Professional Documents

Culture Documents

Session Readings (Debt Market)

Uploaded by

Arathi SundarramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session Readings (Debt Market)

Uploaded by

Arathi SundarramCopyright:

Available Formats

DEBENTURES/ BONDS A bond or debenture is a long term instrument of debt issued by a business or government.

It represents debt in that the bond buyer actually lends the face amount to the bond issuer. The certificate itself is evidence of a lender creditor relationship. It is a security because unlike a car loan or homeimprovement loan, the debt can be bought and sold in the open market. In fact a bond is a loan intended to be bought and sold. It is long-term by definition; in order to be called a bond. The term must be longer than five years. Debt securities with maturities under five years are called bills, notes or other terms. Since bonds are intended to be bought and sold, all the certificates of a bond issue contain a master loan agreement. This agreement between issuer and investor (or creditor and lender), called the bond indenture or deed of trust, contains all the information you would normally expect to see in any loan agreement, including the following: (a) Par Value: The face amount par value. or principal is the amount of the loan - the amount that the bond issuer has agreed to repay at the bonds maturity. (b) Coupon Rate and Interest: Bonds are issued with a specified coupon or nominal rate, which is determined largely by market conditions at the time of the bonds primary offering. Once determined, it is set contractually for the life of the bond. The amount of the interest payment can be easily calculated by multiplying the rate of interest (or coupon) by the face value of the bond. For instance, a bond with a face amount of Rs. 1000 and a coupon of 8% pays the bondholder Rs. 80 a year. (c) Schedule or Form of Interest Payments: Interest is paid on most bonds at six-month intervals, usually on either the first or the fifteenth of the month. The Rs.80 of annual interest on the bond in the previous example would probably be paid In two installments of Rs. 40 each. (d) Maturity Period: A bonds maturity or the length of time until the principal is repaid varies greatly but is always more than five years. Debt that matures in less than a year is a money market instrument such as commercial paper or bankers acceptances. While government bonds have maturity periods extending up to 20-25 years. A short-term bond, on the other hand, may have an initial maturity of five years. A long- term bond typically matures in 20 to 40 years. The maturity of any bond is predetermined and stated in the trust indenture. At the time of maturity the par (face) value plus nominal premium is payable to the bondholder. (e) Call Feature (if any): A call feature, if specified in the trust indenture, allows the bond Issuer to call in the bonds and repay them at a predetermined price before maturity. Bond issuers use this feature to protect themselves from paying more interest than they have to for the money they are borrowing. Companies call in bonds when general interest rates are lower than the coupon rate on the bond, thereby retiring expensive debt and refinancing it at a lower rate. Illustration 1: Suppose IDBI had issued 6 years Rs. 1000 bonds in 1998 @14% pa. But now the current interest rate is around 9% to 10%. If the issuer wants to take advantage of the call feature in the bonds indenture it will call back the earlier issued bonds and reissue them @9% p.a. The sale proceeds of this new issue will be used to pay the old debt. In this way IDBI now enjoys a lower cost for its borrowed money. Some bonds offer call protection; that is, they are guaranteed not to be called for five to ten years. Call features can affect bond values by serving as a ceiling for prices. Investors are generally unwilling to pay more for a bond than its call price, because they are aware that the bond could be called at a lower call price. If the bond issuer exercises the option to call bonds, the bond holder is usually paid a premium over par for the inconvenience.

(f) Refunding: If, when bonds mature, the issuer does not have the cash on hand to repay bondholders; it can issue new bonds and use the proceeds either to redeem the older bonds or to exercise a call option. This process is called refunding. (f) Credit Rating: For issue, both public and rights, of a debt instrument, including convertibles, credit rating irrespective of the maturity or conversion period is mandatory and should be disclosed. The disclosure should also include the unaccepted credit rating. Two ratings from two different credit rating agencies registered with SEBI should be obtained in case of public/rights issue of Rs.100 crore and more. All credit ratings obtained during the three years preceding the public/rights issue for any listed security of the issuing company should also be disclosed in the offer document. BOND VALUATION MODEL The holder of a bond receives a fixed annual interest payment for a certain number of years and a fixed principal repayment (equal to par value) at the time of maturity. So the value of a bond is:

