Professional Documents

Culture Documents

Mission Resources - 10-20-03 Report

Uploaded by

no escapeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mission Resources - 10-20-03 Report

Uploaded by

no escapeCopyright:

Available Formats

Energy

Exploration & Production

High Yield Research

October 22, 2003

Greg Imbruce 800/937-5333 gimbruce@jefco.com

Mission Resources Corp.

(MSSN)

Expect Company to Eye Debt Exchange with Sharp Run-up in Stock

Recommendation: Strong Buy

We are increasing our price target on Mission Resources' 10.875% Sr. Sub. Notes 07 ("Notes") to 89% from 75% (March 31, 2003 report). We, therefore, recommend the Notes as a strong buy at 78% as we expect management to pursue a combination debt-for-debt and debt-for-equity exchange within 6-months - our concept of such a restructuring unlocks value and provides Noteholders an expected 104% future recovery with upside to 117%. The catalyst to this exchange is the uptick in the Senior Secured Facility coupon to 13% from 12% in February 2004, as well as the Company's ability to take advantage of the impressive upward move in MSSN's stock price. Absent a debt exchange, we believe (i) the Notes' 19.7% YTW is attractive relative to the 12.9% CCC-rated high yield index; (ii) Company fundamentals provide adequate credit statistics that, based on the Notes at market, include: 1.5x (1.4x at par) asset coverage, 4.2x (4.8x at par) total debt leverage, and 1.8x cash interest coverage; and (iii) the Notes at the current level create the Company at nearly a 50% discount to comparables with at $0.77/MCFE and 3.6x LTM EBITDA. The credit statistics are supported by historically elevated oil and gas prices, however, the Company's financial performance is somewhat insulated from commodity prices with almost 60% and 34% of 2H03 and 2004 production, respectively, hedged at prices north of $4/MCFE. We are also encouraged by the recently announced asset sale of Mission's lower quality reserves in East Texas in addition to the Company's impressive drilling program through 3Q03 (excluding asset sales). We estimate these activities have high-graded Mission's oil and gas reserve quality, while simultaneously increasing reserves an estimated 4% during the first nine-months of 2003, resulting in an estimated 153% reserve replacement ratio. 3Q03 Outlook Our 3Q03 EBITDA estimate is $11.2 mm, after accounting for a $2.7 mm cash hedge loss in the quarter ($13.9 mm unadjusted EBITDA) based on an expected production rate of 63 MMCFE per day (MMCFEpd) (high-end of 58-63 MMCFEpd guidance). We expect the Company's drilling activities The Company will release its 3Q03 earnings on November 13, before the market opens. A conference call will be held that day at 2:00 PM (ET) and may be accessed by dialing 877-894-9681 (replay is 800-642-1687 #3408973, available until November 30).

Company Description: Exploration & production company Mission Resources Corporation (NASDAQ: MSSN) is a Houston-based independent created by the merger of Bellwether Exploration Company with Bargo Energy Company in 2001. Mission's oil properties are located in the Permian Basin of West Texas (32% of proven reserves, proforma for the East Texas property divestiture announced in October 2003) with natural gas properties in the Gulf Coast (30%) and to a lesser degree, the Gulf of Mexico (17%). At December 31, 2002, MSSN's 229 BCFE (64% Oil, 77% Proved Developed) of proved reserves, as engineered by Netherland Sewell, maintained a 10year reserve life based on the Company's most recent quarter's production rate (61.7 MMCFE per day). MSSN's long-term strategy is to be geographically focused onshore in the Louisiana Gulf Coast, South Texas and the Permian Basin and shift its asset mix to primarily 70% natural gas in an effort to lower lifting costs and high-grade its oil and gas quality. In addition to its oil and gas assets, the Company holds leases on over 61,000 net undeveloped acres in the US. The Company expects 2003 CapEx to total $32 million with nearly $27 million or 83% allocated to development and exploration drilling.

Mission Resources Corp.

Energy: Exploration & Production

High Yield Research

Potential Restructuring We expect MSSN's strong stock price (+607% YTD) provides the Company with the currency required to complete a restructuring that is attractive for Noteholders as well as existing shareholders and management. In fact, based on the current $2.63 stock price, we could see MSSN's Notes trade as high as 96% (12-month PV20) if a similarly structured debt exchange as outlined herein becomes reality, and assuming the stock trades at levels comparable to today's price. We anticipate that in a restructuring, Noteholders would receive: (i) $80 mm in new Senior Secured Notes ("New Notes"), representing a 63% recovery; and (ii) 50% of the Company's common shares. We believe shareholders would view the deal positively since it appears to be 6% accretive to current shareholders. The Company would be required to issue an aggregate of $160 mm in New Notes to repay the existing $80 mm Sr. Secured Term Loan. We envision, however, that the New Notes and existing Revolver would be the only debt outstanding at Mission post this exchange. Such a deal would benefit both current shareholders and Noteholders in the long-term. First, a successful restructuring as outlined would save MSSN $10 mm annually in interest costs that would allow the Company to redeploy those funds toward its drilling and acquisition effort. The deal may also serve as a segue to a merger or acquisition, whereby MSSN becomes part of a larger, more efficient E&P platform. Absent a Restructuring Absent a restructuring and in the case that commodity prices collapse to normalized levels, we estimate that the Notes' downside risk is limited to a 77% future recovery with the more likely liquidation scenario being our base case scenario, which indicates a 92% future recovery. Since we expect the Company to remain current on its coupon payments and don't foresee a covenant default, these future recoveries combined with almost an 11% coupon provide an 88% and 103% total recovery for the downside and base case scenarios, respectively. This implies a 12.4% to 28.8%, 12month return based on today's level in the event a debt exchange fails to materialize and the Company continues to operate its existing asset base. Further, the Notes at the current level create the Company at attractive asset and cash flow valuations that provide downside protection. Those valuation metrics are as follows: Value/Proved Reserve: $0.77/MCFE applying net debt and $0.91/MCFE assuming total debt (utilizes 9/30/03E proved reserves, proforma for E. Texas property sale) Net Debt/EBITDA: 3.5x last quarter annualized (LQA) EBITDA and 3.6x LTM EBITDA Total Debt/EBITDA: 4.1x and 4.2x LQA and LTM EBITDA, respectively

