Professional Documents

Culture Documents

Emerging Markets M&A Activity

Uploaded by

Gerald KohCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emerging Markets M&A Activity

Uploaded by

Gerald KohCopyright:

Available Formats

EMERGING MARKETS M&A REVIEW

FINANCIAL ADVISORS

First Nine Months 2012

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Emerging Markets M&A

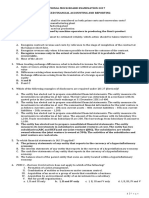

Emerging Markets M&A Down 7% | Represents 28% of Global M&A | Fees Down 35% | Energy and Power Most Active Sector

Emerging Markets Deals Intelligence

Emerging Market Announced M&A

$900

Accounting for 28% of global activity during the first nine months of 2012, the total value of announced M&A

activity in the Emerging Markets reached US$465.1 billion, a 7.1% decrease compared to the same period in

2011. Third quarter deal value totaled US$144.9 billion, an 18.2% decline from the second quarter.

According to Thomson Reuters/Freeman Consulting, total estimated fees earned from completed Emerging

Market M&A transactions during the first three quarters of 2012 was US$2.9 billion, representing a 34.6%

decrease compared to the same period in 2011.

Goldman Sachs took the top spot in the Emerging Markets for the first three quarters of 2012, with US$98

billion in announced deals. JP Morgan and Credit Suisse took the second and third spots, respectively.

Average EBITDA multiples across the Emerging Markets decreased to 10.7x, ranging from 6.2x in South

Africa to 13.7x in India. Bid premia (to 4 weeks prior stock price) averaged 28%. Middle East/North African

targets earned the largest average premium paid, at 34.8%.

Emerging Market Completed M&A - Imputed Fees

$8

Jan 1 - Jun 29

Q2 Volume (US$b)

16.7%

$400

13.8%

9.6%

$200

5%

$100

$0

2002

Imputed Fees (US$b)

$4

1.4

$1

1.2

1.8

1.3

0.5

$0

1.0

1.6

1.8

0.4

0.4

0.4

0.4

0.3

0.5

2002

2003

2004

2004

2005

2006

2007

2008

2009

2010

2011

2012

Jan 1 - Sep 28 2012

$43.8

0.9

0.6

2005

1.2

2006

2007

$14.0

$12.5

Malaysia

0.9

1.7

0.9

1.0

1.1

2009

2010

1.4

2011

$10.1

Chile

1.2

1.8

2008

$20.8

1.5

0.9

1.4

$24.3

Indonesia

1.5

1.1

0.8

$33.4

India

1.4

0%

$115.3

Mexico

1.6

1.6

0.6

2003

Russian Federation

1.5

0.4

10%

Brazil

$5

0.6

15%

China

1.5

0.5

14.0%

Top 10 Targeted Emerging Market Nations - US$ bil

1.8

0.5

14.3%

13.7%

$300

Q1 Volume (US$b)

$2

25%

23.2%

20%

$500

Q2 Volume (US$b)

$3

23.2%

$600

Q3 Volume (US$b)

$6

30%

25.3%

EM % of Global (YTD)

Q4 Volume (US$b)

$7

28.0%

Q1 Volume (US$b)

$700

Rank Value (US$b)

The most prolific sector of Emerging Market activity during the first nine months of 2012, Energy and Power

accounted for 17.1% of M&A volumes, with US$77.9 billion in deal activity. Following closely, the Materials

sector totaled US$71.8 billion.

Q3 Volume (US$b)

$800

Chinese targets dominated M&A activity in Emerging Markets, with 2,388 transactions worth a combined

US$115.3 billion. Brazil and Russia followed, accumulating US$43.8 billion and US$33.4 billion of activity,

respectively.

35%

33.2%

Q4 Volume (US$b)

0.8

$8.2

Turkey

$7.3

South Africa

0

2012

20

40

60

Rank Value (US$b)

80

100

120

https://www.thomsonone.com

1

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Emerging Markets M&A

Exit Multiple Matrix - Year to Date Average Rank Value / EBITDA

2012 UP

2011 DOWN

2011

Emerging Markets

BRIC

Jan 1 - Jun 29 Jan

20121 - Sep 28

Latin America

Middle East & North

Africa

South Africa

Consumer Products and Services

9.5x

9.8x

11.4x

8.5x

7.5x

9.4x

11.5x

1.5x

Consumer Staples

9.9x

11.2x

10.5x

12.6x

9.4x

8.9x

7.9x

12.9x

Energy and Power

11.1x

9.6x

10.2x

11.7x

6.5x

11.2x

17.9x

Healthcare

17.2x

12.9x

16.7x

19.3x

13.0x

High Technology

10.5x

11.1x

13.5x

11.5x

15.9x

Industrials

10.2x

11.1x

13.3x

11.4x

Materials

10.0x

12.2x

12.3x

Media and Entertainment

10.9x

12.0x

Real Estate

15.6x

Retail

Telecommunications

Average Industry Total

Eastern Europe

Asia Pacific

Emerging Mkts

China

2.3x

10.2x

6.2x

10.0x

10.3x

9.1x

6.5x

12.5x

10.1x

10.7x

8.2x

10.0x

12.0x

9.0x

14.4x

12.8x

13.2x

7.2x

8.3x

8.5x

13.9x

9.5x

20.1x

10.7x

9.1x

14.5x

31.0x

14.4x

9.4x

8.8x

7.8x

16.5x

13.3x

15.9x

18.5x

19.6x

21.3x

10.0x

3.4x

10.6x

13.0x

11.5x

11.3x

13.7x

13.1x

12.5x

10.1x

12.6x

13.8x

5.4x

7.9x

5.8x

7.9x

10.5x

12.1x

11.8x

10.9x

17.6x

12.1x

13.9x

11.5x

17.0x

11.9x

11.7x

10.7x

23.7x

6.7x

9.3x

6.5x

6.5x

11.1x

12.5x

21.1x

11.7x

12.6x

22.3x

14.7x

18.0x

6.6x

6.2x

6.6x

11.6x

13.8x

8.9x

23.3x

16.3x

12.5x

12.3x

18.4x

8.6x

21.0x

9.5x

14.9x

21.9x

10.1x

15.4x

10.7x

16.7x

5.8x

26.0x

12.1x

11.2x

9.1x

12.6x

11.7x

11.3x

12.7x

5.3x

9.8x

14.3x

11.4x

8.4x

13.4x

12.0x

6.8x

12.9x

7.1x

8.3x

6.9x

9.6x

5.9x

26.8x

2.9x

5.8x

13.7x

8.0x

14.4x

6.1x

9.5x

4.0x

14.7x

10.7x

11.4x

12.2x

12.9x

9.9x

10.8x

10.3x

12.0x

6.2x

8.5x

9.0x

11.8x

11.7x

13.6x

12.6x

13.7x

15.2x

11.1x

Bid Premium Matrix - Year to Date Average Premium to 4 Week Stock Price

2012 UP

2011 DOWN

2011

India

Emerging Markets

BRIC

Jan 1 - Jun 29 2012

Jan 1 -Sep 28

Latin America

Consumer Products and Services

18.4

25.7

22.6

27.5

Consumer Staples

25.7

19.9

22.1

19.1

30.9

Energy and Power

34.6

22.9

35.6

28.5

Financials

29.1

27.2

24.9

Healthcare

33.1

29.2

High Technology

24.8

Industrials

Middle East & North

Africa

3.2

South Africa

Eastern Europe

Asia Pacific

Emerging Mkts

China

India

26.8

18.3

33.6

18.5

26.2

0.0

28.9

27.1

26.5

23.8

36.3

41.2

16.3

10.0

27.6

28.4

25.9

16.9

22.1

11.4

23.9

22.7

17.7

24.7

35.3

18.3

16.8

57.8

25.3

78.7

42.5

11.3

18.8

39.0

11.4

46.0

38.5

19.2

36.1

30.8

33.8

25.5

27.4

17.9

28.3

24.6

31.5

10.8

32.8

36.7

88.5

33.2

16.8

22.7

10.8

44.7

20.8

28.0

22.6

20.9

32.0

25.3

22.1

61.2

3.7

17.1

20.5

24.3

26.7

9.8

18.1

27.5

21.9

27.5

18.1

12.6

5.7

32.7

69.5

30.0

6.1

32.0

19.7

26.8

22

33.6

17.4

28.6

16.8

Materials

31.0

29.8

32.9

34.7

37.3

22.1

5.1

24.0

49.1

29.9

14

31.6

32.5

31.7

36.8

33.3

36

Media and Entertainment

43.9

8.7

47.5

18.4

67.6

10.2

39.2

8.1

41.7

49.4

12

Real Estate

21.9

30.8

34.5

28.7

36.0

18.6

34.3

40.0

20.6

15.2

40.7

Retail

19.5

27.0

24.3

19.6

5.7

22.8

34

9.8

20.6

38.8

Telecommunications

28.2

16.2

38.5

15.0

26.5

Average Industry Total

28.0

24.2

29.7

25.4

28.3

15.6

11.5

18.6

62.7

21.6

4.7

2.2

16.8

35.3

18.4

71.9

18.5

19.2

18.3

13.2

7.0

10.6

34.8

25.7

30.1

22.4

27.3

24.8

29.2

26.6

29.8

24.3

19.8

31.8

3.4

* Using the valuations matrix you can analyze the average rank value to EBITDA and average premium to 4 week stock price prior to announcement by nation/region, which is indicated in the top row and broken down by target macro industries.

