Professional Documents

Culture Documents

Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan Mod

Uploaded by

Tim BryantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan Mod

Uploaded by

Tim BryantCopyright:

Available Formats

THIS COMMUNICATION IS FROM A DEBT COLLECTOR.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

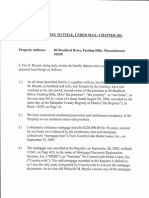

SUBORDINATION REQUIREMENTS

This communication is in response to your request for the Specialized Loan Servicing LLC (SLS) subordination requirements. Below are the general guidelines for either a refinance or loan modification subordination. We may request additional information before making a decision. 1. The SLS loan must be current at the time of the request. 2. SLS does not subordinate to reverse amortization, negative amortization, option arm or interest only loans. 3. The HUD 1 or Settlement Statement must show less than $100.00 cash back to the borrower and may not include the consolidation of any other debt or credit cards. 4. Ideally, the proposed combined loan to value ratio (CLTV) must not increase by more than 3.5% from the current CLTV. Due to the current market conditions, all approvals are made on a case by case basis. 5. SLS will only subordinate if it is already in a second lien position. SLS will not subordinate if its lien is the existing first lien. 6. If in conjunction with the subordination you would like to reduce the available balance on a home equity line of credit, a loan modification will be required. The following guidelines apply: A. The loan modification is contingent upon subordination approval. B. The line of credit will be permanently frozen. C. A fee of $250.00 may apply, if allowed under applicable law. D. The loan modification approval documents must be signed and returned. Please provide the requested new available balance and authorized contact information. Requirements for refinance subordinations: 1. A $250.00 non-refundable subordination fee to be paid by certified funds, made payable to SLS, and received at the time of the request. 2. A completed checklist, found on the following page, including all supporting documentation. Please note: All items must be received in our office in order to begin processing your request for subordination. Requirements for loan modification subordinations: 1. A $125.00 non-refundable subordination fee to be paid by certified funds (made payable to SLS) and received at the time of the request. 2. A letter of authorization, signed by all named customers on our account, permitting us to discuss and/or release SLS account information to the title company/broker/mortgage company. This letter must be specific in regard to the name of the title company/broker/mortgage company that you permit us to discuss your account with. See attached authorization or you may provide your own. 3. Completed Current First Lien Information Sheet for Subordination, as attached. 4. A copy of a new appraisal or Broker Price Opinion, dated within six months. An additional fee may be assessed to your loan to obtain one of these items if not provided. 5. A subordination agreement completed by the requestor for SLS execution upon approval. SLS does not supply the subordination form. 6. A copy of the Loan Modification Agreement, if applicable. 7. Copies of financial information used to qualify the borrower for a loan modification and any hardship letters provided by the borrower. This information is needed only if the Loan Program is not improving the borrowers financial situation and/or the principal and interest payment is increasing. 8. Your contact information for questions (name, phone number and email address) Submission of this information does not guarantee an approval. Upon a thorough review of your submittal, SLS will make a decision based on the guidelines and the information provided. Upon conclusion of our review, you will be notified of our decision. For your convenience we have attached a document check list. Additionally, there will be a $25.00 fee assessed to the account for any document changes within the first ninety (90) days after the subordination has been approved and completed. After 90 days, a new subordination package and fee will be required. In addition to the subordination fee, in any state that requires a Substitution of Trustee form, an additional legal fee of $250.00 will be assessed for preparation and execution of these documents. If you have any questions, please contact us at 1-866-220-0021, Monday Friday 7:00am - 3:30pm MT or email us at subordination@sls.net. Sincerely, Customer Support Department Specialized Loan Servicing LLC

Bankruptcy Notice If you are a customer in bankruptcy or a customer who has received a bankruptcy discharge of this debt: Please be advised that this notice is to advise you of the status of your mortgage loan. This notice constitutes neither a demand for payment nor a notice of personal liability to any recipient hereof, who might have received a discharge of such debt in accordance with applicable bankruptcy laws or who might be subject to the automatic stay of Section 362 of the United States Bankruptcy Code. However, it may be a notice of possible enforcement of the lien against the collateral property, which has not been discharged in your bankruptcy. If you have any questions, please contact a Bankruptcy Specialist in our Customer Care Center at 800-306-6057 .

