Professional Documents

Culture Documents

Croton On Hudson, 10520, Market Update 4th Quarter 2012

Uploaded by

Suzanne WelchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Croton On Hudson, 10520, Market Update 4th Quarter 2012

Uploaded by

Suzanne WelchCopyright:

Available Formats

MARKET ACTION REPORT

Suzanne Welch

December 2012

Associate Broker-Sales Specialist 914-557-3760 suzanne4homes@gmail.com suzannewelch.com

Trending Versus*: Trending Versus*:

Zip Code: ALL

Price Range: | Properties: Single Family Home, Condo

Market Profile & Trends Overview

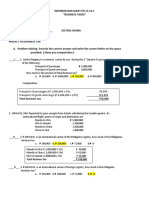

Median List Price of all Current Listings Average List Price of all Current Listings December Median Sales Price December Average Sales Price Total Properties Currently for Sale (Inventory) December Number of Properties Sold December Average Days on Market (Solds) Asking Price per Square Foot (based on New Listings) December Sold Price per Square Foot December Month's Supply of Inventory December Sale Price vs List Price Ratio

Month

$435,000 $776,554 $425,000 $633,649 5,204 653 172 $254 $243 8.0 94.7%

LM

L3M PYM

LY

YTD

PriorYTD

PriorYear

$429,950 $614,021 7,524 167 $274 $250 13.9 94.4%

* LM=Last Month / L3M=Last 3 Months / PYM=Same Month Prior Year / LY=Last Year / YTD = Year-to-date

Property Sales

December Property sales were 653, up 21.4% from 538 in December of 2011 and 9.9% higher than the 594 sales last month. December 2012 sales were at their highest level compared to December of 2011 and 2010. December YTD sales of 7,524 are running 14.8% ahead of last year's year-to-date sales of 6,554.

Prices

The Median Sales Price in December was $425,000, up 7.9% from $394,000 in December of 2011 and up 13.3% from $375,000 last month. The Average Sales Price in December was $633,649, up 18.5% from $534,855 in December of 2011 and up 20.0% from $528,002 last month. December 2012 ASP was at highest level compared to December of 2011 and 2010.

Based on information from Empire Access Multiple Listing Service, Inc. for the period 1/1/2010 through 12/31/2012. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Residential Brokerage does not guarantee the data accuracy. Data maintained by the MLS's may not reflect all real estate activity in the market.

MARKET ACTION REPORT

Suzanne Welch

December 2012

Associate Broker-Sales Specialist 914-557-3760 suzanne4homes@gmail.com suzannewelch.com

Zip Code: ALL

Price Range: | Properties: Single Family Home, Condo

Inventory & MSI

The Total Inventory of Properties available for sale as of December was 5,204, down -22.4% from 6,705 last month and down -27.9% from 7,219 in December of last year. December 2012 Inventory was at the lowest level compared to December of 2011 and 2010. A comparatively lower MSI is more beneficial for sellers while a higher MSI is better for buyers. The December 2012 MSI of 8.0 months was at its lowest level compared with December of 2011 and 2010.

Market Time

The average Days On Market(DOM) shows how many days the average Property is on the Market before it sells. An upward trend in DOM tends to indicate a move towards more of a Buyer's market, a downward trend a move towards more of a Seller's market. The DOM for December was 172, down -1.1% from 174 days last month and down -1.1% from 174 days in December of last year. The December 2012 DOM was at a mid range compared with December of 2011 and 2010.

Selling Price per Square Foot

The Selling Price per Square Foot is a great indicator for the direction of Property values. Since Median Sales Price and Average Sales price can be impacted by the 'mix' of high or low end Properties in the market, the selling price per square foot is a more normalized indicator on the direction of Property values. The December 2012 Selling Price per Square Foot of $243 was up 4.3% from $233 last month and up 4.3% from $233 in December of last year.

Based on information from Empire Access Multiple Listing Service, Inc. for the period 1/1/2010 through 12/31/2012. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Residential Brokerage does not guarantee the data accuracy. Data maintained by the MLS's may not reflect all real estate activity in the market.

MARKET ACTION REPORT

Suzanne Welch

December 2012

Associate Broker-Sales Specialist 914-557-3760 suzanne4homes@gmail.com suzannewelch.com

Zip Code: ALL

Price Range: | Properties: Single Family Home, Condo

Selling Price vs Listing Price

The Selling Price vs Listing Price reveals the average amount that Sellers are agreeing to come down from their list price. The lower the ratio is below 100% the more of a Buyer's market exists, a ratio at or above 100% indicates more of a Seller's market. The December 2012 Selling Price vs List Price of 94.7% was up from 94.4% last month and up from 93.6% in December of last year.

Inventory / New Listings / Sales

'This last view of the market combines monthly inventory of Properties for sale along with New Listings and Sales. The graph shows the basic annual seasonality of the market as well as the relationship between these items. The number of New Listings in December 2012 was 471, down -35.9% from 735 last month and down -22.1% from 605 in December of last year.

