Professional Documents

Culture Documents

Ad Hoc Edison For Rule 2019

Uploaded by

DistressedDebtInvestOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ad Hoc Edison For Rule 2019

Uploaded by

DistressedDebtInvestCopyright:

Available Formats

Case 12-49219

Doc 282

Filed 01/16/13 Entered 01/16/13 10:36:41 Document Page 1 of 3

Desc Main

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION In re: EDISON MISSION ENERGY, et al.,1 Debtors. ) ) Chapter 11 ) ) Case No. 12-49219 (JPC) ) ) (Jointly Administered) )

VERIFIED STATEMENT OF AD HOC COMMITTEE OF SENIOR NOTEHOLDERS OF EDISON MISSION ENERGY PURSUANT TO BANKRUPTCY RULE 2019 Pursuant to Rule 2019 of the Federal Rules of Bankruptcy Procedure, the ad hoc committee of certain holders (the Senior Noteholder Committee) of the (i) 7.50% Senior Fixed Rate Notes due 2013 (the 2013 Notes) and 7.75% Senior Fixed Rate Notes due 2016 (the 2016 Notes) issued pursuant to that certain Indenture by and between Edison Mission Energy (EME) and Wells Fargo Bank, N.A., as trustee (in such capacity, the Indenture Trustee), dated as of June 6, 2006 (as amended, modified, waived, or supplemented through the date hereof), and (ii) 7.00% Senior Fixed Rate Notes due 2017 (the 2017 Notes), 7.20% Senior Fixed Rate Notes due 2019 (the 2019 Notes), and 7.625% Senior Fixed Rate Notes due 2027 (the 2027 Notes, and together with the 2013 Notes, 2016 Notes, 2017 Notes, and 2019 Notes, the Notes) issued pursuant to that certain Indenture by and between EME and the Indenture Trustee, dated as of May 7, 2007 (as amended, modified, waived, or supplemented through the

The Debtors in these chapter 11 cases, along with the last four digits of each Debtors federal tax identification number, include: Edison Mission Energy (1807); Aguila Energy Company (3425); Camino Energy Company (2601); Edison Mission Energy Fuel Services, LLC (4630); Edison Mission Fuel Resources, Inc. (3014); Edison Mission Fuel Transportation, Inc. (3012); Edison Mission Midwest Holdings Co. (6553); Midwest Finance Corp. (9350); Midwest Generation EME, LLC (1760); Midwest Generation, LLC (8558); Midwest Generation Procurement Services, LLC (2634); Midwest Peaker Holdings, Inc. (5282); Pleasant Valley Energy Company (3233); San Joaquin Energy Company (1346); Southern Sierra Energy Company (6754); and Western Sierra Energy Company (1447). The location of parent Debtor Edison Mission Energys corporate headquarters and the Debtors service address is: 3 MacArthur Place, Suite 100, Santa Ana, California 92707.

32814103_3

Case 12-49219

Doc 282

Filed 01/16/13 Entered 01/16/13 10:36:41 Document Page 2 of 3

Desc Main

date hereof), hereby submits this verified statement (the Verified Statement) by and through its undersigned counsel and in support thereof states: 1. In May 2012, certain holders of the Notes contacted Ropes & Gray LLP (Ropes & Gray) to represent them in connection with a potential restructuring of the above-captioned debtors and debtors-in-possession (collectively, the Debtors), resulting in the formation of the Senior Noteholder Committee. In the intervening months before the date of this Verified

Statement, certain additional holders of the Notes joined the Senior Noteholder Committee, and other holders of Notes withdrew from the Senior Noteholder Committee. As of the date of this Verified Statement, Ropes & Gray represents only the Senior Noteholder Committee and does not represent or purport to represent any entities other than the Senior Noteholder Committee in connection with the Debtors chapter 11 cases. In addition, the Senior Noteholder Committee does not represent or purport to represent any other entities in connection with the Debtors chapter 11 cases. 2. The names and addresses of the members of the Senior Noteholder Committee as of the date hereof are set forth on Exhibit A hereto. The members of the Senior Noteholder Committee hold claims or manage accounts that hold claims against the Debtors arising from the purchase of Notes in the aggregate amount of $2,371,705,000.00. 3. As reported to Ropes & Gray by each member of the Senior Noteholder Committee, as of the date the Debtors filed their chapter 11 cases, the members of the Senior Noteholder Committee held or managed accounts that held in the aggregate the disclosable economic interests set forth on Exhibit B. 4. Nothing contained in this Verified Statement (or Exhibits A or B hereto) should be construed as a limitation upon, or waiver of, any Senior Noteholder Committee members rights

2

32814103_3

Case 12-49219

Doc 282

Filed 01/16/13 Entered 01/16/13 10:36:41 Document Page 3 of 3

Desc Main

to assert, file and/or amend its claims in accordance with applicable law and any orders entered in these cases. 5. Ropes & Gray reserves the right to amend or supplement this Verified Statement.

