Professional Documents

Culture Documents

December F4 English

Uploaded by

Ayesha Tahir KhiljiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December F4 English

Uploaded by

Ayesha Tahir KhiljiCopyright:

Available Formats

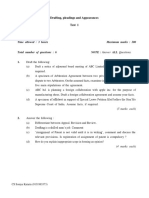

Fundamentals Level Skills Module

Corporate and Business Law (English)

Tuesday 7 December 2010

Time allowed Reading and planning: Writing:

15 minutes 3 hours

ALL TEN questions are compulsory and MUST be attempted.

Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

Paper F4 (ENG)

ALL TEN questions are compulsory and MUST be attempted 1 In relation to the English legal system: (a) explain and distinguish between: (i) primary legislation; and (ii) secondary/delegated legislation. (6 marks)

(b) explain the powers of the courts in relation to challenging the validity of primary and secondary/delegated legislation. (4 marks) (10 marks)

State and explain the remedies available for breach of contract. (10 marks)

In relation to the law of tort explain: (a) the neighbour principle; (b) remoteness of damage; (c) liability for economic/financial loss. (4 marks) (4 marks) (2 marks) (10 marks)

In relation to the issuing of company shares explain: (a) pre-emption rights; (b) rights issues; (c) bonus issues. (3 marks) (3 marks) (4 marks) (10 marks)

In relation to the Companies Act 2006: (a) state, and explain the purpose of, the various registers that have to be kept by a company; (b) describe what accounting records will have to be produced and maintained by a company. (4 marks) (6 marks) (10 marks)

In relation to company law, explain the duties owed by directors to their companies. (10 marks)

In relation to employment law explain: (a) the meaning of unfair dismissal; and (b) the remedies available for unfair dismissal. (6 marks) (4 marks) (10 marks)

In January 2009, Amy started a business as an independent website designer. To give her a start in her career, her brother Ben, who ran a retail business, said he would give her 1,000 if she updated his business website. At the same time, her friend Che asked her to do work for his business, also for a set fee of 1,000. However, by the time Amy had completed the two projects her design business had become a huge success and she had lots of other clients. When Ben and Che discovered how successful Amys business had become they both felt that they should not be asked to pay for the work they had commissioned. Ben said he would not pay anything as he had only offered the work to help his sister out. Che said he would not pay anything either, on the basis that he had only given her work to do on the basis of their friendship. Required: Advise Amy as to whether she can insist on Ben and Che paying the full amounts of their initial promises. (10 marks)

Dee and Eff are major shareholders in, and the directors of, the public company, Fan plc. For the year ended 30 April 2009 Fan plcs financial statements showed a loss of 2,000 for the year. For the year ended 30 April 2010 Fan plc made a profit of 3,000 and, due to a revaluation, the value of its land and buildings increased by 5,000. As a consequence, Dee and Eff recommended, and the shareholders approved, the payment of 4,000 in dividends. Required: Advise Dee and Eff as to: (a) the legality of the dividend payment; and (b) any potential legal liability in regard to the dividend payment. (6 marks) (4 marks) (10 marks)

[P.T.O.

10 Geo, Ho and Io formed a partnership three years ago to run a hairdressing business. They each provided capital to establish the business as follows: Geo Ho Io 20,000; 12,000; and 8,000.

The partnership agreement stated that all profits and losses were to be divided in proportion to the capital contribution. After 18 months Geo provided the partnership with a loan of 3,000 in order to finance the purchase of more stock. The loan was to be paid back from the profits of the business. Unfortunately the business was not successful and the partners decided to dissolve the partnership rather than risk running up any more losses. At the time of the dissolution of the partnership its assets were worth 20,000. Its external debts were 7,000 and none of the debt to Geo has ever been paid. Required: Advise the partners as to how the financial aspects of the dissolution will be conducted and how the assets will be distributed. (10 marks)

End of Question Paper

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- Corporate and Business Law: (English)Document4 pagesCorporate and Business Law: (English)Jahangir DogarNo ratings yet