These valuation metrics represent a deep discount to E&P comparables, which (based on the median) trade at $1.45/MCFE ($1.44/MCFE avg.), 5.9x LQA EBITDA (9.6x avg.) and 6.6x LTM EBITDA (7.0x avg.). Even assuming Notes at par and incorporating the public equity value, MSSN remains undervalued at $1.21/MCFE, 5.6x LQA EBITDA, and 5.7x LTM EBITDA. Management We believe Noteholders would be best served by supporting an exchange similar to our concept due to management's accomplishments achieved to date in its "restructuring" effort. The Company began its transformation in August 2002 with the addition of Mr. Robert Cavnar as Chairman and CEO. Prior to joining Mission, Mr. Cavnar served as CFO of El Paso Production Company. Previous to his positions at El Paso, he held senior management positions with Cornerstone Natural Gas and with the Global Energy Division of the Chase Manhattan Bank. In October 2002, Mr. Richard (Rick) Piacenti joined the Company as CFO. Mr. Piacenti came to Mission from El Paso Production Company as well, where he also served as CFO (just after Mr. Cavnar's departure) and was Controller of the production company and director of accounting for the midstream company. Prior to El Paso, Mr. Piacenti was Controller of Cornerstone Natural Gas Inc, where he worked with Mr. Cavnar. We like the fact that management and directors own 4.4% of the stock and that Mr. Cavnar and Mr. Piacenta have a significant history together. We also point out that management takes a majority of their compensation in the form of options with the lowest cash compensation packages of any E&P company that we follow. In 2002, for example, total cash compensation for Robert Cavnar (Chairman,

October 22, 2003

Mission Resources Corp.

Page 2

Energy: Exploration & Production

High Yield Research

President & CEO) and Richard Piacenti (CFO) was approximately $132k and $68k, respectively, or $200k in aggregate. The following highlight management's accomplishments since late 2002 and evidence their ability to build a successful E&P company: Successfully executed debt repurchase in March 2003 Established new $12.5 mm Revolver in June 2003, improving liquidity to nearly $25 mm proforma for 2Q03, which we expect to decline to over $18 mm at the end of 3Q03 after payment of the Notes 10/1/03 coupon, Term Loan interest costs, and estimated CapEx Fended off a NASDAQ delisting in June 2003. Sale of the high unit cost East Texas properties at $0.90/MCFE in October 2003, a relatively attractive price, and inline with management's strategy to high-grade the Company's oil and gas assets (expected to close end of October) - it seems MSSN's properties in Federal offshore and the state water of the Gulf of Mexico (GOM) will be next Excellent YTD drilling results - the most notable being the LeBlanc well in Louisiana, which we expect to produce at 9.4 MMCFE per day net to MSSN's estimated 52% net revenue interest in the first year, and add 9.8 BCFE (net) at a $0.32/MCFE F&D cost The E. Texas sale combined with new production from the 2003 drilling program should improve the Company's production mix from approximately 39% natural gas in 2Q03 to approximately 50% gas by the end of the year Results continue to exceed production and EBITDA guidance - 2Q03 production came in at 61.7 MMCFE per day compared to the Company's 55-60 MMCFE per day guidance

October 22, 2003

Mission Resources Corp.

Page 3

Energy: Exploration & Production

High Yield Research

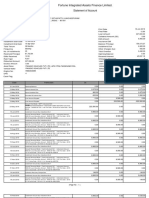

Capital Structure

At 6/30/03, Mission's debt totaled $207 mm, consisting of $80 mm of Sr. Secured Term Loan outstanding under its Senior Secured Facility, and $127 mm of 10.875% Sr. Sub. Notes '07. During 2Q03, the Company established a $12.5 mm Revolver with Foothill Capital Corp. (Prime+50 bps, subject to minimum 4.75% annual rate), which we expect remains undrawn at the close of 3Q03.

