Professional Documents

Culture Documents

Notes On Managerial Economics

Uploaded by

ERAKACHEDU HARI PRASADOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes On Managerial Economics

Uploaded by

ERAKACHEDU HARI PRASADCopyright:

Available Formats

Q.1 Define Managerial Economics. Explain the scope of Managerial Economics.

Or Explain the role of Managerial Economics in Decision making. Answer: Managerial Economics can be defined as amalgamation of economic theory with business practices so as to ease decision-making and future planning by management. Managerial economics is best defined as the study of how managers make decisions about the use of scarce resources. Managerial economics is a fundamental academic subject which seeks to understand and to analyse the problem of business decision taking. By D.C.Hayue Managerial Economics is the application of theory and methodology to business administration practice. By Brigham and Pappas. Managerial Economics assists the managers of a firm in a rational solution of obstacles faced in the firms activities. It makes use of economic theory and concepts. It helps in formulating logical managerial decisions. The key of Managerial Economics is the microeconomic theory of the firm. It lessens the gap between economics in theory and economics in practice. Managerial Economics is a science dealing with effective use of scarce resources. It guides the managers in taking decisions relating to the firms customers, competitors, suppliers as well as relating to the internal functioning of a firm. It makes use of statistical and analytical tools to assess economic theories in solving practical business problems. Business decision-making is essentially a process of selecting the best out of alternative opportunities open to the firm. The process of decision-making comprises four main phases :1) Determining and defining the objective to be achieved; 2) Collections and analysis of information regarding economic, social, political and foreseeing the necessity and occasion for decision; 3) inventing, developing and analyzing possible course of action; 4) selecting a particular course of action, from the available alternatives. Managerial decision areas assessment of investible funds selecting business area choice of product determining optimum output determining price of product determining input-combination and technology sales promotion Almost any business decision can be analyzed with managerial economics techniques, but it is most commonly applied to:

Risk analysis various models are used to quantify risk and asymmetric information and to employ them in decision rules to manage risk. Production analysis - microeconomic techniques are used to analyze production efficiency, optimum factor allocation, costs, economies of scale and to estimate the firm's cost function. Pricing analysis - microeconomic techniques are used to analyze various pricing decisions including transfer pricing, joint product pricing, price discrimination, price elasticity estimations, and choosing the optimum pricing method. Capital budgeting - Investment theory is used to examine a firm's capital purchasing decisions.

Business decision making is essentially a process of selecting the best out of alternative opportunities open to the firm. The steps below put managers analytical ability to test and determine the appropriateness and validity of decisions in the modern business world. Following are the various steps in decision making process: 1. Establish objectives 2. Specify the decision problem 3. Identify the alternatives 4. Evaluate alternatives 5. Select the best alternatives 6. Implement the decision 7. Monitor the performance Modern business conditions are changing so fast and becoming so competitive and complex that personal business sense, intuition and experience alone are not sufficient to make appropriate business decisions. It is in this area of decision making that economic theories and tools of economic analysis contribute a great deal. Basic economic tools in managerial economics for decision making: Economic theory offers a variety of concepts and analytical tools which can be of considerable assistance to the managers in his decision making practice. These tools are helpful for managers in solving their business related problems. These tools are taken as guide in making decision. Following are the basic economic tools for decision making: 1. Opportunity cost 2. Incremental principle 3. Principle of the time perspective 4. Discounting principle 5. Equi-marginal principle Decision-making is a process of selection from a set of alternative courses of action, which is thought to fulfill the objectives of the decision problem more satisfactorily than others. It is a course of action, which is consciously chosen for achieving a desired result. A decision is a process that takes place prior to the actual performance of a course of action that has been chosen. In terms of managerial decision-making, it is an act of choice, wherein a manager selects a particular course of action from the available alternatives in a given situation. Managerial decision making process involves establishing of goals, defining tasks, searching for alternatives and developing plans in order to find the best answer fo

the decision problem. The essential elements in a decision making process include the following: 1. The decision maker, 2. The decision problem, 3. The environment in which the decision is to be made, 4. The objectives of the decision maker, 5. The alternative courses of action, 6. The outcomes expected from various alternatives, and 7. The final choice of the alternative. Characteristics of decision-making: 1. It is a process of choosing a course of action from among the alternative courses of action. 2. It is a human process involving to a great extent the application of intellectual abilities. 3. It is the end process preceded by deliberation and reasoning. 4. It is always related to the environment. A manager may take one decision in a particular set of circumstances and another in a different set of circumstances. 5. It involves a time dimension and a time lag. 6. It always has a purpose. Keeping this in view, there may just be a decision not to decide. 7. It involves all actions like defining the problem and probing and analyzing the various alternatives, which take place before a final choice is made. Scope of Managerial Economics: As far as Managerial Economic is concerned it is very wide in scope. It takes into account almost all the problems and areas of manager and the firm. ME deals with Demand analysis, Forecasting, Production function, Cost analysis, Inventory Management, Advertising, Pricing System, Resource allocation etc. 1. Demand analysis and forecasting: Unless and until knowing the demand for a product how can we think of producing that product. Therefore demand analysis is something which is necessary for the production function to happen. Demand analysis helps in analyzing the various types of demand which enables the manager to arrive at reasonable estimates of demand for product of his company. Managers not only assess the current demand but he has to take into account the future demand also. 2. Production function: Conversion of inputs into outputs is known as production function. With limited resources we have to make the alternative uses of this limited resource. Factor of production called as inputs is combined in a particular way to get the maximum output. When the price of input rises the firm is forced to work out a combination of inputs to ensure the least cost combination. 3. Cost analysis: Cost analysis is helpful in understanding the cost of a particular product. It takes into account all the costs incurred while producing a particular product. Under cost analysis we will take into account determinants of costs, method of estimating costs, the

relationship between cost and output, the forecast of the cost, profit, these terms are very vital to any firm or business. 4. Inventory Management: Managerial economics will use such methods as ABC Analysis, simple simulation exercises, and some mathematical models like Economic Order quantity, to minimize inventory cost. 5. Advertising: Advertising is a promotional activity. In advertising while the copy, illustrations, etc., are the responsibility of those who get it ready for the press, the problem of cost, the methods of determining the total advertisement costs and budget, the measuring of the economic effects of advertising- -- - are the problems of the manager. Advertising forms the integral part of decision making and forward planning. 6. Pricing system: While pricing commodity the cost of production has to be taken into account, but a complete knowledge of the price system is quite essential to determine the price. It is also important to understand how product has to be priced under different kinds of competition, for different markets. Managerial economics equips the management executive with the tools and techniques of analysis,principles and concepts of analysing situation for the purpose of decision making. As already noted, managerial economics as an applied science , concentrates on applying the principles and theory of economics and the theory of economics to managerial issues/problems. The major decision making techniques that help managerial economics to take decision are 1 what to produce? 2 when to produce? 3 how to produce? 4 how much to produce? 5 for whom to produce? .

