Professional Documents

Culture Documents

Macroeconomics For Financial Markets Module

Uploaded by

davidd121Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroeconomics For Financial Markets Module

Uploaded by

davidd121Copyright:

Available Formats

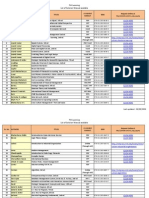

NATIO ONAL STOCK EXCHA S ANGE OF INDIA LIMITE A ED

Depart rtment : SB BU-Educatio on NCFM COURS OUTLINE M SE

Macroec conomics fo Financial Markets Mo or l odule Introduction to Macro Economics n E 1. Intro oduction 2. Micr roeconomics and Macroe s economics 3. Why Macroecon y nomics is imp portant for the financial se ector 4. The concept of equilibrium in economics s 5. Broa outline ad Inflation and Interest Rates R 1. Wha is inflation? at 2. How to measure inflation? w e 3. Theories of inflation 4. Impa of inflatio on macroe act on economic va ariables 5. Con ntrolling inflat tion 6. Interest Rates 7. Fact tors affecting the level of Interest Rat g f te 8. Impa of interes rates act st 9. Con ncept of Real Interest Rat te National Inc come Accou unting 1. National Income Accounting : Measuring Economic Activity e A 2. Som other way to measure National In me ys re ncome 3. Saving and Inve estment in Ind dia 4. The changing co omposition o Indias economic enviro of onment nt al Governmen and Fisca Policy 1. Role of the Gove e ernment in a Economy an 2. Gov vernment Exp penditure an d Revenue: Understanding the Gove ernment acco ounts 3. Bringing togethe the Reven ue and the Expenditure side er E s 4. The Deficit Indic cators 5. Fina ancing of def by the Go ficit overnment 6. Fisc Deficit and sustainabillity of Interna Debt cal d al 7. Fisc policies and their impa on the fin cal act nancial marke ets Money and Monetary Policy P 1. Wha is the role of Money? at 2. Com mponents of Money in Ind dia

Regd.Of ffice:Exchan ngePlaza,Ba andraKurlaC Complex,Bandra(E),Mu umbai400 051Page 1 of 2

3. Demand for Money 4. Supply of Money 5. Different roles of RBI in India 6. Role of Commercial Banks in Money Supply 7. Other Instruments of Money Supply 8. Market Stabilization Scheme 9. Use of Monetary policy 10. Use of Fiscal policy The External Sector: Open Economy Macroeconomics 1. Why do countries trade? 2. India and International Trade 3. Balance of Payments 4. Foreign Direct Investment 5. Foreign Portfolio Investment 6. Exchange Rates 7. Foreign Exchange Reserves 8. Impact of capital flows on money supply 9. Sterilization of Capital Flows Financial Markets 1. Basic roles of the financial market 2. Why and how are financial markets different from other markets? 3. Role of different financial systems: Bank based financial systems and Capital Market based financial systems 4. Role and contribution of different segments in Indias Financial Market 5. The Equity Market 6. Derivatives Market in India 7. The Debt Market Regulatory Institutions in India 1. Role of regulatory institutions in a market-based economy 2. The Reserve Bank of India (RBI) 3. The Securities and Exchange Board of India (SEBI) 4. Insurance Regulatory and Development Authority (IRDA) 5. Pension Fund Regulatory and Development Authority (PFRDA) 6. Forward Markets Commission (FMC) 7. Stock Exchanges in India

Regd.Office:ExchangePlaza,BandraKurlaComplex,Bandra(E),Mumbai400051Page 2 of 2

You might also like

- NCFM ModulesDocument4 pagesNCFM Modulesrevathi_itsme100% (1)

- SecuritiesDocument196 pagesSecuritiesAdarsh KumarNo ratings yet

- SCM J.k.shah Free Revision Classes For May 2019Document155 pagesSCM J.k.shah Free Revision Classes For May 2019Anuj AgrawalNo ratings yet

- Chartered Economics - Detailed CurriculumDocument43 pagesChartered Economics - Detailed CurriculumRAVI KUMAR DWIVEDI100% (2)

- Mutual Funds - NCFMDocument123 pagesMutual Funds - NCFMUDAYAN SHAHNo ratings yet

- Security Analysis & Portfolio Management Syllabus MBA III SemDocument1 pageSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruNo ratings yet

