Professional Documents

Culture Documents

Key Words

Uploaded by

ukhan_79Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Words

Uploaded by

ukhan_79Copyright:

Available Formats

BUSS3 Key Words

Functional Objectives & Strategies

Aims / goals

General statements of what a business intends to achieve. Precise details of those intentions are set out in objectives How a business attempts to compete successfully in a particular market

Business unit strategy

Corporate objectives Objectives that relate to the business as a whole. Usually set by top management. Corporate strategy Cost leadership Concerned with the overall purpose and scope of the business activities A business strategy concerned with aiming to be the lowest-cost producer in an industry. Usually requires exploitation of economies of scale

Functional objectives Set for each major business function designed to ensure that the corporate objectives are met Shareholder value SWOT analysis Where shareholders earn a return from their investment which is greater than their required rate of return Assessment of the internal strengths and weaknesses of a business and the external opportunities and threats that the business needs to consider Similar to objectives. Targets are often set at an individual or team level

Targets

BUSS3 Key Words

Financial Strategies and Accounts

Acid-test ratio Asset turnover Average rate of return Capital expenditure Cost minimisation Current ratio A liquidity ratio that looks at whether a business can pay for current liabilities out of cash and near-cash assets (it ignores the value of stocks) A ratio that calculates the relationship between revenues and the total assets employed in a business A measure of the total accounting return from an investment project Expenditure on assets which are intended to be kept in the business (e.g. IT systems, machinery) rather than sold or turned into products A strategy of achieving the most cost-effective way of delivering goods and services to the required level of quality A simple and popular measure of liquidity that assess the ability of current assets (e.g. cash, stocks) to finance current liabilities (e.g. trade creditors) A long-term source of finance a debenture is a form of bond or longterm loan issued by a company A ratio that focuses on the average time it takes for trade debtors to settle their accounts. Usually measured in days An accounting estimate of the fall in value of a fixed asset over time The multiplication factor that converts a projected cost or benefit in a future year into its present value Amounts paid to shareholders out of the profits earned by a company. A measure of shareholder return calculated by comparing the dividend per share by the share price A business that is viable and able to continue in business for the foreseeable future An intangible asset that can be included in a balance sheet = the difference between the net assets of a business acquired and the price paid for the business Analytical techniques to help management evaluate the returns from potential investments, and to help choose between competing investments The present value of a series of future net cash flows that will result from an investment, minus the amount of the original investment The profit earned by a business from its entire trading operations stated before financing (e.g. interest) and tax The time it takes for a project to repay its initial investment

Debentures Debtor days Depreciation Discount factor Dividend Dividend yield Going concern Goodwill

Investment appraisal

Net present value Operating profit

Payback period

BUSS3 Key Words Profit centres A separately-identifiable part of a business for which it is possible to identify revenues and costs and calculate a relevant profit The sustainability of profit from one period to the next. Higher quality profit is profit that is likely to be repeated rather than affected by oneoff items The amount of profit earned in a period (absolutely measure) or rate of profit earned compared with revenue (relatively measure) Amounts set aside to cover future costs or liabilities (e.g. redundancies, business closures, legal disputes) Interpretation of financial performance by calculating and interpreting ratios Spending on day-to-day operation of the business e.g. paying for materials, staff costs, management salaries, advertising The issue of new shares to existing shareholders in order to raise new finance. The new shares are usually offered at a significant discount to the existing share price to encourage take-up A measure of the percentage return that a business earns from the capital employed in the business. Often referred to as the primary ratio The amount invested into a company by shareholders The rewards earned by shareholders = dividends paid to them + any increase in the value of their shares A liquidity ratio that looks at how often a business rotates its stock during a year Amounts that a business owes to its suppliers Amounts that are owed to a business from its customers The net amount invested by a business to finance day-to-day trading: usually calculated as current assets less current liabilities

Profit quality

Profitability

Provisions Ratio analysis Revenue expenditure

Rights issue

ROCE

Share capital Shareholder returns Stock turnover Trade creditors Trade debtors Working capital

