Professional Documents

Culture Documents

Talking Point - Response To S. Ritter Correspondence

Uploaded by

My-Acts Of-SeditionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Talking Point - Response To S. Ritter Correspondence

Uploaded by

My-Acts Of-SeditionCopyright:

Available Formats

CITY OF LAUDERDALE LAKES TALKING POINTS January 29, 2013 The following correspondence addresses concerns outlined in a letter

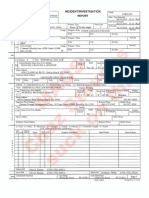

written by County Commissioner Stacy Ritter. Citys Use of CRA funds In 2010, the City utilized CRA funds in excess of $2.5 Million without proper approval by the Community Redevelopment Agency (CRA) and in conflict with Florida Statute (FS) Chapter 163. In 2011, this issue was investigated through an independent CRA Forensic Audit that was requested by the CRA Board of Directors. In 2011, the issue was also investigated further by the Broward County Office of the Inspector General (OIG). According to the OIG Report, there were three City employees who played a possible role in the documented improper utilization of CRA funds all of whom were no longer employed by the City at the time the report findings were finalized and released. In response, a repayment agreement (i.e. Forbearance Agreement) between the City and CRA was prepared and executed to ensure that the City would repay the CRA for all funds due. The City and CRA acted and initiated corrective actions for all the major findings listed in the independent CRA Forensic Audit and the OIG Report.

City/CRA Forbearance Agreement Prior to the completion of the OIG report, the City and CRA negotiated, approved and executed a binding Forbearance Agreement under which the City will, over time, repay the CRA all monies owed to the agency. The repayment of funds by the City to the CRA will ensure that the CRA and Broward County residents receive the benefits intended under the CRA plan through the utilization of these funds for approved CRA activities in the future. All actions taken by both the City and the CRA in investigating/documenting/reporting and structuring the Forbearance Agreement were initiated with public notice and with proper published agendas and recorded minutes of all proceedings.

Rollover of Funds and Waiver of Interest The CRA, in accordance with FS 163 Part III, properly adopts annual budgets, including the re-appropriation of prior year fund balance amounts, and follows all required standards for the reallocation of CRA funds remaining unspent at the close of each Fiscal Year. Waivers of interest amounts due have not taken place although the Forbearance Agreement is structured and was properly approved and executed to require principal payments only. The CRA Board has, in accordance with FS 163, approved the waiver of late payment penalties in relation to receiving the annual CRA Tax Increment Fund (TIF) payment from the City after the required payment due date of January 1st. This is proper conduct for a CRA and the approval was provided at a noticed public meeting as well.

Fund Balance Annually, the CRA adopts a budget that re-allocates unspent prior year CRA funds (Including re-appropriation of annual fund balances) in accordance with Florida Statute 163. CRA line item budget entries are approved for specified eligible activities. The reported failure on the part of the CRA to properly re-appropriate fund balances is not accurate. We do not, based upon our budget adoption process and the structure of the adopted budget as published, believe that the appropriation of CRA resources has been done improperly and certainly. We do not believe that any sort of refund would be due to the paying agencies including Broward County based upon the facts presented herein.

Financial Irresponsibility and Mismanagement The documented actions undertaken by prior City Staff relative to the improper utilization of CRA funds by the City have been thoroughly documented and reported to the proper authorities. The current City Administration has taken great strides forward in addressing documented past financial mismanagement or conduct by developing the Forbearance Agreement. Both City and CRA staff provide current and fully transparent accountability for all fiscal processes. It is standard/adopted policy that staff provide regular (monthly) and comprehensive fiscal reporting to all interested parties including: Elected Officials, members of the community, Tax Increment Fund paying entities (such as Broward County) and our lenders who are, as they should be, on high alert for assurances of fiscal integrity and for documentation relative to the ongoing financial stabilization in the City of Lauderdale Lakes.

For more information, please contact the Office of the City Manager.

You might also like

- Maos Chaz Stevens Suck On This: L L L LDocument3 pagesMaos Chaz Stevens Suck On This: L L L LMy-Acts Of-SeditionNo ratings yet

- Sasser Decision - 022315Document7 pagesSasser Decision - 022315My-Acts Of-SeditionNo ratings yet

- Delrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMDocument1 pageDelrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMMy-Acts Of-SeditionNo ratings yet

- Chaz - Misuse Seal DonnellyDocument3 pagesChaz - Misuse Seal DonnellyMy-Acts Of-SeditionNo ratings yet

- Coddington - 106.071 - Sign - ElecCommDocument2 pagesCoddington - 106.071 - Sign - ElecCommMy-Acts Of-SeditionNo ratings yet

- RedactedDocument2 pagesRedactedMy-Acts Of-SeditionNo ratings yet

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- Waste ManagementDocument38 pagesWaste ManagementMy-Acts Of-SeditionNo ratings yet

- Maos Cease and Desist RobbDocument2 pagesMaos Cease and Desist RobbMy-Acts Of-SeditionNo ratings yet

- BinderDocument17 pagesBinderMy-Acts Of-SeditionNo ratings yet

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionNo ratings yet

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- Coffey Wheelbrator BullshitDocument1 pageCoffey Wheelbrator BullshitMy-Acts Of-SeditionNo ratings yet

- Suggestion of BankruptcyDocument5 pagesSuggestion of BankruptcyMy-Acts Of-SeditionNo ratings yet

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Document13 pagesCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNo ratings yet

