Professional Documents

Culture Documents

Delta Neutral Dynamic Hedging

Uploaded by

Parmit ChoudhuryOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Delta Neutral Dynamic Hedging

Uploaded by

Parmit ChoudhuryCopyright:

Available Formats

Delta Neutral Dynamic Hedging

October 23, 2009 This article discusses Delta () neutral hedging, and Delta () neutral dynamic hedging. The article disusses the theory, the mathematics and a theoretical example. Future revisions to this article will include some concrete examples. If you would like to contact the author, send a message to . If there are any errors, typos, or defects with this article please make the effort to contact the author.

1 Delta Neutral Hedging

Having a portfolio that contains an option on an underlying stock contains some risk. Specifically, the option will have risk that its value will change as a function of time, and as a function of the underlying stock price. Hedging is to reduce or hedge away risk. When one talks of Delta Hedging, what one is saying is that they own an option on an underlying (e.g. options on a stock), and would like to reduce the risk to the portfolio due to changes in the underlying stocks price. For small changes in the stocks price this can be accomplished by going long or short on the underlying. The choice of going long or short on the underlying will depend if you are long or short on a call or put option. Delta hedging is more complex for large changes in the underlying stocks price. Finally, a discussion of risks associated with assembling these various portfolios will be presented. Future revisions to this document will contain a discussion of Value at Risk, Catostrophic Failure, Mark to Market and Mark to Model aspects of risk. 1.1 Definition Delta neutral hedging is defined as keeping a portfolios value neutral to small changes in the underlying stocks price. Delta is the sensitivity of an options value to the stock price while all other variables remain unchanged. Because the option pricing equations are partial differential equations, Delta is mathematically represented as:

this can be read as the partial derivative of the options value with respect to changes in the underlying stocks price. Delta ( ) must be between 0 and 1 for call options and -1 to 0 for put options. This previous statement can be though of quite intuitively as: a call option gives you the right to buy a stock at a predetermined price (called the strike price) therefore, as the price of the stock moves up the value of the option moves up and as the value of the stock moves down the value of the option moves down. In other words, for call options the value of the option will move in the same direction as the value of the stock. Now, intuitively thinking about a put option which gives one the right to sell a stock at a predetermined price, as the price of the stock goes up the value of the option goes down (e.g. if the put options strike price is $100, and the stocks price goes from $90 to $95 on the day of expirey then the put options value dropped from $10 to $5). In other words, the put options price will move in the opposite direction of the stock price.

NOTE: all the options discussed in this section were long options (i.e. long put options or long call options). A long options is a contract that gives the holder the right to buy or sell an underlying stock at a predetermined price on or before a predetermined day. Shorting a call option means to sell a contract giving another party the right to buy a stock at a predetermined price on or before a predetermined day. There are caveats related to the diferences between American options, European options and other more exotic options. Example 1 An options trader is looking to make some money, and decides to look at FSLR (First Solar Corpration). Selecting a stock to add to a portfolio is a bit like selecting your next move on the chess board. You have to look at both tactical as well as stretegic details. This article is covering only the tactical aspect. However, just pick up any good book about portfolio management and you will quickly see that the strategic decisions are every bit as important as the tactical decisions. Q. 1.1 How would the trader calculate the value of (Delta)? Q. 1.2 Lets say the stocks price is volitile through out the day, moving more than 10% above and below the open. What could you say about the value of (Delta) calculated above? Lets say that very few options contracts traded hands for the strike price and expirey of interested, what would that say about the error associated with the traders determination of . Q. 1.3 What are all the other variables that could affect the options price, and how could they affect the accuracy and correctness of the calculation above? A. 1.1 There are many techniques to calculate this. However, a simple technique would be to generate a table containing the value of the option, and the value of the underlying stock. Then use this table to generate a scatter chart plotting the options value on one axis and the underlying stocks price on the other. The slope of the line would represent Delta (). The interesting thing about doing this activity is that you could start to see how Delta () changes as the price changes. Delta () is not constant, but is a function of the underlyings stock price. Therefore as the stocks price changes the sensitivity of the options value to the stocks price will change. This concept is complex and is really the second derrivative of options value with respect to stock price or mathematically it is .