8742 Lucent Blvd., Suite 300, Highlands Ranch, Colorado 80129 Direct 1-866-220-0021 Fax 720-241-7218

THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

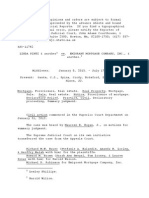

REQUIREMENTS CHECKLIST

Please note: Subordination requirements are consistent for all refinances, regardless of the refinance program.

If you would like SLS to review your loan for subordination, please submit the items listed below. All items must be received in our office in order to begin processing your request for subordination. The expected completion time once all required items are received is 30 business days. Borrower Name Borrower Contact Number Borrower Email Address Item or document to be sent to SLS Fee of $250.00, nonrefundable for refinance subordinations Fee of $125.00, nonrefundable for loan modification subordinations New lender information Letter of authorization for release of loan information to a third party Details Co-Borrower Name Co-Borrower Contact Number Co-Borrower Email Address

No fee for properties located in New York, Texas, Virginia, or other states not allowed by applicable law.

No fee for properties located in New York, Texas, Virginia, or other states not allowed by applicable law. Contact information including: name, phone number and email address. A letter of authorization, signed by all named borrowers on the account, permitting us to discuss and/or release SLS account information. The letter must specify the name(s) of all companies (title, broker, and/or mortgage) authorized to receive requested information. Must include the following: Authorized company/person contact information such as name, company, phone number and email address. Printed name of all borrowers currently on the loan. Signatures of all borrowers currently on the loan. See included information sheet. Must include a copy of the current first lien note. Good through the closing date. Cannot be expired and must include all current lienholders associated with the property. No more than $100.00 cash back to the borrower. No debt consolidation or pay down. New first lien loan amount matches on all documents. Includes first lien payoff amount. Estimated closing date: _______________ Cannot be expired. Home Value Explorer, Streamlink, Automated Valuation Model, Brokers Price Opinion, dated within six months. We do not accept Fannie Mae Desktop Underwriter findings or tax assessed values. If the combined loan to value ratio (CLTV) increases by more than 3.5%, an appraisal or Brokers Price Opinion, no older than six months old completed by an accredited appraiser, must be provided. (Forms 1004, 2055, 1025 only). An additional order fee may be assessed to your loan if one of these items is not provided. New first lien loan amount must match on all documents. Do not list SLS anywhere on the agreement. Please provide MERS verbiage and the original lender information if our loan is registered with MERS. New first lien loan amount must match on all documents. All subordination agreements drafted for execution by Mortgage Electronic Registration Systems, Inc. (MERS) must have the MERS phone number (1-888-679-6377) and the MIN number associated with the loan placed on the agreement in the correct location. Mississippi Only- for subordination agreements with MERS verbiage to be recorded in the State of Mississippi, please include both of the following addresses for MERS: 1901 E Voorhees Street, Suite C Danville, IL 61834 and P.O. Box 2026 Flint, Michigan 48501 Must include all current lienholders of the property. Must include a copy of the report for all borrowers and co-borrowers. If not received, the documents will be returned via regular mail. 8742 Lucent Blvd., Suite 300, Highlands Ranch, Colorado 80129 Direct 1-866-220-0021 Fax 720-241-7218

Current first lien note Payoff quote for first lien Full title report Estimated HUD 1/ Settlement Statement

Rate lock confirmation Appraisal or acceptable value

1008 form, Uniform Underwriting Transmittal Form Subordination agreement

Title search Copy of a current consumer credit report A prepaid express mail label to return the subordination documents

THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

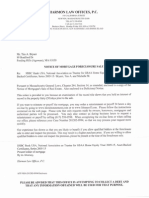

THIRD-PARTY AUTHORIZATION FORM

Specialized Loan Servicing LLC Mortgage Lender/Servicer Name (Servicer) Account Number