Q.2 Define Demand. State the types of Demand. What are the determinants of Demand? Demand in ordinary languages is a desire or a want for something. In economics, demand means effective demand Effective demand is a desire backed by ability to pay and willingness to pay for it Demand= Want + Ability to pay +Willingness to pay for it. For e.g. if a beggar has a desire to pay a car. It is a not a potential demand, as his (want) desire is not backed by ability to pay. A miser has a desire, and he is able to pay but he is not willing to part with his purchasing power (money), so it does not become an effective demand. Thus, all three conditions must be simultaneously fulfilled.

Demand is a relative term. It is related to price and time. For example, Anil demands 10 liters of milk. This statement is incorrect. The definition is correct only when it started asAnil demands 10 liters of milk at Rs. 10 per liter in a weak Demand is defined as Demand for any commodity, at a given price, is the quantity of it which will be purchased per unit of time at that price. Q. Explain Law of Demand The demand is a function of price i.e. demands depends upon price. The law of demand explains the functional relationship between price and demand. The law of demand state that other things being same. The quantity of goods purchased will vary inversely with its price i.e. the lower price, more will be the quantity demanded and vice versa. As Marshall define .The law of demand states that the amount demanded increases with fall in the price. The law of demand can be better understood with the help of demand schedule. Demand schedule shows the various quantities of a commodity which bought at different prices during a specific period. Price of Vegetable per Quantity Kg in Rs in Kg 10 8 6 4 2 Demanded 15 25 30 45 55

Quantity Demanded in Kg

60 50 40 30 20 10 0 0 5 10 15 Quantity Demanded in Kg

From the given diagram and demand schedule it is clear that the relationship between price and demand is inverse, it means when price increases demand decreases or when price decreases demand increases.

Q. Explain the concept of Increase or Decrease (shift) in demand. A shift in demand curve results from changes in all other factors that were held constant in constructing the demand curve. Such other factors include the change in price of other commodities, change in supply of the commodity in question, change in tastes and preferences of consumers, change in income of consumers etc.

For instance, given The price of the commodity in question say Bic pen, an increase in the price of Reynold pen will bring about an increase in demand for Bic pen, representing the increase in demand of Bic pen due to the increase in price of the Reynold pen on a demand curve without a price change in Bic pen, the demand curve shifts outwards at the same price level.

Also if the taste of the consumer changes without a price change of th good in question, there will be a shift in The demand curve. A change in quantity demanded is where all other factors mentioned above remains unchanged ( all things being equal) and the price of the commodity changes, in this case movement is along the original demand curve. However, for a shift in the demand curve all other factors are made to vary with the exception of the price of th good in question. In this case, there is a bodily shift or movement in the demand curve resulting in more than one demand curve- the original and the new. Demand Shift - The demand curve introduces price for the first time as the common denominator. The law of demand yields an inverse relationship. We distinguish between changes in quantity demanded, movements along a single demand curve caused by price changes, and shifts in the entire curve caused by a change in a factor other than price

Q.4 What is Price Elasticity of Demand? What are the different types of price Elasticity of Demand? The law of demand indicates only the direction of change in quantity demanded in response to a change in piece. But law of demand is unable to tell us how much or what extent the quantity demanded of a good will change in response in change in its price. This information as to how much or to what extent provided by the concept of a good will change as a result of change in its price is provided by the concept of price elasticity of demand. Dr.Marshall has defined price elasticity of demand as follows:The elasticity of demand in market is great or small according to the amount demanded increases much or little for a given rise in the price. We can define price elasticity of demand as the degree of responsiveness of demand for commodity to a change in price. Price elasticity of demand is the ratio of proportionate change in the quantity demanded of commodity to given proportionate change in its price. Alternatively, it is the ratio of the relative change in quantity to a relative change in price. If E pd stands for price elasticity then, %change in the elasticity demanded of X -------------------------------------------------%change price of X

Price elasticity Epd = For example:Price Demand 10 100 11 95

Epd=% Change in Demand % Change in Price %Change in Demand=D2-D1/D1*100 =95-100/100*100 =-5% % Change in Price=P2-P1/P1*100 =11-10/10*100 =10% Epd= -5%/10% =-0.5 Types of Price Elasticity of Demand There are six types of Price Elasticity of Demand as under:1) Zero elastic Demand. 2) Less than Unitary Elastic Demand 3) Unitary Elastic Demand 4) More than Unitary Elastic Demand 5) Perfectly Elastic Demand 6) Negative Elastic Demand

Price Elasticity of Demand. Change in Demand due to Change in Price. Epd = % Change in Demand % change in Price S.N 1 Type of elasticity Zero Meaning No change in Demand even though there is change in Price Example Price Changes from Rs.10/- to Rs.11/-. Demand remains at 100 units Price Changes from Rs.10/- to Rs.11/-. Demand Changes from 100 to 95 units Price Changes from Rs.10/- to Rs.11/-. Demand Changes from 100 to 90 units Price Changes from Rs.10/- to Rs.11/-. Demand Changes from 100 to 85 units Price remains at Rs.10/Demand Changes from 100 to 85 units Price Changes from Rs.10/- to Rs.11/-. Demand Changes from 100 to 110 units Formula Epd = 0 Graph Angle 90

Less Than Change in Unitary Demand is less proportionate to change in Price

Epd <1

<90 >45

Unitary

Change in Demand is proportionate to change in Price

Epd =1

45

More Than Unitary

Change in Demand is more proportionate to change in Price

Epd >1

<45

Infinity

Change in Demand even though there is no change in Price Demand increases the increases vice versa also when Price and

Epd =

Negative Elasticity

Epd <0

>90

Income Elasticity of Demand. Change in Demand due to Change in income. Epd = % Change in Demand % change in Income S.N 1 Type of elasticity Zero Meaning No change in Demand even though there is change in Income Example Income Changes from Rs.10,000/- to Rs.11,000/-. Demand remains at 100 units Income Changes from Rs.10,000/- to Rs.11,000/-. Demand Changes from 100 to 105 units Income Changes from Rs.10,000/- to Rs.11,000/-. Demand Changes from 100 to 110 units Income Changes from Rs.10,000/- to Rs.11,000/-. Demand Changes from 100 to 115 units Income remains at Rs.10,000/Demand Changes from Formula Eid = 0 Graph Angle 90

Less Than Change in Unitary Demand is less proportionate to change in Income

Eid <1

<90 >45

Unitary

Change in Demand is proportionate to change in Income

Eid =1

45

More Than Unitary

Change in Demand is more proportionate to change in Income

Eid >1

<45

Infinity

Change in Demand even though there is no change in Income

Eid =

Negative Elasticity

100 to 115 units Demand Income Eid <0 decreases when Changes from the Income Rs.10,000/- to increases and Rs.11,000/-. vice versa Demand Changes from 100 to 90 units

>90

Q. Explain the different methods of measurement of price elasticity of Demand. Measurement of Elasticity. 1) Percentage method. Epd = % change in Demand % change in Price

Example: price Change from 10 to rs.11 and Demand changes from 100 to 80 % change in Demand = (D2-D1)X100/D1 = (80-100)X100/100 = 20% % change in Price = (P2-P1)X100/P1 = (11-10)X100/10 = 10% Epd = % change in Demand % change in Price = 20%/10% = 2 2) Ratio Method. Epd= (D2-D1) X D1 (80-100)/100 X P1 (P2-P1) 10/(11-10) =2

3) Point Method. Epd = segment AD/ Segment DB. Where D is the Point of Demand. A is the point of Zero elasticity and B is the point of Infinity Elasticity.

