Professional Documents

Culture Documents

FINS3616 - Mid Semester

Uploaded by

dwm1855Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINS3616 - Mid Semester

Uploaded by

dwm1855Copyright:

Available Formats

Chapter

1 An Introduction to Multinational Finance Goals of MNC - Maximize shareholder wealth. - Stakeholders: VREVENUES = VEXPENSES + VGOVT + VOTHER + VDEBT + VEQUITY. - Agency Costs. - Protection of stakeholders (ie. Tariffs, Subsidies, Price Support etc.) ie. Rice industry in Japan. Challenges of MNCs - Cultural Differences (Language, Customs, Beliefs etc.) Affects marketing - Differences in systems (Tax, Accounting, Legal, Financial) - Risks: Country Risk (Risk that business environment in host country will change) Political Risk: Risk that political events will change business environment. Financial Risk: Risk that financial/economic environment will change. Opportunities of MNCs - Value = t [E[CFt] / (1+it)t] - MNC has more investment choices and more financing choices than a domestic company. Investment Opportunities - Enhancing Revenues: Global Branding, Marketing Flexibility, Advantages of Scale & Scope. - Reducing Operating Costs: Low-cost materials/labour, Flexibility site global selection, sourcing and production, Economies of scale/scope, Vertical integration. Perfect Financial Market Assumptions - Frictionless Markets - Rational Investors - Equal access to costless information - Equal access to market prices Market Efficiency - Operational Efficiency: No loss of funds when moved around. Frictionless markets. - Information Efficiency: Rational investors have equal access to markets. Prices reflect info. - Allocational Efficiency: Allocating capital to its most productive uses. - Comparative Advantage: Linked to Allocational Efficiency. A country should produce and export what it is efficient at producing. It should import goods from nations that produce things more efficiently. Chapter 2 World Trade and the Monetary System Balance of Payments - Shows inflows and outflows of goods, services and capital. - Trade Balance: Shows if it is net export (surplus) or net import (deficit). - Current Account: Shows the balance of import/export activity. - Financial Account: Shows changes in financial assets/liabilities. Bretton Woods Agreement - Created World Bank and IMF. - Pegged Gold System. Gold is worth US$35/oz. Other currencies pegged to it. - Stopped on August 15, 1971 due to market forces pressuring the system.

Exchange Rate Systems - Pegged/Fixed: Governments maintain currency values at a set exchange rate. Devaluations and Revaluations. - Floating: Supply and Demand (Market) determines value of currency. Depreciation and Appreciation. Currency Crises - Common Causes: Fixed/Pegged Rates, Large foreign currency debt, Low reserves. IMF Lending and Moral Hazard - Existence of a contract can change behaviours of parties to the contract. That is, the existence of bailouts change behaviours by making countries more risky, knowing that they will be saved by the IMF.

Chapter 3: Foreign Exchange and Eurocurrency Markets Characteristics - Liquidity: Ease of conversion to cash. - Efficiency: Operational/Informational/Allocational. Eurocurrencies - Bank deposits and loans residing outside of a single country. - Floating rate price (low interest rate [LIBOR]/default risk), Short maturities (5 years or less), Few regulations, High Liquidity, Competitive Pricing. Participants - Wholesale Market: Dealers, Brokers - Retail Market: Governments, Corporations, Financial Institutions, Individuals. Rules for Multinational Finance - Rule 1: Keep track of currency units. - Rule 2: Always buy or sell the currency in the denominator of the foreign exchange quote. (Allows buying low and selling high.) - European Quotes: Dollar in the denominator. - American Quotes: Euro in the denominator. - Direct Quotes: Foreign currency in denominator. - Indirect Quotes: Foreign currency in the numerator. Forward Premiums/Discounts - Premium: Nominal value is higher than the spot exchange market. - Discount: Nominal value is lower than the spot exchange market. - Formula: (Forward Rate Spot Rate) / Spot Rate Change in FX Rate - Formula: (Spot Rate1 Spot Rate0) / Spot Rate0 - Converting to the other currency: (1 + Spot RateORIGINAL) = 1 / Spot RateOTHER GARCH - Variance depends on previous variance. Changes are approximately normally distributed. - Formula: t2 = a0 + a1 t-12 + b1 st-12 [GIVEN] Value-at-Risk (VaR) - Estimates potential losses with a certain level of confidence over a certain time period.