- NCFM Capital Market Dealer's ModuleDocument1 pageNCFM Capital Market Dealer's ModuleIntelivisto Consulting India Private LimitedNo ratings yet

- Settlement Officers ExamDocument95 pagesSettlement Officers ExamNqabisa MtwesiNo ratings yet

- Assignment 01 FMDocument8 pagesAssignment 01 FMChinky JaiswalNo ratings yet

- NCFM Nse Wealth Management Module BasicsDocument49 pagesNCFM Nse Wealth Management Module BasicssunnyNo ratings yet

- Steel 10.2 Sector AnalysisDocument10 pagesSteel 10.2 Sector AnalysisKarmukilan PNo ratings yet

- Apple Model EDUCBADocument5 pagesApple Model EDUCBAAakashNo ratings yet

- CT9 GuideDocument6 pagesCT9 GuidejasonNo ratings yet

- What Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.Document15 pagesWhat Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.SRINIVASAN100% (4)

- Real Estate Investment in India:: Analysing The Near FutureDocument15 pagesReal Estate Investment in India:: Analysing The Near FutureVipin SNo ratings yet

- Indian Banking System Syllabus PDFDocument2 pagesIndian Banking System Syllabus PDFMahek BaigNo ratings yet

- Micro, Small & Medium Enterprises (MSME'SDocument39 pagesMicro, Small & Medium Enterprises (MSME'Sshrinivas88100% (3)

- NCFM Technical AnalysisDocument173 pagesNCFM Technical AnalysisPRUTHIV GOKULAN.RNo ratings yet

- Accounting For ManagementDocument2 pagesAccounting For ManagementShibasish BhattacharyaNo ratings yet

- Phi Learning List of Solution ManualDocument8 pagesPhi Learning List of Solution ManualRavish Yadav0% (1)

- NISM-Series-VII-Securities Operations and Risk Management-July 2015Document134 pagesNISM-Series-VII-Securities Operations and Risk Management-July 2015Amit Kumar NarayanNo ratings yet

- WWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)Document29 pagesWWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)sharadNo ratings yet

- Foundation Modules: + Expand All - Collapse AllDocument1 pageFoundation Modules: + Expand All - Collapse AllManoj SharmaNo ratings yet

- Nism ViiDocument33 pagesNism ViiRavi BhartiNo ratings yet

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam WorkbookDocument214 pagesNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbookpiyush_rathod_13No ratings yet

- Indian Commodity Market - GroundnutDocument42 pagesIndian Commodity Market - GroundnutAnjali PanchalNo ratings yet

- PGDFMDocument6 pagesPGDFMAvinashNo ratings yet

- Pass 4 Sure NotesDocument76 pagesPass 4 Sure NotesNarendar KumarNo ratings yet

- Fimmda SumsDocument33 pagesFimmda SumsNamrata RoyNo ratings yet

- NCFM Fees Details PDFDocument2 pagesNCFM Fees Details PDFkadambari naikNo ratings yet

- Banking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)Document13 pagesBanking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)sunगीत मजे्seNo ratings yet

- Future and Option Questions PDFDocument6 pagesFuture and Option Questions PDFAshok ReddyNo ratings yet

- NSDL NotesDocument14 pagesNSDL NotesAnmol RahangdaleNo ratings yet

- Financial Services MbaDocument251 pagesFinancial Services MbaMohammed Imran50% (2)

- Ncert XII Micro EconomicsDocument153 pagesNcert XII Micro EconomicsVasanth SaiNo ratings yet

- Nism Investment Adviser Level1 Study Notes PDFDocument33 pagesNism Investment Adviser Level1 Study Notes PDFTumpa BoseNo ratings yet

- SEBI ICDR Regulations 2018 Key Amendments 1Document19 pagesSEBI ICDR Regulations 2018 Key Amendments 1jimit0810No ratings yet

- Commercial Banking in India (Basic)Document112 pagesCommercial Banking in India (Basic)Ankur Shah100% (1)

- Security Analysis and Portfolio - S. KevinDocument595 pagesSecurity Analysis and Portfolio - S. KevinShubham Verma100% (1)

- National Stock Exchange of India Limited: Financial Markets (Advanced) ModuleDocument132 pagesNational Stock Exchange of India Limited: Financial Markets (Advanced) ModuleNavleen Kaur100% (2)

- Overview of Financial ManagementDocument57 pagesOverview of Financial ManagementMohamedNo ratings yet