4) Expenditure Method of Calculating Elasticity: It refers to total Revenue or Total Expenditure incurred by the consumer on a commodity at a given price. His total outlay on the commodity may change with the change in price. Total outlay or expenditure = Price x Quantity demanded

3) Unitary Elastic The term "Unitary elastic" is used when the price elasticity of demand is equal to 1. For example, change in price from 10 to11 (+10%) causes change in quantity from 10 to 9 (-10%). 10%/10%=1.

Unitary Elastic for the Elasticity of Demand is a proportionate change in price and quantity.

5) Perfectly Elastic Demand Perfectly elasticity refers to that situation where the slightest rise in price cause the quantity demanded of the commodity to fall to zero; and conversely the slightest fall in price causes an infinite increase in the quantity demanded of the commodity. The demand thus is hypersensitive and the elasticity of demand is infinity. As such, this is an extreme case of elasticity which is very rarely to found in practice but is of great theoretical importance. In terms of our formula, a 5% increase in demand with no fall in price will give us the equation: Ep=5/0=

Thus, infinite elastic elasticity of demand means that the firm can sell any amount of commodity at the ruling price, but if the price is increased by 1 paisa, the demand will come to zero. Diagram of Elastic Demand

If demand is perfectly elastic, it means that at a certain price demand is infinite (A good with a very high elasticity of demand). In other words if a firm increased price by 1%, it would see all its demand evaporate.

Q. Explain Cross Elasticity of Demand Definition:-The cross elasticity demand refers to the degree of responsiveness of demand for a commodity to a given change in the price of some related commodity In practical problems of demand analysis the commodities are seldom completely independent they stand in more or less definite clusters of substitntes and complements. In other words, the two goods can be either substititus to each other or complementary to each other.The term cross elasticity of demand may be defind as the ratio of proportionate change in quantily demanded of commodity X to a given proportionate change in price of the related commodity. The cross elasticity demand can be measured with the following formula EC= percentage change in demand for X Percentage change in price at Y If on the contrary the two goods are no substitutes at all (or not related to each other) the, cross elasticity will be zero. E.g:-steel and paper the change in price of steel will not affect demand of paper at all Commodity Original change price Quantity(unit) price Quality(unit)

Tea Coffee Bread butter

3 4 2 75

50 30 80 30

3 5 2 6

60 20 90 40

We can explain this concept with the following example Tea and coffee are two commodities which are substitutes to each other, Now if price of coffee increase, assuming that price of tea is constant, the demand for Tea will increase because now consumer will direct their demand from coffee to tea. Cross Elasticity of Demand. Change in Demand of X commodity due to Change in Price of Y commodity. Epd = % Change in Demand of X commodity % change in Price of Y commodity S.N 1 Type of elasticity Zero Meaning No change in Demand of X even though there is change in Price of Y Decrease in Demand of X commodity if the price of Y commodity increases. Increase in Demand of X commodity if the price of Y commodity increases. Change in Demand even though there is no change in Price Example Unrelated goods Formula Epd = 0 Graph Angle 90

Negative

Complementar y Goods

Epd >1

<90 >0

Positive

Near Substitutes

Epd <1

>90

Infinity

Perfect Substitutes

Epd =

Q. Explain Law of Supply: Answer: There is direct relationship between the price of a commodity and its quantity offered for sale over a specified period of time. When the price of a goods rises, other things

remaining the same, its quantity which is offered for sale increases as and price falls, the amount available for sale decreases. This relationship between price and the quantities which suppliers are prepared to offer for sale is called the law of supply.

Law of Supply Curve/Diagram: The market supply data of the commodity x as shown in the supply schedule is now presented graphically.

In the figure (5.1) price is plotted on the vertical axis OY and the quantity supplied on the horizontal axis OX. The four points d, c, b, and a show each price quantity combination. The supply curve SS/ slopes upward from left to right indicating that less quantity is offered for sale at lower price and more at higher prices by the sellers not supply curve is usually positively sloped.

Over supply results in lack of customers. An over supply is often a loss, for that reason. Under supply generates a demand in the form of orders, or secondary sales at higher prices. If ten people want to buy a pen, and there's only one pen, the sale will be based on the level of demand for the pen. The supply function requires more pens, which generates more production to meet demand. Importance of Law of Supply: Law of supply is an economic principle that states that there is a direct relationship between the prices. Q: Explain various types of Price elasticity of Supply. PERFECTLY ELASTIC SUPPLY An elasticity alternative in which infinitesimally small changes in one variable (usually price) cause infinitely large changes in another variable (usually quantity). Quantity is infinitely

responsive to price. Any change in price, no matter how small, triggers an infinite change in quantity. This characterization of elasticity is most important for the price elasticity of demand and the price elasticity of supply. Perfectly elastic is one of five elasticity alternatives. The other four are perfectly inelastic, relatively elastic, relatively inelastic, and unit elastic. Perfectly elastic means an infinitesimally small change in price results in an infinitely large change in quantity demanded or supplied. This elasticity alternative exists when the price is fixed, that is, an infinite range of quantities is associated with the same price. Perfectly elastic demand can occur, in theory, when buyers have the choice among a large number of perfect substitutes in the consumption of a good. In an analogous way, perfectly elastic supply can occur when sellers have the choice among a large number of perfect substitutes in the production. The chart to the right displays the five alternatives based on the coefficient of elasticity (E). In technical shorthand, the coefficient of elasticity (E) is given as: E= This technical shorthand works for both the price elasticity of demand and the price elasticity of supply, because the negative value of the price elasticity of demand is ignored. If the negative sign is not ignored, then the price elasticity of demand is given by E = -. Supply The key for perfectly elastic supply is that the good has a large number of very, very, very close (as in perfect) substitutes-in-production readily available. Any quantity of the good can be produced at the same production cost and price because the productive resources can be easily (as in perfectly) switched back and forth between other goods

Price Elasticity of Supply. Change in Supply due to Change in Price. Epd = % Change in Supply % change in Price S.N Type of Meaning Example Formula Graph Angle

elasticity Zero

No change in Supply even though there is change in Price

Less Than Change in Supply Unitary is less proportionate to change in Price

Unitary

Change in Supply is proportionate to change in Price

More Than Unitary

Change in Supply is more proportionate to change in Price

Infinity

Change in Supply even though there is no change in Price Supply decreases when the Price increases and vice versa