The undersigned Borrower and Co-Borrower (if any) (individually and collectively, Borrower or I), authorize the above Servicer and the following third parties (individually and collectively, Third Party) to obtain, share, release, discuss, and otherwise provide to and with each other public and non-public personal information contained in or related to the mortgage loan of the Borrower. This information may include (but is not limited to) the name, address, telephone number, social security number, credit score, credit report, income, government monitoring information, loss mitigation application status, account balances, program eligibility, and payment activity of the Borrower. The Servicer will take reasonable steps to verify the identity of a Third Party, but has no responsibility or liability to verify the identity of such Third Party. The Servicer also has no responsibility or liability for what a Third Party does with such information. Authorized Third Party Contact Information

Name

Phone Number

Email Address

Name

Phone Number

Email Address

This Third-Party Authorization is only valid when signed by all borrowers and co-borrowers named on the mortgage and until the Servicer receives a written revocation signed by any Borrower or Co-borrower.

I UNDERSTAND AND AGREE WITH THE TERMS OF THIS THIRD-PARTY AUTHORIZATION:

Borrower Signature

Co-Borrower Signature

Borrower Printed Name

Co-Borrower Printed Name

Date

Date

8742 Lucent Blvd., Suite 300, Highlands Ranch, Colorado 80129 Direct 1-866-220-0021 Fax 720-241-7218

THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE.

CURRENT FIRST LIEN INFORMATION SHEET FOR SUBORDINATION Must include a copy of the current first lien note when submitting a subordination request

Current loan information: Current interest rate: % Current maturity date:

Proposed loan information: Proposed interest rate: % Proposed maturity date:

Current principal balance: $ Current principal and interest payment $ Capitalized amount (interest & escrow): $ Current due date:

Proposed principal balance: $ Proposed principal and interest payment $ Proposed due date:

Proposed loan program:

Current loan program:

Proposed mortgagee:

Estimated closing date for refinancing transaction:

8742 Lucent Blvd., Suite 300, Highlands Ranch, Colorado 80129 Direct 1-866-220-0021 Fax 720-241-7218

You might also like

- Business Credit ApplicationDocument4 pagesBusiness Credit ApplicationRocketLawyerNo ratings yet

- Example Simple Social Security TrustDocument2 pagesExample Simple Social Security TrustFreeman Lawyer86% (7)

- Michael C. Dematos Equifax Credit Report SummaryDocument10 pagesMichael C. Dematos Equifax Credit Report SummaryCarlos M. De Matos0% (1)

- Receivable and Collections Policy - SampleDocument10 pagesReceivable and Collections Policy - SampleMrLarry168No ratings yet

- General ForbearanceDocument2 pagesGeneral Forbearancemyedaccount.orgNo ratings yet

- Credit Counseling Service ContractDocument3 pagesCredit Counseling Service ContractBridget May CruzNo ratings yet

- Sample Payday Loan ApplicationDocument6 pagesSample Payday Loan ApplicationAdrian Keys86% (7)

- Sample Loan Mod Package W ProposalDocument12 pagesSample Loan Mod Package W ProposalJules Caesar VallezNo ratings yet

- Qualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsDocument9 pagesQualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsUnemployment Hotline100% (30)

- Bank of America HELOC Short Sale ApprovalDocument2 pagesBank of America HELOC Short Sale ApprovalkwillsonNo ratings yet

- Someone Elses Pay Off I Put The Link Here N A TexDocument3 pagesSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- Loan Modification: Contract & FormsDocument16 pagesLoan Modification: Contract & Formsldobbins2No ratings yet

- Harmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDDocument10 pagesHarmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDTim BryantNo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- Credit Repair SolutionsDocument6 pagesCredit Repair SolutionsCarolNo ratings yet

- Credit Repair KitDocument9 pagesCredit Repair KitChristine Skiba0% (1)

- Card 2 InfoDocument4 pagesCard 2 Infoapi-285069637No ratings yet

- QWR RequestDocument5 pagesQWR RequestChris Doxzen100% (1)

- Short Term: Applicant InformationDocument3 pagesShort Term: Applicant InformationAnahit Yakubovich100% (1)

- Anderson County's Delinquent Tax SaleDocument3 pagesAnderson County's Delinquent Tax SaleUSA TODAY Network50% (2)

