Professional Documents

Culture Documents

Public Provident Fund (PPF)

Uploaded by

rupesh_kanabar1604Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPublic Provident Fund (PPF)

Uploaded by

rupesh_kanabar1604rupeshkanabar@gmail.

com

Public Provident Fund (PPF)

What is Public Provident Fund?

The public provident fund schemes are provided by the Government of India

and are widely used by employees all over India.

Duration: The PPF have a maturity period of 15 years.

Mode of Investment: Single, Joint (Two or more), HUFs and Minor with

parent/guardian

Investments: Min Amt. Rs.500/- and additional investment in multiples of

Rs. 5/- Max Amount Rs. 70,000/-

Returns: PPF provides an interest rate of 8% p.a. (compounded yearly) is

Credited to the PPF account at the end of each financial year.

Advantages:

· Tax benefits can be availed under sections 88 for the amount invested.

Interest accrued is Tax free.

· A PPF account cannot be attached by the Govt. or any court of law or

through any decree.

Features:

Apart from a Post Office, a PPF account can also be opened in SBI & its

associates and other select nationalized banks.

Nomination can be done at the time of opening the account or during the tenor

of the account.

15 years from the date of initial investment with a block of 5 years there-after

up to a max of 30 years incl. 15 years.

The PPF account matures after 15 years. One can then exercises on option of

continuing the account for an additional block of 5 years or close it.

1/16/2009 PUBLIC PROVIDENT FUND (PPF) Page 1 of 3

rupeshkanabar@gmail.com

The first loan can be taken in the third financial year from the date of opening

of the account, or up to 25% of the amount at credit at the end of the first

financial year. The facility can be availed of any before expiry of 5 years from

the end of the year in which the initial subscription was made. The loan is

repayable either in lump sum or in convenient installments numbering not

more than 36. Interest at 1% would be charged if loan is repaid in 36 months.

Such interest should of loan is not repaid within 36 months, interest on

outstanding amount of loan would be charged at 6%.

A withdrawal is permissible every year from the seventh financial year of the

date of opening of the account, of an amount not exceeding 50% of the

balance at the end of the 4th proceeding year or the year immediately

proceeding the year of the withdrawal, whichever is lower, less the amount of

loan if any.

A PPF account can be opened by an individual on his own behalf or on behalf

of a minor of whom he is the guardian or on behalf of Hindu Undivided

Family (H.U.F) of which he is a member or on behalf of an association of

persons or a body of individuals. An individual can open only one account for

himself.

The account can be transfered at the request of the subscriber from one office

to another, including from Bank to Post Office and vice- versa all over the

country.

A subscriber may nominate one or more persons to receive the amount

standing to his credit in the event of his death. No nomination can, however,

be made in respect of an account opened on behalf of a minor.

In the event of the death of the subscriber, the amount standing to his credit

can be repaid to his nominee or legal heir, as the case may be, even before the

expiry of fifteen years. Legal hairs can claim the amount up to Rupees One

Lakh without production of succession certificate after observing certain

formalities. P.P.F. account can be revived by paying a fee of Rs 10/- for each

year of default along with the arrear subscription of Rs 100/- for each year of

such default.

1/16/2009 PUBLIC PROVIDENT FUND (PPF) Page 2 of 3

rupeshkanabar@gmail.com

No PPF account can be terminated before its completion. However, if requests

for premature closure of PPF accounts and refund of deposits from the

subscribers are genuine in nature, such cases can be dealt with under Rule 13

of the scheme. Since no withdrawal is permissible before the expiry of four

years from the end of the year in which the account was opened vide para 9

(withdrawal) of the scheme, the request for termination or closure of accounts

can be considered only after the expiry of the said period.

For example, the request for premature closure of accounts opened in 1988-89

can be considered only after 1.4.1994.

Such requests may, therefore, be forwarded to the Ministry of Finance along

with the following information –

· Name and address of the account holder

· Account number

· Date on which the account was opened

· Loans availed of if any from the account with dates and position regarding

repayment

· Satisfactory reasons given for the request and evidence in support thereof

· Designation and address of the income tax authority under whose

jurisdiction the subscriber falls

· Any other information relevant to the request.

A PPF account is free from any attachment under any order or decree of a

court in respect of any debt or other liability incurred by him

Non Resident Indians may also open a PPF account out of the funds in the

applicant's non-resident account in India in banks subject to the following

conditions –

· The account is marked as non-resident account

· All credits therein or debits thereto are made subject to the same

regulations as are applicable to non-resident account.

