Professional Documents

Culture Documents

Hospital Corporation Case

Uploaded by

Rithika BaruahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hospital Corporation Case

Uploaded by

Rithika BaruahCopyright:

Available Formats

Indian Institute of Management, Kozhikode Strategic Financial Management

Hospital Corporation of America

Group 1-Section A| Case Submission

Kavadi Omprakash* Abhishek Bhalotia Divesh Ranjan Rithika Baruah Saurabh Pillai Siddhartha Roy (PGP/15/226) (PGP/15/263) (PGP/15/275) (PGP/15/313) (PGP/15/318) (PGP/15/321) 15% 20% 20% 10% 20% 15%

[Type text]

Page 0

1. Assess HCAs performance and business strategy. How are these likely to change in the future? Specifically, what is the likely impact of the proposed change to prospective reimbursement by Medicare/Medicaid programs? More generally, should HCA push for maximum growth, or slow down and focus on increasing profitability? HCAs strategy is largely linked to achieving annual growth of 25-30% (including inflation effects) for several years in the future. It has largely grown in the recent past by means of acquisition of existing hospitals, construction of new hospitals and acquisition of other proprietary hospital management companies. However, in the future, especially with regulatory changes in the pipeline, HCA might have to shift its focus from growth to profitability. Considering the prospective reimbursement by Medicare/Medicaid programs, a hospitals profitability (or even survival) would be linked to cost of services provided. In such a scenario, growth (especially by acquisition) would have very high investment costs which would put a lot of pressure on HCAs return on investment. Therefore, in light of the upcoming prospective reimbursement regulations, it would be prudent to consider slowing down and focusing on profitability instead of growth.

2. How does HCAs financial strategy affect its product-market strategy? How important is finance to HCA? In what ways? HCAs financial strategy would affect its growth strategy since acquisitions as well as new construction of hospitals have very high investment costs and covering these costs need sufficient debt for the project see the light of day. The debt ratio also affects the efficiency of HCA in raising funds in the capital market. Undoubtedly, finance is very important to HCA as is evident from the composition of its board of directors. Its debt ratio is crucial in how it grows as well as the way it copes with the anticipate regulatory changes. In addition, HCAs earnings per share affect its profitability and stock performance.

3. Evaluate HCAs set of financial goals. Are they achievable as a group? Which are most important and why? How might HCAs debt policy affect its ability to achieve these goals? How might it affect HCAs ability to raise funds in capital markets?

1|Page

HCAs set of financial goals include maintaining a debt to total capital ratio of 60% (the number was arrived at by a rather informal method and continued to stay there due to conservatism), return on capital was expected to stay around 11% after taxes, return on equity around 17% after taxes and dividend payout of 15% of net income as well as maintenance and improvement of net profit margin as a percentage of operating revenues. In addition, the CFO wanted the average interest cost of HCAs debt at 15% or lower. Among these, the most important goal was to deal with the debt ratio. Since the 60% figure was arrived at during HCAs initial years by downsizing from the average debt for real estate development projects, there was a lot of speculation that it might be a very small number. It was argued that the debt ratio should be maintained to be as high as 75%-80% to accommodate HCAs growth strategy in the future. The availability of debt would be helpful in acquisition and construction projects to achieve the required growth. However, an increased debt ratio would lead to a drop in HCAs credit rating. This would lead to a limitation in raising capital via bonds. Moreover, 60% might be a high number considering the potential changes in the regulatory environment. 4. Should HCA be concerned about the possibility of losing its single-A bond rating? How does HCAs rating compare to its competitors bond ratings? In general, how much importance should a company attach to credit ratings when establishing a target debt ratio? What are the consequences of too much or too little leverage for HCA? The current debt ratio of HCA is 70%much higher than established target ratio of 60%. In order to maintain the rating of A, HCA has to maintain its debt structure of 60-40. The concern associated with losing the rating is the amount of debt holding. With more debt under the hand the position can be leveraged for investing in future growth of the company. Some investors believe that a more aggressive use of leverage would present greater opportunities in the future. Others feel that with changes in Medicare/Medicaid reimbursement structure on the horizon, HCA should remain conservative.

HCA belongs to the construction industry and the general trend in this industry was high debt, even up to 95% of debt was acceptable norm. However, HCAs assets included

2|Page

equipment rather than buildings or plants. So going by conserving attitude 70% of debt was acceptable. Companies dont pay much attention to the credit rating while establishing Debt/Equity ratio. Rather the company determines the appropriate amount of debt popular in the industry and customizes it to own requirement. There are two alternatives: Scenario 1: Maintain current debt ratio of 70%.