Based on information from Empire Access Multiple Listing Service, Inc. for the period 1/1/2010 through 12/31/2012. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Residential Brokerage does not guarantee the data accuracy. Data maintained by the MLS's may not reflect all real estate activity in the market.

MARKET ACTION REPORT

Suzanne Welch

December 2012

Associate Broker-Sales Specialist 914-557-3760 suzanne4homes@gmail.com suzannewelch.com

Zip Code: ALL

Price Range: | Properties: Single Family Home, Condo

Homes Sold 3 Mo. Roll Avg

(000's)

J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D 441 376 477 496 536 1,082 665 665 571 471 450 540 431 388 474 422 530 690 688 788 624 523 458 538 401 419 496 475 626 803 881 909 632 635 594 653 431 450 503 705 761 804 634 569 497 487 474 453 431 428 475 547 636 722 700 645 535 506 466 453 439 463 532 635 770 864 807 725 620 627 J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D 424 450 435 411 430 465 600 530 453 470 435 461 438 429 395 423 425 525 481 525 449 404 387 394 390 362 390 412 435 510 515 480 411 385 375 425 436 432 425 435 498 532 528 484 453 455 445 443 420 416 414 458 477 510 485 459 413 395 390 382 381 388 412 452 487 502 469 425 390 395 J 10 F 21 M 18 A 19 M 19 J 9 J 15 A 14 S 17 O 20 N 19 D J 11 14 17 F 20 M 18 A 22 M 19 J 15 J 15 A 12 S 15 O 17 N 18 D J 12 13 19 F 19 M 18 A 20 M 15 J 12 J 10 A 9 S 13 O 12 N 11 D 8

MedianSalePrice 3 Mo. Roll Avg

Inventory MSI

7,381 7,896 8,692 9,615 10,006 9,863 9,815 9,437 9,482 9,195 8,508 7,341 7,346 7,587 8,528 9,364 10,144 10,285 10,105 9,552 9,171 8,945 8,303 7,219 7,472 8,044 8,799 9,362 9,683 9,402 8,999 8,427 8,193 7,646 6,705 5,204

17

Days On Market 3 Mo. Roll Avg

J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D 180 170 180 164 156 149 142 137 152 168 149 159 172 174 185 180 176 146 138 146 146 163 168 174 184 194 193 181 172 155 146 150 167 161 174 172 177 171 167 156 149 143 144 152 156 159 160 168 177 180 180 167 153 143 143 152 159 168 175 184 190 189 182 169 158 150 154 159 167 169 J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D 260 264 250 258 259 272 299 284 262 260 249 261 243 256 244 251 245 286 281 270 261 236 232 233 235 228 245 251 255 272 271 256 241 245 233 243 258 257 256 263 277 285 282 269 257 257 251 253 248 250 247 261 271 279 271 256 243 234 233 232 236 241 250 259 266 266 256 247 240 240 J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D

Price per Sq Ft 3 Mo. Roll Avg

Sale to List Price 3 Mo. Roll Avg

0.947 0.945 0.938 0.947 0.948 0.953 0.952 0.953 0.950 0.943 0.943 0.946 0.943 0.943 0.927 0.943 0.944 0.956 0.960 0.950 0.948 0.941 0.947 0.936 0.932 0.939 0.937 0.946 0.945 0.952 0.955 0.953 0.949 0.946 0.944 0.947 0.943 0.943 0.944 0.949 0.951 0.953 0.952 0.949 0.945 0.944 0.944 0.944 0.938 0.938 0.938 0.948 0.953 0.955 0.953 0.946 0.945 0.941 0.938 0.936 0.936 0.941 0.943 0.948 0.951 0.953 0.952 0.949 0.946 0.946

J 10 New Listings Inventory Sales

(000's)

D J 11

D J 12

1,526 1,515 2,082 2,487 1,903 1,777 1,520 1,340 1,694 1,305 937 659 1,327 1,263 2,200 2,122 2,136 1,744 1,414 1,097 1,319 1,226 888 605 1,480 1,557 1,991 1,937 1,775 1,419 1,287 1,055 1,301 1,116 735 471 7,381 7,896 8,692 9,615 10,006 9,863 9,815 9,437 9,482 9,195 8,508 7,341 7,346 7,587 8,528 9,364 10,144 10,285 10,105 9,552 9,171 8,945 8,303 7,219 7,472 8,044 8,799 9,362 9,683 9,402 8,999 8,427 8,193 7,646 6,705 5,204 441 376 477 496 536 1,082 665 665 571 471 450 540 431 388 474 422 530 690 688 788 624 523 458 538 401 419 496 475 626 803 881 909 632 635 594 653

Avg Sale Price 3 Mo. Roll Avg

J 10 F M A M J J A S O N D J 11 F M A M J J A S O N D J 12 F M A M J J A S O N D 594 621 592 608 594 624 803 734 619 627 560 595 533 635 602 589 617 734 709 690 669 530 525 535 536 551 562 625 630 705 699 634 538 597 528 634 602 607 598 608 673 720 719 660 602 594 563 588 590 609 603 647 687 711 689 630 575 530 532 541 550 579 605 653 678 679 624 590 554 586