* The data given refers to the time period 01/01/2012 - 09/28/2012 and all spinoffs, splitoffs, open market repurchases, exchange offers and equity carveouts are excluded.

* The figures in red indicate a decline, while green indicates an increase, compared to the figures from the same time period last year listed in black.

* Additionally, for Rank Value/EBITDA the data is capped at 50x and for average premium to 4 week stock price prior to announcement is capped at 100%.

https://www.thomsonone.com

2

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Emerging Markets M&A

Jan 1 Sep 28

Any Emerging Markets Involvement Announced

Financial Advisor

Goldman Sachs & Co

JP Morgan

Credit Suisse

Morgan Stanley

Deutsche Bank

Citi

Bank of America Merrill Lynch

UBS

Barclays

Lazard

Rothschild

BMO Capital Markets

HSBC Holdings PLC

China International Capital Co

Itau Unibanco

RBC Capital Markets

DBS Group Holdings

Banco BTG Pactual SA

Sberbank

Banco Bradesco SA

Santander

United Overseas Bank Ltd

Standard Chartered PLC

Allen & Co Inc

Somerley Ltd

Industry Total

Rank Value per Advisor (US$m)

2012 2011

Rank Value Market

Market

Rank Rank

US$m Sh (%) Share Ch.

1

1

97,959.8

21.1

5.9

2

5

79,685.5

17.1

8.8

3

3

73,666.1

15.8

5.0

4

2

69,174.9

14.9

3.2

5

8

67,732.0

14.6

7.7

6

6

67,594.9

14.5

7.5

7

4

59,103.1

12.7

4.0

8

10

56,637.2

12.2

6.3

9

16

48,046.3

10.3

7.0

10

17

34,086.0

7.3

4.7

11

7

27,172.3

5.8

-1.2

12

34

23,531.1

5.1

4.0

13

11

22,854.6

4.9

-0.2

14

27

22,623.9

4.9

3.4

15

12

20,160.9

4.3

-0.4

16

59

18,883.9

4.1

3.7

17

82

16,918.8

3.6

3.3

18

14

15,654.7

3.4

-0.4

19

26

14,710.5

3.2

1.7

20

20

10,298.7

2.2

-0.2

21

15

9,812.0

2.1

-1.5

22

9,219.3

2.0

2.0

23

29

8,965.0

1.9

0.6

24

8,510.3

1.8

1.8

25

50

7,595.1

1.6

1.0

465,135.5

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-7.1%

-18.2%

Jan 1 Sep 28

Any Emerging Markets Involvement Completed

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

85

0.9 +1

59

0.6

-9

79

0.8

-4

63

0.6 +5

45

0.5

-6

64

0.7

-2

34

0.3 -17

43

0.4

-4

27

0.3 +7

32

0.3 +7

49

0.5 -18

3

0.0

-7

33

0.3

-1

20

0.2

-4

54

0.6 +16

10

0.1 +2

8

0.1

-1

67

0.7 +31

22

0.2 +5

25

0.3 +3

13

0.1 -12

1

0.0 +1

11

0.1

-1

5

0.1 +5

12

0.1

-2

9,733

-1,645

Financial Advisor

Credit Suisse

Goldman Sachs & Co

Deutsche Bank

UBS

JP Morgan

Citi

Bank of America Merrill Lynch

Rothschild

Barclays

Banco BTG Pactual SA

Morgan Stanley

Itau Unibanco

HSBC Holdings PLC

Banco Bradesco SA

Lazard

Sberbank

Standard Chartered PLC

BNP Paribas SA

China International Capital Co

Nomura

Societe Generale

Banco Espirito Santo SA

Allen & Co Inc

Malayan Banking Bhd

Santander

Industry Total

-14.5%

-5.4%

Rank Value per Advisor (US$m)

2012 2011

Rank Value Market

Market

Rank Rank

US$m Sh (%) Share Ch.

1

4

63,787.7

20.3

8.7

2

2

58,458.0

18.6

-0.1

3

7

44,303.7

14.1

6.3

4

8

42,927.3

13.6

6.1

5

3

39,508.2

12.6

0.7

6

6

34,034.6

10.8

2.3

7

5

31,699.7

10.1

-0.7

8

10

29,098.7

9.2

2.7

9

21

28,326.6

9.0

6.7

10

15

27,871.6

8.9

4.9

11

1

23,678.9

7.5

-13.7

12

14

23,470.5

7.5

3.1

13

11

20,321.6

6.5

0.0 14

53

19,741.4

6.3

5.5

15

16

16,196.9

5.1

1.5

16

31

15,132.7

4.8

3.5

17

44

13,599.0

4.3

3.3

18

20

12,883.4

4.1

1.3

19

22

11,659.4

3.7

1.4

20

17

10,469.0

3.3

-0.2

21

78

10,039.3

3.2

2.8

22

36

8,166.6

2.6

1.5

23

8,091.3

2.6

2.6

24

66

7,826.3

2.5

2.0

25

12

7,783.3

2.5

-2.6

314,857.4

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-28.8%

-30.9%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

57

0.9 -18

64

1.0 -11

45

0.7

-1

36

0.6 -19

45

0.7 -24

39

0.6 -17

33

0.5 -15

42

0.7 -22

18

0.3 +3

47

0.8 +15

29

0.5 -56

25

0.4

-3

27

0.4

-6

14

0.2 +3

31

0.5 +3

17

0.3 +3

10

0.2

-6

12

0.2

-9

12

0.2

-5

6

0.1 -23

13

0.2 +7

8

0.1

-4

3

0.0 +3

20

0.3 +11

8

0.1 -19

6,119

-1,334

-17.9%

-11.2%

-34.6%

-27.6%

Emerging Markets Involvement Announced M&A by Target Industry ($bil)

9.9%

11.4%

Jan 1 - Sep 28 2012

9.8%

7.5%

5.6%

12.4%

15.7%

$71.8

Energy and Power

Materials

Consumer Staples

Financials

Telecommunications

Industrials

High Technology

Media and Entertainment

Healthcare

Retail

17.1%

$77.9

3.6% Real Estate

3.2%

1.9%

Consumer Products and Services

2.8%

Any Emerging Markets Involvement Announced - Top Deals

Rank Date

6/29/2012

8/22/2012

7/23/2012

9/13/2012

5/20/2012

2/7/2012

6/28/2012

4/24/2012

4/2/2012

2/6/2012

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

134.4

4.6

0.6

167.6

5.7

0.5

106.3

3.6

1.3

95.0

3.2

0.1

126.6

4.3

0.7

88.3

3.0

0.5

92.2

3.1

0.1

84.0

2.9

0.4

58.5

2.0

1.1

85.3

2.9

1.2

78.7

2.7

3.0

34.5

1.2

0.2

52.0

1.8

0.0 31.1

1.1

0.4

79.4

2.7

1.2

15.0

0.5

0.0 38.1

1.3

0.9

26.8

0.9

0.2

6.5

0.2

0.2

35.3

1.2

0.3

25.9

0.9

0.7

7.6

0.3

0.1

7.1

0.2

0.2

24.9

0.9

0.7

18.2

0.6

0.9

2,934.9

100.0

Date Effective

Pending

Pending

Pending

Pending

9/18/2012

Pending

Pending

4/24/2012

Pending

Pending

Target (% Sought/Acquired)

