Professional Documents

Culture Documents

WineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKER

Uploaded by

Brad DempseyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKER

Uploaded by

Brad DempseyCopyright:

Available Formats

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 1 of 25

Main Document

Hearing Date: TBD

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK -------------------------------------------------------------x : : Chapter 11 In re: : : Case No.: 13-______ WineCare Storage LLC, : : Debtor. -------------------------------------------------------------x DECLARATION OF DEREK L. LIMBOCKER (I) IN SUPPORT OF CHAPTER 11 PETITION AND FIRST DAY MOTIONS AND (II) PURSUANT TO LOCAL BANKRUPTCY RULE 1007-2 I, Derek L. Limbocker, hereby declare, under penalty of perjury pursuant to 28 U.S.C. 1746, as follows: 1. I am the Managing Member and Chief Executive Officer of WineCare I submit this

Storage LLC (the "Debtor") and have served in that capacity since 2005.

declaration (the "Declaration") in accordance with Rule 1007-2 of the Local Bankruptcy Rules for the Southern District of New York (the "Local Rules") to assist this Court and parties in interest in understanding the circumstances that compelled the commencement of this chapter 11 case and in support of (i) the Debtor's petition for relief under chapter 11 of title 11 of the United States Code (the "Bankruptcy Code") filed on the date hereof (the "Petition Date"); and (ii) the emergency relief that the Debtor has requested from the Court pursuant to the motions and applications described herein (collectively, the "First Day Pleadings"). In that capacity, I have personal knowledge of (i) the Debtor's financial condition, business, operations, policies and procedures, (ii) the events leading up to these chapter 11 cases, and (iii) other matters set forth herein.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 2 of 25

Main Document

2.

The Debtor commenced this chapter 11 case to provide Debtor with time

to restore its operations, maximize the value of its estate for the benefit of all creditors and parties in interest and prevent intrusive and unauthorized access to its facilities by certain persons or entities that would harm the Debtor's property. Hurricane Sandy had a devastating effect on the Debtor, causing a massive disruption to the Debtor's business operations, destroying the Debtor's critical electronic databases and records and forcing the Debtor to physically relocate nearly 27,000 cases of wine, a relocation done by hand one case at a time. Several of the Debtor's customers have commenced proceedings against the Debtor demanding, among other things, immediate access to the Debtor's facilities to inspect their wines and seeking damages of at least $4,000,000 for the Debtor's alleged "wrongful retention" of their property. Others have threatened legal action by mail, email, and on internet blogs. 3. The Debtor believes that at least 95 percent of the wine stored with the

Debtor has been undamaged by the disruption caused by Hurricane Sandy. Nevertheless, given the destruction of the Debtor's computerized inventory control systems, locating an individual client's wine collection is virtually impossible, and would entail the onerous process of inspecting and scanning thousands of individual cases. Wine stored by the Debtor is extremely fragile, thus additional unnecessary handling would only risk damage to the Debtor's clients' property. Moreover, such efforts will only further delay the return of all clients' wines to their designated locations within Debtor's wine cellars and resumption of regular operations. 4. The First Day Pleadings seek relief necessary to avoid immediate and

irreparable harm to the Debtor as it pursues its restructuring by allowing it to continue to rebuild its operations and minimize disruptions to its business that could otherwise result from the commencement of the chapter 11 case. Specifically, the First Day Pleadings seek relief allowing

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 3 of 25

Main Document

the Debtor to limit disruption to the Debtor's business by continuing the use of its prepetition cash management system and continuing the payment of wages and benefits to Debtor's employees. 5. Except as otherwise indicated, all facts set forth in this Declaration are

based upon my personal knowledge, my discussions with other employees of the Debtor, my review of relevant documents or my opinion based upon experience, knowledge and information concerning the Debtor's operations and financial affairs. I am authorized to submit this

Declaration on behalf of the Debtor. If called to testify, I would testify competently to the facts set forth in this Declaration. 6. To assist the Court in familiarizing itself with the Debtor, its business, and

the initial relief sought by the Debtor to stabilize its operations and facilitate its restructuring, this Declaration is organized into four sections. Section I provides background information with respect to the Debtor's corporate history and its business operations. Section II describes the circumstances leading to the commencement of the chapter 11 cases. Section III summarizes the relief requested in, and the facts supporting, each of the First Day Pleadings. Section IV provides an overview of the exhibits attached hereto that set forth certain additional information about the Debtor, as required by Local Rule 1007-2. I. General Background 7. The Debtor is a limited liability corporation organized under New York

law with its headquarters and principal place of business in New York, New York. 8. The Debtor was founded in 2005 and offers its clients temperature-

controlled premium wine storage service in the heart of Manhattan. The Debtor currently stores approximately 27,000 cases of wine for more than 380 clients. The Debtor's clients typically are

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 4 of 25

Main Document

wine collectors, fine restaurants with inadequate space to store their wines, retail wine shops, local auction houses and small wine wholesalers and importers. 9. controlled cellars. The Debtor stores its clients' wines in state-of-the-art temperatureThe cellars are equipped with backup systems to ensure uninterrupted

protection. The Debtor uses a sophisticated proprietary warehousing system to effectively and securely control and deliver its clients' wine inventories. Every case of wine the Debtor receives from a client is given a unique bar code and the contents of each case are recorded in an electronic database. Each case is then placed on the next available shelf space in the Debtor's cellars and the bar code is scanned to add the precise shelf location to the electronic database. 10. The Debtor maintains an online interface that allows clients to view and

manage their entire inventory online, schedule deliveries between the Debtor's cellars and their home or business and find detailed information about their collections. The Debtor offers same day delivery service to its clients throughout the New York metropolitan area and uses speciallyoutfitted vehicles to ensure safe delivery. 11. The Debtor provides storage services to its clients pursuant to storage

agreements (the "Client Storage Agreements"). The Client Storage Agreements, among other things, fix the storage fee, set payment terms and limit the Debtor's liability. 12. Prior to Hurricane Sandy, the Debtor had seven (7) employees. As

described in greater detail in paragraph 16 below, the Debtor more than doubled its headcount after Hurricane Sandy to assist with and expedite the Debtor's business restoration projects. As of the Petition Date, the Debtor has five (5) full-time employees. 13. As described in Paragraph 1 above, I serve as the Debtor's managing

member and chief executive officer. I founded the business and developed the business plan.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 5 of 25

