Professional Documents

Culture Documents

Research Topic

Uploaded by

Rajkumar35Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research Topic

Uploaded by

Rajkumar35Copyright:

Available Formats

Financial Reporting Quality

The quality of financial reporting is crucial for the efficient functioning of capital markets and for management decisions to direct scarce resources to their best use. The objective of current developments of accounting standards and quality assurance institutions is to improve the quality of financial reporting. This project explores aspects of quality and at analyzes the economic effects of these developments in reporting standards. It studies financial reporting quality from both a financial and a management accounting perspective, that is, a stewardship perspective. It tackles the basic characteristics and their economic effects, and it also considers transactions- to events-based accounting and the form of standards (rules- or principles-based). While much has been written on these issues, they are still not well understood, particularly given the increasing dynamics of markets, the rise of intangibles as a major value driver, and the increasing use of financial instruments. Issues are measurement concepts, such as fair values, and attributes of core financial numbers used in financial reporting, the trade-off between relevance and reliability, and the use of conservative reporting and timeliness of information. The way financial reporting is designed has important implications for management incentives, and these incentives may bias the desired reporting quality in equilibrium. The research methods employed are analytical modelling and empirical methods, particularly using archival data. Auditor regulation and audit quality The quality of financial reporting depends crucially on the quality of audits. The auditors task is to provide reasonable assurance that the financial statements presented to the capital market conform to rules and/or standards as required by national and/or international GAAP. To guarantee high quality audits, there is extensive regulation of the audit profession worldwide such as, e.g., the Sarbanes-Oxley Act (SOX) 2002 in the USA and the Auditor Directive 2006 in the EU. Auditing is no longer mainly selfregulated by the auditing profession but is now overseen by independent supervisory bodies (due to the status of its members, financing etc.) from the audit profession. Furthermore, the regulation restricts services that audit firms may provide to their clients in addition to assurance, and the issue of auditor liability and market structure has come under scrutiny. It is an open question whether the recent regulatory activities of standard setters in the auditing area are really beneficial for fostering audit quality (and financial reporting quality). The SOX has even been termed quack corporate governance because at least some of its rules have apparently turned out to be ill-conceived in the light of results from audit research. This project aims to comprehensively assess the effectiveness of recent trends in audit regulation with respect to audit quality and to develop proposals based on conceptual insights that lead to more appropriate regulatory actions. Accounting and corporate governance In selecting governance mechanisms, decision makers in firms try to deal with conflicts of interests, incentive issues, dispersed and distorted information, and allocation of decision rights. A critical element in the choice of the design of an organization is the information which decision makers have or obtain from an accounting system, including observability, verifiability, and timeliness of this information. It is important to consider, however, that in addition to generating and influencing management incentives, the organizational form and accounting reports also have strategic consequences in product markets. The relation between the internal governance and the external environment has not been as thoroughly researched as it could be. Therefore, this project focuses on the link between the (choice of the) organizational mode/governance structure and the performance measures in firms in imperfectly competitive product markets. In order to analyze and evaluate how performance measurement and governance mechanism are connected with a firms competitive advantage, elements from agency theory, transaction cost theory, and property rights theory are combined with the rich arsenal of market models.