Negative Elasticity

Price Changes from Rs.10/- to Rs.11/-. Supply remains at 100 units Price Changes from Rs.10/- to Rs.11/-. Supply Changes from 100 to 105 units Price Changes from Rs.10/- to Rs.11/-. Supply Changes from 100 to 110 units Price Changes from Rs.10/- to Rs.11/-. Supply Changes from 100 to 115 units Price remains at Rs.10/Supply Changes from 100 to 85 units Price Changes from Rs.10/- to Rs.11/-. Supply Changes from 100 to 90 units

Eps = 0

90

Eps <1

<90 >45

Eps =1

45

Eps >1

<45

Eps =

Eps <0

>90

Q. Explain the concept of Price Equillibrium Answer: PRICE EQUILIBRIUM Supply and demand are perhaps one of the most fundamental concepts of economics and they are the backbone of a market economy. Demand refers to how much (quantity) of a product or service is desired by buyers. The quantity demanded is the amount of a product people are willing to buy at a certain price; the relationship between price and quantity demanded is known as the demand relationship. Supply represents how much the market can offer. The quantity supplied refers to the amount of a certain good producers are willing

to supply when receiving a certain price. The correlation between price and how much of a good or service is supplied to the market is known as the supply relationship. Price, therefore, is a reflection of supply and demand. Equilibrium When supply and demand are equal (i.e. when the supply function and demand function intersect) the economy is said to be at equilibrium. At this point, the allocation of goods is at its most efficient because the amount of goods being supplied is exactly the same as the amount of goods being demanded. Thus, everyone (individuals, firms, or countries) is satisfied with the current economic condition. At the given price, suppliers are selling all the goods that they have produced and consumers are getting all the goods that they are demanding.

As you can see on the chart, equilibrium occurs at the intersection of the demand and supply curve, which indicates no allocative inefficiency. At this point, the price of the goods will be P* and the quantity will be Q*. These figures are referred to as equilibrium price and quantity.

Price of a commodity is the result of the interaction of forces of demand and supply. The demand is influenced by utility, while the supply is influenced by cost of production. Buyers want a commodity at the lowest price and sellers wants to sell it at the highest price. Price of commodity is the result of the interaction between those two opposite forces. The law of demand and supply together explain how price is determined. Since price is determined at the level where the forces of demand and supply are balanced. Price is called equilibrium price. Price if price Qty. demanded Qty. supplied (Rs. per Kg.) (Quintals) (Quintals) 5 70 100 4 25 80

3 2 1

50 75 100

50 30 10

From the above schedule, we can see that at Rs.5 per kg, quantity demanded is less than that is being offered for sale. The buyer would buy more at lower price. But, the sellers would contract their supply at lower price at Rs.1 per kg. For instance, demand is 100 quintals, while the supply is just 10 quintals. At price Rs.1 and Rs.2, the demands exceed the supply. At prices Rs.4 and Rs. 5, the supply exceeds the demand. But at the price of Rs.3 demand and supply are equal (50 quintals). Thus in this case, equilibrium price is Rs.3 when demand is equal to supply. Q. Explain the different Types of Markets in Economics Answer: A market is a formal or informal social relation, institution or infrastructure in which the exchange of services, goods, information and trade takes place. It is an organized arrangement that brings together buyers and sellers. Markets vary in location, types, geographic range and size. The main purpose of a market is to facilitate trade and distribute resources to the economy. TYPES OF MARKETS :PERFECT COMPETITION :In economic theory, perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets. Still, buyers and sellers in some auction-type markets say for commodities or some financial assets may approximate the concept. Perfect competition serves as a benchmark against which to measure real-life and imperfectly competitive markets. Perfect Competition Perfect competition is an important concept in the price theory. Perfect competition is a narrower concept than your competition. For competition to be perfect, it has to satisfy all the condition. Of pure competition plus. It has to satisfy three additional conditions. In other words, beside the three conditions mentioned above, which must fulfilled for having a pure market, the following three conditions must also be. 1) Perfect Knowledge of the market: That buyers and sellers should have a perfect knowledge of the market. This is the first necessary condition of perfect competition. Every buyer knows that what price every seller is ready to accept and every seller knows what price every buyer is willing to offer. This knowledge guarantees uniform price throughout the market. Because there is perfect knowledge of the market no seller will

accept a price lower than that ruling at the market; nor will any buyer offer a price higher than the market price. 2) Absence of Transport Costs: Another assumption of perfect competition is the absence of transport costs or else. Free transport facilities have to be assumed. In the absence of this assumption, the production costs of firm producing at two different centers will differ and, therefore, price will be different. Different prices are an indication of market imperfection. That is why this assumption is important. 3) Perfect Mobility of Factors of Production: For a firm to adjust its supply to market demand. It is necessary that the factors of production are perfectly mobile. With the help of this assumption we can show how a firm and the industry can attain equilibrium. Thus, when all the six conditions are satisfied, the market is said to be perfectly competitive. While drawing a distinction between pure competition and perfect competition. MONOPOLY :A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity. This contrasts with a monophony which relates to a single entity's control of a market to purchase a good or service, Monopolies are thus characterized by a lack of economic competition to produce the good or service and a lack of viable substitute goods. The verb "monopolise" refers to the process by which a company gains much greater market share than what is expected with perfect competition. A monopoly is a market structure where there is only one buyer of a product or service. A monopoly may also have monophony control of a sector of a market. MONOPOLISTIC COMPETITION :Monopolistic competition is a form of imperfect competition where many competing producers sell products that are differentiated from one another (that is, the products are substitutes but, because of differences such as branding, not exactly alike). In monopolistic competition, a firm takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other firms. In a monopolistically competitive market, firms can behave like monopolies in the short run, including by using market power to generate profit. In the long run, however, other firms enter the market and the benefits of differentiation decrease with competition; the market becomes more like a perfectly competitive one where firms cannot gain economic profit. OLIGOPOLY :An oligopoly is a market form in which a market or industry is dominated by a small number of sellers (oligopolists). Because there are few sellers, each oligopolist is likely to be aware of the actions of the others. The decisions of one firm influence, and are influenced by, the decisions of other firms. Strategic planning by oligopolists needs to take into account the likely responses of the other market participants. Oligopoly is a common market form. As a quantitative description of oligopoly, the four-firm concentration ratio is often utilized. This measure expresses the market share of the four largest firms in an industry as a percentage. Oligopolistic competition can give rise to a wide range of different outcomes. In

some situations, the firms may employ restrictive trade practices to raise prices and restrict production in much the same way as a monopoly. Oligopoly: Another form of imperfect competition is oligopoly or competition among a few. This type of market does not have only one producer as under monopolistic competition. this is a market of a few or limited number of sellers as under the word oligopoly is derived from two greek words oligon meaning a a few polian meaning to sell thus , the meaning of the words itself explains what an oligopolistic market is like. 1.features of oligopoly the characteristics of an oligopolistic market are as under: (a) small number of sellers/producers. (b)product differentiation not a necessary condition. (c)control over price circumscribed by mutual interdependence. (d)barriers to entry. (e)advertising and sales promotion. 2. the basis of oligopoly:Why does an oligopolistic market exists ? the obvious answer is because entry of new firms is difficult thus the factors are as under. Patented techniques of production and control over the supply of raw material provide a cost advantage to the existing firms.

