Professional Documents

Culture Documents

Create Swot Chart Using Excel

Uploaded by

ozachintanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Create Swot Chart Using Excel

Uploaded by

ozachintanCopyright:

Available Formats

Charting the Results of a SWOT Analysis

A graphic representation of the results of a SWOT analysis facilitates the quick assimilation of the key features and highlights of the results. The SWOT Chart model differentiates between strenghts and weaknesses of different scales, relevance and strategic impact. The different probabilities of threats or opportunities are also incorporated. However, at first glance the SWOT analysis is not underpinned by a rigorous analytical framework on which to base the chart. The framework presented here allows the SWOT results to be plotted in a logical and meaningful way. The X-Axis Any SWOT factor, such as financial resources, management team or market reputation, is in itself neither a strength nor a weakness. The availability of substantial financial resources or a strong management team could be deemed to be a strength while their absence could be deemed as a weakness. From a graphic representation perspective a weakness is a negative strength. Strengths and weaknesses can be plotted on a continuous axis with: Significant Strength Strength Minor Strength Neutral Minor Weakness Weakness Significant Weakness 5 3 1 0 -1 -3 -5

Similarly, threats are negative opportunities and threats and opportunities can also be plotted on a continuous axis with Significant Opportunity 5 Opportunity 3 Minor Opportunity 1 Neutral 0 Minor Threat -1 Threat -3 Significant Threat -5 Thus, this first axis (x-axis) measures the scale or magnitude of the SWOT factor. Y-Axis All strengths or weaknesses do not have the same relevance or importance. The relevance of, say financial resources is clearly different in a business that requires long-term market development and investment to one that is generating significant positive cash flows. Similarly, all threats or opportunities are not equally likely to materialise. Clearly two threats that have significantly different probabilities of occurring should be treated differently. Thus, it is appropriate to use probability as an axis when plotting threats and opportunities. The second axis (Y-axis) is used to plot the relevance of strengths or weaknesses and the probability of threats or opportunities as follows: Strength/Weakness Highly Relevant Strength/Weakness Relevant Strength/Weakness little Relevance Neutral Opportunity/Threat Low Probability Opportunity/Threat Medium Probability Opportunity/Threat High Probability 5 3 1 0 -1 -3 -5

Z-Axis SWOT analysis is normally used as part of the strategic planning process. Within that context it is appropriate to consider the strategic impact of the relevant SWOT factor on the organisation. Two threats with equal probability of occurring can have significantly different impacts, if they occur. The Z-Axis (the diameter of the bubble in a bubble chart) is used to plot the impact as follows: High Impact Medium Impact Low Impact 5 3 1

Interpretation

Items plotted close to the (0,0) are the least significant, either because they are not rated as important or the relevance or probability is very low. Those that are at the extremes of the chart are rated as most important and are rated as highly relevant or a high probability of occurring. The size of the bubble indicates the strategic impact of the SWOT factor.

(c) Marketware International 2001-2004

SWOT Chart

www.marketware.biz

SWOT Chart User Guide

Copyright MarketWare International 2001-2004

User Instructions

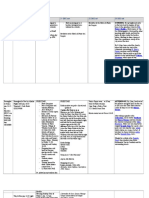

The EXCEL model has a simple Push Button Menu system at the top of the Workbook in cells A2. The following general guidelines should be followed. Cells in Green are intended for User Input. Cells in Black are calculated and should not be altered by the user. On first use it is recommended that the Menu Options be used in the sequence in which they are numbered, 1, 2, 3, etc. On subsequent use the options can be selected as required to make amendments to the data originally entered.

Enter the SWOT Factors. These are the factors that you will subsequently be classified as Strengths, Weaknesses, Opportunities or Threats Factor Classification. Use the dropdown list to classify each of the SWOT Factors The choices are: Significant Strength Strength Minor Strength Minor Weakness Weakness Significant Weakness Significant Opportunity Opportunity Minor Opportunity Significant Threat Threat Minor Threat

Relevance/Probability. Use the dropdown list to rate each of the SWOT Factors The choices are: Strength/weakness highly relevant Strength/weakness relevant Strength/weakness little relevance Opportunity/Threat high probability Opportunity/Threat medium probability Opportunity/Threat low probability

Strategic Impact Use the dropdown list to rate each of the SWOT Factors The choices are: High Impact Medium Impact Low Impact Once the relevant data is entered the SWOT chart is automatically produced.