A. 1.2 may not be acurately determined because if few or no options actually trade hands then there is effectively no market for the options themselves. Therefore, the error in the value of could be quite large. A. 1.3 Options are less liquid than stocks. Options value is based on more than just the underlying stock price, it is based on the stocks volitility time to expirey, price of the underlying, and possibly other factors such as liquidity and open interest. 1.2 A Simple Delta Neutral Strategy

Assembling a strategy and portfolio is where the theory and application of hedge or derivative investment strategies come together. Here we will look at a very simple strategy in which the investor will buy a call option, and short the actual underlying stock. This is just about the simplest strategy available. The investor will hold a call option on an underlying stock; that means that the investor will hold the rights to purchace shares of stock on or before a predetermined day at a predetermined price. The investor will also sell shares of the underlying stock that he does not own. This is called shorting. Before going any further with this example, lets take a moment to think about this position. By purchasing the call option the investor is betting on the stock to go up in price. Call options increase in value as the underlying stock increases in price. On the contrary by selling short stocks of the underlying the investor is betting on the stock to go down in price. Now, what does the neutral aspect of a Delta Neutral strategy mean? This is the somewhat subtle point of a neutral strategy. At this point the astute student of quantitative finance would also pose the question how many shared of the underlying should one short, and how many options contracts should be bought? The very astute student of quantitative finance would further pose the question of how far out should I purchace an options contract and what stike price should I choose? These are actually quite complex questions to answer, and in some cases require experince and vision not just mathematical analysis and simplification. Since these questions are not being answered presently in this section, they will be presented in a list for future reference. Questions to be answered for a sucssessful delta neutral hedging strategy: 1. 2. 3. 4. 5. 6. What does the neutral aspect of delta neutral hedging mean? How many shares of the underlying should one short? How many options should be bought? How far out should I purchase the options expirey for? What strike price should I choose for the options? How often should I re-balance the portfolio to make it neutral?

Taking a completely contrived example lets say that an option and its underlying exhibit the following behavior: 1. 2. , or the options value changes 50 cents for every dollar change in the underlying stocks price.

, or will change by 2 cents for every dollar change in the price of the underlying. 3. S, the stock price at T0 = $100 4. V, the option price at T0 = $10 Assumptions:

The options expirey is a long ways out. The underlying stock has a constant and predictable volatility. the sensitivity of to the stock price is a constant and will not change due to either the passage of time, or the fluctuation of the underlying stock price.

The options value will only change do to based changes. In other words the passage of time, change in volatility, etc will not affect the value of the option.

Therefore, it is time to assemble the portfolio. Answering question 1 from above, what does the neutral aspect of delta neutral hedging mean? An observation that should be clear by now is that the value of the options purchased will move in the oposite direction to the profit or loss due to the short sell bet that is made. Being neutral means that for every dollar increase in the options value due to change in the underlying stock price, there will be an exactly equal and offsetting decrease in the value of the short sell bet. If the stock is moving down in price, then for every dollar decrease in the options value, the short sell bet will increase by an equal amount. There is an important caveat to note at this point. The value of the short sale is very real, the stock is absolutely liquid in nature and therefore the value of the short sale is quantitatively determined based on the movements of the underlying stock. However, the value of the option is based on a large number of fuzzy variables which make it take on a model value. The market value of the option (i.e. the value of the option if it were executed) would be 0, due to the fact that neutral hedging tends to start with out-of-the-money options. Therefore, the initial portfolio will start with options contracts and short sells in a ratio of 2 : 1 or 2 options for every stock which is shorted. For the sake of mathematics, decimal shares can be used. In a real world example these normalized values would have to translated into values that make much more sense once balancing frequency and trading transaction costs are factored in. Prior to starting the cash flow analysis, we will derive some simple equations that will allows us to do the math without thinking too much. One thing to keep in mind as we are doing this differential calculus exersize, is that the real world is a more discrete environment. Firstly, we will need to know what the Mark-To-Model value of the options are worth.

