Professional Documents

Culture Documents

Caprolactam

Uploaded by

Archie HisolerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caprolactam

Uploaded by

Archie HisolerCopyright:

Available Formats

PERP Program - Caprolactam INTRODUCTION

Caprolactam (white crystals, moderately soluble in water, mp 69 C) may be represented by the structure shown below:

+ Click image to enlarge

Essentially, all of its production is consumed in the manufacture of nylon 6 which is used for fiber (clothing, carpets and industrial fibers) and for resin production, where it is used as an engineering thermoplastic, mainly in the automotive, electrical and electronics sectors, and for extrusion for products such as monofilaments and film. In the early 2000s, the global caprolactam market suffered from declining demand and operating rates as a result of the economic downturn. Since then, global capacity additions have been limited as producers remained cautious of the caprolactam market outlook. On the other hand, plant operating rates have increased to the point where capacity is coming close to limiting industry growth. Developed regions such as Western Europe and North America are projected to show minimal growth, but China has been and is expected to remain a major net importer due to rapid growth in the corresponding end-use sectors. As a result, significant capacity additions will be required in the upcoming years, most likely in Asia and conceivably, the Middle East, to sustain demand growth. Since the only real end-use for caprolactam is in the production of nylon 6, the caprolactam market is highly cyclical due to the dependency of the nylon 6 market and economic activity in the various automotive and textile sectors. This report discusses:

Key business developments and technology licensing status General strategic issues to be considered by those in the caprolactam business (i.e., ammonium sulfate byproduct, barriers to entry, competitiveness, key success factors, market fundamentals, pricing fundamentals). Commercial technologies Alternative/ developing technologies Cost of production economics for commercial and alternative/developing processes Commercial market applications and supply, demand and trade analyses

CURRENT TECHNOLOGY

Several process technologies are discussed:

Aromatics Feedstock based Technologies

Currently, practically all commercial caprolactam production globally is based on aromatics feedstocks:

Over 95 percent of this global production is either from cyclohexane (from benzene) or phenol via cyclohexanone and the cyclohexanone oxime. The remaining less than five percent of installed caprolactam capacity is via the cyclohexane photonitrozation process of Toray, which goes directly from cyclohexane to the oxime, or the SNIA Viscosa process, which utilizes toluene as feedstock and proceeds via oxidation-hydrogenation-nitrozation.

This aromatics-based technology, which is currently the only real method employed for commercial production, is mature and consequently, there have been few developments noted in the last five years. In brief, cyclohexanone oxime is the key intermediate and it is produced mainly via oximation of cyclohexanone with hydroxylamine (although commercial production via two other routes is employed, (i.e., photonitrozation of cyclohexane) or ammoximation of cyclohexanone with hydrogen peroxide and ammonia). Cyclohexanone oxime (gray crystals, insoluble in water, mp 208 C) is converted to caprolactam mainly via a process known as the Beckmann rearrangement. A solution of cyclohexanone in oleum/sulfuric acid is heated and maintained at a temperature of around 100 C, and within a few minutes the oxime is rearranged to the lactam sulfate, as shown by the first equation below. The lactam sulfate is then neutralized with ammonia releasing the caprolactam product with coproduction of ammonium sulfate as illustrated in the second equation below.

+ Click image to enlarge

Cyclohexanone sulfate is also converted to caprolactam in some commercial processes by another route known as the Sumitomo rearrangement. This involves direct conversion of the oxime to the lactam using a modified zeolite catalyst at elevated temperature in the vapor phase. The process is illustrated by the chemical equation below.

+ Click image to enlarge

Caprolactam production from aromatic feedstocks process chemistry is discussed in detail. In addition, the following technologies are described in some depth:

DSM process Honeywell phenol process Cyclopol process Toray photonitrozation process EniChem ammoximation Sumitomo rearrangement SNIA Viscosa toluene process

ALTERNATIVE PROCESSES

Since caprolactam production is relatively complex and capital intensive, considerable effort has been made to find alternative routes to caprolactam, both using alternative petrochemical feedstocks as well as, more recently, using renewable raw materials.

Two main petrochemical-based technologies have been developed, based on the primary feedstocks butadiene and adiponitrile

Both these technology processes are discussed in detail in this report.