Main Document

My experience in the wine industry dates back to 1964, when I bought Gateway Wine & Spirits ("Gateway"), a small wine shop in Manhattan. In 1984, Gateway merged into Park Avenue Liquors. I have maintained involvement with Park Avenue Liquors since that time. I have also held positions at several financial services firms, including J.P. Morgan, Morgan Stanley and Train Babcock Advisors, LLC. I will remain as managing member and chief executive officer after the Petition Date. II. Events Leading to the Chapter 11 Filing 14. Due to the devastating impact of Hurricane Sandy, which struck the New

York metropolitan area in late October, 2012, the Debtor has experienced significant challenges and ongoing disruptions to its ordinary business operations. Although the Debtor has worked diligently since Hurricane Sandy to fully restore normal operations, the Debtor estimates that the restoration process will likely continue for approximately another four months. 15. Hurricane Sandy caused significant damage to the building at which the

Debtor maintains its wine cellars. Upon receipt of an order from the New York City Department of Environmental Protection, the Debtor's landlord ordered all tenants in the basements of the Waterfront New York Building, including the Debtor, to move property out of the building's basements. Thus, the Debtor approximately 27,000 cases of wine from the building's basement to special climate-controlled storage rooms on higher floors. 16. To assist with the move and avoid any potential breakage or other damage

to its clients' wine during the move, the Debtor hired ten to fifteen additional employees, more than doubling its pre-Sandy headcount of seven. The difficult task of physically moving the wine was exacerbated by the lack of access to the building's elevator systems, which were not

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 6 of 25

Main Document

restored until five weeks after the storm. Nevertheless, the Debtor maintained the wine at appropriate temperatures during the move and continues to do so in the special storage rooms. 17. In addition to the disruption caused by the landlord's order to relocate the

wine from the Debtor's cellars, an issue with one of the building's drainage pipes caused flooding in the Debtor's offices. This flooding destroyed the Debtor's computer systems, requiring the Debtor to replace its computer equipment and retrieve offsite backups of its electronic databases and records. The Debtor was unable to complete this process until late November 2012, nearly a month after its computer systems were destroyed. 18. As a result of the loss of its computer systems, the Debtor was forced to

move the vast majority of its clients' wine cases from their designated locations in the Debtor's wine cellars before the Debtor had the ability to scan and track the precise new location of each case. Consequently, the only way to determine specific information about a particular wine case is to scan and inspect every case within the special storage rooms. The Debtor has worked tirelessly since the storm in an effort to restore normal business operation and recently has begun the process of returning its clients' wine cases to its cellars, a process that entails scanning and indexing each of the 27,000 cases as it is returned to its designated location. As of the Petition Date, however, only one of Debtor's six cellars has been restored. The other cellars remain subject to further repairs and inspections. 19. Because of the warehousing and indexing systems described above, the

Debtor will not be able to locate with specificity every case of wine it stores until the vast majority of cases have been scanned, indexed and returned to their designated locations within the cellars.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 7 of 25

Main Document

20.

Nevertheless, certain of the Debtor's clients have commenced actions

against the Debtor, either demanding immediate access to their wine collections or seeking damages in excess of $4,000,000 arising out of the Debtor's alleged "wrongful retention" of their property. Others have sent letters or emails to the Debtor threatening further legal action. As described above, I believe that at least 95 percent of the wine stored with the Debtor remains undamaged, even after disruption caused by Hurricane Sandy. Wine stored by the Debtor is extremely fragile, however, thus additional unnecessary handling and ad hoc inspections by customers of the Debtor would only increase the risk of damage to the Debtor's clients' property. Moreover, unauthorized access to the Debtor's storage facilities compromises the security and safety of all client property held by the Debtor. Accordingly, the Debtor filed this petition to

allow it time to focus on business restoration efforts, without the tremendous distraction of ongoing litigation, maximize the value of its estate for the benefit of all of its creditors (and clients) and other parties in interest and prevent intrusive and unauthorized access to its facilities that would harm both the Debtor's and its clients' valuable property. III. First Day Pleadings 21. To enable Debtor to minimize the adverse effects of the commencement of

this chapter 11 case on its ongoing business operations and promote a smooth transition to chapter 11, Debtor has requested various relief in its First Day Pleadings. I believe that the relief requested in the First Day Pleadings is necessary to allow Debtor to operate with minimal disruption during the pendency of this chapter 11 case. A description of the relief requested and the facts supporting each of the Debtor's First Day Pleadings is set forth below. 22. It is my understanding that Rule 6003 of the Federal Rules of Bankruptcy

Procedure (the "Bankruptcy Rules") provides that "except to the extent that relief is necessary to