Where, V = value of the bond I = annual interest payable on the bond F = principal amount (par value) of the bond repayable at the time of maturity n = maturity period of the bond. Illustration 2: A Rs 1,000 par value bond bearing a coupon rate of 14 per cent matures after 5 years, the required rate of return on this bond is 13 per cent. Calculate the value of the bond. Solution The value of the bond is V = Rs 140(PVIFAss13%, 5yrs) + Rs 1,000(PVIF13%,5yrs) = Rs 140(3.517) + Rs 1,000(0.543) = Rs 1,035.4 BOND VALUE THEOREMS Some basic rules which should be remembered with regard to bonds are: (a) When the required rate of return equals the coupon rate, the bond sells at par value. (b) When the required rate of return exceeds the coupon rate, the bond sells at a discount. The discount declines as maturity approaches. (c) When the required rate of return is less than the coupon rate, the bond sells at a premium. The premium declines as maturity approaches. (d) The longer the maturity of a bond, the greater is its price change with a given change in the required rate of return. YIELD TO MATURITY

If the market price of a Rs 1,000 par value bond, carrying a coupon rate of 9 per cent and maturing after 8 years, is Rs 800. What would be the rate of return, if one buys the bond and holds it till its maturity? The rate of return one earns is called the Yield to Maturity (YTM). The value of kd is

To find the value of kd, several values of kd are considered till the right value is obtained. With a discount rate of 12 percent and putting a value of 12 per cent for kd the right-hand side becomes Rs 90 (PVIFA12%, 8yrs) + Rs 1,000 (PVIF12%, 8yrs) = Rs 90 (4.968) + Rs 1,000(0.404) = Rs 851.00 Since this value is greater than Rs 800 a higher value for kd is opted. Let kd = 14 per cent so that Rs 90(PVIFA14%,yrs)+ Rs 1,000 (PVIF14%,8yrs) = Rs 90(4.639) + Rs 1,000(0.351) = Rs 768.10 Since this value is less than Rs 800 a lower value for kd is used. Let us try kd = 13 per cent. Rs 90(PVIFA13%,8yrs) + Rs 1,000 (PVIF13%,8yrs) = Rs 90 (4.800)+ Rs 1,000(0.376) = Rs 808 Thus kd lies between 13 per cent and 14 per cent. Using linear interpolation in the range of 13 percent to 14 percent, kd is equal to 13.2 per cent

13% + (14% - 13%) 808 800 808-7681

= 13.2%

Illustration 3: If the price per bond is Rs 90 and the bond has a par value of Rs 100, a coupon rate of 14 per cent, and a maturity period of 6 years, calculate its yield to maturity. Solution YTM = 14 + (100-90)/6/0.4x100 + 100+0.6x90 = 16.67 per cent BOND VALUES WITH SEMI-ANNUAL INTEREST Bonds pay interest semi-annually. This requires the bond valuation equation to be modified as follows: (a) The annual interest payment, I, divided by two to obtain the semi-annual interest payment. (b) The number of years to maturity is multiplied by two to get the number of half-yearly periods. (c) The discount rate divided by two to get the discount rate applicable to half-yearly periods. The basic bond valuation equation thus becomes:

Where, V = Value of the bond I/2 = Semi-annual interest payment Kd/2 = Discount rate applicable to a half-year period F = Par value of the bond repayable at maturity 2n = Maturity period expressed in terms of half-yearly periods. Illustration 4: If a Rs 100 par value bond carries a coupon rate of 12 per cent and a maturity period of 8 years and interest payable semi-annually then the value of the bond with required rate of return of 14 per cent will be what?

Solution V = 16t=1 {6 / (1.07)t} + {100 / (1.07)16} = 6(PVIFA7%, 100(0.388) = Rs 95.5 PRICE-YIELD RELATIONSHIP

16yrs)

+ 100(PVIF7%,

16yrs)

= Rs 6(9.447) + Rs

A basic property of a bond is that its price varies inversely with yield. The reason is simple. As the required yield increases, the present value of the cash flow decreases; hence the price decreases. Conversely, when the required yield decreases, the present value of the cash flow increases; hence the price increases. The graph of the price-yield relationship for any callable bond has a convex shape as shown in diagram. Price Yield Relationship