A novel recent development has been research into a renewables based route to caprolactam, which, if commercialized, would enable the production of bio nylon 6. Two approaches are being pursued, both using lysine derived from dextrose fermentation as the starting material. Both these processes are still in their infancy. Nevertheless, they offer exciting developments in caprolactam technology, not least because of the ever increasing price of crude oil.

This technology process is discussed in detail in this report.

ECONOMICS

Nexant has developed several costs of production estimates for caprolactam production and these can be summarized as follows:

Commercial aromatic-based routes: production cost evaluations for seven process technologies (summarized below) that employ this route have been developed.

+ Click image to enlarge

Speculative economics for two non-commercial but petrochemical-based processes, one based on butadiene feedstock and the other on adiponitrile feedstock. Speculative economics for embryonic biobased production processes based on lysine via dextrose. Regional economics comparison: Since production economics between regions can show significant differences depending on domestic prices for raw material, utilities, labor etc. the economics of production in three major regions Western Europe, the United States, and China - and also examines the potential of caprolactam production in the Middle East. The widely licensed DSM HPO technology with a leader-scale plant capacity of 200 kta and purchasing cyclohexane on the market has been chosen as the basis for comparison. All cost factors are taken at region specific values.

All cost tables given in this report include a breakdown of the cost of production in terms of raw materials, utilities direct and allocated fixed costs, by unit consumption and per metric ton and annually, as well as contribution of depreciation to arrive at a cost estimate (a simple nominal return on capital is also included).

COMMERCIAL APPLICATIONS & REGIONAL MARKET REVIEW

In essence, all production of caprolactam is consumed in the synthesis of nylon 6 fibers and resins. Around 70 percent of caprolactam is used to manufacture nylon 6 fibers for clothing, carpets and industrial fibers. The remaining 30 percent is consumed for nylon 6 resin production, where it is used as an engineering thermoplastic, mainly in the automotive, electrical and electronics sectors, and for extrusion for products such as monofilaments and film. Consumption of nylon 6 fiber into clothing has been declining in developed markets due to a general shift towards polyester. Demand in this sector is largely driven by growth in Asia, and in niche applications such as microfiber.

The carpet fiber market is highly regional, with growth plateauing in North America and Europe due to competition from polypropylene, polyethylene terephthalate (PET) and polytrimethylene terephthalate (PTT). However, there is demand growth in regions such as Central Europe, and in the higher performance carpeting market.

Global supply, demand and trade data are given and discussed. In addition, supply, demand and trade data is given for the regions of North America, South America, Western European, Central and Eastern Europe, and Asia Pacific A list of plants in each region above is given showing plant capacity, owning company, location and annual tonnage produced is given

These reports are for the exclusive use of the purchasing company or its subsidiaries, from Nexant, Inc., 44 South Broadway, White Plains, New York 10601-4425 U.S.A. For further information about these reports contact the following: New York: Dr. Jeffrey S. Plotkin, Vice President, PERP Program, phone: +1-914-609-0315; e-mail: jplotkin@nexant.com, or Heidi Junker Coleman, Multi-client Program Administrator, phone: +1-914-609-0381; e-mail:hcoleman@nexant.com London: Dr. Alexander Coker, PERP Program Manager, phone: +44-20-7950-1570; e-mail: acoker@nexant.com Download Table of Contents Click here to order your copy of this report Click here to see all PERP reports

We regularly send out an email when we place new items on our News pages. if you would like to be added to ChemSystems' mailing list.

Click here -

You might also like

- New Aspects of Spillover Effect in Catalysis: For Development of Highly Active CatalystsFrom EverandNew Aspects of Spillover Effect in Catalysis: For Development of Highly Active CatalystsNo ratings yet

- Acetic AcidDocument8 pagesAcetic AcidMohammedRahimNo ratings yet

- 0809S2 - Abs Nexant Report Phosphoric AcidDocument6 pages0809S2 - Abs Nexant Report Phosphoric Acidlhphong021191No ratings yet

- Ullmann's Enc. of Industrial Chemistry PLANTA.Document12 pagesUllmann's Enc. of Industrial Chemistry PLANTA.yoelarismendi100% (1)

- Maleic AnhydrideDocument6 pagesMaleic AnhydrideTechnologist ChemicalNo ratings yet

- Lessons Learned With Ammonia Synthesis CatalystsDocument12 pagesLessons Learned With Ammonia Synthesis CatalystssugumarNo ratings yet

