Professional Documents

Culture Documents

Executive Benefit Plan (EBP) (Flyer)

Uploaded by

CFSUSCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Benefit Plan (EBP) (Flyer)

Uploaded by

CFSUSCopyright:

Available Formats

Executive Benefit Plan (EBP)

A Capital Accumulation Plan for Employees of Non-Profits

For over 20 years, Executive Benefit Strategies has provided leading edge solutions for executives and physicians of tax-exempt organizations. We assist nonprofits and their higher compensated employees with tax planning strategies that provide the needed tools to retain, reward and recruit the highest level of executive and physician talent. Our proprietary solutions and concepts allow the higher compensated employee to achieve their retirement goals by implementing supplemental capital accumulation programs that allow the individual to create ultimate financial security

As a higher compensated executive or physician, the great benefits to the community of a non-profit organization do not translate in advantages for you in terms of employer-sponsored retirement planning. Current tax laws have created an environment for higher compensated employees of exempt organizations that essentially limit or, in most cases, eliminate supplemental pre-tax savings for retirement. The Executive Benefit Plan (EBP) is a third generation supplemental capital accumulation program that meets all current IRS regulations and, in a conservative design and concept, provides the higher compensated employee the opportunity to meet their retirement goals and dreams. Designed to allow for substantial pre-tax contributions, the EBP avoids the restrictive and unattractive aspects of traditional non-qualified plans and on both a qualitative and quantitative basis, delivers flexibility and value like no other program or concept.

Executive Benefit Plan (EBP)

Plan Features and Benefits

Key Features and Benefits

Pre-tax contributions No Legislative Limit on annual contributions Tax-favored distributions Immediately Vested Benefits Plan Benefits secure from Employer Creditors Variety of investment choices and products May include a supplemental life insurance benefit Superior Post employment benefits Financially neutral on Employer financial statements

To tal Net Reti rement Benefi ts Pai d

Finding a Non-qualified plan for tax exempt organizations that is effective has been a puzzling process due to the very restrictive legislative controls causing these plans to be unattractive for employees. These limitations require employees to be unvested in their own benefits, then be taxed on a lump sum basis when they become vested, not when they receive benefit payments. The EBP avoids these seemingly impossi-

$900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 Traditional Plan After-tax Plan EBP

ble provisions and provides a capital accumulation platform that has the flexibility and performance to meet employees needs and goals.

1215 HIGHTOWER TRAIL SUITE B-120 BATLANTA, GA 30350 (678) 787-8683 787-

442 NORTH BUNKER HILL ROAD P. O. BOX 368 COLFAX, NC 27235 (336) 996-3524 996-

Chart results above is based on the following assumptions: Participant age 45, contributing $20,000 annually for 15 years. benefits payable annually for 20 years beginning at age 65. Assumed investment rate of 7.0% for Indexed life and alternatives, assumed federal and state combined tax rate of 39%, assumed tax rate on after tax plan earnings of 27%. All benefits illustrated above are provided net of all taxes, fees and expenses.

www.ebsconsulting.org

You might also like

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Edu 2013 10 Ret Plan Exam Case Kuk671xDocument20 pagesEdu 2013 10 Ret Plan Exam Case Kuk671xjusttestitNo ratings yet

- Choosing: A Retirement SolutionDocument8 pagesChoosing: A Retirement Solutionapi-309082881No ratings yet

- Executive Benefits: Recruit, Retain and Reward Your Top TalentDocument8 pagesExecutive Benefits: Recruit, Retain and Reward Your Top Talentalmirb7No ratings yet

- Submitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashDocument20 pagesSubmitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashPriyanshuChauhanNo ratings yet

- Cliff Notes - PM RetirementDocument5 pagesCliff Notes - PM RetirementJohnathan JohnsonNo ratings yet

- Incentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveDocument14 pagesIncentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveShaine CalabiaNo ratings yet

- Summarizing Chapter 17 Herring Ton The Risk ManagementDocument4 pagesSummarizing Chapter 17 Herring Ton The Risk ManagementMd Shohag AliNo ratings yet

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Lab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application AssignmentDocument4 pagesLab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application Assignmentsandeepraina0% (1)

- CFG Reference GuideDocument38 pagesCFG Reference GuideStefan IonescuNo ratings yet

- PPP For Accountants - Celernus Investment PartnersDocument8 pagesPPP For Accountants - Celernus Investment PartnersCGrantNo ratings yet

- May2012 Newsletter Print - InddDocument1 pageMay2012 Newsletter Print - InddesuttNo ratings yet