RELATIONSHIP BETWEEN BOND PRICE AND TIME Since the price of a bond must equal its par value at maturity (assuming that there is no risk of default), bond prices change with time. For example, a bond that is redeemable for Rs.1000 (which is its par value) after five years when it matures, will have a price of Rs.1,000 at maturity, no matter what the current price is. If its current price is Rs.1,100, it is said to be a premium bond. If the required yield does not change between now and the maturity date, the premium will decline over time as shown by curve A in the following diagram. On the other hand, if the bond has a current price of Rs.900, it is said to be a discount bond. The discount too will disappear over time as shown by curve B in the same diagram. Only when the current price is equal to par value in such a case only the bond is said to be a par bond there is no change in price as time passes, assuming that the required yield does not change between now and the maturity date. This is reflected by the dashed line in the diagram. Price Changes with Time

THE YIELD CURVE The term structure of interest rates, popularly known as Yield Curve, shows how yield to maturity is related to term to maturity for bonds that are similar in all respects, except maturity. Consider the following data for Government securities:

The yield curve for the above bonds is shown in the diagram. It slopes upwards indicating that long-term rates are greater than short-term rates. Yield curves, however, do not have to necessarily slope upwards. They may follow any pattern. Four patterns are depicted in the given diagram: Types of Yield Curve

Another perspective on the term structure of interest rates is provided by the forward interest rates, viz., the interest rates applicable to bonds in the future. To get forward interest rates, begin with the one-year Treasury bill: 88,968 = 100,000 / (1 + r1) Where, r1 is the one-year spot rate i.e. the discount rate applicable to a risk less cash flow receivable a year hence. Solving for r1, we gets r1 = 0.124.

Next, consider the two-year government security and split its benefits into two parts, the interest of Rs.12,750 receivable at the end of year 1 and Rs.112,750 (representing the interest and principal repayment) receivable at the end of year 2. The present value of the first part is:

To get the present value of the second years cash flow of Rs.112,750, discount it twice at r 1 (the discount rate for year 1) and r2 (the discount rate for year 2)

r2 is called the forward rate for year two, i.e., the current estimate of the next years one-year spot interest rate. Since r1, the market price of the bond, and the cash flow associated with the bond are known the following equation can be set up:

Solving this equation we get r2 = 0.1289 To get the forward rate for year 3(r3), set up the equation for the value of the three year bond:

Solving this equation we get r3=0.1512. This is the forward rate for year three. Continuing in a similar fashion, set up the equation for the value of the four-year bond:

Solving this equation for r4, leads to r4 = 0.1458. The following diagram plots the one-year spot rate and forward rates r2, r3, r4. Notice that while the current spot rate and forward rates are known, the future spot rates are not known they will be revealed as the future unfolds. Given this information on yields to maturity and forward rates, these are two distinct, yet equivalent, ways of valuing a risk less cash flow.

The 8% bond with 15 years to maturity must sell at a little over Rs. 800 to compete with 10% bonds. The possibility that interest rates will cause outstanding bond issues to lose value is called Interest rate risk. Yet there is an upside to this risk. If interest rates decline during the five years that the 8% bond is outstanding, the holder could sell it for enough of a premium to make its YTM rate equal to the lower yields of recent issues. For instance, should Interest rates decline to 7%, the price of the 8% bond with 15 years to maturity will increase by about Rs. 100. ISSUE OF DEBT INSTRUMENTS A company offering convertible/non-convertible debt instruments through an offer document should, in addition to the other relevant provisions of these guidelines, complies with the following provisionsREQUIREMENT OF CREDIT RATING A public or rights issue of debt instruments (including convertible instruments) in respect of their maturity or conversion period can be made only if the credit rating has been obtained and disclosed in the offer document. For all issues greater than or equal to Rs.100 crore, two ratings from two different credit rating agencies should be obtained. REQUIREMENTS IN RESPECT OF DEBENTURE TRUSTEES In the case of issue of debentures with maturity of more than 18 months, the issuer should appoint debenture trustees whose name must be stated in the offer document. The issuer company in favor of the debenture trustees should execute a trust deed within six months of the closure of the issue. CREATION OF DEBENTURE REDEMPTION RESERVES (DRR) A company has to create DRR in the case of the issue of debentures with maturity of more than 18 months.