Interest Costs The Sr. Sub. Notes' next semi-annual coupon payment is 4/1/04 in the amount of $6.9 mm ($13.9 mm annually). The Company pays interest monthly on the Term Loan at 12% currently and is approximately $9.6 mm per annum based on the $80 mm outstanding at the end of 2Q03 - Mission's interest expense related to the Term Loan will increase in February 2004 by approximately $0.8 mm. In aggregate, the Company's total cash interest cost is approximately $24.4 mm per year, which will increase to $25.2 mm per year if the Company fails to restructure. Note Repurchase The Company originally issued $225 mm of 10.875s in two parts - $100 mm in April 1997 with an addon of $125 mm of the Notes with identical terms in May 2001. In March 2003, MSSN borrowed $80.0 mm in the form of a Term Loan under a secured credit facility (Facility) to acquire approximately $97.6 mm face amount of Notes, to pay accrued interest on the Notes purchased, and to pay closing costs. The highlights of the Term Loan are as follows: Led by Farallon Capital Management (Farallon Energy Lending, LLC) $75 mm funded bond purchase and associated closing costs Borrow Base: $80 mm (fully drawn) Maturity: 1/6/05 (21 months) Rate: Initial 12%, 13% after 2/16/04 Additional $10 mm available at lenders' discretion for additional Note repurchases Allowed MSSN to put up to $12.5 mm Revolver with 3rd party In the Note repurchase, the Company: Paid $71.7 mm (73% of face value) plus accrued interest Reduced the face amount of Notes outstanding to $127.4 mm Captured almost $26 mm of value through bond repurchase New Credit Facility In June 2003, the Company amended the Facility to add a revolving credit facility (Revolver) of up to $12.5 mm, including a letter of credit sub-facility of up to $3.0 mm. The Facility, which includes the Term Loan and Revolver, is secured by a lien on substantially all of the Company's property and the property of all of the Company's subsidiaries, including a lien on at least 90% of their respective oil and gas properties and a pledge of the capital stock of all the subsidiaries.

October 22, 2003

Mission Resources Corp.

Page 4

Energy: Exploration & Production

High Yield Research

The Term Loan matures 1/6/05 and the Revolver 6/6/06. However, if the maturity of the Term Loan is not extended to at least 30-days after the Revolver's maturity date, the maturity date of the Revolver will accelerate to 12/6/04 and (ii) 30-days prior to the xxxxxxxxxxxxxxxxxxxxxxxx. New Credit Facility Covenants Exploration CapEx during any fiscal year shall not exceed $15.0 mm CapEx not spent in 2003 may be carried forward to 2004

October 22, 2003

Mission Resources Corp.

Page 5

Energy: Exploration & Production

High Yield Research

Net Asset Value (NAV)

We believe that the current market prices E&P equities using NYMEX prices of $27.25/Bbl and $4.80/Mcf - representative of our high case scenario in the below table, to which we assign a 67% probability. The Base and Low case scenarios apply more normalized commodity prices as indicated and are assigned a 27% and 7% probability, respectively. Pre-restructuring, our weighted average calculation or "Expected" scenario points to a $1.70 per share NAV and a 147% P/NAV. In comparison, the High case results in a $2.36 share price and more inline with today's stock price (112% P/NAV) - and in the Low case we don't believe the current capital structure lends any value to existing shareholders. The restructuring, however, provides existing shareholders with almost $32 mm of equity value or $0.67 per share in the Low case scenario and is expected to be 6% accretive overall. On the upside, post-restructuring in the Base case is 52% accretive. The only downside to existing shareholders postrestructuring on an NAV basis is in the High case scenario, which shows the deal would be 7% dilutive. We don't think the dilution is a factor due to the deal being accretive on an overall basis and creating share value in the base and low case scenarios. In the long-term, shareholders would also benefit from the estimated $10 mm in annual interest cost savings the Noteholders would forego - the Company would be able to redeploy those funds toward its drilling and acquisition program in an effort to grow the Company. The deal may also serve as a segue to a merger or acquisition, whereby MSSN becomes part of a larger, more efficient E&P platform. Post-restructuring, we are confident that the Company would generate equity interest due to its larger market capitalization, increasing to an estimated $115 mm from its current $62 mm. Plus, the stock will be more liquid. We also expect that the stock would perform well post-restructuring due to the Company's ability to high-grade its reserve base through its drilling and divestiture effort. We also expect the Company's 3Q03 will come in at the high-end of guidance with 4Q03 guidance that shows a upward production trend.

October 22, 2003

Mission Resources Corp.

Page 6

Energy: Exploration & Production

High Yield Research

Proved Reserves

At December 31, 2002, Mission's total proved reserves were 229.1 BCFE or 38.2 MMBOE, as engineered by Netherland, Sewell & Associates (NSA), with the majority of reserves in the Gulf Coast (33% of total, 55% natural gas) and the Permian Basin (36% of total, 20% natural gas). Missions proved reserves were 36% natural gas, 77% developed, and based on the Companys most recent quarters production rate of 61.7 MMCFE per day, maintained a 10.2-year reserve life - based on our internal 6/30/03 reserve estimate, the reserve life declines to 9.0-years. Of note, management stated in its 2Q03 conference call that Mission's reserves will be calculated by Noble & Tool and Associates at year-end 2003, a change from NSA.