1/16/2009 PUBLIC PROVIDENT FUND (PPF) Page 3 of 3

You might also like

- Public Provident Fund SchemeDocument3 pagesPublic Provident Fund SchemeAshish PatilNo ratings yet

- Everything You Need to Know About PPF AccountsDocument2 pagesEverything You Need to Know About PPF AccountsVikash SuranaNo ratings yet

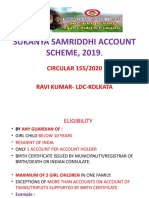

- What Is Sukanya Samriddhi YojanaDocument7 pagesWhat Is Sukanya Samriddhi Yojanaaarja sethiNo ratings yet

- Public Provident Fund (PPF) interest rate drops to 8.7Document5 pagesPublic Provident Fund (PPF) interest rate drops to 8.7Sumit GuptaNo ratings yet

- Government Business Products HandbookDocument8 pagesGovernment Business Products HandbookraghuviltapuramNo ratings yet

- Untitledpdf HTCDocument1 pageUntitledpdf HTCRahulSinghNo ratings yet

- 15 Year Public Provident Fund AccountDocument1 page15 Year Public Provident Fund AccountAndRoid DeveLoPerNo ratings yet

- Guide to India's Public Provident Fund SchemeDocument3 pagesGuide to India's Public Provident Fund SchemePratap Narayan SinghNo ratings yet

- 7 Must Know Facts About PPF AccountsDocument2 pages7 Must Know Facts About PPF AccountsAmit VermaNo ratings yet

- Post Office Savings SchemesDocument8 pagesPost Office Savings SchemesKailashnath GantiNo ratings yet

- PPF Section 80cDocument8 pagesPPF Section 80cPaymaster ServicesNo ratings yet

- Handbook On Govt Business Products 20210818174621Document9 pagesHandbook On Govt Business Products 20210818174621omvir singhNo ratings yet

- What Is PPFDocument11 pagesWhat Is PPFkgsanghaviNo ratings yet

- PPF & Sukanya SamriddhiDocument7 pagesPPF & Sukanya Samriddhicarry minatteeNo ratings yet

- Public Provident Fund Scheme 1968: Salient FeaturesDocument16 pagesPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNo ratings yet

- Public Provident FundDocument10 pagesPublic Provident FundJubin JainNo ratings yet

- Post Office Monthly Income SchemeDocument7 pagesPost Office Monthly Income SchemeLaxman RathodNo ratings yet

- FAQs On PPFDocument21 pagesFAQs On PPFER SAABNo ratings yet

- Top 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFDocument3 pagesTop 10 Reasons Why PPF Is An Attractive Investment!: E-Mail - Print - PDFsrirangar2993No ratings yet

- How To Open PPF AccountDocument6 pagesHow To Open PPF Accountnitinsharma1984No ratings yet

- What Is The Differences Between GPF EPFDocument7 pagesWhat Is The Differences Between GPF EPFsanthoshkumark20026997No ratings yet

- SB and Jan Suraksha SchemesDocument54 pagesSB and Jan Suraksha SchemesSreemon P VNo ratings yet

- Govt Schemes 3.1.23Document27 pagesGovt Schemes 3.1.23Sumit Suman ChaudharyNo ratings yet

- Post Office SchemesDocument27 pagesPost Office SchemesvarshapadiharNo ratings yet

- Public Provident Fund (PPF) Scheme 1968Document1 pagePublic Provident Fund (PPF) Scheme 1968Karthic KeyanNo ratings yet

- PPF Scheme ExplainedDocument9 pagesPPF Scheme ExplainedpeepspopNo ratings yet

- Public Provident Fund (PPF) Returns:: MRC101.htmlDocument1 pagePublic Provident Fund (PPF) Returns:: MRC101.htmlRavi NagrajNo ratings yet

- 02 SCSS SchemeDocument3 pages02 SCSS Schemeరాజశేఖర్ రెడ్డి కందికొండNo ratings yet

- Sources of finance and Post Office savings schemesDocument24 pagesSources of finance and Post Office savings schemesAnkit Sinai TalaulikarNo ratings yet

- PNB Savings Account FeaturesDocument28 pagesPNB Savings Account Featuresgauravdhawan1991No ratings yet

- 7816 - CBS PPF - PPFDocument14 pages7816 - CBS PPF - PPFsrinu reddyNo ratings yet