Taxation and incentives Tax research plays a major role in linking the research agendas of economics and business administration, particularly in accounting, finance, public economics, and law. Taxation and tax aspects are getting more international and intertwined with corporate governance. This project particularly picks up the interrelation of taxation and incentives with respect to economic decisions in firms. Taxes are being widely neglected in models, such as agency theory, transaction cost theory, and property rights theory. Hitherto, the impact of taxation on managerial decisions in the realistic setting of informational asymmetry has been rarely investigated. Whereas the effects of incentive schemes are well-known in the absence of taxation, the impact of corporate and individual income taxation on the effectiveness of these incentive schemes has been investigated only for linear contracts. The design of optimal performance measurement systems and optimal incentive schemes in the presence of taxation is still unknown. Recent research in accounting as well as in public finance indicates that a firms organizational structure is essential for the way taxation affects investment and financing decisions, especially for multinational corporations facing substantial tax rate differentials between different subsidiaries. There is little knowledge about the optimal organizational structure under different international tax allocation rules. Managerial performance measurement A central issue in managerial accounting is the design of incentive systems for employees. Frequently expressed concerns are that employees may undertake (investment) decisions which are not in line with the firms overall objectives. In practice, almost every well-known consulting company has developed its own metric and incentive system which is typically based on a trademarked variant of the residual income concept (for instance, Stern Stewarts Economic Value Added, McKinseys Economic Profit or the Boston Consulting Groups Cash Value Added). Many of these metrics require adjustments of financial reporting numbers, which implies that financial reporting systems often include measurement rules that are not optimal from an incentives and managerial decision-making perspective. Most incentive schemes applied in practice include kinks, caps and floors in the pay-performance relation. In theory, different approaches have been utilized to analyze the design of incentive systems properly, including agency theory, goalcongruence, and preference-similar approaches. While there has been a lot of progress, there are still many questions that remain unresolved. For example, most of the approaches require that goals coincide, but this needs quite ideal settings. They also assume technological independence, and typically simple organizational contexts. It is not clear what happens with an imperfect matching of preferences and technological dependencies, and how this interacts with the organizational structure. Accounting and Intangibles Accounting standards define the amount and quality of information in financial reports. Corporate governance rules ask users outside a firm, particularly investors for additional information. Despite detailed requirements, there is a demand for additional information on intangibles. Firms do provide such information on a voluntary basis. It is an open question if it is beneficial for firms to provide information, e.g., on research and development (R&D) or know how, and what reporting incentives they really have. Reports on intangibles may provide relevant information for investors, but the information is less reliable than mandatory accounting information. Auditing may help to increase reliability, but specific characteristics of reports on intangibles make that task difficult. Another question is what impact information on intangibles has on management decisions within the firm. Can known results in management accounting and control procedures be applied in the context of controlling intangibles? The reliability of such information also has an impact on the choice of performance measures and the design of incentive contracts. Therefore, the increasing importance of intangibles within firms provides a challenge for accounting research and requires a close interrelationship between different areas of accounting research. While much of the literature uses qualitative research, and more recently, also empirical methods to address problems of intangibles in accounting, this project uses analytical economic modelling to study these issues and to advance our knowledge in this area.

You might also like

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Strategy Mapping: An Interventionist Examination of a Homebuilder's Performance Measurement and Incentive SystemsFrom EverandStrategy Mapping: An Interventionist Examination of a Homebuilder's Performance Measurement and Incentive SystemsNo ratings yet

- Final Term Project 15-01-2020Document7 pagesFinal Term Project 15-01-2020Muhammad Umer ButtNo ratings yet

- Ibiye Roject WorkDocument49 pagesIbiye Roject Workpeter eremieNo ratings yet

- PSComplianceDocument7 pagesPSComplianceapi-3828277No ratings yet

- Audit Quality - The IAASB's FrameworkDocument5 pagesAudit Quality - The IAASB's FrameworkSadia 55No ratings yet

- RMK 1 - Advanced Behaviorial AccountingDocument7 pagesRMK 1 - Advanced Behaviorial Accountingyurika regiNo ratings yet

- A Reveiw of The Earnings Managemnet Literature and Its Implications For Standard SettingsDocument20 pagesA Reveiw of The Earnings Managemnet Literature and Its Implications For Standard Settingsrahulnanda87No ratings yet

- Management AccountingDocument188 pagesManagement Accountingabdul100% (1)

- AutoRecovery Save of ConclusionDocument2 pagesAutoRecovery Save of ConclusionNUR FARAH ALIAH RAMLANNo ratings yet

- Literature Review Earnings ManagementDocument6 pagesLiterature Review Earnings Managementfihynakalej2100% (1)

- Financial AccountingDocument11 pagesFinancial AccountingBunga putri PraseliaNo ratings yet

- Assignment No-5: Q. What Are The Evaluation Criteria of Benefits of Innovation For BussinessDocument9 pagesAssignment No-5: Q. What Are The Evaluation Criteria of Benefits of Innovation For BussinessPROFESSIONAL SOUNDNo ratings yet