- 1164914469ls 1Document112 pages1164914469ls 1krishnan bhuvaneswariNo ratings yet

- Sapm NotesDocument305 pagesSapm Notesrajvinder deolNo ratings yet

- AFM Important QuestionsDocument2 pagesAFM Important Questionsuma selvarajNo ratings yet

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersDocument2 pagesCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssNo ratings yet

- Mba II Sem - Imp Questions - 2015-17 BatchDocument14 pagesMba II Sem - Imp Questions - 2015-17 BatchNALLANKI RAJA KUMARNo ratings yet

- Ba5011 Merchant Banking and Financial Services PDFDocument1 pageBa5011 Merchant Banking and Financial Services PDFAbhinayaa SNo ratings yet

- PFA Vegetron CaseDocument14 pagesPFA Vegetron CaseKumKum BhattacharjeeNo ratings yet

- Ccra Level 2 SyllabusDocument8 pagesCcra Level 2 SyllabusPavan ValishettyNo ratings yet

- B. Ed. Prospectus 2011Document16 pagesB. Ed. Prospectus 2011deepak4uNo ratings yet

- Mutual Fund Distributor Exam Nism Study Material PDFDocument56 pagesMutual Fund Distributor Exam Nism Study Material PDFamita YadavNo ratings yet

- Indirect Tax 4 Sem MbaDocument11 pagesIndirect Tax 4 Sem Mbakrushna vaidyaNo ratings yet

- JK Shah Economics Revisionery NotesDocument54 pagesJK Shah Economics Revisionery Notesकनक नामदेवNo ratings yet

- FRM Part 2 Video LessonsDocument2 pagesFRM Part 2 Video Lessonsratan203No ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Course Mfme18Document2 pagesCourse Mfme18Sushil MundelNo ratings yet

- Macroeconomics For Financial Markets ModuleDocument4 pagesMacroeconomics For Financial Markets ModuleSankalp SinghNo ratings yet

- Course MfmeDocument3 pagesCourse MfmeShivang PrabhuNo ratings yet

- Indian Financial System 1Document10 pagesIndian Financial System 1fananjelinaNo ratings yet

- General Studies (Finance and Economics) : (Syllabus) SSC: Assistant Audit Officer (AAO) Exam SyllabusDocument3 pagesGeneral Studies (Finance and Economics) : (Syllabus) SSC: Assistant Audit Officer (AAO) Exam SyllabusRishabhDevShivanandNo ratings yet

- FCI Advt 2015 PDFDocument24 pagesFCI Advt 2015 PDFAnkit GhildiyalNo ratings yet

- Advertisement For Teaching Posts - 2016Document10 pagesAdvertisement For Teaching Posts - 2016davidd121No ratings yet

- Recruitment of Manager / Assistant Manager / Officer in Grade Ii in The Maharashtra State Cooperative Bank LTD., MumbaiDocument11 pagesRecruitment of Manager / Assistant Manager / Officer in Grade Ii in The Maharashtra State Cooperative Bank LTD., Mumbaidavidd121No ratings yet

- Notification UCO Bank Chartered Accountant PostsDocument10 pagesNotification UCO Bank Chartered Accountant PostsAnirban DasNo ratings yet

- NCFM Insurance ModuleDocument92 pagesNCFM Insurance ModuleBronil D'abreoNo ratings yet

- Macroeconomics For Financial Markets: National Stock Exchange of India LimitedDocument88 pagesMacroeconomics For Financial Markets: National Stock Exchange of India LimitedShilpi PriyaNo ratings yet

- Course CDBMDocument1 pageCourse CDBMDipen Ashokkumar KadamNo ratings yet

- Course BsmeDocument2 pagesCourse BsmeKaran LalwaniNo ratings yet

- Mutual Funds: A Beginner's ModuleDocument2 pagesMutual Funds: A Beginner's Moduledavidd121No ratings yet

- Financial Markets: A Beginner's ModuleDocument2 pagesFinancial Markets: A Beginner's Moduledavidd121No ratings yet

- 3a Ela Day 3Document5 pages3a Ela Day 3api-373496210No ratings yet

- Colour Communication With PSD: Printing The Expected With Process Standard Digital!Document22 pagesColour Communication With PSD: Printing The Expected With Process Standard Digital!bonafide1978No ratings yet

