Professional Documents

Culture Documents

Corporate Centre, Mumbai - 400 021: State Bank of India

Uploaded by

joshijaysoftOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Centre, Mumbai - 400 021: State Bank of India

Uploaded by

joshijaysoftCopyright:

Available Formats

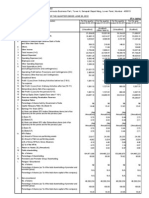

STATE BANK OF INDIA

Corporate Centre, Mumbai - 400 021

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER/ NINE MONTHS ENDED 31ST DECEMBER 2012

(Rs.in crores)

State Bank of India (Standalone)

Particulars

Interest Earned (a) + (b) + (c) + (d)

(a) Interest/discount on advances / bills

(b) Income on Investments

State Bank of India (Consolidated)

Quarter ended

30.09.2012

(Unaudited)

31.12.2011

(Unaudited)

30343.62

22800.19

7071.97

29606.84

22538.08

6714.68

27714.35

20891.37

6466.03

88872.91

67472.89

20165.60

77938.67

58936.60

17856.94

106521.45

81077.70

23949.14

42422.61

31908.57

9926.43

41648.34

31437.29

9590.22

38212.43

28858.92

8924.66

124703.76

94240.55

28681.17

107390.90

80824.24

25022.85

147197.39

111341.46

33705.21

109.74

361.72

3648.49

33992.11

19189.16

7012.19

4351.23

2660.96

26201.35

118.01

236.07

3346.63

32953.47

18633.02

6966.80

4280.19

2686.61

25599.82

107.19

249.76

2073.02

29787.37

16195.56

6331.81

4163.28

2168.53

22527.37

379.00

855.42

10488.16

99361.07

55620.03

20419.96

12768.54

7651.42

76039.99

248.87

896.26

8974.69

86913.36

46238.62

18697.99

12225.04

6472.95

64936.61

350.47

1144.14

14351.45

120872.90

63230.37

26068.99

16974.04

9094.95

89299.36

227.08

360.53

8519.53

50942.14

27035.06

13410.66

5813.36

7597.30

40445.72

328.05

292.78

8269.13

49917.47

26493.29

13616.75

5728.38

7888.37

40110.04

217.97

210.88

4894.06

43106.49

22942.44

10244.20

5388.41

4855.79

33186.64

917.14

864.90

22938.55

147642.31

78841.17

37711.74

17052.01

20659.73

116552.91

554.86

988.95

16028.14

123419.04

65123.85

29689.62

15878.62

13811.00

94813.47

776.26

1374.46

29691.58

176888.97

89319.55

46856.03

22084.03

24772.00

136175.58

7790.76

7353.65

7260.00

23321.08

21976.75

31573.54

10496.42

9807.43

9919.85

31089.40

28605.57

40713.39

2667.91

1825.60

2407.42

6949.84

9949.82

13090.23

3534.96

2805.90

3407.29

9687.02

12397.71

16244.44

2766.18

5122.85

1726.79

3396.06

3396.06

3396.06

671.05

1837.19

5528.05

1869.91

3658.14

3658.14

3658.14

671.04

3006.12

4852.58

1589.54

3263.04

3263.04

3263.04

635.00

7393.64

16371.24

5565.48

10805.76

10805.76

10805.76

671.05

8709.01

12026.93

4369.91

7657.02

7657.02

7657.02

635.00

11545.85

18483.31

6776.02

11707.29

11707.29

11707.29

671.04

3508.49

6961.46

2200.77

4760.69

4760.69

55.10

167.35

4648.44

671.05

2854.13

7001.53

2325.88

4675.65

4675.65

53.84

154.18

4575.31

671.04

3749.35

6512.56

2134.12

4378.44

4378.44

49.46

109.82

4318.08

635.00

9993.50

21402.38

6997.83

14404.55

14404.55

165.72

471.82

14098.45

671.05

10465.72

16207.86

5580.98

10626.88

10626.88

112.05

437.95

10300.98

635.00

14209.98

24468.95

8639.50

15829.45

15829.45

143.85

630.20

15343.10

671.04

31.12.2012

(Unaudited)

9 Months ended

31.12.2012

31.12.2011

(Unaudited)

(Unaudited)

Year ended

31.03.2012

(Audited)

Quarter ended

30.09.2012

(Unaudited)

31.12.2012

(Unaudited)

31.12.2011

(Unaudited)

9 Months ended

31.12.2012

31.12.2011

(Unaudited)

(Unaudited)

Year ended

31.03.2012

(Audited)

