Professional Documents

Culture Documents

52 de Haan-Air Service Development For Cargo Versus Passengers1

Uploaded by

W.J. ZondagOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

52 de Haan-Air Service Development For Cargo Versus Passengers1

Uploaded by

W.J. ZondagCopyright:

Available Formats

AIRPORT DEVELOPMENT

Airports Developing Air Services for Cargo versus Passenger Airlines

Over the years Air Service Development has developed into a valuable tool for airports to keep their fate into their own hands. By actively providing air service analyses to airlines, airports are able to expand their client and route portfolio. Besides actively targeting passenger airlines also cargo airlines are being targeted by airports. At the yearly held World Route Development Forum airlines are approached by airports in attempts to convince airlines of flying to their respective airports. This paper provides an overview of the differences in approaching cargo airlines versus passenger airlines. Besides, for sure, cargo plays a contributing role in the revenue generation of passenger airlines, once a passenger airline has decided to start operating a route. The majority of the information provided is from experience of the author, having done passenger and cargo air service development for airports, amongst others: Amsterdam, New Delhi and Cologne Bonn.

by: Floris de Haan

Markets Within passenger airlines and airports markets are distinguished based on the reason of travel. Depending on whether passengers y for business reasons, vacation or to visit family and friends there is a clear difference in the buying behavior of each passenger group. A tradeoff is made in terms of travel time, price, schedule, airline product, frequent yer programs and more. In particular travel time, or circuitry becomes important when no direct connections are offered. For passenger airlines Quality Service Indices (QSI) calculate what share of trafc an airline can have, bearing in mind the competition that is offering the same connection between two cities, direct and with intermediate stops or transfers. In cargo markets, the approach is slightly different. First of all, cargo typically needs onward transport to either a distribution center or a warehouse. Specically in developed countries, like in North Western Europe, but also in the US and Japan, the road network is very well developed. Freight forwarders and trucking companies offer scheduled services to onward locations as far as 1500 km from an Airport. Still, about 80% of air cargo is delivered at destinations within a 500 km range from an airport, but it proves that many airports in North Western Europe are competing for the same cargo in their catchment area. Today half of the air cargo is being transported by a globally operating freight forwarding company. Usually freight forwarders decide about which airport to use based on cost, schedule and handling rather than being able to reach the nal destination through one hub better than through another hub. Also high circuitry routes are seen often, as long as the Service Level Agreement (SLA) of the shipper is met.

Photo 1: KLM Cargo operated by Martinair Cargo Boeing 747-400ERF at Amsterdam Airport Schiphol. Photo courtesy of KLM Cargo

e-zine issue 52

Photo 2: Air cargo area at Amsterdam Airport Schiphol. Photo by Hubert Croes

Secondly cargo travels only one way, whereas most passengers do return to their origin. Airlines that y from a cargo hub therefore need also return loads for their return ights. Passenger airlines can steer through capacity management in the balance between OD passengers that originate from the spoke city, passengers that originate from the hub and transfer passengers. In cargo, the ow is more straight forward, but at the same time requires more sales effort at the spokes of their network. Through General Sales Agents (GSA) and own sales staff, cargo airlines strive for an optimal outbound and inbound cargo balance. Airports where air cargo is available for the return ight of foreign carriers are thus attractive. This can be achieved by either production in the region of such airport or by a road feeder networks that provides the cargo through extensive trucking. Thirdly it must be mentioned that handling air cargo is more attractive at a hub with more scale, compared to passengers. Specically Low Cost Carriers have shown that ying at places with hardly any trafc can work because demand for such connection can be created. In cargo this mechanism of creating demand wont work. Air cargo will only y if the goods have been produced rst. And then still a tradeoff is made between other modes of transport, also for intercontinental cargo ows. Scale, as well as directionality and catchment area cause air service development for cargo to be a different ball game from passenger air service development