Grupo Modelo SAB de CV

China Telecom Corp-3G Assets

Nexen Inc

Fraser & Neave Ltd

Alibaba Group Holding Ltd

Redecard SA

Progress Energy Resources Corp

MegaFon

Bank Danamon Tbk PT

Infraero-Guarulhos Concession

Jan 1 - Sep 28 2012

Acquiror

Anheuser-Busch Inbev

China Telecom Corp Ltd

CNOOC Canada Holding Ltd

TCC Assets Ltd

Alibaba Group Holding Ltd

Banestado Participacoes

Petronas Carigali Canada Ltd

Investor Group

DBS Group Holdings Ltd

Undisclosed SPV

Acquiror / Target Nation

Belgium / Mexico

China / China

Canada / Canada

British Virgin / Singapore

China / China

Brazil / Brazil

Canada / Canada

Cyprus / Russian Fed

Singapore / Indonesia

Brazil / Brazil

Rank Value (US$m)

20,093.4

18,047.3

17,665.6

9,219.3

7,100.0

6,821.7

5,865.5

5,200.0

4,970.5

4,789.8

Target Macro / Mid Industry

Consumer Staples / Food and Beverage

Telecommunications / Wireless

Energy and Power / Oil & Gas

Consumer Staples / Food and Beverage

Consumer Products and Services / Professional Services

High Technology / Computers & Peripherals

Energy and Power / Oil & Gas

Telecommunications / Wireless

Financials / Banks

Industrials / Transportation & Infrastructure

https://www.thomsonone.com

3

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

BRIC M&A

Jan 1 Sep 28

Any BRIC Involvement Announced

Rank Value per Advisor (US$m)

2012 2011

Rank Value Market

Market

Rank Rank

US$m Sh (%) Share Ch.

1

1

62,660.5

22.4

9.8

2

3

52,343.7

18.7

8.4

3

14

48,941.8

17.5

13.1

4

16

35,402.1

12.7

8.5

5

4

34,161.5

12.2

4.6

6

11

27,048.6

9.7

4.7

7

21

22,623.9

8.1

5.6

8

9

21,194.7

7.6

1.6

9

5

19,107.5

6.8

-0.6

10

6

18,179.3

6.5

-0.8

11

69

18,073.1

6.5

6.1

12

31

17,665.6

6.3

4.9

13

2

16,338.4

5.8

-6.6

14

12

14,859.9

5.3

0.3

15

20

14,563.5

5.2

2.6

16

7

14,480.6

5.2

-1.4

17

8

12,780.4

4.6

-1.7

18

15

10,298.7

3.7

-0.5

19

17

8,432.4

3.0

-0.7

20

8,091.3

2.9

2.9

21

47

7,595.1

2.7

2.0

22

39

7,155.0

2.6

1.8

23

13

6,948.8

2.5

-2.1

24

103

5,869.8

2.1

2.0

25

35

5,596.0

2.0

1.1

279,557.1

100.0

Financial Advisor

Goldman Sachs & Co

Credit Suisse

Citi

UBS

JP Morgan

Deutsche Bank

China International Capital Co

Rothschild

Itau Unibanco

Bank of America Merrill Lynch

RBC Capital Markets

BMO Capital Markets

Morgan Stanley

Barclays

Sberbank

Banco BTG Pactual SA

HSBC Holdings PLC

Banco Bradesco SA

Lazard

Allen & Co Inc

Somerley Ltd

BR Partners

Santander

Grant Thornton

KPMG

Industry Total

-4.0%

4.5%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

Jan 1 Sep 28

Any BRIC Involvement Completed

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

42

0.7

-2

47

0.8 +1

35

0.6 +10

19

0.3

-7

32

0.6

-1

25

0.4

-5

20

0.4

-4

30

0.5 +6

51

0.9 +21

14

0.2

-9

3

0.1

0

1

0.0

-5

37

0.6

0

14

0.2 +1

19

0.3 +3

64

1.1 +28

15

0.3

-6

25

0.4 +3

17

0.3 +4

2

0.0 +2

12

0.2 +2

9

0.2

-2

10

0.2

-4

5

0.1 +3

21

0.4

0

5,697

-1,015

Financial Advisor

Credit Suisse

Deutsche Bank

Goldman Sachs & Co

JP Morgan

Banco BTG Pactual SA

Bank of America Merrill Lynch

UBS

Citi

Itau Unibanco

Barclays

Rothschild

Banco Bradesco SA

Sberbank

HSBC Holdings PLC

China International Capital Co

Lazard

BNP Paribas SA

Banco Espirito Santo SA

Allen & Co Inc

Morgan Stanley

Societe Generale

CITIC

Santander

VTB Capital

BBVA

Industry Total

-15.1%

-10.6%

Rank Value per Advisor (US$m)

2012 2011

Rank Value Market

Market

Rank Rank

US$m Sh (%) Share Ch.

1

3

48,159.5

25.0

12.1

2

15

36,099.7

18.7

14.2

3

2

32,235.3

16.7

-2.8

4

6

27,508.8

14.3

4.4

5

11

26,697.5

13.9

7.3

6

5

25,603.6

13.3

2.4

7

8

25,389.8

13.2

5.9

8

7

23,431.3

12.2

4.2

9

12

23,275.5

12.1

5.5

10

19

21,266.7

11.0

8.0

11

13

21,179.0

11.0

4.8

12

39

19,741.4

10.3

9.0

13

24

15,132.7

7.9

5.7

14

10

12,050.8

6.3

-0.7

15

16

11,659.4

6.1

2.3

16

20

9,178.3

4.8

1.9

17

132

8,972.7

4.7

4.7

18

30

8,121.6

4.2

2.4

19

8,091.3

4.2

4.2

20

1

8,081.5

4.2

-19.5

21

59

8,055.6

4.2

3.6

22

22

7,317.8

3.8

1.4

23

14

6,609.1

3.4

-1.1

24

4

5,797.9

3.0

-7.9

25

5,431.6

2.8

2.8

192,650.4

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-28.5%

-41.1%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

33

1.0

-9

31

0.9 +10

36

1.1

-5

25

0.7

-6

45

1.3 +13

16

0.5 -10

13

0.4 -14

20

0.6

-5

23

0.7 +3

11

0.3 +1

24

0.7

-5

14

0.4 +3

16

0.5 +3

13

0.4

-6

12

0.4

-5

13

0.4 +4

6

0.2

0

5

0.1

-7

2

0.1 +33

13

0.4 -41

10

0.3 +5

17

0.5 +11

7

0.2

-7

8

0.2 -11

3

0.1 +33

3,421

-737

-17.7%

-19.3%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

79.8

5.5

0.1

71.7

5.0

3.6

89.9

6.2

0.4

55.9

3.9

0.2

81.0

5.6

2.3

50.4

3.5

0.1

40.4

2.8

0.8

47.3

3.3

0.1

32.0

2.2

0.1

38.7

2.7

1.8

47.6

3.3

0.7

31.1

2.2

0.9

14.8

1.0

0.1

21.5

1.5

0.5

6.5

0.5

0.2

34.9

2.4

1.3

14.8

1.0

0.6

5.8

0.4

0.0 6.6

0.5

0.5

42.7

3.0

4.2

24.8

1.7

1.4

13.0

0.9

0.8

11.1

0.8

1.0

21.1

1.5

0.4

9.9

0.7

0.7

1,444.3

100.0

-39.2%

-38.3%

BRIC Involvement Announced M&A by Target Industry ($bil)

Jan 1 - Sep 28 2012

11734.1

4%

6%

8%

6%

5%

12%

12%

$32.1

18%

$48.6

13490.9

5%

3625.1

1%

9283

3%

20%

$54.6

Energy and Power

Materials

Industrials

Telecommunications

Financials

High Technology

Real Estate

Consumer Staples

Consumer Products and Services

Media and Entertainment

Healthcare

Retail

Any BRIC Involvement Announced - Top Deals

Rank Date

8/22/2012

7/23/2012

5/20/2012

2/7/2012

4/24/2012

2/6/2012

3/30/2012

2/25/2012

6/8/2012

4/24/2012

Date Effective

Pending

Pending

9/18/2012

Pending

4/24/2012

Pending

6/19/2012

Pending

8/28/2012

4/24/2012

Target (% Sought/Acquired)

China Telecom Corp-3G Assets (100%)

Nexen Inc (100%)

