Professional Documents

Culture Documents

Alcohol Solvents: United States

Uploaded by

Michael WarnerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alcohol Solvents: United States

Uploaded by

Michael WarnerCopyright:

Available Formats

Freedonia Focus Reports

US Collection

Alcohol Solvents:

United States

Highlights

CH

UR

E

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

November 2012

Industry Overview

Solvents Overview | Product Segmentation | Market Segmentation

Environmental and Regulatory Considerations

BR

O

Demand Forecasts

Market Environment | Product Forecasts | Market Forecasts

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition | Industry Leaders | Additional Companies Cited

www.freedoniafocus.com

Alcohol Solvents: United States

ABOUT THIS REPORT

Sources

Alcohol Solvents: United States is based on Solvents, a comprehensive industry study

published by The Freedonia Group in November 2012. Reported findings represent the

synthesis of data from various primary, secondary, macroeconomic, and demographic

sources including:

firms participating in the industry

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated August 2012

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Scope and Method

This report provides total US alcohol solvent demand in pounds. Demand is segmented

by type in terms of:

ethanol

methanol

isopropanol

other solvents such as butanol.

Total demand is also segmented by market in terms of:

cosmetics and toiletries

paints and coatings

transportation

cleaning products

other markets such as printing inks, adhesives and sealants, and

chemical processing.

Total demand and the various segments are sized at five-year intervals for historical

years 2006 and 2011 with a forecast to 2016. Forecasts emanate from the identification

and analysis of pertinent statistical relationships and other historical trends/events as

well as their expected progression/impact over the forecast period. Changes in

quantities between reported years of a given total or segment are typically provided in

terms of five-year compound annual growth rates (CAGRs). For the sake of brevity,

2012 by The Freedonia Group, Inc.

Alcohol Solvents: United States

forecasts are generally stated in smoothed CAGR-based descriptions to the forecast

year, such as demand is projected to rise 3.2% annually through 2016. The result of

any particular year over that period, however, may exhibit volatility and depart from a

smoothed, long-term trend, as historical data typically illustrate.

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

324110

325110

325199

2865

Petroleum Refineries

Petrochemical Mfg

All Other Basic Organic Chemical Mfg

2869

2911

Cyclic Organic Crudes and Intermediates,

and Organic Dyes and Pigments

Industrial Organic Chemicals, NEC

Petroleum Refining

Copyright and Licensing

The full report is protected by copyright laws of the United States of America and

international treaties. The entire contents of the publication are copyrighted by The

Freedonia Group, Inc.

2012 by The Freedonia Group, Inc.

Alcohol Solvents: United States

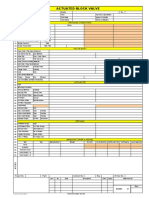

Table of Contents

Section

Page

Highlights....................................................................................................................................................... 1

Industry Overview ......................................................................................................................................... 2

Solvents Overview ................................................................................................................................... 2

Chart 1 | United States: Solvent Demand Trends, 2001-2011 ........................................................... 2

Product Segmentation ............................................................................................................................. 3

Chart 2 | United States: Solvent Demand by Type, 2011 ................................................................... 3

Ethanol. ............................................................................................................................................... 3

Methanol. ............................................................................................................................................ 3

Isopropanol. ........................................................................................................................................ 4

Other. .................................................................................................................................................. 4

Market Segmentation ............................................................................................................................... 5

Chart 3 | United States: Solvent Demand by Market, 2011 ................................................................ 5

Cosmetics & Toiletries. ....................................................................................................................... 5

Paints & Coatings. .............................................................................................................................. 5

Transportation. .................................................................................................................................... 6

Cleaning Products. ............................................................................................................................. 6

Other Markets. .................................................................................................................................... 6

Environmental & Regulatory Considerations ........................................................................................... 7

Demand Forecasts ........................................................................................................................................ 8

Market Environment ................................................................................................................................. 8

Table 1 | United States: Key Indicators for Alcohol Solvent Demand (billion 2005 dollars) ............... 8

Product Forecasts .................................................................................................................................... 9

Table 2 | United States: Alcohol Solvent Demand (million pounds) ................................................... 9

Ethanol. ............................................................................................................................................... 9

Methanol. .......................................................................................................................................... 10

Isopropanol. ...................................................................................................................................... 10

Other. ................................................................................................................................................ 10