- Top 5 Small Saving Schemes by Government of India GK Notes As PDFDocument6 pagesTop 5 Small Saving Schemes by Government of India GK Notes As PDFsachin vastrakarNo ratings yet

- Corp Tax Saver Plus: Terms & ConditionsDocument1 pageCorp Tax Saver Plus: Terms & ConditionsranajithdkNo ratings yet

- PPF and NriDocument44 pagesPPF and NriHunny GargNo ratings yet

- Small Saving SchemeDocument30 pagesSmall Saving SchemePallaviNo ratings yet

- Post Office Small Savings Ready ReckonerDocument1 pagePost Office Small Savings Ready Reckonerabhinav0115No ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- Public Provident Fund Scheme RulesDocument6 pagesPublic Provident Fund Scheme Rulesraj rajNo ratings yet

- The Basics of PPFDocument2 pagesThe Basics of PPFgvrnaiduNo ratings yet

- Unit-1 Social Security Schemes NotesDocument12 pagesUnit-1 Social Security Schemes NotesAnupriyaNo ratings yet

- Govt SchemesDocument49 pagesGovt SchemesArul pratheebNo ratings yet

- Public Provident FundDocument1 pagePublic Provident FundAvinash singhNo ratings yet

- Public Provident Fund, National Pension Scheme, Senior Citizen Savings Scheme and Sovereign Gold Bonds SchemeDocument26 pagesPublic Provident Fund, National Pension Scheme, Senior Citizen Savings Scheme and Sovereign Gold Bonds SchemeElizabeth ThomasNo ratings yet

- Difference between PPF and PF accounts explainedDocument3 pagesDifference between PPF and PF accounts explainednonyaNo ratings yet

- Public Provident Fund Scheme (PPF) Bod - 25112021Document5 pagesPublic Provident Fund Scheme (PPF) Bod - 25112021Priya KalraNo ratings yet

- UCO Bank's Sukanya Samriddhi Scheme GuidelinesDocument10 pagesUCO Bank's Sukanya Samriddhi Scheme Guidelinessri arjunNo ratings yet

- PPF - Short NotesDocument1 pagePPF - Short NotesPoorani SundaresanNo ratings yet

- Presentation on Post Offices and their ServicesDocument21 pagesPresentation on Post Offices and their Servicesparag sonwaneNo ratings yet

- Difference Between EPF GPF & PPFDocument3 pagesDifference Between EPF GPF & PPFSrikanth VsrNo ratings yet

- Postal InsuranceDocument21 pagesPostal InsuranceMaha RasiNo ratings yet

- Various Investment Avenues in IndiaDocument74 pagesVarious Investment Avenues in IndiaRakeshNo ratings yet

- SSA - Short NotesDocument1 pageSSA - Short NotesPoorani SundaresanNo ratings yet

- National Savings Monthly IncomeDocument3 pagesNational Savings Monthly Incomejack sNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- PPF RulesDocument36 pagesPPF RulesSakthivel VenkidusamyNo ratings yet

- FLS011 Application For PenCon Special STLDocument2 pagesFLS011 Application For PenCon Special STLwillienorNo ratings yet

- CC CCCDocument5 pagesCC CCCUday Krishna GiriNo ratings yet

- Post Office SchemesDocument10 pagesPost Office SchemesmuntaquirNo ratings yet

- AutoCAD Basic CommandsDocument1 pageAutoCAD Basic Commandsrupesh_kanabar1604No ratings yet

- Tollfree NumbersDocument3 pagesTollfree Numbersmourya2175No ratings yet

- What Is Recession Gujarati TranslationDocument1 pageWhat Is Recession Gujarati Translationrupesh_kanabar1604100% (1)

- Inflation (WPI)Document5 pagesInflation (WPI)rupesh_kanabar1604100% (1)

- List of Festivals - 2009Document1 pageList of Festivals - 2009rupesh_kanabar1604No ratings yet

- Nabard BondsDocument1 pageNabard Bondsrupesh_kanabar1604No ratings yet

- Assured Return InvestmentsDocument1 pageAssured Return Investmentsrupesh_kanabar1604No ratings yet

- Post Office Monthly Income Scheme (MIS)Document2 pagesPost Office Monthly Income Scheme (MIS)rupesh_kanabar1604100% (1)

- Infrastructure BondsDocument1 pageInfrastructure Bondsrupesh_kanabar1604No ratings yet