Dated: January 16, 2013 Chicago, Illinois /s/ Stephen Moeller-Sally ROPES & GRAY LLP Keith H. Wofford, Esq. (pro hac vice pending) 1211 Avenue of the Americas New York, NY 10036-8704 Telephone: (212) 596-9000 Facsimile: (212) 596-9090 E-mail: keith.wofford@ropesgray.com -ANDROPES & GRAY LLP Stephen Moeller-Sally (pro hac vice) Patricia I. Chen (pro hac vice pending) Matthew F. Burrows (pro hac vice) Prudential Tower 800 Boylston Street Boston, MA 02199-3600 Telephone: (617) 951-7000 Facsimile: (617) 951-7050 E-mail: ssally@ropesgray.com patricia.chen@ropesgray.com matthew.burrows@ropesgray.com -ANDMeghan J. Dolan, Esq. 111 South Wacker Drive, 46th Floor Chicago, IL 60606 Telephone: (312) 845-1200 Facsimile: (312) 845-5500 E-mail: meghan.dolan@ropesgray.com Attorneys for the Senior Noteholder Committee

3

32814103_3

Case 12-49219

Doc 282-1

Filed 01/16/13 Entered 01/16/13 10:36:41 A Page 1 of 3

Desc Exhibit

EXHIBIT A

32814103_3

Case 12-49219

Doc 282-1

Filed 01/16/13 Entered 01/16/13 10:36:41 A Page 2 of 3

Desc Exhibit

NAME Alden Global Capital Arrowgrass Capital Partners LLP

ADDRESS 885 Third Avenue, 34th Floor New York, NY 10022 1330 Avenue of the Americas 32nd Floor New York, NY 10019 399 Park Avenue, 6th Floor New York, NY 10022 200 Park Avenue New York, NY 10166 280 Park Avenue #5E New York, NY 10017 399 Park Avenue, 16th Floor New York, NY 10022 2000 Avenue of the Stars, 11th Floor Los Angeles, CA 90067 399 Park Avenue, 7th Floor New York, NY 10022 900 3rd Avenue #29 New York, NY 10022 777 Third Ave., Suite 19A New York, NY 10017 8044 Montgomery Road, Suite 555 Cincinnati, OH 45236 1 Station Place Stamford, CT 06902 237 Park Avenue, Suite 900 New York, NY 10017 865 S. Figueroa Street Los Angeles, CA 90017 190 South LaSalle Street Suite 2400 Chicago, IL 60603 2 World Financial Center, Building B 18th Floor New York, NY 10281 9 West 57th Street, 39th Floor New York, NY 10019 1350 Avenue of the Americas, 21st Floor New York, NY 10019 757 Fifth Avenue, #20 New York, NY 10153 1114 Avenue of the Americas 41st Floor

Avenue Capital Group LLC Barclays Capital Inc. BlueMountain Capital Management, LLC Brigade Capital Management, LLC Canyon Capital Advisors, LLC Citi Capital Advisors Claren Road Asset Management, LLC Credit Value Partners, LP Cincinnati High Yield Group of J.P. Morgan Investment Management Inc. Jefferies High Yield Trading, LLC Litespeed Partners, L.P. Metropolitan West Asset Management, LLC Neuberger Berman Fixed Income LLC

Nomura Corporate Research and Asset Management OZ Management LP (on behalf of certain of its investment funds) P. Schoenfeld Asset Management LP Perry Capital River Birch Capital, LLC

32814103_3

Case 12-49219

Doc 282-1

Filed 01/16/13 Entered 01/16/13 10:36:41 A Page 3 of 3

Desc Exhibit

NAME Strategic Value Master Fund, Ltd. Strategic Value Special Situations II, L.P. Strategic Value Special Situations Feeder Fund II-A, Ltd. TCW Asset Management Company TCW Investment Management Company The Distressed Debt Trading Desk of Citigroup Global Markets Inc. Visium Asset Management, L.P.