- PCA Power StatusDocument10 pagesPCA Power Statussanju_81No ratings yet

- QUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaDocument43 pagesQUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaPatrick EdrosoloNo ratings yet

- Battle of The ChoirDocument3 pagesBattle of The Choirkoizume_reiNo ratings yet

- Emcee - Graduation DayDocument5 pagesEmcee - Graduation DayBharanisri VeerendiranNo ratings yet

- Settling The Debate On Birth Order and PersonalityDocument2 pagesSettling The Debate On Birth Order and PersonalityAimanNo ratings yet

- Instructional Supervisory Plan BITDocument7 pagesInstructional Supervisory Plan BITjeo nalugon100% (2)

- Musical Rhythm, Linguistic Rhythm, and Human EvolutionDocument7 pagesMusical Rhythm, Linguistic Rhythm, and Human Evolutiongeneup3587100% (1)

- Fundamentals of Biochemical Engineering Dutta Solution ManualDocument6 pagesFundamentals of Biochemical Engineering Dutta Solution Manualhimanshu18% (22)

- A Triumph of Surgery EnglishDocument13 pagesA Triumph of Surgery EnglishRiya KumariNo ratings yet

- Simple Past Story 1Document7 pagesSimple Past Story 1Ummi Umarah50% (2)

- Comparative Analysis of Levis Wrangler & LeeDocument10 pagesComparative Analysis of Levis Wrangler & LeeNeelakshi srivastavaNo ratings yet

- Africanas Journal Volume 3 No. 2Document102 pagesAfricanas Journal Volume 3 No. 2Gordon-Conwell Theological Seminary100% (2)

- A Social Movement, Based On Evidence, To Reduce Inequalities in Health Michael Marmot, Jessica Allen, Peter GoldblattDocument5 pagesA Social Movement, Based On Evidence, To Reduce Inequalities in Health Michael Marmot, Jessica Allen, Peter GoldblattAmory JimenezNo ratings yet

- GrandEsta - Double Eyelid Surgery PDFDocument2 pagesGrandEsta - Double Eyelid Surgery PDFaniyaNo ratings yet

- Dexter Quilisadio-Tanzo BSA-2 Unit-1 Quiz-1: OPMATQM-490Document1 pageDexter Quilisadio-Tanzo BSA-2 Unit-1 Quiz-1: OPMATQM-490Red AriesNo ratings yet

- Shreya Keshari PDFDocument75 pagesShreya Keshari PDFANKIT SINGHNo ratings yet

- Football Trading StrategyDocument27 pagesFootball Trading StrategyChem100% (2)

- Demo StatDocument5 pagesDemo StatCalventas Tualla Khaye JhayeNo ratings yet

- 580 People vs. Verzola, G.R. No. L-35022Document2 pages580 People vs. Verzola, G.R. No. L-35022Jellianne PestanasNo ratings yet

- PublicadministrationinthephilippinesDocument29 pagesPublicadministrationinthephilippinesGorby ResuelloNo ratings yet

- Psi SiDocument3 pagesPsi Siapi-19973617No ratings yet

- Book - IMO Model Course 7.04 - IMO - 2012Document228 pagesBook - IMO Model Course 7.04 - IMO - 2012Singgih Satrio Wibowo100% (4)

- Possessive Adjectives 3Document1 pagePossessive Adjectives 3RAMIRO GARCIA CANCELANo ratings yet

- Year 8 - Higher - Autumn 2019Document16 pagesYear 8 - Higher - Autumn 2019nooraNo ratings yet

- Managing Individual Differences and BehaviorDocument40 pagesManaging Individual Differences and BehaviorDyg Norjuliani100% (1)

- Test Bank For Davis Advantage For Medical-Surgical Nursing: Making Connections To Practice, 2nd Edition, Janice J. Hoffman Nancy J. SullivanDocument36 pagesTest Bank For Davis Advantage For Medical-Surgical Nursing: Making Connections To Practice, 2nd Edition, Janice J. Hoffman Nancy J. Sullivannombril.skelp15v4100% (15)

- Ahimsa From MahabharataDocument70 pagesAhimsa From MahabharataGerman BurgosNo ratings yet

- My AnalysisDocument4 pagesMy AnalysisMaricris CastillanoNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Nickel and Dimed: On (Not) Getting By in AmericaFrom EverandNickel and Dimed: On (Not) Getting By in AmericaRating: 3.5 out of 5 stars3.5/5 (197)