Professional Documents

Culture Documents

Baby Dolls Case Solution

Uploaded by

adolfpovedaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baby Dolls Case Solution

Uploaded by

adolfpovedaCopyright:

Available Formats

Baby Dolls. 4 Session 1.

P&L analysis

th

Based on Exhibit 3: The sales are considered to be stagnating, although the advertising and marketing expenses decrease (should at least be at the same level to support sales). Decrease in overheads we consider to be too optimistic no details on potential economies is provided Significant increase in financial expenses is expected mainly related to the gap between days of receivables and payables (growing financing requirements). This negative trend will continue along with sales growth unless we equilibrate the payment terms policy (clients Vs suppliers) Decrease in ROS mainly driven by the decrease in Gross Margin. BS analysis

2.

The company does not have enough own funds to finance the operations. The only months when the company has cash surpluses - between March and May. Mismatch between trade payables payment terms are significantly worse comparing to receivables collection ones. Currently the company is growing, financing its operations through the use of credit. The credit has helped the company to operate during peak seasons resulting in significant financial expenses (related to borrowed funds). This practice does not seem to be sustainable in the medium term. Last year, the company almost reached the limit of financing (20 million), thus is unlikely that the company will be able to grow if it continues to finance its operations in this way. Baby dolls needs to reformulate its cash management policy in order to start generating cash and to have a sustainable business model. One of the ways of doing that relates to receivables collection days improvement (decrease of days of collection). Inventory days do not represent an issue. Given the seasonality of the business, the best 2 months to understand companys financial requirements we consider December and January, as this are the critical months in terms of operational cycle (with the lowest number of (NFO-WC)). 3. China P&L forecast

In terms of expected profit, it is worth to move to China, as the expected profit would be four times the one expected in Spain, although credit line limit would require reconsideration (significant increase due to prepayments required) 4. China BS forecast

Comparing NFO, WC and Credit required for operations in China, we noticed that in absolute terms, main items tend to increase in China scenario. Furthermore, in case we move the operation to China, we may face financial problems lack of free financing in the form of trade payables our funding would be based only on external loans. In addition, between November and January, the Credit needed would be much higher than EUR 20 M.

5.

6.

China an option? We would not recommend moving the operation to China, based on the following assumptions: a. Operations: no experience managing operations overseas and probable loss of flexibility b. HR: no experience doing business in China. Moreover, they may have different labor laws than Spain. c. Financing: need for financing would be higher than current. Prepayments may damage our financial stability since our cash collections cycle is very long (120 days) d. Sales: need for better planning due to more transportation time. Most risky month

December, since our receivables balance reaches its peak. In case of none payments / delay in payments from our clients we will not be able to pay to our bank and execute other payments

You might also like

- Hampton Machine Tool CoDocument13 pagesHampton Machine Tool CoArdi del Rosario100% (12)

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99No ratings yet

- Case #1 Bluntly MediaDocument3 pagesCase #1 Bluntly MediaAlexandra Bento50% (2)

- Case Study - Prestige Telephone Co.Document12 pagesCase Study - Prestige Telephone Co.James Cullen100% (3)

- NFL's Scoofles: Scooped With Marketing Research Problem?Document1 pageNFL's Scoofles: Scooped With Marketing Research Problem?ETCASES0% (1)

- Dollarama Case DCFDocument22 pagesDollarama Case DCFDaniel Jinhong Park25% (4)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionKaushal Agrawal100% (1)

- Industrial Grinders N VDocument9 pagesIndustrial Grinders N Vapi-250891173100% (3)

- E-Dentel Planner - A FreeDocument24 pagesE-Dentel Planner - A FreeMaría José Alvarado SuárezNo ratings yet

- Play Time Toy CompanyDocument16 pagesPlay Time Toy CompanyBrian Balagot100% (3)

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Hausser Food ProductsDocument4 pagesHausser Food ProductsHumphrey Osaigbe100% (1)

- Kool King Division (A)Document10 pagesKool King Division (A)Rajesh Kumar AchaNo ratings yet

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Micoderm v0.2Document21 pagesMicoderm v0.2Glory100% (1)

- Frequent FliersDocument4 pagesFrequent Fliersarchit_shrivast908467% (3)

- Joint Cost SignatronDocument8 pagesJoint Cost SignatronGloryNo ratings yet

- Gravity Payments Salary Case StudyDocument13 pagesGravity Payments Salary Case StudyGhanshyam Thakkar67% (3)

- Arck SystemsDocument8 pagesArck SystemsRohanNo ratings yet

- Bioco: Preparation SheetDocument0 pagesBioco: Preparation SheetMss BranchesNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Cartwright LumberDocument5 pagesCartwright LumberRushil Surapaneni50% (2)