Oil & Gas Price Differentials The Company's realized price for natural gas has averaged $0.15/Mcf less than the NYMEX price over the twelve months ended 6/30/02. The Company's realized price for oil has averaged $0.61/Bbl less than the NYMEX price over the same period. Realized prices differ from NYMEX due to factors such as the location of the property, the heating content of natural gas and the quality of oil. Proforma Reserves In 1H03, we estimate the Company allocated approximately 83% or $12.9 mm to its drilling effort and added 18.4 BCFE during the period. This reserve estimate is based on (i) an expected 9.8 BCFE addition from the LeBlanc well at a net cost of $3.1 mm ($0.32/MCFE F&D cost); and (ii) an assumed $1.14/MCFE F&D applied to the estimated $9.9 mm balance of the Company's drilling activities. The overall F&D cost is, therefore, $0.70/MCFE for 1H03. The estimated reserve additions indicate a 163% reserve replacement ratio after accounting for 11.3 BCFE of 1H03 production and would represent a 3% increase in proved reserves to nearly 236 BCFE at mid-year 2003 from the 229 BCFE reported at 12/31/02. The Company, however, also announced the sale of E. Texas oil properties, estimated to be 4 MMBOE or 24 BCFE. After accounting for this sale and the 10 BCFE sale associated with the of the Point Pedernales field, we expect reserves would be approximately 202 BCFE at 6/30/03, representing a 12% decline from the year-end 2002 figure.

October 22, 2003

Mission Resources Corp.

Page 7

Energy: Exploration & Production

High Yield Research

High-Grade Strategy In 1H03, we estimate the Company allocated approximately 83% or $12.9 mm to its drilling effort and added 18.4 BCFE during the period. This reserve estimate is based on (i) an expected 9.8 BCFE The value of these reserves, however, Not all reserves are created equal, and as such, in MSSN's goal to transform the Company form oil to natural gas, we believe that even if the company only replaces production through its 2003 drilling program, the value per unit of proved reserve becomes more valuable, whereby the oil and gas value per MCFE may increase from its current $0.83/MCFE to above $1.00/MCFE. Such action would add $38 mm in asset value or almost 30 bond points, without altering the proved reserve value.

October 22, 2003

Mission Resources Corp.

Page 8

Energy: Exploration & Production

High Yield Research

Estimated Recoveries

In 1H03, we estimate the Company allocated approximately 83% or $12.9 mm to its drilling effort and added 8.4 BCFE during the period. This reserve estimate is based on (i) an expected 9.8 BCFE The stock currently trades at 114% of NAV (high case). Assuming a similar premium, we would expect the stock to trade at $2.46, representing just under $120 mm marketcap company, a similar marketcap to such E&P companies as ATP Oil & Gas (ATP), Carrizo Oil & Gas (CRZO), Clayton Williams Energy (CWEI), North Coast Energy (NCEB), and Wiser Oil (WZR). Equally weighting the three scenarios (low, base, and high) indicates that the deal would be 49% accretive to the Company's NAV. The most measurable increase is in the base case scenario, increasing to $1.53 per share from $1.10 per share or 39%. The low scenario is also important to consider in that such a transaction creates equity value for existing shareholders, altering the NAV from negative to $0.62 per share. Although the high scenario is13% dilutive, this "cost" is minimal relative to the value that the deal creates for existing shareholders and may be irrelevant in the equity market due to MSSN's enhanced financial flexibility to grow the Company's reserves with the $10 mm in annual interest cost savings that the Noteholders are foregoing. Additionally, Restructuring as outlined herein would provide more liquid stock with larger MarketCap We also expect that the New 9% Sr. Sec. Nts would trade up to yield 8.25% (+75 bps for Security), implying a 102.5 price.

October 22, 2003

Mission Resources Corp.

Page 9

Energy: Exploration & Production

High Yield Research

Valuation

Asset Value The valuation method we employed for Mission is a blend of hard asset and cash flow analysis. Our expected value for MSSN's 12/31/02 proved reserves is $240 mm ($1.10/MCFE). At 9/30/03, we believe the oil and gas reserve value is $224 mm after applying the same unit value to our 204 BCFE reserve estimate, and $248 mm including proforma working capital. Our cash flow valuation is based on $42.9 mm LTM EBITDA and a 5.3x EV/EBITDA multiple, equating to a $227 enterprise value which when after including proforma working capital totals $251 mm. The average of the asset and cash flow valuations is $250 mm (Expected Asset Value).

The oil and gas reserve value represents an internal market value, based on NYMEX prices of $22.00$27.25/Bbl and $3.50-$4.80/Mcf, according the scenario as indicated - the weighted averages are $26.30/Bbl and $4.57/Mcf. The realized prices applied incorporate price differentials of -$0.61/Bbl and -$0.15/Mcf, representing the LTM averages. In addition, we risk the proved developed and proved undeveloped reserves at a 97% and 80% success rate, respectively.

October 22, 2003

Mission Resources Corp.

Page 10

Energy: Exploration & Production

High Yield Research

Reserve Value Sensitivity For the commodity bulls and bears, we also provide sensitivity tables of Mission's oil and gas reserve value per below. We recognize that our NYMEX prices, even in the high case scenario, are conservative when compared to today's 12-month strip prices of $28.15/Bbl and $4.94/Mcf. We estimate, however, that buyers of oil and gas assets utilize the 5-year forward curve, representative of our High case scenario, which applies NYMEX prices of $27.25/Bbl and $4.80/Mcf.

October 22, 2003

Mission Resources Corp.