(c) Interest on balances with Reserve Bank

of India and other inter bank funds

(d) Others

Other Income

2

3

TOTAL INCOME (1+2)

Interest Expended

5

Operating Expenses (i) + (ii)

(i) Employee cost

(ii) Other Operating Expenses

4

TOTAL EXPENDITURE (4) + (5)

(excluding Provisions and Contingencies)

OPERATING PROFIT (3 - 6)

(before Provisions and Contingencies)

Provisions (other than tax) and Contingencies (net of

write-back)

--- of which provisions for Non-performing assets

Exceptional Items

Profit from Ordinary Activities before tax (7-8-9)

8

9

10

11

Tax expenses

Net Profit from Ordinary Activities after tax (10-11)

Extraordinary items (net of tax expense)

Net Profit for the period (12+13)

Share in profit of Associates

Share of Minority

12

13

14

15

16

17

Net Profit after Minority Interest (14+15-16)

Paid-up equity share capital

(Face Value of Rs. 10 per share)

Reserves excluding Revaluation Reserves

18

19

83280.16

105558.97

(As per balance sheet of previous acccounting year)

Analytical Ratios

20

(i)

Percentage of shares held by Government of India

61.58%

61.58%

59.40%

61.58%

59.40%

61.58%

61.58%

61.58%

59.40%

61.58%

59.40%

10.70%

12.21%

11.17%

12.63%

10.19%

11.60%

10.70%

12.21%

10.19%

11.60%

12.02%

13.83%

61.58%

50.61

54.51

51.39

161.03

120.58

50.61

54.51

51.39

161.03

120.58

184.31

69.27

68.18

68.00

210.10

162.22

241.55

184.31

69.27

68.18

68.00

210.10

162.22

53457.79

25370.31

5.30%

2.59%

0.87%

49202.46

22614.59

5.15%

2.44%

0.96%

40098.43

18803.17

4.61%

2.22%

0.97%

53457.79

25370.31

5.30%

2.59%

0.95%

40098.43

18803.17

4.61%

2.22%

0.79%

39676.46

15818.85

4.44%

1.82%

0.88%

241.55

257792831

38.42%

257792395

38.42%

257792395

40.60%

257792831

38.42%

257792395

40.60%

257792395

38.42%

(ii) Capital Adequacy Ratio

Basel I

Basel II

(iii) Earnings Per Share (EPS) (in Rs.)

(a) Basic and diluted EPS before Extraordinary items (net of tax

expense) (Quarter/9 Months numbers not annualised)

(b) Basic and diluted EPS after Extraordinary items

(Quarter/9 Months numbers not annualised)

(iv) NPA Ratios

(a) Amount of gross non-performing assets

(b) Amount of net non-performing assets

(c) % of gross NPAs

(d) % of net NPAs

(v) Return on Assets (Annualised)

21

Public Shareholding

--- No. of shares

--- Percentage of Shareholding

22 Promoters and Promoter Group Shareholding

(a) Pledged/Encumbered

Number of Shares

NIL

Percentage of Shares (as a percentage of the total

shareholding of promoter and promoter group)

Percentage of Shares (as a percentage of the total

share capital of the company)

(b) Non-encumbered

Number of Shares

413252443

413252443

377207200

413252443

377207200

413252443

100.00%

100.00%

100.00%

100.00%

100.00%

100.00%

61.58%

61.58%

59.40%

61.58%

59.40%

61.58%

Percentage of Shares (as a percentage of the total

shareholding of promoter and promoter group)

Percentage of Shares (as a percentage of the total

share capital of the company)

Unaudited Segment-wise Revenue, Results and Capital Employed

State Bank of India (Standalone)

Particulars

1

a

b

c

d

e

f

2

a

b

c

d

e

f

Segment Revenue (income)

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

Insurance Business

Other Banking Operations

Add / (Less) : Unallocated

Total

Segment Results (Profit before tax)

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

Insurance Business

Other Banking Operations

Total

Add / (Less) : Unallocated

Operating Profit

Less : Income Tax

Less : Extraordinary Profit / Loss

Net Profit

(Rs.in crores)

State Bank of India (Consolidated)

Quarter ended

30.09.2012

(Unaudited)

31.12.2011

(Unaudited)