Remembering that (P) and knowing that represents the sensitivity of to price, We can make the very academic sounding statememt that we can assume that is constant.

which leads to:

therefore:

Assuming that is a constant, allows for to be pulled out of the integral and reduces the equation to:

This equation could be simplified a bit by defining Pinit - P = P, which would give:

In addition to being able to determine the value of the option at each price movement, we need to determined the value of the short position and we need to determine the number of shares to buy or sell. Finally, we will need to come up with a nice tabular view to encapsulate each transaction. As a famous mutual fund manager once said, the definition of a good investor is to sell high and buy low. So, keeping that in mind, we will do just exactly what that fund manager indicated we should. Every time the underlying stock goes down a buck, we will buy, and every time the underlying stock goes up we will sell. The amount that we buy or sell will be enough to keep the portfolio neutral to movements in the stock price. Lets assume that the stock has the following movements: P1 100 P2 99 P3 98 P4 97 P5 96 P6 97 P7 98 P8 99 P9 100 P10101 P1 = NA ACTION: Initial Entry buy 1 Option Sell 0.5 shares short.

cost options short cash in Total 10.00 -50.00 0.00 -40.00

value Value - Cost 10.00 -50.00 0.00 -40.00 0.00 0.00 0.00 0.00

P2 = -1 ACTION: Buy .02 shares.

Shares Sort Will be 0.48

cost options short Cash IN Total 10.00 -50.00 1.98 -38.02

value Value - Cost 9.49 -47.52 0.0 -38.03 -0.01

P3 = -1 ACTION: Buy .02 shares. Shares Sort Will be 0.46

cost options short Cash IN Total 10.00 -50.00 3.94 -36.06

value Value - Cost 8.96 -45.08 0.0 -36.12 -0.06

P4 = -1 ACTION: Buy .02 shares. Shares Sort Will be 0.44

cost options short Cash IN Total 10.00 -50.00 5.88 -34.12

value Value - Cost 8.41 -42.68 0.0 -34.27 -0.15

P5 = -1 ACTION: Buy .02 shares. Shares Sort Will be 0.42

cost

value Value - Cost

options short Cash IN Total

10.00 -50.00 7.80 -32.20

7.84 -40.32 0.0 -32.48

-0.28

P6 = 1 ACTION: Sell .02 shares. Shares Sort Will be 0.44

cost options short Cash IN Total 10.00 -50.00 5.86 -34.14

value Value - Cost 8.41 -42.68 0.0 -34.27 -0.13

P7 = 1 ACTION: Sell .02 shares. Shares Sort Will be 0.46

cost options short Cash IN Total 10.00 -50.00 3.90 -36.10

value Value - Cost 8.96 -45.08 0.0 -36.12 -0.02

P8 = 1 ACTION: Sell .02 shares. Shares Sort Will be 0.48

cost options short Cash IN 10.00 -50.00 1.92

value Value - Cost 9.49 -47.52 0.0 -

Total

-38.08 ACTION: Sell .02 shares.

-38.03

0.05

Shares Sort Will be 0.50

cost options short Cash IN Total 10.00 -50.00 -.08 -40.08

value Value - Cost 10.0 -50.00 0.0 -40.00 0.08

P10 = 1 ACTION: Sell .02 shares. Shares Sort Will be 0.52

cost options short Cash IN Total 1.3 Risks 10.00 -50.00 -2.10 -42.10

value Value - Cost 10.51 -52.52 0.0 -42.01 0.09

Asembling a portfolio as the one above has some risks. These risks will be discussed briefly. 1. The underlying stock move strongly in one direction. In otherwords the stock does not fluctuate around a given price, but instead trends up or down. Delta neutral strategies tend to work best if the stock moves equaly up and down in a Markov like process. 2. The volatility suddenly changes (or really the Implied Volatility changes) neutral strategies are not typically protecting against this type of change. However, the volitiliy can be a much more significant term in the value of an option than . 3. Counter party risk. You will be buying an option from a counter party. If, at expirey, the option is in the money you will need to exercise the option. This will require the counter party which sold you the option to be solvent and able to service their obligations. 4. There are other risks, however they will be discussed in a later revision to this article.