Page 11

Energy: Exploration & Production

High Yield Research

Asset Coverage The Expected $250 mm total asset value provides 133% asset coverage or almost $170 mm of value to the $127 mm of Notes outstanding after $80 mm of secured debt. Asset coverage increases to 143% based on NYMEX prices of $27.25/Bbl and $4.80/Mcf applied to our High case scenario, which increases to over 160% using today's 12-Month strip prices.

October 22, 2003

Mission Resources Corp.

Page 12

Energy: Exploration & Production

High Yield Research

Debt Exchange

We anticipate that in a debt exchange, Noteholders would receive (i) $80 mm in new debt conducted through a new $160 mm new 9% Senior Secured Note offering; and (ii) 50% of the Company's common shares. The New Notes and existing Revolver would be the only debt outstanding at Mission post this exchange. We based the amount of the new bond issue targeting a 3x net debt leverage and 3x interest coverage, while limiting Net Debt/Proved Developed to below $0.95/MCFE. Magnum Hunter's Sr. Notes appear to be the most comparable bond issue of the group with slightly higher leverage, albeit better interest coverage. Of course we recognize that MHR's market capitalization is four times that of MSSN on a post restructuring basis. However, MHR's bond issue is unsecured compared to our expectation of a secured note for Mission. , while simultaneously being ___% accretive to current shareholders. The Company would be required to raise an $160 mm of New Notes in aggregate in order to repay the existing $80 mm outstanding under the existing Sr. Secured Term Loan. We envision, however, that the New Notes and existing Revolver would be the only debt outstanding at Mission post this exchange. Such a deal would benefit both current shareholders and Noteholders in the long-term as we expect E&P consolidation to continue and as such, a successful restructuring serves as a segue to a merger or acquisition whereby MSSN becomes part of a larger platform.

October 22, 2003

Mission Resources Corp.

Page 13

Energy: Exploration & Production

High Yield Research

Credit Statistics We believe MSSN could adequately support up to $160 mm of 9% Senior Secured Debt, for which the credit statistics would be as follows: $0.91/MCFE in debt per proved developed reserve unit, 3.0x leverage, and 3.7x interest coverage. The Company's weighted cost of capital would decline to below 9% (dependent on any Revolver drawn). Simultaneously, total debt would be reduced by over $47 mm and cash interest expense would plummet almost 40% or nearly $10 mm per year to $14.4 mm from $23.5 mm.

Debt Comparables The below high yield comparable analysis indicates that the median for E&P companies with similar statistics is 637 bps. Conveniently, this spread-to-treasuries translates into a 9.0% yield for a 4-year note. We believe that a newly issued, second lien E&P Notes would most likely trade up upon issuance based on its Sr. Secured position and decent amount of public equity value. The Company would most likely retain its existing $12.5 mm working capital facility and possible request and receive approval for up a total $20 mm carve-out in place to replace the working capital facility. If an additionally $20 mm in first lien debt were fully drawn, the additional debt capacity would increase the debt per proved developed reserve to $1.02/MCFE, increase leverage to 4.2x leverage, and cause interest coverage to decline to 2.6x. We trust, however, that certain milestones would be required to draw any available debt beyond the existing $12.5 mm.

October 22, 2003

Mission Resources Corp.

Page 14

Energy: Exploration & Production

High Yield Research

October 22, 2003

Mission Resources Corp.

Page 15

Energy: Exploration & Production

High Yield Research

Asset Sales in 2003

Point Pedernales In March 2003, the Company sold its interests in the Point Pedernales field to Nuevo Energy (NEV), the operator of the property. This transaction divested Mission of all California properties; however, MSSN retained the option to participate in future drilling at Tranquillion Ridge. The Company paid $1.8 million to the purchaser, who in turn assumed the Company's environmental, plugging and abandonment (P&A) liabilities, estimated to be between $3 million and $5 million. Point Pedernales produced approximately 1,000 Barrels of oil per day (6 MMCFE per day) with lease operating expenses (LOE) averaging $10.00/BOE ($1.67/MCFE), subject to a $9.00/BOE price cap. The field, therefore, represented a negative future value excluding the associated P&A liabilities. East Texas On 10/1/03, Mission Resources announced that it singed a definitive agreement to sell all of its East Texas assets to Danmark Energy for $21.5 million and expected to close in October. Highlights are as follows: All of the properties are in the East Texas Field, a mature oil field with relatively high unit operating costs LOE (including taxes) related to the asset sold was $13.35/BOE or $2.22/MCFE; as a result of the asset sale, the Company's overall LOE including taxes should decline to $11.09/MCFE or $1.85/MCFE, still high when compared to $1.13/MCFE for the high yield group in 2Q03 Deal equates to $5.38/BOE or $0.90/MCFE based on the estimated 4.0 MMBOE Production related to properties being sold is 1,150 Bbls/Day or 6.9 MMCFE/Day (11.2% of MSSN's 2Q03 production) Deal increases Company's liquidity to $44-45 mm from $24 mm ($12 mm cash @ 6/03 plus $12 mm avail. under WorkCap Facility) Company plans to use cash from asset sale to acquire Gulf Coast properties Sale and new production coming online will improve MSSN's production mix from 39% to 50% natgas by year-end Combination of property acquisition enhances MSSN's goal of shifting from high unit cost oil properties to low unit cost natgas properties We estimate the Company will generate $19 million in net proceeds after fees and adjustments related to the August 1, 2003 effective date. Assuming that MSSN's new production comes online at $0.80/MCFE due to its natgas composition, we estimate the Company's overall LOE (including production taxes) would decline to $_____/MCFE or more than 5% below the 2Q03 level. Potential Acquisitions We estimate that the Company could purchase natural gas properties at $1.75/MCFE and that the Company could afford a $25 million acquisition. This would equate to 14 BCFE size acquisition and increase estimated mid-year 2003 reserves from 207 to 221 BCFE.