- Credit and Collections PolicyDocument7 pagesCredit and Collections PolicySrinivasan Kadangot33% (3)

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Deed of Sale of Unregistered Land (Milagros Soriano and Patrick Bungay)Document3 pagesDeed of Sale of Unregistered Land (Milagros Soriano and Patrick Bungay)Jeremiah EstrasNo ratings yet

- Demand Letter Qualified Written Request2Document7 pagesDemand Letter Qualified Written Request2klg_consultant8688No ratings yet

- MERS To BAC Assignment 05 11 2011Document1 pageMERS To BAC Assignment 05 11 2011Tim BryantNo ratings yet

- Affidavits of Title - EXECUTED - 06 26 2015Document10 pagesAffidavits of Title - EXECUTED - 06 26 2015Tim BryantNo ratings yet

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- EFF - DocuColor Tracking Dot Decoding GuideDocument6 pagesEFF - DocuColor Tracking Dot Decoding GuideTim BryantNo ratings yet

- FTC Disclosure ExampleDocument12 pagesFTC Disclosure ExampleReden Oriola100% (1)

- Personal loan details letterDocument4 pagesPersonal loan details letterchelladuraik25% (4)

- Agency ReviewerDocument71 pagesAgency ReviewerMarvi BlaiseNo ratings yet

- Loan Mod AgreementDocument4 pagesLoan Mod AgreementggavinreiterNo ratings yet

- 10000001667Document79 pages10000001667Chapter 11 DocketsNo ratings yet

- Credit Card 3Document8 pagesCredit Card 3api-285960909No ratings yet

- Extrajudicial Settlement With Donation (Deotep)Document3 pagesExtrajudicial Settlement With Donation (Deotep)Deil L. Navea100% (2)

- Remote Mortgage Underwriter JobDocument2 pagesRemote Mortgage Underwriter JobDaniel Sands0% (1)

- Sample Qualified Written Request Under Re SpaDocument3 pagesSample Qualified Written Request Under Re SpaPamGrave100% (1)

- Mortgages Notes Deeds and Loans in Crime-Gary MichaelsDocument15 pagesMortgages Notes Deeds and Loans in Crime-Gary MichaelsTim Bryant100% (2)

- Lease Form ContractDocument3 pagesLease Form Contract여자마비No ratings yet

- Forcible Entry CasesDocument22 pagesForcible Entry CasesBeverlyn JamisonNo ratings yet

- Annex "B" Contract of Lease Know All Men by These PresentsDocument2 pagesAnnex "B" Contract of Lease Know All Men by These PresentsGerald Rojas100% (1)

- Real Estate Mortgage GuideDocument3 pagesReal Estate Mortgage GuideCharlotte GallegoNo ratings yet

- Solitude - Lockett - BOA 2-13 PDFDocument3 pagesSolitude - Lockett - BOA 2-13 PDFDarian MooreNo ratings yet

- credit-and-collections-policy-pdf-freeDocument7 pagescredit-and-collections-policy-pdf-freenevena.stankovic986No ratings yet

- SunTrust Short Sale Approval (Fannie Mae)Document3 pagesSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- David Lending Service Term Sheet and Loan DetailsDocument3 pagesDavid Lending Service Term Sheet and Loan DetailsNino NinosNo ratings yet

- Confidential report as per iba format summaryDocument3 pagesConfidential report as per iba format summarySriram ReddyNo ratings yet

- Kensington (Taylor) Chase 9-13 PDFDocument8 pagesKensington (Taylor) Chase 9-13 PDFDarian MooreNo ratings yet

- Bank of America Cooperative Short Sale ApprovalDocument3 pagesBank of America Cooperative Short Sale ApprovalkwillsonNo ratings yet

- Elite HARP Open Access ReliefDocument4 pagesElite HARP Open Access ReliefAccessLendingNo ratings yet

- Contact Details Modification Form Federal BankDocument16 pagesContact Details Modification Form Federal BankSidhi KodurNo ratings yet

- Retainer Agreement for New Pilot Caregiver Legal ServicesDocument7 pagesRetainer Agreement for New Pilot Caregiver Legal Servicesvimar teroNo ratings yet

