Professional Documents

Culture Documents

Access To Water and Waste Water Management in India.

Uploaded by

Saurabh Chandra RaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Access To Water and Waste Water Management in India.

Uploaded by

Saurabh Chandra RaiCopyright:

Available Formats

Access to Water and Waste Water Management in India General Facts about Water availability: UN estimates, the total

amount of water on earth to be about 1400 million cubic kilometer. However the fresh water constitutes a very small proportion, about 2.7 per cent of the total water available on the earth is fresh water of which about 75.2 per cent lies frozen in Polar Regions and another 22.6 per cent is present as ground water. The rest is available in lakes, rivers, atmosphere, moisture, soil and vegetation. The crisis about water resources development and management thus arises because most of the water is not available for use; secondly it is characterized by its highly uneven spatial distribution and thirdly ignorance is leading to wasteful uses and poor waste water management. Indian Scenario: India accounts for 2.45% of land area and 4% of water resources of the world but represents 16% of the world population. National Water Mission estimates total utilizable water resource in the country to be about 1123 Billion Cubic Meter (690 BCM from surface and 433 BCM from ground), which is just 28% of the water derived from precipitation. Annual groundwater recharge is about 433 BCM of which 212.5 BCM used for irrigation and 18.1 BCM for domestic and industrial use (Central Ground Water Board, 2011). By 2025, demand for domestic and industrial water usage may increase to 29.2 BCM. With the present population growth-rate (1.9% per year), the population is expected to cross the 1.5 billion mark by 2050. Due to increasing population and all round development in the country, the per capita average annual freshwater availability has been reducing since 1951 from 5177 m3 to 1869 m3, in 2001 and 1588 m3, in 2010. It is expected to further reduce to 1341 m3 in 2025 and 1140 m3 in 2050. Hence, there is an urgent need for efficient water resource management through enhanced water use efficiency and waste water recycling. Table-1 Projected water demand by different sectors (CWC, 2010) Sector Irrigation Drinking Water Industry Energy Others Total 2000 541 42 8 2 41 634 Water Demand (BCM) 2010 2025 688 910 56 73 12 23 5 15 52 72 813 1093 2050 1072 102 63 130 80 1447

Access to Drinking Water: National Sample Survey Organization (NSSO) in its 54th round conducted during Jan1,1998 to June 30 ,1998 collected data in relation to source and quality of water in India. It is evident from Table 2 that major source of drinking water in urban households(70.1%) is tap and in rural households is tube-well and hand pump(50.1%). The overall pattern in terms of importance of the different sources remained unchanged over the last decade. However, among rural households, the proportion served by tube well and hand pump gradually increased while those served by well gradually decreased during the last decade. Out of all the sources about 31% of rural and 66% of urban households reported their source to be present with in premises of the household rest have to travel a distance to access water. Table-2 Percentage distribution of households by principal source of drinking water Source of Drinking Water Tap Tubewell, hand pump Well Tank/ pond reserved for drinking other tank/ pond River/ canal/ lake Spring Tanker Other Source* NSSO- 54th round-Report no -449 % age Drinking Water Rural Urban 18.7 70.1 50.1 21.3 25.8 6.7 1.3 0.2 0.6 0.1 1.3 1.7 0.2 0.2 0.2 0.1 1 0.1

As the summer approaches Indian household faces severe insufficiency of drinking water May , June and April being the worst affected months for both Urban and Rural India as depicted in Table-3.Out of these house hold About 24% of rural households and 17% of urban HHs reported no measures being normally taken by them to meet the insufficiency. Table-3 Per 1000 number of households reporting insufficiency of drinking in specific month of the year. Sectors Rural Jan 8 Feb 14 Mar 42 Apr 86 May 120 141 Jun 99 120 Jul 30 49 Aug 11 23 Sep 7 14 Oct 5 12 Nov 5 11 Dec 6 13

14 24 53 101 Urban th Source* NSSO- 54 round-Report no -449

Quality of Water and Hygiene: Deteriorating quality of surface and ground water is affecting the net availability of water for consumptive uses, water supplies to house hold from different sources are frequently reported to

be unsatisfactory. In survey by NSSO 85% of Rural and 90% of Urban HHs found their supplies to be satisfactory. Table-4 Percentage distribution of households by quality of drinking water from the source. Havind Bad tatste Cloudy Known to due to due to be Unknown Unknown Sectors polluted reason causes 1.1 1.3 1.7 Rural 1.9 1.2 1.8 Urban Source* NSSO- 54th round-Report no -449 Clean but have excess of Iron and other minerals 5.2 3