Based on information from Empire Access Multiple Listing Service, Inc. for the period 1/1/2010 through 12/31/2012. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Residential Brokerage does not guarantee the data accuracy. Data maintained by the MLS's may not reflect all real estate activity in the market.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Theories of Economic DevelopmentDocument77 pagesTheories of Economic Developmentdigvijay909100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- General Mills 2017 Annual ReportDocument96 pagesGeneral Mills 2017 Annual ReportIrfan Ahmed Ayaz AhmedNo ratings yet

- Bidder 1 Bidder 2 Bidder 3 Technical Score Commercial Score: Bid EvaluationDocument11 pagesBidder 1 Bidder 2 Bidder 3 Technical Score Commercial Score: Bid EvaluationAncaNo ratings yet

- A Beginner's Guide To Altcoin Day TradingDocument16 pagesA Beginner's Guide To Altcoin Day Tradingblowinzips67% (6)

- Claim MGT - FIDIC ClausesDocument3 pagesClaim MGT - FIDIC Clausesමනෝජ් තුඩුගලNo ratings yet

- Interest Rates and Security ValuationDocument60 pagesInterest Rates and Security Valuationlinda zyongweNo ratings yet

- Peekskill 4th Quarter Market Report 2012Document4 pagesPeekskill 4th Quarter Market Report 2012Suzanne WelchNo ratings yet

- Croton On Hudson Real Estate Market Update 2nd Quarter 2012Document4 pagesCroton On Hudson Real Estate Market Update 2nd Quarter 2012Suzanne WelchNo ratings yet

- Wine Tasting Sunday, September 18, 20112 PM To 5 PM Monteverde at Oldstone Benefit For The BCC 911 MemorialDocument1 pageWine Tasting Sunday, September 18, 20112 PM To 5 PM Monteverde at Oldstone Benefit For The BCC 911 MemorialSuzanne WelchNo ratings yet

- Toughman FlyerDocument2 pagesToughman FlyerSuzanne WelchNo ratings yet

- Croton On Hudson Market Update YTD 3/2011Document4 pagesCroton On Hudson Market Update YTD 3/2011Suzanne WelchNo ratings yet

- Treasures N TalesDocument1 pageTreasures N TalesSuzanne WelchNo ratings yet

- Goblin Flyer 2010Document1 pageGoblin Flyer 2010Suzanne WelchNo ratings yet

- Quiz 12Document3 pagesQuiz 12mwende faiyuuNo ratings yet

- Diagnostic Service: Factors Factor Weight Rating Factor ScoreDocument2 pagesDiagnostic Service: Factors Factor Weight Rating Factor ScoreAlayou TeferaNo ratings yet

- AMFI Question & AnswerDocument67 pagesAMFI Question & AnswerVirag67% (3)

- 5202 Rashed, With Solution - 123541Document10 pages5202 Rashed, With Solution - 123541RashedNo ratings yet

- 1Document51 pages1dakine.kdkNo ratings yet

- Sped'Ers C.A.R.E Organization Financial Statement: Don Mariano Marcos Memorial State UniversityDocument2 pagesSped'Ers C.A.R.E Organization Financial Statement: Don Mariano Marcos Memorial State Universitychenee liezl horarioNo ratings yet

- MR ZulfaDocument14 pagesMR ZulfaHalim Pandu LatifahNo ratings yet

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliNo ratings yet

- 001 FundamentalsDocument30 pages001 FundamentalsTutuch NidonatoNo ratings yet

- BillofEntry 40622301107-1Document5 pagesBillofEntry 40622301107-1Richard BoatengNo ratings yet

- Premium & Warranty LiabilitiesDocument16 pagesPremium & Warranty LiabilitiesKring Zel0% (1)

- 2023 HSC Business StudiesDocument22 pages2023 HSC Business StudiesSreemoye ChakrabortyNo ratings yet

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11No ratings yet

- 23-24. Mrunal Economy Lecture 23-24 PDFDocument29 pages23-24. Mrunal Economy Lecture 23-24 PDFHemachandar RaviNo ratings yet

- 2 Lesson 2 Handout Cbmec 2Document6 pages2 Lesson 2 Handout Cbmec 2Lynireca Rica Valles LoveteNo ratings yet

- Chap4 TheoryDocument2 pagesChap4 TheoryAnonymous LC5kFdtcNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- ERP Post Implementation Challenges 3Document11 pagesERP Post Implementation Challenges 3Neelesh KumarNo ratings yet

- AnnualReport2017 2018 PDFDocument236 pagesAnnualReport2017 2018 PDFsuryateja kudapaNo ratings yet

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Banking FraudDocument24 pagesBanking FraudchaitudscNo ratings yet

- Aims and Objectives: This Course Aims To Provide Students With A Sound KnowledgeDocument3 pagesAims and Objectives: This Course Aims To Provide Students With A Sound KnowledgeuannakaNo ratings yet

- Operations Management: Creating Value Along The Supply ChainDocument43 pagesOperations Management: Creating Value Along The Supply ChainveenajkumarNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet