Professional Documents

Culture Documents

Financial Accounting Scanner Section II

Uploaded by

mknatoo1963Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Scanner Section II

Uploaded by

mknatoo1963Copyright:

Available Formats

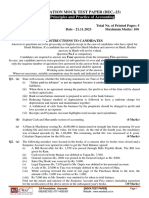

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

209

SCANNER

SECTION-II

Compiles Question asked in the Intermediate Examination of ICWAI under Syllabus 2008 in December 08 and June 09.

210

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

[GROUP - I]

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

211

FINANCIAL ACCOUNTING

ACCOUNTING CONVENTIONS AND PRACTICES

Objective -Type Questions :

Q1. Distinguish between liability and provisions. Q2. State whether following statements are true or false : (i) Goodwill is a fictitious assets. (ii) Land is a depreciable asset. [Ref : Q1. (d), June 09 / Paper-5] 4 [Ref : Q1. (a), June 09 / Paper-5] 3

Descriptive & Practical Questions :

Q1. Materiality concept. [Ref : Q8. (e), Dec 08 / Paper-5] 3 Q2. What are the objects of charging depreciation and problems of measurement of depreciation? Explain. [Ref : Q2. (b), June 09 / Paper-5] 5 Q3. State the advantages and disadvantages of Weighted Average method of valuation of inventory. [Ref : Q5. (b), June 09 / Paper-5] 5

212

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

ROYALTY

Descriptive & Practical Questions :

Q1. Define the Concept of Minimum/Dead Rent. [Ref : Q3. (b), June 09 / Paper-5] 5

HIRE PURCHASE

Objective -Type Questions :

Q1. Choose the correct answer : Under the hire-purchase system the buyer becomes the owner of goods : (i) (ii) (iii) (iv) Immediately after the delivery of goods. Immediately after the down payments. Immediately after the first instalment is paid. Immediately after the payment of last instalment.

[Ref : Q1. (h), Dec. 08 / Paper-5] 3

Descriptive & Practical Questions :

Q1. Sunshine Company sells goods for cash and on hire purchase and latter being the cash retail price plus 12.5% thereon. Following are the particulars for the year ended 31st December, 2007 : Rs. Stock with hire purchase (at hire purchase price) with customers on 1.1.2007 29,700 Purchase during the year 1,58,400 Stcok at shop : On 1.1.2007 22,000 On 31.12.2007 26,400 48,400 Cash Sales during the year 79,200 Cash received during the year (Hire purchase instalments) 1,01,750 Instalments due but not received : On 1.1.2007 4,400 On 31.12.2007 6,600 Hire purchase sales during the year 1,18,800 Prepare the following : (a) General Trading Account. (b) Hire Purchase Trading Account. (c) Hire Purchase Sales Account, for the year ended 31st December, 2007. [Ref : Q4. (a), June 09 / Paper-5] 10 Q2. Distinguish between Hire Purchase System and Instalment System. [Ref : Q4. (b), June 09 / Paper-5] 5

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

213

RECEIPTS & PAYMENTS/INCOME & EXPENDITURE ACCOUNTS

Objective -Type Questions :

Q1. A non-profit organisation has furnished the following data in connection with finalisation of accounts for the year ended 31st March 2008 : Rs. Membership subscriptions received as per books Subscription in arrear for 2007-08 Contribution to indoor games section included in item no. one above Advance receipt of subscriptions (for 2008-09) Subscription outstanding for 2006-07 now received 57,000 1,400 2,000 480 3,000

The amount of subscription to be taken as income for 2007-08 is A : Rs. 57,000, B : Rs. 51,520, C : Rs. 55,000, D : Rs. 52,920, Select the correct one. [Ref : Q1. (f), Dec. 08 / Paper-5] 3

Descriptive & Practical Questions :

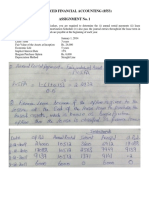

Q1. The income and expenditure account of an association for the year ended 31st March 2008 is as under : Rs. To Salaries Printing and Stationery Telephone Postage General expenses Interest and bank charges Audit fees Annual dinner expenses Depreciation Surplus Total 1,20,000 6,000 1,500 500 12,000 5,500 2,500 25,000 7,000 30,000 2,10,000 By Subscription Entrance fee Contribution for dinner Rs. 1,70,000 4,000 36,000

2,10,000

The aforesaid income and expenditure account has been prepared after the following adjustments : Subscription outstanding as on 31st March 2007 Subscription outstanding on 31st March 2008 Subscription received in advance as on 31st March 2007 Subscription received in advance as on 31st March 2008 16,000 18,000 13,000 8,400

214

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

Salaries outstanding as on 31st March 2007 6,000 Salaries outstanding as on 31st March 2008 8,000 Audit fees for 2006-2007 paid during 2007-2008 2,000 Audit fee for 2007-2008 not paid 2,500 The building owned by the association since 1990 costs 1,90,000 Equipment as on 31st March 2007 valued at 52,000 At the end of the year after depreciation of Rs. 7,000, equipment amounted to 63,000 In 2006-2007, the association raised a bank loan of which is still not paid 30,000 Cash in hand as on 31st March 2008 28,500 You are required to prepare Receipts and Payments Account of the association for the year ended 31st March 2008 and the Balance Sheet as at that date. [Ref : Q6. (a), Dec. 08 / Paper-5] 10 Q2. Distinguish between Receipts and Payments Account and Income and Expenditure Account. [Ref : Q6. (b), Dec. 08 / Paper-5] 5 Q3. The following is the Receipts and Payment Account of Sodepore Recreation Club for the year ended 31.12.2008 : Rs. To Cash in hand Cash at Bank Members Subscription 2007 200 2008 3,600 2009 400 Life Membership Subscription Sale of Ticket of annual exhibition Sale of refreshment Interest on investment Sale of furniture (Original Cost on 1.1.02 Rs. 1,000) 1,000 12,000 By Rent of Club House Painting of Club House Wages of Ground Maintenance General Expenses Electricity Charges Investment Secretarys Honorarium Annual Meeting Expenses Sports Equipment Purchase of refreshment Printing & Stationery Insurance Cash in hand Cash at Bank Rs. 2,600 1,400 3,000 2,600 3,600 20,000 1,200 800 3,600 11,000 1,000 600 4,000 12,600 68,000

4,200 4,000 20,000 24,000 2,600 200

68,000

The following information are available to you : (a) On 31.12.2007 outstanding subscription for 2007 was Rs. 300. (b) On 31.12.2007 advance subscription for 2008 received was Rs. 100. (c) On 31.12.2008 outstanding subscription for 2008 was Rs. 600. [Ref : Q6. (b), Dec. 08 / Paper-5] 5

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

215

PARTNERSHIP ACCOUNTING

Objective -Type Questions :

Q1. A & B are two partners of a firm sharing the profits & losses in the ratio of 7/12 and 5/12 respectively. On 1st April 2008 they take C as a partner giving him 1/6 share. A & B agreed further to share the future profits in the ratio of 13/24 and 7/24 respectively. C, in addition to his capital, brings in Rs. 96,000 as his goodwill for 1/6 share. This goodwill amount is to be shared between A & B. The share of goodwill amount of A & B respectively will be : A : Rs. 24,000 and Rs. 72,000 B : Rs. 72,000 and Rs. 24,000 C : Rs. 56,000 and Rs. 40,000 D : Rs. 52,000 and Rs. 44,000 Choose the correct answer :. Q2. State briefly the Rule of Gerner vs. Murray.

[Ref : Q1. (g), Dec. 08 / Paper-5] 3 [Ref : Q1. (f), June 09 / Paper-5] 4

Descriptive & Practical Questions :

Q1. A and B carry on independent business in provisions and their position as at 31.03.09 are reflected in the Balance Sheets given below : A Rs. 1,70,000 89,000 13,000 987 2,750 513 2,76,250 1,10,000 13,250 1,53,000 2,76,250 B Rs. 98,000 37,000 7,500 234 1,766 1,44,500 47,000 2,000 95,500 1,44,500

Stock in Trade Sundry Debtors Cash at Bank Cash in hand Furniture and fixture Investments Represented by Sundry Creditors for Purchases Expenses Caipital Account

Both of them want to form a partnership firm from 1st April, 2009 on the following understanding : (a) The capital of the partnership would be Rs. 3 lakhs which would be contributed by them in the ratio of 2 : 1.