- Corporate and Business Law (Global) : Tuesday 4 December 2007Document4 pagesCorporate and Business Law (Global) : Tuesday 4 December 2007api-19836745No ratings yet

- F4GLO 2013 Jun QDocument4 pagesF4GLO 2013 Jun QLeonard BerishaNo ratings yet

- Corporate and Business Law Exam QuestionsDocument5 pagesCorporate and Business Law Exam QuestionsAdnan NasirNo ratings yet

- f4vnm 2008 Jun QDocument4 pagesf4vnm 2008 Jun Qapi-19836745No ratings yet

- Corporate and Business Law: (English)Document4 pagesCorporate and Business Law: (English)anon-34257No ratings yet

- Corporate and Business Law (Scots) : Tuesday 4 December 2007Document4 pagesCorporate and Business Law (Scots) : Tuesday 4 December 2007api-19836745No ratings yet

- Corporate and Business Law (English) : Tuesday 2 December 2008Document3 pagesCorporate and Business Law (English) : Tuesday 2 December 2008macashNo ratings yet

- Corporate and Business Law (English) : Tuesday 2 June 2009Document4 pagesCorporate and Business Law (English) : Tuesday 2 June 2009asad2007No ratings yet

- Corporate and Business Law: (English)Document4 pagesCorporate and Business Law: (English)black999100% (2)

- f4hgk 2008 Jun QDocument3 pagesf4hgk 2008 Jun Qapi-19836745No ratings yet

- Corporate and Business Law (Singapore) : Monday 9 June 2014Document4 pagesCorporate and Business Law (Singapore) : Monday 9 June 2014Jonathan GillNo ratings yet

- Fundamentals Level - Skills ModuleDocument4 pagesFundamentals Level - Skills ModuleEhtasham JanjuaNo ratings yet

- F4rus 2007 Dec QDocument4 pagesF4rus 2007 Dec Qapi-19836745No ratings yet

- Corporate and Business Law: (English)Document5 pagesCorporate and Business Law: (English)black999100% (2)

- Corporate and Business Law (China) : Tuesday 3 June 2008Document6 pagesCorporate and Business Law (China) : Tuesday 3 June 2008api-19836745No ratings yet

- Corporate and Business Law (Malaysia) : Tuesday 4 December 2007Document4 pagesCorporate and Business Law (Malaysia) : Tuesday 4 December 2007api-19836745No ratings yet

- F4mys 2008 Jun QDocument4 pagesF4mys 2008 Jun Qapi-19836745No ratings yet

- Business Law Exam Questions PDFDocument4 pagesBusiness Law Exam Questions PDFchavoNo ratings yet

- Corporate and Business Law (South Africa) : Monday 9 June 2014Document3 pagesCorporate and Business Law (South Africa) : Monday 9 June 2014VasunNo ratings yet

- F4ENG 2013 Jun QDocument4 pagesF4ENG 2013 Jun QWaqas AnwerNo ratings yet

- 2003 December Corporate & Business LawDocument4 pages2003 December Corporate & Business LawDEAN TENDEKAI CHIKOWONo ratings yet

- Corporate and Business Law (Zimbabwe) : Monday 9 June 2014Document4 pagesCorporate and Business Law (Zimbabwe) : Monday 9 June 2014Phebieon MukwenhaNo ratings yet

- PST CL 2015 2023Document42 pagesPST CL 2015 2023PhilipNo ratings yet

- Corporate and Business Law (Malaysia) Paper 2.2(MYSDocument6 pagesCorporate and Business Law (Malaysia) Paper 2.2(MYSChoo YieNo ratings yet

- f4chn 2007 Dec QDocument5 pagesf4chn 2007 Dec Qapi-19836745No ratings yet

- May 2016 Professional Examination Business & Corporate Law (1.3) Examiner'S Report, Questions and Marking SchemeDocument14 pagesMay 2016 Professional Examination Business & Corporate Law (1.3) Examiner'S Report, Questions and Marking SchemeAARON AYIKUNo ratings yet

- F4bwa 2010 Dec QDocument4 pagesF4bwa 2010 Dec QMuhammad Kashif RanaNo ratings yet

