Professional Documents

Culture Documents

05pa WS 2 2 PDF

Uploaded by

Marcelo Varejão CasarinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05pa WS 2 2 PDF

Uploaded by

Marcelo Varejão CasarinCopyright:

Available Formats

Petrochemical Steam Crackers as Refinery Upgrading Units

Dr. J.F. von Velsen, Shell & DEA Oil GmbH, Cologne, Germany Rik H. Gierman, Shell Global Solutions International, The Hague, The Netherlands Dr. W.J.A.H. Schoeber, Shell & DEA Oil GmbH, Cologne, Germany Jerry C.L. Wood, Shell International Chemicals, London, United Kingdom

Abstract

Steam Crackers use a wide range of petroleum feedstocks spanning from gases to hydrocracked distillates boiling well beyond 400 C. The exploitation of the interface of crackers with oil refineries has therefore a long tradition. In the recent past in Europe the interest in this oil/chemical interface has been revitalised for a number of reasons: in the competitive environment cracker profitability crucially depends on the availability of economic feedstocks, with the decline in heating oil demand and the future automotive fuels specifications product valuations are bound to drastically change, and the value of pygas is expected to reduce due to future aromatics and sulphur specifications of motor gasoline. With cracker feedstocks coming from the refinery and the cracker co-products returning, the future additional constraints will require an evermore sophisticated optimisation to eventually also include short term price variations. In Germany in the Cologne/Wesseling area with its neighbouring 2 complex refineries, 4 ethylene crackers and the petrochemical derivative manufacturing facilities, the integrated optimization of the steamcrackers and the refinery processes would deliver considerable benefits. In such a configuration further profit could be expected from the cracking of feedstocks not normally commercially available, and from an integrated utilisation of refinery and cracker unit constraints.

Introduction

The oil industry, as well as the petrochemical industry have been under an enormous competitive pressure for several years. The large number of mergers with their objective to reap synergies via the economy of scale are one indication of this. Controllable costs (salaries, materials) only represent about 12% of the total, but nevertheless they have been vigourously forced down. Raw materials and energy costs add another 82% leading to a revival of energy saving programmes, and to a major effort to flexibly select the most advantageous feedstock for the processing units. On the margin side trends can be identified to innovatively adjust and modify the existing units in order to bring them into line with forecasted market demands showing growth in ethylene and propylene consumption but overall a decline in refined products, especially for motor gasoline and heating oil, with only a slight increase in automotive gasoil consumption. Furthermore, due to the auto/oil legislation, the opportunities and constraints for all market participants have been shifted and companies strive to achieve the required legislative product specifications at the lowest costs, and allowing to flexibly adjust to volatile market prices and spot feedstock offerings. This paper describes the approach to accommodate these changes in the refining/petrochemical complex in Cologne in Germany.

Past integration of oil and petrochemicals

In the petrochemical and refining industry three relatively independent business activities could be distinguished: oil refining, steam cracking and aromatics production, essentially BTX. Each of these activities had its relatively well defined economic boundaries and they were all separated from each other by liquid markets. Synergies between the three businesses were clearly lower than the internal driving forces of each activity.

