Professional Documents

Culture Documents

Chap 006

Uploaded by

dbjnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 006

Uploaded by

dbjnCopyright:

Available Formats

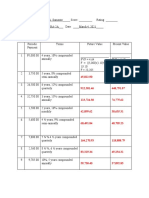

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 06-05

CLAUSSEN PURCHASE Estimated Cash Flows Yearly Cash Flow Years 1-5 $ 70,000 Years 6-10 70,000 265,355 Years 11-20 70,000 395,515 245,583 End of Year 20 400,000 Maximum Purchase Price * Use the Present and Future Value Tables in the text or enter the proper formula rounded to 5 decimal places Time Period 5 5 5 10 5 5 10 Interest Rate 8% 10% 8% 12% 10% 8% 12%

*Factor 3.99271 3.79079 0.68058 5.65022 0.62092 0.68058 0.32197

PVA 279,490 265,355 $ 395,515

PV

180,596 245,583 167,139 54,424

681,648

Correct!

Given Data P06-05: CLAUSSEN PURCHASE Anticipated cash flows per year for 20 years Selling price in 20 years Desired rate of return: Years 1-5 Years 6-10 Years 11-20 $ $ 70,000 400,000 8% 10% 12%

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 06-06 Part 1: JOHN JAMISON PV of $1 factor = 30,000 60,000 = 0.5 *

*Present value of $1: n=?, i=8% (from Table 2, n=approximately

Correct!

years)

Part 2: JASMINE TEA COMPANY Annuity factor = $28,700 $7,000 = 4.10000 *

Present value of an ordinary annuity of $1: n=5, i=? (from Table 4, i = approximately

Correct!

Part 3: SAM ROBINSON Annuity amount = $10,000 6.41766 =

*

$1,558

Correct!

Payment

Present value of an ordinary annuity of $1: n=10, i=9% (from Table 4)

%)

Given Data P06-06: Part 1: JOHN JAMISON Amount needed to accumulate Amount invested today Desired rate of return: Annually compounded interest Part 2: JASMINE TEA COMPANY Amount paid for merchandise Required annual payments Number of payments required Part 3: SAM ROBINSON Amount borrowed Number of installments Annual rate $ 10,000 10 9% $ $ 28,700 7,000 5 $ $ 60,000 30,000 8%

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 06-07 THE LOWLIFE COMPANY Calculations Time PVA Period 250,000 4 250,000 5 250,000 250,000 3 Interest Rate 10% 8% 10% Annuity *Factor 3.16987 3.99271 4.86845 2.40184 Annuity Amount

Part 1 Part 2 Part 3 Part 4

$ $ $ $

Calculation $ 78,868 Payment $ 62,614 Payment $ 51,351 7 Payments $ 104,087 12% Interest

* Use the Present and Future Value Tables in the text or enter the proper formula rounded to 5 decimal places

Given Data P06-07: LOWLIFE COMPANY Amount of loan Part 1: Interest rate Number of payments Part 2: Interest rate Number of payments Part 3: Interest rate Annual payment amount Part 4: Number of payments Annual payment amount $ 250,000 10% 4 8% 5 10% 51,351 3 104,087

Student Name: Instructor Class: McGraw-Hill/Irwin Problem 06-14 HORIZON DISTRIBUTING COMPANY Pension Obligations as of December 31, 2011 Requirement 1: Date of Annual First Employee Payment Payment Tinkers $ 20,000 12/31/2014 Evers $ 25,000 12/31/2015 Chance $ 30,000 12/31/2016 Time Periods 17 2 18 3 19 4 Interest Rate 11% 11% 11% *Deferred PV of Annuity Pension Factor Obligations 5.83627 $ 116,725 5.25791 $ 131,448 4.73684 $ 142,105

- Correct! - Correct! - Correct!

* Use the Present and Future Value Tables in the text or enter the proper formula rounded to 5 decimal places Pension Obligations as of December 31, 2014 Requirement 2: PV as of Employee 12/31/2011 Tinkers $ 116,725 Evers $ 131,448 Chance $ 142,105 Total present value Amount of annual contribution: Time Period 3 3 3 Interest Rate 11% 11% 11% *FV FV Annuity as of Factor 12/31/2014 1.36763 $ 159,637 1.36763 $ 179,772 1.36763 $ 194,347 $ 533,756 3.70970 $ 143,881

- Correct! - Correct! - Correct! - Correct! - Correct!