- Systematic Investment Plan (SIP)Document3 pagesSystematic Investment Plan (SIP)rupesh_kanabar160486% (7)

- Portfolio Analysis ToolsDocument6 pagesPortfolio Analysis Toolsrupesh_kanabar1604100% (5)

- Life InsuranceDocument7 pagesLife Insurancerupesh_kanabar1604100% (8)

- Equity Linked Savings Schems (ELSS)Document7 pagesEquity Linked Savings Schems (ELSS)rupesh_kanabar1604No ratings yet

- Corena s2 p150 - Msds - 01185865Document17 pagesCorena s2 p150 - Msds - 01185865Javier LerinNo ratings yet

- InvoiceDocument1 pageInvoiceAnurag SharmaNo ratings yet

- ITIL - Release and Deployment Roles and Resps PDFDocument3 pagesITIL - Release and Deployment Roles and Resps PDFAju N G100% (1)

- Factory Hygiene ProcedureDocument5 pagesFactory Hygiene ProcedureGsr MurthyNo ratings yet

- Recommended lubricants and refill capacitiesDocument2 pagesRecommended lubricants and refill capacitiestele123No ratings yet

- AutocadDocument8 pagesAutocadbrodyNo ratings yet

- CONFLICT ManagementDocument56 pagesCONFLICT ManagementAhmer KhanNo ratings yet

- UKBM 2, Bahasa InggrisDocument10 pagesUKBM 2, Bahasa InggrisElvi SNo ratings yet

- FC Bayern Munich Marketing PlanDocument12 pagesFC Bayern Munich Marketing PlanMateo Herrera VanegasNo ratings yet

- The Power of Flexibility: - B&P Pusher CentrifugesDocument9 pagesThe Power of Flexibility: - B&P Pusher CentrifugesberkayNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- Fact Sheet Rocket StovesDocument2 pagesFact Sheet Rocket StovesMorana100% (1)

- Cantilever Retaining Wall AnalysisDocument7 pagesCantilever Retaining Wall AnalysisChub BokingoNo ratings yet

- Ultrasonic Inspection Standards for Wrought MetalsDocument44 pagesUltrasonic Inspection Standards for Wrought Metalsdomsoneng100% (1)

- Leapfroggers, People Who Start A Company, Manage Its Growth Until They Get Bored, and Then SellDocument3 pagesLeapfroggers, People Who Start A Company, Manage Its Growth Until They Get Bored, and Then Sellayesha noorNo ratings yet

- Modulus of Subgrade Reaction KsDocument1 pageModulus of Subgrade Reaction KsmohamedabdelalNo ratings yet

- STS Chapter 5Document2 pagesSTS Chapter 5Cristine Laluna92% (38)

- Lenex 3.0 Technical DocumentationDocument31 pagesLenex 3.0 Technical DocumentationGalina DNo ratings yet

- Micro Controller AbstractDocument6 pagesMicro Controller AbstractryacetNo ratings yet

- Model Paper 1Document4 pagesModel Paper 1Benjamin RohitNo ratings yet

- Structures Module 3 Notes FullDocument273 pagesStructures Module 3 Notes Fulljohnmunjuga50No ratings yet

- Terminología Sobre Reducción de Riesgo de DesastresDocument43 pagesTerminología Sobre Reducción de Riesgo de DesastresJ. Mario VeraNo ratings yet

- Iso 4624Document15 pagesIso 4624klkopopoonetdrghjktl100% (2)

- Kuliah Statistik Inferensial Ke4: Simple Linear RegressionDocument74 pagesKuliah Statistik Inferensial Ke4: Simple Linear Regressionvivian indrioktaNo ratings yet

- BUSN7054 Take Home Final Exam S1 2020Document14 pagesBUSN7054 Take Home Final Exam S1 2020Li XiangNo ratings yet

- JRC Wind Energy Status Report 2016 EditionDocument62 pagesJRC Wind Energy Status Report 2016 EditionByambaa BattulgaNo ratings yet

- 272 Concept Class Mansoura University DR Rev 2Document8 pages272 Concept Class Mansoura University DR Rev 2Gazzara WorldNo ratings yet

- Memento Mori: March/April 2020Document109 pagesMemento Mori: March/April 2020ICCFA StaffNo ratings yet

- 2 - Nested IFDocument8 pages2 - Nested IFLoyd DefensorNo ratings yet

- 2016 04 1420161336unit3Document8 pages2016 04 1420161336unit3Matías E. PhilippNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (80)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeFrom EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)