Professional Documents

Culture Documents

Atlanta Hotel Motel Tax Renewal Bill 2010

Uploaded by

Allie M GrayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atlanta Hotel Motel Tax Renewal Bill 2010

Uploaded by

Allie M GrayCopyright:

Available Formats

10 House Bill 903 (AS PASSED HOUSE AND SENATE) By: Representatives Burkhalter of the 50th and Stephens

of the 164th

HB 903/AP

A BILL TO BE ENTITLED AN ACT

1 2 3 4 5 6 7 8 9 10 11 12

To amend Code Section 48-13-51 of the Official Code of Georgia Annotated, relating to county and municipal tax levies on hotels and motels and other public accommodations, so as to revise provisions relating to a levy at the rate of 7 percent by certain counties and municipalities; to provide that, where such tax was levied for the purpose of funding a multipurpose domed stadium facility and is subject to a stated expiration date, the expiration date may be extended under certain circumstances; to provide for extension for purposes of funding a successor facility upon certification of certain conditions by a state authority; to provide for expenditure through a contract with the state authority; to provide for a new extended expiration date; to provide for the protection of bondholders; to authorize certain counties and municipalities to levy such taxes at the rate of 7 percent; to provide for procedures, conditions, and limitations; to provide for other related matters; to provide an effective date; to repeal conflicting laws; and for other purposes.

13

BE IT ENACTED BY THE GENERAL ASSEMBLY OF GEORGIA:

14 15 16 17 18 19 20 21 22 23 24 25 26

SECTION 1. Code Section 48-13-51 of the Official Code of Georgia Annotated, relating to county and municipal tax levies on hotels and motels and other public accommodations, is amended by revising paragraph (5) of subsection (a) as follows: "(5)(A)(i) Notwithstanding any other provision of this subsection, a county (within the territorial limits of the special district located within the county) or municipality is authorized to levy a tax under this Code section at a rate of 7 percent. A county or municipality levying a tax pursuant to this paragraph shall expend an amount equal to at least 51.4 percent of the total taxes collected prior to July 1, 1990, at the rate of 7 percent and an amount equal to at least 32.14 percent of the total taxes collected on or after July 1, 1990, at the rate of 7 percent for the purpose of: (A) (I) promoting tourism, conventions, and trade shows; (B) (II) supporting a facility owned or operated by a state authority for convention and trade show purposes or any other H. B. 903 -1-

10

HB 903/AP similar or related purposes; (C) (III) supporting a facility owned or operated by a local authority or local government for convention and trade show purposes or any other similar or related purposes, if a written agreement to provide such support was in effect on January 1, 1987, and if such facility is substantially completed and in operation prior to July 1, 1987; (D) (IV) supporting a facility owned or operated by a local government or local authority for convention and trade show purposes or any other similar or related purposes if construction of such facility is funded or was funded in whole or in part by a grant of state funds; or (E) (V) for some combination of such purposes. Amounts so expended shall be expended only through a contract or contracts with the state, a department of state government, a state authority, or a private sector nonprofit organization or through a contract or contracts with some combination of such entities, except that amounts expended for those purposes specified in subparagraphs subdivisions (C) (III) and (D) (IV) of this paragraph division may be so expended in any otherwise lawful manner. (ii) In addition to the amounts required to be expended above under division (i) of this subparagraph, a county or municipality levying a tax pursuant to this paragraph (5) shall further expend (in each fiscal year during which the tax is collected under this paragraph (5)) an amount equal to 14.3 percent of the total taxes collected prior to July 1, 1990, at the rate of 7 percent and an amount equal to 39.3 percent of the total taxes collected on or after July 1, 1990, at the rate of 7 percent toward funding a multipurpose domed stadium facility. Amounts so expended shall be expended only through a contract originally with the state, a department or agency of the state, or a state authority or through a contract or contracts with some combination of the above. Any tax levied pursuant to this paragraph shall terminate not later than December 31, 2020, unless extended as provided in subparagraph (B) of this paragraph, provided that during any period during which there remains outstanding any obligation which is incurred prior to January 1, 1991, issued to fund a multipurpose domed stadium as contemplated by this paragraph (5), and secured in whole or in part by a pledge of a tax authorized under this Code section, or any such obligation which is incurred to refund such an obligation incurred before January 1, 1991, the powers of the counties and municipalities to impose and distribute the tax imposed by this paragraph (5) shall not be diminished or impaired by the state and no county or municipality levying the tax imposed by this paragraph shall cease to levy the tax in any manner that will impair the interest and rights of the holders of any such obligation. This proviso shall be for the benefit of the holder of any such obligation and, upon the issuance of any such obligation by an authority of the state, shall constitute a contract with the holder of such obligations. H. B. 903 -2-