Chapter 4: International Parity Conditions The Law of One Price - Purchasing Power Parity (PPP): Equivalent assets sell for the same price. - Rarely holds for non-traded assets, assets with variable quality and market frictions. - Arbitrage opportunity if Pt$ = PtA$ St$/A$ does not hold. Arbitrage - Locational Arbitrage: Involving two or more locations. Sd/e (X) / Sd/e (Y) = 1. Locational arbitrage opportunity if this is not true. - Triangular Arbitrage: Involves three currencies. Sd/e Se/f Sf/d < 1. Buy denominator with numerator. Vice versa for > 1. - Covered Interest Arbitrage: Takes advantage of disequilibrium in interest rate parity. Ftd/f/S0d/f > [(1+id)/(1+if)]t [GIVEN]. Borrow id, buy S0d/f, Invest if, Sell Ftd/f. Vice versa for <. - Might not undertake arbitrage because of: transaction costs, political risks, tax differences, liquidity preferences, capital controls and market imperfections. Relative Purchasing Power Parity - Formula: E[Std/f]/S0d/f = (1+E[pd])t /(1+ E[pf])t [GIVEN] - Only holds on average since expected inflation and expected future spot rates are not traded. International Fisher Relation - Formula: (1+nominal interest rate) = (1+inflation rate)(1+real interest rate) - Takes into account inflation. Real Exchange Rate - Adjusts nominal exchange rate for differential inflation. - (1+xtd/f) = (Std/f/St-1d/f )[(1+pf)/(1+pd)] [GIVEN] Exchange Rate Forecasting - Forecasting can be done based on parity conditions, since these must always hold true. - E[Std/f]/Ftd/f - E[Std/f] = S0d/f [(1+id)/(1+if)]t [GIVEN] - E[Std/f] = S0d/f [(1+pd)/(1+pf)]t - Technical Analysis: Using past exchange rates to predict future. - Fundamental Analysis: Using macroeconomic data to predict future. Chapter 5: Currency Futures and Futures Markets Futures Contracts - Forwards are a zero-sum game so one party always has incentive to default. - Clearinghouse takes one side of a futures contract to solve this. Margins ensure settlement. - Marked-to-market daily. Differences between Forwards and Futures - Forwards are highly customisable. Gains/Losses realised at maturity. Usually settled at maturity. - Futures are highly standardised. Gains/Losses realised daily. Usually settled early. - Futures are like a bundle of consecutive one-day forward contracts. - Both are equal: Futt,Td/f = Ft,Td/f = Std/f [(1+id)/(1+if)]T-t [GIVEN] Basis Risk - Risk of change in relation between futures and spot prices. - These two will converge at expiry. - Maturity mismatches mean futures may not provide the perfect hedge compared to forwards.

Futures Hedges - Perfect Hedge (No Mismatch): std/f = + std/f + et [GIVEN] - Delta Hedge (Maturity Mismatch): std/f = + futtd/f + et [GIVEN] - Cross Hedge (Currency Mismatch): std/f1 = + std/f2 + et [GIVEN] - Delta-Cross Hedge (Maturity & Currency Mismatch): std/f1 = + futtd/f2 + et [GIVEN] - - = (amount in futures)/(amount exposed) [GIVEN]