References

You might also like

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3From EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3No ratings yet

- Option Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5From EverandOption Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5No ratings yet

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4From EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Rating: 4 out of 5 stars4/5 (1)

- What About Options?: A Prelude to Profitable Options TradingFrom EverandWhat About Options?: A Prelude to Profitable Options TradingRating: 3 out of 5 stars3/5 (1)

- Option Greek - The Option GuideDocument6 pagesOption Greek - The Option GuidePINALNo ratings yet

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsFrom EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo ratings yet

- Summary of Nishant Pant's $25K Options Trading Challenge, Second EditionFrom EverandSummary of Nishant Pant's $25K Options Trading Challenge, Second EditionNo ratings yet

- Understanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageFrom EverandUnderstanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageRating: 3 out of 5 stars3/5 (1)

- Delta Neutral StrategiesDocument50 pagesDelta Neutral Strategiesjainvivek0% (2)

- Options Volatility Trading: Strategies for Profiting from Market SwingsFrom EverandOptions Volatility Trading: Strategies for Profiting from Market SwingsRating: 3 out of 5 stars3/5 (2)

- Advanced Options Trading: Approaches, Tools, and Techniques for Professionals TradersFrom EverandAdvanced Options Trading: Approaches, Tools, and Techniques for Professionals TradersRating: 4 out of 5 stars4/5 (4)

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- How to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to VegaFrom EverandHow to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to VegaRating: 5 out of 5 stars5/5 (1)

- 12 - Advanced Option GreeksDocument72 pages12 - Advanced Option Greekssoutik sarkar100% (2)

- IronCondors CBOEDocument11 pagesIronCondors CBOEPablo OrellanaNo ratings yet

- High Probability Option Trading Covered Calls and Credit SpreadDocument69 pagesHigh Probability Option Trading Covered Calls and Credit Spreadjeorba56100% (3)

- Trading Options Strategies Risk Reversal SummaryDocument35 pagesTrading Options Strategies Risk Reversal Summarynaimabdullah275% (4)

- Mastering Options StrategiesDocument40 pagesMastering Options Strategiesluong847180% (1)

- 10-Trading Strategies Involving OptionsDocument24 pages10-Trading Strategies Involving OptionsSaupan UpadhyayNo ratings yet

- Options Trading Strategies - Wrong Use of Historical Volatility and Implied Volatility CrossoversDocument2 pagesOptions Trading Strategies - Wrong Use of Historical Volatility and Implied Volatility CrossoversHome Options Trading100% (3)

- Sheridan Top 5 Mistakes When Creating Monthly Income Feb10Document32 pagesSheridan Top 5 Mistakes When Creating Monthly Income Feb10ericotavaresNo ratings yet

- Advanced Option TraderDocument1 pageAdvanced Option TradergauravroongtaNo ratings yet

- Option Spread Trading: A Comprehensive Guide to Strategies and TacticsFrom EverandOption Spread Trading: A Comprehensive Guide to Strategies and TacticsNo ratings yet

- Summary of Michael Sincere's Understanding Options 2EFrom EverandSummary of Michael Sincere's Understanding Options 2ERating: 2 out of 5 stars2/5 (1)

- Double Calendar Spreads, How Can We Use Them?Document6 pagesDouble Calendar Spreads, How Can We Use Them?John Klein120% (2)

- Option Strategies That Can Be Implemented Based On Implied VolatilityDocument8 pagesOption Strategies That Can Be Implemented Based On Implied Volatilitysivasundaram anushanNo ratings yet

- Option Volatility & Pricing Workbook: Practicing Advanced Trading Strategies and TechniquesFrom EverandOption Volatility & Pricing Workbook: Practicing Advanced Trading Strategies and TechniquesRating: 4.5 out of 5 stars4.5/5 (11)

- Options For Volatility: Sample Investing PlansDocument10 pagesOptions For Volatility: Sample Investing PlansNick's GarageNo ratings yet

- Option Trading: Pricing and Volatility Strategies and TechniquesFrom EverandOption Trading: Pricing and Volatility Strategies and TechniquesRating: 3.5 out of 5 stars3.5/5 (5)

- The Only Options Trading Book You'll Ever Need: Options Trading Workbook for Beginners to Hedge Your Stock Market Portfolio and Generate IncomeFrom EverandThe Only Options Trading Book You'll Ever Need: Options Trading Workbook for Beginners to Hedge Your Stock Market Portfolio and Generate IncomeNo ratings yet

- Options Trading For Beginners: Discover & Learn The Secrets & Strategies to Making a Living Trading OptionsFrom EverandOptions Trading For Beginners: Discover & Learn The Secrets & Strategies to Making a Living Trading OptionsNo ratings yet