October 22, 2003

Mission Resources Corp.

Page 16

Energy: Exploration & Production

High Yield Research

Drilling Update

MSSN will participate in drilling 13 (4.7 net) wells during 2003, 6 of which were located in the gas-prone Miocene trend of southern Louisiana and evenly split betweet exploratory and development projects. The remaining seve ninclude 2 Wilcox exploratory wells in central Texas, a high potential prospect in the South Texas Vicksburg trend, a development well in the Raccoon Bend field and 3 wells in the offshore Louisiana shelf (2 of which the Company has a minor interest). Completing Wells Phillip LeBlanc #1 (Vermillion Parish, Louisiana). We estimate that the LeBlanc well respresents 18.8 BCFE gross or 9.8 BCFE net to MSSN (based on estimated 52% NRI). This reserve figure is based on a 4-year reserve life and 15% average decline rate. This well is primarily natgas and designed as a dual completion allowing for simultaneous production from two zones (Camerina 2 and the Marg Howei). First production is expected during October at an anticipated initial gross rate of 10-20 MMCf per day (up from 5-15 MMcf in 2Q03 press release) and we understand from industry sources that the production rate will most likely be at top end of this range - for the analysis we assume an initial rate of 18 MMcf. MSSN holds a 77% working interest in the Marg Howei zone and a 68% working interest in the Camerina zone. We estimate that the net weighted average working interest in the LeBlanc #1 is 75% and 69% on a net interest basis. CapEx allocated to this well is $----- mm (gross) and $___ net to MSSN, indicating a $____/MCFE finding and development (F&D) cost. ____ is operator. The Bluntzer #1 (Goliad County, Texas). This well was drilled to a total depth of almost 16,000 feet and production casing has been set for completion testing of the Lower and Middle Wilcox indicated natgas zones. Testing of this well, in which MSSN holds a 20% working interest (increased from 20% in 2Q03 press release), will begin in late October. ____ is operator. Black Stone #1 (Hidalgo County, Texas). MSSN owns a 30% working interest in this well, which has drilled to a total depth of 18,500 feet to test Vicksburg objectives. The well has been perforated and fracture stimulated, and is being prepared to flow back. ____ is operator.

Drilling Wells Davis #26-3 well (Cameron Parish, Louisiana). This well has a 15,000 foot target in the Abbeville 2 sand as the primary objective with secondary potential in the Abbeville la sand. Mission operates this well and holds a 50% working interest to casing point and a 57% working interest thereafter. The Company reported the well was drilling at 11,900 feet in early October and we, therefore, expect results will be available by MSSN's 3Q03 earnings release. JL&S Well #146 (St. Martin Parish, Louisiana). Mission is operator of this West Lake Verret development well, reported to be at 4,000 feet in early October toward its 7,900 foot target. We would expect to learn the result of this well, which will test the Micocene age "N", "O" and "Q" sands, by the 3Q03 earnings release.

Wells to Begin Drilling A-11/C-5 Wells (South Marsh Island, Block 142). Mission is participating in two wells in this offshore Gulf of Mexico block. The A-11 well is scheduled to spud later this month and will be drilled to 9,340 feet to test multiple natgas objectives. The C-4 well will be drilled in late October to 9,300 feet to test multiple gas zones. MSSN holds a 31% working interest in each of these wells. ____ is operator.

October 22, 2003

Mission Resources Corp.

Page 17

Energy: Exploration & Production

High Yield Research

Quarter Highlights

EBITDAX: 2Q03 adjusted EBITDAX was $____ mm and $___ mm on an LTM basis (after a negative $3.3 mm and $17.2 mm adjustment for cash losses from hedging activities in the 1Q03 and LTM period, respectively) - excluding the hedge losses for the LTM period, WZR would have reported almost $60 mm of EBITDAX. The quarter's adjusted EBITDAX improved 8% from $13.4 mm ($6.6 mm negative adjustment for cash losses from hedging activities) in the prior quarter and improved 81% from $8.0 mm (negative $2.4 mm adjustment) in the year-ago period. The sequential and year-over-year improvement is due to increased production, lower unit costs, and reduced hedge losses. As the below table indicates, we expect quarterly EBITDAX to increase in 2H03 due to the expiration of out-of-the-money hedge contracts and estimate $58 mm and $59 mm of EBITDAX in 2003 and 2004, respectively.

Credit Statistics: 2Q03 adjusted EBITDAX covered cash interest expense 3.9x (2.8x LTM), while total debt to annualized 2Q03 EBITDAX was 2.7x (3.7x LTM). The Company should be able to reduce debt an additional $6-8 mm by year-end 2004 ($2 mm in 2H03 and $2-$4 mm in 2004) and further improve the Company's credit statistics.