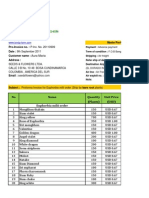

Figure 1: Forwarder Structure

Differences in Cargo and Passenger Airlines Business Model Mainstream passenger airlines do sell the majority of their capacity directly to customers, the passengers. Either through the internet or call centers, there is a direct relationship between customer and supplier. Only charter airlines are an exemption in which the tour operating company books blocks of seats that they can sell to their customers. In that respect charter airlines and cargo airlines look like each other. The direct relationship of mainstream passenger airlines between customer and supplier forces the airlines to have a value proposition that is tempting for numerous consumers in the market segments they want to serve. Passenger airlines lure passengers with a service concept amongst others frequent yer programs and preferred seating opportunities. Cargo is somewhat different. At the very beginning air cargo has been developed as a byproduct of passenger services. Flying empty bellies with suitcases only, was an opportunity for the airlines to earn ancillary revenues. Over the past years cargo has been growing at a higher pace than passenger business and therefore many airlines started operating full freighters after their bellies were lled up. At the same time freight forwarding companies gained bargaining power in the transport chain. Increasingly the larger shippers, such as high tech companies, started doing business with the forwarders instead of the airlines. The big advantage of forwarders is that they serve regions through more than 1 hub and therefore are able to negotiate on price. As long as Service Level Agreements are met, these shippers do not really care about the routing of their shipments. The cargo airlines became the trucking company through the air while the shippers were talking to the forwarders. This inuences Air Service Development heavily, since the forwarders now want a role in where their suppliers of air cargo space are ying to. Differences are evident, but in the situation of cargo being carried in the bellies of passenger airplanes, both go hand in hand as well. Cargo can contribute to passenger revenues and make the coin ip to the right side. Since margins are minimal, a few

Source: Aviation Information Research & Consulting, www.aviainform.org

Figure 2: Commercial parties involved in Transport Chain

percent of additional revenue can turn a route from loss into prot. Like air cargo transport started decades ago, cargo has become an ancillary revenue on a number of mainly intercontinental routes. For low cost carriers the operational complexity of cargo does not t into their business models. Besides, trucking is often cheaper and as fast on the continental routes that low cost carriers serve. Available Market Data Part of convincing airlines in Air Service Development is a data analysis that shows the nancial feasibility of a proposed route. This focuses on the revenue side of the equation, since airports have limited insight in the cost side of airlines they are targeting. Regarding routes for passenger airlines there is ample information available. Sources like Airport IS (IATA) and MIDT provide good insight in the number of passengers that is currently travelling between two airports. If there is no direct connection, these sources tell via which connecting airport passengers are traveling. As described, so called QSI models can then provide a best estimate for a new route. In cargo there is limited data available. Cargo Air Service Development specialists can rely on two sources that both have their limitations. IATA provides data which comes from the Cargo Accounts Settlement System (CASS). This is own cargo also referred to as trafc data. Alternatively there are various sources available that contain trade data from customs organizations or statistic agencies in various countries. In the CASS data only own cargo is presented of those airlines that are IATA members. There is number of full

freighter operators that is not a member of IATA and therefore does not contribute to the data. Besides, goods that travel via other modes of transport are not in the data. Trade data on the other hand is often inconsistent. It contains import data from country A to B that do not match export data from country B to A. Besides in larger economic regions in Europe the port of entry is seen as the country that goods go to. So, for example, if Sony has a Distribution Centre in Luxemburg that will be reected as if every citizen possesses 14 TVs in Luxemburg. A lot of tailored adjustments need to be made in order to make data presentable for Air Service Development purposes. Concluding For Airports, Air Service Development is very different for cargo airlines than it is for passenger airlines. Apart from markets and business models that differ, also the data available for route analyses is limited in cargo. Cargo ies one way, passengers mostly return.Cargo does not complain with high circuitry routes, passengers do. Dynamics are different, but sophisticated cargo Air Service Development is the more challenging. About the Author

Floris de Haan has more than a decade of experience in the aviation industry. His area of expertise is related to Airline Marketing and Revenue Management (both cargo and passengers segments, for airports as well as airlines). Floris de Haan has worked at, amongst others, KLM, where he was responsible for Revenue Management and Planning & Analysis, as well as Schiphol Group, where he was Director Cargo Marketing.

Photo 3: MD-11 Freighter at Cargo Platform. Photo courtesy of Lufthansa Cargo

e-zine issue 52

You might also like

- Aranko JenniDocument87 pagesAranko JenniW.J. ZondagNo ratings yet

- Creating Transparency in Resource Utilization and Flexibility of DHL Express NLDocument226 pagesCreating Transparency in Resource Utilization and Flexibility of DHL Express NLW.J. ZondagNo ratings yet

- 480970Document87 pages480970W.J. Zondag100% (1)

- The Spatial Dimension of Domestic Route Networks of Russian CarriersDocument96 pagesThe Spatial Dimension of Domestic Route Networks of Russian CarriersW.J. ZondagNo ratings yet