- Binder 2Document12 pagesBinder 2My-Acts Of-SeditionNo ratings yet

- Unpaid LienDocument1 pageUnpaid LienMy-Acts Of-SeditionNo ratings yet

- H Inners SettlementDocument18 pagesH Inners SettlementMy-Acts Of-SeditionNo ratings yet

- Ron Gilinsky EvictionDocument4 pagesRon Gilinsky EvictionMy-Acts Of-SeditionNo ratings yet

- Gha Oig Letter 10 2014Document47 pagesGha Oig Letter 10 2014My-Acts Of-Sedition100% (1)

- Appeal Letter Purchasing AgentDocument7 pagesAppeal Letter Purchasing AgentMy-Acts Of-SeditionNo ratings yet

- Florida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539Document4 pagesFlorida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539My-Acts Of-SeditionNo ratings yet

- RE: Donation of Pabst Blue Ribbon Festivus PoleDocument1 pageRE: Donation of Pabst Blue Ribbon Festivus PoleMy-Acts Of-SeditionNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Downtown SLO Business Owners Ask City Council To Consider Parking ChangesDocument4 pagesDowntown SLO Business Owners Ask City Council To Consider Parking ChangesKaytlyn LeslieNo ratings yet

- Manuale捲板機Document96 pagesManuale捲板機Andy WuNo ratings yet

- UDM SYLLABUS Phil HistoDocument10 pagesUDM SYLLABUS Phil HistoJervis HularNo ratings yet

- Effectives of e Wallets NewDocument15 pagesEffectives of e Wallets NewRicardo SantosNo ratings yet

- Urban Square Design: Landscape Design Studio III LAR 803Document44 pagesUrban Square Design: Landscape Design Studio III LAR 803Peter DokpesiNo ratings yet

- Robot Structural Analysis 2017 Help - Push Over Analysis ParametersDocument3 pagesRobot Structural Analysis 2017 Help - Push Over Analysis ParametersJustin MusopoleNo ratings yet

- 1982 B47 Lehigh County Gunsmithing FamiliesDocument12 pages1982 B47 Lehigh County Gunsmithing FamiliesAmr DeabesNo ratings yet

- Entrep Module 4 Q1 Week 4 1Document14 pagesEntrep Module 4 Q1 Week 4 1VirplerryNo ratings yet

- Essentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions ManualDocument11 pagesEssentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions Manualjeffreyhayesagoisypdfm100% (13)

- Settlement Geography: Unit No-1&2Document11 pagesSettlement Geography: Unit No-1&2Arindam RoulNo ratings yet

- The Real World An Introduction To Sociology Test Bank SampleDocument28 pagesThe Real World An Introduction To Sociology Test Bank SampleMohamed M YusufNo ratings yet

- Enga10 Speaking Test3Document2 pagesEnga10 Speaking Test3luana serraNo ratings yet

- Allama Iqbal Open University, Islamabad: (Secondary Teacher Education Department) WarningDocument2 pagesAllama Iqbal Open University, Islamabad: (Secondary Teacher Education Department) WarningAiNa KhanNo ratings yet

- Ap Government Imperial PresidencyDocument2 pagesAp Government Imperial Presidencyapi-234443616No ratings yet

- Fluid Mechanics Formulas Nov 2021Document6 pagesFluid Mechanics Formulas Nov 2021Benjie MorenoNo ratings yet

- Lesson 4.2 - Operations On Modular ArithmeticDocument12 pagesLesson 4.2 - Operations On Modular ArithmeticMYLS SHRYNN ELEDANo ratings yet

- Satellite Motion NotesDocument23 pagesSatellite Motion NotesVarshLok100% (1)

- 20 Heirs of Alfredo Bautista VS LindoDocument3 pages20 Heirs of Alfredo Bautista VS LindoJerome LeañoNo ratings yet

- E5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LDocument24 pagesE5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LNelsonNo ratings yet

- L-M349 (L1b1a) Kenézy Ancestral JourneyDocument20 pagesL-M349 (L1b1a) Kenézy Ancestral JourneyGábor Balogh100% (2)

- IFRS Session 1 To 3Document40 pagesIFRS Session 1 To 3techna8No ratings yet

- Bearing Capacity of Closed and Open Ended Piles Installed in Loose Sand PDFDocument22 pagesBearing Capacity of Closed and Open Ended Piles Installed in Loose Sand PDFAnonymous 8KOUFYqNo ratings yet

- Chapter 1Document38 pagesChapter 1Kurt dela Torre100% (1)

- Method Statement Free Download: How To Do Installation of Suspended False CeilingsDocument3 pagesMethod Statement Free Download: How To Do Installation of Suspended False Ceilingsmozartjr22100% (1)

- University of Physician V CIRDocument24 pagesUniversity of Physician V CIROlivia JaneNo ratings yet

- Hazardous Location Division Listed LED Light: Model 191XLDocument2 pagesHazardous Location Division Listed LED Light: Model 191XLBernardo Damas EspinozaNo ratings yet

- The Magical Diaries of Ethel ArcherDocument7 pagesThe Magical Diaries of Ethel Archerleeghancock100% (1)

- The Biography of Hazrat Shah Qamaos Sahib in One PageDocument3 pagesThe Biography of Hazrat Shah Qamaos Sahib in One PageMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaNo ratings yet

- Arabic Unit 1 June 2011 Mark SchemeDocument9 pagesArabic Unit 1 June 2011 Mark SchemeGhaleb W. MihyarNo ratings yet

- UNIX Introduction 1Document18 pagesUNIX Introduction 1Akash SavaliyaNo ratings yet