- Executive Deferred Comp PlanDocument6 pagesExecutive Deferred Comp PlanSatyendra KumarNo ratings yet

- A Project Report On Thecompensation Analysis On Tata MotorsDocument7 pagesA Project Report On Thecompensation Analysis On Tata MotorsParvathy Shelly vadakkedathuNo ratings yet

- A Project Report On Thecompensation Analysis On Tata MotorsDocument7 pagesA Project Report On Thecompensation Analysis On Tata MotorsAbhishek KumarNo ratings yet

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanNo ratings yet

- Fundamentals of Human Resource Management: Ninth EditionDocument30 pagesFundamentals of Human Resource Management: Ninth Editionkingshukb100% (1)

- Tax Planning IndiaDocument20 pagesTax Planning IndiaRohanTheGreatNo ratings yet

- Lecture Notes Payroll Tochnology - Payroll Fundamentals IIDocument11 pagesLecture Notes Payroll Tochnology - Payroll Fundamentals IIirfanNo ratings yet

- Tax Exempt and Government Entities (TE/GE) Employee PlansDocument34 pagesTax Exempt and Government Entities (TE/GE) Employee PlansIRSNo ratings yet

- Tax Planning For Salaried IndividualsDocument20 pagesTax Planning For Salaried IndividualsRAJNo ratings yet

- HRM9 Employee Benefits and CompensationDocument11 pagesHRM9 Employee Benefits and CompensationarantonizhaNo ratings yet

- Employees Benefits ProgramDocument23 pagesEmployees Benefits ProgramMarriiam AliNo ratings yet

- Monika Rehman Roll No 10Document19 pagesMonika Rehman Roll No 10Monika RehmanNo ratings yet

- BMS Financial AccountsDocument38 pagesBMS Financial AccountsJicksonNo ratings yet

- PSG Module 7Document30 pagesPSG Module 7Deepak KumarNo ratings yet

- Compensation StructureDocument7 pagesCompensation StructureRajni Kant SinghNo ratings yet

- The PAYE System Guide 21 Feb 2012 - Esc VDocument53 pagesThe PAYE System Guide 21 Feb 2012 - Esc VTrent DavisNo ratings yet

- Components of CompensationDocument4 pagesComponents of CompensationAnil Kumar SinghNo ratings yet

- SheldonAcharekar Vrs CrsDocument16 pagesSheldonAcharekar Vrs CrsNitin KanojiaNo ratings yet

- Deferred Compensation PlansDocument5 pagesDeferred Compensation Plansreggie1010No ratings yet

- Taxation Assignment PDFDocument15 pagesTaxation Assignment PDFDeekhsha KherNo ratings yet

- Executive RemunerationDocument7 pagesExecutive Remunerationkrsatyam10No ratings yet

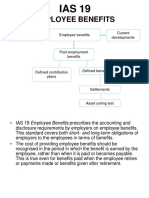

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- HRM Reward and IncentivesDocument45 pagesHRM Reward and IncentivesElnur MahmudovNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectMohal gargNo ratings yet

- Legal Opinion de MinimisDocument6 pagesLegal Opinion de MinimisjoyiveeongNo ratings yet

- BAHR 222 - Week 1-2Document16 pagesBAHR 222 - Week 1-2Prescious Joy Donaire100% (1)

- Good Small Business Actionlist: Introducing A Cafeteria Benefits ProgramDocument5 pagesGood Small Business Actionlist: Introducing A Cafeteria Benefits ProgramhdfcblgoaNo ratings yet

- GGCADocument2 pagesGGCAPrakash BaldaniyaNo ratings yet

- Ebs Brochure November 2011Document4 pagesEbs Brochure November 2011CFSUSNo ratings yet

- Compensating Human ResourcesDocument13 pagesCompensating Human ResourcesM RABOY,JOHN NEIL D.No ratings yet

- Fringe Benefits TaxDocument3 pagesFringe Benefits TaxGrace EspirituNo ratings yet

- Payroll Glosary InglesDocument7 pagesPayroll Glosary InglesAlejoTiradoNo ratings yet

- Pay and Benefits IndiaDocument7 pagesPay and Benefits IndiababatoofaniNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- New Jersey Secure ChoiceDocument4 pagesNew Jersey Secure ChoiceJohn BartlettNo ratings yet

- Choice of Accounting SystemDocument4 pagesChoice of Accounting SystemAnkush At Shiv ShaktiNo ratings yet