Oil refining was usually valued against Rotterdam or Med spot prices. The crude oil was mainly selected on its value for the bulk petroleum products, and the products were, even in integrated sites, only modestly influenced by the BTX or the steam cracker feed requirements. Ethylene crackers (ECU) tended to be run on naphtha complemented by LPG particularly in summer when the mogas vapour pressure specifications kept it from being blended into the road transport fuel. Very occasionally single stage hydrocrackers delivered hydrowax to ECUs replacing naphtha. Such hydrowaxes have been made out of vacuum distillates at pressures between 100 and 300 bars. The incentive to deliver such steam cracker feedstock instead of naphtha came for the refineries from the upgrading of the vaccum distillates, i.e. heavy fuel oil value, to a value quite close to naphtha. For the ECUs processing such feed required sufficient furnace capacity. In consequence, in times of relatively unconstrained sales of cat cracker products such investment was not very frequently found. The steam cracker margin on the hydrocarbon side was mainly determined by competitive naphtha supply corrected for quality differences. Product sales were against quarterly contract prices. BTX production was typically based on pygas, and with the naphtha being the typical steamcracker feedstock in Europe some 20% of it became available as byproduct. This pygas was after hydrogenation either blended into mogas or the aromatics were isolated and sold separately. Years ago pygas was valued as naphtha, later its value was based on its benzene content, with the remainder valued as either naphtha or its value as a mogas component derived from a few key properties such as density or octane number. In Cologne in Germany the former Shell Godorf refinery and the neighbouring petrochemical complex currently owned by Basell were run under the above business model for the last 30 years. Initially the refinery mainly delivered naphtha and in turn received the pygas for further processing. But with time the links were further refined by adding a xylene unit, and later a single stage hydrocracker on the refinery side complemented by furnace modifications on the steam cracker. The diagramm depicts the streams exchanged in 2001 between the 3 processing complexes.

Oil-Chemical Interface Godorf-BASELL-Aromatics

Hydrogen Fuel Gas Butane/Propane Chemfeed (Naphtha) Gasoil Hydrowaxy

BASELL

Godorf refinery

Pygas Mogas Components Hydrogen Reformate Heartcut

Aromatics

The margin optimization of the three processing blocks was initally independent because of the separate bottom lines but also because of the difficulty to manage the integrated complexity across company boundaries. With time tools and techniques were developed further and the advantages of an integrated planning view became more evident. Currently state-of-the-art is to optimize the sites in an integrated way but to later allocate the business results to the separate bottom lines via a system of transfer prices. The development of Godorf into a refinery with a strong chemical leg has proven to be valuable. The refining business delivered over the last 8 years on average a return on investment of well beyond 20%.

Auto/oil scenario

In Europe legislators have developed product quality specifications for motor gasolines and automotive gasoil touching right at the heart of the relatively unconstrained exchange of products between the 3 processing complexes.

Main Auto-Oil Specs 2005

for Germany

Reg Sulphur ppm Benzene vol% Aromatics vol% Olefins vol% MON RON CN 10 1 35 18 82.5 91.0 Prem 10 1 35 18 85.0 95.0 Prem+ 10 1 35 18 88.0 99.0 Diesel 10

51.0

For a hydrocracker refinery with attached ECU the new specs for motor gasoline for sulphur, for benzene, for aromatics, for vapour pressure and for ON are becoming so stringent that all of them will be constraining in each individual blend. In case of the automotive gasoil sulphur, boiling range and CN have been sharpened up with sulphur being the most difficult to comply with. The future specifications with e.g. sulphur levels of 10 ppm are very difficult to achieve not only from a blending point of view but also in an absolute sense hardly allowing to correct deviations later on. These problems will obviously be common to the entire industry in one way or the other depending on the individual configuration. In Cologne typically the below interactions will occur: sulphur brought into the ECU via the feedstock is returned to the motor gasoline via the pygas route,

heavier feedstocks produce more pygas and thus more aromatics to be absorbed in the gasoline pool, Increased desulphurization requires more hydrogen which could result in a higher reformer load and hence an increased benzene or other aromatics production, removal of aromatics from the gasoline pool reduces its octane numbers which have to be replenished by other components, highly paraffinic gasoil components compete between the diesel pool and suitability as steam cracker feed. the shrinking heating oil demand either leads to crude run cuts or requires further measures to permit routing into other outlets, e.g. desulphurisation, hydrocracking, steam cracking, etc. Most of the new constraints will change the way of pricing the various streams. Pygas has to be valued not only according to its benzene content but also according to its sulphur content and the amount of higher aromatics. Platformate will attract a work-up premium for benzene removal. Naphtha and alternative steam cracker feeds will attract quality premia different from todays figures.