Production: 2Q03 production totaled 6.4 BCFE or 69.9 MMCFE per day (56% natural gas) and beat guidance of 67.7 MMCFE per day (MMCFEpd). This quarter's production was up an impressive 11% from 62.9 MMCFEpd (53% natural gas) in the prior quarter and up 9% from last year's 64.0 MMCFEpd (52% natural gas). Management mentioned in its conference call that current production is approximately 66-67 MMCFEpd, although down from 2Q03, remains slightly above WZR's 2H03 production guidance of 65.3 MMCFEpd. The Company noted that the Gulf of Mexico wells are producing 11 MMCFEpd net or approximately 17% of the Companys overall production.

Wild River Discovery: The new Wild River well in Alberta, Canada, tested at rate of up to 14 MMCFEpd gross and in the Companys 2Q03 conference call, management noted that they expect production to come online at 20 MMCFEpd gross in December 2003 or approximately 8 MMCFEpd net to WZR's 50% WI and after royalties (WZR is the operator). Management stated that 2 to 3 wells would be required to drain the reservoir and that, in response to the discovery and other wells in the area that are not yet online, the Company is sizing natural gas production facilities to handle 40 MMCFEpd. At a $4.50/MCFE NYMEX price ($3.50/MCFE realized), conservative compared to the current $5.14/Mcf 12-month strip, this discovery would add over $7 mm of incremental EBITDAX net to WZR excluding any other success in the area. West Cameron 488 Discovery: Wiser announced the discovery of West Cameron 288 #1, located 100 miles offshore Louisiana in 125 feet of water, in which WZR owns a 25% working interest. This well was drilled to 9,250 feet and encountered 56 feet of net gas pay. The well was not flow tested and has been temporarily abandoned while platform facilities and pipeline are installed. The Company expects production in 1H04.

October 22, 2003

Mission Resources Corp.

Page 18

Energy: Exploration & Production

High Yield Research

West Cameron 428 #1: The West Cameron 428 #1 well went online 7/31/03 at a rate of 10.5 MMCFEpd or 2.6 MMCFEpd net to WZRs 25% working interest. Unit Costs: Average 2Q03 Lease Operating Expenses (LOE), including production taxes, declined 21% to $1.16/MCFE from $1.47/MCFE in the prior quarter. Although this is a 5% increase from last year's $1.10/MCFE, it is not comparable since last year's quarter benefited from lower production taxes as a result of softer oil and gas prices. The sequential decline in LOE is attributable primarily to Wellman CO2 sales, which began May 14, 2003 and are reported as a reduction of LOE. Overall, unit costs declined 14% sequentially to $2.14/MCFE from $2.50/MCFE in 1Q03 and remained flat with the year-ago quarter. The Company expects LOE (including production taxes) to increase 7% in the second half of 2003 as a result of lower production when compared to the Company's record 2Q03 production rate. G&A, however, should decline almost 8% to $0.37/MCFE and allow the Company to keep total unit costs below $2.20/MCFE.

October 22, 2003

Mission Resources Corp.

Page 19

Energy: Exploration & Production

High Yield Research

CapEx

Mission's 2003 exploration and development CapEx budget is $32 mm, up from the previous year's $21 mm. 2Q03 and 1H03 CapEx totaled $6.5 mm and $15.6 mm, respectively, implying a $16.9 mm 2H03 CapEx budget. Of the annual budget, approximately 65% or $23-$25 mm is to be allocated to Canadian activities with the balance targeted for US properties. The increase includes the Companys new Buick Creek exploration project in Canada and its Wild River development project in Alberta, Canada. Additional CapEx was also approved for the Companys Gulf of Mexico activities. In its conference call, management indicated that the revised CapEx budget would be allocated as follows: 30%-35% to exploration, 60-65% for development projects, and 5% toward seismic, land and other capital uses. The majority of the development capital has been spent in the Permian Basin and the onshore Gulf Coast regions.

October 22, 2003

Mission Resources Corp.

Page 20

Energy: Exploration & Production

High Yield Research

Liquidity

As a result of its new Revolver received in June 2003, MSSN's total liquidity stood at almost $25 mm at the end of 2Q03 with full availability under the Revolver. Including an expected $19 mm in net proceeds from the recently announced E. Texas property sale, we estimate liquidity was close to $55 mm with the inclusion of $11.3 mm for 3Q03E EBITDA. We expect the Company's "uses" during 3Q03 to total an estimated $18 mm so that the Company closes 3Q03 with $44 mm of liquidity and just over $37 mm post its 10/1/03 coupon payment on the 10.875s.

October 22, 2003

Mission Resources Corp.

Page 21

Energy: Exploration & Production

High Yield Research

Hedge Contracts

Based on the Company's 2Q03 production and as of 8/12/03, MSSN had 60% and 49% of its 2H03 and 2004 oil production (all swaps), respectively, hedged at $23.77/Bbl and $24.55/Bbl. The Company also had 58% and 19% of natural gas hedged (using collars), respectively, at $4.32/Mcf and $4.42/Mcf for the same periods. Additionally, a small portion of 2005 natural gas production (3%) is also hedged at $4.91/Mcf using collars with a $4.25/Mcf floor. Overall, Mission hedge portfolio 59% of 2H03 production at $4.11/MCFE, 34% of 2004 production at $4.24/MCFE and 3% of 2005 production at $4.91/MCFE. We estimate the value of the hedge contracts is $4.5 mm , ($1.6 mm), and ($7.0 mm) in the low ($22.00/$3.50), base ($25.00/$4.25), and high case ($27.25/$4.80) scenarios, respectively.

