injury and the accident and the work done in cause of employment. Employment should be the distinctive and the proximate cause of the injury. The tests for determining whether an accident arose out of employment are: (i) Injury must have resulted from some risk incidental to the duties of the service, or inherent in the nature of condition of employment, and (ii) At the time of injury workman must have been engaged in the business of the employer and must not be doing something for his personal benefit. 9.0 In Course of Employment can not only with actual work but also any other engagement natural and necessary there to, reasonable extended both as regards workhours and work-place. Thus, an employer will be liable to pay compensation if a workman meets with an accident while proceeding to his workplace on a bicycle [Indian Rare Earth Ltd. B. Surinder Beevi & Ors 1981 (43) FLR 293]. Heart injury when brought

BSNL, India For Internal Circulation Only

Page: 9

E5-E6 Telecom

Rev date: 18-03-11

about by a strain due to the work in the employment (and not by natural wear and tear of employment) is compensable through pre-existing and this is irrespective of the percentage of the part played by either of them viz., the work and the condition. [Zubida Bano & Ors. Maharashtra state Road Transport corp. & Ors. (1992) 1 LLJ 66 (Bom)]. 10.0 The Evidence Act as such does not apply to the proceedings under the workmans compensation Act. The phrase in course of employment is understood to mean that the injury has resulted during the course of employment from some risk incidental to the duties of the service, which unless engaged in the duty owing to the master, it is reasonable to believe the workman would not otherwise have suffered. In other words, there must be causal relationship between accident and the employment [Director (T&M) DNK Projects Vs. Smt. D. Buchitali (1989) 1 LLJ 259 (Ori)]. A factory worker suffering from a heart disease, while coming out of the factory, died inside the factory premises. The stress and strain of work were the accelerating factor to death and therefore the employer was liable to pay compensation. [Director (T & M) DNK Projects Vs. Smt. D. Buchitali (1989) 1 LLJ 259 (Ori)]. The workman on duty went to canteen for bringing tea and he died. Held, the accidental injury arose in course of the employment and the period of recess did not disrupt the continuity of employment [Reg. Dir. ESIC Vs. Batulbibi, 1988 (58) FLR (Guj. HC) 1990 LLR (SC), 30 Journal Sec]. 11.0 Payment of Compensation to Contract Labour: The principal employer is liable to pay compensation to contract labour in the same manner as his departmental labour. He is entitled to be indemnified by the contractor [Sec. 12] [Mg. Dir., Orissa State Ware Housing Corporation Vs. Smt. Geetarani Seal & Ors. (1992) 1LLJ 619 (Ori)]. The principal employer shall not however be liable to pay any interest and penalty leviable under the Act. [Sarjerao Unkar Jadhav Vs. Gurinder Singh & Ors. (1992) 1 LLJ. 156 (Bom.)]. 12.0 Occupational Diseases: A worker contracting an occupational disease is deemed to have suffered an accident out of and in course of employment and the employer is liable to pay compensation for the same. Occupational diseases have been categorized in parts A, B and C of [schedule III].

13.0 Compensation When Not Payable: [Sec. 3] (i) When disablement is for a period less than 3 days, (ii) When accident (not resulting in death) is due to the fault of the workman or his willful disobedience of an order (to be proved by the employer), (iii) The workman has contacted a disease which is not directly attributable to a specific injury caused by the accident or to that occupation, or,

BSNL, India For Internal Circulation Only

Page: 10

E5-E6 Telecom

Rev date: 18-03-11

(iv)

When the employee has filed a suit for damages against the employer or any other person, in a civil court.

14.0 Statement of Fatal Accidents [Sec. 10(a)]: Where a commissioner receives information from any source that a workman has died as a result of an accident arising out of and in course of his employment, he may require the employer, by serving upon him a registered notice, to submit within 30 days of its service, a statement in the prescribed from: (a) (b) Giving the circumstances attending the death of the workman, & Indicating whether he is or is not liable to pay compensation. If the employer feels that he is liable to pay compensation, then he shall make the deposit to the commissioner within 30 days of the notice. If he disclaims the liability, then he should indicate the grounds for so. [Sec. 10(A)].