Alibaba Group Holding Ltd (20%)

Redecard SA (50%)

MegaFon (25.1%)

Infraero-Guarulhos Concession (51%)

CIMPOR Cimentos de Portugal (40.34%)

Sterlite Industries(India)Ltd (100%)

Denizbank AS (99.85%)

Telekominvest (26.06%)

Jan 1 - Sep 28 2012

Acquiror

China Telecom Corp Ltd

CNOOC Canada Holding Ltd

Alibaba Group Holding Ltd

Banestado Participacoes

Investor Group

Undisclosed SPV

InterCement Austria Holding

Sesa Goa Ltd

Sberbank Rossii

AF Telecom Holding

Acquiror / Target Nation

China / China

Canada / Canada

China / China

Brazil / Brazil

Cyprus / Russian Fed

Brazil / Brazil

Austria / Portugal

India / India

Russian Fed / Turkey

Cyprus / Russian Fed

Rank Value (US$m)

18,047.3

17,665.6

7,100.0

6,821.7

5,200.0

4,789.8

4,096.8

3,910.8

3,550.9

3,292.4

Target Macro / Mid Industry

Telecommunications / Wireless

Energy and Power / Oil & Gas

Consumer Products and Services / Professional Services

High Technology / Computers & Peripherals

Telecommunications / Wireless

Industrials / Transportation & Infrastructure

Materials / Construction Materials

Materials / Metals & Mining

Financials / Banks

Telecommunications / Wireless

https://www.thomsonone.com

4

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Latin American M&A

Jan 1 Sep 28

Any Latin American Inv Announced (AD38)

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

17

37,235.9

34.3

29.4

2

9

30,941.3

28.5

18.7

3

16

28,321.2

26.1

20.8

4

13

26,969.1

24.8

17.8

5

12

24,190.2

22.3

15.2

6

10

23,093.9

21.3

11.6

7

3

21,738.6

20.0

2.4

8

2

20,852.0

19.2

1.5

9

1

20,160.9

18.6

-1.1

10

5

17,888.1

16.5

2.3

11

4

15,654.7

14.4

-1.6

12

11

15,195.1

14.0

4.9

13

7

10,298.7

9.5

-0.7

14

6

8,386.8

7.7

-5.3

15

21

7,155.0

6.6

4.7

16

15

5,705.7

5.3

-0.2

17

8

4,789.8

4.4

-5.4

18

35

4,455.3

4.1

3.5

19

29

3,380.1

3.1

2.3

20

2,087.8

1.9

1.9

21

14

1,638.8

1.5

-5.4

22

1,324.7

1.2

1.2

23

28

1,061.5

1.0

0.2

24

38

1,007.6

0.9

0.5

25

925.5

0.9

0.9

108,562.9

100.0

Financial Advisor

JP Morgan

Bank of America Merrill Lynch

Lazard

Deutsche Bank

Barclays

Morgan Stanley

Credit Suisse

Goldman Sachs & Co

Itau Unibanco

Citi

Banco BTG Pactual SA

Rothschild

Banco Bradesco SA

Santander

BR Partners

UBS

BNP Paribas SA

Banco Espirito Santo SA

RBS

Societe Generale

HSBC Holdings PLC

Evercore Partners

Mediobanca

BBVA

Bansud Capital

Industry Total

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-9.3%

-67.3%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

17

1.3

-4

13

1.0 +3

13

1.0 +6

10

0.7

0

2

0.1

-4

14

1.0

-2

36

2.7

0

22

1.6

-4

54

4.0 +17

17

1.3

-7

67

5.0 +31

23

1.7 +7

25

1.9 +3

11

0.8 -13

9

0.7

-2

9

0.7 +1

4

0.3 -10

8

0.6

-2

1

0.1

-2

2

0.1 +2

7

0.5 +1

6

0.4 +6

2

0.1

0

5

0.4 +2

1

0.1 +1

1,340

-172

-11.4%

-12.5%

Jan 1 Sep 28

Any Latin American Involvement Completed (AF45)

Financial Advisor

Banco BTG Pactual SA

Itau Unibanco

Bank of America Merrill Lynch

Banco Bradesco SA

Credit Suisse

JP Morgan

Barclays

Rothschild

Citi

UBS

Goldman Sachs & Co

BNP Paribas SA

Lazard

Santander

Societe Generale

BBVA

Deutsche Bank

Banco Espirito Santo SA

Houlihan Lokey

Banco Votorantim

Evercore Partners

Morgan Stanley

Virtus BR Partners

Wells Fargo & Co

Stephens Inc

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

4

27,871.6

38.4

22.5

2

3

23,470.5

32.3

14.8

3

9

21,003.0

28.9

20.6

4

20

19,741.4

27.2

24.2

5

2

19,623.2

27.0

8.4

6

11

17,688.6

24.3

16.8

7

19

11,389.5

15.7

12.2

8

10

11,198.8

15.4

7.6

9

5

10,323.7

14.2

-0.4

10

12

10,126.2

13.9

6.7

11

1

9,207.7

12.7

-6.5

12

47

9,043.4

12.4

12.2

13

13

7,992.0

11.0

4.7

14

6

7,783.3

10.7

-1.9

15

34*

6,624.0

9.1

8.4

16

41

6,222.6

8.6

8.2

17

17

4,176.9

5.8

1.6

18

15

4,141.8

5.7

1.3

19

1,531.7

2.1

2.1

20

29

1,316.7

1.8

0.5

21

24

1,294.2

1.8

0.2

22

8

743.6

1.0

-7.9

23

720.6

1.0

1.0

24*

655.6

0.9

0.9

24*

655.6

0.9

0.9

72,668.3

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-35.4%

-60.8%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

47

5.2 +15

25

2.8

-3

12

1.3 +2

14

1.6 +3

21

2.3 -15

16

1.8

-1

3

0.3

0

13

1.4

-6

10

1.1 -10

7

0.8

-4

14

1.6 -18

5

0.6 +1

10

1.1

-2

7

0.8 -17

2

0.2 +1

7

0.8 +4

6

0.7 +1

4

0.4

-8

2

0.2 +2

1

0.1

-5

5

0.6 +2

2

0.2 -15

5

0.6 +5

1

0.1 +1

1

0.1 +1

902

-200

-18.1%

-9.2%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

85.3

10.2

4.5

34.5

4.1

0.6

37.3

4.5

2.3

31.1

3.7

1.4

55.8

6.7

2.2

43.2

5.2

0.5

4.9

0.6

0.7

28.6

3.4

0.6

16.4

2.0

3.2

25.1

3.0

0.0 47.4

5.7

0.3

10.8

1.3

0.9

37.7

4.5

2.0

14.4

1.7

2.3

17.3

2.1

2.1

15.6

1.9

1.6

27.9

3.3

2.0

2.9

0.4

0.3

10.4

1.3

1.3

6.0

0.7

0.1

8.7

1.0

0.8

4.8

0.6

2.6

7.5

0.9

0.9

6.5

0.8

0.8

4.8

0.6

0.6

834.4

100.0

-39.3%

-37.9%

* tie * tie

Latin American Involvement Announced M&A by Target Industry ($bil)

2302.3

2.1%

7.3%

4.6%

3506

1555.8

3.2%

1.4%

1129.4

1.0%

24.1%

$25.9

3.5%

7.5%

12.7%

$13.6

Jan 1 - Sep 28 2012

16.1%

$17.3

16.4%

$17.6

Consumer Staples

Materials

Industrials

Energy and Power

High Technology

Financials

Telecommunications

Real Estate

Retail

Consumer Products and Services

Healthcare

Media and Entertainment

Any Latin American Inv Announced (AD38) - Top Deals

Rank Date

6/29/2012

2/7/2012

2/6/2012

3/30/2012

5/8/2012

3/26/2012

4/24/2012

8/22/2012

5/3/2012

6/7/2012

Date Effective

Pending

Pending

Pending

6/19/2012

Pending

4/24/2012

4/27/2012

8/23/2012

Pending

Intended

Target (% Sought/Acquired)

Grupo Modelo SAB de CV (49.7%)

Redecard SA (50%)

Infraero-Guarulhos Concession (51%)

CIMPOR Cimentos de Portugal (40.34%)

Koninklijke KPN NV (22.7%)

Centennial Asset Brazilian (5.63%)

Participes en Brasil SL (100%)

Anglo American Sur SA (24.5%)