27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63

10

HB 903/AP (B) Notwithstanding the termination date stated in division (ii) of subparagraph (A) of this paragraph (5), notwithstanding paragraph (6) of this subsection (a), and notwithstanding subsection (b) of this Code section, a tax levied under this paragraph may be extended by resolution of the levying county or municipality and continue to be collected through December 31, 2050, if a state authority certifies: (i) that the same portion of the proceeds will be used to fund a successor facility to the multipurpose domed facility as is currently required to fund the multipurpose domed facility under division (ii) of subparagraph (A) of this paragraph; (ii) that such successor facility will be located on property owned by the state authority; and (iii) that the state authority has entered into a contract with a national football league team for use of the successor facility by the national football league team through the end of the new extended period of the tax collection. During the extended period of collection provided for in this subparagraph, the county or municipality levying the tax shall continue to comply with the expenditure requirements of division (i) of subparagraph (A) of this paragraph. During the extended period of collection, the county or municipality shall further expend (in each fiscal year during which the tax is collected during the extended period of collection) an amount equal to 39.3 percent of the total taxes collected at the rate of 7 percent toward funding the successor facility certified by the state authority. Amounts so expended shall be expended only through a contract with the certifying state authority. Any tax levied pursuant to this paragraph shall terminate not later than December 31, 2050, provided that during any period during which there remains outstanding any obligation which is incurred to fund the successor facility certified by the state authority, and secured in whole or in part by a pledge of a tax authorized under this Code section, or any such obligation which is incurred to refund such an obligation, the powers of the counties and municipalities to impose and distribute the tax imposed by this paragraph (5) shall not be diminished or impaired by the state and no county or municipality levying the tax imposed by this paragraph shall cease to levy the tax in any manner that will impair the interest and rights of the holders of any such obligation. This proviso shall be for the benefit of the holder of any such obligation and, upon the issuance of any such obligation by an authority of the state, shall constitute a contract with the holder of such obligations."

64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94

95 96 97 98 99

SECTION 2. Said Code section is further amended by revising paragraph (7) of subsection (a) as follows: "(7) As used in this subsection, the term: (A) 'Fund' and 'funding' means mean the cost and expense of all things deemed necessary by a state authority for the construction and operation of a multipurpose H. B. 903 -3-

10

HB 903/AP domed stadium and a successor facility to such multipurpose domed stadium including but not limited to the study, operation, marketing, acquisition, construction, finance, development, extension, enlargement, or improvement of land, waters, property, streets, highways, buildings, structures, equipment, or facilities, and the repayment of any obligation incurred by an authority in connection therewith. (B) 'Obligation' means bonds, notes, or any instrument creating an obligation to pay or reserve moneys incurred prior to January 1, 1991, and having an initial term of not more than 30 years. (C) 'Multipurpose domed stadium facility' means a multipurpose domed stadium facility and any associated parking areas or improvements originally owned or operated incident to the ownership or operation of a facility used for convention and trade show purposes by the state, a department or agency of the state, a state authority, or a combination thereof."