15.0 Accident Report [Sec. 10(B)]: Employer to communicate to commissioner within 7 days of the accident leading to death or serious bodily injury. 16.0 Amount of Compensation: [Sec. 4(1)]. The Calculation for the amount of compensation shall be as follows:(a) In case of death 50% of the monthly wages X Relevant factor or Rs. 80,000/- whichever is more. 60% of the monthly wages X relevant factor or Rs. 90,000/- whichever is more

(b)

In case of Total permanent disablement specified under Sch. [I]

Note:- Relevant Factor means a Factor specified in schedule IV depending upon the age of the workman on his last birthday before accident. e.g. R.F. is 216.91 at 25 years age and 184.17 at 40 years age. (c) In case of partial permanent disablement loss specified under schedule [I] In case of partial Permanent disablement not specified under schedule [I] Such % of the compensation payable in case of (b) above, as is proportionate to the of earning capacity (as assessed by a qualified medical practitioner), Such % of the compensation payable in case of (b) above, as is proportionate to the loss of earning capacity (as assessed by a qualified medical practitioner).

(d)

BSNL, India

For Internal Circulation Only

Page: 11

E5-E6 Telecom

Rev date: 18-03-11

(e)

In case of temporary Disablement (whether Total or partial) shorter.

a half-monthly installment equal to 25% of the monthly wages, for the period of disablement or 5 year whichever is

NOTE: Wages for this act includes any benefit or perquisite expressible in terms of money but excludes traveling allowance/ concession, employers contribution to pension or P.F. or a sum paid to cover any special expenses incidental to his employment [Sec.2 (1)(m)]. It includes bonus, night out allowance, D.A., gratuity, free quarter, food allowance etc. also.

17.0 Time & Mode of Payment: Liability of paying compensation starts as soon as the injury was caused [Pratap Narain singh Vs. Srinivas Sabata & Ors. (1976) AIR 222(SC)]. If payment is not made within one month from the date it fell due a simple interest @ 12% may be levied by the commissioner. A further sum not exceeding 50% of the compensation may be levied by the commissioner over and above 12% by way of penalty [Sec.4-A] if there is no justification for delay. Half monthly installments may be converted into a lumpsum payment, by an agreement between the employer and the workman or by applying to the commissioner [Sec7]. This half monthly payment may be reviewed by the commissioner on an application [Sec.6]. 18.0 Compensation to be Deposited With the Commissioner [Sec 8]: The amount of compensation is not payable to the workman directly but to the commissioner who will then pay to the workman/their dependents. The receipt of the deposit with the commissioner shall be sufficient proof of discharge of employers liability. 19.0 Distribution of Compensation by Commissioner: [Sec 8]. The commissioner shall distribute the compensation among the dependents in such proportion as he deems fit. The employer can obtain the details of all disbursements made by the commissioner by an application to that effect. 20.0 Notice of Accident: [Sec 10(2) &(4)]. Notice of accident should be sent to the commissioner and establishment by the workmen with such particular as the names & address of person injured, the date and cause of accident etc. this notice may be served either personally or by registered post or by means of an entry in the notice-book maintained by the employer.