- The Complete Guide to Option Selling, Second EditionFrom EverandThe Complete Guide to Option Selling, Second EditionRating: 3.5 out of 5 stars3.5/5 (4)

- Option Income Strategies Overview/Survey: Raleigh-Durham Traders Meetup 1/11/2017Document50 pagesOption Income Strategies Overview/Survey: Raleigh-Durham Traders Meetup 1/11/2017Sergio Balli100% (2)

- The Advanced Options Trading Guide: The Best Complete Guide for Earning Income with Options Trading, Learn Secret Investment Strategies for Investing in Stocks, Futures, ETF, Options, and Binaries.From EverandThe Advanced Options Trading Guide: The Best Complete Guide for Earning Income with Options Trading, Learn Secret Investment Strategies for Investing in Stocks, Futures, ETF, Options, and Binaries.Rating: 3 out of 5 stars3/5 (17)

- Butterfly + Broken Wing ButterflyDocument4 pagesButterfly + Broken Wing ButterflyMrityunjay KumarNo ratings yet

- Options for the Stock Investor: How to Use Options to Enhance and Protect ReturnsFrom EverandOptions for the Stock Investor: How to Use Options to Enhance and Protect ReturnsRating: 4 out of 5 stars4/5 (2)

- Options Strategies PDFDocument66 pagesOptions Strategies PDFsrinivas_urv100% (3)

- 5 Favorite Options Setups PDFDocument40 pages5 Favorite Options Setups PDFquantum70No ratings yet

- The Market Taker's Edge: Insider Strategies from the Options Trading FloorFrom EverandThe Market Taker's Edge: Insider Strategies from the Options Trading FloorNo ratings yet

- Euan Sinclair Option Trading PDFDocument2 pagesEuan Sinclair Option Trading PDFBeth33% (3)

- Trading the Volatility Skew of S&P Index OptionsDocument41 pagesTrading the Volatility Skew of S&P Index OptionsSim Terann100% (1)

- Options Trading for Beginners - The 7-Day Crash Course I Start Achieving Your Financial Freedoom Today I Options, Swing, Day & Forex TradingFrom EverandOptions Trading for Beginners - The 7-Day Crash Course I Start Achieving Your Financial Freedoom Today I Options, Swing, Day & Forex TradingNo ratings yet

- Option GreeksDocument135 pagesOption GreeksYugen NamiNo ratings yet

- Power: Passive Option Writing Exceptional Return StrategyFrom EverandPower: Passive Option Writing Exceptional Return StrategyNo ratings yet

- Trading Options Developing A PlanDocument32 pagesTrading Options Developing A Planjohnsm2010No ratings yet

- Ryan Road Trip Trade PresentationDocument32 pagesRyan Road Trip Trade PresentationHernan DiazNo ratings yet

- Gamma Trade OptionsDocument40 pagesGamma Trade Optionssnowbash50% (2)

- Options Trading Strategies: Option Spread Strategy Description Reason To Use When To UseDocument6 pagesOptions Trading Strategies: Option Spread Strategy Description Reason To Use When To UseSGNo ratings yet

- The Options Edge: An Intuitive Approach to Generating Consistent Profits for the Novice to the Experienced PractitionerFrom EverandThe Options Edge: An Intuitive Approach to Generating Consistent Profits for the Novice to the Experienced PractitionerRating: 4 out of 5 stars4/5 (1)

- Hyperion Planning QuestionsDocument25 pagesHyperion Planning Questionsrams080% (2)

- PR-1000 - Operations Handover ProcedureDocument19 pagesPR-1000 - Operations Handover ProcedureParmit Choudhury100% (1)

- Essbase QuestionsDocument1 pageEssbase QuestionsParmit ChoudhuryNo ratings yet

- Hyperion Smart View OptimizationDocument3 pagesHyperion Smart View OptimizationParmit ChoudhuryNo ratings yet

- A Deeper Insight Into Drill-ThroughDocument9 pagesA Deeper Insight Into Drill-ThroughParmit ChoudhuryNo ratings yet