216

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

(b) The assets of the individual business would be evaluated by C at which values, the firm will take them over and the value would be adjusted against the contribution due by A and B. (c) C gave his valuation report as follows : Business of A : Stock in Trade to be written down by 15% and a portion of Sundry Debtors amounting to Rs. 9,000 estimated unrealisable not to be assumed by the firm; furniture and fixtures to be valued at Rs. 2,000 and investments to be taken of market value of Rs. 1,000. Assets of B : Stocks to be increased by 10%, and Sundry Debtors to be admitted at 85% of their value; rest of the assets to be assumed at their book value. (d) The firm is not to assume any Creditors other than dues on acount of purchase made. Prepare the opening Balance Sheet of the firm. [Ref : Q5. (a), June 09 / Paper-5] 10 Q2. Suchandra, Ashmita and Kasturi were running partnership business sharing Profit and Losses in 2 : 2 : 1 ratio. Their Balance Sheet as on 31.03.2008 stood as following : (Rs. in 000s) Liabilities Fixed Capital : Suchandra Ashmita Kasturi Current Account : Suchandra Kasturi Unsecured Loan Current Liabilities Rs. 690.00 460.00 230.00 138.00 92.00 Rs. Assets Fixed Assets Investment Current Assets : Stock Debtors Cash at Bank Rs. Rs. 920.00 115.00 230.00 632.50 287.50

1,380.00

1,150.00

230.00 230.00 345.00 2,185.00

2,185.00

On 1.4.2008, they agreed to form new company Tata (P) Ltd. withAshmita and Kasturi each taking up 460 eq. share of Rs. 10 each, which shall take over the firm as going concern including Goodwill, but excluding cash and bank balance. The following are also agreed upon : (a) Goodwill will be valued at 3 years purchase of super profit. (b) The actual profit for the purpose of Goodwill valuation will be Rs. 4,60,000. (c) The normal rate of return will be 18% p.a. on Fixed Capital. (d) All other assets and liabilities will taken at Book value. (e) Ashmita and Kasturi are to acquire interest in the new company at the ratio 3 : 2. (f) The purchase consideration will be payable partly in shares of Rs. 10 each and partly in cash. Payment in cash being to meet the requirement to discharge Suchandra, who has agreed to retire. (g) Realisation expenses amounted to Rs. 1,17,300. You are required to close the books of the firm by passing necessary journal entries. [Ref : Q4. (a), Dec. 08 / Paper-5] 10

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

217

BRANCH AND DEPARTMENTAL ACCOUNTS

Descriptive & Practical Questions :

Q1. Write short notes on treatment of abnormal losses in Branch Account. [Ref : Q4. (b), Dec. 08 / Paper-5] 5

ACCOUNTING STANDARDS

Objective -Type Questions :

Q1. Match the following : I II III IV AS1 AS3 AS4 AS10 I II III IV Contingencies and events occuring after the Balance Sheet date. Accounting for Fixed Assets. Disclosure of Accounting policies. Cash flow statement. [Ref : Q1. (d), Dec. 08 / Paper-5] 4

Q2. Match the following : 1. 2. 3. 4. AS-7 AS-9 AS-19 AS-20 (i) (ii) (iii) (iv) Earning per Share Construction Contracts (Revised) Revenue Recognition Leases [Ref : Q1. (c), June 09 / Paper-5] 3

Q3. State whether the following statements are true or false : (i) AS-26 applies when computer software is acquired for sale in the ordinary course of business. (ii) Cost incurred in salaries/wages in internally generated software are included in the cost computation. [Ref : Q1. (g), June 09 / Paper-5] 3

Descriptive & Practical Questions :

Q1. Mention any five areas in which different accounting policies may be adopted by different enterprises. [Ref : Q3. (b), Dec. 08 / Paper-5] 5 Q2. Segment reporting. [Ref : Q8. (d), Dec. 08 / Paper-5] 5 Q3. State clearly the provisions contained in the Accounting Standard in respect of Revaluation of fixed Assets. [Ref : Q6. (b), June 09 / Paper-5] 5 Q4. Disclosure requirement in a case where the companies do not comply with Accounting standard. [Ref : Q8. (d), June 09 / Paper-5] 3

218

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

JOINT STOCK COMPANIES

Objective -Type Questions :