Monopsony A monopsony is a type of market in which a single powerful buyer controls and affects market prices. Multiple sellers offer goods and services, but there is only a single buyer who has exclusive control of market power and can bring the prices of goods/services down. According to the textbook "Microeconomics: Principles and Applications," a pure monopsony is rare. An example of a monopsony is a coal company in a small town. Oligopsony An oligopsony market has a few buyers and multiple sellers. A duopsony is a type of oligopsony that has two buyers. The buyers affect each other's buying action. An example of an oligopsony is the U.S. fast food market, in which a few major buyers (Burger King, McDonald's and Wendy's) control the meat market. Q. Explain the concept of MARGINAL COST Answer:

In Economics and Finance marginal cost is the change in Total Cost that arises when the quantity produced changes by one unit. It is the cost of producing one more unit of a good. If the good being produced is infinitely divisible, so the size of a marginal cost will change with volume. The marginal cost of an additional unit of output is the cost of the additional inputs needed to produce that output. The marginal cost of production is the increase in Total cost as a result of producing one extra unit. It is the variable costs associated with the production of one more units. Marginal Cost is governed only by variable cost which changes with changes in output. Formula: Marginal Cost = Change in Total Cost = TC Change in Output Q Illustration: Schedule: Units of Output Total Cost 1 5 2 9 3 12 4 16 5 21 6 29 Graph/Diagram: Marginal Cost 5 4 3 4 5 8

MC curve can also be plotted graphically. The marginal cost curve in fig. (13.8) decreases sharply with smaller Q output and reaches a minimum. A production is expanded to a higher level; it begins to rise at a rapid rate.

Q. Explain the law of returns to scale The law of returns are often confused with the law of returns to scale. The law of returns operates in the short period. It explains the production behavior of the firm with one factor variable while other factors are kept constant. Whereas the law of returns to scale operates in the long period. It explains the production behavior of the firm with all variable factors. There is no fixed factor of production in the long run. The law of returns to scale describes the relationship between variable inputs and output when all the inputs, or factors are increased in the same proportion. The law of returns to scale analysis the effects of scale on the level of output. Here we find out in what proportions the output changes when there is proportionate change in the quantities of all inputs. The answer to this question helps a firm to determine its scale or size in the long run. It has been observed that when there is a proportionate change in the amounts of inputs, the behavior of output varies. The output may increase by a great proportion, by in the same proportion or in a smaller proportion to its inputs. This behavior of output with the increase in scale of operation is termed as increasing returns to scale, constant returns to scale and diminishing returns to scale. These three laws of returns to scale are now explained, in brief, under separate heads. (1) Increasing Returns to Scale: If the output of a firm increases more than in proportion to an equal percentage increase in all inputs, the production is said to exhibit increasing returns to scale. For example, if the amount of inputs are doubled and the output increases by more than double, it is said to be an increasing returns returns to scale. When there is an increase in the scale of production, it leads to lower average cost per unit produced as the firm enjoys economies of scale. (2) Constant Returns to Scale: When all inputs are increased by a certain percentage, the output increases by the same percentage, the production function is said to exhibit constant returns to scale. For example, if a firm doubles inputs, it doubles output. In case, it triples output. The constant scale of production has no effect on average cost per unit produced. (3) Diminishing Returns to Scale: The term 'diminishing' returns to scale refers to scale where output increases in a smaller proportion than the increase in all inputs.

For example, if a firm increases inputs by 100% but the output decreases by less than 100%, the firm is said to exhibit decreasing returns to scale. In case of decreasing returns to scale, the firm faces diseconomies of scale. The firm's scale of production leads to higher average cost per unit produced.

Q. Explain different methods of Pricing policies. Definition :- The policy by which a company determines the wholesale and retail prices for its products or services. Pricing Factors to Consider 1 Determine primary and secondary market segments. 2 Assess the product's availability and near substitutes. Underpricing hurts your product as much as overpricing does. If the price is too low, potential customers will think it can't be that good. 3 Survey the market for competitive and similar products. 4 Examine market pricing and economics. 5 Calculate the internal cost structure and understand how pricing interacts with the offering. 6 Test different price points if possible. Monitor the market and your competition continually to reassess pricing. Market dynamics and new products can influence and change consumer needs. Methods of Pricing Policies. The simplest way to set price is through uniform pricing. At the profit-maximizing uniform price, the incremental margin percentage equals the reciprocal of the absolute value of the price elasticity of demand. The most profitable pricing policy is complete price discrimination, where each unit is priced at the benefit that the unit provides to its buyer. To implement this policy, however, the seller must know each potential buyers individual demand curve and be able to set different prices for every unit of the product. The next most profitable pricing policy is direct segment discrimination. For this policy, the seller must be able to directly identify the various segments. The third most profitable policy is indirect segment discrimination. This involves structuring a set of choices around some variable to which the various segments are differentially sensitive. Uniform pricing is the least profitable way to set a price. A commonly used basis for direct segment discrimination is location. This exploits a difference between free on board and cost including freight prices. A commonly used method of indirect segment discrimination is bundling. Sellers may apply either pure or mixed bundling. Q. Differential between Public Goods and private Goods.

. PUBLIC GOODS 1-Public goods as being non rival excludable. 2-Public goods satisfied collective wants of society. 3-Public goods there are products that are public in nature, but do not exhibit fully the feature of non excludability. 4-Example-Air, national defense, free to air TV, satellite TV, roads. 5-Government property is public goods. PRIVATE GOODS Private goods are rival and excludable. Private goods satisfied an individual wants. Private goods are totally opposite of public goods. They are private in nature. Example-food, clothing, cars, personal electronics, household, club goods. Nongovernment property is private goods.

Q. Explain the effect of Liberalisation, Privatisation and Globalisation Economic Liberalisation Definition :Economic liberalization is a very broad term that usually refers to fewer government regulations and restrictions in the economy in exchange for greater participation of private entities. Liberalization refers to a relaxation of previous government restrictions, usually in areas of social or economic policy. Liberalization of autocratic regimes may precede democratization In the arena of social policy it may refer to a relaxation of laws restricting for example divorce, abortion, homosexuality or drugs. Most often, the term is used to refer to economic liberalization, especially trade liberalization or capital market liberalization Although economic liberalization is often associated with privatization, the two can be quite separate processes. For example, the European Union has liberalized gas and electricity markets, instituting a system of competition; but some of the leading European energy companies remain partially or completely in government ownership.