7715.10

11605.03

14594.67

7088.57

11224.29

14640.61

5457.77

10942.15

13387.45

21739.53

34031.50

43504.89

17665.02

31131.10

37984.31

23874.88

42773.40

54091.69

77.31

33992.11

32953.47

29787.37

85.15

99361.07

132.93

86913.36

132.93

120872.90

1406.18

2434.49

2114.37

1241.54

2495.91

2791.36

692.50

1681.10

3385.08

4712.59

6595.76

7787.39

-196.99

4402.64

10384.72

217.24

6106.12

15619.23

5955.04

-832.19

5122.85

1726.79

3396.06

6528.81

-1000.76

5528.05

1869.91

3658.14

5758.68

-906.10

4852.58

1589.54

3263.04

19095.74

-2724.50

16371.24

5565.48

10805.76

14590.37

-2563.44

12026.93

4369.91

7657.02

21942.59

-3459.28

18483.31

6776.02

11707.29

167466.71

93034.31

-126855.43

156778.02

69328.29

-101034.07

139523.68

49405.81

-76529.43

167466.71

93034.31

-126855.43

139523.68

49405.81

-76529.43

138794.44

80103.63

-100180.07

-37358.83

96286.76

-33054.00

92018.24

-37099.53

75300.53

-37358.83

96286.76

-37099.53

75300.53

-34766.79

83951.21

31.12.2012

(Unaudited)

9 Months ended

31.12.2012

31.12.2011

(Unaudited)

(Unaudited)

Year ended

31.03.2012

(Audited)

Quarter ended

30.09.2012

(Unaudited)

31.12.2012

(Unaudited)

31.12.2011

(Unaudited)

9 Months ended

31.12.2012

31.12.2011

(Unaudited)

(Unaudited)

Year ended

31.03.2012

(Audited)

8851.75

17008.63

19879.37

4381.16

876.33

50997.24

8675.42

15793.58

20153.37

4695.33

653.61

49971.31

9182.54

13355.99

17714.35

2369.12

533.95

43155.95

26065.24

48449.46

59764.17

11417.21

2111.95

147808.03

23920.74

40587.58

51317.45

5911.76

1793.56

123531.09

31923.89

56017.05

72593.56

13932.27

2566.05

177032.82

1350.72

3163.46

3163.51

85.72

298.88

8062.29

-1045.73

7016.56

2200.77

4815.79

1177.60

3600.44

3189.17

125.29

177.77

8270.27

-1214.90

7055.37

2325.88

4729.49

534.01

2717.49

4247.39

50.01

121.74

7670.64

-1108.62

6562.02

2134.12

4427.90

4717.19

9316.49

9852.72

386.08

660.26

24932.74

-3364.64

21568.10

6997.83

14570.27

-613.20

7281.95

11915.10

241.48

665.28

19490.61

-3170.70

16319.91

5580.98

10738.93

-478.88

9336.06

18598.40

528.14

879.09

28862.81

-4250.01

24612.80

8639.50

15973.30

221562.83

158049.16

-215774.46

3018.71

3113.34

-47856.64

122112.94

179479.88

125000.51

-150887.31

2926.74

3392.88

-43486.35

116426.35

200004.71

94145.15

-153565.73

2423.64

3424.94

-49703.04

96729.67

221562.83

158049.16

-215774.46

3018.71

3113.34

-47856.64

122112.94

200004.71

94145.15

-153565.73

2423.64

3424.94

-49703.04

96729.67

198588.12

138869.83

-195730.94

2655.26

2900.26

-41052.52

106230.01

Capital Employed (Segment Assets - Segment Liabilities)

a

b

c

d

e

f

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

Insurance Business

Other Banking Operations

Unallocated

Total

Summarised Statement of Assets & Liabilities

(Rs.in crores)

Particulars

1

a

b

c

d

e

f

2

a

b

c

d

e

f

Capital and Liabilities

Capital

Reserves & Surplus

Minority Interest

Deposits

Borrowings (includes preference

shares and subordinate debts)

Other liabilities and Provisions

Total Capital and Liabilities

Assets

Cash and balances with RBI

Balances with Banks and money

at call and short notice

Investments

Advances

Fixed Assets

Other Assets

Total Assets

31.12.2012

(Unaudited)

Standalone

31.12.2011

(Unaudited)

31.03.2012

(Audited)

31.12.2012

(Unaudited)

Consolidated

31.12.2011

(Unaudited)

31.03.2012

(Audited)