This would also indicate that HCA receives a lower rating. This could prove to be good and bad. In some instances, companies with lower ratings experience a rise in their cost of debt or loss access to the debt market. But with growth rate of 15% and ROE of 17.6% signifies efficiency and company is headed in right direction. Loss of the A rating could make the access to the debt markets difficult. Scenario 2: Reduce debt to equity ratio.

If HCA decreases their debt ratio to 60%, they will retain their A bond rating in exchange for a decline in their ROE and growth rate. 5. What is the order of magnitude of HCAs funds over the next few years? Are these needs deferrable? HCAs growth objective implied capital expenditure of $575 million in 1982. This level could be expected to expand by 20% a year for the next several years. HCA would like to see the annual growth rate in the 25-30% range, although they have also set a minimum of 13%. The debt payment can be deferred in the current scenario but we believe that interest coverage and debt coverage ratio is quite adequate in order for the payments to be made at the original schedule and therefore, there is no additional benefit derived out of withholding the debt payments. 6. Outline the key components of financial strategy and policy for HCA. The broader strategic and financial goals as specified by Hospital Corporation of America are as follows: a. Financial Objectives for Hospital Corporation of America: o Minimum Pay-Out Ratio: 15%

3|Page

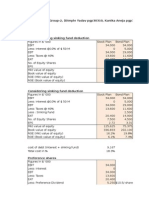

o Target/Original Debt to Equity Ratio: 60:40 o Cost of Debt <= 15% b. Growth Rates being targeted is equal to or greater than 13% in real terms or 2530% in nominal terms adding the inflation effect onto the growth rate. Since the maximum retention ratio can be 85%, minimum RoE can be calculated using Sustainable Growth Rate Equation, which will give Required Return on Equity= 32.35%, which is in excess of current Return on Equity (23.7%) ROE (Current) is lesser than nominal ROE that will be required by Hospital Corporation in order to keep the growth rate at 28% as desired. ROE can be increased either through increased leverage or increase in the return on total capital. Minimum Return on Equity in order to sustain 32.35% has to be arrived at and therefore, HCA needs to be aggressive in its financial strategy. Also, the current interest rate as per the calculations derived from Exhibit 5 suggests that there will not be any significant deviation (10.54% compared to 11.54% with BB bond). Thus, HCA must be aggressive in financial policy. Since there will not be any significant increase in cost of debt with downgrade in bond ratings, target bond rating must be BB (Cost of Debt: 11.54%). Maximum Return on Capital amongst all the comparable organizations currently is 14.26%, which can be assumed to be the best possible, due to improvement in operational parameters. We can assume the return on capital to be average of current return on capital and maximum return on capital (i.e. 13.02%). Using the data, Debt to Equity Structure should be equal to 76:24 in the capital structure. Since there will be additional capital expenditure to the tune of $575mn in 1982, equity capital will also be required to be raised to the tune of $ 128.48 mn for maintaining the capital structure. The choice between fixed rate and floating rate bond will be contingent upon the capital market conditions. However, using the current schedule of outstanding debt, LIBOR Rate comes to be around 8.2%. For maximum cost of debt equal to 11.54%, the ratio of fixed to floating rate must be equal to same ratio as the one prevailing in the current debt structure. Cash Flow to Debt Coverage Ratio for HCA stands at 5.34 for FY 1982 even at current earnings level i.e. ignoring the growth in earnings that will occur in the next year. The same is applicable further, for the next five years as well. Therefore, HCA must retire the long term debt for the next five years as per the original maturity schedule.

4|Page

7. What specific financing action would you recommend that HCA implement in January 1982? As already discussed in the previous question, there will need to be equity capital infusion along with issue of new debts for HCA in order to maintain an aggressive debt to capital ratio of 76%. Debt coverage ratio for HCA remains fairly comfortable at 5.34, even at the current quantum of earnings. But given the current market conditions, with equity stock price being significantly undervalued in comparison to the current conditions, amount raised through equity issue will be low and there will be unnecessary corrosion of EPS, leading to excessive, avoidable dividend pay-outs. Therefore, for meeting the US $ 575 mn capital expenditure requirements for FY 1982, we recommend that the entire amount be raised through issuing 25 year debentures at rate of 16.5%.