Liberalized and privatized public services may be dominated by just a few big companies, particularly in sectors with high capital costs, or high sunk cost, such as water, gas and electricity. In some cases they may remain legal monopolies, at least for some part of the market (e.g. small consumers).Liberalization is one of three focal points of the Washington consensus's trinity strategy for economies in transition. An example of Liberalization is the "Washington Consensus" which was a set of policies created and used by Argentina.. There is a distinct difference between liberalization and democratization, which are often thought to be the same concept. Liberalization can take place without democratization, and deals with a combination of policy and social change specialized to a certain issue such as the liberalization of government-held property for private purchase, whereas

democratization is more politically specialized that can arise from a liberalization, but works in a broader level of government. According to the Oxford English Dictionary, the word "globalization" was first employed in a publication entitled Towards New Education in 1930, to denote a holistic view of human experience in education. An early description of globalization was penned by the founder of the Bible Student movement Charles Taze Russell who coined the term 'corporate giants' in 1897, although it was not until the 1960s that the term began to be widely used by economists and other social scientists. The term has since then achieved widespread use in the mainstream press by the later half of the 1980s. Since its inception, the concept of globalization has inspired numerous competing definitions and interpretations, with antecedents dating back to the great movements of trade and empire across Asia and the Indian Ocean from the 15th century onwards. The United Nations ESCWA says globalization "is a widely-used term that can be defined in a number of different ways. When used in an economic context, it refers to the reduction and removal of barriers between national borders in order to facilitate the flow of goods, capital, services and labour... although considerable barriers remain to the flow of labor... Globalization is not a new phenomenon. It began towards the end of the nineteenth century, but it slowed down during the period from the start of the First World War until the third quarter of the twentieth century. This slowdown can be attributed to the inward-looking policies pursued by a number of countries in order to protect their respective industries... however, the pace of globalization picked up rapidly during the fourth quarter of the twentieth century..."HSBC, one of the world's largest banks, operates across the globe. Shown here is the HSBC Global Technology Centre in Pune, India which develops software for the entire HSBC group. Tom G. Palmer of the Cato Institute defines globalization as "the diminution or elimination of state-enforced restrictions on exchanges across borders and the increasingly integrated and complex global system of production and exchange that has emerged as a result."Thomas L. Friedman has examined the impact of the "flattening" of the world, and argues that globalized trade, outsourcing, supplychaining, and political forces have changed the world permanently, for both better and worse. He also argues that the pace of globalization is quickening and will continue to have a growing impact on business organization and practice. Finally, Takis Fotopoulos argues that globalization is the result of systemic trends manifesting the market economy's growor-die dynamic, following the rapid expansion of transnational corporations. Because these trends have not been offset effectively by counter-tendencies that could have emanated from trade-union action and other forms of political activity, the outcome has been globalization. This is a multi-faceted and irreversible phenomenon within the system of the market economy and it is expressed as: economic globalization, namely, the opening and deregulation of commodity, capital and labour markets which led to the present form of neoliberal globalization; political globalization, i.e., the emergence of a transnational elite and the phasing out of the all-powerful nation-state of the statist period; cultural globalization, i.e., the worldwide homogenization of culture; ideological globalization; technological globalization; social globalization. Realization of a global common market, based on the freedom of exchange of goods and capital. Almost all notable worldwide IT companies have a presence in India. Four Indians were among the world's top 10 richest in

2008, worth a combined $160 billion. In 2007, China had 415,000 millionaires and India 123,000.Further, in the job market, employees compete indirectly in a global job market. In the past, the economic fate of workers was tied to the fate of national economies. With the advent of the information age and improvements in communication, this is no longer the case. Because workers compete in a global market, wages are less dependent on the success or failure of individual economies. This has had a major effect on wages and income distribution. Survival in the new global business market calls for improved productivity and increased competition. Due to the market becoming worldwide, companies in various industries have to upgrade their products and use technology skillfully in order to face increased competition

Q. What are the various types of costs? Costs of production are the most important force governing the supply of a product. A firm chooses a combination of factors which minimizes its cost of production for a given level of output. Production of a commodity involves expenses to be incurred on different factors. It is the sum total of expenses incurred by the producer to pay for the factors of production. Costs of production have different meanings. To some cost of production are all types of expenditure expressed in term of money. Some takes it as the totality of sacrifice undergone by the factors in the production. Some considers it in terms of alternative which are foregone. Below are given some of the costs of production. (1) Accounting Cost and Economic Cost: All these expenses incurred by a producer that enter the accounts of the accountant in course of production is known as accounting cost. An entrepreneur pays wages to the labour employed, rent for hiring land and building, interest on the capital borrowed, prices for raw material, transport, electricity etc. for doing the business. All these expenses are placed in the accounts. (2) Money Cost:As we have a monetary economy costs are generally expressed in terms of money. money cost includes various monetary expenditure made by a producer in the production. These are the Wages and salaries paid to labour, the expenditure on machinery, the payment for materials, power, and transportation, advertisement and insurance etc. Therefore the sum of money spent for producing a particular quantity of commodity is called its money cost. (3) Real Cost:The concept of real cost is another view of classical economists. Real cost is viewed in terms of pains and sacrifices. According to Marshall the real cost of production of a commodity is expressed not in money but in efforts and sacrifices undergone in the

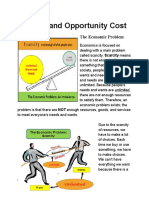

making of a commodity. A worker at work derives pain and displeasure and a capitalist sacrifices his present for the future in laving his money. (4) Opportunity Cost:The concept of opportunity cost is based on scarcity and choice. The opportunity cost of a commodity is the next best alternative commodity sacrificed. In other words opportunity cost of a commodity is forgoing the opportunity to produce alternative goods and services. This is because resources are scarce. In view of scarcity of resources, every producer has to make a choice among several alternatives. (5) Explicit cost and implicit cost:Explicit cost includes these payments which are made by the employer to those factors of production which do not belong to the employer himself. These costs are explicitly incurred by the producer for buying factors from others on contract. For example, the payments made for raw materials, power, fuel, wages and salaries, the rent on land and interest on capital are all contractual payments made by the employer. Explicit cost is also called accounting cost. These costs are interred in the accountant's list. 6. Social cost: Social cost is the total cost of the society which includes the directed and indirect costs that the society pays for the production of the commodity. The producer always tries to cover his private costs. But he never takes care of the costs that the society bears consequent upon his production of commodity. For example a producer counts his costs of production and never those of people living around the factory. Production of commodity pollutes air and water which impair health and property. This is a cost to the society which always exceeds private cost. 7. Fixed cost and variable cost: In the short-run there exist certain factors which are fixed. These factors can't be changed. And the costs incurred on these factors constitute fixed cost. Fixed cost does not change with the change in out-put. Whatever the volume of production fixed cost remains the same. Fixed cost is to be incurred if there is production or no-production. Fixed cost includes those costs like interest on capital, salary of the permanent staff, insurance premium, property taxes etc. Fixed cost is otherwise known as supplementary cost. Variable cost is that cost which varies with the volume of output. Variable cost is to be incurred if there is production only. Variable cost is more or less depending oh the increase and decrease in the volume of production. Variable cost is otherwise known as, prime cost. Thus labour, raw materials, chemicals etc. are the factors which can be readily varied with the change in output. 8. Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen (that is foregone). It is the sacrifice related to the second best choice available to someone who has picked among several mutually exclusive choices. Opportunity cost is a key concept in economics , and has been described as expressing "the basic relationship between scarcity and choice". The notion of opportunity cost plays a crucial part in ensuring that scarce resources are used efficiently. Thus , opportunity costs are not restricted to monetary or financial costs: the real cost of output forgone , lost time,

pleasure or any other benefit that provides utility should also be considered opportunity costs. Q. Explain the Cost, Volume and Profit Relations Answer: Average Fixed Cost n.a. 500 250 167 125 100 67 50 40 33 29 25 22 Average Variable Cost 0 100 100 100 100 100 100 100 100 100 100 100 100 Aver Total Cost n.a 600 350 267 225 200 167 150 140 133 129 125 122