- Creating Transparency in Resource Utilization and Flexibility of DHL Express NLDocument226 pagesCreating Transparency in Resource Utilization and Flexibility of DHL Express NLW.J. ZondagNo ratings yet

- Sustainable Infrastructure Development - A Socio-Economic Impact Analysis of Airport Development in Vietnam PDFDocument188 pagesSustainable Infrastructure Development - A Socio-Economic Impact Analysis of Airport Development in Vietnam PDFW.J. ZondagNo ratings yet

- 48 Galvin Orly SchipholDocument5 pages48 Galvin Orly SchipholW.J. ZondagNo ratings yet

- 49 Bookreview Gaurav Agarwal-Cheng-Lung Wu Airline Operations and Delay ManagementDocument2 pages49 Bookreview Gaurav Agarwal-Cheng-Lung Wu Airline Operations and Delay ManagementW.J. ZondagNo ratings yet

- 48 MeulmanDocument4 pages48 MeulmanW.J. ZondagNo ratings yet

- 48 Bookreview Vondensteinen Abeyratne AeropoliticsDocument2 pages48 Bookreview Vondensteinen Abeyratne AeropoliticsW.J. ZondagNo ratings yet

- 49 Bellmann Knorr Schomaker-Delay Cost Overrun Aircraft ProgramsDocument4 pages49 Bellmann Knorr Schomaker-Delay Cost Overrun Aircraft ProgramsW.J. ZondagNo ratings yet

- 48 Ralf Vogler Principal-Agent ProblemDocument4 pages48 Ralf Vogler Principal-Agent ProblemW.J. ZondagNo ratings yet

- 48 Bubalo Airport Productivity Benchmark FinalDocument6 pages48 Bubalo Airport Productivity Benchmark FinalW.J. ZondagNo ratings yet

- 48 Laplace FAST-Future Airport StrategiesDocument5 pages48 Laplace FAST-Future Airport StrategiesW.J. ZondagNo ratings yet

- 50 Bookreview Flying in The Face Of-Criminalization SchnitkerDocument2 pages50 Bookreview Flying in The Face Of-Criminalization SchnitkerW.J. ZondagNo ratings yet

- 49 Jimrnez Hrs Air SpainDocument4 pages49 Jimrnez Hrs Air SpainW.J. ZondagNo ratings yet

- 49 Terpstra HST Ams BruDocument5 pages49 Terpstra HST Ams BruW.J. ZondagNo ratings yet

- 51 Fortes Oliveira Catering ServicesDocument4 pages51 Fortes Oliveira Catering ServicesJoao Luiz FortesNo ratings yet

- 49 Hvass Social MediaDocument4 pages49 Hvass Social MediaW.J. ZondagNo ratings yet

- 49 Heinitz Meincke-Systematizing Routing Options Air CargoDocument5 pages49 Heinitz Meincke-Systematizing Routing Options Air CargoW.J. ZondagNo ratings yet

- 51 BookReview VanWijk Aerotropolis Kasarda-LindsayDocument2 pages51 BookReview VanWijk Aerotropolis Kasarda-LindsayW.J. ZondagNo ratings yet

- 51 Ronzani - Correia World Cup 2014Document4 pages51 Ronzani - Correia World Cup 2014W.J. ZondagNo ratings yet

- 49 Bookreview Heerkensbeaverstockderudderfaulconbridgewitlox-International Business Travel in The Global EconomyDocument2 pages49 Bookreview Heerkensbeaverstockderudderfaulconbridgewitlox-International Business Travel in The Global EconomyW.J. ZondagNo ratings yet

- 50 Bookreview Foundations of Airline Finance VdzwanDocument2 pages50 Bookreview Foundations of Airline Finance VdzwanW.J. ZondagNo ratings yet

- 51 Santos Ppgis GruDocument4 pages51 Santos Ppgis GruW.J. ZondagNo ratings yet

- 51 Muller Evaluation PRM SOIA GRUDocument5 pages51 Muller Evaluation PRM SOIA GRUW.J. ZondagNo ratings yet

- 54 Rafael Bernardo Carmona Benitez-Design of Large Scale Airline NetworkDocument3 pages54 Rafael Bernardo Carmona Benitez-Design of Large Scale Airline NetworkW.J. ZondagNo ratings yet

- 51 BookReview Venema StormySkies PaulClark WithPrefaceDocument2 pages51 BookReview Venema StormySkies PaulClark WithPrefaceW.J. Zondag100% (1)