- Tips and Tricks To Get More Out of Essbase - Webinar 3-29-13v2Document47 pagesTips and Tricks To Get More Out of Essbase - Webinar 3-29-13v2Parmit ChoudhuryNo ratings yet

- Hplanclassic 120328073540 Phpapp01Document29 pagesHplanclassic 120328073540 Phpapp01Parmit ChoudhuryNo ratings yet

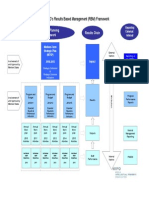

- WIPO's Results Based Management (RBM) FrameworkDocument1 pageWIPO's Results Based Management (RBM) FrameworkParmit ChoudhuryNo ratings yet

- Design Tune Oracle e PMDocument40 pagesDesign Tune Oracle e PMParmit ChoudhuryNo ratings yet

- Project Handover DocumentDocument12 pagesProject Handover DocumentAmo Frimpong-Manso89% (9)

- Getting The Most Out of FDM:: Integrating With Essbase and PlanningDocument55 pagesGetting The Most Out of FDM:: Integrating With Essbase and PlanningParmit ChoudhuryNo ratings yet

- Creating Oracle Hyperion Planning Applications With EPMADocument20 pagesCreating Oracle Hyperion Planning Applications With EPMAparmitchoudhuryNo ratings yet

- Aso Compact Outline 133544Document4 pagesAso Compact Outline 133544ksrsarmaNo ratings yet

- Sydney - Top 10 Essbase Optimization Tips That Give You 99 Percent Faster CalculationsDocument49 pagesSydney - Top 10 Essbase Optimization Tips That Give You 99 Percent Faster Calculationssen2natNo ratings yet

- ASO What you need to knowDocument40 pagesASO What you need to knowmanohar_anchanNo ratings yet

- Oda Hyperionplanning 1899066Document11 pagesOda Hyperionplanning 1899066Parmit ChoudhuryNo ratings yet

- Using Maxl To Automate Essbase: Cameron Lackpour Interrel ConsultingDocument74 pagesUsing Maxl To Automate Essbase: Cameron Lackpour Interrel ConsultingKrishna TilakNo ratings yet

- Pre-Tuning and Sizing Your Hyperion Planning and Essbase Applications Before Building AnythingDocument74 pagesPre-Tuning and Sizing Your Hyperion Planning and Essbase Applications Before Building AnythingSri Harsha AtluriNo ratings yet

- VB Tutorial FullDocument98 pagesVB Tutorial FullkevotooNo ratings yet

- Outline Load Utility Import & ExportDocument9 pagesOutline Load Utility Import & Exportbalujbb100% (2)

- Annual Operating PlanDocument3 pagesAnnual Operating PlanParmit ChoudhuryNo ratings yet

- 4822 Tuning Essbase Aso WP 133014Document7 pages4822 Tuning Essbase Aso WP 133014prabhu23No ratings yet

- Essbase Data LoadDocument35 pagesEssbase Data LoadAmit Sharma100% (2)

- Hyperion Planning IntroductionDocument12 pagesHyperion Planning IntroductionAmit Sharma100% (3)

- Hyperion Planning Manual (Template For Reference)Document43 pagesHyperion Planning Manual (Template For Reference)sudhircerin100% (1)

- Whats New in Essbase 11 Essbase Studio - HUGmn TechdayDocument44 pagesWhats New in Essbase 11 Essbase Studio - HUGmn TechdayParmit ChoudhuryNo ratings yet

- How-To Tips For Integrating Essbase Into OBIEEDocument33 pagesHow-To Tips For Integrating Essbase Into OBIEENantha KumarNo ratings yet

- Tips For Filling Out The Performance Planning and Appraisal Form (PPAF)Document5 pagesTips For Filling Out The Performance Planning and Appraisal Form (PPAF)Sudhakar ChollangiNo ratings yet

- Allenpaper PDFDocument45 pagesAllenpaper PDFParmit ChoudhuryNo ratings yet

- Appraisal Guide - ACASDocument22 pagesAppraisal Guide - ACASdeborah_tearNo ratings yet

- PNP P.A.T.R.O.L. 2030 Score Card Dashboard FormulationDocument89 pagesPNP P.A.T.R.O.L. 2030 Score Card Dashboard FormulationMark Payumo83% (41)