Cia de Gas de Sao Paulo Comgas (60.1%)

Promigas SA ESP (75%)

Jan 1 - Sep 28 2012

Acquiror

Anheuser-Busch Inbev

Banestado Participacoes

Undisclosed SPV

InterCement Austria Holding

AMOV Europa BV

Mubadala Development Co PJSC

Investor Group

Inversiones Mineras Acrux SpA

Provence Participacoes SA

Corficolombiana

Acquiror / Target Nation

Belgium / Mexico

Brazil / Brazil

Brazil / Brazil

Austria / Portugal

Netherlands / Netherlands

Utd Arab Em / Brazil

Spain / Brazil

Chile / Chile

Brazil / Brazil

Colombia / Colombia

Rank Value (US$m)

20,093.4

6,821.7

4,789.8

4,096.8

3,380.1

2,000.0

1,824.0

1,800.0

1,781.8

1,680.4

Target Macro / Mid Industry

Consumer Staples / Food and Beverage

High Technology / Computers & Peripherals

Industrials / Transportation & Infrastructure

Materials / Construction Materials

Telecommunications / Telecommunications Services

Materials / Metals & Mining

Industrials / Building/Construction & Engineering

Materials / Metals & Mining

Energy and Power / Oil & Gas

Energy and Power / Oil & Gas

https://www.thomsonone.com

5

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Brazilian M&A

Jan 1 Sep 28

Any Brazilian Involvement Announced (AD44)

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

4

19,314.5

35.8

12.1

2

1

19,107.5

35.4

-0.8

3

11

16,271.2

30.1

17.1

4

2

14,480.6

26.8

-5.2

5

17

11,789.5

21.8

17.5

6

3

10,777.4

20.0

-6.2

7

6

10,298.7

19.1

-1.4

8

9

10,206.1

18.9

3.9

9

8

9,715.3

18.0

2.5

10

19

7,155.0

13.3

9.5

11

5

6,948.8

12.9

-9.3

12

13

6,456.0

12.0

1.5

13

7

4,789.8

8.9

-6.9

14

25

4,410.3

8.2

7.1

15

12

4,096.8

7.6

-4.9

16

10

2,933.5

5.4

-8.3

17

1,824.0

3.4

3.4

18

16

1,630.7

3.0

-3.1

19

20

1,318.5

2.4

-1.0

20

24

942.8

1.8

0.2

21

864.3

1.6

1.6

22*

631.6

1.2

1.2

22*

44

631.6

1.2

1.2

24

479.6

0.9

0.9

25

437.6

0.8

0.8

53,989.3

100.0

Financial Advisor

Credit Suisse

Itau Unibanco

Citi

Banco BTG Pactual SA

JP Morgan

Goldman Sachs & Co

Banco Bradesco SA

Rothschild

Bank of America Merrill Lynch

BR Partners

Santander

Lazard

BNP Paribas SA

Banco Espirito Santo SA

Barclays

Deutsche Bank

Societe Generale

Morgan Stanley

UBS

Mediobanca

Virtus BR Partners

Ernst & Young LLP

BBVA

Credit Agricole CIB

China International Capital Co

Industry Total

-9.6%

-52.1%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

Jan 1 Sep 28

Any Brazilian Involvement Completed (AF51)

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

30

5.0 +10

51

8.6 +21

8

1.3 +1

64

10.7 +28

11

1.8 +3

8

1.3

-8

25

4.2 +3

14

2.3 +6

8

1.3 +3

9

1.5

-2

9

1.5

-5

6

1.0 +4

2

0.3

-7

7

1.2

-3

1

0.2

-2

7

1.2

-2

1

0.2 +1

10

1.7

-1

4

0.7 +2

1

0.2

-1

6

1.0 +6

1

0.2 +1

2

0.3 +1

1

0.2 +1

3

0.5 +3

596

+38

Financial Advisor

Banco BTG Pactual SA

Itau Unibanco

Banco Bradesco SA

Bank of America Merrill Lynch

JP Morgan

Credit Suisse

Barclays

Citi

BNP Paribas SA

Rothschild

Societe Generale

Santander

UBS

BBVA

Lazard

Deutsche Bank

Banco Espirito Santo SA

Goldman Sachs & Co

Banco Votorantim

Houlihan Lokey

Virtus BR Partners

Ernst & Young LLP

Banco Modal

BR Partners

Morgan Stanley

Industry Total

6.8%

-38.7%

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

1

26,697.5

54.8

28.3

2

2

23,275.5

47.8

21.5

3

19

19,741.4

40.5

35.4

4

7

19,199.4

39.4

27.4

5

13

16,440.3

33.7

25.2

6

4

16,118.8

33.1

13.4

7

11,389.5

23.4

23.4

8

6

9,715.5

19.9

2.0

9

45*

7,752.3

15.9

15.9

10

9

7,513.1

15.4

4.6

11

27*

6,624.0

13.6

12.5

12

5

6,609.1

13.6

-4.5

13

12

6,159.9

12.6

4.0

14

5,431.6

11.1

11.1

15

10

5,352.2

11.0

1.7

16

18

4,176.9

8.6

1.9

17

15

4,096.8

8.4

1.0

18

3

4,053.6

8.3

-13.4

19*

24

1,316.7

2.7

0.6

19*

1,316.7

2.7

2.7

21

720.6

1.5

1.5

22

631.6

1.3

1.3

23

335.4

0.7

0.7

24

17

255.4

0.5

-6.4

25

8

238.6

0.5

-10.6

48,740.6

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-27.5%

-81.4%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

45

11.4 +13

23

5.8 +3

14

3.5 +3

8

2.0 +1

11

2.8 +5

15

3.8

-3

3

0.8 +3

6

1.5

-1

4

1.0 +3

7

1.8

-5

2

0.5 +1

6

1.5

-8

3

0.8

0

3

0.8 +3

4

1.0 +2

6

1.5 +2

3

0.8

-9

7

1.8

-8

1

0.3

-5

1

0.3 +1

5

1.3 +5

1

0.3 +1

2

0.5 +2

7

1.8

-6

1

0.3 -11

395

-22

-5.3%

-26.8%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

81.0

15.5

6.3

32.0

6.1

0.3

31.1

6.0

2.3

25.6

4.9

2.8

31.6

6.1

1.5

36.9

7.1

1.1

4.9

0.9

0.9

9.5

1.8

2.7

6.6

1.3

1.1

13.2

2.5

0.1

17.3

3.3

3.3

10.6

2.0

3.1

11.9

2.3

0.1

9.9

1.9

1.9

12.8

2.5

0.9

18.1

3.5

1.7

2.1

0.4

0.7

27.6

5.3

0.6

6.0

1.2

0.2

7

1.3

1.3

8

1.4

1.4

.3

0.1

0.1

3.9

0.7

0.7

6.6

1.3

1.4

2.8

0.5

2.4

521.1

100.0

-38.5%

-63.6%

* tie

Brazil Involvement Announced M&A by Target Industry ($bil)

Jan 1 - Sep 28 2012

1%

1%

4%

6%

1%

1%

4%

25%

$13.6

8%

15%

$7.9

16%

$8.7

18%

$9.6

Industrials

Materials

Energy and Power

High Technology

Consumer Staples

Financials

Real Estate

Consumer Products and Services

Retail

Healthcare

Telecommunications

Media and Entertainment

Any Brazilian Involvement Announced (AD44) - Top Deals

Rank Date

2/7/2012

2/6/2012

3/30/2012

3/26/2012

4/24/2012

5/3/2012

2/6/2012

9/4/2012

2/6/2012

4/16/2012

Date Effective

Pending

Pending

6/19/2012

4/24/2012

4/27/2012

Pending

Pending

Pending

Pending

5/11/2012

Target (% Sought/Acquired)

Redecard SA (50%)

Infraero-Guarulhos Concession (51%)

CIMPOR Cimentos de Portugal (40.34%)

Centennial Asset Brazilian (5.63%)

Participes en Brasil SL (100%)

Cia de Gas de Sao Paulo Comgas (60.1%)

Infraero-Brasilia Concession (51%)

CELPA (61.4%)

Infraero-Campinas Airport (51%)

Cerveceria Nacional Dominicana (41.76%)