Chapter 6: Currency Options and Options Markets Options - Call Option: Holder has right to buy. - Put Option: Holder has the right to sell. - European: Exercisable only on expiration date. - American: Exercisable any day up to expiration date. - Other things equal, this means American options are worth more. - In-the-money (Call Option): Exercise price is less than spot price. - At-the-money (Call Option): Exercise price is the same as spot price. - Out-of-the-money (Call Option): Exercise price is higher than spot price. Payoffs of Currency Options - Call Option: CallTd/f = max[STd/f-KTd/f , 0] [GIVEN] - Put Option: PutTd/f = max[KTd/f - STd/f, 0] [GIVEN] - Where, KTd/f is the exercise price and STd/f is the spot rate. Payoff Profiles Option Value - Option Value = Intrinsic Value + Time Value Intrinsic Value: The value of the option if exercised immediately. Time Value: Market Value less intrinsic value. (FX rate, Price, Risk-free rate, Volatility, Time) Time and Volatility - Instantaneous changes are a random walk. - Equation: t2 = T2 [GIVEN] - In words: 1-period variance multiplied by T-periods is T-period variance. Chapter 7: Currency Swaps and Swaps Markets Parallel Loans - Borrow in local currency, then swap it with the debt of a foreign counterparty. - Benefits: Allows legal circumvention of taxes, possibly at lower cost of capital and provides foreign source. Main benefit is a lower interest rate.

- Problems: Default Risk, Must be capitalized on balance sheet, search costs high. Swaps - Currency Swaps: Parallel loan packaged into a single contract. Counters problems to parallel loans. Interest payments usually also swapped. - Banks gain profit from bid/ask spread using LIBOR. They sell swap contracts and match them to others. - Interest Rate Swaps: Same as currency swap, except in one country. Normally used to change fixed to floating rate or vice versa. - Commodity Swaps: Allows the fixing of commodity prices. Most normally are fixed-for-floating swaps based on swap prices. - Debt-for-Equity Swaps: Giving the equity returns to a swap dealer and getting a fixed rate debt. Day Count Convention - Eurocurrency rates (such as LIBOR), are quoted at money market yield (MMY) [360 days]. - Normal fixed rate instruments are quoted using bond equivalent yield (BEY) [365 days]. - Equation: MMY = BEY (360/365) [GIVEN]

Chapter 8: The Rationale for Hedging Currency Risk Perfect Market Assumptions Revisited - If financial markets are perfect, then hedging is irrelevant. - Hedging must either increase expected future cash flows or decrease the discount rate. Hedging Matters - Indirect and Direct costs of financial distress. - Agency costs - Tax schedule convexity. Calculating Firm Value - Find the value of bonds and stock, by multiplying the possible scenarios by the expected value in that scenario, taking into account any costs. - In absence of financial distress, hedging does not create value and wealth transfers from shareholders to bondholders. When there is hedging, shareholders benefit from this by reducing borrowing costs. Consequences of Hedging - Shareholders benefit from the gain in hedging compared to the shift in wealth to debt holders. - Increase cash flow by reducing costs of financial distress. - Reduces debts required return and cost of capital. Agency Costs - Managers have an incentive to hedge their performance. But if the firm is already hedged itself, any additional hedging by individual managers will be a waste of money. Progressive Taxation - Calculated expected tax in same way as calculating firm value. - Expected tax savings are generally small Chapter 9: Multinational Treasury Management Setting MNC Goals & Strategies - Identify core competencies and growth opportunities

- Evaluate business environment. - Formulate strategic plan for sustainable competitive advantage. - Develop processes to implement a strategic business plan. Problems of International Trade - Exporters need to assure timely payment. - Importers need to ensure timely delivery. - Geographic and cultural discrepancies. - Trade disputes can be difficult to settle. International Payment Methods - Cash in advance: Payment prior to shipment. - Open account: Billed under agreed terms to be paid within an agreed time period. - Documentary credits: Letter of Credit. Same as documentary collections but with 2 banks. - Documentary collections: Sight drafts (paid on demand) and Time drafts (paid on a set date) - Countertrade: Exchange of goods/services (no cash). Can be counterpurchase or offset. All-in cost of trade finance - (Foregone cash flow) / (Discounted Value) 1 - The internal rate of return associated with a financing alternative. Hedging with Forward Contracts - Hedge a long position with a short forward contract in the foreign currency. Types of Exposure to Currency Risk - Economic Exposure Transaction Exposure (contractual CF) and Operating Exposure (non-contractual CF) - Translation (Accounting) Exposure Exposure to changes in financial statements from changes in exchange rates. 5-step Currency Risk Management Program - Identify exposures to future exchange rates. - Estimate the sensitivity of revenues and expenses. - Determine if hedging is desirable. - Evaluate alternatives. - Monitor the hedged position and re-evaluate.