Business opportunities

Severe constraints require new measures but also offer new opportunities. With the approval of the cartel authorities the integration of the former Shell refinery and the DEA site is proceeding adding an additional dimension to the well proven Basell partnership. In close neighbourhood today the following process units are being operated:

GODORF Block Scheme

MTBE iC5/iC6

MBC/ Hysomer PLT Tops HTUs SPL

Mogas

+Components

nC6->Chemfeed

PFUs

Feedprep

C7,C8,C9 C6-C7 Aromatics

Chemfeed

(BASELL)

Benzene Toluene

Crude

CDUs HDSs

Import Platformate Import Pygas

AVTUR Gasoil

HVUs HCU

Hydrowax/

(BASELL)

To HDS

Import Waxy

TGUs

Power

Claus/SCOT

Sulphur HFO Bitumen

As outlined above the Godorf complex is closely integrated with the two Basell steamcrackers

Wesseling Block Scheme

Alkylate

Gasoline Desulf.

Mogas

+Components

Feedprep& Xylene

HTU

PFU

Aromatics

O-Xylene p-Xylene Benzene Toluene

Crude

CDU

Chemfeed HDSs

AVTUR Gasoil

HVU HCU

Steam Crackers

Ethylene Propylene

Polygasoline

Bulk to HDS

MTBE Power

VB

Claus/SCOT

Sulphur HFO

Natural Gas

Hydrogen Manufacture Gasifiers

Methanol Synthesis

Methanol DME CO2

DME Unit CO2 Unit

Looking at the various processes it is striking that for many critical product properties there are more than one option open to choose the economically attractive answer. Starting with the crude supply. Here a wide range of crudes from low sulphur to very high sulphur can be processed due to ample hydrotreating capacity, several options to thermally crack vacuum residue, to burn highly viscous residue in the power station, to produce bitumen and to gasify the residues. An integrated element of the crude valuation will be the optimal feedstock selection for the steam crackers. As potential feed to the 4 ECUs (2 in Basell and 2 in Wesseling) a variety of feedstocks is available potentially further complemented by imports of LPG or naphtha. The self produced feedstocks span the entire boiling range of the crude oil: refinery gases, preferably the stabilizer overheads being particularly rich in C2, but potentially also the refinery fuel gas though being clearly less attractive due to its higher methane content; propane and butane internally offering the advantage not having to meet the full set of specifications all the time; alternatively butane is obviously routed to mogas. Butene from the ECUs can be dimerized in a polygasoline unit. C5 to C7: here exists a super fractionation unit allowing to separate the isos from the normals, including a C5 isomerisation unit. The normals are an excellent cracker feed, the isos are a high octane low density mogas component. Paraffinic naphtha is routed to the ECU, the napthenic is preferably processed in the reformers. The reformate is then distilled in order to produce a benzene and toluene rich stream for the Sulfolane extraction unit, and the C8 aromatics are being fed to the xylene complex. The separation of BTX removes a large part of the aromatics from the mogas pool thus helping to achieve the severe mogas aromatics specifications. With 2 single stage hydrocrackers being available not only several fractions of different boiling ranges of steam cracker feed can be sent to the ECU but also excellent automotive gasoil components can be produced or fractions particularly suitable for the luboil production. Complementing the hydrocracked material also straight run gasoil fractions can be steamcracked, obviously depending on the economical situation.

It was earlier mentioned that the pygas return streams reflect the kind of feed which was sent to the ECU in the first place. In the Cologne complex several options have been made available to decouple the units: there is sufficient hydrotreating capacity available to not only treat the streams coming from the own steam crackers but also to flexibly process import streams of varying quality. The large combined motor gasoline pool can absorb the aromatics remaining after the recovery of the BTX, and the octane requirements are being met via the earlier mentioned superfractionation, the isomerisation, the dimerisation and a MTBE unit. The resulting gasoline fully meets the auto/oil spec. Another important aspect of the integration is the supply/demand balance of hydrogen: usually refineries get their hydrogen from reformers, in Cologne obviously also from the steam crackers and the HMU but in addition to that from the gasification, which had been built initially to upgrade thermally cracked residue to methanol. The hydrogen is the welcome byproduct.