DISTRIBUTION OF DIVIDENDS In the case of new companies, distribution of dividends would require the approval of the trustees to the issue and the lead institution, if any. In case of existing companies, prior permission of the lead institution for declaring dividend, exceeding 20% as per the loan covenants, is necessary if the company does not comply with institutional condition regarding interest and debt service coverage ratio. REDEMPTION The issuer company should redeem the debentures as per the offer documents. DISCLOSURE AND CREATION OF CHARGE The offer document should specifically state the assets on which the security would be created as also the ranking of the charge(s). In the case of second/residual charge or subordinated obligation, the risks associated with should clearly be stated. FILING OF LETTER OF OPTION A letter of option containing disclosures with regards to credit rating, debentures holders resolution, option for conversion, justification for conversion price and such other terms which SEBI may prescribe from time to time should be filed with SEBI through an eligible merchant banker, in case of a roll over of non-convertible portions of PCD/NCDs, etc. BOOK BUILDING Book-building means a process by which a demand for the securities proposed to be issued by a body corporate is elicited and built up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by means of notice/ circular / advertisement/ document or information memoranda or offer document. An issuer company may make an issue of securities to the public through a prospectus in the following manner 100% of the net offer to the public through the book building process or 75% of the net offer to the public through the book building process and 25% at the price determined through the book building. A company proposing to issue capital through book building has to comply with the requirements of SEBI in this regard. The issuer company should appoint the eligible merchant banker(s) as book runner(s)and their names should be mentioned in the draft prospectus. The issuer company should enter into an agreement with stock exchange(s) which have the requisite system of on line offer of securities specifying, inter alia, their inter se rights, duties, responsibilities and obligations. However, the company may apply for listing of its securities on a stock exchange other than the one through which it offers its securities to the public through the online system. The lead merchant banker(s) should act as lead book runner and other eligible merchant banker(s) are termed as co-book runners. In case the issuer company appoints more than one book runner, the name of all such book runners who have submitted the due diligence certificate to the SEBI may be mentioned on the front cover page of the prospectus. The primary responsibility of building the books is that of lead book runner. The book runners may appoint the SEBI registered intermediaries who are permitted to carry on activity as underwriters as syndicate members. The book runner(s)/syndicate members should appoint SEBI registered brokers of the stock exchange who are financially capable of honouring their commitments arising out of defaults of their clients/investors to accept bids, applications, application money and placing orders with the company. Such brokers would be considered as bidding/collection centres. They should collect the money from

the client(s) for every order(s) placed by them. On failure of the investors to pay for the allotted shares, they would have to pay the amount. The company for the services would pay them a commission/fee and the stock exchange(s) must ensure that the broker(s) do not charge a service fee from their clients/investors. The draft prospectus containing all the disclosures as laid down by the SEBI in respect of securities to be offered to the public, should be filed by the lead merchant banker with the SEBI. The red herring prospectus should disclose either the floor price of the securities offered through it or a price band along with the range within which price can move. The SEBI, within 21 days of the receipt of the draft prospectus, may suggest modifications to it. The lead merchant banker would be responsible for ensuring that the modifications/final observations made by the SEBI are incorporated in the prospectus. The issuer company should, after receiving the final observations on the offer document from the SEBI, make an advertisement in an English national daily with wide circulation, one Hindi national newspaper and regional newspaper with wide circulation at the place where the registered office of the company is situated, containing the salient features of the final offer document as specified in the form 2-A of the Companies Act circulated along with the application form. The advertisement, in addition to other required information, should also contain the following: the date of opening and closing of the issue; the method and process of application and allotment; the names/addresses/telephone nos. of the stock brokers and centres for bidding; On determination of the price, the number of securities to be offered should be determined. Once the final price (cut off price) is determined all those bidders whose bids are found to be successful (i.e. at or above the final price or cut-off price) would be entitled for the allotment of securities. On determination of the entitlement, the information regarding the same should be intimated immediately to the investors. PROCEDURE FOR BIDDING The bid should be open for at least five days and not more than 10 days, which may be extended to 13 days in case the price band is revised. The advertisement should also contain the following: the date of opening and closing of the bidding (not less than five days); the name and addresses of the syndicate members as well as the bidding terminals for accepting the bids; the method and process of bidding; Bidding should be permitted only if an electronically linked transparent facility is used. The syndicate members should be present at the bidding centres so that at least one electronically linked computer terminal at each bidding centres is available for the purpose of bidding. In case of issue of 100% of the net offer to the public through 100% book building process i) at least 25% of the net offer to the public should be available for allocation to retail individual investors ii) at least 25% to the non-institutional investors (i.e. investors other than retail individual investors and QIBs) iii) not more than 50% to QIBs. However 50% of the issue size should be, on a mandatory basis, allotted to the QIBs in case of public issue by an unlisted company through book building. After finalisation of the basis of allocation, the Registrar to the issue/issuing company should send the computer file containing the allocation details along with broker-wise funds pay-in -obligation to the broker to the issue and the stock exchange(s). The company /lead manager/book runner should announce and intimate the pay-in day to brokers and stock exchanges. The broker would be responsible to deposit the amount in the escrow account to the extent of allocation of his client in the pay-in date.