BSNL, India For Internal Circulation Only

Page: 12

E5-E6 Telecom

Rev date: 18-03-11

21.0 Filing of Claims: [Sec. 10(1)]: No claim for compensation shall be entertained unless the notice of accident in the prescribed manner has been given by the workmen except in the following cases: (a) In case of the death of the workman. (b) In case the employer had knowledge of the accident from any other source, at or about the time of its occurrence; (c) In case the failure to give notice or prefer the claim was due to sufficient cause. The case must be preferred within 2 years from the occurrence of the accident or from the date of death. It must proceeded by (i) a notice of accident and (ii) the claimant employee must present himself for medical examination so required by the employer. Failure of employer to have the workman medically examined does not debar him from challenging the medical certificate produce by the workman. [Burhsal Sugar Mills Ltd. Vs. Ramjan (1982) Lab IC 84 (All)]. 22.0 Attachment and Assignment of Compensation: Compensation payable under this act cannot be attached, charged or passed on to any person other than the workman by operation of law, nor can it be set-off against any other claim [Sec.9]. 23.0 Returns as to Compensation: [Sec.16]. The employer is required to submit a return specifying (a) The no. of injuries in respect of which compensation has been paid during the previous year; (b) The amount of such compensation; and (c) Such other particulars as to the compensation as may be prescribed. 24.0 Obligation of Employer: (i) To pay compensation for an accident to the workman under the Act, (ii) To submit a statement to the commissioner, within 30 days of receiving the notice, in the prescribed form giving the circumstances attending the death of workman as result of an accident and indicating whether he is liable to deposit any compensation [Sec. 10-A]. (iii) To submit accident report to the commissioner in the prescribed from within 7 days of the accident which result in death of a workman or serious bodily injury. [sec. 10-B]. (iv) To submit an annual return of accidents specifying the number of injuries for which compensation has been paid during the year, the amount of such compensation and other prescribed particular [Sec. 16].

BSNL, India

For Internal Circulation Only

Page: 13

E5-E6 Telecom

Rev date: 18-03-11

25.0 Obligation of Employees: (i) to send a notice of the accident in the prescribed from, to the commissioner and the employer, within such time as soon as it practicable for him. This notice is a precondition for the admission of the claim for compensation [Sec.10(2) &(4)]. (ii) To present himself for medical exam, if required by the employer [Sec.11(1)] 26.0 Rights of Employers and Employees: Certain important rights of the employees and the employers are :(i) To apply to the commissioner for reviewing the half monthly payment (in case of temporary disablement) on the ground of change in condition of the employee, the application should be accompanied by a certificate of a medical practitioner [Sec.6]; (ii) To refer any dispute as to liability to pay compensation, amount or duration of the compensation, or as to nature or extent of disablement, etc. to the commissioner for settlement [Sec. 19]; (iii) To appeal against and order of the commissioner to the High court, within 60 days of the order [Sec. 30]. The employer is required to deposit the compensation before filing the appeal [Provision to Sec. 30; see Narayanan Nair Vs. U.O.I. (1990) 11 LLJ 520 (KER).].

27.0 Offences and Penalties: Sr. No. 1 2 OFFENCES PENALTIES Unjustified delay in payment of (1) upto 50% of the amount of compensation besides interest compensation Beyond one month 12% PA [Sec. 4A(3). (i) Failure to maintain a notice book Fine upto Rs. 5000/- (Sec. 18 A) U/S 10(3) (ii) Failure to submit a statement of - As abovefatal accident U/S 10-A (iii) Failure to submit an accident report - As aboveU/S 10-B (iv) Failure to file annual return of - As abovecompensation U/S 16.

BSNL, India

For Internal Circulation Only

Page: 14

E5- E6 Civil

Rev Date: 15-03-11

28.0

Important Sections of Act and its Provisions Section No. Sec. 2 Provisions Definitions e.g. Commissioner, Compensation, Dependent, Employer, Disablement, Wages, Workman etc. Employers Liability for compensation and compensation when not payable. Amount of Compensation Penalty and interest for delayed payment. Half monthly installments may be converted in lump sum payment. Compensation to be deposited with commissioner. Commissioner shall distribute the compensation. Compensation not to be assigned, attached or charged. Notices and Claim Notice of accident is to sent by workman to the commissioner & employer. Employer should submit the statement in prescribed form to the commissioner within 30 days of receiving the notice To submit Accident Report by Employer to commissioner within seven days of accident. Employee is to be present for Medical Examination. Returns to be submitted by Employer to the commissioner. Disputes may be referred to commissioner. Penalties. Appeal against the order of commissioner to the High Court.

Sr. No. 1.