Q1. Distinguish between shares and stock. Q2. What is meant by Revesionary Bonus? [Ref : Q1. (a), Dec. 08 / Paper-5] 3 [Ref : Q1. (e), Dec. 08 / Paper-5] 3

Q3. Choose the correct answer : The excess amount received over the face value of shares, should be credited to (i) Current Liabilities; (ii) Currents Assets; (iii) Reserves & Surplus; (iv) Securities Premium Account. [Ref : Q1. (b), June 09 / Paper-5] 3 Q4. Can dividend be declared out of Security Premium Account? [Ref : Q1. (e), June 09 / Paper-5] 3 Q5. State whether the following statements are true or false : (i) Capital Redemption Reserve Account is created to meet legal requirements. (ii) Partly paid-up preference shares can be redeemed. (iii) Capital Redemption Reserve Account cannot be utilised for issuing fully paid bonus shares. [Ref : Q1. (h), June 09 / Paper-5] 3

Descriptive & Practical Questions :

Q1. Mention any five purposes for which share premium account can be utilised. [Ref : Q3. (a), Dec. 08 / Paper-5] 5 Q2. The summarized balance sheet of A Co. Ltd. as on 30th June 2008 is as under : Share Capital : 10% redeemable preference shares of Rs. 100 each Equity shares of Rs. 10 each 12% Debentures Revenue reserves Total Represented by Net assets

10,00,000 15,00,000 7,00,000 40,00,000 72,00,000 72,00,000

The redeemable preference shares were due for redemption on 31st August 2008 and were redeemed and duly paid off. The company is permitted to redeem the debentures at any time at a premium of 10% and did so on 30th September 2008. The company was in a reasonably liquid position but to assist in providing funds for redemption of the redeemable preference shares, a rights issue of equity shares was made. 20000 equity shares were issued for cash at a premium of Rs. 20 per share, Rs. 12.50 payable on application

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

219

on 15th July 2008 and the balance on allotment on 31st July 2008. All cash due was received on the due dates. During the three months ended 30th September 2008, the company traded at a profit of Rs. 2,50,000. Required : (i) Pass journal entries (including cash transactions) showing the relevant entries in respect of the above. (ii) Prepare summarized balance sheet of the company as on 30th September 2008. [Ref : Q7. (a), Dec. 08 / Paper-5] 10 Q3. Reserve Capital. Q1. Bonus shares. [Ref : Q8. (e), June 09 / Paper-5] 3

[Ref : Q8. (c), Dec. 08 / Paper-5] 3 5

Q2. Discuss the conditions of Companies Act with regard to buy-back of shares. [Ref : Q7. (b), June 09 / Paper-5]

220

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

PREPARATION OF COMPANY ACCOUNTS

Descriptive & Practical Questions :

Q1. Preparation the Balance Sheet as at 31st March, 2008 from the particulars furnished by Vision Ltd., as per Schedule VI of Companies Act. Equity Share Capital (Rs. 10 each fully paid) Calls in arrear Land Building Plant & Machinery Furniture General Reserve Loan from IDBI Loans (Unsecured) Provision for Taxation Sundry Debtors Advances (Dr.) Proposed dividend Profit & Loss A/c. Cash balance Cast at Bank Preliminary Expenses Sundry Creditors (For goods & expenses) Stock : Finished goods 1,60,000 Raw material 40,000 Adjustment : (i) 1500 equity shares were issued for consideration other than cash. (ii) Loan of Rs. 1,20,000 fro IDBI is inclusive of Rs. 6,000 for interest accrued but not due. The loan is hypothecated by plant & machinery. (iii) Debtors of Rs. 50,000 are due for more than six months. (iv) The cost of assets : Rs. Building 3,20,000 Plant & Machinery 5,60,000 Furniture 50,000 Rs. 8,00,000 800 1,60,000 2,80,000 4,20,000 40,000 1,68,000 1,20,000 96,800 54,400 1,60,000 34,160 48,000 80,000 24,000 1,97,000 10,640 1,60,000

2,00,000

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

221

(v) Bank balance includes Rs. 2,000 with Trust Bank Ltd., which is not a schedule Bank. (vi) Bills receivable for Rs. 2,20,000 maturing on 30th June, 2008 have been discounted. (viii) The company had contract for the erection of machinery at Rs. 1,50,000 which is still incomplete. [Ref : Q2. (a), June 09 / Paper-5] 10