671.05

95615.72

0.00

1156691.15

635.00

74665.53

0.00

1000964.52

671.04

83280.16

0.00

1043647.37

671.05

121441.89

4207.48

1562077.63

635.00

96094.67

3605.63

1353232.98

671.04

105558.97

3725.67

1414689.40

148374.35

67384.71

1468736.98

124157.85

100984.55

1301407.45

127005.57

80915.09

1335519.23

178541.48

134675.42

2001614.95

153730.60

157652.36

1764951.24

157991.36

147319.73

1829956.17

51709.52

71875.56

54075.94

72549.97

93259.79

79199.21

29315.90

359959.46

978115.31

6685.60

42951.19

1468736.98

21236.12

308476.11

846265.96

5224.00

48329.70

1301407.45

43087.22

312197.61

867578.89

5466.55

53113.02

1335519.23

31865.39

521959.19

1306757.47

9057.26

59425.67

2001614.95

28715.46

451104.51

1122126.59

7154.48

62590.41

1764951.24

48391.62

460949.14

1163670.21

7407.96

70338.03

1829956.17

The above results have been approved by the Central Board of the Bank at the meeting held on 14th February 2013

and were subjected to "Limited Review" by the Bank's Statutory Central Auditors.

Place : Mumbai

Date : 14.02.2013

S Vishvanathan

MD & GE (A & S)

A.Krishna Kumar

MD & GE (Nat. Bkg.)

Diwakar Gupta

MD & CFO

H G Contractor

MD & GE (Int'l Bkg.)

Pratip Chaudhuri

Chairman

You might also like

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- State Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Document1 pageState Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Rajat PaniNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Review Report 311210Document1 pageReview Report 311210Hriday PandeyNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- BsheetDocument4 pagesBsheetDeepak KumarNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Karnataka Bank 2022 PerfomaceDocument59 pagesKarnataka Bank 2022 Perfomacesahal95264No ratings yet

- Avt Naturals (Qtly 2011 06 30) PDFDocument1 pageAvt Naturals (Qtly 2011 06 30) PDFKarl_23No ratings yet

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Midterm Exam R45D Coke. Co. TemplateDocument20 pagesMidterm Exam R45D Coke. Co. TemplateAchmad BaehakiNo ratings yet

- Userfiles Financial 6fDocument2 pagesUserfiles Financial 6fTejaswini SkumarNo ratings yet

- Fin Resu Dec 12Document1 pageFin Resu Dec 12Adil SiddiquiNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- AAPL Financial ReportDocument110 pagesAAPL Financial ReportChuks VincentNo ratings yet

- Financial Results Sep 2011Document1 pageFinancial Results Sep 2011Shankar GargNo ratings yet

- Ar 31mar09Document1 pageAr 31mar09Nikhil RanaNo ratings yet

- 2nd Quarter Results 2011 12Document1 page2nd Quarter Results 2011 12satyendra_upreti2011No ratings yet

- Areeb Consolidated INDEX P&l.jpegDocument4 pagesAreeb Consolidated INDEX P&l.jpegAreeb AsifNo ratings yet

- Standard Chartered Bank Nepal Ltd. Naya Baneshwor, KathmanduDocument1 pageStandard Chartered Bank Nepal Ltd. Naya Baneshwor, Kathmandukheper1No ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- I Practice of Horizontal & Verticle Analysis Activity IDocument3 pagesI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNo ratings yet

- I Practice of Horizontal & Verticle Analysis Activity IDocument3 pagesI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNo ratings yet

- Financially Yours - Induction 2021 - Financial StatementsDocument16 pagesFinancially Yours - Induction 2021 - Financial StatementsSumalakshya TatabhatlaNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Flash MemoryDocument8 pagesFlash Memoryranjitd07No ratings yet

- DCF Valuation Pre Merger Southern Union CompanyDocument20 pagesDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNo ratings yet

- Abb 1Q Cy 2013Document11 pagesAbb 1Q Cy 2013Angel BrokingNo ratings yet

- BKSL 2011 ArDocument175 pagesBKSL 2011 ArPanama TreasureNo ratings yet

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Voltas LatestDocument10 pagesVoltas LatestSambaran DasNo ratings yet

- Abc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesDocument24 pagesAbc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesSharbani ChowdhuryNo ratings yet

- GAR02 28 02 2024 FY2023 Results ReleaseDocument29 pagesGAR02 28 02 2024 FY2023 Results Releasedesifatimah87No ratings yet

- Auto Model PDFDocument21 pagesAuto Model PDFAAOI2No ratings yet

- Consolidated Financial HighlightsDocument1 pageConsolidated Financial HighlightsMuvin KoshtiNo ratings yet

- Annual Financial HighlightsDocument1 pageAnnual Financial HighlightsManish JaiswalNo ratings yet

- SR DM 05Document42 pagesSR DM 05Sumit SumanNo ratings yet

- Axis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006Document3 pagesAxis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006alayprajapatiNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Roll-W 7012014Document12 pagesRoll-W 7012014joshijaysoftNo ratings yet

- Spoken EnglishDocument225 pagesSpoken EnglishKumuda Srinath100% (2)