No of units 0 200 400 600 800 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500

Fixed cost 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000

Variable Cost 0 20,000 40,000 60,000 80,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000

Total Cost 100,000 120,000 140,000 160,000 180,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 550,000

Sales 0 30,000 60,000 90,000 120,000 150,000 225,000 300,000 375,000 450,000 525,000 600,000 675,000

Profit or Loss 100,000 -90,000 -80,000 -70,000 -60,000 -50,000 -25,000 0 25,000 50,000 75,000 100,000 125,000

You might also like

- Cost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)Document46 pagesCost Profit Analysis: Romnick E. Bontigao, Cpa, CTT, Mritax, Mba (O.G.)KemerutNo ratings yet

- National Income DeterminationDocument45 pagesNational Income DeterminationKyla BadilloNo ratings yet

- Managerial EconomicsDocument6 pagesManagerial EconomicsAhmad Hirzi Azni100% (1)

- Chapter 1 Introduction To Cost Accounting - PDF PDFDocument27 pagesChapter 1 Introduction To Cost Accounting - PDF PDFAyushi GuptaNo ratings yet

- Managerial Accounting 10Document63 pagesManagerial Accounting 10Dheeraj Suntha100% (3)

- Risk Management Strategies for Del Monte PhilippinesDocument9 pagesRisk Management Strategies for Del Monte PhilippinesPricia AbellaNo ratings yet

- 9 Partnership Question 21Document11 pages9 Partnership Question 21kautiNo ratings yet

- Kings College of The PhilippinesDocument6 pagesKings College of The PhilippinesIzza Mae Rivera KarimNo ratings yet

- Scarcity & EconomicsDocument3 pagesScarcity & EconomicsJohn Remmel RogaNo ratings yet

- (Final) Acco 20113 - Strategic Cost ManagementDocument18 pages(Final) Acco 20113 - Strategic Cost ManagementJona kelssNo ratings yet

- Multiple choice and accounting practice questionsDocument3 pagesMultiple choice and accounting practice questionsSewale AbateNo ratings yet

- Conversion CycleDocument2 pagesConversion Cyclejoanbltzr0% (1)

- 2.6 Activity Based Costing Abc Activity Based Management AbcDocument22 pages2.6 Activity Based Costing Abc Activity Based Management AbcだみNo ratings yet

- Quiz 4Document6 pagesQuiz 4BibliophilioManiac100% (1)

- Managerial Economics - A Decision Science andDocument5 pagesManagerial Economics - A Decision Science andSam NietNo ratings yet

- Marketing Environment Simulation and Summary Week 1Document7 pagesMarketing Environment Simulation and Summary Week 1Serena100% (1)

- Managerial Economics and Business Strategy 8th Ed Chpt. 4 QuestionsDocument2 pagesManagerial Economics and Business Strategy 8th Ed Chpt. 4 QuestionsBoooNo ratings yet

- Cost Accounting Reviewer Chapter 1: Introduction To Cost AccountingDocument38 pagesCost Accounting Reviewer Chapter 1: Introduction To Cost AccountingJoyce MacatangayNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- DemandDocument22 pagesDemandSerenity KerrNo ratings yet

- 1 Simplex MethodDocument17 pages1 Simplex MethodPATRICIA COLINANo ratings yet

- MBA 511 Final ReportDocument13 pagesMBA 511 Final ReportSifatShoaebNo ratings yet

- JPIA CA5101 MerchxManuf Reviewer PDFDocument7 pagesJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNo ratings yet

- Accounting Concept and Principles - 20160822Document32 pagesAccounting Concept and Principles - 20160822jnyamandeNo ratings yet

- Chapter 2Document5 pagesChapter 2Sundaramani SaranNo ratings yet

- Chapter 7: Production and Cost in The FirmDocument3 pagesChapter 7: Production and Cost in The FirmemilianodelgadoNo ratings yet

- The Following Unadjusted Trial Balance Is For Ace Construction CoDocument1 pageThe Following Unadjusted Trial Balance Is For Ace Construction Cotrilocksp SinghNo ratings yet

- Methods of BudgetingDocument5 pagesMethods of BudgetingShinjiNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- Finance Notes SifdDocument104 pagesFinance Notes SifdSuresh KumarNo ratings yet

- Rhodes Corp financial analysisDocument6 pagesRhodes Corp financial analysisAshish BhallaNo ratings yet

- Bond Valuation PDF With ExamplesDocument17 pagesBond Valuation PDF With ExamplesAmar RaoNo ratings yet

- Types of Demand & DeterminantsDocument13 pagesTypes of Demand & DeterminantsARUN KUMARNo ratings yet

- Public Debt Lesson 6 and 7Document19 pagesPublic Debt Lesson 6 and 7BrianNo ratings yet

- Homework 2 - Answer KeyDocument4 pagesHomework 2 - Answer Key蒋歌No ratings yet

- 1657540172887-Chpter 03 An Introduction To Management ScienceDocument41 pages1657540172887-Chpter 03 An Introduction To Management ScienceAnushka KanaujiaNo ratings yet

- Managerial EconomicsDocument10 pagesManagerial EconomicsDipali DeoreNo ratings yet

- Process Costing, RAMAN ROYDocument109 pagesProcess Costing, RAMAN ROYramanroy0% (1)

- Ch-11 (Integrated Marketing Comminication)Document19 pagesCh-11 (Integrated Marketing Comminication)api-19958143No ratings yet

- Vol 2. SampleDocument23 pagesVol 2. SamplevishnuvermaNo ratings yet

- Economic Systems and Their Impact on International BusinessDocument8 pagesEconomic Systems and Their Impact on International BusinessKhalid AminNo ratings yet

- Reviewquestion Chapter5 Group5Document7 pagesReviewquestion Chapter5 Group5Linh Bảo BảoNo ratings yet

- Final Term Paper Managerial Economics 2019Document10 pagesFinal Term Paper Managerial Economics 2019Andleeb AKhtarNo ratings yet

- Consumer Research TechniquesDocument2 pagesConsumer Research TechniquesSiva RatnamNo ratings yet

- Responsibility AccountingDocument3 pagesResponsibility AccountinglulughoshNo ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Financial Management Comprehensive ExamDocument15 pagesFinancial Management Comprehensive ExamDetox FactorNo ratings yet