- Acetic Acid - 010614Document1 pageAcetic Acid - 010614JESSICA PAOLA TORO VASCONo ratings yet

- Modeling of Maleic Anhydride Production From c4 in Fludized Bed ReactorsDocument8 pagesModeling of Maleic Anhydride Production From c4 in Fludized Bed ReactorsAntonio MoroNo ratings yet

- Maleic Anhydride 2Document4 pagesMaleic Anhydride 2Virginia Rosales Olmos100% (1)

- Energy Saving of A Methyl Methacrylate Separation Process PDFDocument11 pagesEnergy Saving of A Methyl Methacrylate Separation Process PDFClaudia CelestinoNo ratings yet

- Ammonia Converter FailureDocument15 pagesAmmonia Converter FailureAnonymous UoHUagNo ratings yet

- G 1 PDFDocument199 pagesG 1 PDFKing HenryNo ratings yet

- Butadiene Production ProcessDocument5 pagesButadiene Production ProcessRohit SinhaNo ratings yet

- Industry OverviewDocument26 pagesIndustry OverviewNajihah Ramli100% (1)

- Maleic Anhydride DerivativesDocument290 pagesMaleic Anhydride DerivativesRégis Ongollo100% (2)

- Manufacturing Process - Docx Maleic AnhydrideDocument5 pagesManufacturing Process - Docx Maleic AnhydrideShadab AslamNo ratings yet

- US6852877-Process For The Production of Vinyl AcetateDocument8 pagesUS6852877-Process For The Production of Vinyl AcetateRahmahPuspitaSariNo ratings yet

- PET OverviewDocument38 pagesPET OverviewMunnawar Hayat100% (1)

- AmmoniaDocument33 pagesAmmoniaWilly ChandraNo ratings yet

- Egeberg 2010 - Hydrotreating in The Production ofDocument13 pagesEgeberg 2010 - Hydrotreating in The Production ofNadia RizanedewiNo ratings yet

- Butanediol and Derivatives PDFDocument4 pagesButanediol and Derivatives PDFJaamac DhiilNo ratings yet

- Report BTPDocument47 pagesReport BTPvpsrpuchNo ratings yet

- PropyleneIts Derivatives-Feb 2014Document53 pagesPropyleneIts Derivatives-Feb 2014asrahaman9No ratings yet

- 100 Years of Ammonia Synthesis Technology: Ib DybkjærDocument10 pages100 Years of Ammonia Synthesis Technology: Ib DybkjærGrootNo ratings yet

- Acetic Acid: US Chemical ProfileDocument1 pageAcetic Acid: US Chemical ProfileJESSICA PAOLA TORO VASCONo ratings yet

- BASF Phthalic Anhydride Broschuere ScreenDocument11 pagesBASF Phthalic Anhydride Broschuere ScreenYasemin KaradağNo ratings yet

- Ethanol To Ethylene Technology FolderDocument3 pagesEthanol To Ethylene Technology FolderChris van der ZandeNo ratings yet

- N-Butane To Maleic AnhydrideDocument6 pagesN-Butane To Maleic AnhydrideNomeacuerdo Yo MismoNo ratings yet

- Metyl MetacrylatDocument12 pagesMetyl MetacrylatNguyen Duy Vu VuNo ratings yet

- Poliol Lurgi Proces PDFDocument4 pagesPoliol Lurgi Proces PDFAgung SiswahyuNo ratings yet

- Xymax Xylene Isomerization EnpdfDocument2 pagesXymax Xylene Isomerization Enpdflucky SNo ratings yet

- Methanol DistillationDocument6 pagesMethanol DistillationNaseeb AliNo ratings yet

- Polypropylene Homopolymer Via Bulk Process - Cost Analysis PP E11ADocument54 pagesPolypropylene Homopolymer Via Bulk Process - Cost Analysis PP E11AAsad KhanNo ratings yet

- KRES TechnologyDocument10 pagesKRES TechnologyabubakarNo ratings yet

- Acetaldehyde EconomicsDocument26 pagesAcetaldehyde EconomicsKudouNo ratings yet

- StyreneDocument22 pagesStyreneMohd Masri A. Razak100% (1)

- Project: Design of A Reactor For The Aniline ProductionDocument19 pagesProject: Design of A Reactor For The Aniline ProductionLUIS ESTEBAN VÁSQUEZ CASTANEDANo ratings yet