100 101 102 103 104 105 106 107 108 109 110 111 112

113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135

SECTION 3. Said Code section is further amended by adding a new subsection to read as follows: "(b.1) As an alternative to the provisions of subsection (b) of this Code section, any county (within the territorial limits of the special district located within the county) and any municipality which is levying a tax under this Code section at the rate of 6 percent under paragraph (3.4) or (4) of subsection (a) of this Code section shall be authorized to levy a tax under this Code section at the rate of 7 percent in the manner provided in this subsection. Both the county and municipality shall adopt a resolution which shall specify that an amount equal to the total amount of taxes collected under such levy at a rate of 6 percent shall continue to be expended as it was expended pursuant to either paragraph (3.4) or (4) of subsection (a) of this Code section, as applicable, and such resolution shall specify the manner of expenditure of funds for an amount equal to the total amount of taxes collected under such levy that exceeds the amount that would be collected at the rate of 6 percent for any tourism, convention, or trade show purposes, tourism product development purposes, or any combination thereof. Each resolution shall be required to be ratified by a local Act of the General Assembly. Only when both such local Acts have become law, the governing authority of the county and municipality shall be authorized to levy an excise tax pursuant to this subsection at the rate of 7 percent of the charge for the furnishing for value to the public of any room or rooms, lodgings, or accommodations furnished by any person or legal entity licensed by, or required to pay business or occupation taxes to, the municipality for operating a hotel, motel, inn, lodge, tourist camp, tourist cabin, campground, or any other place in which rooms, lodgings, or accommodations are regularly or periodically furnished for value." H. B. 903 -4-

10

HB 903/AP SECTION 4.

136 137 138

This Act shall become effective upon its approval by the Governor or upon its becoming law without such approval.

139 140

SECTION 5. All laws and parts of laws in conflict with this Act are repealed.

H. B. 903 -5-

You might also like

- Original Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesDocument20 pagesOriginal Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesAllie M GrayNo ratings yet

- Gregg Grant Lincoln County Georgia Overlay GORA Whole ResponseDocument133 pagesGregg Grant Lincoln County Georgia Overlay GORA Whole ResponseAllie M GrayNo ratings yet

- Jefferies Bond AnnouncementDocument1 pageJefferies Bond AnnouncementAllie M GrayNo ratings yet

- Financial Services Memo of Aptil 13, 2010 To The Columbia County Management and Financial Services CommitteeDocument10 pagesFinancial Services Memo of Aptil 13, 2010 To The Columbia County Management and Financial Services CommitteeAllie M GrayNo ratings yet

- ARC TIA GiveawayDocument1 pageARC TIA GiveawayAllie M GrayNo ratings yet

- Financial Services Ranking of GB&T As StableDocument1 pageFinancial Services Ranking of GB&T As StableAllie M GrayNo ratings yet

- ARC TIA GiveawayDocument1 pageARC TIA GiveawayAllie M GrayNo ratings yet

- GWCCA Naming RightsDocument1 pageGWCCA Naming RightsAllie M GrayNo ratings yet

- GB&T Board From 2008 Annual Report Issued in 2009Document1 pageGB&T Board From 2008 Annual Report Issued in 2009Allie M GrayNo ratings yet

- Atlanta NSP Agreement Financing Through FY 2050Document3 pagesAtlanta NSP Agreement Financing Through FY 2050Allie M GrayNo ratings yet

- GWCCA December 2012 Financial ReportDocument14 pagesGWCCA December 2012 Financial ReportAllie M GrayNo ratings yet

- Atlanta NSP Concessions ProjectionsDocument1 pageAtlanta NSP Concessions ProjectionsAllie M GrayNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

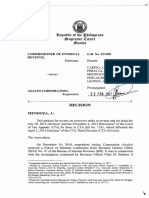

- 15 CIR vs. Asalus Corporation (GR No. 221590 Dated February 22, 2017)Document14 pages15 CIR vs. Asalus Corporation (GR No. 221590 Dated February 22, 2017)Alfred GarciaNo ratings yet