- IPM Presentation 010312 FINALDocument17 pagesIPM Presentation 010312 FINALTerri BimmNo ratings yet

- Cut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesFrom EverandCut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesNo ratings yet

- Compensation and IncentivesDocument2 pagesCompensation and IncentivesLuis WashingtonNo ratings yet

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234No ratings yet

- Wages and SalaryDocument12 pagesWages and SalaryPrema SNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- Fiscal 2012 Budget Overview Department of LaborDocument6 pagesFiscal 2012 Budget Overview Department of LaborRob PortNo ratings yet

- Letter of CreditDocument3 pagesLetter of CreditRakesh_Kumar_A_8181No ratings yet

- A BAH ResumeDocument3 pagesA BAH ResumePrasadd ReddyNo ratings yet

- ResumeDocument4 pagesResumeSumit KumarNo ratings yet

- LP4.1 Assignment - Chapter 4 Text ProblemsDocument10 pagesLP4.1 Assignment - Chapter 4 Text ProblemslisaNo ratings yet

- Credit Transactions Final ReviewerDocument31 pagesCredit Transactions Final ReviewerGF SottoNo ratings yet

- 2 - Labour Laws For HR ProfessionalsDocument50 pages2 - Labour Laws For HR ProfessionalsManinder SinghNo ratings yet

- 2016 - G.R. No. 183486, (2016-02-24)Document23 pages2016 - G.R. No. 183486, (2016-02-24)ArahbellsNo ratings yet

- B. Deed of Absolute SaleDocument5 pagesB. Deed of Absolute SaleKim John Villa0% (1)

- MGEC Final ExamDocument17 pagesMGEC Final ExamAashiNo ratings yet

- GTAG 9 Identity and Access Management 11 07Document32 pagesGTAG 9 Identity and Access Management 11 07himpor100% (1)

- Labor Law Arbitration 2016Document168 pagesLabor Law Arbitration 2016Ck Bongalos AdolfoNo ratings yet

- Quotation PDFDocument4 pagesQuotation PDFLucky RawatNo ratings yet

- p2 Revision PackDocument233 pagesp2 Revision PackRana Hasan RahmanNo ratings yet

- Final Summary Report ACA Employer SurveyDocument12 pagesFinal Summary Report ACA Employer Surveyapi-210167567No ratings yet

- Customer Buying Behaviour With A Focus On Market Segmentation in HDFC Life InsuranceDocument78 pagesCustomer Buying Behaviour With A Focus On Market Segmentation in HDFC Life Insurancedcp004No ratings yet

- Canara BankDocument8 pagesCanara BankKrithika SalrajNo ratings yet

- Concurrent Delay ApproachDocument5 pagesConcurrent Delay ApproachMazuan LinNo ratings yet

- Ravi Retire and Enjoy 48y To 75yDocument4 pagesRavi Retire and Enjoy 48y To 75yRavindranath TgNo ratings yet

- TeleDirctory2004 (Big) 16 19Document47 pagesTeleDirctory2004 (Big) 16 19Sneha Roy NandiNo ratings yet

- Base Drive Manual Rev - 7.0Document233 pagesBase Drive Manual Rev - 7.0ajysharmaNo ratings yet

- CD511-V1 1 PDFDocument1 pageCD511-V1 1 PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Standing Instruction and Indemnity Form 2023Document4 pagesStanding Instruction and Indemnity Form 2023Clint AnthonyNo ratings yet

- Quotation Request: Mabruk Oil OperationsDocument4 pagesQuotation Request: Mabruk Oil OperationsOsama OkokNo ratings yet

- Pavilion Rental AgreementDocument5 pagesPavilion Rental AgreementJ. Daniel SpratlinNo ratings yet

- Pefindo Score: DashboardDocument21 pagesPefindo Score: Dashboardrendra akNo ratings yet

- My Own Legal Dictionary 2Document1,252 pagesMy Own Legal Dictionary 2kymposcheNo ratings yet

- Building The Business: Because Learning Changes EverythingDocument37 pagesBuilding The Business: Because Learning Changes EverythingMax SinghNo ratings yet

- Foreign Currency Deposit Case Digest 1Document2 pagesForeign Currency Deposit Case Digest 1Mervic Al Tuble-Niala100% (1)

- Tender TNDocument29 pagesTender TNRaj BorkuteNo ratings yet

- Structural Forensic Engineering (Garrett)Document91 pagesStructural Forensic Engineering (Garrett)Angel J. AliceaNo ratings yet