5|Page

You might also like

- Hca FMDocument40 pagesHca FMankit_shah_24100% (2)

- Hospital Corporation Of America Maintains A RatingDocument16 pagesHospital Corporation Of America Maintains A RatingDhruv Kalia50% (2)

- Lecture 7-Toy WorldDocument5 pagesLecture 7-Toy Worldonlyur44100% (2)

- Winfield CaseDocument8 pagesWinfield CaseAbhinandan Singh67% (3)

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- American Home Products CorporationDocument7 pagesAmerican Home Products Corporationpancaspe100% (2)

- Working Capital Simulation Managing Growth Key Metrics and Strategic DecisionsDocument5 pagesWorking Capital Simulation Managing Growth Key Metrics and Strategic DecisionsAvinashDeshpande1989No ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Harvard Case Study Toy WorldDocument18 pagesHarvard Case Study Toy WorldWescsmith93No ratings yet

- Comparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDocument3 pagesComparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDoritosxuNo ratings yet

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocument2 pagesMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7No ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNo ratings yet

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Case Analysis - Toy WorldDocument11 pagesCase Analysis - Toy Worldvarjin71% (7)

- Butler Lumber Case DiscussionDocument3 pagesButler Lumber Case DiscussionJayzie Li100% (1)

- Krispy Naturals Case WriteupDocument13 pagesKrispy Naturals Case WriteupVivek Anandan100% (3)

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Continental CarriersDocument2 pagesContinental Carrierschch917100% (1)

- Friendly Cards CaseDocument3 pagesFriendly Cards CaseJeff Farley50% (2)

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (2)

- Deluxe's Restructuring and Capital StructureDocument4 pagesDeluxe's Restructuring and Capital StructureshielamaeNo ratings yet

- Hill Country Snack Food Co. Optimal Capital StructureDocument7 pagesHill Country Snack Food Co. Optimal Capital StructureAnish NarulaNo ratings yet

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- Corporate Finance - Hill Country Snack FoodDocument11 pagesCorporate Finance - Hill Country Snack FoodNell MizunoNo ratings yet

- Dell's Working Capital StrategyDocument9 pagesDell's Working Capital StrategyTalluri HarikaNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Winfieldpresentationfinal 130212133845 Phpapp02Document26 pagesWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNo ratings yet

- ACFINA2 Case Study HanssonDocument11 pagesACFINA2 Case Study HanssonGemar Singian50% (2)

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- HAMPTON MACHINE TOOL Case - PresentationDocument7 pagesHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- Cartwright Lumber CompanyDocument6 pagesCartwright Lumber Companykiki0% (2)

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- 454K Loan for Cartwright Lumber CoDocument5 pages454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- Case Study of Stryker CorporationDocument5 pagesCase Study of Stryker CorporationYulfaizah Mohd Yusoff40% (5)

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- Dell's Working Capital: Case BriefDocument6 pagesDell's Working Capital: Case BriefTanya Ahuja100% (1)

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- WACC, Growth Rates, and DCF Valuation for Bluntly MediaDocument18 pagesWACC, Growth Rates, and DCF Valuation for Bluntly Mediahimanshu sagarNo ratings yet

- Continental CarrierDocument10 pagesContinental CarrierYetunde James100% (1)

- Harvard CaseDocument9 pagesHarvard CaseGemar Singian0% (2)

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Foldrite Furniture Company: CASE StudyDocument4 pagesFoldrite Furniture Company: CASE StudyJapkirat Oberai0% (1)

- American Home Products Corporation CaseDocument3 pagesAmerican Home Products Corporation CaseSatish Dabhade100% (1)

- Deluxe Corporation's Debt Policy AssessmentDocument7 pagesDeluxe Corporation's Debt Policy Assessmentankur.mastNo ratings yet

- Case 35 Deluxe CorporationDocument6 pagesCase 35 Deluxe CorporationCarmelita EsclandaNo ratings yet

- Case 3: Rockboro Machine Tools Corporation Executive SummaryDocument1 pageCase 3: Rockboro Machine Tools Corporation Executive SummaryMaricel GuarinoNo ratings yet

- University Health ServicesDocument8 pagesUniversity Health ServicesXavier Mascarenhas100% (2)

- 1 Heinz Case StudyDocument8 pages1 Heinz Case Studysachin2727100% (2)

- Boeing 7E7 Project WACC AnalysisDocument5 pagesBoeing 7E7 Project WACC AnalysisTanvir Ahmed100% (1)

- Case Study Q4 - Hill Country Snack FoodsDocument2 pagesCase Study Q4 - Hill Country Snack FoodsSpencer1234556789No ratings yet

- Case Study On Hospital Corporation of AmericaDocument40 pagesCase Study On Hospital Corporation of AmericaEduardo BautistaNo ratings yet

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- The Hutchinson Whampoa Case - CLASS 18, BINDING BONDS Marco PattiDocument5 pagesThe Hutchinson Whampoa Case - CLASS 18, BINDING BONDS Marco PattiMarco PattiNo ratings yet

- Homework - Sales and Income Growth GoalsDocument3 pagesHomework - Sales and Income Growth GoalsARCHIT KUMARNo ratings yet