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 8 of 25

Main Document

avoid immediate and irreparable harm," the Court shall not consider motions to pay prepetition claims during the first twenty one (21) days following the filing of a chapter 11 petition. Accordingly, as set forth below, the Debtor has narrowly tailored its requests for authority to pay any prepetition claims to those circumstances where failure to pay such claims would cause immediate and irreparable harm to the Debtor and its estate. A. Motion of Debtor and Debtor-in-Possession for Entry of an Order Granting Debtor Additional Time Within Which to File Schedules and Statements (the "Schedules Extension Motion") 23. The Debtor requests an additional 30 days to file its schedule of assets and

liabilities, schedule of executor contracts and unexpired leases, and statements of financial affairs (collectively, the "Schedules and Statements"). The requested extension would give the Debtor a total of 44 days from the Petition Date to file its Schedules and Statements. 24. To prepare its Schedules and Statements, the Debtor will have to compile

information from books, records and documents relating to claims, assets, liabilities and contracts. The collection of necessary information will require a significant expenditure of time and effort on the part of the Debtor and its employees, and the Debtor anticipates that it will be unable to complete its Schedules and Statements in the 14 days provided under Bankruptcy Rule 1007(c). This task is further complicated by the fact that the Debtor's employees will have to continue to work full-time restoring Debtor's wine inventory system while responding to the demands of the chapter 11 case. 25. I believe that the relief requested in the Schedules Extension Motion is in

the best interest of the Debtor's estate, its creditors, and all other parties in interest, and will enable the Debtor to continue to operate its business in chapter 11 with minimal disruption. Accordingly, on behalf of the Debtor, I respectfully submit that the Schedules Extension Motion should be approved.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 9 of 25

Main Document

B.

Motion of Debtor and Debtor-in-Possession for Entry of an Order (I) Authorizing, But Not Directing, Debtor to Pay Prepetition Wages, Salaries and Benefits, (II) Authorizing, But Not Directing, Debtor to Pay Prepetition Payroll Taxes, Withholdings and Reimbursable Expenses, (III) Authorizing, But Not Directing, Debtor to Continue Employee Benefits Programs on a Postpetition Basis, and (IV) Authorizing All Financial Institutions to Honor All Related Checks and Electronic Payment Requests (the "Employee Motion") 26. The Debtor seeks authority to pay and honor, in its sole discretion, certain

prepetition claims and obligations related thereto for, among other things, wages, salaries, payroll services, federal, state and local withholding taxes, and other amounts withheld (including employees' share of insurance premiums, taxes and 401(k) contributions), health insurance, workers' compensation benefits, vacation time and other paid time off, short- and long-term disability, and all other benefits that the Debtor has historically provided to its employees in the ordinary course of business (collectively, the "Employee Obligations"), to pay all costs incident to the Employee Obligations, and to continue to pay and honor the Employee Obligations in the ordinary course of business on a postpetition basis. I am familiar with the Employee Obligations. 27. As of the Petition Date, the Debtor has five (5) employees, all of whom

are full-time employees ( collectively, the "Employees"). Of the Employees, two (2) are salaried and three (3) are paid on an hourly basis. No Employee is represented by a union or covered by a collective bargaining agreement. The Employees perform a variety of critical functions, including sales, accounting, administration, finance, management, operations, inventory management and other tasks. The Employees' highly specialized skills, knowledge and

understanding of the Debtor's business and operations are essential to the effective reorganization of the Debtor's business. To maintain the morale and stability of the Employees during this critical time, the Debtor seeks authority to pay and continue to honor the Employee Obligations.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 10 of 25

Main Document

28.

I believe that without the requested relief being granted by this Court, it is

likely that some of the Employees would seek alternative employment opportunities. Such a development would deplete the Debtor's workforce, hindering the Debtor's ability to successfully reorganize and maximize value for all of its stakeholders. The loss of valuable Employees and the resulting recruiting of new employees that would be necessary to find replacements would be distracting and costly at this critical time when the Debtor is seeking to normalize operations and maximize asset values. Further, if the Debtor loses Employees, it will incur recruiting expenses in locating replacement employees if, under the Debtor's circumstances, replacement employees could be recruited at all. Accordingly, I believe that approving the Debtor's request to pay or otherwise honor the Employee Obligations is imperative to the Debtor's ability to maximize value of its estate for the benefit of its stakeholders. 29. Finally, to effectuate the payment of the Employee Obligations, the Debtor

requests that the Court enter an order authorizing all banks and financial institutions to honor all prepetition checks for payment of prepetition wages and benefits and prohibiting all banks from placing any holds on, or attempting to reserve, any automatic transfers to the Employees' accounts for prepetition wages and benefits. 30. I believe that the relief requested in the Employee Motion is in the best

interests of the Debtor's estate, its creditors, and all other parties in interest, and will enable the Debtor to continue to operate its business in chapter 11 with minimal disruption. Accordingly, on behalf of the Debtor, I respectfully submit that the Employee Motion should be approved.

DOC ID - 19599551.2

10

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 11 of 25

Main Document

C.

Motion of Debtor and Debtor-in-Possession for Interim and Final Orders (I) Authorizing Continued Use of Existing Cash Management System, and (II) Authorizing Continued Use of Existing Business Forms (the "Cash Management Motion") 31. By the Cash Management Motion, the Debtor is requesting that the Court

enter interim and final orders (i) authorizing the Debtor's continued use of its existing cash management system, and (ii) authorizing the continued maintenance of existing business forms. 32. As of the Petition Date, the Debtor maintains one (1) bank account (the

"Account") in the ordinary course of its business, which serves as a conduit for revenue obtained from business operations for distribution to employees, vendors and other creditors. The Debtor uses the Account and its simple cash management system to meet its operating needs, ensure cash availability and liquidity, reduce administrative expenses by facilitating the efficient movement of funds, and enhance the development of accurate account balances. I believe that any disruption could have a severe and adverse impact on the Debtor's reorganization efforts and would jeopardize the underlying value of the Debtor's assets. 33. Additionally, in the ordinary course of business, the Debtor uses a variety

of checks and business forms (collectively, the "Business Forms"). To minimize expenses to its estate and avoid unnecessarily confusing its employees, clients and vendors, I believe it is appropriate to continue to use all such Business Forms as they existed immediately prior to the Petition Date without reference to the Debtor's status as debtor in possession rather than requiring the Debtor to incur the expense and delay of ordering entirely new business forms. 34. In the Cash Management Motion, the Debtor also seeks a waiver of the