(c) MarketWare International

SWOT Chart

www.marketware.biz

SWOT Chart

Copyright MarketWare International 2001-2004

SWOT Factors

Financial resources Market share Brand Image R&D Management Team Manufacturing Technology Sales Team Cost Base Innovation Exchange Rates Industry Specialisation Economic Outlook Government Policies Pricing Globalisation

Factor Classification

Relevance/Probability

Strategic Impact

Neutral Opportunity Opportunity Minor Opportunity Significant Strength Strength Minor Strength Significant Threat Threat Minor Threat Significant Weakness Weakness Minor Weakness Significant

0 1 3 5 3 1 5 -3 -1 -5 -3 -1 -5

7 5 6 13 11 12 4 2 3 10

3 2 1 2 3 1 4 5 6 4

3 2 1 3 2 1 3 2 1 3

Financial resources Market share Brand Image R&D Management Team Manufacturing Technology Sales Team Cost Base Innovation Exchange Rates

SWOT Chart Rating Probability Impact 5.0 5.0 5.0 3.0 3.0 3.0 1.0 1.0 1.0 -5.0 3.0 5.0 -3.0 5.0 3.0 -1.0 1.0 1.0 5.0 -5.0 5.0 1.0 -3.0 3.0 3.0 -1.0 1.0 -5.0 -5.0 5.0

MarketWare International Confidential

SWOT Input

Page 3

Weaknesses

SWOT Analysis

6.0

Strengths

4.0

2.0 Probability/Relevance

0.0 -6.0 -4.0 -2.0 0.0 2.0 4.0

-2.0

-4.0

-6.0

Threats

Financial resources Manufacturing Technology Market share Sales Team Economic Outlook

Scale

Brand Image Cost Base R&D Innovation Pricing

Opportunities

Management Team Exchange Rates

MarketWare International

Industry Specialisation

SWOT Chart

Government Policies

www.marketware.biz

Globalisation

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ibad Rehman CV NewDocument4 pagesIbad Rehman CV NewAnonymous ECcVsLNo ratings yet

- KCC Strategic Plan 2020-2023Document103 pagesKCC Strategic Plan 2020-2023Kellogg Community CollegeNo ratings yet

- Festo Process Control - CatalogDocument3 pagesFesto Process Control - Cataloglue-ookNo ratings yet

- Claim Form - Group Health InsuranceDocument5 pagesClaim Form - Group Health Insurancevizag mdindiaNo ratings yet

- MA5616 V800R311C01 Configuration Guide 02Document741 pagesMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNo ratings yet

- BUS 301 Final AssesmentDocument15 pagesBUS 301 Final AssesmentTanzim ShahriarNo ratings yet

- Table of Forces For TrussDocument7 pagesTable of Forces For TrussSohail KakarNo ratings yet

- 2011 REV SAE Suspension Kiszco PDFDocument112 pages2011 REV SAE Suspension Kiszco PDFRushik KudaleNo ratings yet

- Application Tracking System: Mentor - Yamini Ma'AmDocument10 pagesApplication Tracking System: Mentor - Yamini Ma'AmBHuwanNo ratings yet

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Document126 pagesRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerNo ratings yet

- Structure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesDocument8 pagesStructure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesJakub BańczerowskiNo ratings yet

- Crypto Is New CurrencyDocument1 pageCrypto Is New CurrencyCM-A-12-Aditya BhopalbadeNo ratings yet

- Presenting India's Biggest NYE 2023 Destination PartyDocument14 pagesPresenting India's Biggest NYE 2023 Destination PartyJadhav RamakanthNo ratings yet

- Example Italy ItenararyDocument35 pagesExample Italy ItenararyHafshary D. ThanialNo ratings yet

- E85001-0646 - Intelligent Smoke DetectorDocument4 pagesE85001-0646 - Intelligent Smoke Detectorsamiao90No ratings yet

- Katie Todd Week 4 spd-320Document4 pagesKatie Todd Week 4 spd-320api-392254752No ratings yet

- SS Corrosion SlidesDocument36 pagesSS Corrosion SlidesNathanianNo ratings yet

- Outdoor Composting Guide 06339 FDocument9 pagesOutdoor Composting Guide 06339 FAdjgnf AANo ratings yet

- Audit Report of CompaniesDocument7 pagesAudit Report of CompaniesPontuChowdhuryNo ratings yet

- Portfolio Corporate Communication AuditDocument8 pagesPortfolio Corporate Communication Auditapi-580088958No ratings yet

- HR PlanningDocument47 pagesHR PlanningPriyanka Joshi0% (1)

- GeM Bidding 2568310Document9 pagesGeM Bidding 2568310SICURO INDIANo ratings yet

- Manual Circulação Forçada PT2008Document52 pagesManual Circulação Forçada PT2008Nuno BaltazarNo ratings yet

- E4PA OmronDocument8 pagesE4PA OmronCong NguyenNo ratings yet

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- University of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizDocument3 pagesUniversity of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizAnmer Layaog BatiancilaNo ratings yet

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNo ratings yet

- Solid Waste On GHG Gas in MalaysiaDocument10 pagesSolid Waste On GHG Gas in MalaysiaOng KaiBoonNo ratings yet

- BS en 12951-2004Document26 pagesBS en 12951-2004Mokhammad Fahmi IzdiharrudinNo ratings yet

- Key Payment For Japan EcomercesDocument9 pagesKey Payment For Japan EcomercesChoo YieNo ratings yet