- Vhurinosara Tapiwanashe A BS Assignment 1Document8 pagesVhurinosara Tapiwanashe A BS Assignment 1Victor HoveNo ratings yet

- Contemporary Challenges in Audit (Vii)Document6 pagesContemporary Challenges in Audit (Vii)najiath mzeeNo ratings yet

- Management Summary Bimtodd 131223Document3 pagesManagement Summary Bimtodd 13122332MJI Made Angga Dwipaguna MudithaNo ratings yet

- Shivi Management AccountantDocument7 pagesShivi Management AccountantShivin OvNo ratings yet

- Accounts NotesDocument15 pagesAccounts NotessharadkulloliNo ratings yet

- Management AccountingDocument155 pagesManagement AccountingBbaggi Bk100% (2)

- Liang (2015)Document90 pagesLiang (2015)ashkanfashamiNo ratings yet

- Contemporary Issues, Project 1Document7 pagesContemporary Issues, Project 1dipika upretyNo ratings yet

- Literature Review On Accounting Information SystemDocument8 pagesLiterature Review On Accounting Information SystemafdtzwlzdNo ratings yet

- Refined Paper Fin ManDocument6 pagesRefined Paper Fin ManRadhel Faith ToloNo ratings yet

- PROJECT Chap. 1Document7 pagesPROJECT Chap. 1Muabecho FatimatuNo ratings yet

- Defining A Cost Management SystemDocument13 pagesDefining A Cost Management SystemAbhilash JackNo ratings yet

- Erico Dwi Septiawan - Accounting TheroyDocument6 pagesErico Dwi Septiawan - Accounting TheroyNdewo ErikoNo ratings yet

- Topic Overview Week 3 - Accounting and ProfessionalismDocument15 pagesTopic Overview Week 3 - Accounting and ProfessionalismWatsanzo ChimaliroNo ratings yet

- The Relationship Between Accounting Information System AIS and The Company Internal ControlDocument34 pagesThe Relationship Between Accounting Information System AIS and The Company Internal ControlMega Pop LockerNo ratings yet

- Management Accounting EssayDocument3 pagesManagement Accounting EssayUsman KhanNo ratings yet

- Aula 1 - The Performance Measument Manifeto Eccles 1991Document9 pagesAula 1 - The Performance Measument Manifeto Eccles 1991LAURA PATRICIA CHAVARRIA VINDASNo ratings yet

- Balanced Scorecard For Law FirmsDocument4 pagesBalanced Scorecard For Law Firmssambhavahuja100% (1)

- Sample Topics For Research Paper About AccountingDocument7 pagesSample Topics For Research Paper About Accountingaflbmfjse100% (1)

- Research Paper of Managerial AccountingDocument6 pagesResearch Paper of Managerial Accountinglzpyreqhf100% (1)

- Research QuestionsDocument37 pagesResearch QuestionsAmmar HassanNo ratings yet

- Internal Control QuestionsDocument4 pagesInternal Control QuestionsWilNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 1Document12 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 1jasperkennedy064% (11)

- Literature Review On Internal Control Cash ManagementDocument8 pagesLiterature Review On Internal Control Cash Managementc5se0nswNo ratings yet

- MA 6e CH01 WebsiteDocument26 pagesMA 6e CH01 WebsiteSewale AbateNo ratings yet

- Accounting TheoryDocument192 pagesAccounting TheoryABDULLAH MOHAMMEDNo ratings yet

- Exit Planning. Survival and Recovery Planning.: BackgroundDocument6 pagesExit Planning. Survival and Recovery Planning.: BackgroundkoblaagbelengorNo ratings yet

- Assignment TwoDocument3 pagesAssignment TwoCharles MachuvaireNo ratings yet

- ( (The Role of AuditorDocument5 pages( (The Role of AuditorMohsin KhanNo ratings yet