- CitiFinancial Consumer Finance India Limited-FPCDocument2 pagesCitiFinancial Consumer Finance India Limited-FPCRadhikarao ErrabelliNo ratings yet

- 2023-07-17T10 22 47 LoanAgreement 691671Document9 pages2023-07-17T10 22 47 LoanAgreement 691671juantirado0777No ratings yet

- TC Sky1 062Document4 pagesTC Sky1 062jeffreygrimm8No ratings yet

- Kohls Cardmember AgreementDocument3 pagesKohls Cardmember AgreementADEDAMOPE ODUESONo ratings yet

- Personal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Document5 pagesPersonal Loan Approval For Mugwagwa Kudakwashe: Dn948317 Reference Number: FPL/20200824Kudakwashe Mugwagwa100% (1)

- FNSCRD301 Process Applications For CreditDocument5 pagesFNSCRD301 Process Applications For Creditpatrick wafulaNo ratings yet

- HARP 2.0 Freddie Open Access Relief UnlimitedDocument4 pagesHARP 2.0 Freddie Open Access Relief UnlimitedAccessLendingNo ratings yet

- Ebl OriginalDocument18 pagesEbl OriginalPushpa BaruaNo ratings yet

- Expert Credit Solutionscustomer AgreementDocument5 pagesExpert Credit Solutionscustomer AgreementrhondazNo ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Wetsign DisclosuresDocument3 pagesWetsign DisclosuresChase CashionNo ratings yet

- Bank of America HELOC Short Sale PackageDocument7 pagesBank of America HELOC Short Sale PackagekwillsonNo ratings yet

- BofA Approval Letter 2Document3 pagesBofA Approval Letter 2Steve Mun GroupNo ratings yet

- Hard Copy Loan Document (4213)Document6 pagesHard Copy Loan Document (4213)kevin.johnsonloanNo ratings yet

- Same For Everyone.: WWW - Sba.govDocument4 pagesSame For Everyone.: WWW - Sba.govBrady MosherNo ratings yet

- FORBDocument2 pagesFORBjotav11No ratings yet

- PricingDocument3 pagesPricingapi-285145795No ratings yet

- Chapter 10: Credit AnalysisDocument34 pagesChapter 10: Credit AnalysisgyistarNo ratings yet

- Citi Short Sale Approval Letter (Non-GSE)Document2 pagesCiti Short Sale Approval Letter (Non-GSE)kwillsonNo ratings yet

- Overdraft Request FormDocument1 pageOverdraft Request Formsam.whincup1No ratings yet

- Terms, Conditions & DisclosuresDocument8 pagesTerms, Conditions & Disclosuresapi-285070305No ratings yet

- GSMSC Certificate - Involuntary RevokationDocument2 pagesGSMSC Certificate - Involuntary RevokationTim BryantNo ratings yet

- Mortgage Page 10 - Line Through SignatureDocument1 pageMortgage Page 10 - Line Through SignatureTim BryantNo ratings yet

- Pinti V Emigrant 2015-Sjc-11742Document44 pagesPinti V Emigrant 2015-Sjc-11742Tim BryantNo ratings yet

- MWG GuidanceDocument73 pagesMWG Guidancejordimon1234No ratings yet

- Print Over SignatureDocument2 pagesPrint Over SignatureTim Bryant100% (2)

- Note and Rider 2005Document8 pagesNote and Rider 2005Tim BryantNo ratings yet

- MA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Document1 pageMA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Tim BryantNo ratings yet

- FRB Report - 100517-Clearing Banks As Loan Funders-BONYDocument43 pagesFRB Report - 100517-Clearing Banks As Loan Funders-BONYTim BryantNo ratings yet

- BofA To Nationstar 07 30 2013-80 BradfordDocument1 pageBofA To Nationstar 07 30 2013-80 BradfordTim BryantNo ratings yet

- 2013 Copy of Note - HarmonLaw - BryantDocument6 pages2013 Copy of Note - HarmonLaw - BryantTim BryantNo ratings yet

- GSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Document1 pageGSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Tim BryantNo ratings yet