Chapter 10: Managing Transaction Exposure to Currency Risk Multinational Netting - Offset and net movements after a period of time. Saves transaction costs by limiting to only necessary movements in funds internally. Leading and Lagging - Leading (Bringing forward) or Lagging (Pushing back) cash flows so that they match. - Charge market rates of interest on these intra-company loans/deposits Financial Market Hedges Vehicle Advantages Disadvantages Forwards Perfect. Low spread. Large spread on thin currencies/long deals. Futures Low cost for small deals. Low risk. Only few currencies. CF mismatch possible with mark-to-market. Options Disaster hedge provides insurance. Premiums can be expensive.

Swaps

Quick and low cost.

Money Market Hedges Synthetic forward positions Money Market Hedge - Synthetic forward positions where no futures market exists, but is expensive. - Borrow, Convert then Invest. Active Treasuries - Large firms with centralised risk management. - Use sophisticated valuation methods. - Derivatives are periodically marked to market. - Managers closely monitored. - Compensation aligns managers with stakeholders - Performance benchmarks to manage potential abuse.

Innovative swaps costly. Not for short-term. Expensive. Not always possible.

You might also like

- ACCT2542 Final Exam With SolutionsDocument16 pagesACCT2542 Final Exam With SolutionsAnhPham100% (2)

- FINS2624 Final Exam 2010 Semester 2Document22 pagesFINS2624 Final Exam 2010 Semester 2AnnabelleNo ratings yet

- Problem Set 2Document3 pagesProblem Set 2teoluoNo ratings yet

- Exam Formula SheetDocument2 pagesExam Formula SheetEmma WorkmanNo ratings yet

- FINS2624 Quiz BankDocument368 pagesFINS2624 Quiz BankRaymond WingNo ratings yet

- How to Improve Our Standard of Living by Understanding Basic EconomicsFrom EverandHow to Improve Our Standard of Living by Understanding Basic EconomicsNo ratings yet

- Student Loan Forgiveness or Ten Years to Life?: A Responsible Visual Guide to Your Federal Student Loan Repayment OptionsFrom EverandStudent Loan Forgiveness or Ten Years to Life?: A Responsible Visual Guide to Your Federal Student Loan Repayment OptionsNo ratings yet

- Summary Of "USA, World War I To 1930s Crisis" By Elena Scirica: UNIVERSITY SUMMARIESFrom EverandSummary Of "USA, World War I To 1930s Crisis" By Elena Scirica: UNIVERSITY SUMMARIESNo ratings yet

- The False Hope of Global Diversification: Confessions of a Portfolio Management MaverickFrom EverandThe False Hope of Global Diversification: Confessions of a Portfolio Management MaverickNo ratings yet

- Tail Risk Killers: How Math, Indeterminacy, and Hubris Distort MarketsFrom EverandTail Risk Killers: How Math, Indeterminacy, and Hubris Distort MarketsRating: 3 out of 5 stars3/5 (1)

- The Annals: Historical Account of Rome In the Time of Emperor Tiberius until the Rule of Emperor NeroFrom EverandThe Annals: Historical Account of Rome In the Time of Emperor Tiberius until the Rule of Emperor NeroNo ratings yet

- History of SparDocument2 pagesHistory of Sparashishmantri89No ratings yet

- MacRury & Poyter To OECD, 2009Document108 pagesMacRury & Poyter To OECD, 2009Fórum de Desenvolvimento do RioNo ratings yet

- Central Banking and The Governance of Credit CreationDocument46 pagesCentral Banking and The Governance of Credit CreationkronblomNo ratings yet

- Portfolio Insurance Strategies - OBPI Versus CPPIDocument16 pagesPortfolio Insurance Strategies - OBPI Versus CPPIKaushal ShahNo ratings yet

- Cowen - The New Monetary EconomcsDocument25 pagesCowen - The New Monetary EconomcsjpkoningNo ratings yet

- What The Great Fama-Shiller Debate Has Taught Us - Justin Fox - Harvard Business Review PDFDocument2 pagesWhat The Great Fama-Shiller Debate Has Taught Us - Justin Fox - Harvard Business Review PDFppateNo ratings yet