Havind Other defects 1.9 1

Satisfactory No Quality response 85 3.7 90.1 0.3

Potable water available to house hold is further reduced in quality by inappropriate storing and consumption habits. It is estimated by NSSO that only 23% of rural household and around 50% of urban house-hold treat their water before actual consumption, out of theses as high as 15% in rural 23% in urban area use most nave technique of filtering with cloth, only 4.3% in rural and 11% in Urban areas resort to boiling the water. The practice of treating water in India is envisioned to improve as government focus, techniques and affordability purifiers has increased sharply in last decade. NSSO also estimated that behavioral patterns are greatest contributor to contamination of stored water. 69% HH in rural and 65% HH in Urban take out water from container by dipping a vessel( with or without Handle) which in turn brings water directly in contact with outer environment and expose water to contaminations carried by vessel. Waste water management in India: Major source of waste water generation in India is urban conglomerate as pollution caused by villages and very small towns is either assimilated by or has negligible effect on the surrounding environment. It is estimated by CPCB that about 38,254 million liters per day (mld) of wastewater is generated in urban centers comprising Class I cities (498) and Class II (410) towns having population of more than 50,000 (accounting for more than 70 per cent of the total urban population). The municipal wastewater treatment capacity developed so far is about 11,787 mld, that is about 31 per cent of wastewater generation in these two classes of urban centers. Further, as per the UNESCO and WWAP (2006) estimates (Van-Rooijen et al., 2008), the industrial water use productivity of India (IWP, in billion constant 1995 US$ per m3) is the lowest (i.e. just 3.42) and about 1/30th of that for Japan and Republic of Korea. It is projected that by 2050, about 48.2 BCM (132 billion liters per day) of wastewaters (with a potential to meet 4.5% of the total irrigation water demand) would be generated thereby further widening this gap (Bhardwaj, 2005).

At present, significant portion of waste water being bypassed to 234-Sewage Water Treatment plants (STPs). Most of these were developed under various river action plans (from 1978-79 onwards) and are located in (just 5% of) cities/ towns along the banks of major rivers (CPCB, 2005a) from where it is sold to the nearby farmers on charge basis by the Water and Sewerage Board or most of the untreated waste water end up into river basins and indirectly used for irrigation.

Source*- Jindal ITF March 2011 Water sector opportunities for Private players : Indian water sector is worth USD 7100(Planning Commission estimates) presently traditionally this water in India has been owned and operated by the government which accounts for market share worth USD 5820Mn rest USD 1280Mn is with private players.. Not being able to solve all problems single-handedly, the government is encouraging the private sector to participate and introduce regulatory reforms. Public Private Partnerships (PPP) for water projects is a recent phenomenon and has been a successful way of promoting investments in this space. The market for water and waste water treatment in India is a fragmented with about 15 large players accounting for approximately 30% share. Several international companies have a presence in the Indian water market. Very large companies such as CH2MHILL, Vivendi (now Veolia Water), Suez de Lyonnaise (Degremont) and VA TECH Wabag have a presence. Large chemical companies such as Nalco and GE Betz-Dearborn also have operations. Other international companies with a significant presence in the Indian water sector include Thames Water (U.K.), Dow Chemicals, DuPont, Emerson, Hydranautics, Pentair (U.S.), Grundfos (Denmark), Endress + Hauser, KSB Pumps, Krohne, Netzsch (Germany), Schlumberger/Actaris (France), Amiantit, Aplaco (Saudi Arabia) and Metrohm (Switzerland). Most foreign manufacturers of water sector equipments either have a presence in India or have ensured that their products are easily available in India. For the leading foreign manufacturers, the technical expertise and know how that they offer is of a similar standard. Therefore, main differentiating factors are aggressive pricing, project execution skills and the ability to engineer processes effectively. This trend is likely to get intense in the coming years.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hustler Mini Z 44/52 Parts ManualDocument125 pagesHustler Mini Z 44/52 Parts ManualGary0% (1)

- Consumer Behavior in Packed Fruit Juice MarketDocument61 pagesConsumer Behavior in Packed Fruit Juice MarketSaurabh Chandra Rai91% (11)

- Total Chloride in Alumina Supported Catalysts by Wavelength Dispersive X-Ray FluorescenceDocument5 pagesTotal Chloride in Alumina Supported Catalysts by Wavelength Dispersive X-Ray FluorescenceJesus Gonzalez GracidaNo ratings yet