U.S. Trustee requirement that the Account be closed and that new postpetition accounts be opened. The closing of the Account, even if for a brief period of time, would cause great harm to the Debtor's business operations and severely hamper the Debtor's ability to collect and disburse

DOC ID - 19599551.2

11

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 12 of 25

Main Document

funds in the ordinary course of business. To ensure as smooth a transition into chapter 11 as possible, and to aid in the Debtor's efforts to complete this chapter 11 case successfully and without delay, it is important that the Debtor be permitted to continue to maintain the Account. 35. The operation of Debtor's business requires that the Debtor's cash

management system continue to be implemented during the pendency of the chapter 11 case. I believe the Debtor's continued use of its cash management system will greatly facilitate its transition into the chapter 11 case by, among other things, avoiding administrative inefficiencies and expenses and minimizing delays in the payment of postpetition debts. Indeed, the inability to maintain the cash management system and the Account would interfere with the Debtor's performance and unnecessarily disrupt its still-recovering business operations. Consequently, continuation of the Debtor's cash management system is not only essential but in the best interests of all creditors and other parties in interest. IV. Information Required by Local Bankruptcy Rule 1007-2 36. Local Rule 1007-2 requires certain information related to the Debtor,

which is set forth below. 37. and II above. 38. There was no ad hoc or informal committee organized prior to the order The information required by Local Rule 1007-2(a)(1) is set forth in Parts I

for relief in this case, disclosure of which is required by Local Rule 1007-2(a)(3). 39. Pursuant to Local Rule 1007-2(a)(4), Exhibit A hereto is a consolidated

list of the holders of the Debtor's twenty largest unsecured claims, excluding claims of insiders. 40. No person or entity holds any secured claim against the Debtor, disclosure

of which is required by Local Rule 1007-2(a)(5).

DOC ID - 19599551.2

12

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 13 of 25

Main Document

41.

Pursuant to Local Rule 1007-2(a)(6), Exhibit B hereto provides a

summary of the Debtor's assets and liabilities. 42. There are no classes of shares of stock, debentures or other securities of

the Debtor that are publicly held, disclosure of which is required by Local Rule 1007-2(a)(7) 43. The Debtor does not hold interests in any property that is in the possession

or custody of any custodian, public officer, mortgagee, pledge, assignee of rents, or secured creditor or agent for any such entity, disclosure of which is required by Local Rule 1007-2(a)(8). 44. Pursuant to Local Rule 1007-2(a)(9), Exhibit C hereto provides a list of

the properties comprising the premises owned, leased or held under other arrangements from which the Debtor operates its business. 45. Pursuant to Local Rule 1007-2(a)(10), Exhibit D hereto provides a list of

the locations of the Debtor's substantial assets and books and records. The Debtor holds no assets outside the territorial limits of the United States. 46. Pursuant to Local Rule 1007-2(a)(11), Exhibit E hereto provides a list of

the nature and present status of each action or proceeding (pending or threatened) against the Debtor or its property where a judgment against the Debtor or a seizure of its property may be imminent. 47. Pursuant to Local Rule 1007-2(a)(12), Exhibit F hereto sets forth a list of

the names of the individuals who comprise the Debtor's existing senior management, their tenure with the Debtor, and a brief summary of their relevant responsibilities and experience. 48. Pursuant to Local Rules 1007-2(b)(1)-(2)(A), Exhibit G hereto provides

for the 30-day period following the Petition Date, the estimated amount of weekly payroll to the

DOC ID - 19599551.2

13

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 14 of 25

Main Document

Debtor's employees (exclusive of officers, directors and stockholders) and the estimated amount paid and proposed to be paid to officers, stockholders and directors. 49. Pursuant to Local Rule 1007-2(b)(3), Exhibit H hereto provides a

schedule for the 30-day period following the Petition Date, of estimated cash receipts and disbursements, net cash gain or loss, obligations and receivables expected to accrue but remain unpaid, other than professional fees, and any other information relevant to an understanding of the foregoing.

DOC ID - 19599551.2

14

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 15 of 25

Main Document

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 16 of 25

Main Document

EXHIBIT A Consolidated List of the Holders of Debtor's 20 Largest Unsecured Claims Pursuant to Local Rule 1007-2(a)(4), the following is a consolidated list of creditors holding the twenty (20) largest unsecured claims against Debtor (the "Consolidated List") based on Debtor's unaudited books and records as of the Petition Date. The Consolidated List has been prepared in accordance with Bankruptcy Rule 1007(d) and does not include persons or entities who come within the definition of "insider" set forth in Bankruptcy Code section 101(31). The information herein shall not constitute an admission of liability by, nor is it binding on Debtor. Debtor reserves all rights to assert that any debt or claim included herein is a disputed claim or debt, and to challenge the priority, nature, amount, or status of any such claim or debt. Debtor's failure to list a claim as contingent, disputed or subject to set-off shall not be a waiver of any of Debtor's rights relating thereto. In the event of any inconsistencies between the summaries set forth below and the respective corporate and legal documents relating to such obligations, the descriptions in the corporate and legal documents shall control.

Nature of claim (trade debt, bank loan, government contracts, etc.) Accounts Payable Indicate if claim is contingent, unliquidated, disputed or subject to set off

Name of Creditor

Complete mailing address, and employee, agents, or department familiar with claim Waterfront NY Realty Corp. as agent for Waterfront NY L.P. 224 12th Avenue New York, NY 10001 Attn: Chris Flagg cflagg@wfny.com Fax: 212-629-8768

Amount of Claim

1.

Waterfront NY L.P. 224 12th Avenue New York, NY 10001

$50,427.03

2.

3.