- United States Court of Appeals For The Third CircuitDocument22 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Vham-Bai 3-The Gift of The MagiDocument20 pagesVham-Bai 3-The Gift of The MagiLý Thị Thanh ThủyNo ratings yet

- 1st Group For Cyber Law CourseDocument18 pages1st Group For Cyber Law Courselin linNo ratings yet

- Types of WritsDocument4 pagesTypes of WritsAnuj KumarNo ratings yet

- Afghan PakDocument48 pagesAfghan PakHifza ButtNo ratings yet

- Agrarian Relations and Friar LandsDocument24 pagesAgrarian Relations and Friar LandsAngelica NavarroNo ratings yet

- William Cooper - Operation MajorityDocument6 pagesWilliam Cooper - Operation Majorityvaneblood1100% (4)

- Esther Bible StudyDocument43 pagesEsther Bible StudyEsther Renda ItaarNo ratings yet

- People v. Dela CruzDocument7 pagesPeople v. Dela CruzJose Antonio BarrosoNo ratings yet

- Camdens Tkam Template InfographicDocument2 pagesCamdens Tkam Template Infographicapi-402621060No ratings yet

- Revised Location Routing Numbers ListDocument8 pagesRevised Location Routing Numbers ListParveen Jindal100% (1)

- Case StudyDocument8 pagesCase StudysakibarsNo ratings yet

- A Day in The Life of Abed Salama Anatomy of A Jerusalem Tragedy Nathan Thrall Full ChapterDocument67 pagesA Day in The Life of Abed Salama Anatomy of A Jerusalem Tragedy Nathan Thrall Full Chapterfannie.ball342100% (7)

- Broward Inspector General Lazy Lake Voter Fraud FinalDocument8 pagesBroward Inspector General Lazy Lake Voter Fraud FinalTater FTLNo ratings yet

- Character Evidence NotesDocument9 pagesCharacter Evidence NotesArnoldNo ratings yet

- Mis Conduct CaseDocument9 pagesMis Conduct CaseBandana Pha Go LimbooNo ratings yet

- Dator v. Carpio MoralesDocument5 pagesDator v. Carpio MoralesPaolo TellanoNo ratings yet

- PPG12 - Q2 - Mod10 - Elections and Political Parties in The PhilippinesDocument14 pagesPPG12 - Q2 - Mod10 - Elections and Political Parties in The PhilippinesZENY NACUANo ratings yet

- President Corazon Aquino's Speech Before The Joint Session of The U.S CongressDocument27 pagesPresident Corazon Aquino's Speech Before The Joint Session of The U.S CongressPat Ty0% (1)

- Uson Vs Del RosarioDocument2 pagesUson Vs Del RosarioNic NalpenNo ratings yet

- Isenhardt v. Real (2012)Document6 pagesIsenhardt v. Real (2012)Orlhee Mar MegarbioNo ratings yet

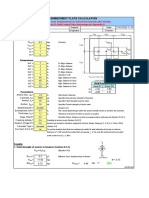

- Embedded Plates Calculation - Part 2Document8 pagesEmbedded Plates Calculation - Part 2Mai CNo ratings yet

- Ballymun, Is The Place To Live inDocument10 pagesBallymun, Is The Place To Live inRita CahillNo ratings yet

- Us Vs PagaduanDocument5 pagesUs Vs PagaduanRon AceNo ratings yet

- G.R. No. L-17526 - Magdusa v. AlbaranDocument2 pagesG.R. No. L-17526 - Magdusa v. AlbaranKimmy May Codilla-AmadNo ratings yet

- Poor in SpiritDocument7 pagesPoor in SpiritWainaina NjokiNo ratings yet

- Legal Ethics 9Document1 pageLegal Ethics 9lhemnavalNo ratings yet

- G.R. No. 159624Document3 pagesG.R. No. 159624mar corNo ratings yet

- Chambertloir Biblio DefDocument8 pagesChambertloir Biblio DefmesaNo ratings yet