- Lyondell Tubular Vs Autoclave 1 PDFDocument2 pagesLyondell Tubular Vs Autoclave 1 PDFJacky V. HerbasNo ratings yet

- DMEDocument7 pagesDMEc_vivi92No ratings yet

- 1,4 Butanediol MSDSDocument8 pages1,4 Butanediol MSDSmiyomiyo567850% (2)

- Chemical Modification of Natural Rubber Under Supercritical CarbonDocument8 pagesChemical Modification of Natural Rubber Under Supercritical CarbonKristina HuffmanNo ratings yet

- PDDocument2 pagesPDnur_ika_1No ratings yet

- 4000 MTPD Ammonia Plant Based On Proven Technology: Joachim Rüther, John Larsen, Dennis Lippmann, Detlev ClaesDocument8 pages4000 MTPD Ammonia Plant Based On Proven Technology: Joachim Rüther, John Larsen, Dennis Lippmann, Detlev Claesvaratharajan g rNo ratings yet

- Production of Acetic Acid From Methanol: Petrovietnam UniversityDocument27 pagesProduction of Acetic Acid From Methanol: Petrovietnam UniversityVăn Bão TôNo ratings yet

- PRODUCTIONOFMALEICANHYDRIDEFROMOXIDATIONOFn BUTANE PDFDocument457 pagesPRODUCTIONOFMALEICANHYDRIDEFROMOXIDATIONOFn BUTANE PDFJayshree Mohan100% (1)

- 01b Eval - Us - LetterDocument16 pages01b Eval - Us - LetternisannnNo ratings yet

- Faculty of Chemical Engineering (Fche)Document114 pagesFaculty of Chemical Engineering (Fche)Divyansh Singh ChauhanNo ratings yet

- BEST NExBTL Renewable DieselDocument12 pagesBEST NExBTL Renewable DieselpalvannanNo ratings yet

- Chapter VIII Process and Economic OverviewDocument38 pagesChapter VIII Process and Economic OverviewWisnu Rochman HidayatullahNo ratings yet

- Acetic Acid PDFDocument12 pagesAcetic Acid PDFhazimraadNo ratings yet

- COWIFinalDocument69 pagesCOWIFinalNovia Mia YuhermitaNo ratings yet

- Methyl Methacrylate Plant CostDocument3 pagesMethyl Methacrylate Plant CostIntratec Solutions50% (2)

- Experimental Methods in Catalytic Research: Physical Chemistry: A Series of MonographsFrom EverandExperimental Methods in Catalytic Research: Physical Chemistry: A Series of MonographsRobert B. AndersonNo ratings yet

- Successful Design of Catalysts: Future Requirements and DevelopmentFrom EverandSuccessful Design of Catalysts: Future Requirements and DevelopmentNo ratings yet

- Modified Polymers, Their Preparation and Properties: Main Lectures Presented at the Fourth Bratislava Conference on Polymers, Bratislava, Czechoslovakia, 1-4 July 1975From EverandModified Polymers, Their Preparation and Properties: Main Lectures Presented at the Fourth Bratislava Conference on Polymers, Bratislava, Czechoslovakia, 1-4 July 1975A. RomanovRating: 5 out of 5 stars5/5 (1)

- Preparation of Catalysts II: Scientific Bases for the Preparation of Heterogeneous CatalystsFrom EverandPreparation of Catalysts II: Scientific Bases for the Preparation of Heterogeneous CatalystsNo ratings yet

- Formation of CyclohexanoneDocument3 pagesFormation of CyclohexanoneArchie HisolerNo ratings yet

- Pure Component Properties Pure Component PropertiesDocument7 pagesPure Component Properties Pure Component PropertiesArchie HisolerNo ratings yet

- Landfill LinersDocument17 pagesLandfill LinersArchie HisolerNo ratings yet

- Cebu Institute of Technology: UniversityDocument10 pagesCebu Institute of Technology: UniversityArchie HisolerNo ratings yet

- Cebu Institute of Technology: UniversityDocument10 pagesCebu Institute of Technology: UniversityArchie HisolerNo ratings yet

- Actual Number of PlatesDocument1 pageActual Number of PlatesArchie HisolerNo ratings yet

- 11th Chemistry EM - Public Exam 2022 - Model Question Paper - English Medium PDF DownloadDocument3 pages11th Chemistry EM - Public Exam 2022 - Model Question Paper - English Medium PDF DownloadAshwini Shankar KumarNo ratings yet