- 1 - Initial Days of Corporate GovernanceDocument5 pages1 - Initial Days of Corporate GovernanceSaurabh Chandra RaiNo ratings yet

- Investment Basics PDFDocument90 pagesInvestment Basics PDFRahul MaliNo ratings yet

- Corporate Level StrategyDocument12 pagesCorporate Level StrategySaurabh Chandra Rai100% (2)

- Common Size AnalysisDocument1 pageCommon Size AnalysisSaurabh Chandra RaiNo ratings yet

- SDHP CataloguesDocument12 pagesSDHP CataloguesPuppala Laxmana PrasadNo ratings yet

- WPH02 01 Que 20160120Document24 pagesWPH02 01 Que 20160120Omar HashemNo ratings yet

- Catalogo MQ HDG SsDocument56 pagesCatalogo MQ HDG SsMiguel CamargoNo ratings yet

- Cs6212 Programming and Data Structures Laboratory I Laboratory ManualDocument28 pagesCs6212 Programming and Data Structures Laboratory I Laboratory Manualprasath_676303No ratings yet

- Design and Analysis For Crane HookDocument6 pagesDesign and Analysis For Crane Hookmukeshsonava076314No ratings yet

- DuPont Sontara Wipes Technical SpecsDocument2 pagesDuPont Sontara Wipes Technical SpecsSkySupplyUSANo ratings yet

- Structural Welding Inspection: 2019 CBC: DSA Forms DSA PublicationsDocument3 pagesStructural Welding Inspection: 2019 CBC: DSA Forms DSA PublicationsfracevNo ratings yet

- Pressure SurgeDocument15 pagesPressure SurgesasikumarmarineNo ratings yet

- General Purpose Hydraulic Valves: Float Level Control ValveDocument2 pagesGeneral Purpose Hydraulic Valves: Float Level Control Valvevelikimag87No ratings yet

- 1964 US Army Vietnam War Military Police Traffic Control 203pDocument202 pages1964 US Army Vietnam War Military Police Traffic Control 203pwwwsurvivalebookscom100% (1)

- MK Conveyor Technology 5.0Document484 pagesMK Conveyor Technology 5.0Samuel Getaneh TNo ratings yet

- M795 Spare PartsDocument139 pagesM795 Spare Partsวิรัตน์ อัครอภิโภคีNo ratings yet

- Bridge Inspection ManualDocument539 pagesBridge Inspection ManualماقوريNo ratings yet

- Agri Brochure PDFDocument20 pagesAgri Brochure PDFMichaelNo ratings yet

- Gapura Company Profile - 17mar17Document43 pagesGapura Company Profile - 17mar17als izmiNo ratings yet

- Depth Semantic SegmentDocument9 pagesDepth Semantic SegmentAivan Dredd PunzalanNo ratings yet

- Geopolymer Reinforced With Bamboo For Sustainable Construction MaterialsDocument7 pagesGeopolymer Reinforced With Bamboo For Sustainable Construction MaterialsSamyuktha SridharNo ratings yet

- Civil & Environmental Engineering: Dept. Report October 2002Document40 pagesCivil & Environmental Engineering: Dept. Report October 2002Leonardo HernandezNo ratings yet

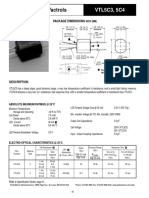

- Low Cost Axial Vactrols: VTL5C3, 5C4Document2 pagesLow Cost Axial Vactrols: VTL5C3, 5C4sillyNo ratings yet

- Systemd CheatsheetDocument1 pageSystemd Cheatsheetzaffa11No ratings yet

- BSS Steel Guide CataloguesDocument52 pagesBSS Steel Guide Cataloguessaber66No ratings yet

- UNNPX206R3Document4 pagesUNNPX206R3David OlayaNo ratings yet

- Banana ChipsDocument5 pagesBanana Chipsbikram limbuNo ratings yet

- Vacuum Distillation (Ok)Document112 pagesVacuum Distillation (Ok)Ahmed Mohamed Khalil100% (1)

- Command Configure v41 Install Guide en UsDocument26 pagesCommand Configure v41 Install Guide en Us733No ratings yet

- ChemicalEq DroppersDocument13 pagesChemicalEq DroppersUtkarsh SharmaNo ratings yet

- Patriot MissileDocument19 pagesPatriot MissileBogdan Claudiu HututuiNo ratings yet

- ML10 OwnersManualDocument16 pagesML10 OwnersManualSalvador OlivasNo ratings yet