222

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

ACCOUNTING SERVICES IN ORGANIZATIONS

Objective -Type Questions :

Q1. Match the following items shown below : I Cash Reserve II Clear Profit III Escalation clause I Electric Supply Co. II Construction Company III Banking Company [Ref : Q1. (b), Dec. 08 / Paper-5] 3 Q2. Choose the correct answer : The amortization of amount of software commences from the date when it is (i) available for use (ii) put to use (iii) developed upto 75%. [Ref : Q1. (c), Dec. 08 / Paper-5] 3

Descriptive & Practical Questions :

Q1. Distinguish between Statutory Reserve and Cash Reserve in respect of Banking Companies. [Ref : Q5. (b), Dec. 08 / Paper-5] 5 Q2. Escrow Account. Q3. Statutory Reserve in case of Bank. [Ref : Q8. (a), June 08 / Paper-5] 3 [Ref : Q8. (c), June 08 / Paper-5] 3

Q4. Kanpur Electric Supply Company rebuild and reequipped one of their plant at a cost of Rs. 80,00,000. The old plant thus, superceded, cost of Rs. 30,00,000. The capacity of new plant is thrice of the old plant. Rs. 1,00,000 realised from sale of old materials. Four old motors valued at Rs. 2,00,000 salvaged from old plant, were used in the construction. The cost of labour and material was respectively 20% and 25% lower than now. The proportion of labour to material in the plant then and now in 2 : 1. Show the journal entries for recording the above transactions if accounts are maintained under double entry system. [Ref : Q3. (a), Dec. 08 / Paper-5] 10 Q5. Double Accounting system. [Ref : Q8. (b), Dec. 08 / Paper-5] 3

SCANNER [SEC-II]

FINANCIAL ACCOUNTING

223

Q6. Following balance have been extracted from the books of an electricity company at the end of 2007 : (Figures in 000) Share Capital 1,00,000 Reserve fund (investment in 4.5% Govt. securities at par) 50,00 Contingencies reserve investment in 5% State Loan 10,00 8% debenture 20,00 Loan from State Electricity Board 40,00 Development Reserve 10,00 Fixed Assets 2,00,00 Depreciation reserve on fixed assets 50,00 Consumer deposit 55,00 Amount contributed by consumer for fixed assets 1,00 Intangible assets 5,00 Tariffs and dividend control reserve 5,00 Current Assets (monthly average) 20,00 The compnay earns a profit of Rs. 8,50,000 (after tax) in 2007. Show how the profit is to be dealt with by the company, assuming bank rate is 5%. [Ref : Q5. (a), Dec. 08 / Paper-5] 10 Q7. Re-insurance. [Ref : Q8. (a), Dec. 08 / Paper-5] 3

Q8. The following balances have been extracted from the books of Star Insurance Co. Ltd. for the year ending 31st December, 2006 : Rs. Amount of Life Assurance at the beginning of the year 12,56,450 Claims by death 93,584 Claims by maturity 77,136 Premia 1,68,457 Expenses of management 23,912 Commission 29,233 Consideration for annuities 8,496 Interest, dividends and rents 41,969 Income-tax paid on profit 2,448 Surrenders 17,414 Annuities 23,536 Bonus paid in cash 7,560 Bonus paid in reduction of premium 2,800 Preliminary expenses 480 Claims admitted but not paid at the end of the year 64,027 Annuities due but not paid 17,904 Capital paid up 4,80,000

224 Government Securities Sundry Assets Investment Reserve

SCANNER [SEC-II]

FINANCIAL ACCOUNTING 13,52,712 4,54,488 48,000 Rs.