- ShadesOfBlue 2020 04Document39 pagesShadesOfBlue 2020 04anuyasane9776No ratings yet

- Unit 4.5Document12 pagesUnit 4.5Tilak K CNo ratings yet

- Questions For Amino Acids QuizDocument3 pagesQuestions For Amino Acids Quizd.salah1722No ratings yet

- Unit I - Water CY3151 Engineering ChemistryDocument30 pagesUnit I - Water CY3151 Engineering ChemistryA/E5LOGESH AKRNo ratings yet

- Common Ion EffectDocument6 pagesCommon Ion Effectruchi_rohilla9603No ratings yet

- 9701 s07 Ms 32Document7 pages9701 s07 Ms 32Hubbak KhanNo ratings yet

- Name DelosaDocument4 pagesName DelosaLyka DelosaNo ratings yet

- Chem 152 Lab #2: Buffers: Deprotonation of Acetic AcidDocument16 pagesChem 152 Lab #2: Buffers: Deprotonation of Acetic Acidapi-27129906550% (8)

- Lab Report On Oxidation and ReductionDocument7 pagesLab Report On Oxidation and ReductionkasuleNo ratings yet

- Reviewer in BiochemistryDocument19 pagesReviewer in BiochemistryMicole Manahan100% (1)

- List of Banned Pesticides (A) : S. # Chemical Name Position in Pakistan Notification NumberDocument2 pagesList of Banned Pesticides (A) : S. # Chemical Name Position in Pakistan Notification NumberjasonNo ratings yet

- Milk Aulteration by Rahul LakhmaniDocument19 pagesMilk Aulteration by Rahul LakhmanirahullakhmaniNo ratings yet

- BIsmuthDocument3 pagesBIsmuthtyler.mcclainNo ratings yet

- Biomolecule Part 01-Merged CompressedDocument2 pagesBiomolecule Part 01-Merged CompressedShaDNo ratings yet

- Chemistry 2013 June - P2 PDFDocument20 pagesChemistry 2013 June - P2 PDFBinu PereraNo ratings yet

- Novo GenDocument11 pagesNovo GenNicole Grasparil100% (1)

- Full Syllabus Test: C Iit-JeeDocument8 pagesFull Syllabus Test: C Iit-JeeshrawantiyaNo ratings yet

- Acidity and BasicityDocument89 pagesAcidity and BasicityAria IsipNo ratings yet

- Zmoq : Narjmwu H$Mos H$Mo Cîma NWPÑVH$M Ho$ - Wi N Ð Na Adí' (Bio & Amob ZDocument19 pagesZmoq : Narjmwu H$Mos H$Mo Cîma NWPÑVH$M Ho$ - Wi N Ð Na Adí' (Bio & Amob ZRavneet KaurNo ratings yet

- Alkyl and Aryl Halides NEETDocument10 pagesAlkyl and Aryl Halides NEETJagrav GargNo ratings yet

- Inorganic IIDocument82 pagesInorganic IImusteabdixNo ratings yet

- HessPumice FactSheetDocument1 pageHessPumice FactSheetjhscribdaccNo ratings yet

- I. Multiple Choice Questions (Type-I)Document17 pagesI. Multiple Choice Questions (Type-I)Roopam TanejaNo ratings yet

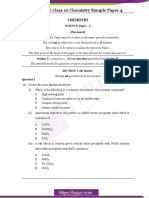

- ICSE Class 10 Chemistry Sample Paper 4Document7 pagesICSE Class 10 Chemistry Sample Paper 4StevenNo ratings yet

- Science EssayDocument2 pagesScience EssayElla S. MatabalaoNo ratings yet

- Chem 23Document8 pagesChem 23listerNo ratings yet

- Quadrant Chemical Resistance ChartDocument27 pagesQuadrant Chemical Resistance ChartRafique AjmeriNo ratings yet

- Substitution vs. Elimination: 2 Reaction, Sometimes The E2 ReactionDocument2 pagesSubstitution vs. Elimination: 2 Reaction, Sometimes The E2 ReactionFadhlih Al-zakiNo ratings yet

- Lesson 7 Acidity, Alkalinity, and SalinityDocument33 pagesLesson 7 Acidity, Alkalinity, and SalinityJosue A. Sespene Jr.No ratings yet