- Maximizing Shareholder Value Through Increased Debt FinancingDocument6 pagesMaximizing Shareholder Value Through Increased Debt Financingabhinav_capoor0% (1)

- Litner Model Firm Objective: Dividend Payout RatioDocument1 pageLitner Model Firm Objective: Dividend Payout RatioRithika BaruahNo ratings yet

- IridiumDocument1 pageIridiumRithika BaruahNo ratings yet

- Product Life CycleDocument12 pagesProduct Life CycleRithika BaruahNo ratings yet

- Hospital Corporation CaseDocument6 pagesHospital Corporation CaseRithika Baruah100% (3)

- Chapter 5 - Capital Structure and Cost of CapitalDocument12 pagesChapter 5 - Capital Structure and Cost of CapitalTAN YUN YUNNo ratings yet

- Cost of Capital - Mcom II ProjectDocument36 pagesCost of Capital - Mcom II ProjectKunal KapoorNo ratings yet

- BUAD 839 GDocument82 pagesBUAD 839 GZainab IbrahimNo ratings yet

- Report On Capital StructureDocument89 pagesReport On Capital StructureAbhishek Jain0% (1)

- 17 International Capital Structure and The Cost of CapitalDocument29 pages17 International Capital Structure and The Cost of CapitalOnkar Singh AulakhNo ratings yet

- Tradeoff Theory and The Pecking Order Theory Are Theories of Capital StructureDocument4 pagesTradeoff Theory and The Pecking Order Theory Are Theories of Capital StructureFarhat NaweedNo ratings yet

- Chapter 2 WACC Q BankDocument22 pagesChapter 2 WACC Q Bankuzair ahmed siddiqi100% (1)

- Role of Technology in International FinanceDocument35 pagesRole of Technology in International FinanceMann SainiNo ratings yet

- FIN 550 Chapter 14Document29 pagesFIN 550 Chapter 14Kesarapu Venkata ApparaoNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoDocument3 pagesTime: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoHimanshuNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Recommended TextbookDocument4 pagesRecommended TextbookjozsefczNo ratings yet

- $CMRY Equity Research ReportDocument10 pages$CMRY Equity Research ReportAzka RifkyNo ratings yet

- 618V1 - Business FinanceDocument24 pages618V1 - Business FinanceZain MaggssiNo ratings yet

- (India Studies in Business and Economics) P.K. Jain, Shveta Singh, Surendra Singh Yadav (Auth.) - Financial Management Practices - An Empirical Study of Indian Corporates (2013, Springer India) PDFDocument426 pages(India Studies in Business and Economics) P.K. Jain, Shveta Singh, Surendra Singh Yadav (Auth.) - Financial Management Practices - An Empirical Study of Indian Corporates (2013, Springer India) PDFmuj_aliNo ratings yet

- Accounting Textbook Solutions - 59Document19 pagesAccounting Textbook Solutions - 59acc-expertNo ratings yet

- Capital StructureDocument10 pagesCapital StructureVivekNo ratings yet

- 4 - Behavioural FinanceDocument12 pages4 - Behavioural FinanceAnonymous x2sAQxWNo ratings yet

- Overview of Financial ManagementDocument187 pagesOverview of Financial ManagementashrawNo ratings yet

- Bbfa2203 Intermediate Financial Accounting IDocument14 pagesBbfa2203 Intermediate Financial Accounting Idicky chongNo ratings yet

- The Capital Structure Determinants of Reits. Is It A Peculiar Industry?Document52 pagesThe Capital Structure Determinants of Reits. Is It A Peculiar Industry?MTMS PsNo ratings yet

- Problems On Cost of CapitalDocument3 pagesProblems On Cost of Capital766 Rutu KhadapkarNo ratings yet

- GC University M.Com Corporate Finance AssignmentDocument4 pagesGC University M.Com Corporate Finance AssignmentKashif KhurshidNo ratings yet

- Chapter 16Document44 pagesChapter 16Baby KhorNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Corporate Governance (Pakistan Journal of Social Sciences) 2019Document18 pagesCorporate Governance (Pakistan Journal of Social Sciences) 2019Areeba.SulemanNo ratings yet

- Hybrid and Derivative Securities: Learning GoalsDocument42 pagesHybrid and Derivative Securities: Learning GoalsRonna Mae Ferrer0% (1)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionFarhanie Nordin100% (2)

- Identify The Industry Analysis of Financial Statements Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument2 pagesIdentify The Industry Analysis of Financial Statements Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesCanvas KathaNo ratings yet

- Chap 12 Cost of Capital - EditedDocument17 pagesChap 12 Cost of Capital - EditedJanine LerumNo ratings yet