11%

* Use the Present and Future Value Tables in the text or enter the proper formula rounded to 5 decimal places

Given Data P06-14: HORIZON DISTRIBUTING COMPANY Life expectancy beyond retirement Interest rate Number of equal contributions 15 11% 3 Date of First Payment 12/31/2014 12/31/2015 12/31/2016

Employee Tinkers Evers Chance

$ $ $

Annual Payment 20,000 25,000 30,000

You might also like

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Chapter 6 - Excel SolutionsDocument8 pagesChapter 6 - Excel SolutionsHalt DougNo ratings yet

- Proposed Scranton Bailout - 08082012Document6 pagesProposed Scranton Bailout - 08082012gary6842No ratings yet

- SolutionsDocument30 pagesSolutionsNitesh AgrawalNo ratings yet

- Financial Math - TopicDocument24 pagesFinancial Math - TopicNiño Mark MoradaNo ratings yet

- Discounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinDocument48 pagesDiscounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinEnna rajpootNo ratings yet

- Chap 1 MathscapeDocument31 pagesChap 1 MathscapeHarry LiuNo ratings yet

- Assignment2 SolutionDocument5 pagesAssignment2 SolutionAnonymous dpWU6H5Lx2No ratings yet

- STARTDocument5 pagesSTARTJust LearnNo ratings yet

- CH 06Document80 pagesCH 06ชัยยศ โชติ100% (1)

- Bapp 01Document20 pagesBapp 01MaybellineTorresNo ratings yet

- Bill Baddorf W 915-3654: Dbaddorf@Ngu - EduDocument52 pagesBill Baddorf W 915-3654: Dbaddorf@Ngu - EdusaminaJanNo ratings yet

- Excel - Financial AnalysisDocument13 pagesExcel - Financial AnalysisHuge EarnNo ratings yet

- Chap 002Document26 pagesChap 002dbjnNo ratings yet

- Financial Management FM 1: Introduction & Time Value of MoneyDocument20 pagesFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNo ratings yet

- Chapter 5 Power PointDocument41 pagesChapter 5 Power PointannalacNo ratings yet

- 8 Simple InterestDocument44 pages8 Simple InterestalamagelyzaNo ratings yet

- Assignment1 SolutionDocument6 pagesAssignment1 SolutionAnonymous dpWU6H5Lx2No ratings yet

- ABM11 Business Mathematics Q1 W8Document12 pagesABM11 Business Mathematics Q1 W8Archimedes Arvie GarciaNo ratings yet

- 0 CFP Investment Cards (7!22!2007)Document467 pages0 CFP Investment Cards (7!22!2007)Arcely HernandoNo ratings yet

- Kieso 6Document54 pagesKieso 6noortiaNo ratings yet

- CH 06Document80 pagesCH 06SSadaffNo ratings yet

- AppcDocument47 pagesAppcdianNo ratings yet

- Engineering EconomyDocument15 pagesEngineering Economyjm1310% (1)

- FM CHAPTER 3 THREE. PPT SlidesDocument84 pagesFM CHAPTER 3 THREE. PPT SlidesAlayou TeferaNo ratings yet

- Chapter 6Document38 pagesChapter 6Baby KhorNo ratings yet

- Time Value of MoneyDocument23 pagesTime Value of MoneyJemiza FallesgonNo ratings yet

- AnnuityDocument3 pagesAnnuitySharina Mhyca SamonteNo ratings yet

- Liabilities: Appendix 0: Time Value of MoneyDocument20 pagesLiabilities: Appendix 0: Time Value of MoneySonali AgarwalNo ratings yet

- Brooks 3e PPT 05Document40 pagesBrooks 3e PPT 05Vy HoàngNo ratings yet

- PV and FV Assigned QuestionsDocument4 pagesPV and FV Assigned QuestionsYakub Ali SalimNo ratings yet

- Maths Test BookDocument689 pagesMaths Test BookAntrew B2No ratings yet

- Interest Rates SummaryDocument28 pagesInterest Rates SummaryMichael ArevaloNo ratings yet

- Tutorial 3. Understanding Yield Spreads. AnswersDocument8 pagesTutorial 3. Understanding Yield Spreads. Answersizzatulloh50% (2)