- Gayu ProjectDocument39 pagesGayu ProjectNizamutheen ANo ratings yet

- Introduction Ni Pauline Sa Concept Paper NiyaDocument8 pagesIntroduction Ni Pauline Sa Concept Paper NiyaOyo BoyNo ratings yet

- AAA - Assignment 2 (BEN)Document7 pagesAAA - Assignment 2 (BEN)Benson KamphaniNo ratings yet

- Management Accounting: Navigation SearchDocument5 pagesManagement Accounting: Navigation SearchDaniel AtemaNo ratings yet

- Auditing AssignmentDocument4 pagesAuditing AssignmentJosemaR21No ratings yet

- Accounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsDocument7 pagesAccounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsPrabina PoudelNo ratings yet

- The Effect of Corporate Taxation On Firm Performance and EquityDocument47 pagesThe Effect of Corporate Taxation On Firm Performance and EquitytafNo ratings yet

- Managing Regulatory Compliance in Business Processes PDFDocument23 pagesManaging Regulatory Compliance in Business Processes PDFJosé ConstanteNo ratings yet

- MAEDocument9 pagesMAEArjen PaderogNo ratings yet

- Literature Review On External AuditingDocument7 pagesLiterature Review On External Auditingaflsqfsaw100% (1)

- Article Assignment (Ahtisham)Document12 pagesArticle Assignment (Ahtisham)AhtishamNo ratings yet

- A New Look at Management AccountingDocument14 pagesA New Look at Management AccountingWan LingNo ratings yet

- Abdel Razza Khoirie-185020307141016-Assignment 1Document5 pagesAbdel Razza Khoirie-185020307141016-Assignment 1Abdel RazzaNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Political Standards: Corporate Interest, Ideology, and Leadership in the Shaping of Accounting Rules for the Market EconomyFrom EverandPolitical Standards: Corporate Interest, Ideology, and Leadership in the Shaping of Accounting Rules for the Market EconomyNo ratings yet

- Breaking Into Wall Street - SyllabusDocument16 pagesBreaking Into Wall Street - SyllabusRajkumar35100% (1)

- PHD by PublicationDocument17 pagesPHD by PublicationRajkumar35No ratings yet

- Importing Text File in RDocument28 pagesImporting Text File in RRajkumar35No ratings yet

- Sergei Fedotov: 20912 - Introduction To Financial MathematicsDocument28 pagesSergei Fedotov: 20912 - Introduction To Financial MathematicsRajkumar35No ratings yet

- Writing A Journal Article: Guidance For Novice Authors: Continuing Professional DevelopmentDocument8 pagesWriting A Journal Article: Guidance For Novice Authors: Continuing Professional DevelopmentRajkumar35No ratings yet

- CL Unilever Organizational Changes in INMARKO ENGDocument28 pagesCL Unilever Organizational Changes in INMARKO ENGRajkumar35No ratings yet

- Org Stru and CultureDocument10 pagesOrg Stru and CultureRajkumar35No ratings yet

- Country Specific IFRSDocument23 pagesCountry Specific IFRSRajkumar35No ratings yet

- PHD Admissions TipsDocument11 pagesPHD Admissions TipsRajkumar35No ratings yet

- FMEA - Student ManualDocument115 pagesFMEA - Student ManualRajkumar35No ratings yet

- Capm and AptDocument10 pagesCapm and AptRajkumar35No ratings yet

- Risk and Return 2009Document10 pagesRisk and Return 2009Rajkumar35No ratings yet

- Distribution of WealthDocument23 pagesDistribution of WealthRajkumar35No ratings yet

- Your Statement of Purpose Should Answer Specific Questions Outlined Below. Applications Will Not Be Successful Without This StatementDocument1 pageYour Statement of Purpose Should Answer Specific Questions Outlined Below. Applications Will Not Be Successful Without This StatementRajkumar35No ratings yet

- IAS16Document18 pagesIAS16Peter, DeogratiasNo ratings yet

- Journal of Behavioral and Experimental Finance Volume 2 Issue 2014 (Doi 10.1016/j.jbef.2014.02.005) Nawrocki, David Viole, Fred - Behavioral Finance in Financial Market Theory, Utility Theory, Por PDFDocument8 pagesJournal of Behavioral and Experimental Finance Volume 2 Issue 2014 (Doi 10.1016/j.jbef.2014.02.005) Nawrocki, David Viole, Fred - Behavioral Finance in Financial Market Theory, Utility Theory, Por PDFvan tinh khucNo ratings yet