Jan 1 - Sep 28 2012

Acquiror

Banestado Participacoes

Undisclosed SPV

InterCement Austria Holding

Mubadala Development Co PJSC

Investor Group

Provence Participacoes SA

Investor Group

Equatorial Energia SA

Investor Group

AmBev Brasil Bebidas SA

Acquiror / Target Nation

Brazil / Brazil

Brazil / Brazil

Austria / Portugal

Utd Arab Em / Brazil

Spain / Brazil

Brazil / Brazil

Brazil / Brazil

Brazil / Brazil

Brazil / Brazil

Brazil / Dominican Rep

Rank Value (US$m)

6,821.7

4,789.8

4,096.8

2,000.0

1,824.0

1,781.8

1,332.4

1,138.7

1,128.8

1,000.0

Target Macro / Mid Industry

High Technology / Computers & Peripherals

Industrials / Transportation & Infrastructure

Materials / Construction Materials

Materials / Metals & Mining

Industrials / Building/Construction & Engineering

Energy and Power / Oil & Gas

Industrials / Transportation & Infrastructure

Energy and Power / Power

Industrials / Transportation & Infrastructure

Consumer Staples / Food and Beverage

https://www.thomsonone.com

6

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Middle Eastern & North African M&A

Jan 1 Sep 28

Any Mid East & N African Inv Announced (AD53)

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

2

7,704.8

21.7

-2.5

2

4,804.7

13.5

13.5

3

5

4,776.3

13.4

-1.8

4

8

4,566.3

12.9

4.3

5

19

4,146.1

11.7

10.6

6

30*

3,499.9

9.9

9.5

7

7

2,503.9

7.1

-3.9

8

9

2,475.2

7.0

-1.3

9

2,204.8

6.2

6.2

10

29

2,002.8

5.6

5.2

11

2,000.0

5.6

5.6

12*

1,932.4

5.4

5.4

12*

1,932.4

5.4

5.4

12*

47

1,932.4

5.4

5.4

15

3

1,566.6

4.4

-17.8

16

1,237.3

3.5

3.5

17

1,206.6

3.4

3.4

18

15

987.3

2.8

0.6

19

18

955.8

2.7

1.1

20

6

781.6

2.2

-12.5

21

685.9

1.9

1.9

22*

485.0

1.4

1.4

22*

42

485.0

1.4

1.3

24

460.0

1.3

1.3

25

434.9

1.2

1.2

35,527.6

100.0

Financial Advisor

Goldman Sachs & Co

Barclays

Credit Suisse

Citi

HSBC Holdings PLC

Lazard

JP Morgan

Morgan Stanley

National Bank of Kuwait SAK

PricewaterhouseCoopers

Itau Unibanco

Beltone Investment Banking

Cairo Financial Investments Co

Societe Generale

Bank of America Merrill Lynch

EFG Hermes

JP Morgan Saudi Arabia Co

Nomura

UBS

Deutsche Bank

Credit Agricole CIB

Robert A. Stanger & Co

Evercore Partners

Emirates Investment Bank PJSC

Protiviti Inc

Industry Total

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-19.7%

-0.4%

Jan 1 Sep 28

Any Middle Eastern & North African Inv Completed (AF60)

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

12

1.6 +2

7

0.9 +7

6

0.8

0

7

0.9 +2

5

0.7

0

6

0.8 +4

9

1.2 +4

5

0.7 +1

1

0.1 +1

4

0.5

-6

1

0.1 +1

1

0.1 +1

1

0.1 +1

1

0.1

0

3

0.4

-4

2

0.3 +2

1

0.1 +1

1

0.1

-2

2

0.3

0

3

0.4

0

1

0.1 +1

1

0.1 +1

2

0.3

0

1

0.1 +1

1

0.1 +1

748

+120

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

1

4,414.6

21.0

-11.2

2

6

4,251.2

20.2

6.6

3

20

3,306.3

15.7

13.3

4

13

2,901.2

13.8

8.7

5

15

2,714.0

12.9

9.2

6

4

2,253.9

10.7

-4.8

7

2,000.0

9.5

9.5

8*

1,932.4

9.2

9.2

8*

1,932.4

9.2

9.2

8*

1,932.4

9.2

9.2

11

8

1,361.8

6.5

-3.0

12

5

1,046.5

5.0

-9.8

13

32*

1,015.4

4.8

4.5

14

10

980.0

4.7

-2.6

15

7

955.8

4.5

-5.2

16

9

781.6

3.7

-3.9

17

575.9

2.7

2.7

18

34

524.7

2.5

2.4

19

434.9

2.1

2.1

20

2

418.0

2.0

-27.9

21*

300.0

1.4

1.4

21*

300.0

1.4

1.4

23

3

269.6

1.3

-19.0

24

250.0

1.2

1.2

25

18

215.0

1.0

-1.4

21,041.2

100.0

Financial Advisor

Goldman Sachs & Co

Citi

Credit Suisse

HSBC Holdings PLC

Lazard

JP Morgan

Itau Unibanco

Beltone Investment Banking

Cairo Financial Investments Co

Societe Generale

Bank of America Merrill Lynch

Morgan Stanley

PricewaterhouseCoopers

RBS

UBS

Deutsche Bank

Barclays

Jefferies & Co Inc

Protiviti Inc

BNP Paribas SA

Piper Jaffray Cos

Robert W Baird & Co Inc

BBVA

Moelis & Co

Rothschild

Industry Total

19.1%

-4.2%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-42.5%

-59.0%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

7

1.5

-1

5

1.0

0

5

1.0 +1

4

0.8

0

6

1.2 +3

6

1.2

-2

1

0.2 +1

1

0.2 +1

1

0.2 +1

1

0.2 +1

6

1.2

-1

4

0.8

-2

3

0.6

-4

4

0.8 +2

3

0.6

-2

4

0.8 +1

2

0.4 +2

3

0.6 +2

1

0.2 +1

2

0.4

-2

1

0.2 +1

1

0.2 +1

1

0.2

-1

1

0.2 +1

5

1.0 +3

482

+21

4.6%

-17.2%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

14.5

5.0

0.4

9.1

3.2

1.7

6.8

2.4

0.9

10.7

3.7

2.6

6.4

2.2

1.0

20.7

7.2

0.0 2.1

0.7

0.7

.9

0.3

0.3

1.4

0.5

0.5

.9

0.3

0.3

10.3

3.6

0.1

5.3

1.8

2.5

1.1

0.4

0.1

12.6

4.4

2.2

4

1.4

0.6

3

0.9

1.0

5

1.8

1.8

8

2.8

2.6

1

0.2

0.2

5

1.6

2.0

2

0.8

0.8

4.7

1.6

1.6

3.1

1.1

0.3

1.2

0.4

0.4

5.7

2.0

0.0 288.0

100.0

-29.7%

-40.0%

* tie

Middle Eastern & N African Involvement Announced M&A by Target Industry ($bil)

Jan 1 - Sep 28 2012

1% 1%

5%

4%

4%

4%

19%

$6.9

7%

10%

11%

$3.7

16%

$5.6

18%

$6.2

Telecommunications

Real Estate

Financials

Energy and Power

Industrials

Materials

Consumer Staples

Media and Entertainment

Retail

Healthcare

High Technology

Consumer Products and Services

Any Mid East & N African Inv Announced (AD53) - Top Deals

Rank Date

8/16/2012

3/26/2012

2/13/2012

6/5/2012

1/10/2012

8/17/2012

6/27/2012

9/10/2012

3/28/2012

3/7/2012

Date Effective

Intended

4/24/2012

5/27/2012

Pending

6/21/2012

Pending

Pending

Pending

Pending

Pending

Target (% Sought/Acquired)

Wataniya (47.5%)

Centennial Asset Brazilian (5.63%)

Egyptian Co for Mobile Svcs (93.92%)

Asiacell Telecommunication LLC (30%)

EDT Ret Trt-Shopping Centres (100%)

FGP Topco Ltd (20%)

Vela International Marine Ltd (100%)

Transocean Ltd-Water Rigs(38) (100%)

Damas International Ltd (100%)

Migdal Ins & Finl Hldg Ltd (69.1%)

Jan 1 - Sep 28 2012

Acquiror

Qtel

Mubadala Development Co PJSC

MT Telecom SCRL

Qtel

BRE DDR Retail Holdings LLC

Qatar Holding LLC

National Shipping Co of Saudi

Shelf Drilling Intl Hldg Ltd

Golden Investments Co Ltd

Eliahu Insurance Co Ltd

Acquiror / Target Nation

Qatar / Kuwait

Utd Arab Em / Brazil

Belgium / Egypt

Qatar / Iraq

United States / United States

Qatar / United Kingdom

Saudi Arabia / Utd Arab Em

Utd Arab Em / India

Utd Arab Em / Utd Arab Em

Israel / Israel

Rank Value (US$m)