- 53 Schlaack BERDocument5 pages53 Schlaack BERW.J. ZondagNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bahco Hydraulics EnglishDocument9 pagesBahco Hydraulics Englishsmk729No ratings yet

- International Airport Codes, IATA 3-Letter Code For AirportsDocument54 pagesInternational Airport Codes, IATA 3-Letter Code For AirportsOleg TysiachnyiNo ratings yet

- 01 Introduction To Air TransportDocument14 pages01 Introduction To Air TransportjohnNo ratings yet

- 01 - Icao - Dgca Regulation-1Document143 pages01 - Icao - Dgca Regulation-1jepriendoNo ratings yet

- Interglobe AviationDocument2 pagesInterglobe AviationPraveen KeskarNo ratings yet

- Air Transportation History PDFDocument25 pagesAir Transportation History PDFERICK SERRANONo ratings yet

- MyTraffic InteractiveDocument6 pagesMyTraffic InteractivejazzmanPLNo ratings yet

- Dokumen BoardingDocument1 pageDokumen BoardingYuli SetiawanNo ratings yet

- UK Cargo Aircraft Safety BrochureDocument3 pagesUK Cargo Aircraft Safety BrochureJonatan BernalNo ratings yet

- Boarding PassDocument1 pageBoarding PassSzczepan KlimczakNo ratings yet

- History of Flight DevelopmentDocument10 pagesHistory of Flight DevelopmentreganNo ratings yet

- Study Id59921 Australian-Aviation-IndustryDocument39 pagesStudy Id59921 Australian-Aviation-IndustryShamim AlamNo ratings yet

- Aerodrome Operational Planning (Aop) : Regional Air Navigation Meeting (Doc 9614, ASIA/PAC/3Document11 pagesAerodrome Operational Planning (Aop) : Regional Air Navigation Meeting (Doc 9614, ASIA/PAC/3Le ThangNo ratings yet

- Global Air Navigation Plan - ICAO 9750 5th EditionDocument142 pagesGlobal Air Navigation Plan - ICAO 9750 5th EditionFederico RolandiNo ratings yet

- CAB Revised Fees and Charges (Dec 2013)Document4 pagesCAB Revised Fees and Charges (Dec 2013)PortCallsNo ratings yet

- 1abut Ethiopia Air LinesDocument3 pages1abut Ethiopia Air LinesTamirat sebaNo ratings yet

- AB206 Parking and Mooring InstructionsDocument3 pagesAB206 Parking and Mooring InstructionsMarjan IvanovskiNo ratings yet

- Instructions For Continued Airworthiness: OrderDocument65 pagesInstructions For Continued Airworthiness: OrdermimecamoNo ratings yet

- Argumentive Essay ExamplesDocument6 pagesArgumentive Essay Examplesafibyoeleadrti100% (2)

- Triptpal Singh Del LHR Yyc Yvr 6sep23Document2 pagesTriptpal Singh Del LHR Yyc Yvr 6sep23Kishan GuptaNo ratings yet

- 2 AmsDocument203 pages2 Amsnimsv1980No ratings yet

- Jet Airways vs Kingfisher Airlines: An Analysis of India's Major AirlinesDocument37 pagesJet Airways vs Kingfisher Airlines: An Analysis of India's Major Airlinespersi06No ratings yet

- Paris LfpoDocument100 pagesParis LfpoJose Javier LarragaNo ratings yet

- Imp 2 OmDocument53 pagesImp 2 OmharshaNo ratings yet

- FOTB 737 21-03 Erroneous Use of Rudder Trim ControlDocument4 pagesFOTB 737 21-03 Erroneous Use of Rudder Trim ControlecjlambertNo ratings yet

- Alaska Airline ReservationDocument3 pagesAlaska Airline ReservationfarecopyNo ratings yet

- Baggage Handling System Study Appendix GDocument30 pagesBaggage Handling System Study Appendix GJohn Perez CaballeroNo ratings yet

- Learning To Fly With Flight SimulatorDocument130 pagesLearning To Fly With Flight Simulatorkyoobum100% (4)

- Antonov An-225 - Google SearchDocument1 pageAntonov An-225 - Google Searchlaksh agarwalNo ratings yet

- Proforma Invoice (No.20110909)Document6 pagesProforma Invoice (No.20110909)Angie Tatiana MendezNo ratings yet