- PST LG 2015 2023Document40 pagesPST LG 2015 2023PhilipNo ratings yet

- Pakistan Institute of Public Finance Accountants: Summer Exam-2016Document27 pagesPakistan Institute of Public Finance Accountants: Summer Exam-2016RALFNo ratings yet

- F4lso 2008 Jun QDocument3 pagesF4lso 2008 Jun Qapi-19836745No ratings yet

- F4zaf 2008 Jun QDocument3 pagesF4zaf 2008 Jun Qapi-19836745No ratings yet

- ACCA F4 Corporate and Business Law Solved Past PapersDocument130 pagesACCA F4 Corporate and Business Law Solved Past Paperslucky334No ratings yet

- EXAMINATION NO. - : MONDAY, 31 MAY 2021 Time Allowed: 3 Hours 2:00 PM - 5:00 PM InstructionsDocument3 pagesEXAMINATION NO. - : MONDAY, 31 MAY 2021 Time Allowed: 3 Hours 2:00 PM - 5:00 PM InstructionsMadalitso MbeweNo ratings yet

- Companies Act Exam: Key Provisions and Case StudiesDocument6 pagesCompanies Act Exam: Key Provisions and Case Studiesblack horseNo ratings yet

- For More Free Revision Papers Visit Kasneb LAW May 23rd 2014 Time Allowed: 3 Hours Question OneDocument2 pagesFor More Free Revision Papers Visit Kasneb LAW May 23rd 2014 Time Allowed: 3 Hours Question OneTimo PaulNo ratings yet

- KASNEB INTRODUCTION TO LAW NOTESDocument2 pagesKASNEB INTRODUCTION TO LAW NOTESTimo PaulNo ratings yet

- F4 GLO Exam GuideDocument4 pagesF4 GLO Exam GuidemercuryrakibNo ratings yet

- PTP PP OS v0.2Document27 pagesPTP PP OS v0.2sanketpavi21No ratings yet

- ACCA Past Exam Questions PaperDocument15 pagesACCA Past Exam Questions PapersayemrbNo ratings yet

- O Level Econs 2 June 2020Document3 pagesO Level Econs 2 June 2020atabongawungnoelNo ratings yet

- Fundamentals Level - Skills ModuleDocument4 pagesFundamentals Level - Skills ModulekhengmaiNo ratings yet

- Question Paper SLMMDocument4 pagesQuestion Paper SLMMAkshra MahajanNo ratings yet

- Acca F4-Mock Dec 2010Document2 pagesAcca F4-Mock Dec 2010Shawn MoralesNo ratings yet

- Corporate and Business Law (Global) : Fundamentals Pilot Paper - Skills ModuleDocument16 pagesCorporate and Business Law (Global) : Fundamentals Pilot Paper - Skills Moduleapi-19836745No ratings yet

- LAW3201 Foundations of Business Law Final ExamDocument3 pagesLAW3201 Foundations of Business Law Final ExamtelieNo ratings yet

- Elements of Business Laws and Management: Part-ADocument6 pagesElements of Business Laws and Management: Part-Ainnocent31No ratings yet

- CA IPCC Old LawDocument7 pagesCA IPCC Old LawFebinNo ratings yet

- Company LawDocument1 pageCompany Lawkassimmakoy05No ratings yet

- 433Document4 pages433kevin12345555No ratings yet

- Secretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperShubham ParmarNo ratings yet

- Secretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperShubham ParmarNo ratings yet

- Board Exam Question Paper on Secretarial Practice from February 2020Document2 pagesBoard Exam Question Paper on Secretarial Practice from February 2020Ashwini NaleNo ratings yet

- Corporate and Business Law: (Malaysia)Document6 pagesCorporate and Business Law: (Malaysia)Mi ZanNo ratings yet

- Amino AttestendiDocument3 pagesAmino AttestendiManoj VariyathNo ratings yet

- Corporate and Business Law: (Zimbabwe)Document6 pagesCorporate and Business Law: (Zimbabwe)DEAN TENDEKAI CHIKOWONo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)