- Polytechnic University of The Philippines College of Business Administration Department of Human Resource Management A.Y 2020-2021Document3 pagesPolytechnic University of The Philippines College of Business Administration Department of Human Resource Management A.Y 2020-2021John Paul BarotNo ratings yet

- Isocost Line: © 2008 Prentice Hall Business Publishing - Microeconomics - Pindyck/Rubinfeld, 7eDocument12 pagesIsocost Line: © 2008 Prentice Hall Business Publishing - Microeconomics - Pindyck/Rubinfeld, 7eMaple OcenaNo ratings yet

- Inventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesDocument16 pagesInventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesKIU PUBLICATION AND EXTENSIONNo ratings yet

- Intro To Cost Accounting ReviewerDocument2 pagesIntro To Cost Accounting ReviewerJosephine YenNo ratings yet

- CHECKMATE User ManualDocument47 pagesCHECKMATE User Manualbrahm2009100% (1)

- CONFIDENTIAL Corporate Finance ExamDocument3 pagesCONFIDENTIAL Corporate Finance ExamAssignment HelperNo ratings yet

- Test Bank MaDocument392 pagesTest Bank MaPhước NguyễnNo ratings yet

- 5 Forecasting-Ch 3 (Stevenson) PDFDocument50 pages5 Forecasting-Ch 3 (Stevenson) PDFsadasdasdasNo ratings yet

- Final AsuprinDocument94 pagesFinal AsuprinProm GloryNo ratings yet

- Unit:-1 MB-106: Managerial Economics By:-Manoj Kumar GautamDocument42 pagesUnit:-1 MB-106: Managerial Economics By:-Manoj Kumar GautamPiyush ChaturvediNo ratings yet

- Introduction To Managerial EconomicsDocument13 pagesIntroduction To Managerial EconomicsPrayag rajNo ratings yet

- Acfrogd7nvqgurwipdf2e7jkjjkok Wjvsajyl Eghtig Fs61bto3ptu2du5wqpo3tdgvjrz9qagz Lvgpve7yxodkzkh5d L555v5wko4a4xipm9g37ers1btp5o3oodme42 K0umt72iholgbDocument14 pagesAcfrogd7nvqgurwipdf2e7jkjjkok Wjvsajyl Eghtig Fs61bto3ptu2du5wqpo3tdgvjrz9qagz Lvgpve7yxodkzkh5d L555v5wko4a4xipm9g37ers1btp5o3oodme42 K0umt72iholgbManu DvNo ratings yet

- SOA TemplateDocument28 pagesSOA Templatepatrick wafulaNo ratings yet

- Ultra Tech Cement Internal AssessmentDocument10 pagesUltra Tech Cement Internal AssessmentDarsh KansalNo ratings yet

- The Contemporary WorldDocument6 pagesThe Contemporary WorldRental SystemNo ratings yet

- Lead QuesDocument2 pagesLead QuesKameshwara RaoNo ratings yet

- Prefabricated Concrete Slabs and Their AdvantagesDocument24 pagesPrefabricated Concrete Slabs and Their AdvantagesmUSINo ratings yet

- WTO Cancun Ministerial Conference Collapses Without AgreementDocument16 pagesWTO Cancun Ministerial Conference Collapses Without AgreementGagan Preet KaurNo ratings yet

- Assignment AccDocument47 pagesAssignment Acchakimstars2003No ratings yet

- 18 HousekeepingDocument3 pages18 HousekeepingMohammed MinhajNo ratings yet

- Atmanirbhar Bharat Abhiyaan: Jain UniversityDocument16 pagesAtmanirbhar Bharat Abhiyaan: Jain UniversityROY PAULNo ratings yet

- Ramazan Umrah 2024 BroucherDocument3 pagesRamazan Umrah 2024 Broucherjacafo7075No ratings yet

- ETSAP-TIMES - The Integrated MARKAL-EFOM SystemDocument5 pagesETSAP-TIMES - The Integrated MARKAL-EFOM SystemVirgil CaballeroNo ratings yet

- Macd PDFDocument5 pagesMacd PDFSandeep MishraNo ratings yet

- The Tata-Mistry SagaDocument7 pagesThe Tata-Mistry SagaAravind ShankarNo ratings yet

- Hook - The Arrival of Tink - John WilliamsDocument2 pagesHook - The Arrival of Tink - John WilliamsAntoine LagneauNo ratings yet

- TTC Is Planning To Raise $3.25 Million For Three Y...Document1 pageTTC Is Planning To Raise $3.25 Million For Three Y...Vinita BhallaNo ratings yet

- Signature Global BlogDocument2 pagesSignature Global BlogOmkar kumarNo ratings yet

- International Survey of Business Failure Prediction ModelsDocument28 pagesInternational Survey of Business Failure Prediction ModelsVương Nguyễn ĐạiNo ratings yet

- SIPCOT - Irungattukkotai: S.No Company Contact PersonDocument4 pagesSIPCOT - Irungattukkotai: S.No Company Contact PersonJiyoPaulNo ratings yet

- Mindmap Ch1. Indian Economy On The Eve of IndependenceDocument1 pageMindmap Ch1. Indian Economy On The Eve of IndependenceAnup DubeyNo ratings yet

- Bolt BM Dimensional DrawingDocument1 pageBolt BM Dimensional DrawingJavier Enrrique Iglesias PelcastreNo ratings yet

- Rajnish Kumar - The Custodian of Trust - A Banker's Memoir-India Viking (2022)Document259 pagesRajnish Kumar - The Custodian of Trust - A Banker's Memoir-India Viking (2022)Shireesh COSindhuNo ratings yet

- Final Internship Report - Amber DasDocument19 pagesFinal Internship Report - Amber DasAmber DasNo ratings yet

- Glenn D Ellison Solutions To Exercises From Fudenberg TiroleDocument202 pagesGlenn D Ellison Solutions To Exercises From Fudenberg TiroleMarcosNo ratings yet

- Multiple Choice Questions and Answers (MCQ) On Financial MarketDocument7 pagesMultiple Choice Questions and Answers (MCQ) On Financial Marketheena100% (1)

- SFAD Assignment 2 (23652)Document3 pagesSFAD Assignment 2 (23652)Muhammad Raffay MaqboolNo ratings yet

- Marxist Fmaily EssayDocument2 pagesMarxist Fmaily Essayapi-267952444No ratings yet

- Define National Interests ArticleDocument2 pagesDefine National Interests ArticleElise Smoll (Elise)No ratings yet

- Scarcity and Opportunity Cost: The Economic ProblemDocument10 pagesScarcity and Opportunity Cost: The Economic ProblemElise Smoll (Elise)No ratings yet

- First Preboard: Mark Alyson B. Ngina, Cpa CmaDocument11 pagesFirst Preboard: Mark Alyson B. Ngina, Cpa CmaSer Crz JyNo ratings yet

- Bitcoinandtheday of The WeekeffectDocument10 pagesBitcoinandtheday of The WeekeffectMohammadNo ratings yet