- Ch. 4 - The Time Value of MoneyDocument46 pagesCh. 4 - The Time Value of MoneyNeha BhayaniNo ratings yet

- Cafe Financial ModelDocument68 pagesCafe Financial ModelShankey Bafna100% (1)

- Math 100 ProjectDocument10 pagesMath 100 Projectapi-566489640No ratings yet

- General AnnuitiesDocument141 pagesGeneral AnnuitiesJuanito71% (7)

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Preview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument84 pagesPreview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldLong TranNo ratings yet

- Contemporary Financial Management 13th Edition Moyer Solutions Manual 1Document36 pagesContemporary Financial Management 13th Edition Moyer Solutions Manual 1thomasbuckley11072002asg100% (25)

- COMM 229 Notes Chapter 1Document3 pagesCOMM 229 Notes Chapter 1Cody ClinkardNo ratings yet

- Chap006 Formulas AmendedDocument55 pagesChap006 Formulas AmendedSchizophrenic RakibNo ratings yet

- Time Value of MoneyDocument60 pagesTime Value of MoneyAtta MohammadNo ratings yet

- IPPTChap 005Document87 pagesIPPTChap 005Mehdi RachdiNo ratings yet

- Ch16 Tool KitDocument18 pagesCh16 Tool Kitjst4funNo ratings yet

- MOPDocument56 pagesMOPvenkatgouthamNo ratings yet

- CH 3 - Understanding Money ManagementDocument32 pagesCH 3 - Understanding Money ManagementMohamad SannanNo ratings yet

- Chap 003Document9 pagesChap 003Rajib Chandra BanikNo ratings yet

- Session 10: Unit II: Time Value of MoneyDocument49 pagesSession 10: Unit II: Time Value of MoneySamia ElsayedNo ratings yet

- Chap 04 and 05 (Mini Case)Document18 pagesChap 04 and 05 (Mini Case)ricky setiawan100% (1)

- Chapter04 Xlssol-1Document42 pagesChapter04 Xlssol-1Aaron NatarajaNo ratings yet

- ACCA F9 June 2015 Suggested AnswersDocument10 pagesACCA F9 June 2015 Suggested AnswersACFNo ratings yet

- Time Value of Money AnnuitiesDocument26 pagesTime Value of Money AnnuitiesRatul HasanNo ratings yet

- Chapter 06Document16 pagesChapter 06coriactrNo ratings yet

- Class 8 Math Worksheet 07-CDocument4 pagesClass 8 Math Worksheet 07-CHereebNo ratings yet

- Revised FitnessTexter Functional Fitness Box Financial Projection Excel SpreadsheetDocument4 pagesRevised FitnessTexter Functional Fitness Box Financial Projection Excel SpreadsheetLouis LarryNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Introduction To Variance SwapsDocument6 pagesIntroduction To Variance Swapsdbjn100% (1)

- Final Exam Fall '12Document7 pagesFinal Exam Fall '12dbjnNo ratings yet

- Smiles, Bid-Ask Spreads and Option PricingDocument24 pagesSmiles, Bid-Ask Spreads and Option PricingdbjnNo ratings yet

- Extra Credit Fall '12Document4 pagesExtra Credit Fall '12dbjnNo ratings yet

- Brealey. Myers. Allen Chapter 17 TestDocument13 pagesBrealey. Myers. Allen Chapter 17 TestMarcelo Birolli100% (2)

- Answer Key QuizDocument4 pagesAnswer Key QuizdbjnNo ratings yet

- Chap 002Document75 pagesChap 002dbjnNo ratings yet

- Chap 016Document12 pagesChap 016dbjn100% (1)

- Chap 019Document11 pagesChap 019dbjnNo ratings yet

- Chap 018Document19 pagesChap 018dbjnNo ratings yet

- Chap 011Document14 pagesChap 011dbjnNo ratings yet

- Chap 013Document8 pagesChap 013dbjnNo ratings yet

- Chap 013Document81 pagesChap 013dbjnNo ratings yet

- Chap 015Document18 pagesChap 015dbjnNo ratings yet

- Chap 014Document12 pagesChap 014dbjnNo ratings yet

- Chap 012Document134 pagesChap 012dbjnNo ratings yet

- Chap 004Document85 pagesChap 004jordan135523No ratings yet

- Chap 009Document97 pagesChap 009wang_victNo ratings yet

- Intermediate Accounting 6e Spiceland Chap005 AnswerDocument97 pagesIntermediate Accounting 6e Spiceland Chap005 Answer4leafclover_2007100% (2)