Planning and scheduling

The Cologne complex offers a large number of alternative processing routes and many options to utilize plant capacities such that several constraints are reached simultaneously. The resulting benefits are certainly very attractive to pursue but in practice unfortunately very difficult to achieve. The problems start with good process models correctly describing the large number of processes in dependence of the variety of different feedstocks. Then the models have to be seamlessly interfaced or preferably be fully integrated, as practice has proven that independent models cannot produce optimal solutions. The benefits of integrated planning and scheduling models are difficult to establish and can only be estimated defining specific cases and comparing alternative decisions that would have been taken. Together with a judgement of the frequency of occurence benefits of several million dollars per annum have been guestimated for the Cologne facilities. Another benefit of integrated planning and scheduling results from the improved personnel efficiency. Good models permit to seamlessly communicate even in difficult operational situations.

Outlook

Upon the approval of the merger a HMR (Hydrocarbon Management Review) has been started. This is a structured Shell process systematically reviewing processes, products and logistics of a site in order to find opportunities for GRM improvements. In an initial pass being executed single-sided prior to the approval, well beyond $40 mln have been identified. The benefits were found in the following areas: integrated crude and feedstock choice, aromatics feedstocks and unit optimisation, integrated motor gasoline and middle distillate pool optimisation, steamcracker feedstock selection. In case of the steam crackers the benefits resulted to a large extent from loading the unit with a combination of feedstocks across the entire boiling range from refinery gas to heavy hydrocracked material. The initial study is currently being reviewed by joint teams with the objective to identify further benefits and to translate them into concrete implementation plans.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- D31Document8 pagesD31NoLo Paramarto100% (2)

- IBP1142 - 19 Offshore Development: Submarine Pipelines-Soil InteractionDocument13 pagesIBP1142 - 19 Offshore Development: Submarine Pipelines-Soil InteractionMarcelo Varejão CasarinNo ratings yet

- IBP1146 - 19 Maintenance Productivity Measurement Study at TranspetroDocument8 pagesIBP1146 - 19 Maintenance Productivity Measurement Study at TranspetroMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1138 Rio Paper Rev01 PDFDocument11 pagesRiopipeline2019 1138 Rio Paper Rev01 PDFMarcelo Varejão CasarinNo ratings yet

- IBP1141 - 19 The Use of Optical Sensor To Investigate Dissolved Oxygen in CrudeDocument12 pagesIBP1141 - 19 The Use of Optical Sensor To Investigate Dissolved Oxygen in CrudeMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1137 201906031307ibp1137 19 Increas PDFDocument10 pagesRiopipeline2019 1137 201906031307ibp1137 19 Increas PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1140 Ibp 1140 Nao Intrusivos Final PDFDocument4 pagesRiopipeline2019 1140 Ibp 1140 Nao Intrusivos Final PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFDocument9 pagesRiopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1115 201906070716fm 3811 00 Formato PDFDocument13 pagesRiopipeline2019 1115 201906070716fm 3811 00 Formato PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1136 Ibp1136 19 Rafael Carlucci Tav PDFDocument7 pagesRiopipeline2019 1136 Ibp1136 19 Rafael Carlucci Tav PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1127 Article Number Ibp1127 19 PDFDocument10 pagesRiopipeline2019 1127 Article Number Ibp1127 19 PDFMarcelo Varejão CasarinNo ratings yet

- IBP1128 - 19 In-Service Welding Hot Tap of Refinary Pipeline With Hydrogen and EthyleneDocument10 pagesIBP1128 - 19 In-Service Welding Hot Tap of Refinary Pipeline With Hydrogen and EthyleneMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1135 Riopipeline2019 t1135 JST Av1Document8 pagesRiopipeline2019 1135 Riopipeline2019 t1135 JST Av1Marcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1124 Worlds First Remote Deepwater PDFDocument10 pagesRiopipeline2019 1124 Worlds First Remote Deepwater PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1126 Article Number Ibp1126 19 PDFDocument11 pagesRiopipeline2019 1126 Article Number Ibp1126 19 PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1121 201906051235ibp1121 19 Final PDFDocument8 pagesRiopipeline2019 1121 201906051235ibp1121 19 Final PDFMarcelo Varejão CasarinNo ratings yet