On receipt of the basis of allocation data, the brokers should immediately intimate the allocation to their clients/applicants. They should ensure that each successful client/applicant pay/submits the duly filled in and signed application form to them along with the application money by the pay-in date. The margin money already paid by the applicant should be adjusted towards the total application money payables. The broker should thereafter hand over the application forms of the successful applicants who paid the application money to the stock exchange to be submitted to the Registrar of the issue/company for their records. The broker(s) should refund the margin money collected earlier within 3 days of receipt of allocation to the applicants who did not receive the allocation. They should also give i) details of amount received from each client/investor and ii) names of those who have not paid the application money to the Registrar/book runner/stock exchange. In the event of the successful applicants failing to pay the application money, the concerned broker should bring in the funds to the extent of the default/shortfall, failing which the exchange would declare him as a defaulter and initiate action under its byelaws. The book runners who have underwritten the issue would have to bring in the shortfall. On pay-in date the clearinghouse would automatically debit the escrow account of each broker to the extent of allocation made to his client/investors, and credit the amount collected to the Issue Account. The Settlement/Trade Guarantee Fund of the stock exchange cannot be used to honour brokers commitments in case of their failure to bring in the funds. The brokers should open Escrow Securities Account with any depository to receive credit of securities on behalf of clients. On payment/receipt of the application money towards minimum subscription, the issuing company would allot the shares to the applicants as per the applicable guidelines. After the allotment the Registrar to the issue would post the share certificates to the investors or instruct the depository to credit the Escrow Securities Account of each broker. The broker as an agent would transfer from the escrow account the shares to the clients/applicants depository account after full payment by them and confirm the same to the book runner/registrar to the issue not later than the day of commencement of trading. Trading would commence within 6 days from the closure of the issue failing which interest at 15% would be paid to the investors.

You might also like

- Session Readings (Euro Issues)Document8 pagesSession Readings (Euro Issues)Arathi SundarramNo ratings yet

- Scale Main Table RetailingDocument4 pagesScale Main Table RetailingArathi SundarramNo ratings yet

- Proj Rdg. HPQ CalculationsDocument61 pagesProj Rdg. HPQ CalculationsArathi SundarramNo ratings yet

- Event Study Analysis: CLM Chapter 4Document18 pagesEvent Study Analysis: CLM Chapter 4Alexandre FavreNo ratings yet

- Store Choice Criteria and Shopping Behavior of Consumers in RetailingDocument8 pagesStore Choice Criteria and Shopping Behavior of Consumers in RetailingArathi SundarramNo ratings yet

- Questionnaire Insurance Survey - EnglishDocument4 pagesQuestionnaire Insurance Survey - EnglishArathi SundarramNo ratings yet

- QRE - Green Con B Rev3Document9 pagesQRE - Green Con B Rev3Arathi SundarramNo ratings yet

- Please Read The Introductory Paragraph Before Answering The QuestionnaireDocument4 pagesPlease Read The Introductory Paragraph Before Answering The QuestionnaireArathi SundarramNo ratings yet

- Hindi Insurance QuestionnaireDocument4 pagesHindi Insurance QuestionnaireArathi SundarramNo ratings yet

- Launching Tofu in IndiaDocument33 pagesLaunching Tofu in IndiaArathi Sundarram100% (6)

- FRL Scale ConstructionDocument2 pagesFRL Scale ConstructionArathi SundarramNo ratings yet

- Project ReportDocument12 pagesProject ReportArathi SundarramNo ratings yet

- Fruits Vegetable Questionnaire UpdatedDocument4 pagesFruits Vegetable Questionnaire UpdatedArathi Sundarram75% (12)