BUSS3 Key Words

Marketing Strategies

Ansoffs Matrix A strategic model for helping a business analyse the relationship between general strategic direction and suitable marketing strategies A term for various measures of central tendency, including the mean, mode and median Skills, competences, resources and other advantages that enable a business to out-perform its competition

Average Competitive advantage

Customer relationship The process of building a long-term, profitable relationship management (CRM) between a business and its customers

Diversification Extrapolation Market development

The relatively risky strategy of trying to enter new markets with new products (from Ansoff matrix) The use of trends established by historical data to make predictions about future values A growth strategy where the business seeks to sell its existing products into new markets - e.g. exporting (from Ansoff matrix) The actions that management intend to take via the marketing mix in order to achieve marketing objectives A growth strategy where a business aims to introduce new products into existing markets (from Ansoff matrix) The way in which the marketing function tries to create an image or identity in the minds of the target market Changing the marketing mix for a product to appeal to a different market segment Techniques for estimating the likely demand (revenue and volume) for a product in future periods The market segment or segments which a business is attempting to enter with the chosen marketing mix Launching a new product or service in a limited part of the target market in order to gauge the viability of the product and assess the most appropriate marketing mix A general direction in which something tends to move

Marketing plan Product development

Product positioning Repositioning Sales forecasting Target market Test marketing

Trend

BUSS3 Key Words

Operational Strategies

Capital intensity Efficiency Industrial inertia Innovation Just-in-time Kaizen The extent to which production or operations depend on investment in and use of capital i.e. machinery, IT systems, buildings etc A measure of the ability of a business to achieve the required level of production whilst minimising the use of resources Where a business decides to stay in its existing location despite potentially better locations being available to it Putting an new idea or approach into action the commercial exploitation of ideas Method of lean production where production resources arrive at the moment they are required rather than being held in stock An approach to lean production and quality assurance. Involves encouraging employees to constantly seek and implement small changes in order to improve quality and efficiency. Continuous Improvement. The extent to which production or operations depend on investment in and use of labour i.e. people, training The level of output per unit of labour The period of time between an order being placed and being received An approach to management that focuses on cutting out waste whilst still ensuring quality. Where a business has work done for it overseas Where a business has work done for it by someone else Cost savings that arise from buying in bulk or from a more powerful relationship with a supplier due to increased output A restriction on the volume or quantity of a good that can enter or be sold in a market (form of trade barrier) The size or output of a business, best measured relative to that of direct competitors Part of outsourcing where another business is used to provide part of the production process A tax levied on imports to increase their price compared with domestic goods (form of trade barrier) Reductions in unit costs arising from the effective use of technology

Labour intensity Labour productivity Lead-time Lean production Offshoring Outsourcing Purchasing economies

Quota Scale Subcontracting Tariff Technical economies

BUSS3 Key Words

Human Resource Strategies

Arbitration An alternative to a court of law in determining legal and employment disputes. Involves a specialist outsider being asked to make a decision on a dispute An organisational structure where authority rests with senior management at the centre of the business The process by which a message or information is exchanged from a sender to a receiver A way of mediating industrial disputes to gain agreement without going to arbitration An organisational structure where authority is delegated further down the hierarchy, away from the centre The reduction in the scale and resources of a business, usually involving job losses and/or the sale or closure of business units The range of employment options designed to help employees balance work and home life (e.g. part-time, job-sharing, Home-working, annualised hours contracts) An approach to HRM based on treating employees as resources in the same way as any other business resource Strategies for managing people in order to achieve business objectives Where a business finds it does not have sufficient employees in number, or with the right skills and experience, for its needs Employees who are on the fringe of the core workforce. They are not essential (core) workers, and their activities can often be outsourced or provided using flexible contracting An approach to HRM based on treating employees as the most important resource in a business The proportion of staff that leave their employment with a business over a period usually measured over a year How a business determines how many and what kind of employees are required A formal meeting of employer and employees to consider issues affecting the business and workplace mandatory for larger businesses in the EU

Centralisation Communication Conciliation Decentralisation Downsizing Flexible working