- IBP1123 - 19 Caliper Ili Experience in Offshore Pre-CommissioningDocument10 pagesIBP1123 - 19 Caliper Ili Experience in Offshore Pre-CommissioningMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1117 Ibp1117 19 Versao Final para e PDFDocument8 pagesRiopipeline2019 1117 Ibp1117 19 Versao Final para e PDFMarcelo Varejão CasarinNo ratings yet

- IBP1122 - 19 High Grade Sawl Linepipe Manufacturing and Field Weld Simulation For Harsh EnvironmentsDocument11 pagesIBP1122 - 19 High Grade Sawl Linepipe Manufacturing and Field Weld Simulation For Harsh EnvironmentsMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1113 201906031824ibp Riopipeline 11 PDFDocument10 pagesRiopipeline2019 1113 201906031824ibp Riopipeline 11 PDFMarcelo Varejão CasarinNo ratings yet

- IBP 1118 - 19 Relationship With Stakeholders of Transpetro in The Amazon: Fire Prevention PlanDocument9 pagesIBP 1118 - 19 Relationship With Stakeholders of Transpetro in The Amazon: Fire Prevention PlanMarcelo Varejão CasarinNo ratings yet

- IBP1119 - 19 Internal Corrosion Detection: Conference and Exhibition 2019Document4 pagesIBP1119 - 19 Internal Corrosion Detection: Conference and Exhibition 2019Marcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1114 201905291733ibp1114 19 Optimiz PDFDocument17 pagesRiopipeline2019 1114 201905291733ibp1114 19 Optimiz PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1107 201905201751ibp1107 19 Jacques PDFDocument7 pagesRiopipeline2019 1107 201905201751ibp1107 19 Jacques PDFMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1106 Ibp 1106 Ultimate High Precisi PDFDocument9 pagesRiopipeline2019 1106 Ibp 1106 Ultimate High Precisi PDFMarcelo Varejão CasarinNo ratings yet

- IBP1110 - 19 The Relevance of Fuel Transmission Pipelines in BrazilDocument10 pagesIBP1110 - 19 The Relevance of Fuel Transmission Pipelines in BrazilMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1112 FM 1112 FinalDocument10 pagesRiopipeline2019 1112 FM 1112 FinalMarcelo Varejão CasarinNo ratings yet

- IBP1111 - 19 Best Alternative For Rigid Offshore Pipelines Decommissioning - A Case StudyDocument13 pagesIBP1111 - 19 Best Alternative For Rigid Offshore Pipelines Decommissioning - A Case StudyMarcelo Varejão CasarinNo ratings yet

- Riopipeline2019 1109 201906051455qav Ibp1109 19 Jet PDFDocument11 pagesRiopipeline2019 1109 201906051455qav Ibp1109 19 Jet PDFMarcelo Varejão CasarinNo ratings yet

- IBP 1105 - 19 Logistics For Maintenance of The Right-Of-Way (Row) in The Northern RegionDocument10 pagesIBP 1105 - 19 Logistics For Maintenance of The Right-Of-Way (Row) in The Northern RegionMarcelo Varejão CasarinNo ratings yet

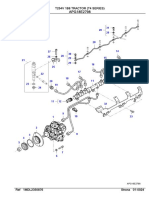

- APG18E2798: T254V 1B8 Tractor (T4 Series)Document2 pagesAPG18E2798: T254V 1B8 Tractor (T4 Series)Patrick LandinNo ratings yet

- Sunny Island Off GridDocument32 pagesSunny Island Off Gridmat_pranNo ratings yet