- Ama Vol Chapter 5 2Document193 pagesAma Vol Chapter 5 2prachi aroraNo ratings yet

- Your M&S Credit Card Statement: %%mail - BarcodeDocument3 pagesYour M&S Credit Card Statement: %%mail - BarcodecarlNo ratings yet

- Project ReportDocument21 pagesProject Reportmasif_janooNo ratings yet

- Latin Words in Business Law Simplified Explanation - WPS OfficeDocument2 pagesLatin Words in Business Law Simplified Explanation - WPS OfficeRheu Reyes50% (2)

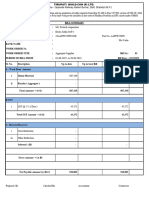

- Disbursement Voucher FidelityDocument1 pageDisbursement Voucher FidelityGigi Quinsay VisperasNo ratings yet

- Bitcoin Halving, Explained: Mar 24, 2020updated Apr 6, 2020Document11 pagesBitcoin Halving, Explained: Mar 24, 2020updated Apr 6, 2020Pieter SteenkampNo ratings yet

- Well'S Consulting Services Worksheet For The Month Ended January 31, 2X1XDocument1 pageWell'S Consulting Services Worksheet For The Month Ended January 31, 2X1Xariane pileaNo ratings yet

- Calamos Market Neutral Income Fund: CmnixDocument2 pagesCalamos Market Neutral Income Fund: CmnixAl BruceNo ratings yet

- Sterlite Technologies PDFDocument302 pagesSterlite Technologies PDFbardhanNo ratings yet

- Bunker HedgingDocument30 pagesBunker Hedgingukhalanthar100% (6)

- Trutech Stone Crusher KubariDocument7 pagesTrutech Stone Crusher Kubarigolu23_1988No ratings yet

- CHAPTER-2 Business Plan.Document40 pagesCHAPTER-2 Business Plan.mohammedkasoNo ratings yet

- 2023-01-02发票清单 5Document1 page2023-01-02发票清单 5Elham HussienNo ratings yet

- Full Download Pfin3 3rd Edition Gitman Solutions ManualDocument36 pagesFull Download Pfin3 3rd Edition Gitman Solutions Manualc3miabutler100% (31)

- InvoiceDocument1 pageInvoiceRPGERNo ratings yet

- Banco CompartamosDocument4 pagesBanco Compartamosarnulfo.perez.pNo ratings yet

- Request To Make A Partfull PrepaymentDocument1 pageRequest To Make A Partfull PrepaymentMritunjai SinghNo ratings yet

- Reserve Bank of India Bulletin August 2011 Volume LXV Number 8Document356 pagesReserve Bank of India Bulletin August 2011 Volume LXV Number 8pt797jNo ratings yet

- Financial+Statements Ceres+Gardening+CompanyDocument13 pagesFinancial+Statements Ceres+Gardening+Companysiri pallaviNo ratings yet

- ChartChampions LearningModulesDocument370 pagesChartChampions LearningModulesFaizan SawaniNo ratings yet

- A.2.5. Letter of Confirmation of The EngagementDocument3 pagesA.2.5. Letter of Confirmation of The EngagementRodeth CeaNo ratings yet

- CCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09Document219 pagesCCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09prowagNo ratings yet

- Cebu T-123 (ND) 060523Document26 pagesCebu T-123 (ND) 060523Shawn Gabriel EscasinasNo ratings yet

- Cint 2018 Ar PDFDocument177 pagesCint 2018 Ar PDFAkun GloryNo ratings yet

- Unit IV Corporate Liquidation PDFDocument20 pagesUnit IV Corporate Liquidation PDFLeslie Mae Vargas ZafeNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Credit OperationsDocument4 pagesCredit OperationsGrace OpeketeNo ratings yet