- Common Errors in The Interpretation of The Ideas of The Black Swan and Associated Papers - SSRN-Id1490769Document7 pagesCommon Errors in The Interpretation of The Ideas of The Black Swan and Associated Papers - SSRN-Id1490769adeka1No ratings yet

- Illicit Financial Flows From Developing Countries: 2002-2011Document68 pagesIllicit Financial Flows From Developing Countries: 2002-2011Global Financial IntegrityNo ratings yet

- Mockterm FINS2624 S1 2013Document12 pagesMockterm FINS2624 S1 2013sagarox7No ratings yet

- Gold Vs Gold StocksDocument4 pagesGold Vs Gold StocksZerohedgeNo ratings yet

- LiberalismDocument14 pagesLiberalismAhmedShujaNo ratings yet

- Bridport&co - From-AT1-to-RT1Document2 pagesBridport&co - From-AT1-to-RT1Bridport CoNo ratings yet

- Supreme Court Decision Casts Doubt On Certain Nominee Structures in MyanmarDocument4 pagesSupreme Court Decision Casts Doubt On Certain Nominee Structures in Myanmarmarcmyomyint1663No ratings yet

- Rosato-The Flawed of Democratic Peace Theory PDFDocument37 pagesRosato-The Flawed of Democratic Peace Theory PDFGabriel Muglary100% (1)

- 2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)Document14 pages2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)jude55No ratings yet

- Carlson Capital Q4Document13 pagesCarlson Capital Q4Zerohedge100% (3)

- Bloomberg - Performance Attribution ModelDocument17 pagesBloomberg - Performance Attribution Modelde deNo ratings yet

- Absolute Return Investing Strategies PDFDocument8 pagesAbsolute Return Investing Strategies PDFswopguruNo ratings yet

- Russell Napier Transcript Jan 23rdDocument17 pagesRussell Napier Transcript Jan 23rdmdorneanuNo ratings yet

- The Soybean Crush Spread - Empirical Evidence and Trading StrategiesDocument19 pagesThe Soybean Crush Spread - Empirical Evidence and Trading StrategiesJames LiuNo ratings yet

- Benjamin Graham S NCAV Approach PDFDocument6 pagesBenjamin Graham S NCAV Approach PDFJames WarrenNo ratings yet

- ÒÇÉÚçÅÕîû èòÞÁäÒÇæYour Complete Guide To Factor-Based Investing by Andrew L. Berkin PDFDocument323 pagesÒÇÉÚçÅÕîû èòÞÁäÒÇæYour Complete Guide To Factor-Based Investing by Andrew L. Berkin PDFcastjam100% (1)

- Capital Flows To Emerging Market EconomiesDocument20 pagesCapital Flows To Emerging Market EconomiesRaghavendra MandavilliNo ratings yet

- Is Globalization A Zero Sum Game or A WinDocument2 pagesIs Globalization A Zero Sum Game or A WinDenisa StefanNo ratings yet

- The Shackled ContinentDocument12 pagesThe Shackled Continenttanzaniaat500% (1)

- Newham Symposium - Olympic Legacy Lessons March 20101Document88 pagesNewham Symposium - Olympic Legacy Lessons March 20101Fórum de Desenvolvimento do RioNo ratings yet

- Ex-Dividend Day Bid-Ask Spread Effects in A Limit PDFDocument38 pagesEx-Dividend Day Bid-Ask Spread Effects in A Limit PDFdebaditya_hit326634No ratings yet

- Fabozzi Ch01Document10 pagesFabozzi Ch01cmb463No ratings yet

- Finance Resume TheoryDocument23 pagesFinance Resume TheoryGracePameeNo ratings yet

- Cfa Book 1 Part 2Document14 pagesCfa Book 1 Part 2pinatov256No ratings yet

- Derivatives MarketsDocument13 pagesDerivatives Marketsfridabass3No ratings yet

- C14 - R Krugman425789 - 10e - FinC03 - GEDocument50 pagesC14 - R Krugman425789 - 10e - FinC03 - GEYiğit KocamanNo ratings yet