Chase Card Services PO Box 15153 Wilmington, Delaware 198865153 1-800-875-5220 New York State Department of Taxation and Finance Bankruptcy Section PO Box 5300 Albany, NY 122050300

Accounts Payable

$7,453.63

Taxes

$3,909.83

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 17 of 25

Main Document

Name of Creditor

Complete mailing address, and employee, agents, or department familiar with claim

Nature of claim (trade debt, bank loan, government contracts, etc.) Payroll

Indicate if claim is contingent, unliquidated, disputed or subject to set off

Amount of Claim

4.

Samantha Carrington c/o WineCare Storage LLC 224 12th Avenue, Ste. 231 New York, NY 10001 5. Adam Strauss c/o WineCare Storage LLC 224 12th Avenue, Ste. 231 New York, NY 10001 6. Todd Jackson c/o WineCare Storage LLC 224 12th Avenue, Ste. 231 New York, NY 10001 7. Jose Duarte c/o WineCare Storage LLC 224 12th Avenue, Ste. 231 New York, NY 10001 8. Vidaliz Ferrer c/o WineCare Storage LLC 224 12th Avenue, Ste. 231 New York, NY 10001 9. Minetta Lane LLC 568 Broadway Suite 401 New York NY 10012 10. Morandi LLC 211 Waverly Place Freight near 15 Charles New York NY 10012

$1,315.39

Payroll

$1,315.39

Payroll

$924.00

Payroll

$859.20

Payroll

$739.20

Robert E Levy 56 Beaver Street PH2 New York, NY 10004 (212) 674-3000 Robert E Levy 56 Beaver Street PH2 New York, NY 10004 (212) 674-3000

Litigation

Contingent, Unliquidated, Disputed

Litigation

Contingent, Unliquidated, Disputed

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 18 of 25

Main Document

Name of Creditor

Complete mailing address, and employee, agents, or department familiar with claim Steven B. Sperber Sperber Denenberg & Kahan, P.C. 48 West 37th Street, 16th Floor New York, NY 10018 (917) -351-1335 Gregg Weiner Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, NY 10004 Attn: Gregg Weiner (212) 859-8579 Gregg.weiner@friedfrank.com

Nature of claim (trade debt, bank loan, government contracts, etc.) Litigation

11. Kayvan Hakim 154 W. 70th Street Suite 200 New York, NY 10023 12. Phillip Waterman III Waterman Interests 400 Park Avenue New York, NY 10022

Indicate if claim is contingent, unliquidated, disputed or subject to set off Contingent, Unliquidated, Disputed

Amount of Claim

Litigation

Contingent, Unliquidated, Disputed

13. 14. 15. 16. 17. 18. 19. 20.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 19 of 25

Main Document

EXHIBIT B Summary of Debtor's Assets and Liabilities Pursuant to Local Rule 1007-2(a)(6), the following are unaudited estimates of Debtor's total assets and liabilities. The following financial data is the latest available information. Assets and Liabilities Total Assets (Book Value as of December 31, 2012) Total Liabilities (Book Value as of December 31, 2012) Amount $237,774.51 $1,090,663.36

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 20 of 25

Main Document

EXHIBIT C Summary of Debtor's Property From Which Debtor Operates its Business Pursuant to Local Rule 1007-2(a)(9), the following lists the location of the premises owned, leased, or held under other arrangement from which Debtor operates its business as of the Petition Date Property Address 628 W. 28th Street Lower Level Cellars 8, 10,12, 14, 16, 24 New York, NY 10001 224 12th Avenue, Suite 22-252 New York, NY 10001 Nature of Property Interest Lease Usage Wine storage space

Lease

Headquarters, office space

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 21 of 25

Main Document

EXHIBIT D Location of Debtor's Substantial Assets and Books and Records Pursuant to Local Rule 1007-2(a)(10), the Debtor's substantial assets and books and records as of the Petition Date are held at: 224 Twelfth Avenue, Suite 22-252 New York, New York 10001

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 22 of 25

Main Document

EXHIBIT E Nature and Present Status of Each Action or Proceeding (Pending or Threatened) Against Debtor or its Property Where a Judgment Against Debtor or a Seizure of its Property may be Imminent Pursuant to Local Rule 1007-2(a)(11), the following provides a list of the nature and present status of each action or proceedings (pending or threatened) against Debtor or its property where a judgment against Debtor or a seizure of its property may be imminent, as of the Petition Date The information herein shall not constitute an admission of liability by, nor is it binding on Debtor. Debtor reserves all rights to assert that claim included herein is a disputed claim, and to challenge the priority, nature, amount, or status of any such claim or debt. Petitioner/Plaintiff

Phillip Waterman III Waterman Interests 400 Park Avenue New York, NY 10022 Minetta Lane LLC 568 Broadway, Suite 401 New York NY 10012 Morandi LLC 211 Waverly Place Freight near 15 Charles St. New York NY 10012 Kayvan Hakim 154 W. 70th Street Suite 200 New York, NY 10023

Venue

Supreme Court of the State of New York, County of New York

Caption and Case Number

Application of Philip Waterman III to Compel Disclosure Pursuant to CPLR 3102(c) from WineCare Storage, LLC Index No. 159213/2012 Minetta Lane LLC and Morandi LLC v. WineCare Storage LLC Index No. 650208/2013 Minetta Lane LLC and Morandi LLC v. WineCare Storage LLC Index No. 650208/2013 Hakim v. WineCare Storage LLC Index No. L&T 89270/12

Supreme Court of the State of New York, County of New York Supreme Court of the State of New York, County of New York

Civil Court of the City of New York, County of New York

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 23 of 25

Main Document

EXHIBIT F Debtor's Senior Management Pursuant to Local Rule 1007-2(a)(12), the following provides the names of the individuals who constitute Debtor's existing senior management, their tenure with Debtor, and a brief summary of their responsibilities and relevant experience as of the Petition Date. Name / Position Derek Limbocker, Managing Member, President and Chief Executive Officer Relevant Experience / Responsibility Founded Debtor in 2005, created its business plan and continues to work full time on all aspects of the business. Limbocker's wine industry experience dates back to 1964 when he bought a small wine shop in Manhattan, Gateway Wine & Spirits. Limbocker remained active with that business after it merged into Park Avenue Liquors in 1984. Limbocker has also held positions at several financial services firms, including J.P. Morgan, Morgan Stanley and Train Babcock Advisors, LLC.