2,204.8

2,000.0

1,932.4

1,470.0

1,428.0

1,412.5

1,206.6

1,050.0

987.3

890.9

Target Macro / Mid Industry

Telecommunications / Wireless

Materials / Metals & Mining

Telecommunications / Wireless

Telecommunications / Telecommunications Services

Real Estate / Non Residential

Industrials / Transportation & Infrastructure

Industrials / Transportation & Infrastructure

Energy and Power / Oil & Gas

Retail / Other Retailing

Financials / Insurance

https://www.thomsonone.com

7

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

South African M&A

Jan 1 Sep 28

Any South African Inv Announced (AD54)

Financial Advisor

Deutsche Bank

Java Capital (Proprietary) Ltd

Rand Merchant Bank

Rothschild

Macquarie Group

KPMG

UBS

RBC Capital Markets

Goldman Sachs & Co

Standard Chartered PLC

Bank of America Merrill Lynch

Standard Bank Group Ltd

JP Morgan

Morgan Stanley

Investec

Gresham Partners

First Annapolis Capital

Barclays

Hartleys Ltd

PricewaterhouseCoopers

Atlantic Law Solicitors

BDO International

Jefferies & Co Inc

PSG Capital (Pty) Ltd

QuestCo(Pty)Ltd

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

14

1,910.0

18.1

12.0

2

25

1,359.1

12.9

11.2

3

13

1,116.6

10.6

3.6

4

5

960.8

9.1

-7.7

5

876.9

8.3

8.3

6

32

780.9

7.4

6.8

7

39

772.2

7.3

7.1

8

28*

731.1

6.9

5.8

9

1

701.7

6.6

-22.7

10

19

629.6

6.0

3.5

11

3

623.2

5.9

-14.8

12

2

606.3

5.7

-16.0

13

4

269.3

2.6

-14.5

14

6

223.6

2.1

-8.7

15

21

183.3

1.7

-0.7

16

179.9

1.7

1.7

17*

84.3

0.8

0.8

17*

22*

84.3

0.8

-1.2

19

26*

72.0

0.7

-0.7

20

71.3

0.7

0.7

21

38.8

0.4

0.4

22

52*

29.8

0.3

0.3

23

15

26.8

0.3

-5.7

24

33

22.4

0.2

-0.3

25

50

22.1

0.2

0.1

10,579.9

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-40.3%

29.2%

Jan 1 Sep 28

Any South African Involvement Completed (AF61)

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

1

0.3

-2

16

5.3 +13

10

3.3

-2

3

1.0

-4

3

1.0 +3

1

0.3

-3

3

1.0 +2

5

1.7 +4

4

1.3

-2

2

0.7 +1

2

0.7

-3

5

1.7

-2

2

0.7

-5

1

0.3

-1

1

0.3

-1

1

0.3 +1

1

0.3 +1

1

0.3

0

1

0.3

0

4

1.3 +4

1

0.3 +1

4

1.3 +3

3

1.0 +2

7

2.3 +2

3

1.0

-1

301

+33

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

5

6,534.6

46.4

24.0

2

6,054.1

43.0

43.0

3

22

5,535.0

39.3

37.5

4

21

5,200.0

36.9

35.1

5

7

1,934.6

13.7

-3.1

6

1

1,910.0

13.6

-18.7

7

1,334.6

9.5

9.5

8

12*

854.1

6.1

-2.0

9

851.5

6.0

6.0

10

23*

627.0

4.5

3.5

11

10

421.3

3.0

-7.2

12*

361.5

2.6

2.6

12*

3

361.5

2.6

-20.6

12*

16

361.5

2.6

-3.2

12*

361.5

2.6

2.6

16

323.5

2.3

2.3

17

26

259.4

1.8

1.0

18

19

251.5

1.8

-2.4

19

8

202.3

1.4

-14.4

20

42*

104.7

0.7

0.7

21

11

80.1

0.6

-8.8

22

6

58.5

0.4

-18.3

23

27

56.1

0.4

-0.3

24

37

45.4

0.3

0.3

25

38.8

0.3

0.3

14,089.2

100.0

Financial Advisor

Goldman Sachs & Co

Standard Chartered PLC

UBS

Nomura

JP Morgan

Deutsche Bank

Moelis & Co

Bank of America Merrill Lynch

Credit Suisse

RBC Capital Markets

Standard Bank Group Ltd

Barclays

Rothschild

Lazard

Commerzbank AG

Hartleys Ltd

KPMG

Qinisele Resources (Pty) Ltd

Java Capital (Proprietary) Ltd

Ernst & Young LLP

Rand Merchant Bank

Investec

PricewaterhouseCoopers

Bridge Capital Advisors

Atlantic Law Solicitors

Industry Total

12.3%

21.7%

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-31.3%

190.6%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

3

1.6

-1

3

1.6 +3

3

1.6 +1

1

0.5

0

2

1.0

-4

1

0.5

-6

1

0.5 +1

3

1.6 +1

2

1.0 +2

3

1.6 +2

4

2.1

-1

1

0.5 +1

1

0.5

-5

2

1.0

-1

1

0.5 +1

2

1.0 +2

3

1.6

-2

1

0.5

0

9

4.7 +5

2

1.0

0

3

1.6 -12

1

0.5

-4

3

1.6 +1

2

1.0 +1

1

0.5 +1

192

+8

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

18.9

10.7

4.5

26.9

15.2

15.2

12.4

7.0

6.4

6.9

3.9

3.0

9.2

5.2

0.2

2.0

1.2

8.6

3.3

1.9

1.9

7.5

4.2

2.8

4.4

2.5

2.5

5.3

3.0

2.6

3.7

2.1

0.4

1.4

0.8

0.8

4.2

2.4

3.9

3.4

1.9

1.6

1.4

0.8

0.8

2.3

1.3

1.3

.3

0.2

0.2

1.3

0.8

1.9

3.1

1.7

4.1

.4

0.2

0.1

2.3

1.3

3.6

1.0

0.6

7.8

.3

0.2

0.1

.8

0.5

0.5

.0

0.0

0.0 176.3

100.0

4.3%

11.7%

-46.8%

97.2%

* tie

South African Involvement Announced M&A by Target Industry ($bil)

Jan 1 - Sep 28 2012

14%

$1.4

57%

$5.7

9%

`

7%

4%

4%

5%

Materials

Real Estate

Financials

Healthcare

Industrials

Consumer Staples

Media and Entertainment

Consumer Products and Services

Energy and Power

53.6, 0% 145, 1%

Any South African Inv Announced (AD54) - Top Deals

Rank Date

9/7/2012

6/5/2012

7/11/2012

4/24/2012

3/27/2012

6/12/2012

3/2/2012

2/16/2012

4/19/2012

4/20/2012

Date Effective

9/7/2012

Pending

Pending

Pending

6/25/2012

Pending

8/7/2012

4/12/2012

Pending

Pending

Target (% Sought/Acquired)

Richards Bay Minerals (37%)

SA Corporate Real Estate Fund (50%)

Nordenia International AG (93.4%)

Scaw Metals Group (100%)

Optimum Coal Holdings Ltd (32.23%)

Avusa Ltd (100%)

First Uranium(Pty)Ltd (100%)

Mondi Swiecie SA (27.19%)

Ecobank Transnational Inc (19.6%)

GlaxoSmithKline-OTC Brands (100%)

Jan 1 - Sep 28 2012

Acquiror

Rio Tinto PLC

Capital Property Fund Ltd

Mondi Ltd

Investor Group

Investor Group

Richtrau 229(Pty)Ltd

AngloGold Ashanti Ltd

FraMondi NV

Public Investment Corp Ltd

Aspen Global Inc

Acquiror / Target Nation

United Kingdom / South Africa

South Africa / South Africa

South Africa / Germany

South Africa / South Africa

South Africa / South Africa

South Africa / South Africa

South Africa / South Africa

Netherlands / Poland

South Africa / Togo

Mauritius / Australia

Rank Value (US$m)