- Intl Finance Cheat SheetDocument6 pagesIntl Finance Cheat Sheetpradhan.neeladriNo ratings yet

- Multinational Financial ManagementDocument95 pagesMultinational Financial ManagementANo ratings yet

- REVIEW OF THE SUBJECT INTERNATIONAL ECONOMICS - Intake 1 20232024 - EditedDocument3 pagesREVIEW OF THE SUBJECT INTERNATIONAL ECONOMICS - Intake 1 20232024 - EditedNguyễn Diệu LinhNo ratings yet

- Lecture 1 (IFM)Document11 pagesLecture 1 (IFM)itxasorequejoNo ratings yet

- Measuring and Managing Foreign Exchange Exposure: International Financial ManagementDocument48 pagesMeasuring and Managing Foreign Exchange Exposure: International Financial ManagementprakashputtuNo ratings yet

- MFIN6003 Derivative Securities: Lecture Note OneDocument47 pagesMFIN6003 Derivative Securities: Lecture Note OneMavisNo ratings yet

- Definition of International FinanceDocument11 pagesDefinition of International FinanceSuperProNo ratings yet

- International Economics Final Exam ReviewDocument28 pagesInternational Economics Final Exam ReviewYash JainNo ratings yet

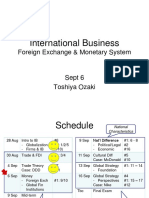

- International Business: Foreign Exchange & Monetary SystemDocument53 pagesInternational Business: Foreign Exchange & Monetary SystemHoàng Hạnh TrangNo ratings yet

- Whirlpool Refrigerator Updated 2012 User ManualDocument36 pagesWhirlpool Refrigerator Updated 2012 User Manualdwm1855No ratings yet

- Whirlpool Refrigerator Updated 2012 User ManualDocument36 pagesWhirlpool Refrigerator Updated 2012 User Manualdwm1855No ratings yet

- Will Supreme Court Health Care Case Boost The GOP, or DemocratsDocument2 pagesWill Supreme Court Health Care Case Boost The GOP, or Democratsdwm1855No ratings yet

- Keurig B40 Elite ManualDocument30 pagesKeurig B40 Elite Manualdwm185550% (2)

- The Big Noise of Senator Elizabeth WarrenDocument3 pagesThe Big Noise of Senator Elizabeth Warrendwm1855No ratings yet

- Know How Waiters Read Your Table To Get Better ServiceDocument23 pagesKnow How Waiters Read Your Table To Get Better Servicedwm1855No ratings yet

- Classroom and Management Decisions Using Student Data - Developing An Information SystemDocument3 pagesClassroom and Management Decisions Using Student Data - Developing An Information Systemdwm1855No ratings yet

- 5 Ways Social Media Could Be Hurting Your Job SearchDocument5 pages5 Ways Social Media Could Be Hurting Your Job Searchdwm1855No ratings yet

- CH 01 Investment Setting SolutionsDocument7 pagesCH 01 Investment Setting Solutionsdwm1855No ratings yet

- CH 01 The Investment SettingDocument56 pagesCH 01 The Investment Settingdwm1855100% (1)

- FINS3616 - FinalDocument8 pagesFINS3616 - Finaldwm1855No ratings yet

- Lecture 1 The Global Financial EnvironmetDocument8 pagesLecture 1 The Global Financial Environmetdwm1855No ratings yet

- CH 003 HWKDocument11 pagesCH 003 HWKdwm1855100% (1)

- CH 13 Study Review QuestionsDocument24 pagesCH 13 Study Review Questionsdwm1855No ratings yet

- Obama, Romney Look For Foreign Policy Edge in Final Debate - Fox NewsDocument2 pagesObama, Romney Look For Foreign Policy Edge in Final Debate - Fox Newsdwm1855No ratings yet

- CH 003 HWKDocument11 pagesCH 003 HWKdwm1855100% (1)

- CH 1 HWKDocument2 pagesCH 1 HWKdwm1855No ratings yet

- CH 001: The Investment SettingDocument16 pagesCH 001: The Investment Settingdwm1855No ratings yet