Hard HRM

Human resource management (HRM) Labour shortage

Peripheral workers

Soft HRM Staff turnover Workforce planning Works council

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Management and Leadership TheoriesDocument43 pagesA Management and Leadership TheoriesKrezielDulosEscobarNo ratings yet

- Music Education (Kodaly Method)Document4 pagesMusic Education (Kodaly Method)Nadine van Dyk100% (2)

- 20 Great American Short Stories: Favorite Short Story Collections The Short Story LibraryDocument10 pages20 Great American Short Stories: Favorite Short Story Collections The Short Story Librarywileyh100% (1)

- The Magical Number SevenDocument3 pagesThe Magical Number SevenfazlayNo ratings yet

- ECON 4035 - Excel GuideDocument13 pagesECON 4035 - Excel GuideRosario Rivera NegrónNo ratings yet

- Introduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF VersionDocument62 pagesIntroduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF Versionmary.krueger918100% (50)

- Read Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallDocument1 pageRead Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallKJRNo ratings yet

- Medical Surgical Nursing Nclex Questions 5Document18 pagesMedical Surgical Nursing Nclex Questions 5dee_day_8No ratings yet

- Datsasheet of LM347 IcDocument24 pagesDatsasheet of LM347 IcShubhamMittalNo ratings yet

- ( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDocument14 pages( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDamon Culbert0% (1)

- SiteVisit - Name (Done Excel, Pending CC)Document147 pagesSiteVisit - Name (Done Excel, Pending CC)CK AngNo ratings yet

- Statistical TestsDocument47 pagesStatistical TestsUche Nwa ElijahNo ratings yet

- Sta 305Document156 pagesSta 305mumbi makangaNo ratings yet

- CSL - Reflection Essay 1Document7 pagesCSL - Reflection Essay 1api-314849412No ratings yet

- Shostakovich: Symphony No. 13Document16 pagesShostakovich: Symphony No. 13Bol DigNo ratings yet

- Activity 2Document2 pagesActivity 2cesar jimenezNo ratings yet

- National ScientistDocument2 pagesNational ScientistHu T. BunuanNo ratings yet

- Zone Raiders (Sci Fi 28mm)Document49 pagesZone Raiders (Sci Fi 28mm)Burrps Burrpington100% (3)

- Eapp Module 1Document6 pagesEapp Module 1Benson CornejaNo ratings yet

- MarketingDocument5 pagesMarketingRose MarieNo ratings yet

- Consolidated PCU Labor Law Review 1st Batch Atty Jeff SantosDocument36 pagesConsolidated PCU Labor Law Review 1st Batch Atty Jeff SantosJannah Mae de OcampoNo ratings yet

- Occ ST 1Document3 pagesOcc ST 1Rona Marie BulaongNo ratings yet

- Project Dayan PrathaDocument29 pagesProject Dayan PrathaSHREYA KUMARINo ratings yet

- Girl: Dad, I Need A Few Supplies For School, and I Was Wondering If - . .Document3 pagesGirl: Dad, I Need A Few Supplies For School, and I Was Wondering If - . .AKSHATNo ratings yet

- Chem31.1 Experiment 2Document28 pagesChem31.1 Experiment 2Mia FernandezNo ratings yet

- Chapter 5, 6Document4 pagesChapter 5, 6anmar ahmedNo ratings yet

- Stephen Law Morality Without GodDocument9 pagesStephen Law Morality Without GodJiReH MeCuaNo ratings yet

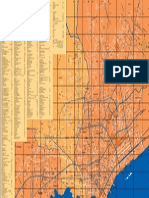

- Map Index: RD - To CE MP AR KDocument1 pageMap Index: RD - To CE MP AR KswaggerboxNo ratings yet

- Course Hand Out Comm. Skill BSC AgDocument2 pagesCourse Hand Out Comm. Skill BSC Agfarid khanNo ratings yet

- Simplified Cost Accounting Part Ii: Solutions ManualDocument58 pagesSimplified Cost Accounting Part Ii: Solutions ManualAnthony Koko CarlobosNo ratings yet