1,910.0

985.1

780.9

437.2

406.0

355.9

335.0

315.4

250.0

232.2

Target Macro / Mid Industry

Materials / Metals & Mining

Real Estate / REITs

Materials / Containers & Packaging

Materials / Metals & Mining

Materials / Metals & Mining

Media and Entertainment / Publishing

Materials / Metals & Mining

Materials / Containers & Packaging

Financials / Banks

Healthcare / Pharmaceuticals

https://www.thomsonone.com

8

First Nine Months 2012 | Mergers & Acquisitions | Financial Advisors

Eastern European M&A

Any Eastern European Inv Announced (AD52)

Financial Advisor

Deutsche Bank

Goldman Sachs & Co

Sberbank

Credit Suisse

Barclays

Bank of America Merrill Lynch

UBS

JP Morgan

Morgan Stanley

Nomura

Rothschild

VTB Capital

Citi

Santander

Aon Benfield

Ernst & Young LLP

Macquarie Group

Xenon Capital Partners

HSBC Holdings PLC

KPMG

BNP Paribas SA

Societe Generale

Wells Fargo & Co

Renaissance Capital Group

SEB Enskilda

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

4

17,742.7

30.8

16.6

2

6

16,909.8

29.4

16.9

3

12

14,710.5

25.6

17.5

4

5

11,497.2

20.0

6.0

5

36

8,863.3

15.4

14.2

6

7

7,061.4

12.3

-0.1

7

15

6,978.9

12.1

5.1

8

2

6,866.6

11.9

-4.5

9

1

5,377.8

9.3

-9.2

10

13

4,891.1

8.5

1.1

11

3

4,325.1

7.5

-7.4

12

16

2,579.3

4.5

-1.6

13

25

2,168.2

3.8

2.0

14

1,425.2

2.5

2.5

15

995.7

1.7

1.7

16

61

870.9

1.5

1.4

17

850.0

1.5

1.5

18*

19

750.0

1.3

-2.5

18*

9

750.0

1.3

-9.9

20

23

690.5

1.2

-0.7

21

22

344.2

0.6

-1.4

22

30

344.1

0.6

-1.1

23

325.0

0.6

0.6

24

10

299.2

0.5

-10.1

25

72*

189.1

0.3

0.3

57,573.3

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-38.8%

-64.9%

Jan 1 Sep 28

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

13

0.5

-6

18

0.7 +10

21

0.8 +4

14

0.5

0

4

0.2 +2

6

0.2

-6

5

0.2

-3

8

0.3

-7

12

0.5

0

3

0.1

-1

8

0.3 -15

8

0.3 +2

6

0.2

0

1

0.0 +1

1

0.0 +1

3

0.1 -11

2

0.1 +2

1

0.0

-2

2

0.1

-4

16

0.6

-8

1

0.0

-2

8

0.3 +5

1

0.0 +1

6

0.2

-4

7

0.3 +5

2,654

-735

-21.7%

-5.6%

Jan 1 Sep 28

Any Eastern European Involvement Completed (AF59)

Financial Advisor

Deutsche Bank

Goldman Sachs & Co

Sberbank

Barclays

Credit Suisse

Rothschild

JP Morgan

Bank of America Merrill Lynch

Citi

UBS

VTB Capital

Nomura

Morgan Stanley

RBS

Gazprombank

BNP Paribas SA

McFarland Dewey & Co

GMP Capital Corp

BMO Capital Markets

Standard Bank Group Ltd

Greenhill & Co, LLC

Lazard

Aon Benfield

Societe Generale

ING

Industry Total

Rank Value per Advisor (US$m)

Rank Value Market

Market

2012 2011

Rank Rank

US$m Sh (%) Share Ch.

1

9

23,897.3

38.1

27.7

2

6

15,594.2

24.9

11.1

3

15

15,132.7

24.1

19.1

4

24

11,779.6

18.8

15.6

5

7

11,342.2

18.1

5.6

6

18

9,512.7

15.2

10.3

7

5

6,687.4

10.7

-5.2

8

3

6,102.6

9.7

-11.9

9

47

6,005.9

9.6

9.2

10

10

5,450.1

8.7

0.4

11

2

5,373.3

8.6

-16.5

12

14

5,112.7

8.2

3.1

13

1

4,658.7

7.4

-33.6

14

3,000.0

4.8

4.8

15

21

2,550.2

4.1

-0.2

16*

37

2,191.5

3.5

2.6

16*

2,191.5

3.5

3.5

16*

2,191.5

3.5

3.5

16*

2,191.5

3.5

3.5

20

36

1,108.0

1.8

0.8

21*

1,000.0

1.6

1.6

21*

20

1,000.0

1.6

-2.7

23

995.7

1.6

1.6

24

38

891.0

1.4

0.7

25

42*

858.6

1.4

0.9

62,712.3

100.0

Industry % Change from Same Period Last Year

Industry % Change from Last Quarter

-46.3%

-53.4%

# of Deals per Advisor

# of Market Change in

Deals Sh (%) # of Deals

21

1.0 +7

14

0.7 +4

16

0.8 +2

5

0.2 +2

10

0.5

-5

12

0.6

-8

7

0.3

-9

6

0.3

-8

5

0.2 +2

3

0.1

-7

7

0.3 -12

3

0.1

-1

5

0.2 -26

1

0.0 +1

4

0.2

-2

1

0.0

-2

1

0.0 +1

1

0.0 +1

1

0.0 +1

2

0.1

-4

1

0.0 +1

1

0.0

-4

1

0.0 +1

6

0.3 +1

2

0.1

-5

2,133

-634

-22.9%

-12.6%

Imputed Fees (US$m)

Advisor Market

Market

Fees Sh (%) Share Ch.

43.2

8.1

6.1

31.6

5.9

3.2

14.8

2.8

0.6

23.9

4.5

3.5

19.5

3.6

1.9

30.9

5.8

1.2

19.6

3.7

2.7

17.5

3.3

2.1

11.1

2.1

1.3

3.8

0.7

3.0

16.4

3.1

1.6

25.1

4.7

4.1

28.9

5.4

6.5

6.2

1.2

1.2

11.9

2.2

0.7

3.0

0.6

0.4

3.0

0.6

0.6

.3

0.1

0.1

15.6

2.9

2.9

2.2

0.4

0.4

.9

0.2

0.2

.6

0.1

1.0

1.0

0.2

0.2

3.8

0.7

0.0 2.3

0.4

0.3

536.0

100.0

-42.8%

-44.2%

* tie

Eastern Europe Involvement Announced M&A by Target Industry ($bil)

2%

Jan 1 - Sep 28 2012

1%

2% 1%

1%

7%

5%

24%

$13.3

10%

17%

$9.7

11%

$6.3

19%

$10.5

Energy and Power

Telecommunications

Financials

Consumer Staples

Industrials

Materials

Real Estate

Media and Entertainment

Healthcare

Consumer Products and Services

High Technology

Retail

Any Eastern European Inv Announced (AD52) - Top Deals

Rank Date

4/24/2012

6/8/2012

4/3/2012

4/24/2012

2/28/2012

2/28/2012

5/31/2012

3/29/2012

1/20/2012

5/16/2012

Date Effective

4/24/2012

8/28/2012

6/18/2012

4/24/2012

6/14/2012

Pending

Pending

3/29/2012

7/1/2012

Pending

Target (% Sought/Acquired)

MegaFon (25.1%)

Denizbank AS (99.85%)

Starbev Management Services (100%)

Telekominvest (26.06%)

NK Rosneft' (3.04%)

Kredyt Bank SA (100%)

Baltika (15.5%)

UGK (90%)

TUiR Warta SA (100%)

UK Unikor-Real Estate Assets (100%)

Jan 1 - Sep 28 2012

Acquiror

Investor Group

Sberbank Rossii

Molson Coors Brewing Co

AF Telecom Holding

NK Rosneft'

Bank Zachodni WBK SA

Baltic Beverages Holding AB

AK Alrosa

Talanx AG

Gruppa BIN

Acquiror / Target Nation

Cyprus / Russian Fed

Russian Fed / Turkey

United States / Czech Republic

Cyprus / Russian Fed

Russian Fed / Russian Fed

Poland / Poland

Sweden / Russian Fed

Russian Fed / Russian Fed

Germany / Poland

Russian Fed / Russian Fed

Rank Value (US$m)

5,200.0

3,550.9

3,530.5

3,292.4

2,356.4

1,425.2

1,088.2

1,037.0

995.7

982.5

Target Macro / Mid Industry

Telecommunications / Wireless

Financials / Banks