- Chapter 2: The Court SystemsDocument2 pagesChapter 2: The Court Systemsdwm1855No ratings yet

- CH 13 Study Review QuestionsDocument24 pagesCH 13 Study Review Questionsdwm1855No ratings yet

- Mitt Romney Outlines Governing Plan - POLITICO - Com Print ViewDocument4 pagesMitt Romney Outlines Governing Plan - POLITICO - Com Print Viewdwm1855No ratings yet

- Worlds Collide Over A Washington Weekend - WSJDocument3 pagesWorlds Collide Over A Washington Weekend - WSJdwm1855No ratings yet

- CA Final - India Export Import GuideDocument548 pagesCA Final - India Export Import GuideKushagra ChadhaNo ratings yet

- Friedman Monetary Policy Theory and PracticeDocument22 pagesFriedman Monetary Policy Theory and PracticeGerardo Hernandez ReyesNo ratings yet

- Singapore Exchange Rate SystemDocument8 pagesSingapore Exchange Rate Systemvidia2000No ratings yet

- Pug87488 FMDocument20 pagesPug87488 FMgloriaNo ratings yet

- Review Questions - CH 7Document2 pagesReview Questions - CH 7bigbadbear3No ratings yet

- BSP 2701Document6 pagesBSP 2701kik leeNo ratings yet

- Bop and Monetary PolicyDocument19 pagesBop and Monetary PolicyAafm IndiaNo ratings yet

- IFFM BookDocument188 pagesIFFM BookTs'epo MochekeleNo ratings yet

- National Income Accounting: A Case Study of CHINADocument29 pagesNational Income Accounting: A Case Study of CHINASaranya KotaNo ratings yet

- FIN 4604 Sample Questions IDocument20 pagesFIN 4604 Sample Questions IReham HegazyNo ratings yet

- Feenstra 19Document37 pagesFeenstra 19Kwesi WiafeNo ratings yet

- Spare A Tear For Argentina (Advanced) PDFDocument6 pagesSpare A Tear For Argentina (Advanced) PDFhahahapsuNo ratings yet

- 10 Balance of PaymentDocument9 pages10 Balance of PaymentP Janaki Raman100% (1)

- Social Science Class-XDocument22 pagesSocial Science Class-Xdhdahanuwala100% (1)

- Dictionary of EconomicsDocument764 pagesDictionary of Economicsalimojalima100% (1)

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesDocument4 pagesWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Topic 4:: Exchange Rate Regimes & PoliciesDocument50 pagesTopic 4:: Exchange Rate Regimes & PoliciesVarun GargNo ratings yet

- Otmar Issing, The Birth of Euro PDFDocument276 pagesOtmar Issing, The Birth of Euro PDFMilan IgrutinovicNo ratings yet

- CH 18 - Policy Under Fixed Exchange Rates PDFDocument40 pagesCH 18 - Policy Under Fixed Exchange Rates PDFamrith vardhanNo ratings yet

- Foreign Exchange ManagementDocument25 pagesForeign Exchange ManagementInSha RafIqNo ratings yet

- Fiscal PolicyDocument90 pagesFiscal PolicyDutta SubhajitNo ratings yet

- Foreign Exchange MarketDocument25 pagesForeign Exchange MarketAnil ChauhanNo ratings yet

- Assignment On Indian RupeeDocument42 pagesAssignment On Indian Rupeepranjaraval100% (5)

- Argentina Case StudyDocument107 pagesArgentina Case StudyFrancis T. TolibasNo ratings yet

- IB PPT On IMFDocument22 pagesIB PPT On IMFAtul YadavNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemCh WaqasNo ratings yet

- International Economics: Exchange-Rate SystemsDocument23 pagesInternational Economics: Exchange-Rate SystemsKaranPatilNo ratings yet

- Fasanara Capital Investment Outlook - May 3rd 2016Document17 pagesFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- DBP Vs Court of Appeals - GR No 138703Document14 pagesDBP Vs Court of Appeals - GR No 138703Christia Sandee SuanNo ratings yet

- Iasourdream Notes Part 2Document82 pagesIasourdream Notes Part 2Gagan KarwarNo ratings yet