ADDRESS New York, NY 10036 100 West Putnam Ave. Greenwich, CT 06830 100 West Putnam Ave. Greenwich, CT 06830 100 West Putnam Ave. Greenwich, CT 06830 865 S. Figueroa Street Los Angeles, CA 90017 865 S. Figueroa Street Los Angeles, CA 90017 1615 Brett Road New Castle. DE 19720 888 Seventh Avenue 22nd Floor New York, NY 10019 3033 Excelsior Boulevard Minneapolis, MN 55416 767 Fifth Avenue, 17th Floor New York, NY 10153

Whitebox Advisors, LLC York Capital Management LP

2

32814103_3

Case 12-49219

Doc 282-2

Filed 01/16/13 Entered 01/16/13 10:36:41 B Page 1 of 2

Desc Exhibit

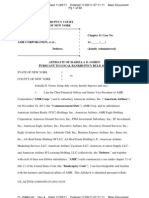

EXHIBIT B

32814103_3

Case 12-49219

Doc 282-2

Filed 01/16/13 Entered 01/16/13 10:36:41 B Page 2 of 2

Desc Exhibit

NATURE OF DISCLOSABLE ECONOMIC INTEREST 2013 Notes 2016 Notes 2017 Notes 2019 Notes 2027 Notes Midwest Generation, LLC 8.56% Series B Pass-Through Certificates (PTCs) Net Long CDS Notes Net Short CDS Notes Short PTCs

AMOUNT $169,041,000.00 $268,598,000.00 $926,548,000.00 $507,581,000.00 $499,937,000.00 $14,100,000.00 $80,028,350.00 $40,800,000.00 $14,094,000.00

32814103_3

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Distressed Debt PresentationDocument16 pagesDistressed Debt PresentationDistressedDebtInvest92% (12)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Notice Concerning Fiduciary RelationshipDocument4 pagesNotice Concerning Fiduciary Relationshipjoe100% (3)

- Financial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaDocument40 pagesFinancial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaChristoper BalangueNo ratings yet

- Home Guaranty Corp. v. La Savoie Corp.Document3 pagesHome Guaranty Corp. v. La Savoie Corp.Labels LoveNo ratings yet

- Case Digest Involving The FRIADocument2 pagesCase Digest Involving The FRIAMarinelle CAGUIMBALNo ratings yet

- BBC Not Exempt from Appeal BondDocument2 pagesBBC Not Exempt from Appeal Bondraikha barraNo ratings yet

- Hedge Funds in Penson BondsDocument5 pagesHedge Funds in Penson BondsDistressedDebtInvestNo ratings yet

- EK Financing MotionDocument103 pagesEK Financing MotionDistressedDebtInvestNo ratings yet

- AMR - Marathon Examiner MotionDocument27 pagesAMR - Marathon Examiner MotionDistressedDebtInvestNo ratings yet

- Thirdpoint 4q12investorletter 010913Document9 pagesThirdpoint 4q12investorletter 010913DistressedDebtInvestNo ratings yet

- AMR - Marathon Examiner MotionDocument27 pagesAMR - Marathon Examiner MotionDistressedDebtInvestNo ratings yet

- Tsa EixDocument71 pagesTsa EixDistressedDebtInvestNo ratings yet

- THQ Bidding ProceduresDocument38 pagesTHQ Bidding ProceduresDistressedDebtInvestNo ratings yet

- THQI Noteholder ObjectionDocument18 pagesTHQI Noteholder ObjectionDistressedDebtInvestNo ratings yet

- AOne Bankruptcy AuctionDocument82 pagesAOne Bankruptcy AuctionDistressedDebtInvestNo ratings yet

- 2012 q3 Letter DdicDocument5 pages2012 q3 Letter DdicDistressedDebtInvestNo ratings yet

- Patriot Coal Venue Change OrderDocument61 pagesPatriot Coal Venue Change OrderDistressedDebtInvestNo ratings yet

- AMR - Marathon Examiner MotionDocument27 pagesAMR - Marathon Examiner MotionDistressedDebtInvestNo ratings yet

- AMR - Marathon Examiner MotionDocument27 pagesAMR - Marathon Examiner MotionDistressedDebtInvestNo ratings yet

- China Medical Technologies Chapter 15 ProceedingDocument17 pagesChina Medical Technologies Chapter 15 ProceedingDistressedDebtInvestNo ratings yet

- AMR EETC RefinancingDocument1,106 pagesAMR EETC RefinancingDistressedDebtInvest100% (1)

- First Affidavit of Steve Cimalore - SealedDocument25 pagesFirst Affidavit of Steve Cimalore - SealedDistressedDebtInvestNo ratings yet

- 2012 Q3 Letter ExternalDocument5 pages2012 Q3 Letter ExternalDistressedDebtInvestNo ratings yet

- Winding-Up Petition - China MedicalDocument14 pagesWinding-Up Petition - China MedicalkerrcapNo ratings yet

- Berkshire Hathaway Motion For Examiner in RescapDocument17 pagesBerkshire Hathaway Motion For Examiner in RescapDistressedDebtInvest100% (1)

- Limited Objection GAPDocument7 pagesLimited Objection GAPDistressedDebtInvestNo ratings yet