Prepare the Revenue Account and the Balance Sheet after taking into account the following : (i) (ii) (iii) (iv) (v) (vi) Claims covered under re-insurance Further claims intimated Further bonus utilised in reduction of premium Interest accrued Premium outstanding Bonus surrendered 8,000 6,400 1,200 12,320 5,920 4,000 [Ref : Q3. (a), June 08 / Paper-5]

10

ACCOUNTING INTERPRETATION OF FINANCIAL STATEMENTS

Q1. Solvency Ratio. [Ref : Q8. (b), June 08 / Paper-5] 3

Q2. From the following information relating to ND Ltd, prepare a Balance Sheet as on 31.12.2007. Current Ratio 2 Fixed Assets/Shareholders net worth .60 Reserve & Surplus/share capital .25 Average Debt collection period 2 months G. P. Ratio 25% Cost of sales/closing stock 9 times Net working Capital Rs. 4,00,000 Liquid Ratio 1.5 [Ref : Q2. (a), Dec. 09 / Paper-5] 10 Q10. The following extracts of financial information relate to Complex Ltd. : (Rs. in lakhs) Balance Sheet as at 31st March 2008-09 2007-08 Rs. Rs. Share Capital 10 10 Reserves and Surplus 30 10 Loan Funds 60 70 100 90 Fixed Assets (Net) 30 30

SCANNER [SEC-II]

FINANCIAL ACCOUNTING (Rs. in lakhs) 2008-09 2007-08 Rs. Rs. 30 30 10 30 100 30 70 100 270 20 30 20 10 80 20 60 90 300

225

Balance Sheet as at 31st March Current Assets : Stock Debtors Cash at Bank Others Current Asset Less : Current Liabilities Net Total Assets Sales (Rs. lakhs)

(i) Calculate for the two yers Debt Equity Ratio, Quick Ratio and Working Capital Turnover Ratio. (ii) Find the Sales volume that should have been generated in 2008-09 if the company were to have maintained its Working Capital Turnover Ratio. Note : All Current Liabilities are quick liabilities. [Ref : Q6. (a), June 08 / Paper-5] 10

You might also like

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Document30 pagesIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- Financial Accounting Practice May 2009Document8 pagesFinancial Accounting Practice May 2009samuel_dwumfourNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- Financial Accounting CFA510 October 2008Document23 pagesFinancial Accounting CFA510 October 2008rain06021992No ratings yet

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77No ratings yet

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Accountancy - Paper-I - 2012Document3 pagesAccountancy - Paper-I - 2012MaryamQaaziNo ratings yet

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- P5 Syl2012 InterDocument27 pagesP5 Syl2012 InterViswanathan SrkNo ratings yet

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2009Document8 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2009mouryastudypointNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Final Accounts QuestionDocument12 pagesFinal Accounts QuestionIndu Gupta0% (2)

- Scanner: Canner Inancial CcountingDocument44 pagesScanner: Canner Inancial CcountingazharnadviNo ratings yet

- Model Question Paper: Financial Accounting (CFA510)Document25 pagesModel Question Paper: Financial Accounting (CFA510)akshayatmanutdNo ratings yet

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- Accountancy HOTSDocument47 pagesAccountancy HOTSYash LundiaNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Class 11th Final TestDocument7 pagesClass 11th Final TestmenekyakiaNo ratings yet

- Accountancy March 2008 EngDocument8 pagesAccountancy March 2008 EngPrasad C M100% (2)

- Accounting concepts and principles in financial statementsDocument6 pagesAccounting concepts and principles in financial statementskartikbhaiNo ratings yet

- 3hr Paper 4feb 2010Document3 pages3hr Paper 4feb 2010Bhawna BhardwajNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- B.Com Corporate Accounting II exam questionsDocument5 pagesB.Com Corporate Accounting II exam questionsjeganrajrajNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Acc Class Test 2008Document9 pagesAcc Class Test 2008Zaafir CotoballyNo ratings yet

- Foundation Major Test – 1 Accounting Principles and PracticeDocument5 pagesFoundation Major Test – 1 Accounting Principles and PracticesonubudsNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- CA IPCC Nov 2010 Accounts Solved AnswersDocument13 pagesCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Multiple Choice Questions: Section-IDocument6 pagesMultiple Choice Questions: Section-Isah108_pk796No ratings yet

- ISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICESDocument6 pagesISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICEStysonhishamNo ratings yet

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Half Yearly Examination 2011-12 Accounting Class XI-XIIDocument3 pagesHalf Yearly Examination 2011-12 Accounting Class XI-XIISk SinghNo ratings yet

- c2 Partnership ProblemsDocument6 pagesc2 Partnership ProblemsSiva SankariNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- 12 Accountancy Accounting For Partnership Firms FundamentalsDocument6 pages12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNo ratings yet