2. 3. 4. 5. 6. 7. 8.

Sec. 3 Sec. 4 Sec. 4 A Sec. 6 Sec. 8 Sec. 9 Sec. 10 Sec. 10(2) & (4) Sec. 10 (A)

Sec. 10 (B) 9. 10. 11. 12. 13. Sec. 11 Sec. 16 Sec. 19 Sec. 18 A Sec. 30

BSNL ,India

For Internal Circulation of BSNL only

Page 1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

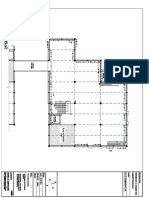

- Basement Floor PlanDocument1 pageBasement Floor PlanAtish KumarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- IELTS Speaking TopicsDocument2 pagesIELTS Speaking Topicsim.alirazaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- E RTN FAQDocument10 pagesE RTN FAQtalsur2002No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Footing Calculation L B HT Cuboid (L+B) Thickness Nos Strap F1 Feets 5 5 2 50 10 1 6 5 5 6 3 90 11 1 5 5.5Document2 pagesFooting Calculation L B HT Cuboid (L+B) Thickness Nos Strap F1 Feets 5 5 2 50 10 1 6 5 5 6 3 90 11 1 5 5.5Atish KumarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- IELTS Writing Master v1 2Document33 pagesIELTS Writing Master v1 2IELTSguruNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- India WikipediaDocument929 pagesIndia WikipediaAtish KumarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Ielts Preparation - SpeakingDocument8 pagesIelts Preparation - Speakingarvindappadoo4243256No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ielts WritingDocument45 pagesIelts Writingahmed_uet_lahoreNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lessons From The TitanicDocument27 pagesLessons From The TitanicKevin KeefeNo ratings yet

- Preparing For The IELTS Test With Holmesglen Institute of TAFEDocument9 pagesPreparing For The IELTS Test With Holmesglen Institute of TAFEhanikaruNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ielts SpeakingDocument9 pagesIelts SpeakingAtish KumarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- IELTS - Writing AssaysDocument6 pagesIELTS - Writing AssaysAtish KumarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IELTS Writing Topics2Document4 pagesIELTS Writing Topics2Atish KumarNo ratings yet

- Structural Components Design in RCC BuildingsDocument72 pagesStructural Components Design in RCC BuildingsVedha NayaghiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Effective Building MainatenanceDocument44 pagesEffective Building MainatenanceAtish KumarNo ratings yet

- Indian Contract Act 1872Document7 pagesIndian Contract Act 1872Atish KumarNo ratings yet

- Green Building PerspectiveDocument20 pagesGreen Building PerspectiveAtish KumarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Indian Contract ActDocument7 pagesIndian Contract ActAtish KumarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Civil TechnicalDocument40 pagesCivil TechnicalAtish KumarNo ratings yet

- Rainwater Conservation & Harvesting.Document19 pagesRainwater Conservation & Harvesting.Atish Kumar100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Mandatory TestDocument34 pagesMandatory TestAtish KumarNo ratings yet

- Quality Assurance in Buillding WorksDocument8 pagesQuality Assurance in Buillding WorksAtish KumarNo ratings yet

- External Services-Road & DrainageDocument17 pagesExternal Services-Road & DrainageAtish KumarNo ratings yet

- Design of RCC Building ComponentsDocument66 pagesDesign of RCC Building Componentsasdfg1h78% (9)

- Design of Internal & External Water SupplyDocument34 pagesDesign of Internal & External Water SupplyAtish KumarNo ratings yet

- Soil Parameters & Applied FoundationDocument45 pagesSoil Parameters & Applied Foundationasdfg1h100% (1)

- Chapter02.Structural Design Using STAAD PRODocument22 pagesChapter02.Structural Design Using STAAD PROSiddharth Chetia100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Estimation & Billing Using SoftwareDocument33 pagesEstimation & Billing Using SoftwareAtish KumarNo ratings yet