Market Forecasts ................................................................................................................................... 11

Table 3 | United States: Alcohol Solvent Demand by Market (million pounds) ................................ 11

Cosmetics & Toiletries. ..................................................................................................................... 11

Paints & Coatings. ............................................................................................................................ 11

Transportation. .................................................................................................................................. 12

Cleaning Products. ........................................................................................................................... 12

Other Markets. .................................................................................................................................. 12

Industry Structure ........................................................................................................................................ 13

Industry Composition ............................................................................................................................. 13

Industry Leaders .................................................................................................................................... 14

The Dow Chemical Company ........................................................................................................... 14

Exxon Mobil Corporation .................................................................................................................. 15

Royal Dutch Shell plc ........................................................................................................................ 16

Additional Companies Cited................................................................................................................... 17

Resources ................................................................................................................................................... 17

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

2012 by The Freedonia Group, Inc.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Manage Risks and Seize OpportunitiesDocument5 pagesManage Risks and Seize Opportunitiesamyn_s100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- HAZOPDocument47 pagesHAZOPMiftakhul Nurdianto100% (4)

- E-Ticket Receipt - Arik AirlineDocument2 pagesE-Ticket Receipt - Arik AirlineChukwuma Emmanuel Onwufuju100% (3)

- PL-3-Policy On Measurement UncertaintyDocument10 pagesPL-3-Policy On Measurement UncertaintymffmadiNo ratings yet

- GGGGGGGGGGGGGGG: FTF Is The Only One Standing OutDocument4 pagesGGGGGGGGGGGGGGG: FTF Is The Only One Standing OutsebastianNo ratings yet

- Specialty Biocides: United StatesDocument4 pagesSpecialty Biocides: United StatesMichael WarnerNo ratings yet

- World SaltDocument4 pagesWorld SaltMichael WarnerNo ratings yet

- Polyurethane: United StatesDocument4 pagesPolyurethane: United StatesMichael WarnerNo ratings yet

- Salt: United StatesDocument4 pagesSalt: United StatesMichael WarnerNo ratings yet

- World Motor Vehicle BiofuelsDocument4 pagesWorld Motor Vehicle BiofuelsMichael WarnerNo ratings yet

- World Material Handling ProductsDocument4 pagesWorld Material Handling ProductsMichael WarnerNo ratings yet

- World Lighting FixturesDocument4 pagesWorld Lighting FixturesMichael WarnerNo ratings yet

- World Medical DisposablesDocument4 pagesWorld Medical DisposablesMichael WarnerNo ratings yet

- Jewelry, Watches, & Clocks: United StatesDocument4 pagesJewelry, Watches, & Clocks: United StatesMichael WarnerNo ratings yet

- Motor Vehicle Biofuels: United StatesDocument4 pagesMotor Vehicle Biofuels: United StatesMichael WarnerNo ratings yet

- Labels: United StatesDocument4 pagesLabels: United StatesMichael WarnerNo ratings yet

- World LabelsDocument4 pagesWorld LabelsMichael WarnerNo ratings yet

- Education: United StatesDocument4 pagesEducation: United StatesMichael WarnerNo ratings yet

- World BearingsDocument4 pagesWorld BearingsMichael WarnerNo ratings yet

- World GraphiteDocument4 pagesWorld GraphiteMichael WarnerNo ratings yet

- Aluminum Pipe: United StatesDocument4 pagesAluminum Pipe: United StatesMichael WarnerNo ratings yet

- Plastic Pipe: United StatesDocument4 pagesPlastic Pipe: United StatesMichael WarnerNo ratings yet

- Graphite: United StatesDocument4 pagesGraphite: United StatesMichael WarnerNo ratings yet

- Public Transport: United StatesDocument4 pagesPublic Transport: United StatesMichael WarnerNo ratings yet

- Ceilings: United StatesDocument4 pagesCeilings: United StatesMichael WarnerNo ratings yet

- Caps & Closures: United StatesDocument4 pagesCaps & Closures: United StatesMichael WarnerNo ratings yet

- Municipal Solid Waste: United StatesDocument4 pagesMunicipal Solid Waste: United StatesMichael WarnerNo ratings yet

- World HousingDocument4 pagesWorld HousingMichael WarnerNo ratings yet

- Industrial & Institutional Cleaning Chemicals: United StatesDocument4 pagesIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNo ratings yet