- The Figures in The Margin On The Right Side Indicate Full MarksDocument16 pagesThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- MT Principles of Accounting Fall 2023 UGDocument5 pagesMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570No ratings yet

- 48 CA Final Old Suggested Ans June 2009Document151 pages48 CA Final Old Suggested Ans June 2009ganduNo ratings yet

- Accounting Solve AssignmentDocument8 pagesAccounting Solve AssignmentDanyal ChaudharyNo ratings yet

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocument7 pagesMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- POFA (ACCT 100) Tutorial: Week 1 Chapter 1 - Accounting in Action Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 1 Chapter 1 - Accounting in Action Topics CoveredAli Zain ParharNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chemistry Part-I Notes on SolidsDocument2 pagesChemistry Part-I Notes on Solidsmknatoo1963No ratings yet

- Maharashtra SSC 2013 Exam Date SheetDocument1 pageMaharashtra SSC 2013 Exam Date Sheetmknatoo1963No ratings yet

- NDMA India's Pocketbook of Do's and Don'ts For Various DisastersDocument118 pagesNDMA India's Pocketbook of Do's and Don'ts For Various DisastersNdma India100% (2)

- Graduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)Document1 pageGraduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)mknatoo1963No ratings yet

- General Election 2014 Live ResultsisNULL MAHARASHTRADocument4 pagesGeneral Election 2014 Live ResultsisNULL MAHARASHTRAmknatoo1963No ratings yet

- Taxation Syllabus SolutionsDocument10 pagesTaxation Syllabus Solutionsmknatoo1963No ratings yet

- Illustration 6Document6 pagesIllustration 6mknatoo1963No ratings yet

- R A & A W: Eactions of Lkenes Lkynes OrksheetDocument2 pagesR A & A W: Eactions of Lkenes Lkynes Orksheetmknatoo1963No ratings yet

- 02 Gravitation PDFDocument6 pages02 Gravitation PDFmknatoo1963No ratings yet

- Paper 5Document9 pagesPaper 5mknatoo1963No ratings yet

- Illustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1Document1 pageIllustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1mknatoo1963No ratings yet

- MknspashtagrahaDocument3 pagesMknspashtagrahamknatoo1963No ratings yet

- ) Maharashtra Board SSC-X Algebra Sample Paper 2Document2 pages) Maharashtra Board SSC-X Algebra Sample Paper 2mknatoo1963No ratings yet

- Maharashtra Board SSC-X Algebra Sample Paper 1Document2 pagesMaharashtra Board SSC-X Algebra Sample Paper 1mknatoo1963No ratings yet

- Clarification Academics DPT 2014Document1 pageClarification Academics DPT 2014mknatoo1963No ratings yet

- Financial Reserves and Capital MovementsDocument1 pageFinancial Reserves and Capital Movementsmknatoo1963No ratings yet

- MarutiDocument6 pagesMarutimknatoo1963No ratings yet

- "Darkred" "Red": For To For ToDocument7 pages"Darkred" "Red": For To For Tomknatoo1963No ratings yet

- SMDocument1 pageSMmknatoo1963No ratings yet

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDocument5 pagesClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963No ratings yet

- Financial Reserves and Capital MovementsDocument1 pageFinancial Reserves and Capital Movementsmknatoo1963No ratings yet

- February 28Document23 pagesFebruary 28mknatoo1963No ratings yet

- Study MaterialDocument6 pagesStudy Materialmknatoo1963No ratings yet

- 800 Andalto 800Document15 pages800 Andalto 800mknatoo1963No ratings yet

- This Program Performs Matrix AdditionDocument6 pagesThis Program Performs Matrix Additionmknatoo1963No ratings yet

- Cons Sa P11-S2Document58 pagesCons Sa P11-S2mknatoo1963No ratings yet

- Corporate Laws MyNotesDocument10 pagesCorporate Laws MyNotesmknatoo1963No ratings yet

- "Darkred" "Red": For To For ToDocument7 pages"Darkred" "Red": For To For Tomknatoo1963No ratings yet

- Car BrochureDocument2 pagesCar Brochuremknatoo1963No ratings yet

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDocument5 pagesClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963No ratings yet

- Employees Benevolent Fund and Group Insurance ActDocument58 pagesEmployees Benevolent Fund and Group Insurance Actrw_riffat2517No ratings yet