Samantha Carrington, Director Samantha began working at the Debtor in February 2007. of Sales & Client Services Samantha is involved primarily in marketing, advertising and client relations. She is a member of the New York Chapters of Commanderie des Cotes du Rhone and the Chaine des Rotisseurs, a recipient of the Diploma of Wines and Spirits and speaks four languages English, Spanish, French and Italian. Adam Straus, Director of Operations Adam began working at the Debtor in May 2007. He oversees management and handling of the Debtor's clients' wines held within the Debtor's cellars and is responsible for scheduling and coordinating deliveries between the Debtor's cellars and its clients' homes or businesses.

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 24 of 25

Main Document

EXHIBIT G Debtor's Payroll for the Thirty (30) Day Period Following the Filing of Debtor's Chapter 11 Petition Pursuant to Local Rules 1007-2(b)(1)-(2)(A), the following provides, for the 30-day period following the Petition Date, the estimated amount of weekly payroll to Debtor's employees (exclusive of officers, directors and stockholders) and the estimated amount paid and proposed to be paid to officers, directors and stockholders. Payments Payments to Employees (Not Including Officers, Directors, and Stockholders) Payments to Officers, Directors and Stockholders Payment Amounts Approximately $34,000 The Debtor does not expect any estimated payments to its Officers, Director and Stockholders

DOC ID - 19599551.2

13-10268-reg

Doc 2

Filed 01/29/13

Entered 01/29/13 20:18:38 Pg 25 of 25

Main Document

EXHIBIT H Debtor's Estimated Cash Receipts and Disbursements for the Thirty (30) Day Period Following the Filing of the Chapter 11 Petition Pursuant to Local Rule 1007-2(b)(3), the following provides, for the 30-day period following the Petition Date, Debtor's estimated cash receipts and disbursements, net cash gain or loss, and obligations and receivables expected to accrue that remain unpaid, other than professional fees. Type Cash Receipts Cash Disbursements Net Cash Gain/(Loss) Unpaid Obligations (excluding professional fees) Unpaid Receivables (excluding professional fees) Amount $42,000 $35,000 $7,000 $65,000 $80,000

DOC ID - 19599551.2

You might also like

- Imerys Talc - Declaration Re Chapter 11 FilingDocument79 pagesImerys Talc - Declaration Re Chapter 11 FilingKirk HartleyNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document19 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Radio Shack CH 11 Part 2Document20 pagesRadio Shack CH 11 Part 2Robert WilonskyNo ratings yet

- 10000005744Document26 pages10000005744Chapter 11 DocketsNo ratings yet

- Le Pain Quotidien DeclarationDocument15 pagesLe Pain Quotidien DeclarationKhristopher J. BrooksNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document7 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- VICEDocument92 pagesVICEVerónica SilveriNo ratings yet

- Case Digests Mercantile LawDocument3 pagesCase Digests Mercantile LawCheryl ChurlNo ratings yet

- Mercon Chap 11Document79 pagesMercon Chap 11jawyssNo ratings yet

- Usdc Bankruptcy Filing of Mortgage Companies June 2012Document3 pagesUsdc Bankruptcy Filing of Mortgage Companies June 2012Julie Hatcher-Julie Munoz Jackson100% (1)

- Vice Ch11petition DeclarationDocument92 pagesVice Ch11petition DeclarationTHRNo ratings yet

- In the Matter of Seminole Park and Fairgrounds, Inc., Bankrupt. Robert Dyer, Trustee, Seminole Park and Fairgrounds, Inc. v. First National Bank at Orlando, Indenture Trustee, 502 F.2d 1011, 1st Cir. (1974)Document7 pagesIn the Matter of Seminole Park and Fairgrounds, Inc., Bankrupt. Robert Dyer, Trustee, Seminole Park and Fairgrounds, Inc. v. First National Bank at Orlando, Indenture Trustee, 502 F.2d 1011, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Main Docs-# I 53489-V !-Crystal - Motion - CashcolateraiDocument20 pagesMain Docs-# I 53489-V !-Crystal - Motion - CashcolateraiChapter 11 DocketsNo ratings yet

- Chap 020Document25 pagesChap 020mas azizNo ratings yet

- RKA v. Kavanaugh - Second Amended Complaint As FiledDocument38 pagesRKA v. Kavanaugh - Second Amended Complaint As FiledkmccoynycNo ratings yet

- MAIN DOCS-# 15D8D5-v2-Crystal - Utili!) 'Document15 pagesMAIN DOCS-# 15D8D5-v2-Crystal - Utili!) 'Chapter 11 DocketsNo ratings yet

- Case 3:09 CV 02129 FABDocument18 pagesCase 3:09 CV 02129 FABvpjNo ratings yet

- Associates v. Gammino, Inc., 1st Cir. (1993)Document33 pagesAssociates v. Gammino, Inc., 1st Cir. (1993)Scribd Government DocsNo ratings yet

- Inre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredDocument11 pagesInre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredChapter 11 DocketsNo ratings yet

- ComplaintDocument52 pagesComplaintCarole WirszylaNo ratings yet

- A&p Store Closing MotionDocument85 pagesA&p Store Closing MotionDEShifNo ratings yet

- Davis ObjectionDocument15 pagesDavis Objectionmarie_beaudetteNo ratings yet

- The Debtors Are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011)Document20 pagesThe Debtors Are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011)Chapter 11 DocketsNo ratings yet