- 2015 Copy of Note - HarmonLaw - BryantDocument6 pages2015 Copy of Note - HarmonLaw - BryantTim Bryant100% (2)

- Bryant Mortgage PG 2Document1 pageBryant Mortgage PG 2Tim BryantNo ratings yet

- Nationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodDocument7 pagesNationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodTim BryantNo ratings yet

- Paths of Notes and Mortgages - Loan 114726037Document24 pagesPaths of Notes and Mortgages - Loan 114726037Tim BryantNo ratings yet

- GS Mortgage Securities Corp Not Authorized To Do Business in NYDocument1 pageGS Mortgage Securities Corp Not Authorized To Do Business in NYTim BryantNo ratings yet

- Bryant Mortgage 2005 - RODDocument16 pagesBryant Mortgage 2005 - RODTim BryantNo ratings yet

- DBNT Not Registered To Do Business in NYDocument1 pageDBNT Not Registered To Do Business in NYTim BryantNo ratings yet

- A0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenDocument3 pagesA0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenTim BryantNo ratings yet

- Closing Version Mortgage-Rider 2005 BryantDocument16 pagesClosing Version Mortgage-Rider 2005 BryantTim BryantNo ratings yet

- Deutsche Bank National Trust Is Not Registered To Do Business in MADocument1 pageDeutsche Bank National Trust Is Not Registered To Do Business in MATim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in NYDocument1 pageGSAA HET 2005 15 Not Registered To Do Business in NYTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in MADocument2 pagesGSAA HET 2005 15 Not Registered To Do Business in MATim BryantNo ratings yet

- Legal Drafting 1-300 Mcqs.Document147 pagesLegal Drafting 1-300 Mcqs.Seemab MalikNo ratings yet

- عقد الايجار PDFDocument7 pagesعقد الايجار PDFSalem AlshehriNo ratings yet

- G.R. No. 164376Document19 pagesG.R. No. 164376Anne MacaraigNo ratings yet

- Lawyerization of The Engineering and Construction IndustryDocument9 pagesLawyerization of The Engineering and Construction IndustryKamal Halawi100% (1)

- TrustDocument8 pagesTrustSaravananNo ratings yet

- Court rules accretion land subject to prescriptionDocument3 pagesCourt rules accretion land subject to prescriptioncloudNo ratings yet

- Court Rules on Conditional Sale ContractDocument8 pagesCourt Rules on Conditional Sale Contractjun_romeroNo ratings yet

- TPA ProjectDocument9 pagesTPA Projectसौम्या जैनNo ratings yet

- Generac Power Systems v. Kohler Et. Al.Document21 pagesGenerac Power Systems v. Kohler Et. Al.PriorSmartNo ratings yet

- Rent-to-Own Contract Lease OptionDocument5 pagesRent-to-Own Contract Lease OptionJack Rollan Soliman AninoNo ratings yet

- Register of Deeds functions regarding title registrationDocument9 pagesRegister of Deeds functions regarding title registrationPierre AlvizoNo ratings yet

- Case DigestsDocument5 pagesCase DigestsmichelleNo ratings yet

- Real Property Tax HandoutDocument6 pagesReal Property Tax HandoutPatrick TanNo ratings yet

- PROPERTY - Key Terms DefinedDocument5 pagesPROPERTY - Key Terms DefinedAnica GomezNo ratings yet

- Livingston County Foreclosed Property Tax AuctionDocument41 pagesLivingston County Foreclosed Property Tax AuctiondfksdksdjkljijiopwpaNo ratings yet

- Ethical Issues in Computing and Information TechnologyDocument20 pagesEthical Issues in Computing and Information TechnologyJeysie ClarksonNo ratings yet

- IjarahDocument2 pagesIjarahSK LashariNo ratings yet

- Net Lease Casual Dining Report - The Boulder GroupDocument3 pagesNet Lease Casual Dining Report - The Boulder GroupnetleaseNo ratings yet

- Donors TaxDocument4 pagesDonors TaxIsrael MarquezNo ratings yet

- Agreement to Sell Philippine Corporation & 82,497sqm LandDocument9 pagesAgreement to Sell Philippine Corporation & 82,497sqm Landanna sheillaNo ratings yet