- 358 IG Fashion Pack PDFDocument4 pages358 IG Fashion Pack PDFbovsichNo ratings yet

- Andrew Beale - Essential Constitutional and Administrative LawDocument123 pagesAndrew Beale - Essential Constitutional and Administrative LawPop Rem100% (4)

- Performance Online - Classic Car Parts CatalogDocument168 pagesPerformance Online - Classic Car Parts CatalogPerformance OnlineNo ratings yet

- Analog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Document74 pagesAnalog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Veena B Mindolli71% (7)

- Starbucks Delivering Customer Service Case Solution PDFDocument2 pagesStarbucks Delivering Customer Service Case Solution PDFRavia SharmaNo ratings yet

- XJ600SJ 1997Document65 pagesXJ600SJ 1997astracatNo ratings yet

- 2 - Water Requirements of CropsDocument43 pages2 - Water Requirements of CropsHussein Alkafaji100% (4)

- 14.symmetrix Toolings LLPDocument1 page14.symmetrix Toolings LLPAditiNo ratings yet

- Engineering & Machinery Corp vs. CADocument8 pagesEngineering & Machinery Corp vs. CALaila Ismael SalisaNo ratings yet

- Flange ALignmentDocument5 pagesFlange ALignmentAnonymous O0lyGOShYG100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- General Milling Corp Vs CA (DIGEST)Document2 pagesGeneral Milling Corp Vs CA (DIGEST)Raima Marjian Sucor100% (1)

- Fresher Jobs July 31Document18 pagesFresher Jobs July 31Harshad SonarNo ratings yet

- Iwcf Section OneDocument20 pagesIwcf Section OnesuifengniliuNo ratings yet

- Assignment 1: Unit 3 - Week 1Document80 pagesAssignment 1: Unit 3 - Week 1sathiyan gsNo ratings yet

- 2023-04-28 NMSU Executive SummaryDocument2 pages2023-04-28 NMSU Executive SummaryDamienWillisNo ratings yet

- 93 .SG, CBR, MDD, PI, SP - GRDocument11 pages93 .SG, CBR, MDD, PI, SP - GRChandra Prakash KarkiNo ratings yet

- IPC Policy 4 PDFDocument128 pagesIPC Policy 4 PDFgary ann jimenez100% (1)

- Design Calculation Sheet: Project No: Date: Sheet No.:1 1 Computed By: SubjectDocument1 pageDesign Calculation Sheet: Project No: Date: Sheet No.:1 1 Computed By: SubjectAbdelfatah NewishyNo ratings yet

- Ruling The CountrysideDocument9 pagesRuling The Countrysiderajesh duaNo ratings yet

- DACReq 016Document19 pagesDACReq 016jillianixNo ratings yet

- RICS APC Candidate Guide-Aug 2015-WEB PDFDocument24 pagesRICS APC Candidate Guide-Aug 2015-WEB PDFLahiru WijethungaNo ratings yet

- Catalogo de Partes Hero KarizmaDocument98 pagesCatalogo de Partes Hero Karizmakamil motorsNo ratings yet

- Company Grasim ProfileDocument48 pagesCompany Grasim ProfileNitu Saini100% (1)

- Kennametal MasterCatalog SEM Preview en MinchDocument119 pagesKennametal MasterCatalog SEM Preview en MinchBeto CovasNo ratings yet

- GM1. Intro To FunctionsDocument5 pagesGM1. Intro To FunctionsGabriel Benedict DacanayNo ratings yet

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorNo ratings yet

- Sikaplan®-1652 Bonded VOC Gas Barrier: Product Data SheetDocument3 pagesSikaplan®-1652 Bonded VOC Gas Barrier: Product Data SheetKhin Sandi KoNo ratings yet

- Final - Far Capital - Infopack Diana V3 PDFDocument79 pagesFinal - Far Capital - Infopack Diana V3 PDFjoekaledaNo ratings yet

- Cover LetterDocument2 pagesCover LetterSasi Gangadhar BNo ratings yet

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (328)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)