- Innovaglobal-042 120219Document20 pagesInnovaglobal-042 120219georgepNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document7 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Hostess Motion To Appoint Chapter 11 TrusteeDocument15 pagesHostess Motion To Appoint Chapter 11 TrusteeChapter 11 DocketsNo ratings yet

- LATAM Airlines Files for Chapter 11 Bankruptcy Protection and Seeks Continued OperationsDocument17 pagesLATAM Airlines Files for Chapter 11 Bankruptcy Protection and Seeks Continued Operationsgreeen.pat6918No ratings yet

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument17 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNo ratings yet

- The Merchants National Bank of Mobile, Plaintiff-Counter v. United States of America, Defendant-Counter, 878 F.2d 1382, 11th Cir. (1989)Document11 pagesThe Merchants National Bank of Mobile, Plaintiff-Counter v. United States of America, Defendant-Counter, 878 F.2d 1382, 11th Cir. (1989)Scribd Government DocsNo ratings yet

- Elliot V Anglo IDocument15 pagesElliot V Anglo IAndy AziNo ratings yet

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsDocument16 pagesMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaNo ratings yet

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- Suitable Technologies DeclarationDocument16 pagesSuitable Technologies DeclarationJillian D'OnfroNo ratings yet

- Declaration of Irit Eluz Pursuant To Local Bankruptcy Rule 1007-2 and in Support of The Debtor'S Chapter 11 Petition and First-Day MotionsDocument23 pagesDeclaration of Irit Eluz Pursuant To Local Bankruptcy Rule 1007-2 and in Support of The Debtor'S Chapter 11 Petition and First-Day MotionsChapter 11 DocketsNo ratings yet

- Counsel For Plaintiff and The Proposed Class: Et Seq.Document23 pagesCounsel For Plaintiff and The Proposed Class: Et Seq.Eric L. VanDussenNo ratings yet

- Response and Limited Objection by The International Bank of Commerce To The Special Counsel'S First Interim Application For Attorney'S Fees & Costs (Doc. No. 284)Document8 pagesResponse and Limited Objection by The International Bank of Commerce To The Special Counsel'S First Interim Application For Attorney'S Fees & Costs (Doc. No. 284)Chapter 11 DocketsNo ratings yet

- 10000001906Document283 pages10000001906Chapter 11 DocketsNo ratings yet

- Nunc Pro Tunc To May 12, 2011Document13 pagesNunc Pro Tunc To May 12, 2011Chapter 11 DocketsNo ratings yet

- NPC vs. CADocument6 pagesNPC vs. CALujan Mercado TangcangcoNo ratings yet

- Sandra E. Mayerson (SEM-8119) 30 Rockefeller Plaza, 23 Floor New York, New York 10112 Telephone: +1.212.872.9800 Facsimile: +1.212.872.9815Document6 pagesSandra E. Mayerson (SEM-8119) 30 Rockefeller Plaza, 23 Floor New York, New York 10112 Telephone: +1.212.872.9800 Facsimile: +1.212.872.9815Chapter 11 DocketsNo ratings yet

- C0120 6Document9 pagesC0120 6Chapter 11 DocketsNo ratings yet

- Wilmington Trust IndictmentDocument6 pagesWilmington Trust IndictmentPhiladelphiaMagazineNo ratings yet

- Case 12-20253-KAO Doc 104 Filed 10/26/12 Ent. 10/26/12 15:31:01 Pg. 1 of 12Document12 pagesCase 12-20253-KAO Doc 104 Filed 10/26/12 Ent. 10/26/12 15:31:01 Pg. 1 of 12Chapter 11 DocketsNo ratings yet

- American Roads First Day DeclDocument110 pagesAmerican Roads First Day DeclChapter 11 Dockets100% (1)

- Don Pablo's DocumentsDocument12 pagesDon Pablo's DocumentsBrett MilamNo ratings yet

- Complaint For Declaratory Judgment: WCSR 4515598v1Document8 pagesComplaint For Declaratory Judgment: WCSR 4515598v1Chapter 11 DocketsNo ratings yet

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument11 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNo ratings yet

- Supplementary Notes For Sole Proprietorship in Financial Distress Unit 1BDocument23 pagesSupplementary Notes For Sole Proprietorship in Financial Distress Unit 1BSëkei LegØdi MpelanëNo ratings yet

- Skeleton Argument (NPO)Document9 pagesSkeleton Argument (NPO)5xgcb4mnhtNo ratings yet

- Bank SecrecyDocument4 pagesBank SecrecyDave A ValcarcelNo ratings yet

- /Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Document29 pages/Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Chapter 11 DocketsNo ratings yet

- Case 12-20253-KAO Doc 105 Filed 10/26/12 Ent. 10/26/12 15:53:02 Pg. 1 of 25Document25 pagesCase 12-20253-KAO Doc 105 Filed 10/26/12 Ent. 10/26/12 15:53:02 Pg. 1 of 25Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument88 pagesUnited States Bankruptcy Court Southern District of New YorkandyNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument11 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Westmont Bank v. InlandDocument3 pagesWestmont Bank v. InlandTricia SandovalNo ratings yet

- The Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Document135 pagesThe Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Chapter 11 DocketsNo ratings yet

- Et Al./: (II) (III)Document15 pagesEt Al./: (II) (III)Chapter 11 DocketsNo ratings yet

- Pro Se Movant - Motion For Appointment of Ch. 11 TrusteeDocument120 pagesPro Se Movant - Motion For Appointment of Ch. 11 TrusteeSNo ratings yet

- MBTC Vs MarinasDocument3 pagesMBTC Vs MarinasMarlbert BorjaNo ratings yet

- D.E. Frey Group, Inc. v. FAS Holdings, Inc. (In Re D.E. Frey Group, Inc.), 387 B.R. 799, 801 (D. Colo. 2008)Document6 pagesD.E. Frey Group, Inc. v. FAS Holdings, Inc. (In Re D.E. Frey Group, Inc.), 387 B.R. 799, 801 (D. Colo. 2008)Brad DempseyNo ratings yet