- Industrial Grinders NVDocument6 pagesIndustrial Grinders NVCarrie Stevens100% (1)

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- University Health ServicesDocument8 pagesUniversity Health ServicesXavier Mascarenhas100% (2)

- BOS Brands ChallengesDocument1 pageBOS Brands ChallengesRohanNo ratings yet

- CartwrightLumber ForecastDocument9 pagesCartwrightLumber ForecastDouglas Fraser0% (1)

- Destin Brass FinalDocument10 pagesDestin Brass FinalKim Garver100% (2)

- Winfield PPT 27 FEB 13Document13 pagesWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- Presentation 1Document3 pagesPresentation 1Debdyuti Datta GuptaNo ratings yet

- Surecut Shears, Inc.: AssetsDocument8 pagesSurecut Shears, Inc.: Assetsshravan76No ratings yet

- Scott & Sons Company Case Solution From Syndicate 3Document3 pagesScott & Sons Company Case Solution From Syndicate 3Murni Fitri FatimahNo ratings yet

- Prestige Telephone Company Case StudyDocument4 pagesPrestige Telephone Company Case StudyNur Al Ahad92% (12)

- Caso Jackson Automotive SystemDocument7 pagesCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- Forner Carpet CompanyDocument8 pagesForner Carpet CompanyJolo LeachonNo ratings yet

- Prestige Telephone Company (Online Case Analysis)Document21 pagesPrestige Telephone Company (Online Case Analysis)astha50% (2)

- Helena HelsenDocument2 pagesHelena HelsenragastrmaNo ratings yet

- Forner Carpet Case StudyDocument7 pagesForner Carpet Case StudySugandha GuptaNo ratings yet

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- Baria Planning Case SolutionDocument6 pagesBaria Planning Case SolutionUsha88% (8)

- Play Time Toy CompanyDocument4 pagesPlay Time Toy CompanychungdebyNo ratings yet

- ML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDocument4 pagesML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDeepak Rnv86% (7)

- David Fletcher CaseDocument1 pageDavid Fletcher CaseLove Rabbyt100% (1)

- Accounting For Frequent Fliers CaseDocument15 pagesAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- CaseDocument5 pagesCaseRedcLumsNo ratings yet

- Huron AutomotiveDocument8 pagesHuron Automotiveanubhav1109No ratings yet

- Group 4 - Tate's DigitalDocument4 pagesGroup 4 - Tate's Digitalpavan kumar tulsijaNo ratings yet

- Thomas Green Power Office Politics and A Career in CrisisDocument2 pagesThomas Green Power Office Politics and A Career in CrisisswapnilNo ratings yet

- Jackson AutomotiveDocument3 pagesJackson AutomotiveErika Theng25% (4)

- The Case Solution of AES Tiete: Expansion Plant in BrazilDocument19 pagesThe Case Solution of AES Tiete: Expansion Plant in BrazilParbon Acharjee0% (1)

- Edentel Case NotesDocument4 pagesEdentel Case NotesBárbara Costa0% (1)

- Bluntly Media Valuatio1Document1 pageBluntly Media Valuatio1SrikantNo ratings yet

- FPL Dividend CaseDocument3 pagesFPL Dividend CaseGovert Wessels100% (1)

- Group 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BDocument14 pagesGroup 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BAccounting 201No ratings yet

- ADMN 2167 - Assignment #1Document14 pagesADMN 2167 - Assignment #1hkarim8641No ratings yet

- Unit 6 Business FinanceDocument33 pagesUnit 6 Business FinanceSalvacion CalimpayNo ratings yet

- Garcia, Cristine Joy G. BSA-1B Mgt1 Assessment Task 3Document4 pagesGarcia, Cristine Joy G. BSA-1B Mgt1 Assessment Task 3Cj GarciaNo ratings yet

- Chartered Professional Accountants of Canada, Cpa Canada, Cpa. © 2015, Chartered Professional Accountants of Canada. All Rights ReservedDocument19 pagesChartered Professional Accountants of Canada, Cpa Canada, Cpa. © 2015, Chartered Professional Accountants of Canada. All Rights ReservedHassleBustNo ratings yet

- Summary of Case DiscussionDocument2 pagesSummary of Case DiscussionNur 'AtiqahNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementPrincess TaizeNo ratings yet

- Jep 23 000079330Document1 pageJep 23 000079330Heintje NopraNo ratings yet

- Function of Financial MarketsDocument4 pagesFunction of Financial MarketsFrances Mae Ortiz MaglinteNo ratings yet