- Anp Oil, Natural Gas and Biofuels Statistical Yearbook 2013Document65 pagesAnp Oil, Natural Gas and Biofuels Statistical Yearbook 2013Hayden VanNo ratings yet

- Raim Air, Ram Jet e Scram Jet Engines 1Document7 pagesRaim Air, Ram Jet e Scram Jet Engines 1Edilson SimiãoNo ratings yet

- 9fa CompressorDocument59 pages9fa CompressorAnonymous ieWpd823LgNo ratings yet

- Pfister DRW WearindextoolDocument4 pagesPfister DRW Wearindextoolhanz aeNo ratings yet

- Unit3icengine 170610094840Document45 pagesUnit3icengine 170610094840Harish 18No ratings yet

- Boiler Feed Pump RevDocument36 pagesBoiler Feed Pump Revamit chahal100% (1)

- Owner'S Manual: Generator / Welder NGW-190HDocument15 pagesOwner'S Manual: Generator / Welder NGW-190HBeto Pf MadridNo ratings yet

- 1.HM Lambda Engine CompletedDocument10 pages1.HM Lambda Engine CompletedAlex GarciaNo ratings yet

- Mechanical Engineering Interview Questions With AnswersDocument2 pagesMechanical Engineering Interview Questions With AnswersSenthamizhselvan RamakrishnanNo ratings yet

- Plogarithm Edited Report 1 NowDocument44 pagesPlogarithm Edited Report 1 NowSrinivasa bnNo ratings yet

- Fuel System Mui Eui HeuiDocument49 pagesFuel System Mui Eui Heuieng83% (6)

- Headquarters, Department of The Army August 2005Document764 pagesHeadquarters, Department of The Army August 2005Thoukididis ThoukididouNo ratings yet

- Free Alkaline Index Biomass CombustionDocument6 pagesFree Alkaline Index Biomass CombustionmsoyoralNo ratings yet

- Question 2: DEP-A & DEP-B Loads: Electrical SystemDocument15 pagesQuestion 2: DEP-A & DEP-B Loads: Electrical SystemJorge LuisNo ratings yet

- Grua Groove RT600Document12 pagesGrua Groove RT600Jose CastilloNo ratings yet

- SolarTurbine O&G OverviewDocument12 pagesSolarTurbine O&G Overviewkecskemet100% (1)

- In The Heart of Bavaria: The New TCA Turbochargers: Press ReleaseDocument4 pagesIn The Heart of Bavaria: The New TCA Turbochargers: Press ReleaseKaushalKishoreNo ratings yet

- Fluid Catalytic Cracking - WikipediaDocument53 pagesFluid Catalytic Cracking - WikipediaManojkumarNo ratings yet

- Komatsu Engine Lta 10c Workshop Manuals 3Document6 pagesKomatsu Engine Lta 10c Workshop Manuals 3howard100% (22)

- Underbalanced DrillingDocument27 pagesUnderbalanced DrillingrahmatNo ratings yet

- Bunker SampleDocument4 pagesBunker Sampledassi99No ratings yet

- Energy Crisis of Pakistan PresentationDocument37 pagesEnergy Crisis of Pakistan PresentationValentine Fernandes100% (2)

- Estimated Data 2016Document115 pagesEstimated Data 2016devNo ratings yet

- A Broad Look at The Workings Types and Applications of Fuel CellsDocument6 pagesA Broad Look at The Workings Types and Applications of Fuel CellsHani M. El-TouniNo ratings yet

- Fuel Injectors PDFDocument11 pagesFuel Injectors PDFanshelNo ratings yet

- Abelmarle Referencia KF-868 PDFDocument24 pagesAbelmarle Referencia KF-868 PDFEdgar Hector GarciaNo ratings yet

- Mechanical Power Transmissions Worldwide: WWW - Kumera.noDocument8 pagesMechanical Power Transmissions Worldwide: WWW - Kumera.noLelosPinelos123No ratings yet