- The Urban Farmer, Inc. Cash Collateral MotionDocument6 pagesThe Urban Farmer, Inc. Cash Collateral MotionBrad DempseyNo ratings yet

- Letter Urging Vote To End BSA's Discriminatory Membership PoliciesDocument2 pagesLetter Urging Vote To End BSA's Discriminatory Membership PoliciesBrad DempseyNo ratings yet

- WineCare Storage LLC Chapter 11 PetitionDocument14 pagesWineCare Storage LLC Chapter 11 PetitionBrad DempseyNo ratings yet

- Summary Judgment Dismissing $5.4 Million Lien For Tap Fees (Later Vacated Per Settlement/stipulation)Document33 pagesSummary Judgment Dismissing $5.4 Million Lien For Tap Fees (Later Vacated Per Settlement/stipulation)Brad DempseyNo ratings yet

- Order Granting Summary Judgment - $11.5 Million Plus All Attorneys' Fees and CostsDocument5 pagesOrder Granting Summary Judgment - $11.5 Million Plus All Attorneys' Fees and CostsBrad DempseyNo ratings yet

- Order Finding Contempt (And Ordering Disgorgement of Funds and Payment of Receiver's Attorneys' Fees and Costs)Document30 pagesOrder Finding Contempt (And Ordering Disgorgement of Funds and Payment of Receiver's Attorneys' Fees and Costs)Brad DempseyNo ratings yet

- Judgment Avoiding Fraudulent Transfer of Classic Car CollectionDocument22 pagesJudgment Avoiding Fraudulent Transfer of Classic Car CollectionBrad DempseyNo ratings yet

- Trust Receipts: Page 1 of 1Document1 pageTrust Receipts: Page 1 of 1RobNo ratings yet

- Abstrac 8Document8 pagesAbstrac 8lucifer morningstarNo ratings yet

- Consti Law PP V PomarDocument1 pageConsti Law PP V PomarRenz FactuarNo ratings yet

- Banking and Insurance (Bbh461) - 1515423225879Document8 pagesBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNo ratings yet

- Bataclan vs. Medina, 102 Phil. 181, 186Document2 pagesBataclan vs. Medina, 102 Phil. 181, 186Elyka SataNo ratings yet

- Ii Mech Iv Sem QB 2013 2014 Even PDFDocument117 pagesIi Mech Iv Sem QB 2013 2014 Even PDFNatesha SundharanNo ratings yet

- 1 Stat 68-69Document3 pages1 Stat 68-69Cee100% (1)

- UnpublishedDocument5 pagesUnpublishedScribd Government DocsNo ratings yet

- Redacted Preliminary Title ReportDocument4 pagesRedacted Preliminary Title ReportAaron LewisNo ratings yet

- By-Laws of Purok SambagDocument5 pagesBy-Laws of Purok SambagMelvin Miscala100% (4)

- Quiazon, de Guzman Makalintal and Barot For Petitioners. The Solicitor General For RespondentsDocument4 pagesQuiazon, de Guzman Makalintal and Barot For Petitioners. The Solicitor General For RespondentsJhay CarbonelNo ratings yet

- PHD RDC Progress Report ProformaDocument6 pagesPHD RDC Progress Report ProformaJitendra Singh RauthanNo ratings yet

- Calculate DensityDocument3 pagesCalculate Densitybeta paramitaNo ratings yet

- Minor Minerals - ArthapediaDocument2 pagesMinor Minerals - Arthapediamani_ip107559No ratings yet

- Republic Act No. 8187Document4 pagesRepublic Act No. 8187mitsune21100% (1)

- Data Protection BillDocument19 pagesData Protection Billsogea456No ratings yet

- 4MAGNO Vs VELASCO-JACOBADocument2 pages4MAGNO Vs VELASCO-JACOBAfermo ii ramosNo ratings yet

- 6500016884Document7 pages6500016884hfewkorbaNo ratings yet

- Court rules on quieting of title and ownership over disputed landDocument3 pagesCourt rules on quieting of title and ownership over disputed landWilton Norman Jvmantoc100% (1)

- City List For 11th December.Document10 pagesCity List For 11th December.Ankit Krishna LalNo ratings yet

- Republic of The Philippines vs. Honorable Domingo ImperialDocument6 pagesRepublic of The Philippines vs. Honorable Domingo ImperialdenvergamlosenNo ratings yet

- Kenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Document8 pagesKenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- G.R. No. L-17635, Sanchez Et Al. v. Municipality of Asingan, Pangasinan, 7 SCRA 559Document2 pagesG.R. No. L-17635, Sanchez Et Al. v. Municipality of Asingan, Pangasinan, 7 SCRA 559anerdezNo ratings yet

- Vda de Delfin vs. Dellota, G.R. No. 143697, January 28, 2008Document5 pagesVda de Delfin vs. Dellota, G.R. No. 143697, January 28, 2008Karen Ryl Lozada Brito100% (1)

- Stranger by The RiverDocument178 pagesStranger by The Riveriii75% (4)

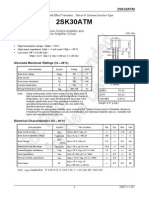

- 2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsDocument4 pages2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsIee Jimmy Zambrano LNo ratings yet

- Girl in Between by Anna Daniels Sample ChapterDocument15 pagesGirl in Between by Anna Daniels Sample ChapterAllen & UnwinNo ratings yet

- Bscic InfoDocument5 pagesBscic InfoMasthan GMNo ratings yet

- Merchant Shipping Act 1854Document323 pagesMerchant Shipping Act 1854Marianna SamaraNo ratings yet