- Business Plan For Machinery Rental and Material SupplyDocument8 pagesBusiness Plan For Machinery Rental and Material SupplyAbenetNo ratings yet

- Tax Literature Clubbingof Income Under What Headof IncomeDocument3 pagesTax Literature Clubbingof Income Under What Headof IncomeKunwarbir Singh lohatNo ratings yet

- (Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Document258 pages(Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Amel AmarNo ratings yet

- Z003800101201740141305080572 448187Document51 pagesZ003800101201740141305080572 448187Dian AnitaNo ratings yet

- World Bank: Developing A Comprehensive Strategy To Access To Micro-FinanceDocument129 pagesWorld Bank: Developing A Comprehensive Strategy To Access To Micro-FinanceGiai CuNo ratings yet

- EPF Circular On Pension For Full Salary 23.3.17Document11 pagesEPF Circular On Pension For Full Salary 23.3.17Vishal IngleNo ratings yet

- Key Facts Missold IVA Legal PartnerDocument1 pageKey Facts Missold IVA Legal PartnerAnthony RobertsNo ratings yet

- Salary Certificate FormatDocument1 pageSalary Certificate FormatshajahanNo ratings yet

- Jurnal Bahasa InggrisDocument15 pagesJurnal Bahasa InggrisYasinta JebautNo ratings yet

- Central Bank-Monetary Policy ReviewDocument6 pagesCentral Bank-Monetary Policy ReviewAda DeranaNo ratings yet

- Ssi FinancingDocument7 pagesSsi FinancingAnanya ChoudharyNo ratings yet

- Individual Corporate R2-52 R3-32Document8 pagesIndividual Corporate R2-52 R3-32Fang JiangNo ratings yet

- Islami Bank Bangladesh Limited: Dhanmondi BranchDocument1 pageIslami Bank Bangladesh Limited: Dhanmondi BranchMonirul IslamNo ratings yet

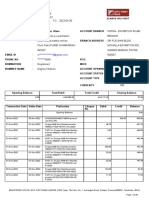

- IDFCFIRSTBankstatement 10094802422Document33 pagesIDFCFIRSTBankstatement 10094802422vikas jainNo ratings yet

- Valuation of Bonds and SharesDocument39 pagesValuation of Bonds and Shareskunalacharya5No ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- MBA (E) 2021-23, 3rd Semester All Subjects SyllabusDocument40 pagesMBA (E) 2021-23, 3rd Semester All Subjects SyllabusANISHA DUTTANo ratings yet

- CH 08Document51 pagesCH 08Daniel NababanNo ratings yet

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDocument6 pagesBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoNo ratings yet

- Swift MT RulesDocument2 pagesSwift MT RulesJit JackNo ratings yet

- Rental AgreementDocument2 pagesRental AgreementKipyegon CheruiyotNo ratings yet

- Sample Contract To SellDocument3 pagesSample Contract To SellCandice Tongco-Cruz100% (4)

- T Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)Document842 pagesT Vijaya Kumar - Accounting For Management-Tata McGraw Hill Education Private Limited (2010)2073 - Ajay Pratap Singh Bhati100% (1)

- 1 Introduction To BankingDocument8 pages1 Introduction To BankingGurnihalNo ratings yet

- 347Document2 pages347TarkimNo ratings yet

- Week 1 MSTA Notes PDFDocument93 pagesWeek 1 MSTA Notes PDFMohd Najmi HuzaiNo ratings yet

- Sinking Fund and Amortization: OP PMT X IDocument10 pagesSinking Fund and Amortization: OP PMT X IKhevin NetflixNo ratings yet

- Country Wide Litigation Database 01072007Document15 pagesCountry Wide Litigation Database 01072007Carrieonic100% (1)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4.5 out of 5 stars4.5/5 (3)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (90)

- Having It All: Achieving Your Life's Goals and DreamsFrom EverandHaving It All: Achieving Your Life's Goals and DreamsRating: 4.5 out of 5 stars4.5/5 (65)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (14)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1027)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (802)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- Every Tool's a Hammer: Life Is What You Make ItFrom EverandEvery Tool's a Hammer: Life Is What You Make ItRating: 4.5 out of 5 stars4.5/5 (249)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveFrom EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveRating: 4.5 out of 5 stars4.5/5 (89)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeFrom EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeRating: 5 out of 5 stars5/5 (25)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberFrom EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberRating: 5 out of 5 stars5/5 (39)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (25)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoFrom EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoRating: 4 out of 5 stars4/5 (1)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyFrom EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyRating: 4.5 out of 5 stars4.5/5 (300)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderFrom EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderRating: 4.5 out of 5 stars4.5/5 (60)