- 1st PU Chemistry Test Sep 2014 PDFDocument1 page1st PU Chemistry Test Sep 2014 PDFPrasad C M86% (7)

- Hi Scan Pro ManualDocument231 pagesHi Scan Pro ManualFaridhul IkhsanNo ratings yet

- Medical StoreDocument11 pagesMedical Storefriend4sp75% (4)

- Radical Acceptance Guided Meditations by Tara Brach PDFDocument3 pagesRadical Acceptance Guided Meditations by Tara Brach PDFQuzzaq SebaNo ratings yet

- Social Case Study Report on Rape VictimDocument4 pagesSocial Case Study Report on Rape VictimJulius Harvey Prieto Balbas87% (76)

- Senator Frank R Lautenberg 003Document356 pagesSenator Frank R Lautenberg 003Joey WilliamsNo ratings yet

- M5-2 CE 2131 Closed Traverse - Interior Angles V2021Document19 pagesM5-2 CE 2131 Closed Traverse - Interior Angles V2021Kiziahlyn Fiona BibayNo ratings yet

- PbisDocument36 pagesPbisapi-257903405No ratings yet

- Course Syllabus (NGCM 112)Document29 pagesCourse Syllabus (NGCM 112)Marie Ashley Casia100% (1)

- Graphic Design Review Paper on Pop Art MovementDocument16 pagesGraphic Design Review Paper on Pop Art MovementFathan25 Tanzilal AziziNo ratings yet

- 15Document74 pages15physicsdocs60% (25)

- Productivity in Indian Sugar IndustryDocument17 pagesProductivity in Indian Sugar Industryshahil_4uNo ratings yet

- One Shot To The HeadDocument157 pagesOne Shot To The HeadEdison ChingNo ratings yet

- Bluetooth Mobile Based College CampusDocument12 pagesBluetooth Mobile Based College CampusPruthviraj NayakNo ratings yet

- Assignment OUMH1203 English For Written Communication September 2023 SemesterDocument15 pagesAssignment OUMH1203 English For Written Communication September 2023 SemesterFaiz MufarNo ratings yet

- Novel anti-tuberculosis strategies and nanotechnology-based therapies exploredDocument16 pagesNovel anti-tuberculosis strategies and nanotechnology-based therapies exploredArshia NazirNo ratings yet

- Indian Archaeology 1967 - 68 PDFDocument69 pagesIndian Archaeology 1967 - 68 PDFATHMANATHANNo ratings yet

- Expansion Analysis of Offshore PipelineDocument25 pagesExpansion Analysis of Offshore PipelineSAUGAT DUTTANo ratings yet

- Practical and Mathematical Skills BookletDocument30 pagesPractical and Mathematical Skills BookletZarqaYasminNo ratings yet

- Experiment 5 ADHAVANDocument29 pagesExperiment 5 ADHAVANManoj Raj RajNo ratings yet

- Detailed Lesson Plan in Science 10Document7 pagesDetailed Lesson Plan in Science 10Glen MillarNo ratings yet

- Araminta Spook My Haunted House ExtractDocument14 pagesAraminta Spook My Haunted House Extractsenuthmi dihansaNo ratings yet

- Revolute-Input Delta Robot DescriptionDocument43 pagesRevolute-Input Delta Robot DescriptionIbrahim EssamNo ratings yet

- Fs Casas FinalDocument55 pagesFs Casas FinalGwen Araña BalgomaNo ratings yet

- Asian Paints Research ProposalDocument1 pageAsian Paints Research ProposalYASH JOHRI-DM 21DM222No ratings yet

- Q-Win S Se QuickguideDocument22 pagesQ-Win S Se QuickguideAndres DennisNo ratings yet

- The "5 Minute Personality Test"Document2 pagesThe "5 Minute Personality Test"Mary Charlin BendañaNo ratings yet

- UTS - Comparative Literature - Indah Savitri - S1 Sastra Inggris - 101201001Document6 pagesUTS - Comparative Literature - Indah Savitri - S1 Sastra Inggris - 101201001indahcantik1904No ratings yet

- Basic Statistical Tools for Data Analysis and Quality EvaluationDocument45 pagesBasic Statistical Tools for Data Analysis and Quality EvaluationfarjanaNo ratings yet