- Chap 012Document7 pagesChap 012dbjnNo ratings yet

- Pay Roll SamDocument2 pagesPay Roll Samsamuel debebeNo ratings yet

- 16@fen - Different Types of AnnuitiesDocument22 pages16@fen - Different Types of Annuitiesjisanus5salehinNo ratings yet

- IT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Document6 pagesIT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Mary Jescho Vidal Ampil100% (1)

- It PPT For F.Y 2023-24Document24 pagesIt PPT For F.Y 2023-24iampnkjjnNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Food Stamp Budget WorksheetDocument2 pagesFood Stamp Budget WorksheetZachary CollinsNo ratings yet

- Parreno v. CoaDocument2 pagesParreno v. CoaJovita Junio-EnguioNo ratings yet

- 2 GO (P) No 208 2013 FinDocument2 pages2 GO (P) No 208 2013 FinHarish NetguyNo ratings yet

- BIR Ruling No. 051 2000 PDFDocument3 pagesBIR Ruling No. 051 2000 PDFVina CeeNo ratings yet

- Life Insurance Policy DocumentDocument24 pagesLife Insurance Policy DocumentDev D-starNo ratings yet

- Riverside County Pension Advisory Review Committee ReportDocument23 pagesRiverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- PLDT V Jeturian From Lawyerly - PHDocument7 pagesPLDT V Jeturian From Lawyerly - PHDaryl YuNo ratings yet

- Muster Roll Cum Wage RegisterDocument6 pagesMuster Roll Cum Wage Registervickyr070% (1)

- Powerpoint - Sss.pamonte - Updated 1Document34 pagesPowerpoint - Sss.pamonte - Updated 1Kzarina Kim DeGuzman Tenorio0% (1)

- Patrick Willis Open Source Storage LaqsuitDocument60 pagesPatrick Willis Open Source Storage LaqsuitDavid FucilloNo ratings yet

- Chinmay Kadam Roll No. 21 Black BookDocument55 pagesChinmay Kadam Roll No. 21 Black BookShubh shahNo ratings yet

- Zambia: Doing Business in ZambiaDocument4 pagesZambia: Doing Business in ZambiaKajal N Jignesh PatelNo ratings yet

- Report Internshipe State Life RizwanDocument56 pagesReport Internshipe State Life Rizwanrizbecks86% (7)

- Analysis of Retirment SegmentDocument16 pagesAnalysis of Retirment SegmentGAURAHARI PATRANo ratings yet

- Reward ManagementDocument15 pagesReward ManagementBuddhima De Silva100% (1)

- Scholarship Income DeclarationDocument4 pagesScholarship Income DeclarationLawyer Chandresh TiwariNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcesyatin rajputNo ratings yet

- Old Age Security Benefits and Canada Pension PlanDocument26 pagesOld Age Security Benefits and Canada Pension PlanChris AngeloNo ratings yet

- AgeUKIG23 Care at Home Guide - InfDocument36 pagesAgeUKIG23 Care at Home Guide - Infnirav1310No ratings yet

- Covering Letter For Form 13 of PF AuthoritiesDocument9 pagesCovering Letter For Form 13 of PF AuthoritiesSampatmaneNo ratings yet

- NPV12Document6 pagesNPV12Rakib RabbyNo ratings yet

- Budget Booklet 2020 by Avinash GuptaDocument47 pagesBudget Booklet 2020 by Avinash GuptaSumit AnandNo ratings yet

- Administration Brief Red BookDocument62 pagesAdministration Brief Red Bookpeter_martin9335No ratings yet

- Form - 2: Nomination and Declaration Form For Unexempted/Exempted EstablishmentsDocument2 pagesForm - 2: Nomination and Declaration Form For Unexempted/Exempted EstablishmentsAnkita PanpaliyaNo ratings yet

- IELTS Writing Task 2 - Ageing Population PDFDocument3 pagesIELTS Writing Task 2 - Ageing Population PDFmaniNo ratings yet