- Food Related Lifestyle ScaleDocument9 pagesFood Related Lifestyle ScaleArathi SundarramNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reg # First Name Month Day Year Registration Date New/ Retn Jerse Y# Player SurnameDocument4 pagesReg # First Name Month Day Year Registration Date New/ Retn Jerse Y# Player SurnameSean DallasNo ratings yet

- Ricardo Pangan Company Journals FrenzairenDocument15 pagesRicardo Pangan Company Journals FrenzairenRain Marie DumasNo ratings yet

- Door Step BankingDocument30 pagesDoor Step Bankingvahid86% (7)

- India PostDocument183 pagesIndia PostShakeel AhamedNo ratings yet

- 5CD First Integrated Bonding Vs HernandoDocument1 page5CD First Integrated Bonding Vs HernandoMilcah MagpantayNo ratings yet

- Ref - No. 4857458-15788895-3: Sharafat AliDocument4 pagesRef - No. 4857458-15788895-3: Sharafat AliYash RajpalNo ratings yet

- Interview Letter From Tata Group - For Fist Batch - 011 PDFDocument3 pagesInterview Letter From Tata Group - For Fist Batch - 011 PDFritesh shrivastavNo ratings yet

- Hotel Audit Work ProgramDocument60 pagesHotel Audit Work Programabhayinvites100% (6)

- Mrunal PDFDocument819 pagesMrunal PDFMayur MeenaNo ratings yet

- How To Prepare For A Transfer Pricing AuditDocument7 pagesHow To Prepare For A Transfer Pricing Auditmejocoba82No ratings yet

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

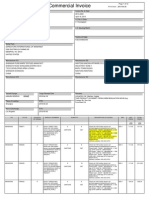

- Commercial Invoice: Consignee L/C Issuing BankDocument12 pagesCommercial Invoice: Consignee L/C Issuing Bankmz007No ratings yet

- ADVANCED AUDIT AND PROFESSIONAL ETHICS-ans PDFDocument15 pagesADVANCED AUDIT AND PROFESSIONAL ETHICS-ans PDFmohedNo ratings yet

- State Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?Document30 pagesState Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?boyburger17No ratings yet

- Intern Report On BRAC BANk LimitedDocument81 pagesIntern Report On BRAC BANk LimitedRoni KumarNo ratings yet

- Sadiq Hoi PDFDocument2 pagesSadiq Hoi PDFHafiz Shoaib MaqsoodNo ratings yet

- Declaration of TrustDocument2 pagesDeclaration of Trustkyra_kae100% (15)

- A Study On Customer Satisfaction of Reliance Life Insurance at HyderabadDocument8 pagesA Study On Customer Satisfaction of Reliance Life Insurance at Hyderabads_kumaresh_raghavanNo ratings yet

- Joint Venture AgreementDocument8 pagesJoint Venture AgreementMatthew DadaNo ratings yet

- 0710787070625000000000025Document195 pages0710787070625000000000025Mai-linhDeanNo ratings yet

- Answer: D. This Is A Function of Banks or Banking InstitutionsDocument6 pagesAnswer: D. This Is A Function of Banks or Banking InstitutionsKurt Del RosarioNo ratings yet

- HDFCDocument12 pagesHDFCKabir SinghNo ratings yet

- 2018 Financial Planning Challenge Case Study PDFDocument7 pages2018 Financial Planning Challenge Case Study PDFakashNo ratings yet

- Keough CFR 6-12 2017Document133 pagesKeough CFR 6-12 2017Houston ChronicleNo ratings yet

- NW Search For PolicyDocument2 pagesNW Search For PolicymayankcNo ratings yet

- FA Study Text 2019 PDFDocument476 pagesFA Study Text 2019 PDFsmlingwa100% (1)

- Audit of ReceivablesDocument9 pagesAudit of Receivablesmissy100% (2)

- BK Stat 05Document2 pagesBK Stat 05Mentesenot AnetenhNo ratings yet

- Performance of Banks With Special Reference To BangladeshDocument15 pagesPerformance of Banks With Special Reference To BangladeshMd. Mesbah UddinNo ratings yet

- Rig Brochures Odfjell Drilling Rig Brochure SkjermvisningDocument9 pagesRig Brochures Odfjell Drilling Rig Brochure SkjermvisningBima MahendraNo ratings yet