October 22, 2003

Mission Resources Corp.

Page 22

Energy: Exploration & Production

High Yield Research

October 22, 2003

Mission Resources Corp.

Page 23

Energy: Exploration & Production

High Yield Research

2001 Jefferies & Company, Inc. All rights reserved.

I, Greg Imbruce, certify that all of the views expressed in this research report accurately reflect my personal views about the subject security(ies) and subject company(ies). I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report.

This material has been prepared by Jefferies & Company, Inc. ("Jefferies") a U.S.-registered broker-dealer, employing appropriate expertise, and in the belief that it is fair and not misleading. It is approved for distribution in the United Kingdom by Jefferies International Limited ("JIL") regulated by the Financial Services Authority ("FSA"). The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore except for any obligations under the rules of the FSA, we do not guarantee its accuracy. Additional and supporting information is available upon request. This is not an offer or solicitation of an offer to buy or sell any security or investment. Any opinion or estimates constitute our best judgment as of this date, and are subject to change without notice. Jefferies and JIL and their affiliates and their respective directors, officers and employees may buy or sell securities mentioned herein as agent or principal for their own account. This material is intended for use only by professional or institutional investors falling within articles 19 or 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001and not the general investing public. None of the investments or investment services mentioned or described herein are available to other persons in the U.K. and in particular are not available to "private customers" as defined by the rules of the FSA or to anyone in Canada who is not a "Designated Institution" as defined by the Securities Act (Ontario)."

October 22, 2003

Mission Resources Corp.

Page 24

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- Solutions To Derivative Markets 3ed by McDonaldDocument28 pagesSolutions To Derivative Markets 3ed by McDonaldRiskiBiz13% (8)

- The California Fire Chronicles First EditionDocument109 pagesThe California Fire Chronicles First EditioneskawitzNo ratings yet

- Core Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvDocument16 pagesCore Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvSandip NandyNo ratings yet

- F2 Exam Kit BPP PDFDocument192 pagesF2 Exam Kit BPP PDFHasan50% (2)

- BBCF4023 - MTDocument5 pagesBBCF4023 - MTbroken swordNo ratings yet

- ValueMax IPO (Clean)Document379 pagesValueMax IPO (Clean)Invest StockNo ratings yet

- MMM Made SimpleDocument30 pagesMMM Made Simplecrazy fudgerNo ratings yet

- Sriphala Carbons FinancialsDocument16 pagesSriphala Carbons Financials8442No ratings yet

- AarthiDocument15 pagesAarthiilkdkNo ratings yet

- Ismatullah Butt: Curriculum VitaeDocument4 pagesIsmatullah Butt: Curriculum VitaebuttismatNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- Dignos V Court of AppealsDocument7 pagesDignos V Court of AppealsJoshua ParilNo ratings yet

- Moody's - PBC - 79004Document46 pagesMoody's - PBC - 79004Umut UzunNo ratings yet

- Central Textile Mills V National Wages CommissionDocument2 pagesCentral Textile Mills V National Wages CommissionPatrick ManaloNo ratings yet

- Solutions For Non-Constant Growth Stock ValuationsDocument2 pagesSolutions For Non-Constant Growth Stock ValuationsNguyễn Bá Khánh TùngNo ratings yet

- Abakada v. ErmitaDocument351 pagesAbakada v. ErmitaJm CruzNo ratings yet

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument5 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDivyanshu ShekharNo ratings yet

- Definition of A ChequeDocument2 pagesDefinition of A Chequeashutoshkumar31311No ratings yet

- Topic No 2Document2 pagesTopic No 2javeria nazNo ratings yet

- Chapter 20 - Shareholder's EquityDocument9 pagesChapter 20 - Shareholder's EquityLiana LopezNo ratings yet

- Role of PAODocument29 pagesRole of PAOAjay DhokeNo ratings yet

- SEC Vs BalwaniDocument23 pagesSEC Vs BalwaniCNBC.comNo ratings yet

- UK House of Lords & Commons Changing Banking For Good Final-report-Vol-IIDocument503 pagesUK House of Lords & Commons Changing Banking For Good Final-report-Vol-IICrowdfundInsiderNo ratings yet

- Rudy Wong Case Analysis of Investment DecisionsDocument7 pagesRudy Wong Case Analysis of Investment DecisionsJuan Camilo Ninco CardenasNo ratings yet

- Introduction to Climate Finance Economics of Climate Change Adaptation Training ProgrammeDocument78 pagesIntroduction to Climate Finance Economics of Climate Change Adaptation Training Programmeadinsmaradhana100% (1)

- Chapter 5 - Sources of CapitalDocument42 pagesChapter 5 - Sources of CapitalLIEW YU LIANGNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- Audit:2auditing Unit 2Document31 pagesAudit:2auditing Unit 2Lalatendu MishraNo ratings yet

- Agile Consultancy ServicesDocument7 pagesAgile Consultancy ServicesAnkit JainNo ratings yet