- Cdcsy SaleDocument126 pagesCdcsy SaleDistressedDebtInvestNo ratings yet

- Dynegy Corp Structure ChartDocument2 pagesDynegy Corp Structure ChartDistressedDebtInvest100% (1)

- Ek 2019Document7 pagesEk 2019DistressedDebtInvestNo ratings yet

- Avenue Capital Et Al Complaint 9-21-2011Document34 pagesAvenue Capital Et Al Complaint 9-21-2011DistressedDebtInvestNo ratings yet

- 2019 2Document75 pages2019 2DistressedDebtInvestNo ratings yet

- AMR AffidavitDocument92 pagesAMR AffidavitDistressedDebtInvestNo ratings yet

- Distressed Investor's Market Panel DDIC July 19Document1 pageDistressed Investor's Market Panel DDIC July 19DistressedDebtInvestNo ratings yet

- Ahyfx q12011 LetterDocument5 pagesAhyfx q12011 LetterDistressedDebtInvestNo ratings yet

- Small Claims Tribunals Pre-Filing Assessment AcknowledgementDocument1 pageSmall Claims Tribunals Pre-Filing Assessment AcknowledgementSalauddeenNo ratings yet

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDocument6 pagesFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 DocketsNo ratings yet

- Case Study Orange CountyDocument3 pagesCase Study Orange CountyJobayer Islam Tunan100% (1)

- 02 S2 Special Topics in Mercantile LawDocument160 pages02 S2 Special Topics in Mercantile Lawsaeloun hrdNo ratings yet

- United States Court of Appeals, Third CircuitDocument19 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Legal Environment of Business in BangladeshDocument30 pagesLegal Environment of Business in BangladeshHosnain Shahin67% (3)

- Insolvency Law in Review - October 2020Document25 pagesInsolvency Law in Review - October 2020Anushi NayakNo ratings yet

- Fitness & Probity DeclarationDocument3 pagesFitness & Probity DeclarationCarlos Uriel Rojas ContrerasNo ratings yet

- MM ModelDocument91 pagesMM ModelBenjamin TanNo ratings yet

- LARCODocument12 pagesLARCOErvin TanNo ratings yet

- Cross-Border Corporate Insolvency Law in India: Dealing With Insolvency in Multinational Group Companies-Determining Jurisdiction For Group InsolvenciesDocument11 pagesCross-Border Corporate Insolvency Law in India: Dealing With Insolvency in Multinational Group Companies-Determining Jurisdiction For Group InsolvenciesAnand SinghNo ratings yet

- In Re: Jermaine Sinclair, 9th Cir. BAP (2013)Document12 pagesIn Re: Jermaine Sinclair, 9th Cir. BAP (2013)Scribd Government DocsNo ratings yet

- DE - Dirk Bliesener - Hengeler MuellerDocument54 pagesDE - Dirk Bliesener - Hengeler MuellerarohiNo ratings yet

- Maldives Banking Act (English)Document88 pagesMaldives Banking Act (English)kosmitoNo ratings yet

- Guidelines For Accreditation of Surety CompanieDocument7 pagesGuidelines For Accreditation of Surety Companiegoannamarie7814No ratings yet

- SC rules criminal charges not covered by corporate rehabilitation stay orderDocument10 pagesSC rules criminal charges not covered by corporate rehabilitation stay orderChow Momville EstimoNo ratings yet

- Et Al.Document162 pagesEt Al.Yessy YasmaraldaNo ratings yet

- Lesson 8 Voluntary Liquidation of CompaniesDocument7 pagesLesson 8 Voluntary Liquidation of CompaniesShiv ShankarNo ratings yet

- Distribution Agreement SummaryDocument11 pagesDistribution Agreement SummaryGaspard de la NuitNo ratings yet

- Carol Lee Page Kountze TX 2017-09-29Document10 pagesCarol Lee Page Kountze TX 2017-09-29green billNo ratings yet

- Numeric Value of Nomenclature As44Document10 pagesNumeric Value of Nomenclature As44Pramad BhattacharjeeNo ratings yet

- Learning Exercises Bsa 3101 Corporate LiquidationDocument2 pagesLearning Exercises Bsa 3101 Corporate LiquidationRachel Mae FajardoNo ratings yet

- Personal Finance Canadian Canadian 5th Edition Kapoor Test Bank 1Document22 pagesPersonal Finance Canadian Canadian 5th Edition Kapoor Test Bank 1karenhalesondbatxme100% (23)

- STADIO Programme Application FormDocument11 pagesSTADIO Programme Application FormMarilize De WeeNo ratings yet

- Larrobis V Phil Veterans Bank PDFDocument24 pagesLarrobis V Phil Veterans Bank PDFKaye Miranda LaurenteNo ratings yet