- H. R. LL: A BillDocument5 pagesH. R. LL: A Billakctan19946No ratings yet

- March 18 2011Document48 pagesMarch 18 2011fijitimescanadaNo ratings yet

- Sameday Delivery Service Guide: A Messenger Courier Association of The Americas Charter MemberDocument15 pagesSameday Delivery Service Guide: A Messenger Courier Association of The Americas Charter MemberDesikanNo ratings yet

- 1989 BAR EXAMINATION QUESTIONSDocument13 pages1989 BAR EXAMINATION QUESTIONSjerushabrainerdNo ratings yet

- 3 Manila Bankers V AbanDocument2 pages3 Manila Bankers V AbanRoger Pascual CuaresmaNo ratings yet

- Teachers LTU LOCAL 1019Document63 pagesTeachers LTU LOCAL 1019Dan RiveraNo ratings yet

- Underwriting of Shares and DebenturesDocument76 pagesUnderwriting of Shares and DebenturesShamik ChakrabortyNo ratings yet

- Summer Internship Project Report ON Investment Strategies: Saving Account and UlipsDocument73 pagesSummer Internship Project Report ON Investment Strategies: Saving Account and UlipsNMA NMANo ratings yet

- People vs. Librando, 390 PHIL 543, 559 (2000)Document2 pagesPeople vs. Librando, 390 PHIL 543, 559 (2000)Rhaegar TargaryenNo ratings yet

- Offer letter for Systems Administrator roleDocument3 pagesOffer letter for Systems Administrator roleAryan ChoudharyNo ratings yet

- Ballotta Savelli PresentationDocument21 pagesBallotta Savelli PresentationTroden MukwasiNo ratings yet

- OA EW Smartwatch 1yrDocument16 pagesOA EW Smartwatch 1yrJali GattuNo ratings yet

- Employees Liability InsuranceDocument24 pagesEmployees Liability InsuranceAshil Asok VennengottNo ratings yet

- Program For Orange County (California) Financial Planning Day, 8 October 2011Document12 pagesProgram For Orange County (California) Financial Planning Day, 8 October 2011Dustin Tyler JoyceNo ratings yet

- Parent Company GuaranteeDocument2 pagesParent Company GuaranteeMahad AbdiNo ratings yet

- PHIL - GUARANTY V CIR Case DigestDocument1 pagePHIL - GUARANTY V CIR Case DigestZirk TanNo ratings yet

- Impact of Fringe Benefits On Job SatisfactionDocument100 pagesImpact of Fringe Benefits On Job SatisfactionNisha Shankar75% (4)

- Insurance Judgements Impact PolicyholdersDocument31 pagesInsurance Judgements Impact PolicyholderscoolsoftyNo ratings yet

- Pledge ReceiptDocument2 pagesPledge ReceiptAneesh CR50% (6)

- IUMI Tutorial Cargo 180813 DigitalDocument4 pagesIUMI Tutorial Cargo 180813 DigitalZoran DimitrijevicNo ratings yet

- Microinsurance For The Poor, by The Poor: The CARD MRI ExperienceDocument15 pagesMicroinsurance For The Poor, by The Poor: The CARD MRI ExperienceAsian Development BankNo ratings yet

- (Nisar) Zakat DeclarationDocument2 pages(Nisar) Zakat Declarationnisaradvocate09100% (1)

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- IbmDocument15 pagesIbmDimple ShahNo ratings yet

- Insurable Interest Requirements and Concealment ExceptionsDocument38 pagesInsurable Interest Requirements and Concealment ExceptionsGianna PeñalosaNo ratings yet

- Kidnap and Ransom Proposal Form-1Document3 pagesKidnap and Ransom Proposal Form-1gargramNo ratings yet

- BANKERS STANDARD INSURANCE COMPANY v. SHARP ELECTRONICS CORPORATION Et Al DocketDocument2 pagesBANKERS STANDARD INSURANCE COMPANY v. SHARP ELECTRONICS CORPORATION Et Al DocketACELitigationWatchNo ratings yet

- Ic 38Document15 pagesIc 38Rajkumar SharmaNo ratings yet

- Jaipur-Kishangarh Concession (38Document100 pagesJaipur-Kishangarh Concession (38Sreejith MohankumarNo ratings yet