- World Specialty SilicasDocument4 pagesWorld Specialty SilicasMichael WarnerNo ratings yet

- Pharmaceutical Packaging: United StatesDocument4 pagesPharmaceutical Packaging: United StatesMichael WarnerNo ratings yet

- Industrial & Institutional Cleaning Chemicals: United StatesDocument4 pagesIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNo ratings yet

- Housing: United StatesDocument4 pagesHousing: United StatesMichael WarnerNo ratings yet

- World Drywall & Building PlasterDocument4 pagesWorld Drywall & Building PlasterMichael WarnerNo ratings yet

- Motor Vehicles: United StatesDocument4 pagesMotor Vehicles: United StatesMichael WarnerNo ratings yet

- My Life - An Illustrated Biograp - A.P.J. Abdul KalamDocument76 pagesMy Life - An Illustrated Biograp - A.P.J. Abdul KalamAnonymous OJsGrxlx6100% (1)

- EmeakDocument3 pagesEmeakSantosh RecruiterNo ratings yet

- Shahzeb Hassan: Career ObjectiveDocument2 pagesShahzeb Hassan: Career ObjectiveomairNo ratings yet

- 8Document69 pages8Yussuf HusseinNo ratings yet

- DSS2060D Actuated Block Valve DatasheetDocument1 pageDSS2060D Actuated Block Valve Datasheetkrishna kumarNo ratings yet

- 24 7 HRM Saas PricingDocument3 pages24 7 HRM Saas PricingRamakanth MardaNo ratings yet

- 2-Measuring Innovation in The Australian Public Sector PDFDocument15 pages2-Measuring Innovation in The Australian Public Sector PDFc-felipefxhotmailcomNo ratings yet

- DepEd Memo Early Registration CommitteeDocument2 pagesDepEd Memo Early Registration CommitteeDERICK REBAYNo ratings yet

- 09250.517.gypsum DrywallDocument7 pages09250.517.gypsum DrywallNguyen BachNo ratings yet

- Revision Sex Death and EpicsDocument77 pagesRevision Sex Death and EpicsAshli KingfisherNo ratings yet

- Application of PWM Speed ControlDocument7 pagesApplication of PWM Speed ControlJMCproductsNo ratings yet

- Ford Pinto Case Study HandoutDocument2 pagesFord Pinto Case Study HandoutSteven Snitch TranNo ratings yet

- Architectural Design of Bangalore Exhibition CentreDocument24 pagesArchitectural Design of Bangalore Exhibition CentreVeereshNo ratings yet

- Euref2 English PDFDocument10 pagesEuref2 English PDFbasileusbyzantiumNo ratings yet

- Aggregate Turf PavementDocument6 pagesAggregate Turf PavementDevrim GürselNo ratings yet

- D5 Novtek Premium Tile Adhesive TDSDocument2 pagesD5 Novtek Premium Tile Adhesive TDSJILBERT DORIANo ratings yet

- C ProgramsDocument54 pagesC Programskodali_madhav100% (3)

- Capilary Tube For Ac and RefrigeratorDocument4 pagesCapilary Tube For Ac and RefrigeratorJoko SubagyoNo ratings yet

- Altitude Encoders SSD120Document3 pagesAltitude Encoders SSD12057722No ratings yet

- Lumascape Lightings CatalogueDocument265 pagesLumascape Lightings CatalogueajlounicNo ratings yet

- Programa Congreso CIDUPDocument2 pagesPrograma Congreso CIDUPGigi GallardoNo ratings yet

- Consistent Engineering Units in FEADocument6 pagesConsistent Engineering Units in FEAAntonis AlexiadisNo ratings yet

- Acer Aspire 5745p 5745pg 5820t Quanta Zr7 Rev 3b SCHDocument49 pagesAcer Aspire 5745p 5745pg 5820t Quanta Zr7 Rev 3b SCHWade DyerNo ratings yet

- Pimpri Chinchwad Education Trust's TPO consolidated format for student list of industrial trainingDocument3 pagesPimpri Chinchwad Education Trust's TPO consolidated format for student list of industrial training0113ATHARVA CHAUDHARINo ratings yet

- UPS KAISE TORRE 6-10kVA SERIES KSDocument2 pagesUPS KAISE TORRE 6-10kVA SERIES KSCARLOS QUISPENo ratings yet