- Data SummaryDocument1 pageData SummaryjoshijaysoftNo ratings yet

- 8oa-T (O . (N, 7: R 4 L Plor,,t, 1.kc-Uri FN (SS?." F "V' (Err A,$r RDocument1 page8oa-T (O . (N, 7: R 4 L Plor,,t, 1.kc-Uri FN (SS?." F "V' (Err A,$r RjoshijaysoftNo ratings yet

- Yogapoint Recipe BookDocument139 pagesYogapoint Recipe BookjoshijaysoftNo ratings yet

- 19 Rava UpmaDocument1 page19 Rava UpmajoshijaysoftNo ratings yet

- Scheduled Commercial Banks - Business in India Item Variation Over Fortnight Financial Year So FarDocument4 pagesScheduled Commercial Banks - Business in India Item Variation Over Fortnight Financial Year So FarjoshijaysoftNo ratings yet

- CH 9Document82 pagesCH 9Michael Fine100% (2)

- Summary - Corporate Finance Beck DeMarzoDocument54 pagesSummary - Corporate Finance Beck DeMarzoAlejandra100% (2)

- Accounts Assign After Plegarism With SSDocument4 pagesAccounts Assign After Plegarism With SSIt's reechaNo ratings yet

- 3.2 Equity Securities Hand OutDocument8 pages3.2 Equity Securities Hand OutAdyangNo ratings yet

- PWP LeafletDocument4 pagesPWP LeafletsatishbhattNo ratings yet

- FULL Download Ebook PDF International Finance 5th Edition Fifth Edition PDF EbookDocument41 pagesFULL Download Ebook PDF International Finance 5th Edition Fifth Edition PDF Ebooksally.marcum863100% (38)

- HNB Annual Report 2011Document300 pagesHNB Annual Report 2011Vaishnavi Thiyagarajah100% (1)

- Chapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingDocument6 pagesChapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingNaurah Atika DinaNo ratings yet

- Book Building Method in Security Market of BangladeshDocument4 pagesBook Building Method in Security Market of BangladeshZubairia Khan100% (3)

- College of Accountancy and Finance: ACCO 30013 Accounting For Special TransactionsDocument4 pagesCollege of Accountancy and Finance: ACCO 30013 Accounting For Special TransactionsKim EllaNo ratings yet

- HW #1 Financial ManagemenrDocument3 pagesHW #1 Financial ManagemenrHaidie DiazNo ratings yet

- Fin Acc Valix PDFDocument58 pagesFin Acc Valix PDFKyla Renz de LeonNo ratings yet

- Ebook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFDocument67 pagesEbook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFjohn.gallardo475100% (24)

- t113 PDFDocument151 pagest113 PDFViswanathan VNo ratings yet

- 2022 - 02 - 03 Revision in Rates of NSSDocument10 pages2022 - 02 - 03 Revision in Rates of NSSKhawaja Burhan0% (2)

- Assignment4Document2 pagesAssignment4Laiba EjazNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Final Questionnair PDFDocument4 pagesFinal Questionnair PDFRinkesh K MistryNo ratings yet

- Credit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceDocument33 pagesCredit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceGeorge Lekatis100% (1)

- Summary PBI Regulation in Regard To The Reporting of Offshore BorrowingDocument3 pagesSummary PBI Regulation in Regard To The Reporting of Offshore BorrowingAditya NuramaliaNo ratings yet

- Types of Risk in MicrofinanceDocument9 pagesTypes of Risk in Microfinancevish100% (1)

- FR Assignment 4Document4 pagesFR Assignment 4shashalalaxiangNo ratings yet

- A 2022 YFC BMC Financials FINAL Rapal Group 1Document7 pagesA 2022 YFC BMC Financials FINAL Rapal Group 1Rapzkie RapalNo ratings yet

- Crim AffidDocument29 pagesCrim AffidAna AdolfoNo ratings yet

- XdocmulationDocument4 pagesXdocmulationKuthe Prashant GajananNo ratings yet

- Pakistan PII - Harvard Kennedy School PAEDocument35 pagesPakistan PII - Harvard Kennedy School PAEAsim JahangirNo ratings yet

- (6-2) Interest Rate Levels CH Answer: B MEDIUMDocument9 pages(6-2) Interest Rate Levels CH Answer: B MEDIUMMohsin2k100% (1)

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocument5 pagesAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNo ratings yet

- Debt Collector Call Script Fair Debt CollectionDocument12 pagesDebt Collector Call Script Fair Debt CollectionmoNo ratings yet